Core views

The last debate in the US election is over, and the countdown to the general election has entered a 10-day countdown. Currently, the market has fully anticipated the election results and its policy impact, but market transactions often have poor expectations. Therefore, this report sorts out the events that may have had a major impact on the market during the final period of the election and their possible changes in poor expectations. Maintain your judgment on the volatile trend of the US dollar until the election results are settled.

summary

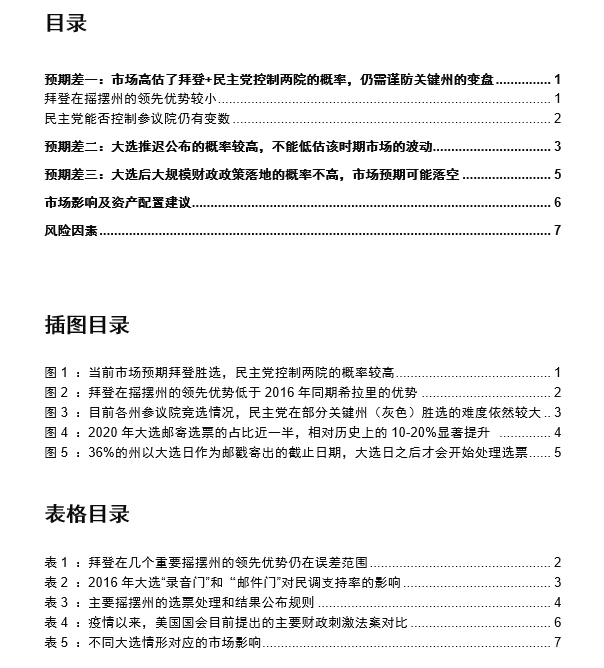

The last debate in the US election has just ended. Judging from the results of the debate, Trump changed his last aggressive offensive stance, and Biden was also relatively free in dealing with the overall debate strategy and topics. It is expected that there will be no obvious impact on the poll results. As the next general election begins its 10-day countdown, the key factors affecting overseas markets will mainly focus on two points. One is election results; the other is fiscal stimulus policy expectations. Judging from the latest polls and gaming data, there is a high probability that Biden will win the election and that the Democratic Party will control both houses. At the same time, the market expects a large-scale fiscal stimulus plan to be implemented after the general election. Compared to market expectations, we think the following three differences in expectations are worth paying attention to in the final stages of the general election:

The last debate in the US election has just ended. Judging from the results of the debate, Trump changed his last aggressive offensive stance, and Biden was also relatively free in dealing with the overall debate strategy and topics. It is expected that there will be no obvious impact on the poll results. As the next general election begins its 10-day countdown, the key factors affecting overseas markets will mainly focus on two points. One is election results; the other is fiscal stimulus policy expectations. Judging from the latest polls and gaming data, there is a high probability that Biden will win the election and that the Democratic Party will control both houses. At the same time, the market expects a large-scale fiscal stimulus plan to be implemented after the general election. Compared to market expectations, we think the following three differences in expectations are worth paying attention to in the final stages of the general election:

One difference in expectations: the market has overestimated the probability that Biden+the Democratic Party will control the two houses to a certain extent, and we still need to beware of changes in key states

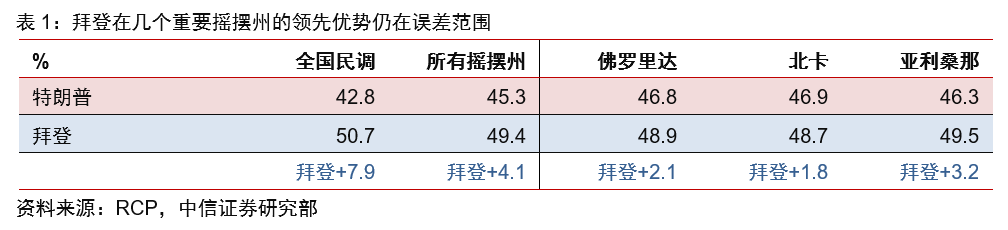

Biden took the lead in national polls, but the swing state's lead was even lower than Hillary's during the same period. It is particularly noteworthy. Yes, Biden's lead in swing states such as Florida, North Carolina, and Arizona is 2-3%, which is still within the margin of error. Currently, it is impossible to think that Biden has a steady winning ticket; investors still need to watch out for changes in swing states. At the same time, whether the Democratic Party can win senate seats in a few key states is still full of variables. Combined with the election conditions in several key states, it is not too difficult for the Democratic Party to obtain an absolute majority of seats in the Senate. Even if the Democratic Party finally wins the Senate, it probably won by a narrow margin (51:49, for example). It's not that the market expects almost no suspense. Therefore, the probability that Biden+the Democratic Party will control both houses is not as high as expected by the market, and if Biden loses some of the swing states in the early stages of the general election count, market expectations may also be revised at an accelerated pace. It is not even ruled out that Trump's unexpected victory in the election will not be ruled out, and the market cannot overestimate this. Until the election results are officially out, we still recommend investors avoid betting on a single outcome.

Expectations gap 2: The probability that the announcement of the general election will be delayed is high, and market fluctuations during this period cannot be underestimated

There are very few cases in history where the announcement of election results is delayed, usually within 1-3 days. However, there is a high probability that the announcement of this year's election results will be delayed. There may be two reasons. One is that the proportion of mail-in ballots in this election is nearly half, a significant increase compared to 10-20% in history. Due to differences in mail-in ballot delivery rules and ballot verification in various states, the publication of the final vote statistics may be delayed; it is expected that under such circumstances, the announcement of the election results may be delayed by about a week; second, if Trump falls behind in the election situation, he may have to wait for the Supreme Court's decision, thereby affecting the election counting process.. Under these circumstances, it is expected that the vote count in the general election may continue for about a month or even longer, and extreme situations where the US president cannot be elected and a political impasse is not ruled out in the end. Therefore, market fluctuations in the face of repeated election results cannot be underestimated.

Expectations are three: The probability that a large-scale fiscal plan will be launched soon after the general election is not high, and market expectations may fall short before the end of this year

Currently, the market generally expects large-scale fiscal stimulus plans to be introduced soon after the general election. However, we think that no matter who comes to power, it is unlikely that a large-scale package of fiscal stimulus will be introduced before the end of this year. Since both Congress and the president are in a transition period until January next year, there is no incentive for either the Democratic Party or the Republican Party to push for another round of large-scale fiscal stimulus measures during this period; it is likely that unemployment relief and corporate loans will only continue to be extended until the beginning of next year. If Biden is elected and the Democratic Party controls both houses, it is possible that a new round of fiscal stimulus plans will be introduced as early as the end of January next year after Biden takes office. The scale may be 1.5-2 trillion US dollars. Therefore, before the end of this year, the market's expectations for a new round of large-scale stimulus plans may fall short.

Risk Factors:

1) Biden's health issues; 2) Unexpected geopolitical events.

Market impact:

As far as the market is concerned, the twists and turns of short-term election results and lower expectations of fiscal stimulus may suppress market risk appetite and maintain judgment on the fluctuating trend of the US dollar until the election results are settled. However, in the medium term, we believe that regardless of the election results, expectations of global economic recovery and liquidity easing will drive the dollar trend downward. If Biden is elected and the Democratic Party controls the fulfillment of the expectations of both houses, expectations of large-scale fiscal stimulus heat up, it may accelerate the weakening trend of the US dollar in the medium term.

Main text

The last debate in the US election has just ended. Judging from the results of the debate, Trump changed his last aggressive offensive stance, and Biden was also relatively free in dealing with the overall debate strategy and topics. It is expected that there will be no obvious impact on the poll results.

As the next general election begins its 10-day countdown, the key factors affecting overseas markets will mainly focus on two points. One is election results; the other is fiscal stimulus policy expectations. Judging from the latest polls and gaming data, there is a high probability that Biden will win the election and that the Democratic Party will control both houses. At the same time, the market expects a large-scale fiscal stimulus plan to be implemented after the general election. Comparing market expectations, we think the following three-point difference in expectations in the final stage of the general election is worth paying attention to.

One difference in expectations: the market overestimates the probability that Biden+the Democratic Party will control the two houses, and we still need to beware of changes in key states

Biden's lead in swing states is small

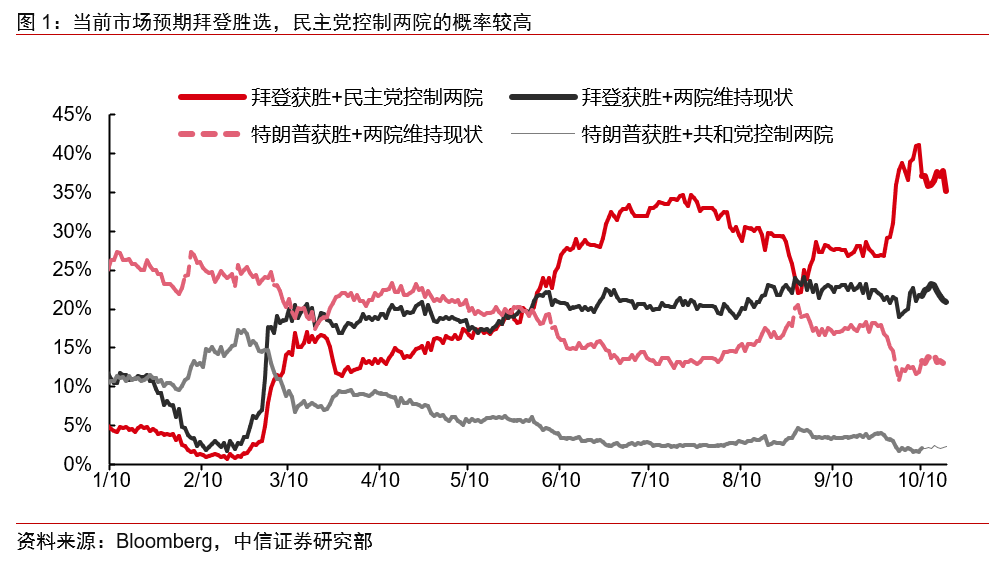

As of October 23, according to the latest data, Biden is 7.9% ahead of Trump in national polls and 4.1% in the six swing states, far below national polls, and lower than Hillary's lead over Trump in the same period in 2016. It is particularly noteworthy. Yes, in several key swing states, including Florida, North Carolina, Arizona, etc., Biden's lead is 2-3 points and is still within the margin of error (Hillary's approval rating in the 2016 poll was 3.2% ahead of Trump, but lost the general election), so we don't think it's easy to think that Biden has a steady win; we still need to watch out for changes in swing states. This may have a direct impact on the final election results.

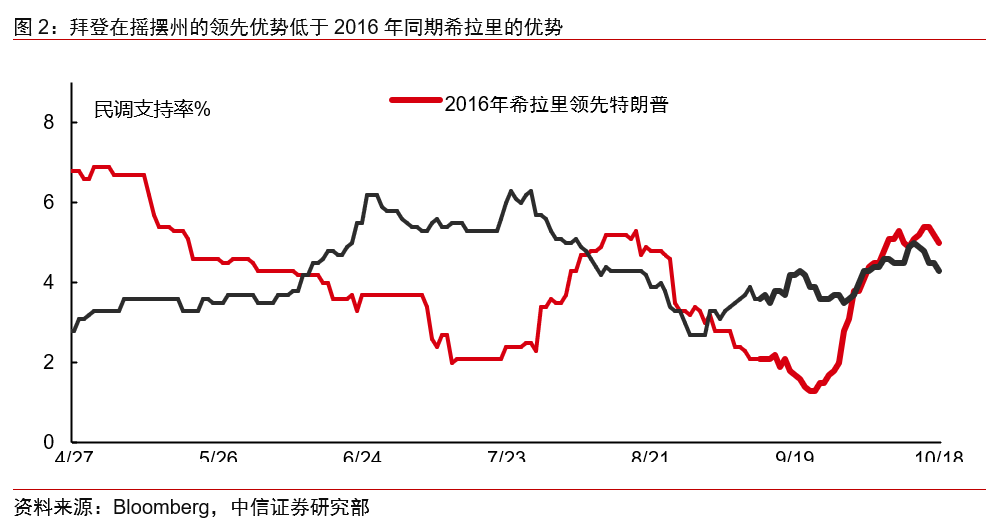

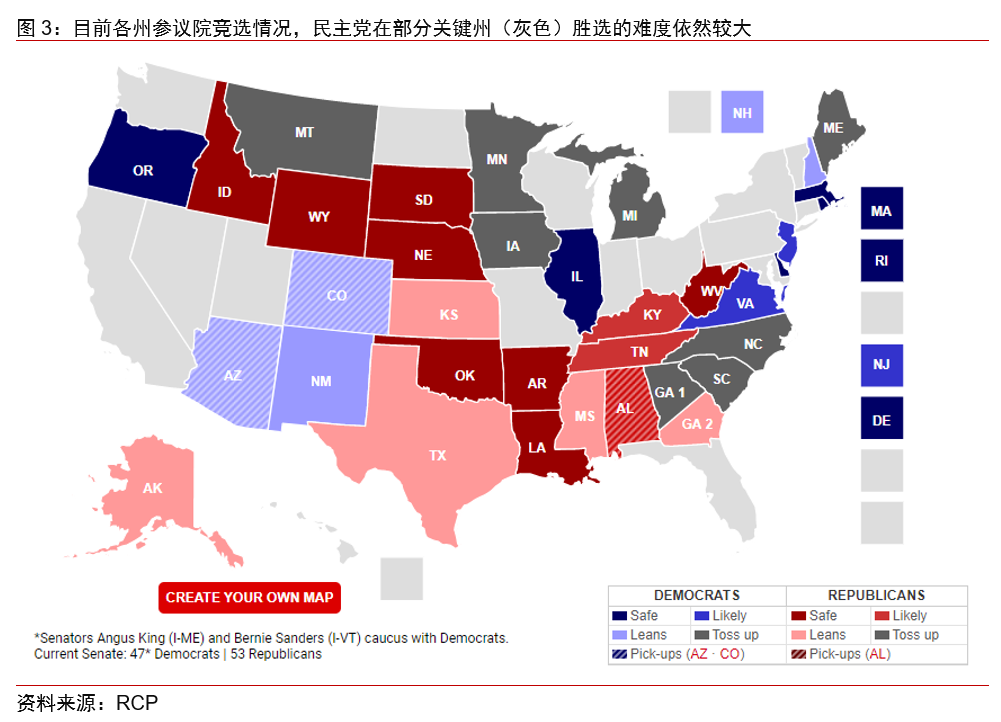

Whether the Democratic Party can control the Senate is still variable

Furthermore, in the congressional election, the market expects the Democratic Party to win both the Senate and the House of Representatives, where the Senate is critical. Judging from the current state government election situation, current Alabama Democratic Senator Doug Jones may lose the election. If the Democratic Party wants to get a majority of seats in the Senate, it will have to win at least 4-5 states. Looking at the senate seats in several key states at present, there are many variables. In particular, the elections in North Carolina and Iowa are stuck, and it is not too difficult for the Democratic Party to successfully win these few states and obtain an absolute majority of seats in the Senate. Currently, the market expects that the probability that the Democratic Party will control the Senate is as high as 64%. We think that even if the Democratic Party finally wins the Senate, it will probably win by a narrow margin (for example, 51:49). It's not that the market anticipates that there is almost no suspense.

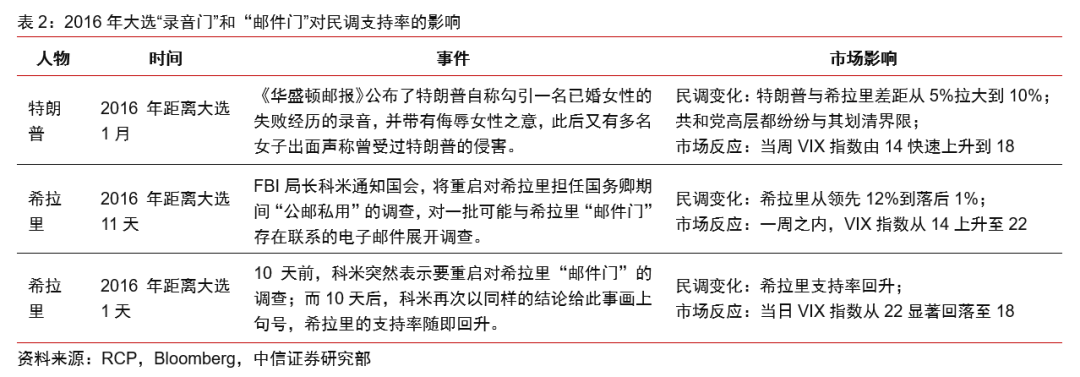

Although we agree that Biden's victory in the election and the Democratic Party's victory is a more probable event under the current circumstances, it has not reached the point of being stable from ten to nine, and there is still some uncertainty about the election results. Furthermore, Biden's current election is influenced by his son's latest “email gate” incident. Before the last debate, Fox News revealed that an insider testified about the incident, which raised market concerns. Similar to Hillary's sudden “email door” revealed in the last minute of 2016, unexpected events at the end of the general election often have a big impact on votes. Whether the incident will continue to ferment in the future is also worth paying attention to. If there is a situation where Biden loses some swing states in the early stages of the general election vote count, market expectations may also accelerate the correction in reverse. The outcome of Trump's unexpected victory is not even ruled out, and the market cannot overestimate this. Until the election results are officially out, we still recommend investors avoid betting on a single outcome.

Expectations gap 2: The probability that the announcement of the general election will be delayed is high, and market fluctuations during this period cannot be underestimated

There are very few cases in history where the announcement of election results is delayed, usually within 1-3 days after election day. However, there is a high probability that the announcement of the results of this year's general election will be delayed. There are two possible reasons for this:

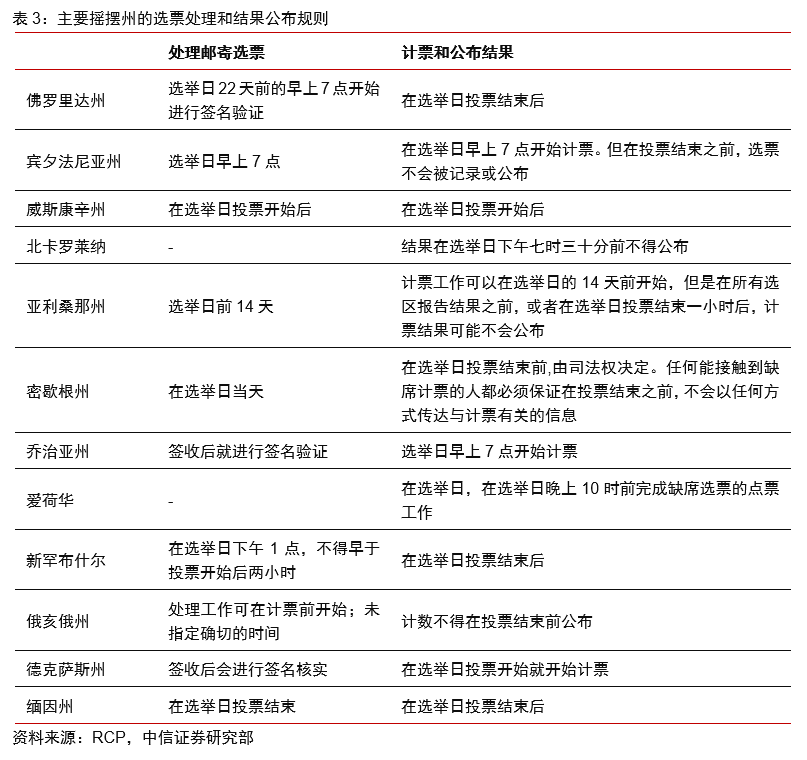

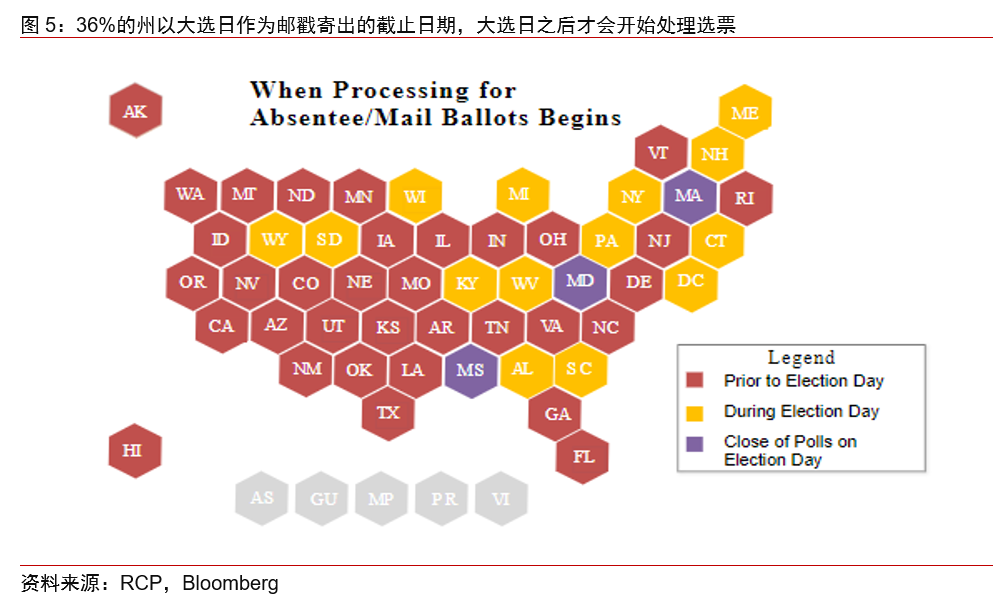

First, the proportion of mail-in ballots in this election was nearly half, a significant increase compared to 10-20% in history. At the same time, due to differences in the rules for sending mail-in ballots in each state and ballot verification, etc., the publication of the final ballot statistics may be delayed. According to each state's ballot processing and results publication rules, most swing states only start processing mail-in ballots on election day, while 36% of states still use November 3 as the postmark deadline. We expect that under such circumstances, the election results may be announced about a week after election day;

Second, if Trump falls behind in the election situation, he may question the validity of the votes, or even have to wait for the Supreme Court to decide in the end, thereby affecting the election counting process and delaying the election results. Compared to the election dispute between Gore and George W. Bush in 2000, if there is a dispute over the mail-in ballot process this time, Trump will probably also file a legal lawsuit to recount the votes. Under such circumstances, it is expected that the vote count for the general election may continue for about a month or even longer, and it is not ruled out that in the end, it is impossible to elect a US president and an extreme situation where a political impasse has occurred. Therefore, it is impossible to underestimate the fluctuations that will occur in the market when election results are repeatedly fermented.

Expectations gap of three: the probability of introducing large-scale fiscal policies after the general election is not high, and market expectations may fall short

Currently, the market generally expects large-scale fiscal stimulus plans to be introduced soon after the general election. However, we think that no matter who comes to power, it is unlikely that a large-scale package of fiscal stimulus will be introduced before the end of this year.

Since the third wave of health events has already occurred in the US, the US economy will once again face great pressure during the general election period, but the dispute between the two parties over the new fiscal stimulus plan continues, and the probability that a fiscal stimulus plan will be launched before the general election is low. As a result, market investors generally expect that a larger fiscal plan may be introduced after the general election.

We think this forecast is likely to fall short by the end of the year. Since both Congress and the president are in a transition period until January next year, there is no incentive for either the Democratic Party or the Republican Party to push for another round of large-scale fiscal stimulus measures during this period; it is likely that unemployment relief and corporate loans will only continue to be extended until the beginning of next year. Comparing the fiscal stimulus bills proposed by the Republican Party and the Democratic Party since the health incident, it can be seen that the current Democratic Party favors large-scale fiscal bills of 2.4 trillion dollars, while most of the Republicans are unwilling to provide a fiscal plan of more than 1 trillion dollars (although Trump proposed a 1.8 trillion plan, it was opposed within the Republican Party). The differences between the two sides mainly focus on state government subsidies. Since this disagreement involves the basic positions of the two parties, it is difficult to resolve it until the general election. However, after the general election, it is expected that the differences between the two sides will not change with the announcement of the election results during the government change. If Biden wins, the Democratic Party can wait until Biden takes office before introducing a larger fiscal plan, and there is no need to make more compromises during the transition period. Of course, there are few differences between the two sides on unemployment relief and corporate loans. We think that the current round of fiscal negotiations may continue until after the general election, and a small-scale stimulus plan may be reached at that time. Therefore, we think that if Biden is elected and the Democratic Party controls both houses, it is possible that a new round of fiscal stimulus plans will be introduced as early as the end of January next year after Biden takes office. The scale may be 1.5-2 trillion US dollars. Therefore, before the end of this year, the market's expectations for a new large-scale stimulus plan may fall short.

risk factors

1) Biden's health issues;

2) unexpected geopolitical events;

Market impact and asset allocation suggestions

As far as the market is concerned, the twists and turns of short-term election results and lower expectations of fiscal stimulus may suppress market risk appetite and maintain judgment on the fluctuating trend of the US dollar until the election results are settled. However, in the medium term, we believe that regardless of the election results, expectations of global economic recovery and liquidity easing will drive the dollar trend downward. If Biden is elected and the Democratic Party controls the fulfillment of the expectations of both houses, it may accelerate the weakening trend of the dollar in the medium term.

In the short term, poor expectations may bring about some trading opportunities. There are three main aspects: 1) the market volatility may rise again; 2) the probability of betting on a single general election situation is declining, leading to opportunities for wrongful killing in the corresponding sector; 3) commodity allocation opportunities brought about by a temporary decline in fiscal strength expectations.

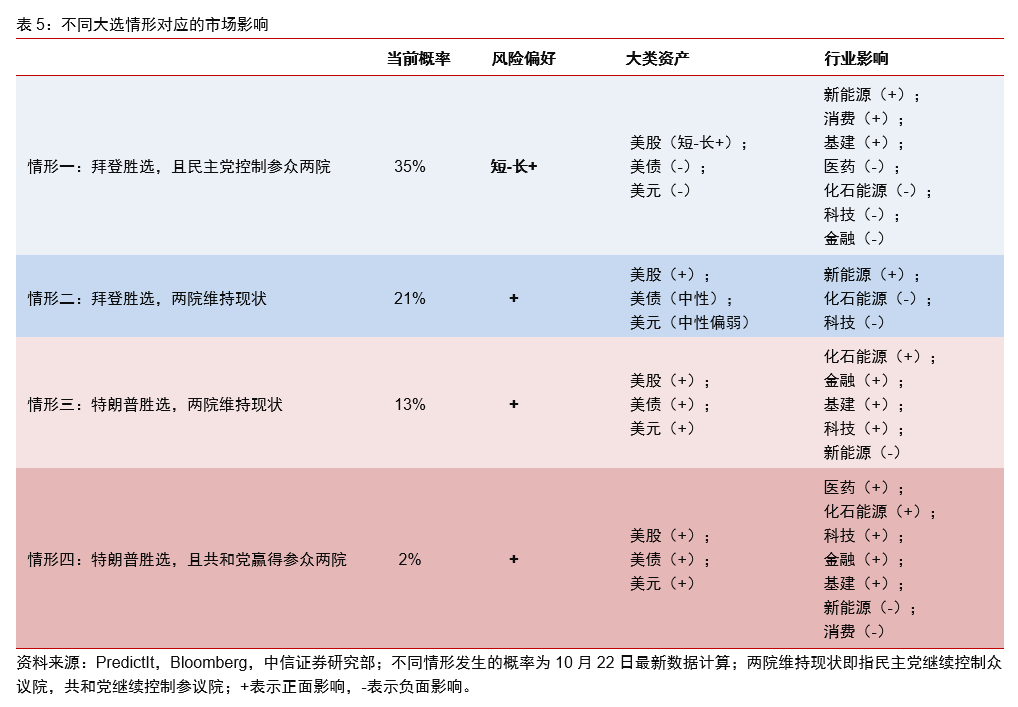

However, we also maintain our previous views on the market allocation after the election results come to fruition. If the Democratic Party wins (corresponding to the first scenario), it will be short and long for US stocks due to Biden's tax increases, tighter supervision, large-scale fiscal and infrastructure plans, and the relative easing of trade disputes. At the same time, the expectations of the fiscal plan will also bring trading opportunities for the US debt curve to steep in the short term. Furthermore, high deficits and possible easing of Sino-US relations (with expectations that tariffs will be lifted when Biden comes to power) are all likely to accelerate the weakening of the US dollar. If Biden wins the general election, the two houses maintain the status quo (the second scenario). Biden's relatively moderate foreign policy may boost market preferences, while policies such as tax increases will face great resistance in both houses. Therefore, after the election, US stocks may show strong short-term performance, US bond yields will not rise rapidly, and the dollar's neutrality is weak. If Trump wins the election, the probability of dealing with the third situation is high. The policy after taking office is expected to continue the previous period. The market's reaction to election results and policy expectations will be relatively moderate, and if an unexpected re-election will also boost the market's risk appetite. US stocks are expected to remain strong, and US debt will remain low, and the US dollar will be relatively strong. For details, please refer to our previous report “2020 US Election Preview Series 5 - Focus on Two Major Trading Themes in the Context of the US Election” (2020-8-22).

美国大选最后一次辩论刚刚结束,从辩论结果来看,特朗普改变了上一场咄咄逼人的进攻态势,拜登在整体的辩论策略和话题应对上也相对自如,预计不会对民调结果产生明显影响。接下来大选进入10天倒计时,影响海外市场的关键因素将主要集中于两点,一是大选结果;二是财政刺激政策预期。从最新的民调和博彩数据来看,拜登胜选,民主党控制两院的概率较高。同时市场预期大选后就会有大规模的财政刺激计划落地。相比于市场预期,我们认为在大选最后阶段有以下三点预期差值得关注:

美国大选最后一次辩论刚刚结束,从辩论结果来看,特朗普改变了上一场咄咄逼人的进攻态势,拜登在整体的辩论策略和话题应对上也相对自如,预计不会对民调结果产生明显影响。接下来大选进入10天倒计时,影响海外市场的关键因素将主要集中于两点,一是大选结果;二是财政刺激政策预期。从最新的民调和博彩数据来看,拜登胜选,民主党控制两院的概率较高。同时市场预期大选后就会有大规模的财政刺激计划落地。相比于市场预期,我们认为在大选最后阶段有以下三点预期差值得关注: