Weishi Jiajie (00856) is a leading technology product solution and supply chain service platform in the Asia-Pacific region. 1H20 net profit reached a new high against the market in the face of public health events, the business structure was more optimized, and cloud computing-related business layout transformation was actively carried out.

Maintain close cooperation with many upstream well-known brand manufacturers to continuously enrich the product portfolio in the future

The company is the leading distributor of IT products in the Asia-Pacific region and has established long-term and stable cooperative relations with more than 300 upstream well-known IT brand manufacturers. We believe that in the future, the company can maintain a sustainable and stable cooperative relationship with existing upstream brands, and can continue to expand cooperative brands and continue to enrich its product portfolio.

Grasp the growth of subdivision categories, and there are opportunities in multiple categories of consumer electronics divisions.

The rich product portfolio reduces the company's dependence on single product or category sales and gives the company the opportunity to enjoy the growth of segment markets. For example, in 17-19 years, while global shipments of smartphones and personal computing devices continued to decline, the company's revenue from the consumer electronics division continued to grow, which is believed to be due to (1) the growth in some segments offset the decline in some products; and (2) the increase in market share. We believe that mobile phones, wearable devices, drones, 3D printers and so on are expected to bring growth opportunities for the company.

Big data promotes the upgrading of cloud computing demand, and the enterprise system + cloud computing business segment is the future growth point.

With the acceleration of the 5G process, the further improvement of network transmission speed will accelerate the increase of massive data, which will put forward higher requirements for the computing power and storage space of cloud computing, which is expected to support the continued rapid development of basic cloud services. in turn, it will lead to an increase in the demand for hardware such as database and storage, and support the growth of the company's enterprise system segment revenue. It is expected that with the development of 5G, cloud computing, AI and technology convergence, the digital transformation of enterprises will accelerate. In addition, the experience that some production and offices cannot be completed offline during public health events has enhanced enterprises' understanding of the cloud, and it is expected that some enterprises may plan to go to the cloud ahead of schedule. Although enterprises heavily affected by public health events may reduce short-term IT expenditure, they will include cloud hosting in the plan, which is expected to support the long-term and rapid growth of the company's cloud computing business division.

The distribution network covers many Southeast Asian regions and has the advantage of regional differentiation of distribution channels.

The company covers more than 50,000 downstream channel partners, in addition to China, but also actively expand in eight Southeast Asian countries. China Digital (000034

SZ), which is also a leading distributor of IT products, covers about 30, 000 channels, mainly in Singapore and Malaysia except China.

Excellent operation and management ability, net profit reached a new high against the trend

Although the distribution industry has the characteristics of low gross profit margin and net profit margin, thanks to excellent operation and management, the company's main financial data show a positive trend. In view of the fact that 2H20 will be less affected by public health events and may enter into cooperation with 300750

SH, China's leading power battery manufacturer, in the field of lithium-ion batteries, we have confidence in the development of the company.

ROE leading industry, valuation has room for improvement, it is recommended to pay attention to

We compare the company with the A-share listed company Digital China, which is also a leader in the distribution of IT products, and consider the A / H share premium factor, and consider that the valuation gap between the company and Digital China is too large, and the valuation is expected to increase with the rapid development of cloud business and the opportunity to expand into more business areas (such as lithium batteries) in the future.

Maintain close cooperation with many upstream well-known brand manufacturers to continuously enrich the product portfolio in the future

Weishijiajie is a leading distributor of IT products in the Asia-Pacific region, distributing a wide range of products, including computers, mobile phones, drones, sports smartwatches, 3D printers, game consoles, as well as IT accessories including CPU and hard drives, as well as enterprise tools for IT infrastructure such as middleware, operating systems, Unix/NT servers, databases and storage. The company has established long-term and stable cooperative relations with many upstream well-known IT brand manufacturers, including Western Digital (WDC

US), STX US (STX US), Hewlett-Packard (HPQ US), Amazon.Com Inc (AMZN US), Apple Inc (AAPL US), Microsoft Corp (MSFT US), Huawei, DJI, Sony Group Corp (SNE

US), NTDOY US (Nintendo), XIAOMI (1810

HK) and other top 500 global IT companies. As a leader in the IT distribution industry, the company has the ability to help upstream brands reach end customers quickly and widely at lower cost, so that brands can focus on R & D and production to enhance product competitiveness. Therefore, we believe that in the future, the company can maintain a sustainable and stable cooperative relationship with existing upstream brands, and can continue to expand cooperative brands and continue to enrich its product portfolio.

Grasp the growth of subdivision categories, and there are opportunities in multiple categories of consumer electronics divisions.

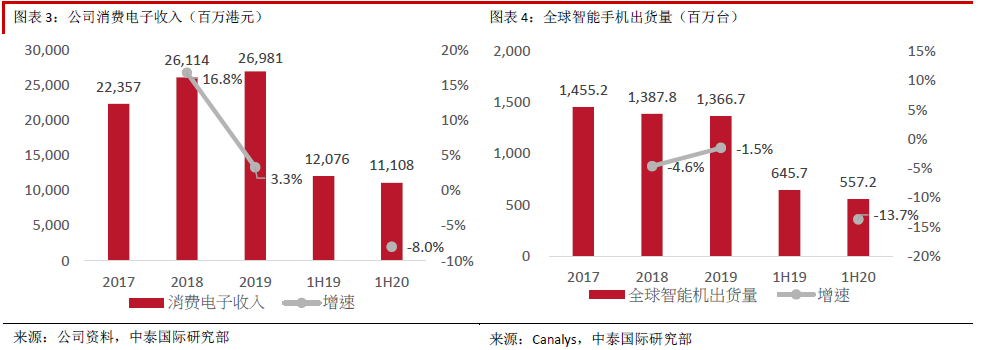

The rich product portfolio reduces the company's dependence on single product or category sales and gives the company the opportunity to enjoy the growth of segment markets. For example, the consumer electronics segment, which accounts for about 40% of the company's total revenue, covers personal computers, tablets, mobile phones and other emerging consumer electronics products, including drones, smart sports watches, 3D printers, game consoles, etc. While global shipments of smartphones and personal computing devices (including traditional PC, tablets and workstations) continued to decline from 2017 to 2019, revenue from the consumer electronics segment continued to grow, which is believed to be due to (1) the increase in some segments offset the decline in some products; and (2) the company's increased market share.

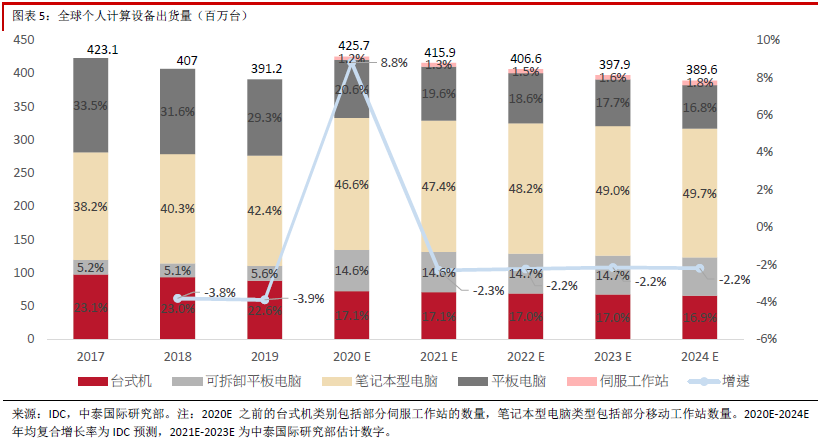

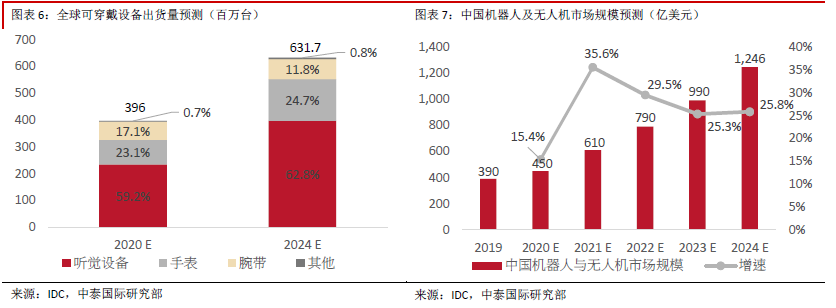

Although the global personal computing devices have entered a state of mature saturation, we believe that mobile phones, wearable devices, drones, 3D printers and so on are expected to bring growth opportunities for the company. In terms of mobile phones, although global smartphone shipments have declined in recent years, China, as the world's largest smartphone market, officially entered the 5G commercial phase in November 2019. It is expected that as China's 5G network construction accelerates, operators begin to launch 5G package offers, 5G mobile phone prices fall rapidly, and the impact of public health events on China's economy decreases, China will welcome the 5G replacement trend, and mobile phone sales are expected to rebound. In terms of wearable devices, thanks to the lower prices of other consumer electronic products and the improvement and popularization of the Internet of things ecosystem such as health and fitness monitoring, IDC expects global wearable device shipments to grow by 14.5% to 400 million units in 2020 compared with the same period last year, and will continue to grow rapidly to 640 million units in 2024 at an average annual compound growth rate of 12.4% in the next five years. In terms of drones, it is still in the early stage. IDC expects the overall expenditure of the global robot and drone market to grow by 13.4% to $124.57 billion in 2020, and to accelerate to $274.62 billion in 2024 at an average annual compound growth rate of 20.1% in the next five years. China is the world's largest robot and drone market, with total expenditure expected to be $47.38 billion in 2020, accounting for 38% of the global total. The growth rate is expected to be higher than that of the global market in the future, and the share of

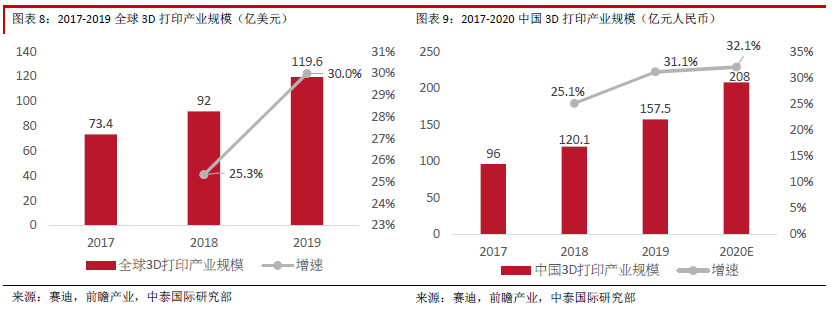

in the global market will increase to 44 per cent by 2024, reaching US $121.12 billion, of which the drones market will have an average annual compound growth rate of 54.3 per cent over the next five years. 3D printing has been used in manufacturing, medical, education, aerospace, military and other fields. According to Sadie data, the scale of the global 3D printing industry increased by 30% to $11.956 billion in 2019, of which China accounted for about 19%, ranking third in the world. In the past two years, the growth rate is roughly similar to the global growth rate, and it is expected to increase by 32.1% to 20.8 billion yuan in 2020. We believe that 3D printers will benefit as one of the most important segments of the 3D printing industry.

Big data promotes the upgrading of cloud computing demand, and the enterprise system + cloud computing business segment is the future growth point.

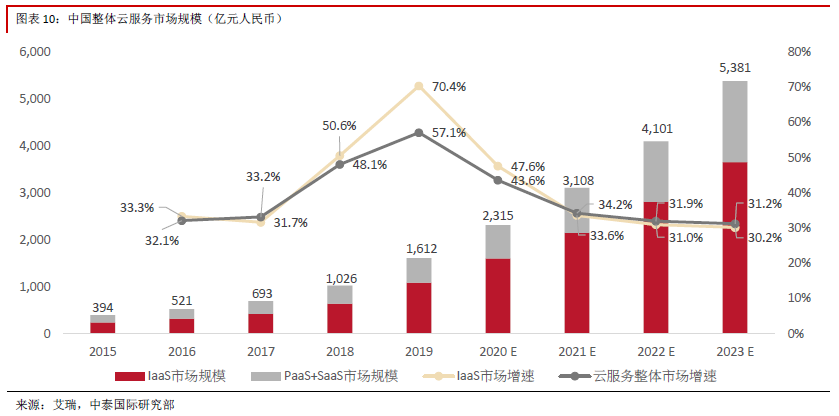

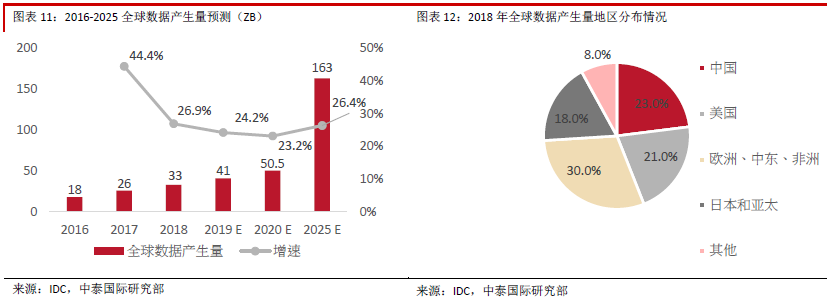

The company provides the required database, storage and other hardware equipment for world-renowned IaaS cloud manufacturers, including AWS, Azure

, Aliyun, Huawei Cloud, etc. IaaS accounts for a relatively large share of China's cloud services market (65.7% in 2019) and maintains rapid growth, with the size of China's IaaS market growing by 70.4% year-on-year to 108.75 billion yuan in 2019. According to IDC data, with the promotion of artificial intelligence, AIoT, cloud computing and other technologies, the global data volume is expanding and increasing indefinitely. It is expected that the global data volume will rapidly increase to 163ZB at an average annual compound growth rate of 26.4% from 2020 to 2025, of which China accounts for a relatively large amount of data, accounting for about 23% of the world in 2018. With the acceleration of the 5G process, the further improvement of network transmission speed will accelerate the increase of massive data, which will put forward higher requirements for the computing power and storage space of cloud computing, which is expected to support the continued rapid development of basic cloud services. in turn, it will lead to an increase in the demand for hardware such as database and storage, and support the growth of the company's enterprise system segment revenue.

The company also has its own cloud MSP

service system, which can provide customers with cloud services, as well as comprehensive cloud services, including basic development, operation and maintenance inspection and training services (AWS examination and training certification). Digital transformation has become a global trend, and it is expected that with the development of 5G, cloud computing, AI and technology convergence, enterprise digital transformation will accelerate. In addition, the experience that some production and offices cannot be completed offline during public health events has enhanced enterprises' understanding of the cloud, and it is expected that some enterprises may plan to go to the cloud ahead of schedule. Although enterprises heavily affected by public health events may reduce short-term IT expenditure, they will include cloud hosting in the plan, which is expected to support the long-term and rapid growth of the company's cloud computing business division.

The distribution network covers many Southeast Asian regions and has the advantage of regional differentiation of distribution channels.

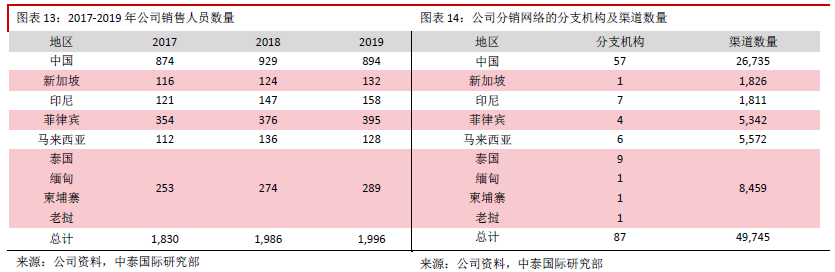

The company covers more than 50, 000 downstream channel partners, including e-commerce, retailers, system integration merchants and company dealers dominated by JD.com (9618

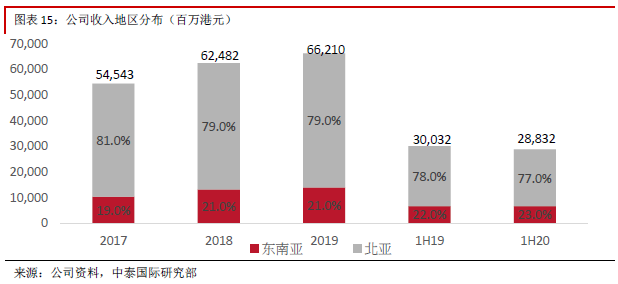

HK). In addition to covering China, it is also actively expanding in eight Southeast Asian countries, namely, Singapore, Indonesia, the Philippines, Malaysia, Thailand, Myanmar, Cambodia and Laos. The number of the company's sales staff in China has remained relatively stable in the past three years, and the number of sales staff in most Southeast Asia has increased steadily, because the sales staff need to connect directly with the channel merchants for a long time. The steady composition of sales staff can ensure that the company has a certain advantage in channel maintenance and expansion and bargaining power. From the perspective of regional distribution of revenue, the proportion of revenue from Southeast Asia has increased from 19% in 2017 to 23% in the first half of 2020; in terms of the regional distribution of the number of channels, the proportion of channels in Southeast Asia has reached about 46.3%. China Digital (000034

SZ), also a leader in IT product distribution, covers about 30, 000 channels. Apart from covering China, it is mainly developed in Singapore and Malaysia. By comparison, the company has the advantage of regional differentiation in distribution channels.

Excellent operation and management ability, net profit reached a new high against the trend

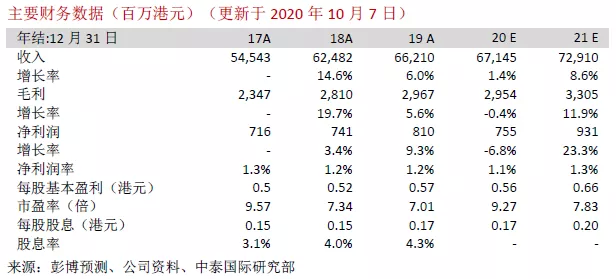

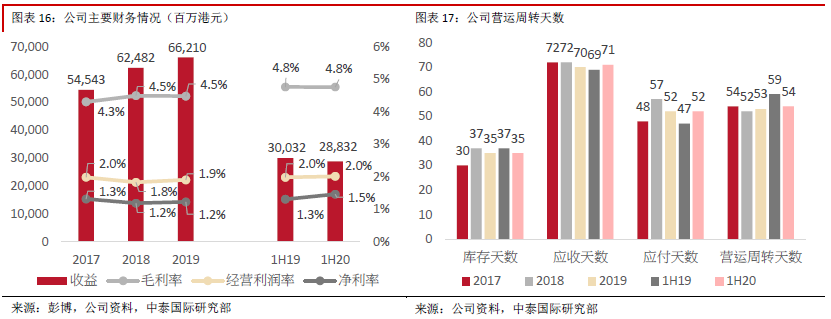

We review the company's main financial situation in the past three years and the first half of 2020. Total revenue maintained a compound annual growth rate of 10.2% from 2017 to 2019 and decreased by 4% in the first half of 2020 compared with the same period last year, mainly due to the impact of public health events on electronic consumption shipments. It is expected that the impact of public health events will decrease in the second half of the year. The gross profit margin increased from 4.3% in 2017 to 4.5% in 2019, and remained stable at 4.8% in the first half of 2020 compared with the same period last year. Sales and distribution expenses accounted for about 1.7% of income, administrative expenses accounted for about 1% of income, operating profit margin was maintained at about 2%, net interest rate was maintained at about 1.3%, and net liabilities / total assets were maintained at about 0.24 on average. In terms of operating turnover, the inventory days are 30-37 days, the days receivable are 70-72 days, the days payable are 48-57 days, and the days of operating turnover are 52-54 days. Although the distribution industry has the characteristics of low gross profit margin and net profit margin, thanks to the company's excellent operation and management ability, the main financial data show a positive trend. In view of the fact that 2H20 will be less affected by public health events and the opportunity for the company to enter into cooperation with 300750

SH, China's leading power battery manufacturer, in the field of lithium-ion batteries, we have confidence in the company's development.

ROE leading industry, valuation has room for improvement, it is recommended to pay attention to

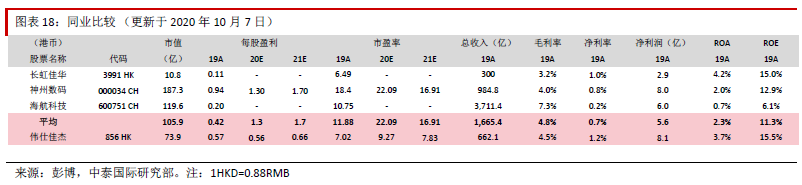

与同为IT产品分销领先企业的A股上市公司神州数码相比,公司在渠道数量、海外地区覆盖数量、净利率、ROE等方面均较高,在收入、销售人员数量(2019年:神州数码2,379人;公司1,996人)方面低于神州数码,但在估值上公司远低于神州数码(2020年预测PE:公司约为9.3倍,神州数码约为22.1倍)。考虑到存在A/H股溢价因素,我们采用恒生指数2020年预测PE约12.82倍及沪深300指数2020年预测PE约15.69倍计算得到A股较H股溢价约22.4%,认为公司相较于神州数码估值差距过大,在云业务快速发展及未来有机会拓展至更多业务领域(如锂电池领域)的情况下,估值有望提升,建议投资者关注。