Report summary:

“All inflation is a monetary phenomenon” is Nobel Prize winner Friedman's classic assertion. However, after the oil crisis in the 70s of the last century, the center of US inflation continued to decline, especially after 2000. Even though monetary policy continued to be flooded, it still failed to boost inflation. Many people think that the conductive effect of currency on inflation has disappeared. However, we believe that the traditional theory has not failed. The key to inflation is not to “print money,” but to “spend money.” If you understand this, you can understand the reason why inflation was abnormal before. Moreover, this time it is not the same; the center of inflation is expected to actually rise in the future.

Previously, the release only concerned “printing money,” that is, the ultimate monetary policy, but no one “spent money,” and the money was stranded in the Fed's accounts as excess reserves or flowed into virtual economies such as the stock market. This time, however, is different. Under unprecedented fiscal stimulus, money has actually flowed into entities, and M2 has soared, which can effectively drive inflation.

Previously, “money was not spent domestically, but abroad,” that is, globalization has led to a sharp expansion of America's trade deficit, inflationary pressure brought about by currency has been carried globally, and cheap goods in emerging markets have depressed inflation. However, this time is different. Under the general trend of de-globalization, rising tariffs and the return of manufacturing will drive long-term inflation upward.

Previously, “no one is spending money, they are all just waiting to be collected”, that is, the crisis since 2000 was all about collapse in demand and sufficient supply, so there was deflation. However, this time is different. “A lot of people spend money, but no one is collecting money”. Fiscal stimulus has led to strong demand, while the supply side is under pressure in both the short and long term. It is similar to wartime, so there is a lot of inflationary pressure.

Previously, “no one is spending money, they are all just waiting to be collected”, that is, the crisis since 2000 was all about collapse in demand and sufficient supply, so there was deflation. However, this time is different. “A lot of people spend money, but no one is collecting money”. Fiscal stimulus has led to strong demand, while the supply side is under pressure in both the short and long term. It is similar to wartime, so there is a lot of inflationary pressure.

All in all, we think the current market may have two core differences in expectations: first, the market may have underestimated the driving effect of fiscal stimulus on demand; second, the market may have underestimated the impact of public health events on the production side of the economy. These two factors will be the reason for future inflation to rise more than expected. We believe that US inflation will recover in the short term, and there will be some downward pressure in the medium term, but the long-term center will rise markedly. For a long time, the Fed will not tighten monetary policy ahead of schedule due to inflationary pressure. There is a clear inverse relationship between US inflation and the US dollar index. Excessive monetary policy and inflationary pressure will cause the US dollar to enter a depreciation cycle, while precious metals have long-term upward momentum.

Risk warning:

1. The US fiscal stimulus failed to be introduced smoothly.

2. The Federal Reserve tightened monetary policy prematurely due to other considerations.

3. A less-than-expected recovery in the US economy has led to a sharp decline in demand.

Report text:

1. A Macro Perspective on US Inflation

Since the health incident began, the global blockade has led to the deepest economic recession since World War II. To counter economic downturn and deflationary pressure, countries have adopted extreme monetary policies and large-scale fiscal policies one after another. The capital market also quickly rebounded from its March low. Extremely loose monetary policies and bottoming out inflation expectations made all types of assets perform well. However, judging from recent statements made by central banks in various countries, there is limited room for major central banks, led by the Federal Reserve, to continue increasing their monetary policies.Thus, changes in the level of inflation will be an important factor affecting the prices of various types of assets in the future.

“All inflation is a monetary phenomenon” is Nobel Prize winner Friedman's classic assertion. However, after the oil crisis in the 70s of the last century, the center of US inflation continued to decline, especially after 2000. Even though monetary policy continued to be flooded, it still failed to boost inflation. “Disappearing inflation” has become a mystery plaguing the market. Therefore, many people think that “all inflation is a monetary phenomenon” has failed in modern economics, so it is still difficult to infer that the extreme monetary policies of central banks in various countries this year will still be difficult to trigger an increase in inflation.

However, we believe that the essence of inflation is still a monetary phenomenon. Previously, the disappearance of the transmission effect of money to inflation was not a failure of traditional theory; rather, there was a lack of proper understanding of the relationship between currency and inflation.We believe that compared with the previous two economic recessions since this century, the path of recession and policy mix caused by this year's health incident are clearly different, and the center of inflation is expected to rise markedly in the future.

1.1. Characteristics of periods of high inflation in US history

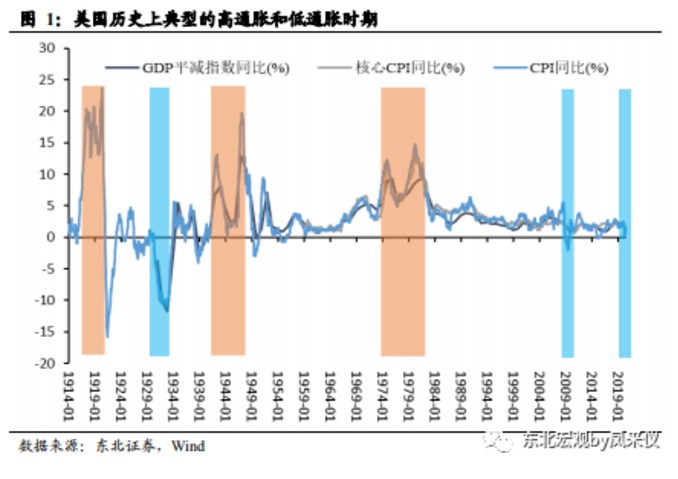

Typical periods of high inflation in US history include the period of the two world wars and the period of great inflation in the 1970s (oil crisis period). Excluding the base effect, the typical period of deflation is the period of the Great Depression of 1929-1933 and the period after the 2008 financial crisis. The global economic recession caused by this year's health incident also triggered a serious deflation crisis at one point. Let's first learn from history and observe the characteristics of periods of high inflation in US history.

1.1.1. The period of the two world wars

The US experienced quite high inflation during and after the two world wars. After World War I, the highest CPI reached 23.7% year over year, and after World War II, the highest CPI reached 19.7% year on year. The main reasons for high wartime inflation are as follows:

First, a sharp increase in the money supply is the root cause of inflation.Countries in war will face large-scale military spending, and their finances will be strained. However, most countries are unwilling to choose to raise taxes to increase fiscal revenue due to political pressure, so issuing a large number of government bonds and then directly or indirectly monetizing fiscal deficits has become the choice in most cases. Scheiber, Vatter, and Faulkner wrote in “American Economic History,” “In World War I, the American people were very typical and unwilling to raise all of their war efforts from tax increases. The same was true during the Civil War, World War II, and the Vietnam War. World War I was funded by increased inflation in the money supply.”

Since 1790, the Civil War, World War I, and several large-scale wars in World War II have all triggered a sharp rise in government debt ratios. Massive amounts of government debt have been converted into money to circulate in the market through monetization of fiscal deficits. For example, during World War II, the Federal Reserve implemented a yield curve control policy (YCC) in February 1942. The specific expression was to focus on short-term treasury bonds with a yield of 0.375% and set a 2% yield cap for 7-9 year treasury bonds and a 2.5% yield limit for longer-term treasury bonds. The Federal Reserve buys a large amount of government bonds to maintain the target yield, and government marketable securities held by the Federal Reserve expanded from less than 3 billion US dollars before the implementation of the YCC to more than 20 billion US dollars within about 5 years of implementing this policy.

Second, war will lead to large-scale redistribution of productivity and labor, leading to a decline in productivity and a collapse in supply.During the war period, since mass production is concentrated in war-related fields, the supply of materials for civilian use will be insufficient, and the imbalance between supply and demand will trigger inflationary pressure. Some time after the war, the economic structure will once again undergo major changes, which will lead to large-scale employment redistribution. This process can lead to more structural unemployment, so that productivity cannot fully develop over a longer period of time, and there is still an imbalance between supply and demand. Shortage of supply has led to a sharp increase in residents' living costs, which is an important reason for high inflation during and after the war.

Furthermore, in times of war, there is great uncertainty, which will have an impact on trust in sovereign currencies, and people prefer to hold precious metals, etc. to replace the currency in their hands. Damaged monetary credit will trigger an increase in inflation expectations, which in turn will encourage merchants to raise prices and self-fulfill their expectations.

1.1.2. Period of great inflation

The Great Inflation (The Great Inflation), which began in 1965 and ended around 1982, continued for almost 20 years. The global monetary system established during World War II was abandoned, and there were four economic recessions, two serious energy shortages, and wage and price control measures unprecedented in peacetime. Compared to the first two periods of inflation, which occurred during World War I and World War II, most of the Great Inflation is regarded by scholars as “the only inflation in the US in a time of peace.”

The oil crisis was the external cause of high inflation during this periodThe shortage of oil has impacted the supply side of the economy and caused global “stagflation.” There were two oil crises during the period of great inflation, the first being the Arabian oil embargo, which began in October 1973 and lasted about five months. The price of crude oil quadrupled during this period. The 1979 revolution in Iran triggered a second oil crisis, and oil prices once again soared sharply. Crude oil is a fundamental raw material in the industrial production system. The rapid rise in its production price has led to an increase in the production cost of other commodities, causing the prices of various commodities to rise one after another, driving service prices to follow suit, and the overall level of inflation in society has risen sharply. At the same time, supply-side shocks also affected the overall level of economic output. During the period of high inflation, the US economy fell into recession, and the unemployment rate rose sharply. The US is mired in serious “stagflation.”

Monetary overflow is the internal cause of major inflation. Although oil prices had a significant and direct effect on inflation, the root cause of inflation remaining high for a long time during this period was the increase in money supply. During the period of major inflation, the Fed's policy goal was “the unemployment rate in the US is not greater than 4%,” and inflation was not used as an important adjustment indicator, so in the face of economic recession, the Fed's priority was to release water to protect the economy, not to control inflation.

In the two years before the two oil crises occurred, the US both experienced a high increase in money supply. M2 was close to 15% year on year. It was the period after World War II where M2 grew at the highest rate other than this year. In contrast, after the financial crisis, even if the Federal Reserve greatly expanded its list, the M2 growth rate was only about 10% year-on-year.

Through the two world wars and the resumption of the period of major inflation, we can see that the period of high inflation in the US usually had two most important characteristics: First, there was a sharp increase in money supply before inflation hit. Whether it was wartime or the oil crisis, the essence of high inflation was still a monetary phenomenon. Second, the supply side of the economy has collapsed. The situation where supply is in short supply and the proliferation of money have caused prices to continue to rise, and inflationary pressure has increased.

1.2. The mystery of the disappearance of inflation

After a period of major inflation, the center of US inflation gradually declined. Using every ten years as a time period, the US CPI year-on-year center has dropped from a level above 7% in the 70s to less than 1.77% in the past 10 years. Especially since 2000, the Fed's balance sheet has continued to expand, yet it has failed to boost inflation. There is more and more “printing money” and prices are rising more and more slowly, making most people doubt the relationship between currency and inflation. We think the core contradiction of the disappearance of inflation is “how much money to spend,” not “how much money to print.” By understanding the relationship between currency and inflation from the perspective of “spending money,” all contradictions can be resolved.

1.2.1. Some people print money, but no one spends it

We think the first reason why the transmission of currency to inflation has failed is that “some people print money, no one spends money,” that is, the Fed has issued a large amount of money, but the money has not flowed through the real economy as scheduled.After the Federal Reserve opened and released water several times, it was accompanied by a sharp drop in the currency multiplier, that is, the real economy's demand for credit was weak, and the money was printed, but it was not spent. So where did the large amount of money issued by the Federal Reserve go?

After the 2008 financial crisis, the Federal Reserve expanded rapidly, but a large portion of the printed money was stored in the Fed's account in the form of bank deposit reserves.The ratio of deposit institutions' reserve balance to the size of the Fed's balance sheet reached a maximum of about 64%. This means that although most of the money printed by the Federal Reserve remains within the banking system and has not flowed into the real economy, it is naturally impossible to boost the level of inflation in the real economy.

Following the release of water from the health incident this year, the reserve balance of depository institutions also rose sharply, similar to the water discharge situation after the financial crisis.However, it should be noted that compared to the scale of the Fed's current statement expansion, the increase in depository institutions' reserves is not significant. It also accounts for about 41% of the Fed's balance sheet, which is far below the peak level.

In addition to being stored in the Fed's accounts in the form of excess reserves, another “reservoir” of currency is a fiscal deposit in the Fed's account.This was obvious after this health incident. After the health incident, the US introduced large-scale fiscal stimulus, and the Treasury then issued treasury bonds to finance it. Money that has not yet been spent by the Ministry of Finance is stored in the Federal Reserve's accounts in the form of fiscal deposits, and this part of the money has not yet been circulated in the real economy.

Why are banknotes printed by the Federal Reserve stuck in the financial system and unable to enter the real economy? We think there are two main reasons:

First, the gap between the rich and the poor in the US is gradually widening, leading to insufficient effective demand.Since the 70s of the last century, the gap between America's rich and poor has gradually widened. The richest people in the top 1% of income account for more than 20% of national income, while the bottom 50% of income groups account for less than 13% of income. This ratio is similar to the situation where the gap between rich and poor was extremely high before the Great Depression of 1929. Capital gains in national income are also far higher than labor income, similar to those before the Great Depression.Since the poor have higher marginal consumption tendencies and the rich have very low marginal consumption tendencies, the widening gap between the rich and the poor will lead to insufficient effective demand, so it is impossible to drive the level of inflation.

Second, a large amount of residents' wealth has flowed into the virtual economy and has not entered the real economy, constituting “virtual inflation.”After the financial crisis bottomed out, the US real estate and stock market both ushered in a bullish market, carrying a large amount of currency. In the past ten years, the average housing price index for the top 20 mid-sized cities in the US was close to 5% year on year, significantly outperforming inflation. The US stock market has also experienced a ten-year bull market, and the total market value of listed companies as a share of GDP has reached an all-time high.The booming virtual economy has absorbed a large amount of liquidity, leaving a lot of money out of circulation in the real economy, so it has failed to boost the center of inflation.

1.2.2. The money was not spent domestically, but abroad

We think the second reason the currency-to-inflation transmission mechanism has failed is that “money is not spent domestically, but abroad,” that is, global trade has significantly lowered the level of inflation in the US.

The process of trade globalization developed rapidly after World War II. Since the 70s of the last century, America's trade deficit has widened dramatically, and large amounts of dollars have flowed all over the world.Due to the unique reserve currency of the US dollar and its status as the main means of international payment, the inflation generated by the excess dollar is, in a sense, borne by the whole world, thereby reducing domestic inflationary pressure.

At the same time, as trade globalization continues to grow, emerging economies are exporting a large number of cheap goods to the US due to their low labor costs. However, labor costs in the US are high and cannot compete with them, so a large number of low-end manufacturing industries have been forced to leave. Remaining local companies also had to lower prices to maintain market share, so global trade has significantly reduced US commodity inflation.This became even more obvious after China joined the WTO.China officially joined the WTO in December 2001. Since then, US imports from China as a share of its GDP have risen rapidly. At the same time, along with a rapid decline in US commodity core CPI, it wasn't until ten years later that the commodity price index returned to the level at the end of 2001.It can be seen from this that trade globalization is also an important reason for low inflation.

1.3. What's different this time

Due to the reasons described above, the center of US inflation has gradually declined over the past few decades, and most people think that the outcome of the rapid expansion of the Federal Reserve after this year's health crisis will also be the same as previous crises, without triggering inflation.However, we believe that the current macro context is clearly different. The reasons that triggered the disappearance of previous inflation have all changed now, and the US inflation center is expected to rise significantly in the future.

1.3.1. Some people are responsible for printing money, and some are also responsible for spending money

As mentioned earlier, one of the reasons why the Fed failed to trigger inflation when it opened and released water before was because “some people print money, but no one spends money,” the currency is stuck in the financial system and cannot flow into the real economy. However, the water release after this crisis is clearly different: some people print money, and even more people spend money.The Federal Reserve is responsible for “printing money,” while the task of “spending money” is carried out by the Ministry of Finance.

After the internet bubble and the 2008 financial crisis, America's bailout policy focused on the monetary sector, and the Federal Reserve triggered a large amount of money to ensure the stability of the financial system. However, what is clearly different from the rescue method after these two crises is that after the health crisis, the US not only adopted an extreme monetary policy, but also cooperated with an unprecedented fiscal policy. On March 27, the US introduced the “Coronavirus Aid, Relief, and Economic Security Act” with a scale of 2.2 trillion dollars; on April 25, the “Paycheck Protection Plan and Health Care Enhancement Act” with a scale of 483.4 billion US dollars was added. By contrast, America's main fiscal stimulus after 2008 was only the $787 billion Recovery and Reinvestment Act.

According to the outlook of the US Congressional Budget Office, this year's federal budget deficit will be 3.3 trillion US dollars. We assume that the US economy will fall by 3.7% this year as the Fed's latest forecast, and the GDP deflator index is 1%, then the nominal GDP of the US in 2020 will be around 20.85 trillion US dollars. In this way, the US fiscal deficit rate this year will reach 15.83%, far exceeding the level after the financial crisis, and only lower than the deficit rate level during the two world wars. According to the Congressional Budget Office's forecast, the US fiscal deficit will reach 9.6% next year.

Huge fiscal stimulus has solved the problem of money being stuck in the financial system and “not being able to spend money”. In particular, the fiscal stimulus plan includes a large amount of “helicopter money throwing” content, giving direct cash relief to residents and businesses.After the health incident broke out, the total income of American residents did not fall but increased. Although “employee compensation” income has declined sharply, “personal transfer” income has risen sharply, bridging the income gap, reflecting the obvious effect of the US fiscal stimulus plan on subsidizing residents' income.

According to a survey by the Chicago Federal Reserve (Chicago Fed), American households spent 48% of their money within two weeks of receiving economic stimulus checks. According to an analysis of the BAC card summary data, the bank also found that most of the increased expenses of American households occurred within 5 days of receiving the money.In other words, most of the money sent out in the fiscal bailout plan can flow directly into the real economy. This is an effect that was difficult to achieve in the past by simply providing bailouts in the form of loans through monetary policy.

The effect of fiscal stimulus on monetary transmission is also very obvious. Currently, the US M2 growth rate has exceeded 23% year on year, far exceeding the highest level since this data was compiled in the 1960s.As mentioned earlier, the highest M2 was close to 15% year on year during the period of high inflation, and the highest M2 was only about 10% year on year after the Federal Reserve opened and released during the financial crisis. This year's fiscal stimulus has had a remarkable effect on monetary transmission. This is the core driving force driving up future inflation centers.

Currently, a new round of US fiscal stimulus negotiations is at an impasse, which has become a major factor limiting inflation expectations in the near future.We think a new round of fiscal stimulus may be late, but it won't be absent.Looking back at the game between the two parties in the US Congress over a new round of fiscal stimulus, the difference is not whether fiscal stimulus is needed, but rather the specific scale and content. Both parties believe that a new round of fiscal stimulus is necessary, and that the final scale range is gradually increasing.

Previously, Trump repeatedly wanted to reduce fiscal stimulus, especially the amount of unemployment benefits for residents, because under the excessive unemployment relief program, many workers' unemployment benefits were higher than their working wages, which in turn reduced their willingness to find work. White House economic adviser Claude said he had received a large number of calls, inquiries, and complaints, and that small businesses, businesses, and restaurants are now unable to recruit personnel. This undoubtedly affects the ratio of US employment data to production data, which in turn affects Trump's political performance. Trump is delaying fiscal stimulus to force the unemployed to actively return to work and raise the employment rate. Positive economic data will become a political achievement Trump can show off in the election.

If fiscal stimulus fails to be introduced before the election, then the exact scale will depend on the election results. If the Democratic Party takes the president and both houses (the Democratic Party sweeps), the scale of stimulus will be greater, and Trump's re-election will be relatively small. In any case, we believe that the US fiscal stimulus negotiations will eventually be launched, which in turn will push the inflation center to rise further.

Furthermore, in the long run, the factors that limit the rise in US inflation gap between rich and poor are also changing.

The issue of the gap between rich and poor is receiving increasing attention from policymakers.The “Populism Index” compiled by Dalio shows that currently populism has reached its highest level since World War II. Populism means “people at the bottom are resisting elite rule,” and its impetus is that the gap between rich and poor continues to widen. As populist regimes in various countries come to power one after another, the issue of the gap between rich and poor has attracted more and more attention from policymakers. As can also be seen from recent public speeches by officials of the Federal Reserve and other institutions, the issue of the gap between rich and poor is being raised more and more frequently.We believe there will be more and more policies addressing the gap between the rich and the poor in the future. Although this problem cannot be solved overnight, a reversal in policy attitudes indicates that the trend of the growing gap between rich and poor may slow down or even reach an inflection point in the future.This marginal change will ease the downward pressure on inflation from the gap between rich and poor previously.

1.3.2. It's getting harder to spend money abroad

As mentioned above, trade globalization is an important reason to depress commodity inflation in developed countries. “Money is spent abroad, not domestically,” yet this trend is also currently being reversed, that is, “it is becoming difficult to spend money abroad.” From Brexit to the Trump administration starting trade wars with other countries, the power of “de-globalization” in the world is currently getting stronger and stronger. The trade openness index began to decline in 2013, and it can be seen that the globalization process that lasted more than 70 years after World War II has been reversed.

Since the trade war began, the average US import tariff against China has been raised from a level of 3% to around 20%. Even after the first phase agreement between China and the US was reached, the average tariff remained at around 20%.Increased tariffs have made cheap imported goods, which are dragging down inflation, no longer cheap. As the trend of de-globalization intensifies, the suppressive effect of trade globalization on US inflation will gradually weaken.

After the health incident broke out, many developed countries realized that the global industrial chain was too dependent on China, and the US, Japan and other countries proposed plans to “return the manufacturing industry.” If a “manufacturing backflow” occurs, it will significantly raise the cost of manufactured goods, thereby driving up prices.Although the “return of manufacturing” plan may not be fully realized, it represents the political orientation of most developed countries and will accelerate the process of “de-globalization.”

1.3.3. More people are spending money, fewer people are collecting money

After the internet bubble and financial crisis, the core contradiction in the US economy showed that demand collapsed, the financial system collapsed, the entire society's balance sheet contracted, and the willingness of businesses and residents to spend and invest was sluggish, while the supply side was not directly impacted, that is, “there are very few people who spend money, and there are many people who collect money,” so deflationary pressure has arisen. However, after the health crisis, it was clearly different. The US economy showed “more people are spending money, but fewer people are collecting money”, that is,The impact on the supply side was greater than on the demand side.

There is a clear difference in the recovery path between China and Western countries after the health incident.Developed countries such as the US and Europe showed “weak production and strong demand.” Due to large-scale fiscal stimulus underpinning demand, the demand side, such as consumer consumption, recovered rapidly, but due to improper control and repeated outbreaks of health incidents, recovery on the production side has been blocked. As of October 12, only 29 states in the US have completed the restart, while 21 other states have not been completely unblocked, and the resumption of work and production has not been smooth. The year-on-year growth rate of the US industrial production index in August was lower than in July, so it can be seen that it is difficult for the production side to recover. However, the situation in China is the opposite. The health incident was properly controlled, the resumption of work and production was smooth, and the production side recovered rapidly; however, no strong fiscal or monetary stimulus policies were introduced, so the recovery in consumer consumption was slow, reflecting the characteristics of “strong production and weak demand.”

The pattern of “weak production and strong demand” in the US has led to inflationary pressure, while in China, on the contrary, the pattern of “strong production and weak demand” has led to a deflationary trend.This trend can be clearly seen from recent changes in core inflation between the two countries. The US core CPI continues to rise above expectations while China's core CPI is relatively sluggish.

The impact of the health incident on the production side is not only reflected in the short-term impact of the blockade, but also in the long-term. It is reflected in the redistribution of labor and the cessation of a large number of scientific research projects that may be triggered by the health incident.

In recent academic research on health incidents in the US, Barrero et al. (2020) pointed out that health incidents cause job redistribution. Health incidents have caused changes in residents' living and working habits. For example, people are learning how to buy all the products they need online without leaving home, and even after a health incident, many people may continue this habit. Business people learn how to get the job done with less travel. Travel restrictions between countries have reached unprecedented levels, and even if the blockade is gradually lifted in the future, it will be difficult to restore the state before the health incident for quite some time. This will lead to certain changes in the social and economic structure, which will cause structural unemployment, and in the process of employment redistribution, the re-creation of new jobs will lag the disappearance of old jobs by 1-2 years. In the process, US productivity will be affected over the long term.

As a result of the health incident, the whole society's R&D investment has been drastically reduced, and it will also affect the increase in social productivity for some time to come. After the health incident broke out, many scientific research projects unrelated to the health incident were shut down in American universities, government laboratories, and commercial institutions. Relevant research shows that investment in scientific research is more sensitive to risk than physical investment. Investments in other intangible assets, such as worker training, etc., also stopped during health incidents. The reduction in investment in these intangible assets will have a long-term impact on increasing the productivity of the whole society in the future.

The impact on the production side is a characteristic that is significantly different from the current health crisis and the previous two crises, and supply collapse is often accompanied by strong inflationary pressure. Overall, the impact of the health incident on the economy is not like the path of the internet bubble and financial crisis, but is more similar to wartime, putting upward pressure on inflation.

In summary, from a macro perspective, the current health crisis is clearly different from the previous two crises. The combination of fiscal policy and monetary policy has prompted money to flow into the real economy. At the same time, the short-term and long-term impacts on the production side have also helped to raise the level of inflation.We think the current market may have two core differences in expectations: first, the market may have underestimated the impact of fiscal stimulus on demand; second, the market may have underestimated the impact of health incidents on the production side of the economy.These two factors will be the reason for future inflation to rise more than expected.

However, judging from experience, transmission from finance and money to inflation usually has a time lag of 2 to 3 years. Therefore, with the gradual withdrawal of fiscal stimulus and the transmission of downward economic pressure to inflation, there will be some downward pressure on the medium-term inflation level. Inflation will then rise again and be above the level of the past 20 years.

2. A Microscopic View of US Inflation

2.1. Structural changes in the US CPI

Compared to China, the US Bureau of Labor Statistics also divides CPI into 8 major categories. Major categories of CPI have changed in US history, reflecting changes in the share of various categories of goods and services in consumer spending.From 1968-1977, the US CPI had 8 categories. In 1978, adjustments were made to incorporate personal care into other product and service categories, 8 categories became 7 categories, and in 1998, it was adjusted again to extract education and communication from other products and services into major categories. The US CPI once again included 8 product categories, and the classification habit has continued until now. It shows that US residents' consumption of personal care products is shrinking, and education and communication support for US residents' consumption is increasing.In order to ensure the comparability of the study, we listed all 9 items that were once major categories for a unified analysis and comparison.

We have divided every ten years since 1968 as a time period. It can be seen that the changes in the contribution rate of each category in the CPI structure have the following characteristics:

First, the contribution rate of housing to CPI is increasing. This is because monetary easing in the US has driven up housing prices over the past 20 years, which in turn affects related living costs.

Second, the contribution of the clothing category to CPI has declined or even made a negative contribution. This shows the impact of globalization on US commodity CPI. Developing countries such as China export a large number of labor-intensive products to the US, reducing the prices of related commodities.

Third, the contribution of the transportation category has declined. This is because oil prices have remained relatively low over the past ten years. Especially since the US shale oil revolution, oil production has risen rapidly in recent years. As of December 2019, shale oil production in the seven major production areas of the US, including the Permian Basin, Bakan, and Eagle Beach, has exceeded 9 million b/d, accounting for 70% of total crude oil production. Sufficient supply has lowered oil prices and reduced transportation CPI.

Fourth, the CPI contribution of health care and other services has increased. This is because most non-tradable sectors in the service sector have been less affected by globalization and are still more in line with the Phillips curve.

2.2. Changes in CPI for informational products

After the information technology revolution, the US Bureau of Labor Statistics included informational products in the CPI construction. Although the weight of information products was not high, prices fell very rapidly in the early stages, which also attracted attention. Especially during the internet bubble, prices fell sharply every year, then gradually stabilized.

The extent of change in the price of information commodities is mainly influenced by the speed of technological progress. Under Moore's Law, the early updates and iterations of high-tech products were very rapid, leading to a rapid decline in product prices.From 1987 to 2000, the total factor productivity (TFP) growth rate of information technology and computer-related industries in the US increased step by step. Technology developed rapidly, production efficiency continued to improve, and comprehensive production costs dropped sharply, driving negative year-on-year growth in prices of information technology and computer products, and the decline increased year by year. In particular, from 1995 to 2000, the annual growth rate of total factor productivity in the computer and peripheral equipment, semiconductor and electronic components industries peaked. Technological progress was rapid, and the price drop for technology products reached a record high. However, since 2000, the average annual rate of change in total factor productivity has increased to a decline. In the period from 2007 to 2018, with the exception of audio-visual equipment, the average annual growth rate of total factor productivity in high-tech related industries was less than 1%. Technological progress has slowed down, production efficiency improvements have not been as long ago, and the cost reduction has narrowed, supporting the prices of information technology and computer products.

We anticipate,As the pace of technological progress slows down and intellectual property protection mechanisms are improved, the year-on-year decline in CPI for information technology and computer-related products in the US will continue to narrow, or there may be a positive year-on-year increase.

2.3. Disassembly and prediction of US CPI

We split CPI into non-core CPI and core CPI, non-core CPI into food and energy categories, and core CPI into commodity core CPI and service core CPI.

2.3.1. Food CPI

The weight of food items in the US CPI is 13.771%. The CRB Food Index led the food CPI for about 7 months. Judging from the trend, food should have declined rather than risen after the health incident, but the blockade caused by the health incident caused residents to panic and hoard food. Coupled with logistics blockages, etc., the food CPI did not fall but rose after the health incident, reaching more than 4% year on year.

We believe that in the short term, due to repeated health incidents in the US, many states are still unable to fully open up, food prices will drop somewhat within a few months, but they will still be in a high position. In the medium term, food prices usually do not deviate much from the trend line. It is expected that with the normalization of health incidents and the lifting of the economic blockade, food prices should fall back to normal levels in the medium term. In the long run, as the overall inflation center rises, the food price center is also expected to rise. For example, food prices also rose markedly during the period of great inflation.

2.3.2. Energy class CPI

The energy weight in the US CPI is 6.706%. Although it does not account for a high proportion, the fluctuation is extremely high, and the impact on the CPI is significant. Oil was ahead of the energy CPI for about a month compared to the previous year. Oil prices fell sharply after the health incident. Crude oil futures fell to a negative value in April, and the spot price of crude oil fell close to 10 US dollars/barrel, which in turn caused the energy CPI to drop sharply.

We think it is unlikely that oil prices will rise significantly over a long period of time. The current crisis has a different background from the global economy after the 2008 financial crisis: developed economies fell into crisis in 2008, but emerging economies, represented by China, recovered strongly, driving a recovery in global demand, and oil prices rose sharply in 2011. However, the current crisis has dealt a huge blow to all countries around the world, and China did not introduce strong stimulus policies after the health incident. Currently, most emerging economies are still mired in a health crisis. The global economic engine has weakened, making it difficult to support a sharp rise in oil prices.

Judging from the relevant forecasts of various overseas institutions and investment banks, the market's expectation for the price of Brent crude oil next year is about 40-60 US dollars/barrel. In the first half of next year, especially in April and May, oil prices will rise significantly year-on-year due to the base figure, which will drive the overall CPI, but the driving effect will weaken thereafter.

2.3.3. Core CPI product category

The weight of product items in the core CPI is 20.137%. Imported goods have a great impact on domestic commodity prices in the US. The CPI for leading commodities in the import price index (excluding petroleum) is about 17 months.

We believe that in the short term, commodity prices will rise rapidly due to the blockage of international trade and the gradual recovery of consumer consumption in the US. Although US imports and exports have gradually recovered after the health incident, so far there has been a lot of negative year-on-year growth, and supply is limited. In the medium term, with the gradual withdrawal of fiscal stimulus and the resumption of international trade, consumer spending capacity will be affected to a certain extent, supply-side imports will increase, and commodity CPI will be under downward pressure. In the long run, as the transmission effect of currency on inflation gradually becomes apparent and the trend of de-globalization continues, commodity CPI is expected to increase centrally year over year.

2.3.4. Core CPI service category

The service CPI weight is 59.387%. Unlike commodities, the service industry is mostly a non-tradable sector, is relatively less affected by global trade, and is still more in line with the Phillips curve. The logic behind it is that residents' income determines labor costs and consumer demand, which in turn affects service prices. America's per capita disposable income was leading the service category CPI for about 13 months year over year.

In the short term, with the support of fiscal stimulus, unemployment benefits for many workers are higher than wages, employment intentions are low, labor supply in the service sector is relatively scarce, and service CPI is likely to continue to rise.

In the medium term, the job market situation is the core factor that determines service CPI prices. If the job market continues to improve and labor demand is strong, then service CPI is expected to continue to rise; if the job market does not recover well and labor demand is weak, then service CPI is under downward pressure. Although the US unemployment rate has declined rapidly in recent months, mainly as a result of the rapid return of temporary workers who were laid off during the health incident lockdown, the number of people permanently unemployed in the US is still increasing, and there has been an accelerated growth trend recently.Judging from historical experience, the number of people permanently unemployed and the unemployment rate are fairly synchronized indicators, but there was a clear divergence after this health incident, which shows that the pressure of the US recession on the job market continues. The job market has not yet reached a real inflection point. The rate of decline in the unemployment rate will slow down significantly in the future, making it difficult to fall back to the low level before the health incident relatively quickly.Due to the job market's leadership in service CPI, we think there will be downward pressure on service CPI in the medium term.

In the long run, as the job market recovers and the overall inflation center rises, the service CPI will rise again.

2.3.5. US CPI Forecast

We used the forward-looking indicators mentioned above to fit the US CPI, and the degree of fit to historical data is quite good. Presumably, there will not be much pressure on CPI in the medium term, and there will be a certain increase in March and April next year due to the base effect. However, it should be noted that due to the special nature of health events, most forward-looking indicators will fail in the current macro context, so the model fitting results can only be used as a reference, and the error may be very large.

We comprehensively consider the short-term, medium-, and long-term impacts of health events and fiscal and monetary policies on inflation, and anticipateThe core CPI will still recover in the short term; there will be further downward pressure in the medium term, but not much; the long-term CPI core CPI high will exceed the high after the financial crisis. The overall CPI may exceed 3%, but there is great uncertainty, mainly depending on the extent of oil price recovery.Under the Fed's new framework, the long-term center is also expected to be significantly higher than the level of the past decade.

3. What impact does a rise in the center of inflation have

Through the above analysis, we believe that the long-term inflation center of the US is expected to rise markedly, and this will also have an obvious impact on monetary policy and the prices of various asset types.

3.1. Monetary policy will not be tightened due to inflation for a long time

If the logic of a rise in the center of inflation holds true, the market's first concern is whether the Fed will tighten monetary policy ahead of schedule as a result. We think there is no need to worry about monetary policy being tightened too quickly for a long time. The main reasons are as follows:

First, the Fed's new framework targets average inflation, that is, an average inflation target of 2% over a period of time. So if inflation exceeds 2% in the short term, it won't trigger the Fed to act too quickly.Moreover, the inflation index anchored by the Fed is the core PCE. Empirically speaking, the core PCE will be slightly lower than the core CPI, which also helps reduce the Fed's sensitivity to inflation.

Second, there is usually a time lag of 2 to 3 years from the transmission of monetary and fiscal policies to inflation.From an empirical point of view, there is a slow process from the gradual circulation of excess currency in the real economy to rising inflation. There will be no obvious pressure on US inflation during this period, so the Fed does not need to worry about inflation too early, so it continues to maintain an easy monetary policy.

Third, judging from historical experience, there is a clear inverse relationship between the US government debt ratio and interest rate levels.That is, when the US government debt ratio is too high, it is difficult for the Fed to tighten monetary policy. Beginning last year, the market discovered that the current independence of the Federal Reserve has weakened. Also during World War II, the Fed's independence was weak, and the macro background is also that the US government's debt ratio is high.We believe that the weakening of the independence of the Fed is not due to Powell succumbing to Trump's political pressure, but because the US government debt ratio is too high, the Fed has to adopt an extremely loose monetary policy to avoid a government debt crisis.In contrast, the Volcker period was the period when the Fed had the strongest independence, and at that time it was also the period when the US government's debt ratio was the lowest. The macro-environment gave Volcker a great deal of room for monetary policy manipulation, so he could raise interest rates with an iron fist to control inflation. However, at present, the Fed does not have this condition, and tightening monetary policy is a difficult decision for the Fed.

For these reasons, we think the Fed will maintain a very loose monetary policy for a long time. Of course, if there is an extreme situation, such as inflation arriving faster and higher than we anticipated, it is not ruled out that the Fed will be forced to take tightening action ahead of time.

3.2. The US dollar has entered a depreciation cycle

There is a clear inverse relationship between the US dollar index and the level of US inflation.A rise in the center of inflation in the US will weaken the purchasing power of the US dollar and thus the credit of the dollar, leading to a depreciation of the dollar. Even after 2000, the market generally believed that US inflation had “disappeared” during the period, the inverse relationship between the US dollar index and US inflation was still very obvious; in most cases, the inflection point was the same.

Of course, in the short term, due to reasons such as Brexit, the second outbreak of health incidents in Europe, and the stalemate in US fiscal stimulus negotiations, etc., the euro and pound depreciated sharply, and the US dollar received clear support. However, as these risk factors gradually subside, the US dollar will continue its previous depreciation trend, and excessive currency investment and a rise in long-term inflation centers will both push the US dollar index downward.

3.3. Precious metals have long-term upward momentum

We predicted the rise in precious metals in our report “The Gold Bull Market Continues” at the beginning of June. Since then, a round of sharp rise in precious metals began in late July. The core driving force behind this round of increase was the decline in real interest rates.

Afterwards, since the Fed did not increase its monetary policy, the decline in nominal interest rates was blocked. At the same time, negotiations on US fiscal stimulus reached an impasse, and inflation expectations were blocked from rising, so real interest rates fluctuated and repeated, and precious metals also entered the volatile adjustment range.

Since September, due to new risks in the Brexit negotiations and the second outbreak of health incidents in Europe, the US dollar index has stopped falling and rebounding, leading to a sharp decline in precious metals. The US dollar index was the core driving force of the precious metals market during this period.

In the short term, a lot of uncertainty has caused precious metals to fluctuate widely, but in the long run, we believe that precious metals still have the momentum to rise. The long-term market for precious metals mainly depends on changes in actual interest rates.In terms of nominal interest rates, as already analyzed above, even if interest rates on 10-year US Treasury bonds rise in the future, there will be extremely limited room. However, from the perspective of inflation, there is plenty of room for US inflation expectations to rise.

Currently, the inflation expectations implied by the market's asset pricing are at a historically low level, that is, the market generally believes that after this unprecedented stimulus policy by the Federal Reserve and the Treasury, US inflation will still be at a very low level. There is a high possibility that there will be poor expectations here. Once the market realizes that the post-crisis context is different from the previous one, then there is a lot of room for inflation expectations to rise.The relationship between US real interest rates and precious metals is not linear, but convex, that is, when real interest rates are at a very low level, a decline in real interest rates will lead to a greater increase in precious metals. We believe that with the gradual rise in future inflation expectations, precious metals will still gain upward momentum.

Risk warning:

1. The US fiscal stimulus failed to be introduced smoothly.

2. The Federal Reserve tightened monetary policy prematurely due to other considerations.

3. A less-than-expected recovery in the US economy has led to a sharp decline in demand.

此前「没人花钱,都等着收钱」,即2000年以来的危机都是需求坍塌,供给充足,所以通缩。但本次不同,「很多人花钱,但没人收钱」,财政刺激导致需求旺盛,而供给端无论短期还是长期都承压,与战时有相似度,所以通胀压力很大。

此前「没人花钱,都等着收钱」,即2000年以来的危机都是需求坍塌,供给充足,所以通缩。但本次不同,「很多人花钱,但没人收钱」,财政刺激导致需求旺盛,而供给端无论短期还是长期都承压,与战时有相似度,所以通胀压力很大。