1. Matters

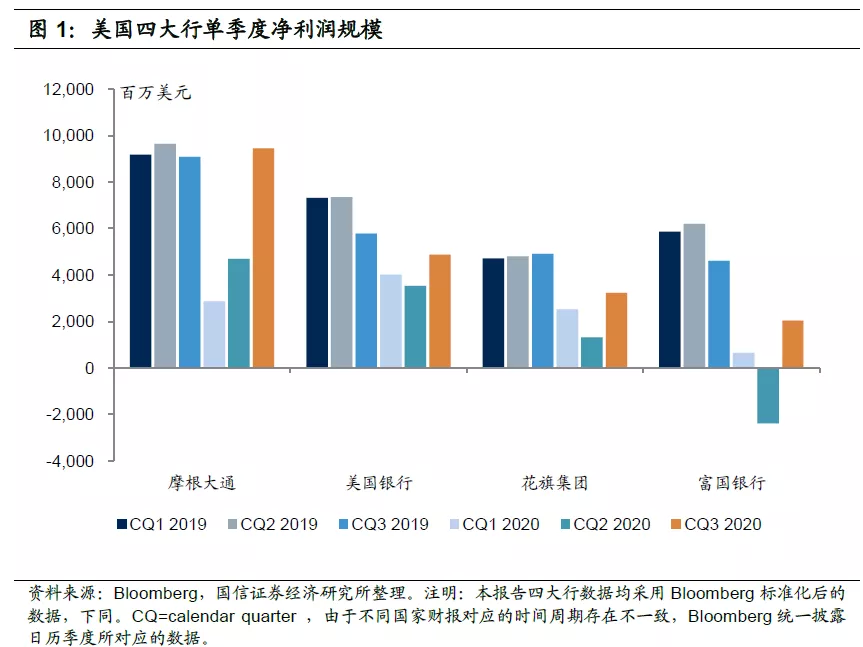

JPMorgan Chase & Co (JPM.US), Bank of America Corporation (BAC.US), Citigroup Inc (C.US) and Wells Fargo & Co (WFC.US) disclosed that third-quarter revenue was $29.1 billion, $20.4 billion, $17.1 billion and $18.9 billion, respectively, and net profit was $9.4 billion, $4.9 billion, $3.2 billion and $2 billion, respectively.

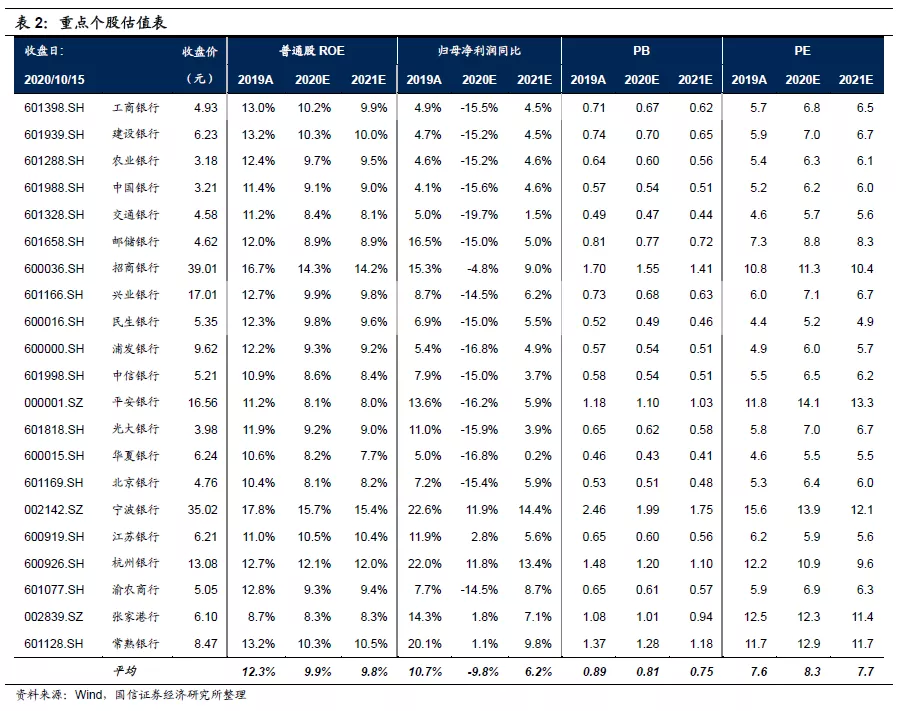

two。 Comment

2.1 the decline in net profit of the four major US banks narrowed in the third quarter.

The net profit of JPMorgan Chase & Co, Bank of America Corporation, Citigroup Inc and Wells Fargo & Co in the first three quarters fell 39.1%, 39.2%, 51.0% and 98.1% respectively from the same period last year, narrowing the decline of 20.8%, 9.3%, 8.6% and 16.2% respectively from the first half of the year. JPMorgan Chase & Co's net profit in the third quarter increased by 4.0% compared with the same period last year. The results of the four major banks in the United States recovered in the third quarter, but overall net profit fell sharply in the first three quarters, reflecting the great impact of health events on the performance of the four major banks in the United States.

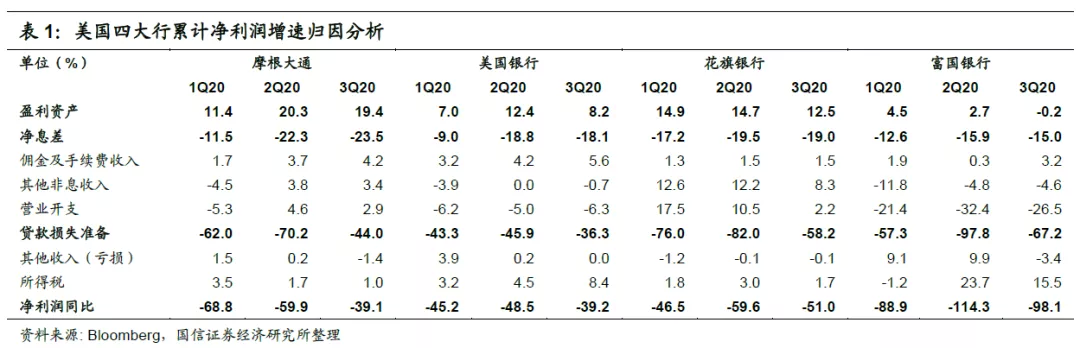

According to the attribution analysis of the net profit growth rate of the four major banks,

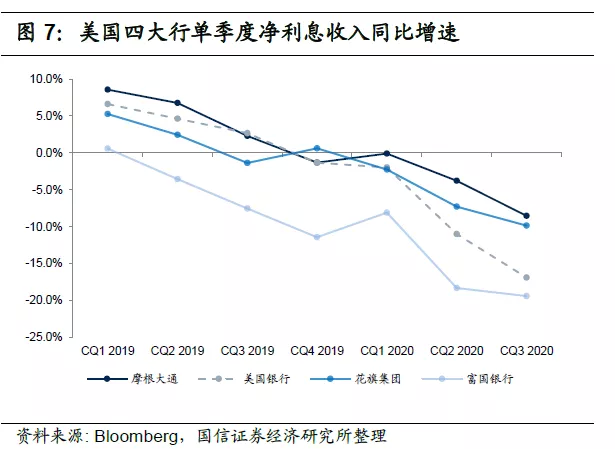

the main factor dragging down the net profit of the four major banks in the first three quarters of this year is the large provision for loan losses, but the drag on net profit by the provision for loan losses in the third quarter has significantly improved. Second, the narrowing of the net interest margin has also brought a big drag on net profit.

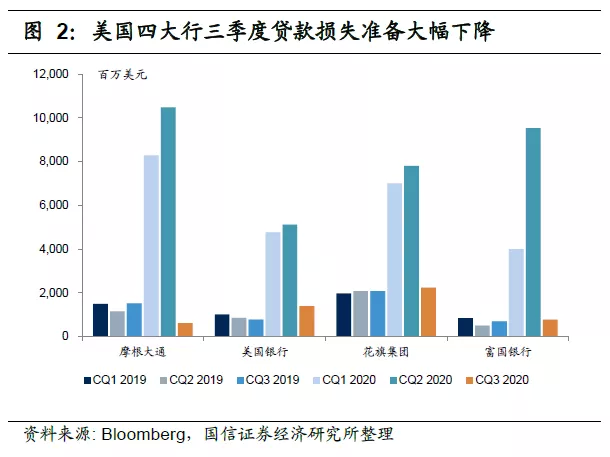

2.2 provisions for the third quarter fell sharply, and the asset quality was stable.

The significant improvement in the month-on-month net profit of the four major banks in the United States in the third quarter was mainly due to a sharp decline in the provision of provisions. in the third quarter, the loan loss provisions of JPMorgan Chase & Co, Bank of America Corporation, Citigroup Inc and Wells Fargo & Co were 610 million US dollars, 1.39 billion US dollars, 2.23 billion US dollars and 770 million US dollars respectively, significantly better than 10.47 billion US dollars, 5.12 billion US dollars, 7.81 billion US dollars and 9.53 billion US dollars in the second quarter.

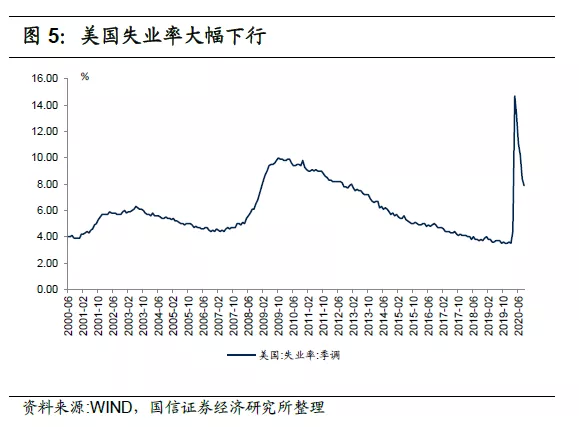

The sharp reduction of provisions in the United States in the third quarter was mainly due to the preparations made by companies in the first half of the year. According to CECL guidelines, JPMorgan Chase & Co, Bank of America Corporation, Citigroup Inc, and Wells Fargo & Co made provisions for a total of US $19.37 billion, US $24.14 billion, US $25.68 billion and US $12.31 billion in the first three quarters, the largest year since the subprime mortgage crisis in 2008. At the same time, it can be seen that the US unemployment rate has continued to decline after its phased peak in April, falling to 7.90% in September, and the asset quality pressure on banks has eased somewhat compared with the second quarter.

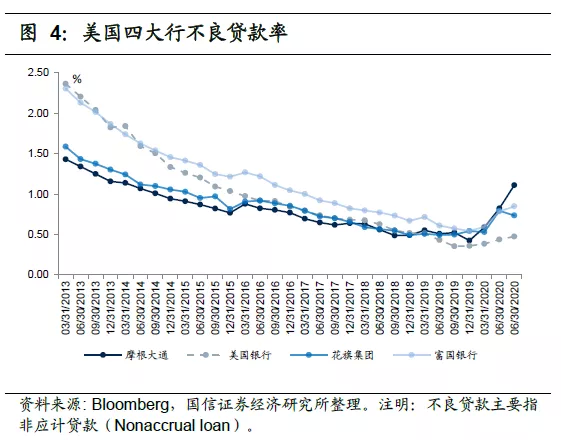

The asset quality of the four major banks in the United States was stable in the third quarter, and the future will usher in a stage of concentrated exposure of bad things, but they have made full preparations. The impact of health events on the asset quality of the four major banks is still not fully apparent. The annualized net write-off rates of JPMorgan Chase & Co, Bank of America Corporation, Citigroup Inc and Wells Fargo & Co in the third quarter were 0.48%, 0.40%, 1.13% and 0.29%, respectively, down 15bps, 5bps, 12bps and 17bps from the second quarter. The defect rate of JPMorgan Chase & Co, Bank of America Corporation and Wells Fargo & Co (Nonaccrual

loan

rate) increased by 29bps, 4bps and 6bps to 1.11%, 0.47% and 0.85%, respectively, while Citigroup Inc's defect rate decreased to 0.73% from the previous month. On the whole, Bank of America Corporation's asset quality performance is still relatively stable. However, considering the lag of adverse exposure, it is expected that the four major lines in the United States will usher in the stage of concentrated exposure in the future.

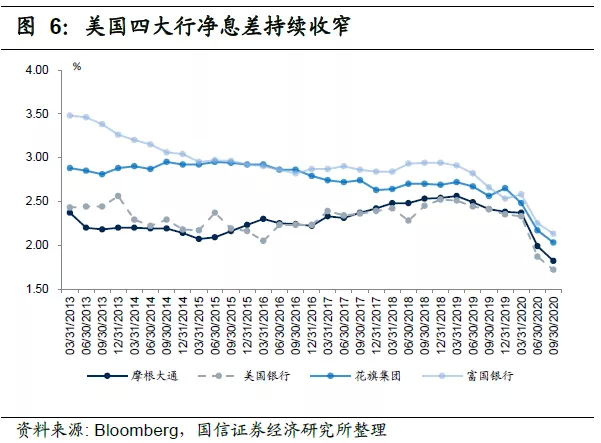

2.3 net interest margin continued to narrow substantially and net interest income declined

In the low interest rate market environment, the net interest margin of the four major US banks continued to narrow sharply, resulting in a decline in net interest income. The annualized net interest margins of JPMorgan Chase & Co, Bank of America Corporation, Citigroup Inc and Wells Fargo & Co in the third quarter were 1.82%, 1.72%, 2.03% and 2.13% respectively, narrowing 59bps, 69bps, 53bps and 53bps respectively compared with the same period last year, and narrowing 17bps, 15bps, 14bps and 12bps respectively. The US economy still faces great pressure in the future, and it is expected that the United States will still maintain a zero interest rate market environment in the fourth quarter, and the net interest margin will continue to narrow under the re-pricing factor.

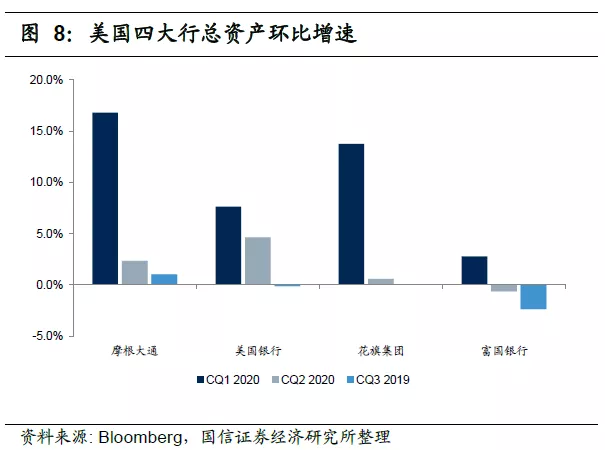

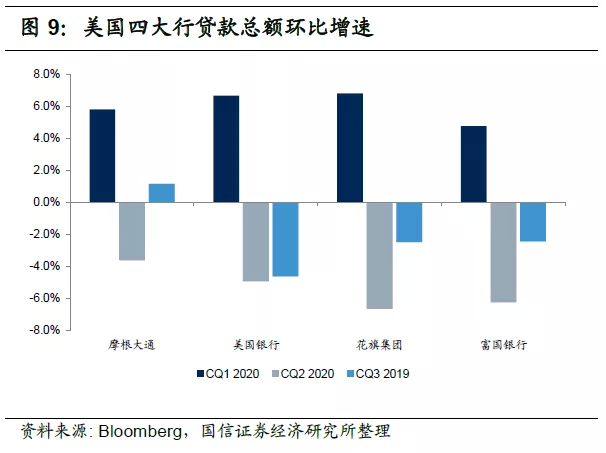

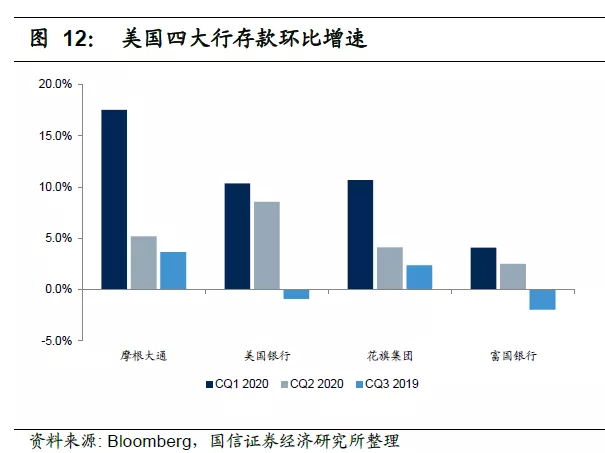

2.4 the size of assets remained basically stable and the growth rate of deposits slowed down.

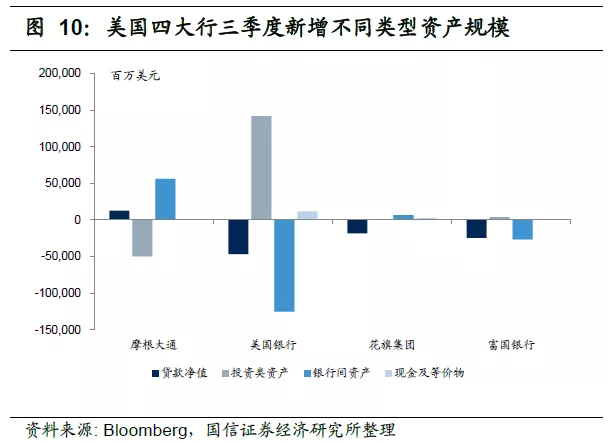

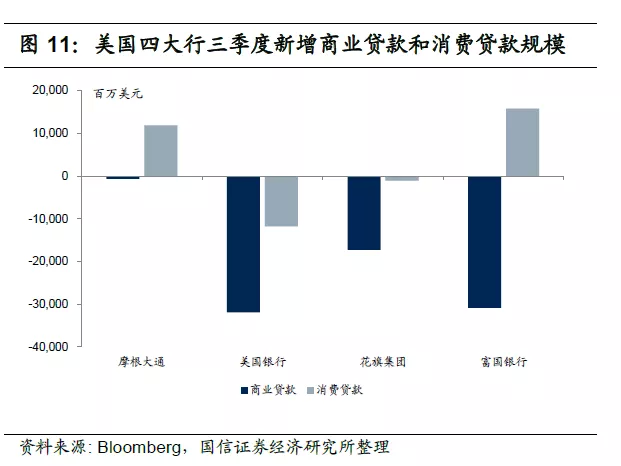

In the third quarter, JPMorgan Chase & Co's total assets expanded slightly by 1.1%, Bank of America Corporation and Citigroup Inc were basically the same, and Wells Fargo & Co compressed 2.4%. Among them, the total loan volume of JPMorgan Chase & Co expanded by 1.1% in the third quarter, while that of Bank of America Corporation, Citigroup Inc and Wells Fargo & Co shrank by 4.8%, 2.6% and 2.6% respectively, but the drop was narrower than that in the second quarter. From the perspective of the new asset types, JPMorgan Chase & Co mainly increased the inter-bank asset allocation and reduced the investment assets, while Bank of America Corporation mainly increased the investment asset allocation and significantly reduced the interbank assets. From the perspective of new credit investment, the four major banks continued to reduce commercial loans in the third quarter, while JPMorgan Chase & Co and Wells Fargo & Co increased the allocation of consumer loans in the third quarter.

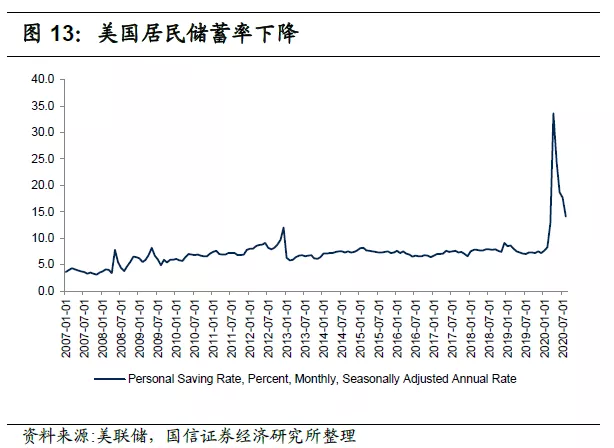

The US household savings rate has fallen and deposit growth has fallen sharply. Deposits in JPMorgan Chase & Co and Citigroup Inc expanded by 3.6% and 2.3% respectively in the third quarter, while deposits by Bank of America Corporation and Wells Fargo & Co fell by 0.9% and 1.9% respectively in the third quarter. On the one hand, the derivative scale of deposits decreased, on the other hand, the household savings rate decreased. The US household savings rate continued to decline after reaching a sex high of 33.6% in April, and the household savings rate fell to 14.1% in August. However, it is still at a high level, reflecting that residents are still worried about the US economy, but it is less worried than in the second quarter.

Investment suggestion

Although there is a good chance that US banks have passed the darkest stage, the uncertainty of the US economic recovery has further increased under the environment of variables in the US economic stimulus plan and no improvement in health events. Therefore, there is also greater uncertainty about when the performance of US banks will rebound. However, at present, China's economy is recovering well, and monetary policy has returned to normalization. Therefore, the improvement of China's banking performance has a high degree of certainty.

At present, the valuation of China's banking sector is at a low level both horizontally and vertically, and we believe that the fourth quarter will usher in the opportunity to repair the valuation and maintain the "overweight" rating of the industry. Individual stocks, the first bad high margin of safety of Ningbo Bank, Changshu Bank, China Merchants Bank, while recommended extremely low valuation, stable fundamentals of Industrial and Commercial Bank of China (01398).

Risk hint

若美国宏观经济大幅下行,可能从多方面影响银行业,比如经济下行时期货币政策宽松对净息差的负面影响、企业偿债能力下降对银行资产质量的影响等。