Core ideas:

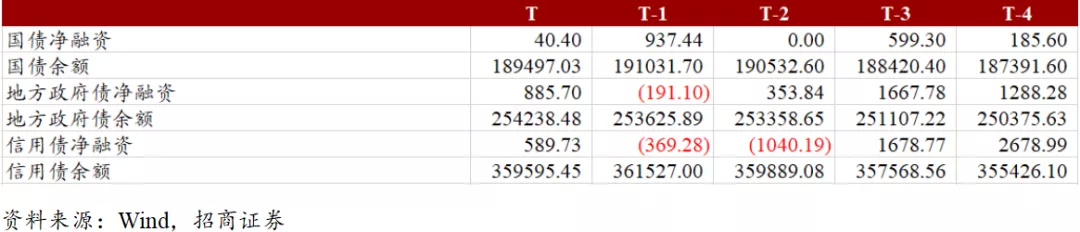

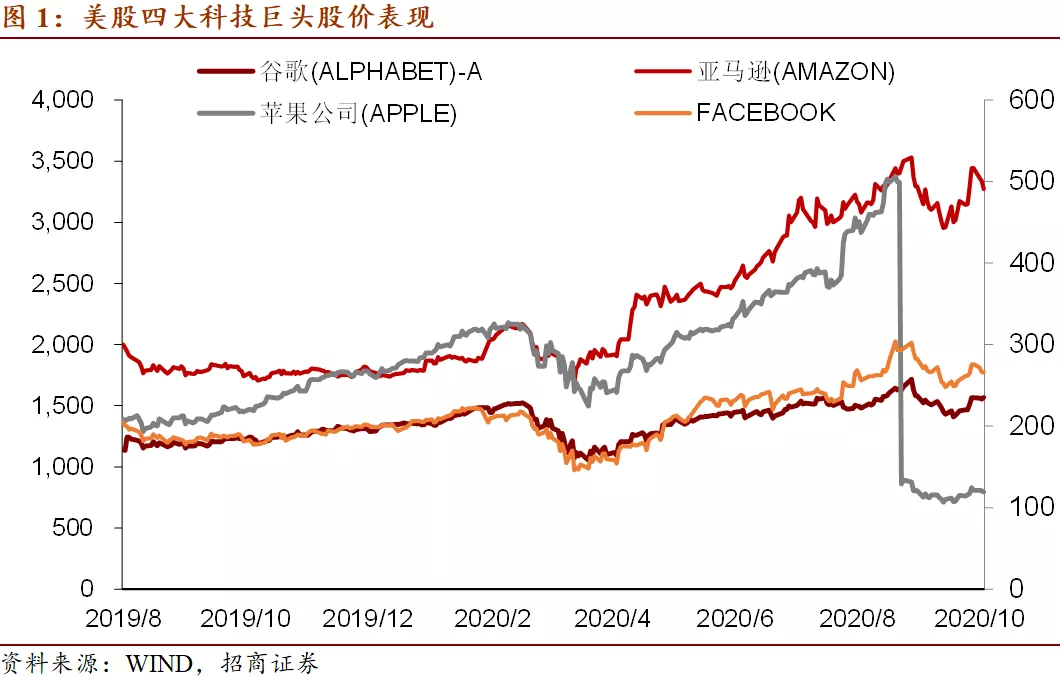

If the United States takes radical measures against digital giants, it can have a greater impact on US stocks:On October 6, the antitrust subcommittee of the House of Representatives Judiciary Committee released the Digital Market Competition Survey, saying that these corporate giants should be subject to stricter regulation and recommending structural separation of these technology companies. for example, forcing enterprises to break up or adjust their business structure and so on. The implementation of this policy is still facing great resistance.

If radical measures are taken against Apple Inc (AAPL.US), Amazon.Com Inc (AMZN.US), FB.US (Facebook) and Alphabet Inc-CL C (GOOG.US), the situation will have a greater impact on US stocks after fermentation. On the whole, Biden's policy orientation is more "fair" between "fairness" and "efficiency", and its possible direction of tax reform such as abolishing Trump tax cuts for businesses and raising taxes on the rich has already made the market worried about the performance of US stocks. Biden and the Democratic Party are also more likely to promote the break-up of big tech companies. According to the fivethirtyeight poll, Biden's lead in the poll was further expanded to 10.6% as of Oct. 16, indicating that Biden is more likely to win the general election. This will heighten concerns about US stocks, as the four technology giants Apple Inc, Amazon.Com Inc, Microsoft Corp and Facebook Inc have made great contributions to the previous rally of US stocks.

Car consumption continues to improve:According to the latest figures from the China Automobile Association, domestic car sales rose 17.4% in September from the previous month, the highest level in the past five months. On the one hand, passenger car sales have maintained a steady rebound, indicating that the rebound in income growth has accelerated the repair of household consumption with the decline of unemployment and the improvement of corporate profits. On the other hand, commercial vehicle sales continue to lead passenger vehicles and maintain rapid growth, and the sharp fall in black commodity futures prices does not indicate a significant decline in investment demand. In the second week of October, the average daily retail sales growth rate of passenger cars increased by 43% compared with the same period last year, which was significantly higher than the average growth rate in the third quarter, according to the Federation of passengers. The recent improvement in car sales means that zero growth will accelerate to the normal level. After the manufacturing production situation picked up in the second quarter, consumer demand in the second half of the year has become the main driving force for the economy to return to normal. This has been supported by an accelerated improvement in car consumption.

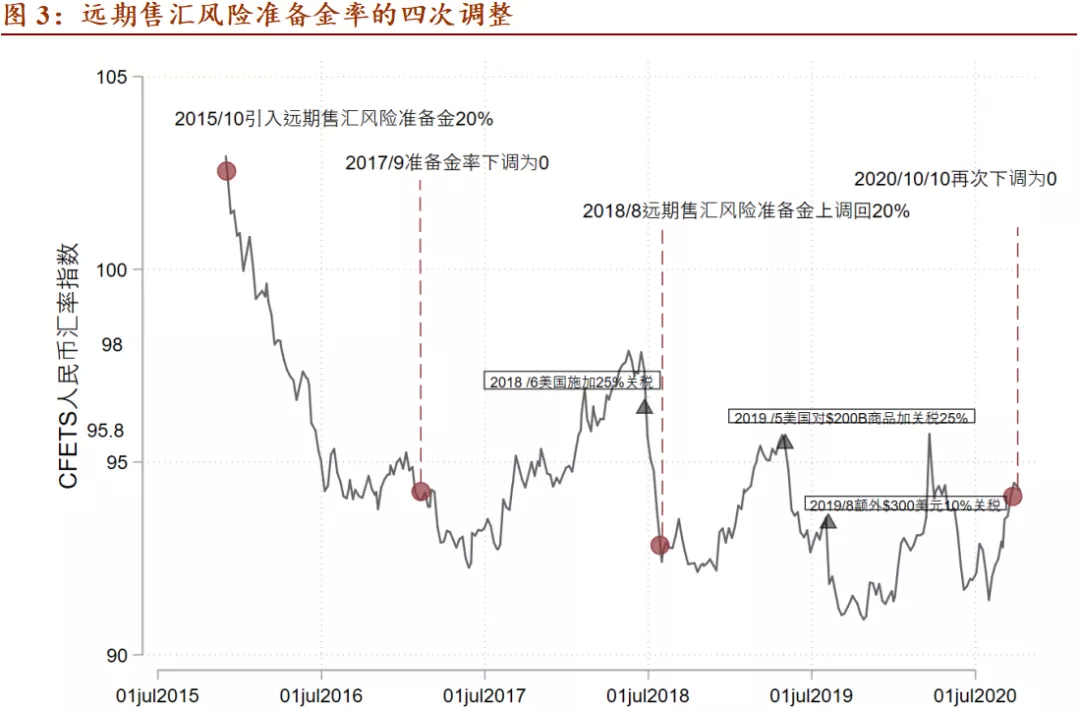

Four adjustments to the risk reserve for forward foreign exchange sales:On October 10, the people's Bank of China announced that it would lower the risk reserve ratio for forward foreign exchange sales to 0. Since the introduction of the forward risk reserve for foreign exchange sales in August 2015, the people's Bank of China has made a total of four adjustments, the first two for exchange rate fluctuations and policy withdrawal after the "811 exchange rate reform". In August 2018, as the Sino-US trade conflict intensified and the CFETS RMB exchange rate index fell rapidly from 98 to about 93, the risk reserve ratio was adjusted back to 20 per cent again. The adjustment comes under the background that China's economic recovery will continue to be stronger than that of other economies, the US dollar enters a downward trend and the renminbi appreciates rapidly, and the authorities have launched a counter-cyclical adjustment in response to the excessive appreciation of the renminbi.

Commodity prices have continued to pick up this week:This week, the CRB index continued its upward trend since September, with the CRB Composite Index closing at 410.7 on Oct. 14, up 4.3 from 406.4 in the same period last week. 466.1, 5.7 and 341.9 from 460.4 in the same period last week, up 2.8 from last week.

The dollar index rose slightly this week, closing at 93.71 on Oct. 16, up 0.7 from last week. U. S. Treasuries closed at 0.76 on October 16, and the spread between China and the United States widened slightly to 246BP. On Oct. 15, the balance of US Treasuries was 27.14 trillion US dollars, up 18.52% from a year earlier. Us Treasuries continued to expand this year, but at a slower pace.

One picture and one point of view

I. the potential impact of the US House of Representatives antitrust investigation on US stocks

On October 6th, the Anti-monopoly Subcommittee of the Judiciary Committee of the US House of Representatives released the Digital Market Competition Survey, which pointed out that the four technology giants Apple Inc, Amazon.Com Inc, Facebook and Alphabet Inc-CL C (GAFA) had monopolistic behavior, which hindered the innovation and development of the industry market and harmed the relevant interests of consumers. Facebook Inc has been criticized for often acquiring competitors or even copying competitors' services to achieve business goals in order to maintain and expand his monopoly position. Alphabet Inc-CL C is pointed out to give priority to showing his products in search results to attack competitors; Amazon.Com Inc uses his market advantage as the largest online retailer and leading e-commerce market to hinder potential competitors Apple Inc is accused of monopolizing the application market for iPhone and iPad, allowing the company to draw excessive commissions from the sales of app developers.

The antitrust panel of the House Judiciary Committee said there should be stricter regulation of these corporate giants and recommended structural separation of these technology companies, such as forcing companies to break up or restructure their businesses. However, from the feedback of all parties, the policy will face greater resistance if it is to be implemented.

If Apple Inc, Amazon.Com Inc, Facebook and Alphabet Inc-CL C take radical measures to ferment may have a greater impact on U. S. stocks.Overall, Biden's policy orientation is more "fair" between "fairness" and "efficiency". Policy directions such as the possibility of canceling Trump's tax cuts for companies and raising taxes on the rich have already made the market more worried about the performance of US stocks, while Biden and the Democratic Party are more likely to push for a break-up of big tech companies. According to the fivethirtyeight poll, Biden's lead in the poll expanded further to 10.6% as of Oct. 16, indicating that Biden is more likely to win the general election, which will add to concerns about US stocks, as the four technology giants Apple Inc, Amazon.Com Inc, Microsoft Corp and Facebook Inc have contributed greatly to the previous rally of US stocks.

II. Continuous improvement in automobile consumption

According to the latest data from the China Automobile Association, domestic car sales rose 12.9 per cent in September from a year earlier, up 17.4 per cent from a month earlier, the highest growth rate in the past five months. On the one hand, passenger car sales maintained a steady rebound. Passenger car sales rose 8.0% in September from a year earlier, while the month-on-month growth rate reached 19%, a significant jump from August, indicating that with the decline in unemployment and the improvement in corporate profits, the rebound in income growth has accelerated the repair rate of household consumption. On the other hand, commercial vehicle sales continue to lead passenger vehicles. Commercial vehicle sales rose 40.3% in September from a year earlier, continuing to maintain rapid growth. The previous sharp drop in black commodity futures prices did not indicate a significant decline in investment demand.

According to data from the Federation of passengers, the average daily retail sales growth rate of passenger cars increased by 43% in the second week of October compared with the same period last year, which was significantly higher than the average growth rate in the third quarter. The recent improvement in car sales means that zero growth will accelerate to the normal level. After the manufacturing production situation picked up in the second quarter, consumer demand in the second half of the year has become the main driving force for the economy to return to normal. This has been supported by an accelerated improvement in car consumption.

III. Four adjustments to the risk reserve for forward sale of foreign exchange

On October 10, 2020, the people's Bank of China announced that the risk reserve ratio for forward foreign exchange sales would be reduced to 0. On the first trading day after the people's Bank of China announced a reduction in the risk reserve for forward foreign exchange sales, the China Foreign Exchange Trading Center announced a 670-point increase in the midpoint of the yuan against the dollar to 6.7126.

Since the introduction of the foreign exchange risk reserve for forward foreign exchange sales in August 2015, the people's Bank of China has made a total of four adjustments, the first two of which are mainly aimed at exchange rate fluctuations and policy withdrawal after the "811 exchange rate reform". After the "811 foreign exchange reform" in 2015, the people's Bank of China for the first time incorporated the bank's forward foreign exchange sale risk reserve into the macro-prudential framework, announcing that financial institutions carrying out forward foreign exchange sale business since October should apply 20% of the reserve. The second adjustment was in September 2017, when the people's Bank of China lowered the required reserve ratio from 20 per cent to zero from September 11 as a suitable window for policy exit due to the weakening of the dollar index and the easing of depreciation pressure on the renminbi.

In August 2018, the people's Bank of China adjusted the risk reserve ratio for forward foreign exchange sales for the third time. According to the RMB midpoint quotation formula since May 2017, the people's Bank of China mainly refers to market supply and demand and the stability of the RMB exchange rate against basket currencies to determine the midpoint and guide market expectations, in which the CFETS RMB exchange rate index roughly fluctuates in the range of 92 to 98. But trade frictions between China and the US have been heating up since mid-2018, when the Trump administration announced a 25 per cent tariff on 50 billion US dollars of Chinese goods on June 15

. In August 2018, as the CFETS RMB exchange rate index fell rapidly from 98 to around 93 in a few months, and the renminbi depreciated rapidly from 6.25 to 6.9 against the dollar, the people's Bank of China raised the risk reserve ratio for forward foreign exchange sales back to 20 per cent.

In October 2020, against the backdrop of China's economic recovery significantly stronger than other economies and the rapid appreciation of the renminbi, the people's Bank of China adjusted the risk reserve ratio for the fourth time, from 20% to 0%. Given that the US dollar has entered a downward trend and that China's economy is stronger than other developed economies in the next quarter or two, this reserve requirement adjustment should reflect the people's Bank of China's policy intention to initiate counter-cyclical adjustments to the excessive appreciation of the renminbi, avoid short-term capital inflows and push up asset prices.

IV. High-frequency observation: commodities continue to pick up

This week, the CRB index continued its upward trend since September, with the CRB Composite Index closing at 410.7 on Oct. 14, up 4.3 from 406.4 in the same period last week. 466.1, 5.7 and 341.9 from 460.4 in the same period last week, up 2.8 from last week. The South China Composite Index closed at 1476.5 on October 16, up 6.0 from the same period the previous week. The wholesale price index of agricultural products closed at 120.0 on October 16th, continuing to maintain a slight downward trend. The national average price of live pigs closed at 29.7 yuan / kg on October 16, continuing the downward trend since the end of August. This week, COMEX copper closed at an average of 3.06, up 1.36% from last week. Comex gold closed at an average of 1902.4, up 0.36% from last week, up 0.36% from last week, and 0.75% from last week. Rebar closed at 3631.0, down 0.19% from last week. The cement price index closed at 149.2 on October 16th, up 2.8 from the same period the previous week.

The dollar index rose slightly this week, closing at 93.71 on Oct. 16, up 0.7 from last week. The offshore spot exchange rate of RMB closed at 6.70, up 0.01 from last week. U. S. Treasuries closed at 0.76 on October 16, and the spread between China and the United States widened slightly to 246BP. On Oct. 15, the balance of US Treasuries was 27.14 trillion US dollars, up 18.52% from a year earlier. Us Treasuries continued to expand this year, but at a slower pace.

The average real estate sales area of 30 large and medium-sized cities this week was 580000 square meters, up 86.9 percent from last week's 310000 square meters. Among them, the real estate sales areas of first-tier, second-tier and third-tier cities were 8.07,31.85 and 181100 square meters respectively, up 46.3%, 114.3% and 69.8% respectively. The average daily retail sales of car sales in the second week of October was 64000, up 43% from a year earlier, and sales were up 50% from the same period in September.

The Baltic dry bulk Index (BDI) closed at 1477 on October 16th, down sharply from the same period the previous week.

As of this week, the balance of treasury bonds was 18.9 trillion yuan. 201.31 billion yuan of new treasury bonds were issued this week, with a net financing of 4.04 billion yuan. Next week, 233 billion yuan is expected to be issued and 10.09 billion yuan is expected to be repaid. The balance of local government debt is 25.4 trillion yuan, with a new issue of 132.65 billion yuan this week, with a net financing of 88.57 billion yuan. Next week, it is expected to issue 102.43 billion yuan, with an estimated repayment of 85.16 billion yuan. The stock of credit bonds is 36 trillion yuan. 404.6 billion yuan of new credit bonds were issued this week, with a net financing of 58.97 billion yuan. Next week, 103.65 billion yuan is expected to be issued and 410.65 billion yuan is expected to be repaid.

As of October 25, 235.08 billion yuan of local bonds were issued in October, and a total of 5.88345 trillion yuan of local bonds were issued, including 4.47753 trillion yuan of new bonds and 1.40592 trillion yuan of refinancing bonds. The new bonds completed 94.7% of the annual issuance plan (4.73 trillion yuan), of which 3.44976 trillion yuan was issued for special bonds, 92.0% of the annual plan (3.75 trillion yuan), and 97.2% of the quota issued (3.55 trillion yuan).