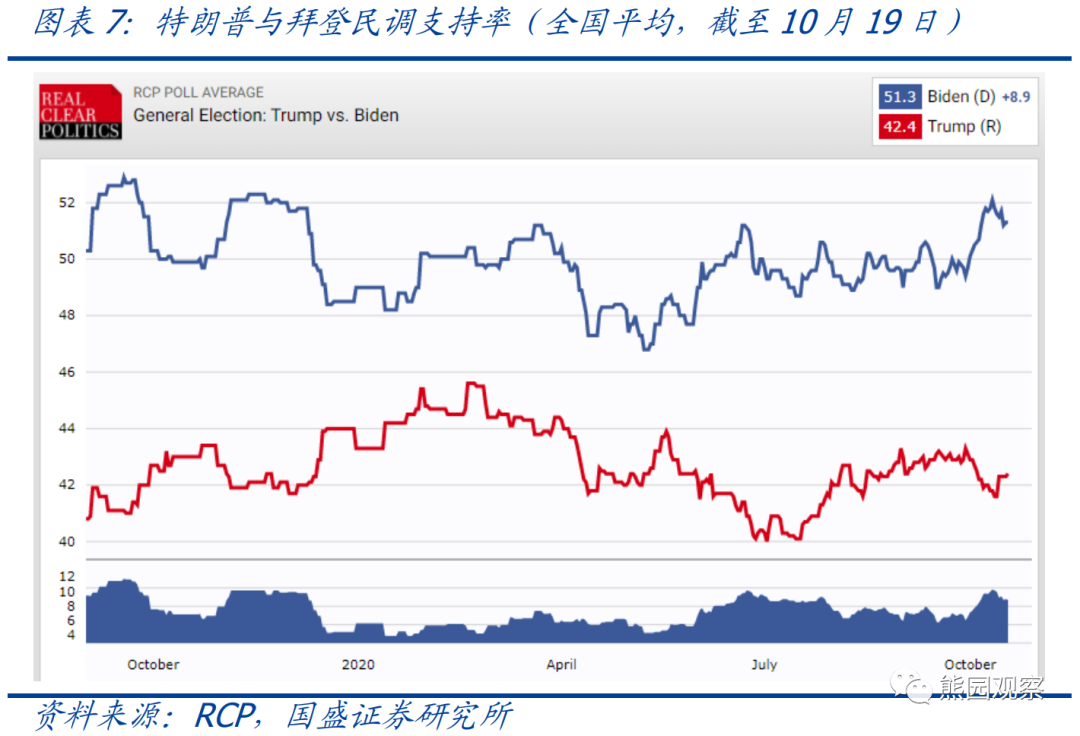

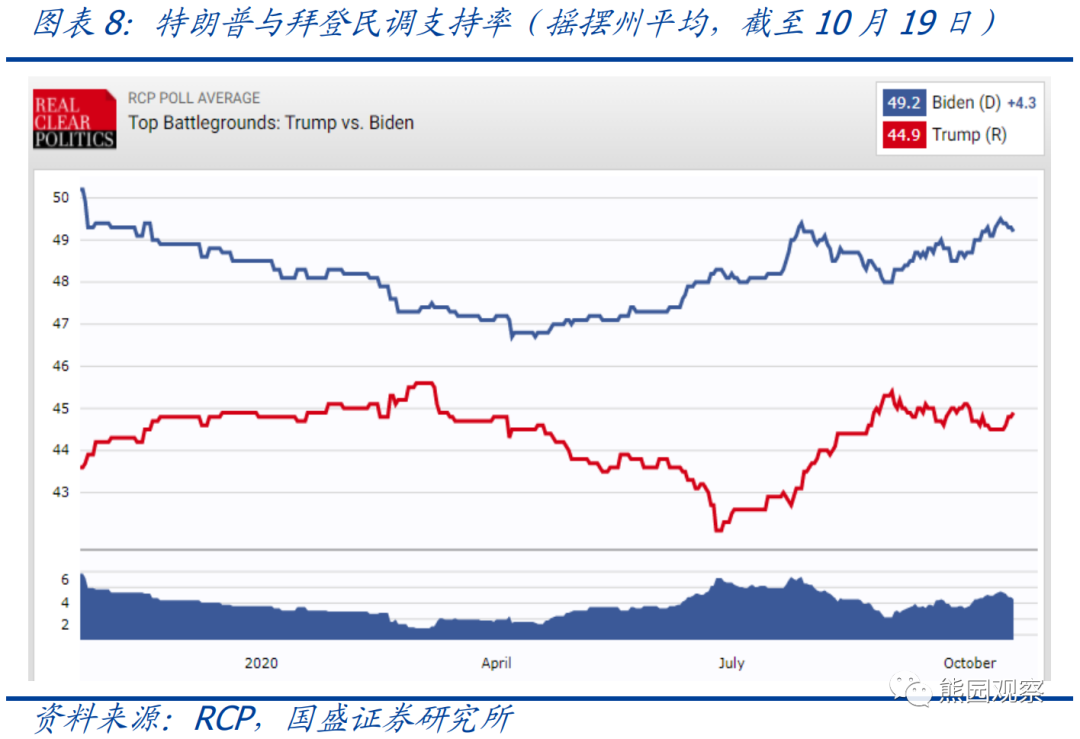

Incidents:Affected by the health incident, mail-in voting in this year's US election was relatively high, and Trump has stated many times that mail-in voting may be fraudulent. It is anticipated that this year's general election is likely to be similar to 2000, with disputed results and the announcement will be postponed.

Core findings:Disputed results are likely to occur on November 3, and the judicial process will begin. The final election results may not be determined until December or even later. According to the experience of the 2000 general election, market risk appetite will clearly be under pressure during the dispute period, but market risk appetite will be restored after the dispute is resolved.

The text is as follows:

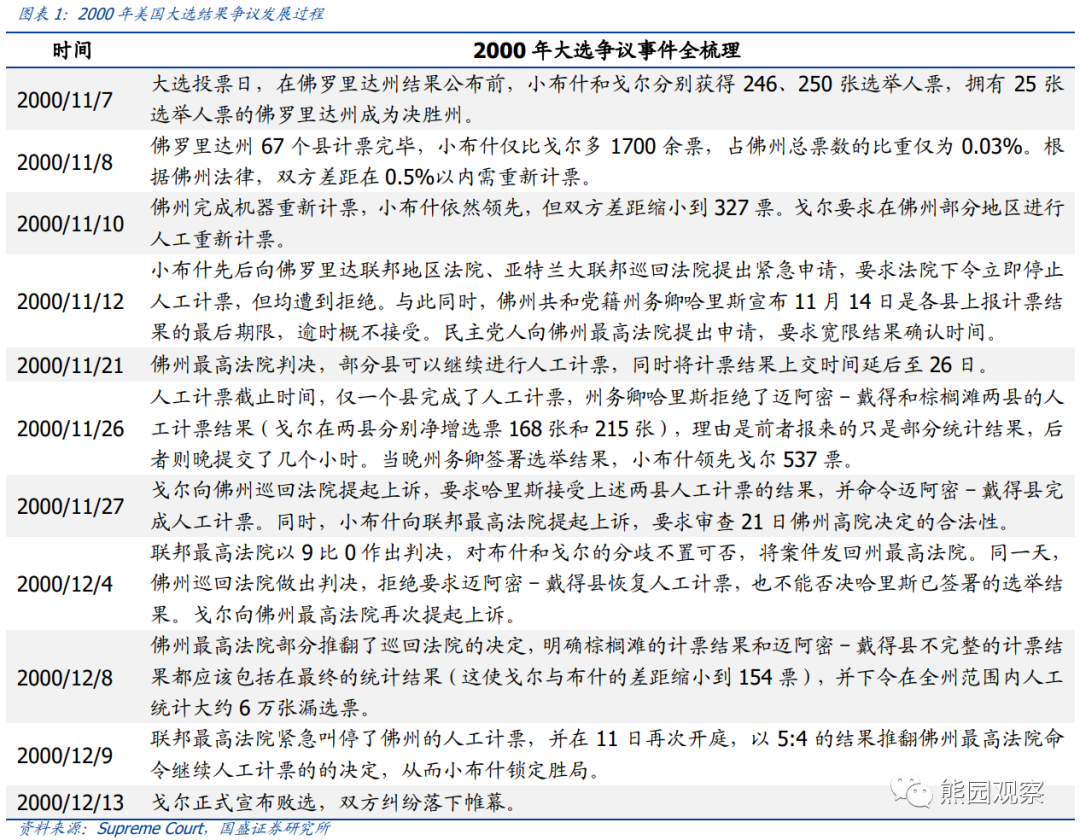

1. Review of the dispute process in the 2000 US election:

Voting situation on election day: November 7, 2000 is voting day for the general election. On the morning of the next day, along with the announcement of voting results by various states, Democratic candidate Al Gore received a total of 250 electoral votes, and Republican candidate George W. Bush received a total of 246 electoral votes. Both sides were evenly matched, and only one step away from the 270 votes needed to win the election. At this point, Florida, which has 25 electoral votes, announced that George W. Bush took the lead, meaning George W. Bush would win the election.

Voting situation on election day: November 7, 2000 is voting day for the general election. On the morning of the next day, along with the announcement of voting results by various states, Democratic candidate Al Gore received a total of 250 electoral votes, and Republican candidate George W. Bush received a total of 246 electoral votes. Both sides were evenly matched, and only one step away from the 270 votes needed to win the election. At this point, Florida, which has 25 electoral votes, announced that George W. Bush took the lead, meaning George W. Bush would win the election.

The development of the dispute: The results of the Florida vote count showed that George W. Bush only surpassed Gold by more than 1,700 popular votes, accounting for only 0.03% of the total vote in Florida. According to Florida law, when the gap between the two parties is within 0.5%, the votes must be recounted. On November 10, 2000, Florida completed a mechanical recount, and George W. Bush's lead was drastically reduced to 327 votes. As a result, Gore applied to the district court for a manual recount. Subsequently, the two sides engaged in a lengthy judicial game over issues such as whether manual counting of votes should be carried out, in which regions, and manual vote counting deadlines.

Dispute resolution results: On December 9, 2000, the Supreme Court of the United States stopped manual counting of votes in Florida and ruled on December 11 that no manual recounts would be carried out and that the voting results previously signed by the Secretary of State were retained. Gore finally announced his defeat in the election on December 13. It took 36 days from voting day in the general election to the determination of the final election results.

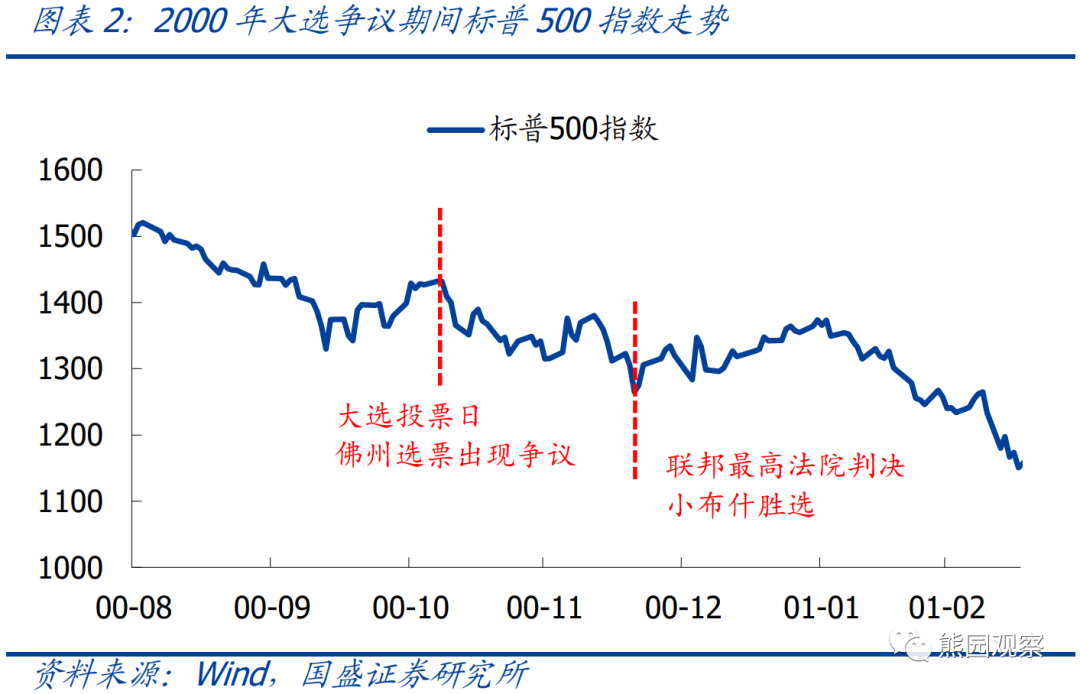

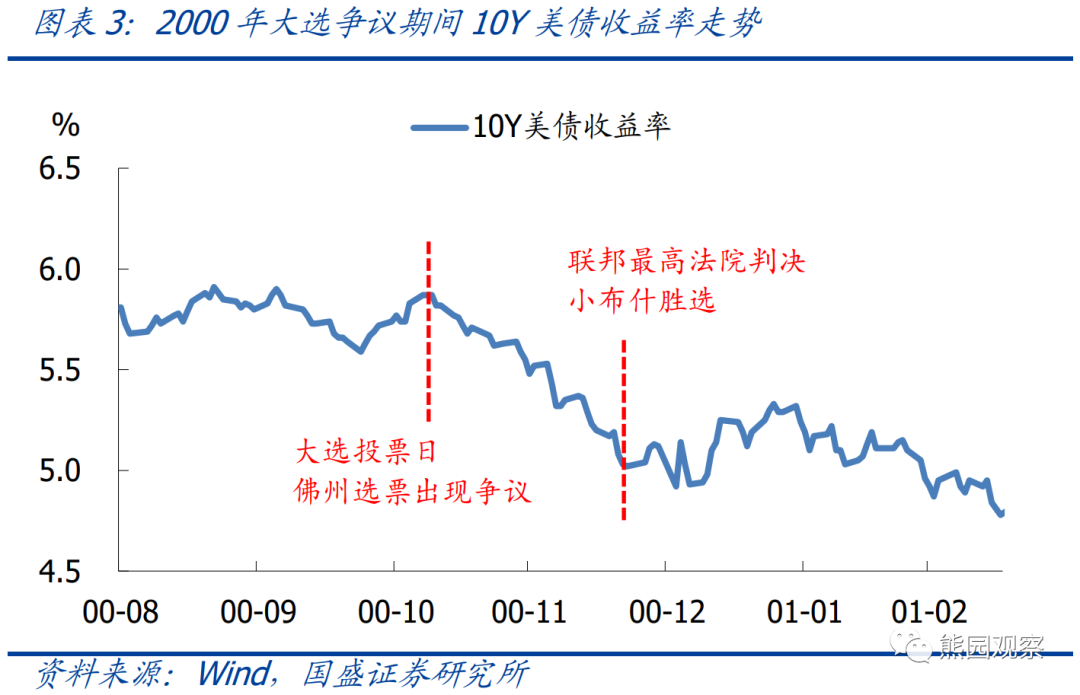

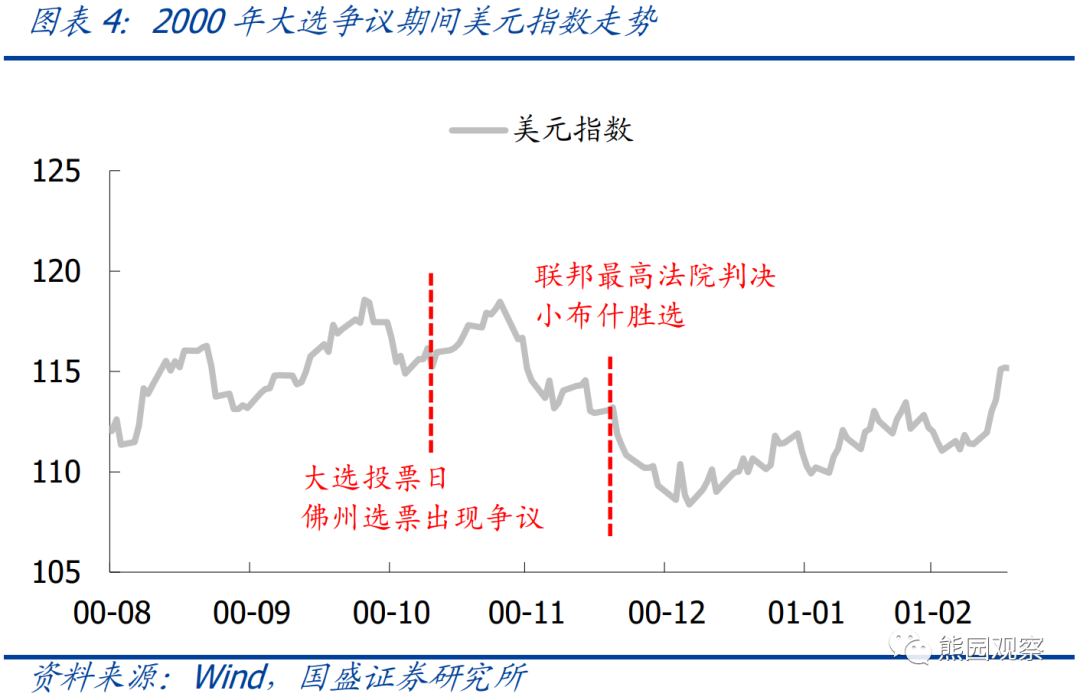

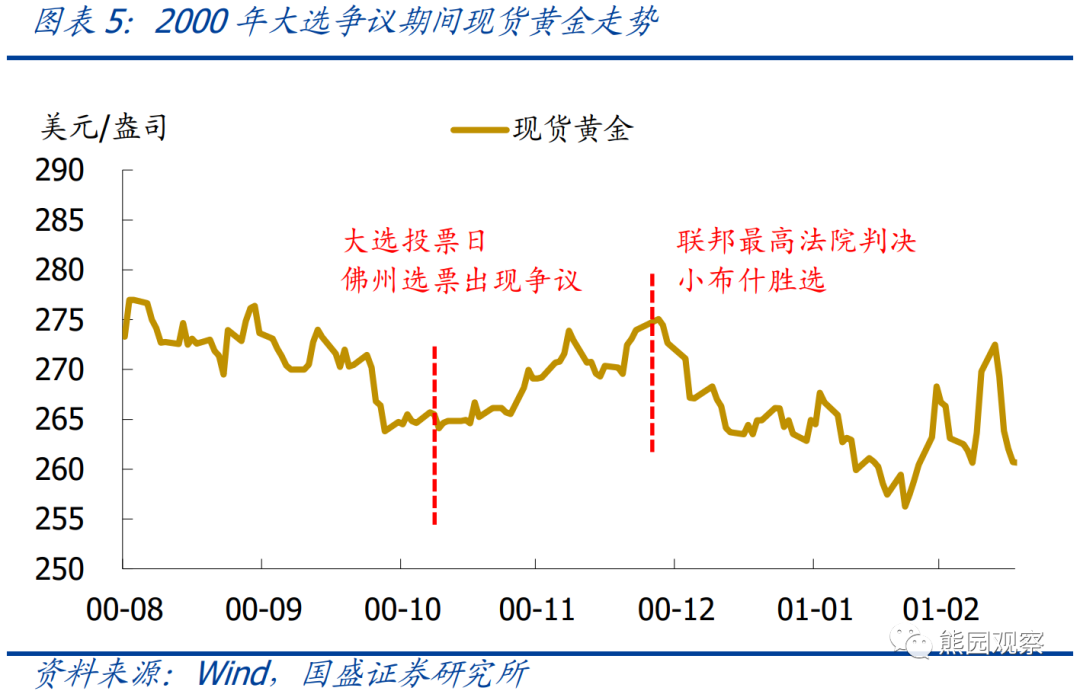

2. The performance of major asset classes during the 2000 election controversy:

US stocks: After the vote count dispute arose, the S&P 500 index continued to decline, with a cumulative decline of 7%; it experienced a rebound period of about one and a half months after the Supreme Court decision; however, since the internet bubble burst at the time, US stocks fell again after a brief rebound.

US bonds: The yield of 10Y US bonds is consistent with the performance of US stocks. It continued to decline after the dispute arose. After the final results were determined, it ushered in a brief rebound, then declined again.

US dollar: During the dispute period, it first rose and then fell. There was no obvious pattern overall.

Gold: After the dispute broke out, it continued to rise by more than 3%, then fell sharply after the final results were determined.

3. The status of early voting and mail-in voting in the current US election:

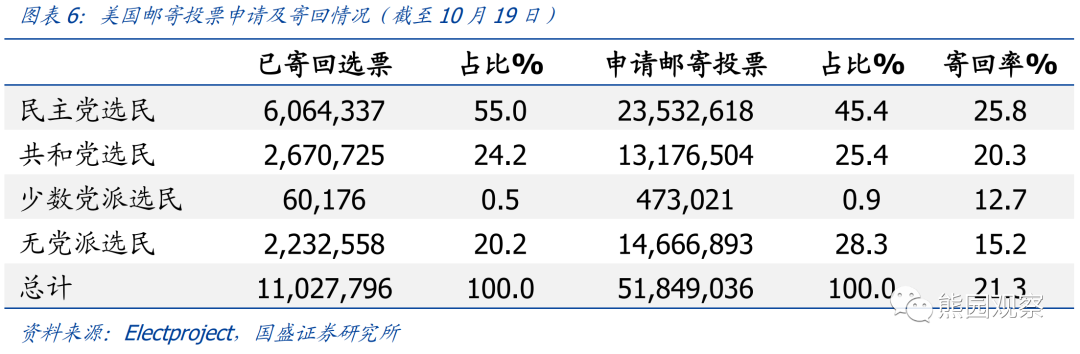

According to Electproject statistics, as of October 19, 28.12 million people in the US voted early, 4.7 times the same period in 2016, accounting for 20.3% of the total number of votes in 2016. Agencies generally predict that this year's turnout will reach a record high. Of the 16 states with data, 51.85 million people applied to vote by mail, of which 45.4% were Democratic voters and 25.4% were Republican voters; however, only 1.03 million votes have been sent back so far, of which 55.0% were Democrats and 24.2% of Republicans.

It can be seen from this that Republican voters prefer live voting, while Democratic voters prefer to vote by mail. Since there are currently only 14 days left until election day, it is expected that a large number of mail-in ballots will not be delivered on November 3. Furthermore, the Senate has decided to hold a nomination vote for the new Chief Justice Barrett on October 23. It is expected that the nomination will pass smoothly, so the new Chief Justice will take office before November 3. If the two sides finally enter the judicial process, as long as Trump can cite evidence that mail-in voting has been falsified, the Supreme Court's ruling may be favorable to Trump.

4. Possible situations in the current US election and their impact on the market: (Scenario 1 and scenario 2 are more likely)

Scenario 1: The results of the November 3 vote count show that Trump is ahead. Trump will directly announce his victory and refuse to acknowledge overdue ballots. Biden will oppose, and both parties have entered the judicial process. Referring to the experience of 2000, market risk appetite will clearly be under pressure. Yields on US stocks and US bonds are likely to fall, and gold is expected to rise. Moreover, the final election results may not be determined until December or even later.

Scenario 2: The results of the November 3 vote count showed that Biden was slightly ahead. Trump will claim that voting by mail is fraudulent, will only accept live voting results, and will refuse to admit defeat in the election. Both parties will still enter the judicial process, and the impact on the market will be the same as the situation.

Scenario 3: The results of the November 3 vote count showed Biden's sharp lead. Even if only live voting is calculated, Trump is far behind. There is no room for maneuver at all; he is forced to admit defeat in the election. The uncertainty of the general election is completely clear, and Sino-US relations are expected to stabilize marginally after Biden's election, and a new round of fiscal stimulus is also expected to be implemented as soon as possible. As a result, US stocks are expected to perform well in the short term, and US bond yields may rebound, which will be bad for gold.

Risk warning: The black swan incident broke out in the US election; the Sino-US conflict evolved beyond expectations.

大选日得票情况:2000年11月7日为大选投票日,次日早上,伴随各州公布得票结果,民主党候选人戈尔累计获得250张选举人票,共和党候选人小布什累计获得246张选举人票,双方势均力敌,距离胜选所需的270票仅一步之遥。此时拥有25张选举人票的佛罗里达州公布投票结果为小布什领先,意味着小布什将胜选。

大选日得票情况:2000年11月7日为大选投票日,次日早上,伴随各州公布得票结果,民主党候选人戈尔累计获得250张选举人票,共和党候选人小布什累计获得246张选举人票,双方势均力敌,距离胜选所需的270票仅一步之遥。此时拥有25张选举人票的佛罗里达州公布投票结果为小布什领先,意味着小布什将胜选。