Events:

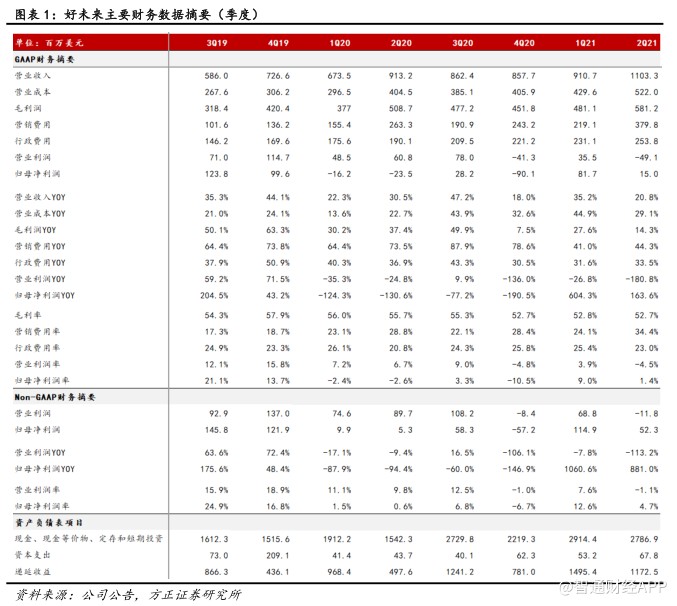

1. TAL Education Group (TAL.US) FY21Q2 operating income is $1.103 billion (YoY+20.8%), net profit is $14.969 million (YoY+163.6%), and net profit of Non-GAAP is $52.276 million (YOY+881%).

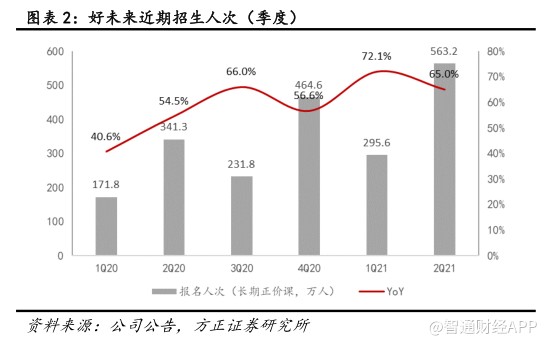

2. The number of applicants for FY21Q2 long-term positive price course is 5.632 million (YoY+65%). As of FY21Q2, there are 936 teaching centers, covering 91 cities.

3. FY21Q3 guidelines: revenue range is expected to be $10.61 to $1.094 billion, YOY+28%~32%.

Comments:

1. Revenue of US $1.1 billion increased by 21%, and sales expenses increased to US $380 million.

Operating income is in line with expectations:FY21Q2 had revenue of $1.103 billion, and YoY+20.8%, posted a quarterly guidance cap of $1.11 billion.

Year-on-year decline in gross margin 3pct:The cost of FY21Q2's main business is US $522 million, YoY+29.1%, 's gross profit is US $581 million, and YoY+14.3%; 's gross profit margin is 52.7%, a decline in 3pct compared with the same period last year. The increase in costs and the decline in gross profit margin are mainly due to the increase in teachers' salaries, rental costs, and the cost of learning materials.

The rate of sales expenses has increased significantly:FY21Q2's sales expenses were $380 million (YoY+44.3%), with a sales expense rate of 34.4%, an increase in 5.6pct over the same period last year, mainly due to marketing expenses and higher salaries for sales and marketing personnel.

Administrative expenses:The management fee of FY21Q2 is US $254 million (YoY+33.5%), and the management expense rate is 23%, which is higher than that of the same period last year (2.2pct). The Non-GAAP management fee (excluding equity incentive expenses) is $226 million (YoY+36.5%).

Operating margins have declined:FY21Q2's operating profit was-$49.116 million, while YoY-180.8%, 's operating margin was-4.5%, down 11.1pct from a year earlier. Non-GAAP 's operating profit was-$11.809 million, while YoY-113.2%,non-GAAP 's operating margin was-1.1%, down 10.9pct from a year earlier.

The net profit margin of homing has improved compared with the same period last year:The net profit of FY21Q2 was US $14.969 million, and the net interest rate of YoY+163.6%, was 1.4%, an increase of 3.9pct.com over the same period last year. The net profit of YoY+881%,non-GAAP was US $522.76 billion, while that of YoY+881%,non-GAAP was 4.7%, which was higher than that of the same period last year. The improvement in homing net profit was mainly due to ① FY21Q2's other income of $45.33 million, compared with-$55.555 million in the same period last year, which was mainly derived from VAT and social security fee deductions provided by the government during health events; the impairment loss on ② FY21Q2's long-term investment narrowed to $49.1 million, compared to $60.8 million in the same period last year.

Cash flow, capital expenditure:FY21Q2's net operating cash flow is approximately-$56.273 million; capital expenditure is approximately $67.8 million.

Cash, cash equivalents and short-term investments:At the end of the FY21Q2 period, the company's cash, cash equivalents and short-term investment balances were $2.79 billion and FY21Q1 was $2.91 billion.

Deferred income:As of the end of the FY21Q2 period, the company's deferred income balance was $1.17 billion, and YoY+135.6%, charged part of the autumn semester fees in advance for small classes and online schools.

2. The number of applicants for long-term regular price courses reached 5.63 million, with an increase of 65%, of which online schools exceeded 2.9 million, with an increase of 116%. Offline outlets suspended expansion, and online school income accounted for 26%, an increase of 87%. The number of applicants increased by 65%:The long-term full price of FY21Q2 is about 5.632 million, compared with 3.413 million in the same period last year, YoY+65%.

The offline center is affected by health events and will continue to expand faster in the future.By the end of FY21Q2, the company had opened a total of 936 teaching centers, an increase of 178 compared with the same period last year, including 716 excellent and small class learning centers, 91 Mobi and Lipu small class learning centers, and 129 Zhikang learning centers. By the end of FY21Q2, 91 cities (90 in China and 1 in the United States) were covered, an increase of 22 over the same period last year and 1 month-on-month increase (Xianyang).

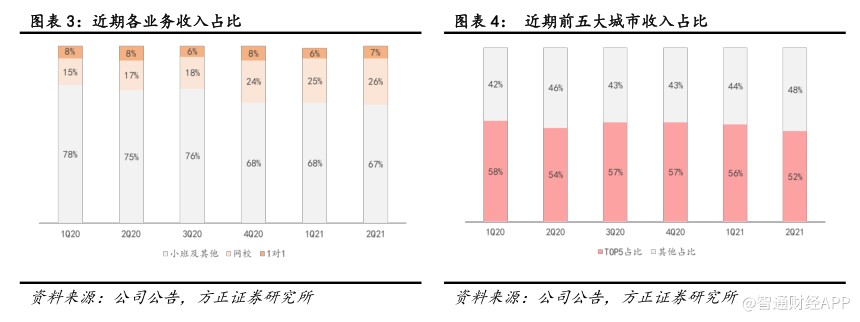

Sub-business situation:

(1) small class business and others:The share of income from FY21Q2 small classes and other businesses in total revenue fell from 75 per cent in the same period last year to 67 per cent this year, corresponding to income of about $740 million, YoY+8%/8% (in US dollars / RMB). Among them, the income of the small class accounts for 57% of the total income, and the corresponding income is about US $630 million, YoY+7%/7% (in US dollars / RMB). The ASPYoY-19%/-18%, of the small class FY21Q2 mainly due to online and offline integration during health events, long-term positive price class registration YoY+31%.

(2) 1-to-1 business:FY21Q2

1-to-1 business revenue accounts for about 7% of total revenue, corresponding to about US $77 million, YoY+6%/6% (in US dollars / RMB). 1 to 1 business ASPYoY+4%/4% (in US dollars / RMB).

(3) online school business:The proportion of FY21Q2 learning and thinking online school business in total revenue increased to 26% from 17% in the same period last year, corresponding to about US $290 million, YoY+87%/88% (in US dollars / RMB), and more than 2.9 million applicants for long-term positive price courses, YoY+116%,ASPYoY+1%/1% (in US dollars / RMB).

3. Profit forecast and valuation:In the short term, with the resumption of offline classes in primary and secondary schools in most parts of the country since September, we believe that the impact of health events on the company's offline training business may further fade, leading to a rebound in Q3 and Q4 revenue and profits. In the medium to long term, in terms of ① online, management mentioned in the earnings call that it would increase investment in "local online schools" (local content, local teachers, local students, local services). Considering the company's advantages in teacher supply, content research and development, brand influence, etc., we are optimistic about the development prospect of the company to maintain the leading position of online K12. ② offline, K12 training market during the health event to accelerate clearance, the future concentration will still be enhanced, good leader. According to consensus expectations, the company's FY2021-FY2023 net profit is US $3.16max 6.41 / 1.049 billion, EPS is US $0.53pm, and PE is 125.8max 62.0max 37.9X.

Risk Tips:公共卫生事件风险、课外培训政策趋严风险、学生人数增加不达预期风险、在线教育行业竞争加剧风险、实体中心扩张不及预期风险、汇率波动风险、市场竞争加剧风险、估值中枢下移风险等。