Core views

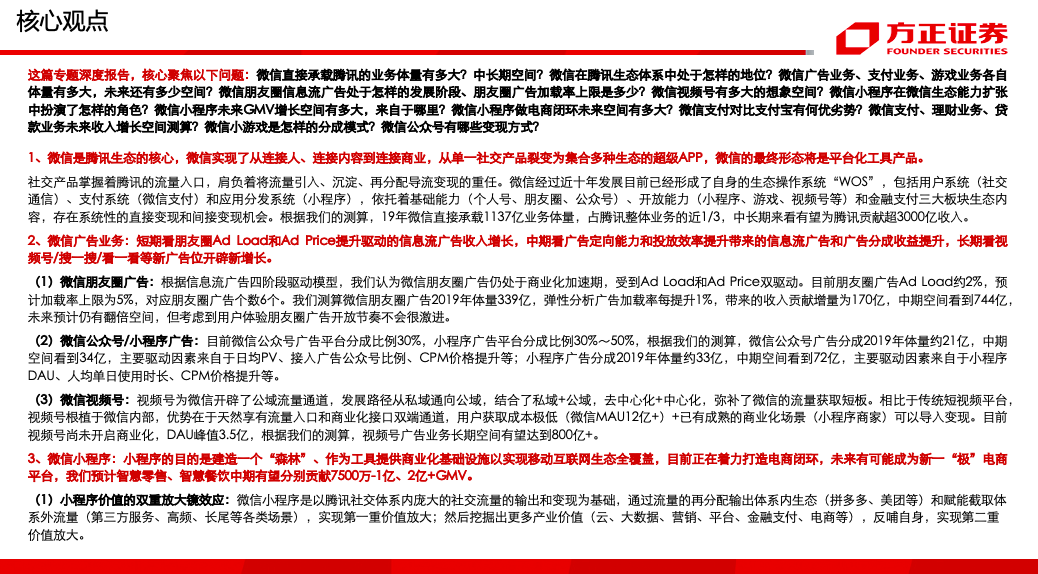

This in-depth special report focuses on the following questions: How big is the business volume that WeChat directly hosts Tencent (00700)? Medium to long term space? What is WeChat's position in the Tencent ecosystem? How big is the WeChat advertising business, payment business, and game business, and how much room is there in the future? What is the stage of development of WeChat friend zone streaming ads, and what is the maximum load rate for friend zone ads? How much room for imagination does the WeChat video account have? What role does the WeChat Mini Program play in expanding the capabilities of the WeChat ecosystem? How much room does the WeChat Mini Program have for GMV growth in the future, and where does it come from? How much room does the WeChat Mini Program have in the closed loop of e-commerce in the future? What are the advantages and disadvantages of WeChat Pay compared to Alipay? Estimation of future revenue growth space for WeChat Pay, financial management business, and loan business? What kind of division model is the WeChat Mini Game? What are the monetization methods for WeChat accounts?

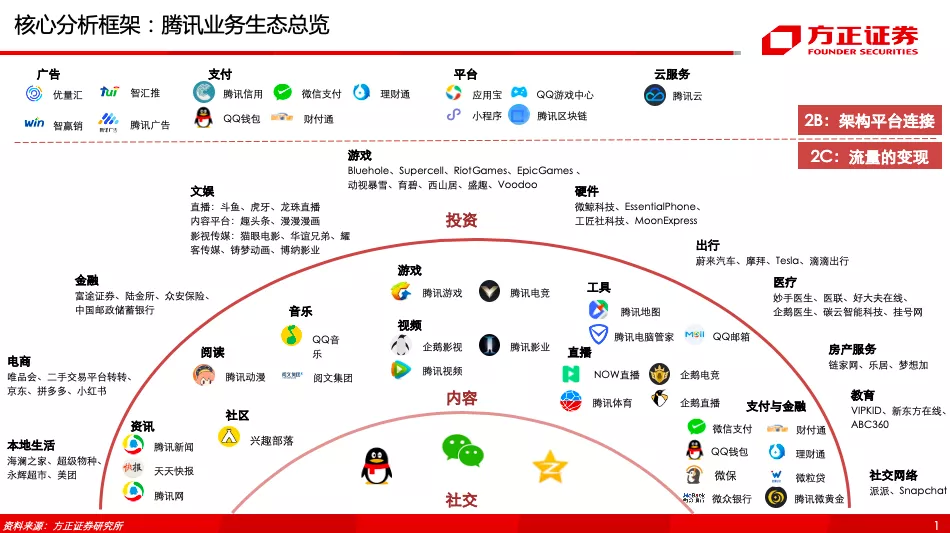

1. WeChat is the core of Tencent's ecosystem. WeChat has achieved the transformation from connecting people and content to connecting commerce, from a single social product to a super app that integrates various ecosystems. The final form of WeChat will be a platform-based tool product.

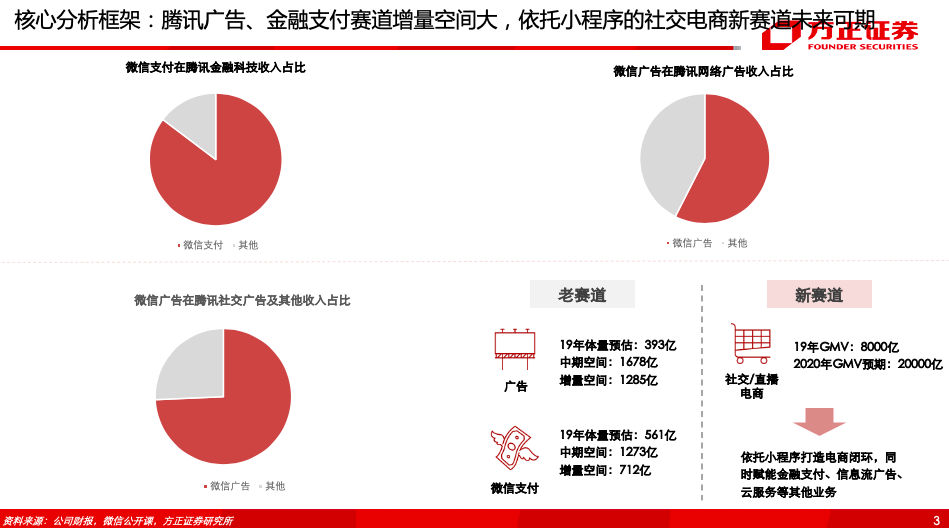

Social networking products control Tencent's traffic entry points and shoulder the heavy responsibility of introducing, storing, and redistributing traffic to divert and monetize. After nearly ten years of development, WeChat has now formed its own ecological operating system “WOS”, including user systems (social communication), payment systems (WeChat Pay), and application distribution systems (applets). Relying on basic capabilities (personal accounts, friend circles, public accounts), open capabilities (mini-programs, games, video numbers, etc.), and ecological content in the financial payment sector, there are systematic direct monetization and indirect monetization opportunities. According to our estimates, in 2019, WeChat directly carried a business volume of 113.7 billion dollars, accounting for nearly 1/3 of Tencent's overall business. It is expected to contribute more than 300 billion dollars in revenue to Tencent in the medium to long term.

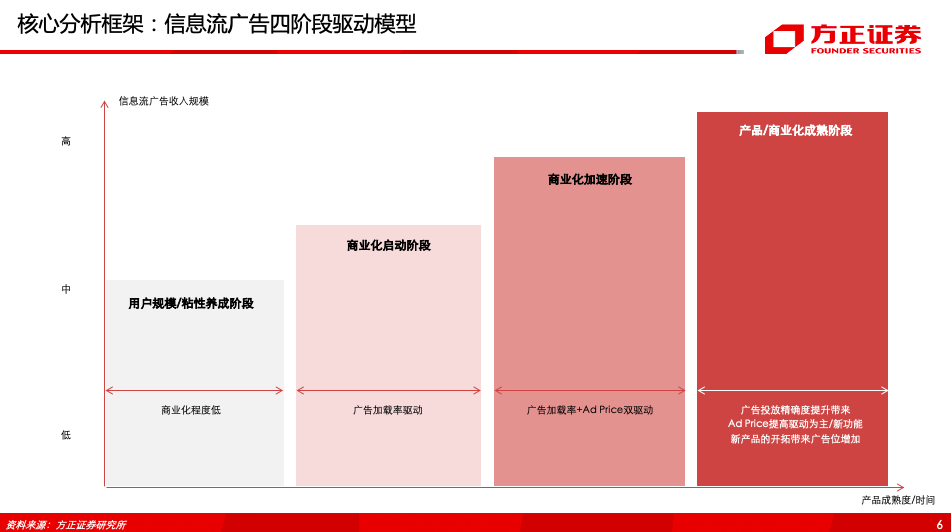

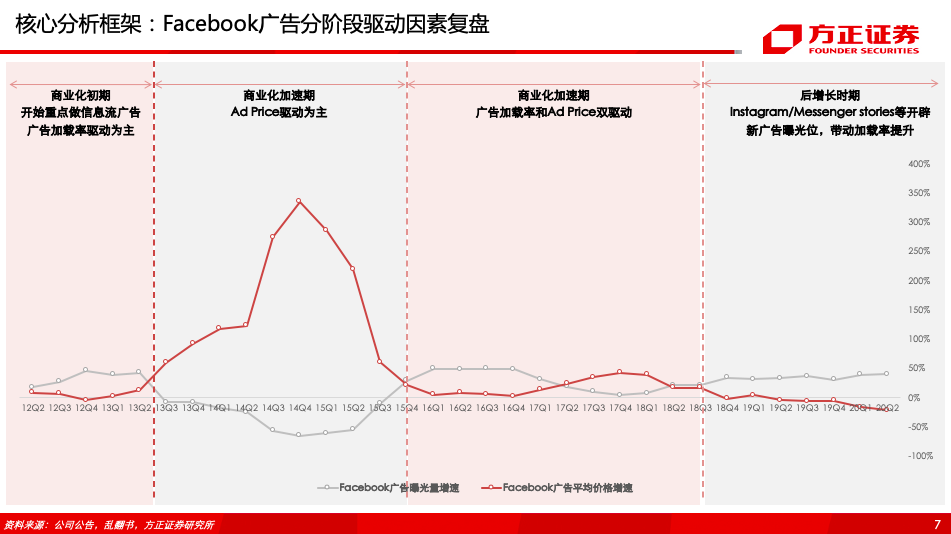

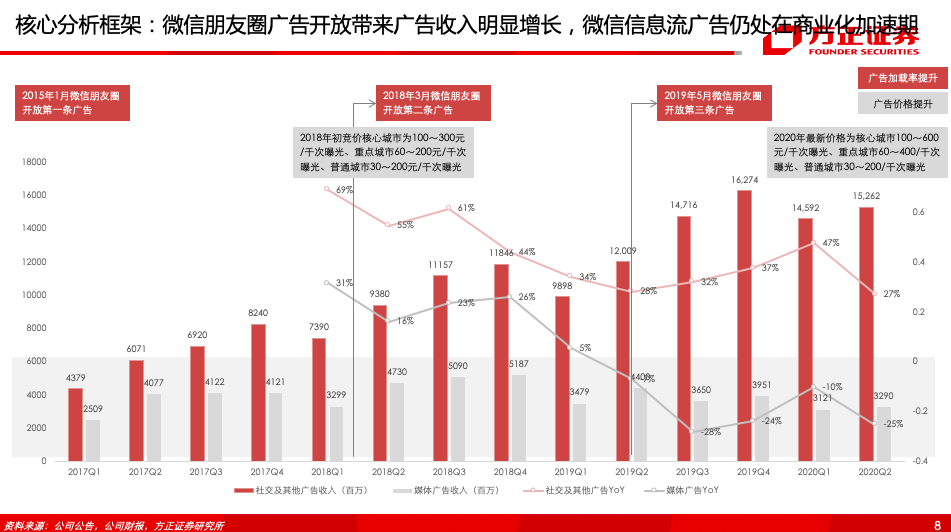

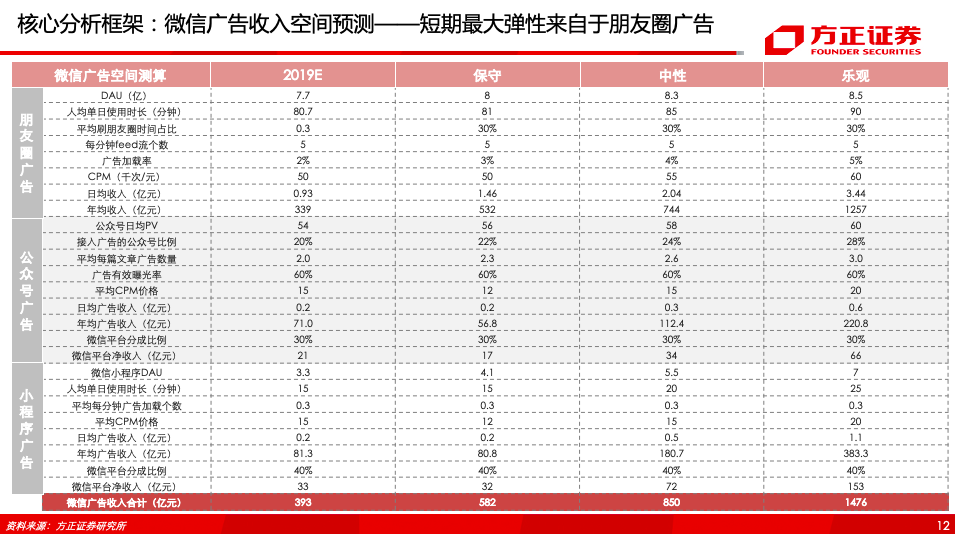

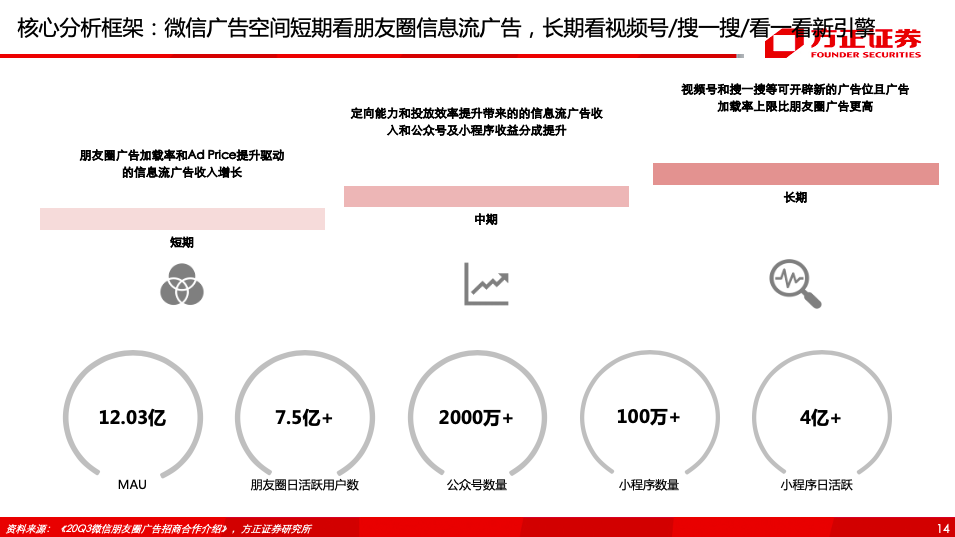

2. WeChat advertising business: In the short term, the increase in information flow advertising revenue driven by the increase in ad load and ad price in the circle of friends; in the medium term, the increase in information flow advertising and ad sharing revenue brought about by the improvement in ad targeting ability and delivery efficiency; and in the long term, new ad slots such as watching video accounts/search/watching have opened up new growth.

2. WeChat advertising business: In the short term, the increase in information flow advertising revenue driven by the increase in ad load and ad price in the circle of friends; in the medium term, the increase in information flow advertising and ad sharing revenue brought about by the improvement in ad targeting ability and delivery efficiency; and in the long term, new ad slots such as watching video accounts/search/watching have opened up new growth.

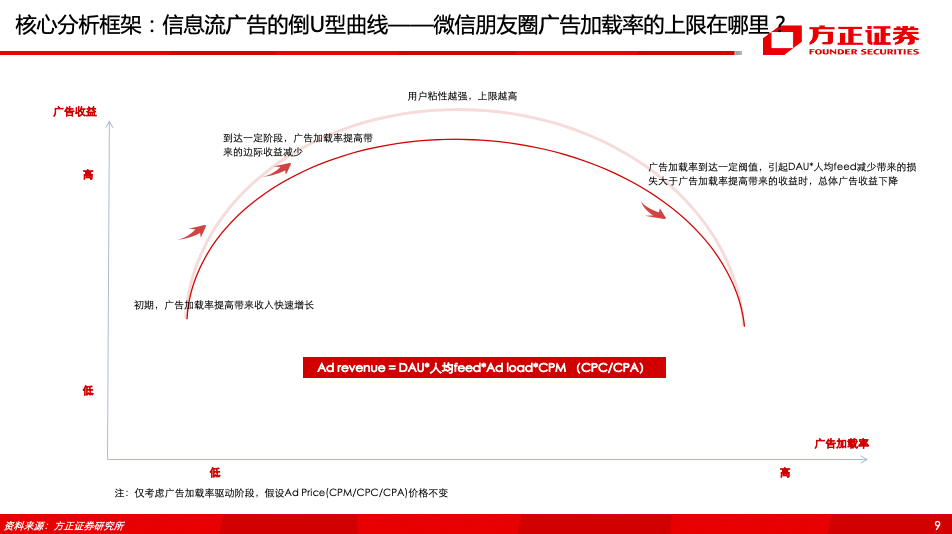

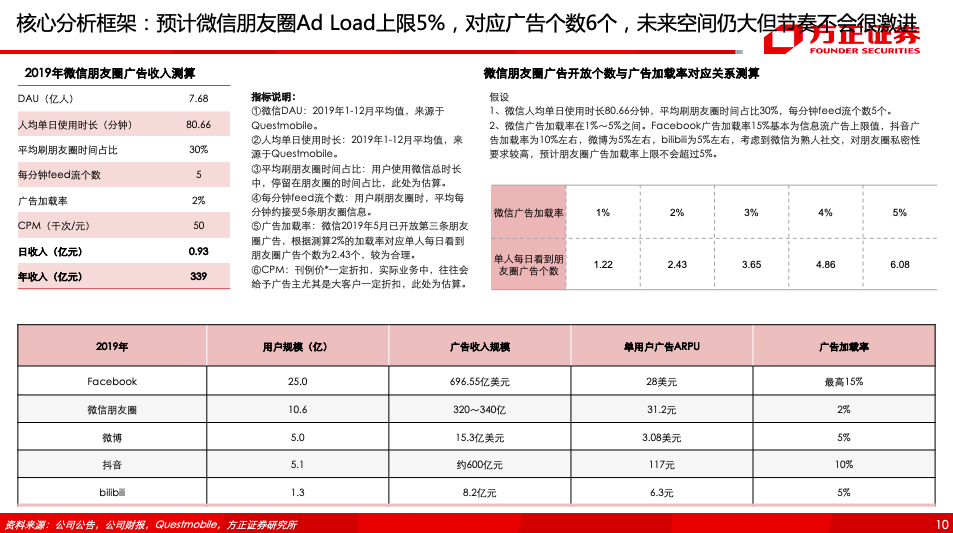

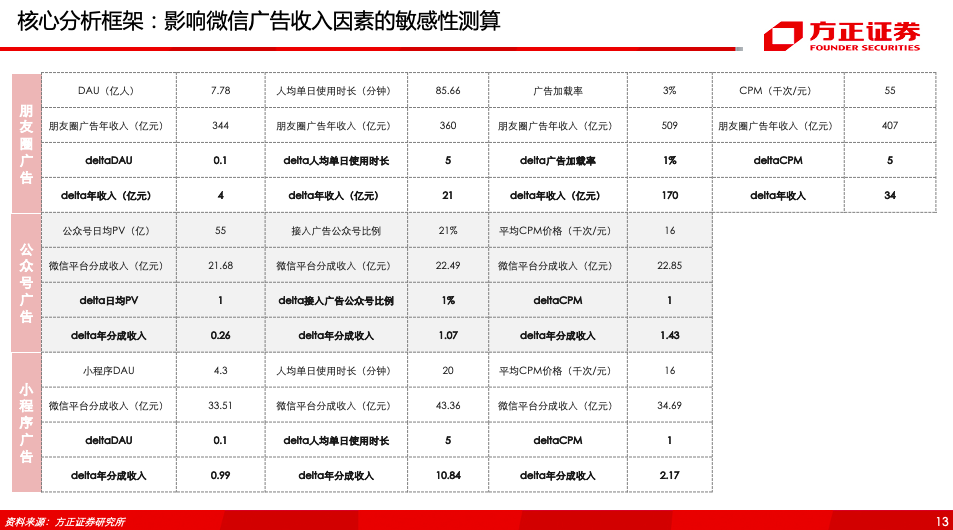

(1) WeChat friend zone advertising: According to the four-stage driving model of information flow advertising, we believe that WeChat friend zone advertising is still in a period of acceleration of commercialization, driven by both Ad Load and Ad Price. Currently, the Ad Load for Circle of Friends ads is about 2%. The estimated maximum load rate is 5%, corresponding to 6 friend zone ads. We estimate that the volume of WeChat friend zone ads in 2019 was 33.9 billion. For every 1% increase in the ad load rate of flexible analysis, the revenue contribution increased by 17 billion dollars. The medium term space saw 74.4 billion dollars. It is expected that there is still room for doubling in the future, but considering the user experience, the pace of opening up friend zone ads will not be very aggressive.

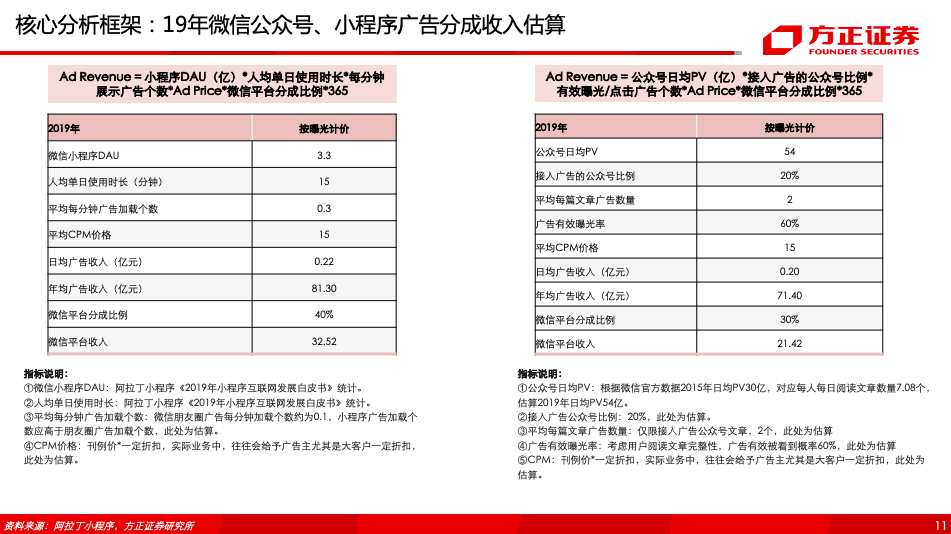

(2) WeChat account/applet advertising: Currently, the WeChat public account advertising platform share ratio is 30%, and the applet advertising platform share ratio is 30% to 50%. According to our estimates, the WeChat public account advertising volume was about 2.1 billion in 2019, and the medium term space saw 3.4 billion. The main driving factors came from the average daily PV, access advertising ratio, CPM price increase, etc.; the main driving factors came from the average daily PV, access advertising ratio, CPM price increase, etc.; the main driving factors came from applet DAU, per capita daily usage time, CPM price increases, etc.

(3) WeChat video account: The video account has opened up a public domain traffic channel for WeChat. The development path leads from private domain to public domain. It combines private domain+public domain, decentralization+centralization, and makes up for WeChat's shortcomings in traffic acquisition. Compared to traditional short video platforms, video accounts are rooted within WeChat. The advantage is that they naturally enjoy both traffic entry and commercial interface channels. User acquisition costs are extremely low (WeChat MAU 1.2 billion +) + and mature commercialization scenarios (applet merchants) can be imported and monetized. Currently, commercialization of video accounts has not yet begun. The DAU peak is 350 million. According to our estimates, the long-term space for the video channel advertising business is expected to reach 80 billion billion+.

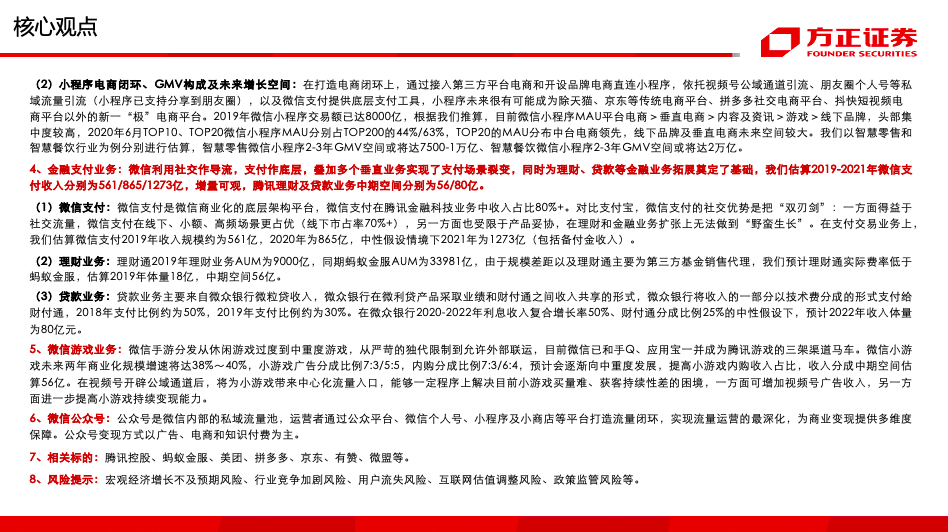

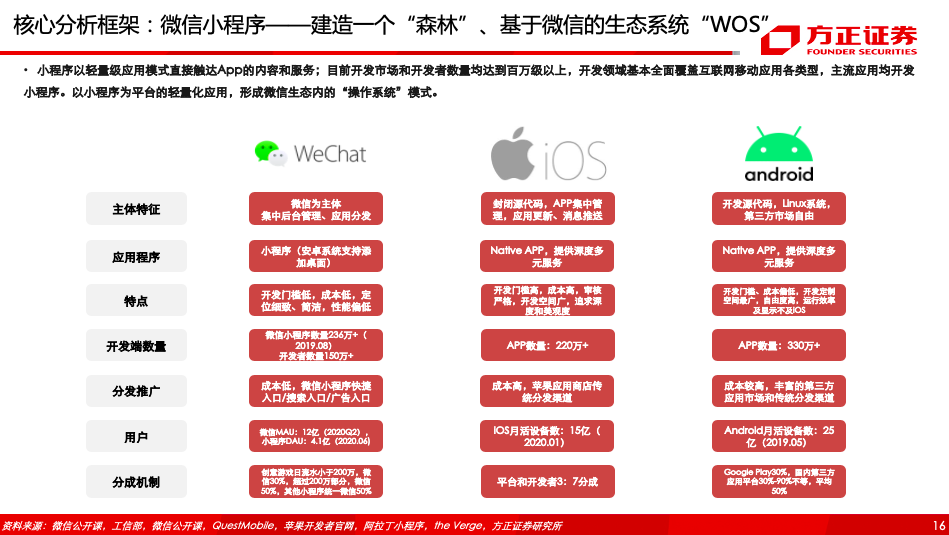

3. WeChat Mini Program: The purpose of the applet is to build a “forest” and provide commercial infrastructure as a tool to achieve full coverage of the mobile Internet ecosystem. Currently, efforts are being made to build a closed loop of e-commerce, and may become a new “extreme” e-commerce platform in the future. We expect smart retail and smart catering to contribute 75 million to 100 million and 200 million + GMV respectively in the medium term.

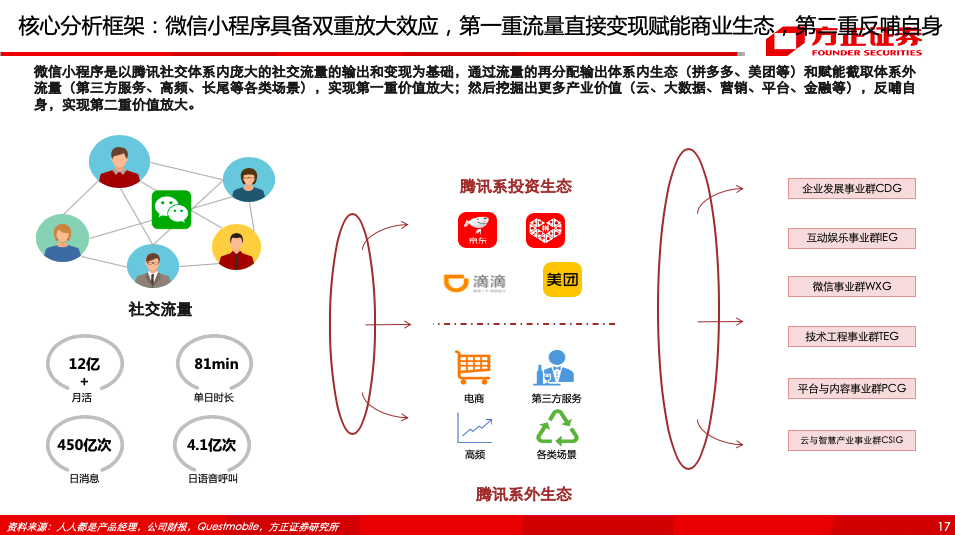

(1) The double magnifying effect of the applet value: The WeChat applet is based on the output and monetization of the huge volume of social communication within Tencent's social networking system. Through the redistribution of traffic, the ecosystem within the system (Pinduoduo, Meituan, etc.) and the ability to intercept traffic outside the system (various scenarios such as third party services, high frequency, long tail, etc.), it then explores more industrial value (cloud, big data, marketing, platforms, financial payments, e-commerce, etc.) to feed itself back and achieve second value amplification.

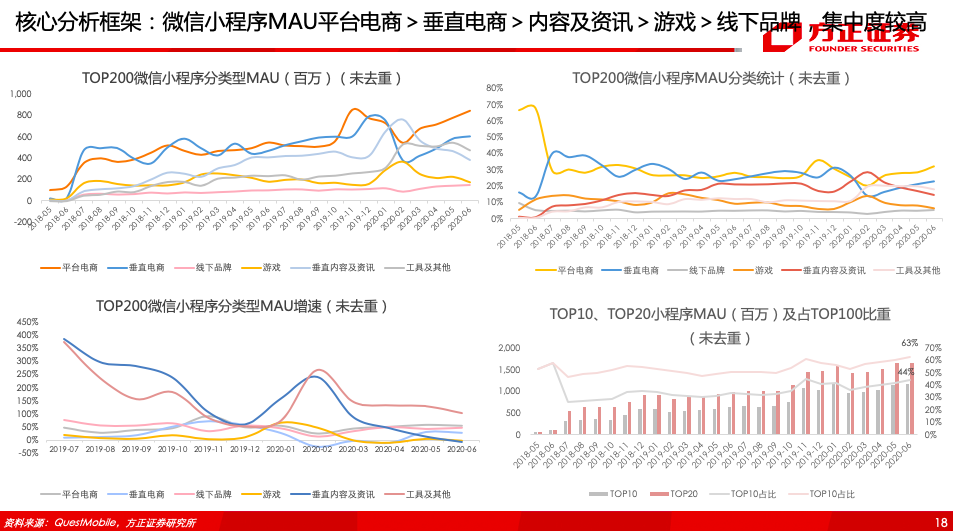

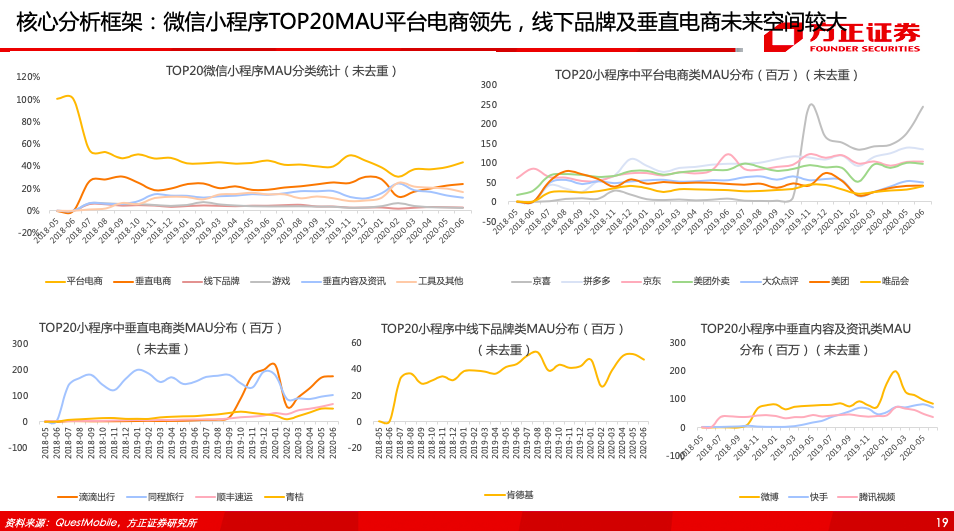

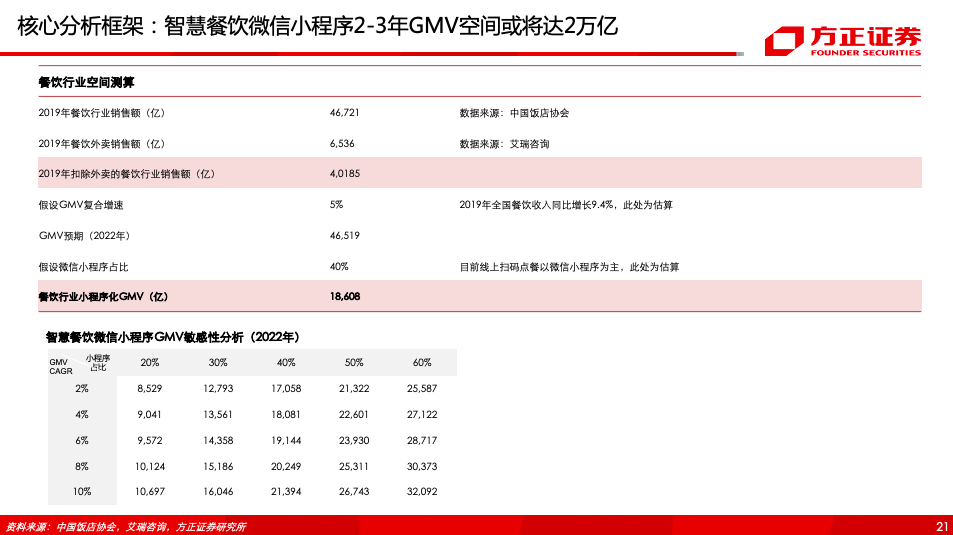

(2) Mini program e-commerce closed loop, GMV structure and future growth space: In creating a closed loop of e-commerce, by connecting to a third-party platform for e-commerce and opening a direct branded e-commerce applet, relying on the streaming of public channels such as video accounts, the circle of friends, personal accounts, etc. (the applet already supports sharing to the circle of friends), and WeChat Pay to provide low-level payment tools, the applet is likely to become a new “extreme” e-commerce platform other than traditional e-commerce platforms such as Tmall and Jingdong, Pinduoduo social e-commerce platforms, and quick and short video e-commerce platforms. In 2019, the transaction volume of the WeChat Mini Program reached 800 billion dollars. According to our estimates, at present, the WeChat Mini Program MAU platform e-commerce > vertical e-commerce > content and information > game > offline brands has a high concentration of leaders. In June 2020, the TOP10 and TOP20 WeChat Mini Program MAU accounted for 44%/63% of the TOP200 respectively. The MAU distribution of TOP20 is leading Taiwan e-commerce, and there is a lot of room for offline brands and vertical e-commerce in the future. Using the smart retail industry and the smart catering industry as examples, we separately estimated that the GMV space for the smart retail WeChat applet may reach 7,500-1 trillion in 2-3 years, and the GMV space for the smart catering WeChat applet may reach 2 trillion in 2-3 years.

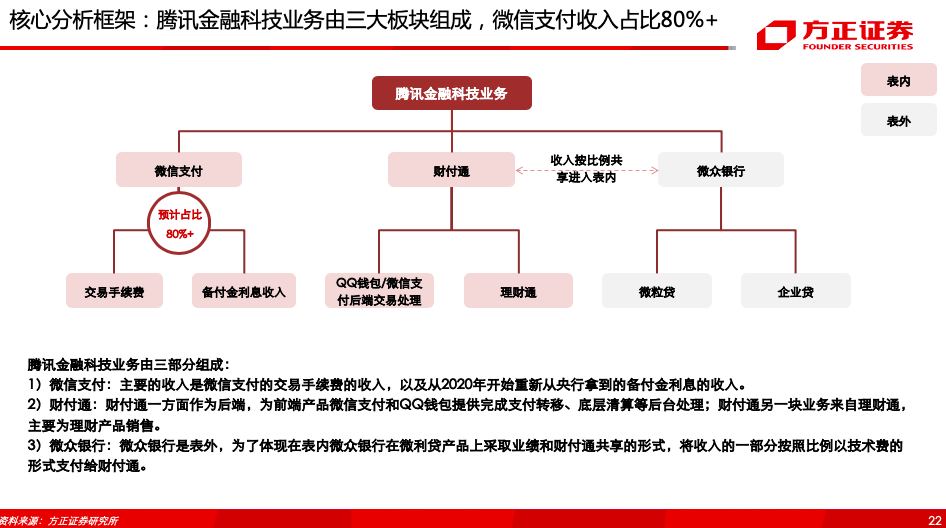

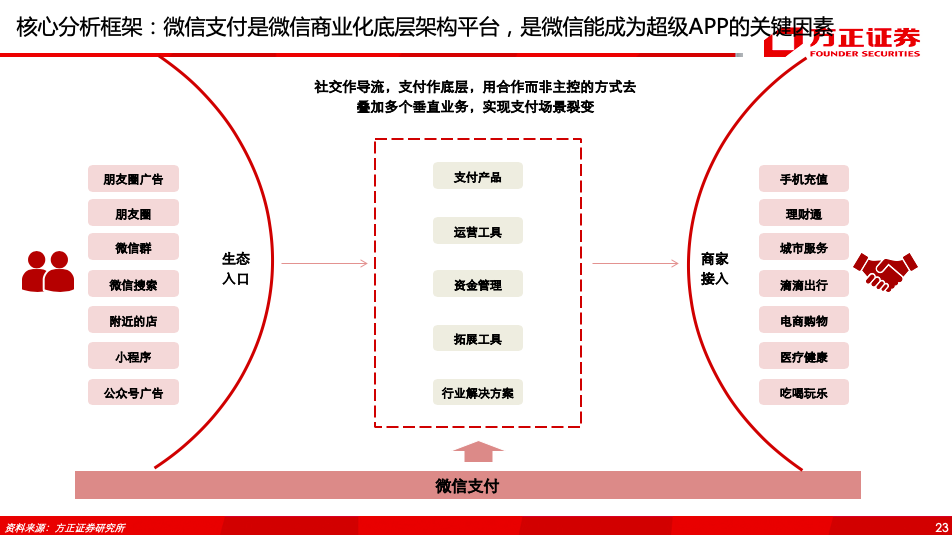

4. Financial payment business: WeChat uses social media as a guide, payment as the bottom layer, and superimposition of multiple vertical businesses to achieve a fission in the payment scenario, while also laying the foundation for financial business expansion such as financial management and loans. We estimate that WeChat Pay revenue in 2019-2021 was 561/865/127.3 billion, respectively, with a considerable increase. The medium term space for Tencent's financial management and loan business was 56/8 billion, respectively.

(1) WeChat Pay: WeChat Pay is the underlying architecture platform for WeChat commercialization. WeChat Pay accounts for 80% + of revenue in Tencent's fintech business. Compared to Alipay, the social advantage of WeChat Pay is a “double-edged sword”: on the one hand, thanks to the volume of social communication, WeChat Pay has an advantage in offline, small-amount, and high-frequency scenarios (offline market share 70% +), and on the other hand, it is also limited by product compromises, and cannot achieve “barbaric growth” in financial management and financial business expansion. In the payment transaction business, we estimate that WeChat Pay's revenue in 2019 was about 56.1 billion, 2020 was 86.5 billion, and under a neutral scenario, was 127.3 billion in 2021 (including reserve revenue).

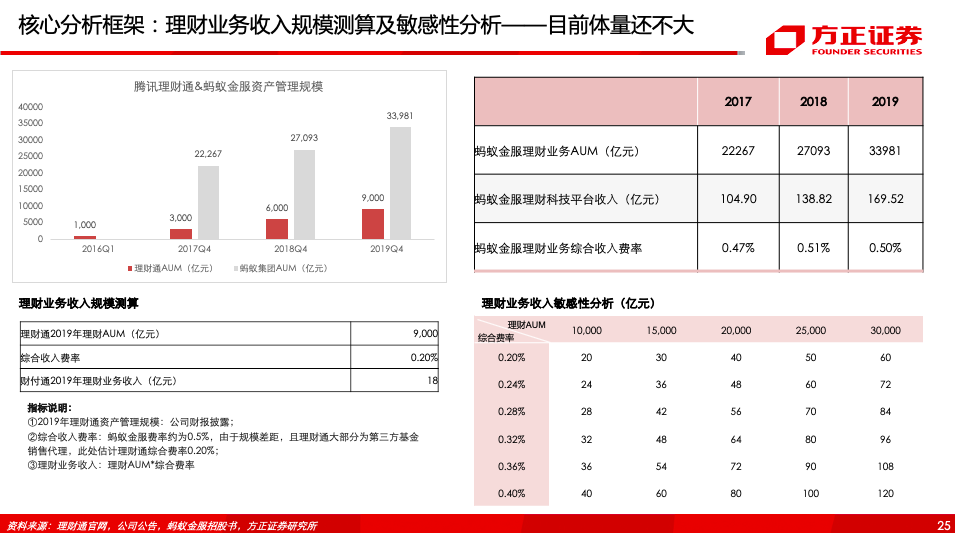

(2) Wealth management business: Wealth Connect's financial management business AUM in 2019 was 900 billion yuan, and Ant Financial's AUM for the same period was 339.81 billion. Due to the size gap and Wealth Connect being mainly a third-party fund sales agent, we expect Wealth Connect's actual fee rate to be lower than Ant Financial's actual fees, with an estimated volume of 1.8 billion in 2019 and 5.6 billion in the medium term.

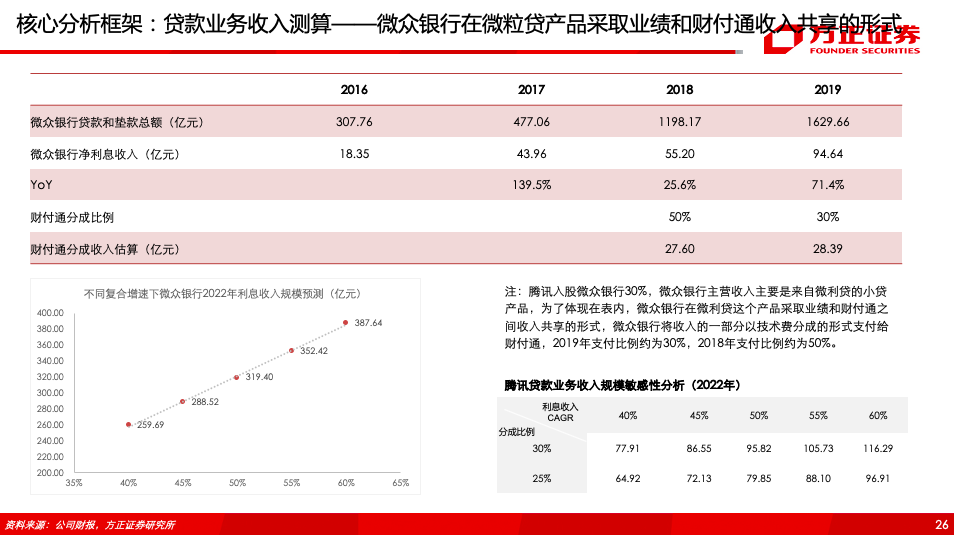

(3) Loan business: The loan business mainly comes from WeChat's microfinance income. WeBank's low-profit loan products take the form of revenue sharing between performance and Tenpay. WeBank pays a portion of the revenue to Tenpay Connect in the form of a share of technical fees. The payment ratio in 2018 was about 50%, and the payment ratio in 2019 was about 30%. Under the neutral assumption that WeBank has a compound interest income growth rate of 50% in 2020-2022 and a 25% share ratio of WePay Connect, the revenue volume is expected to be 8 billion yuan in 2022.

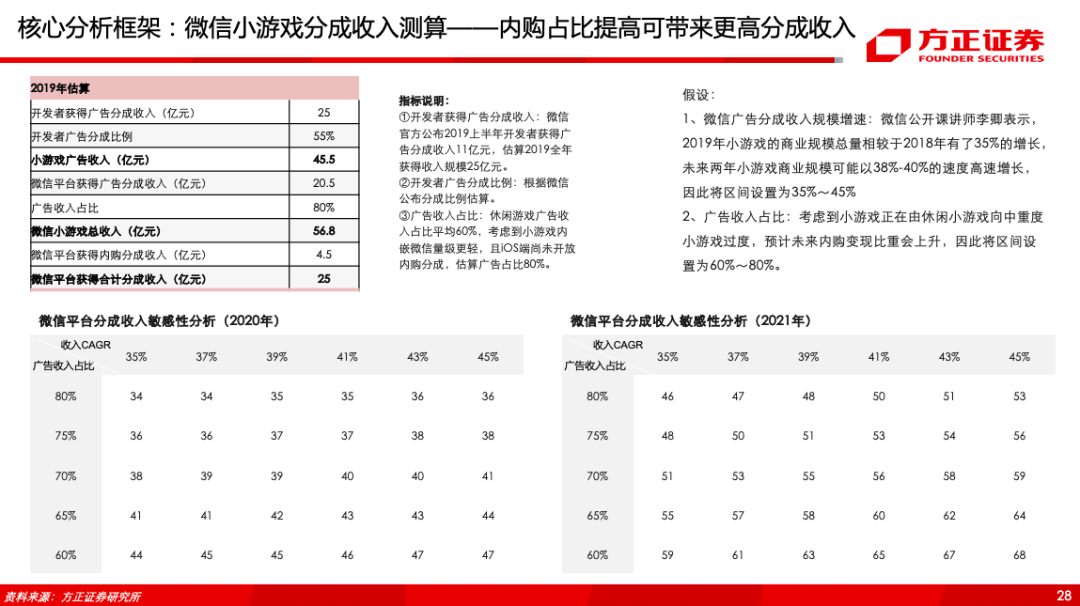

5. WeChat game business:WeChat mobile game distribution has ranged from casual games to medium to heavy games, and from strict exclusive restrictions to permitting external transportation. Currently, WeChat has become the three channel carriages for Tencent games along with Mobile Q and AppBao. The commercial scale growth rate of WeChat games will reach 38% to 40% in the next two years. The advertising ratio for small games is 7:3/5:5, and the internal purchase share ratio is 7:3/6:4. It is expected that it will gradually develop to a medium to heavy level, increasing the share of in-app purchase revenue for small games. The revenue share is estimated at 5.6 billion in the medium term. After the video channel opens up a public domain channel, it will bring a centralized traffic portal to small games, and can resolve the current difficulties of small game purchase volume and poor customer acquisition sustainability in certain procedures. On the one hand, it can increase video channel advertising revenue, and on the other hand, further improve the ability of small games to continuously monetize.

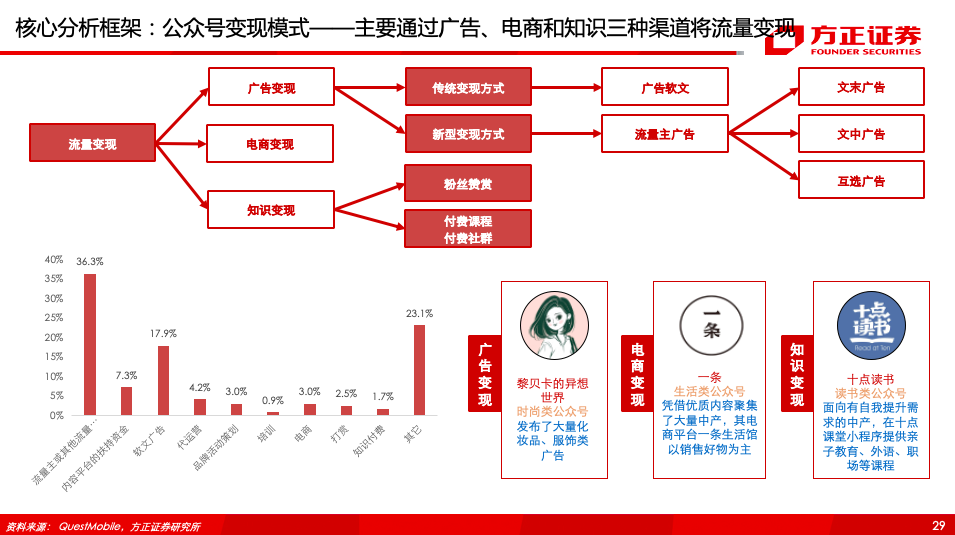

6. WeChat public account:A public account is a private traffic pool within WeChat. Operators create a closed loop of traffic through platforms such as public platforms, WeChat personal accounts, mini-programs, and small stores to maximize traffic operations and provide multi-dimensional guarantees for commercial monetization. Public account monetization methods are mainly advertising, e-commerce, and knowledge payments.

7. Relevant targets:Tencent Holdings, Ant Financial, Meituan (03690), Pinduoduo (PDD.US), JD (09618), Youzan (08083), WeChat (02013), etc.

8. Risk warning:Macroeconomic growth falls short of expectations, risk of increased industry competition, risk of loss of users, risk of Internet valuation adjustments, risk of policy regulation, etc.

Report text

(2)微信公众号/小程序广告:目前微信公众号广告平台分成比例30%,小程序广告平台分成比例30%~50%,根据我们的测算,微信公众号广告分成2019年体量约21亿,中期空间看到34亿,主要驱动因素来自于日均PV、接入广告公众号比例、CPM价格提升等;小程序广告分成2019年体量约33亿,中期空间看到72亿,主要驱动因素来自于小程序DAU、人均单日使用时长、CPM价格提升等。

(2)微信公众号/小程序广告:目前微信公众号广告平台分成比例30%,小程序广告平台分成比例30%~50%,根据我们的测算,微信公众号广告分成2019年体量约21亿,中期空间看到34亿,主要驱动因素来自于日均PV、接入广告公众号比例、CPM价格提升等;小程序广告分成2019年体量约33亿,中期空间看到72亿,主要驱动因素来自于小程序DAU、人均单日使用时长、CPM价格提升等。