There are only 20 days left until the November 3 general election. How to interpret the second half of the “October surprise” before the election and influence global financial markets is a recent focus of attention.

Looking Back: The “October Surprise” of Every Election Year

Historically, the “October Surprise” effect was indeed remarkable. Taking the 1992-2016 election year of seven general election years as an example, the seven-year monthly average of the CBOE Volatility Index had a significant “October surprise” effect, and there would be ripples in November-December after that. This also caused market volatility to be significantly higher throughout the year in the fourth quarter of the election year. As far as 2020 is concerned, the public health incident became a hot topic in the 2020 US election. In the first half of the “October surprise”, one of the candidates for the US election, incumbent Republican President Trump, experienced a “diagnosis - medical treatment - rapid recovery” process, which brought significant fluctuations to global financial markets; in the next 20 days, how will the second half of the “October surprise” be interpreted and what new impact it will bring to the global market is the main focus of market attention.

Looking ahead: The “October surprise” of the 2020 election year

Looking ahead: The “October surprise” of the 2020 election year

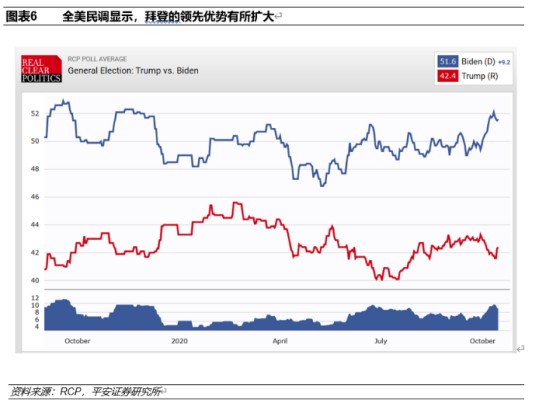

The 2020 election is bound to be the “most special one” of all US elections. As far as polls are concerned, Biden once again took advantage in October. Whether in national polls or key state polls, Biden is in a leading position, and the lead is quite obvious. In addition to polls, judging from the recent performance of financial markets and gaming data, the market's bets on Biden's victory are beginning to show. However, as the incumbent president, although Trump is lagging behind in the election, there is no hope of a reversal. The fluctuations in the second half of the “October surprise” may be significantly stronger than in the first half.

Global Financial Market “Vision”: Increased Volatility Is Unavoidable

Looking at the medium to long term, the volatility of global financial markets, including the foreign exchange market, bond market, stock market, and commodities, will increase. There are two major factors behind this: first, no matter who takes office in this general election, may cause the volatility of global financial markets to soar; second, the Federal Reserve's new monetary policy framework may also lead to an increase in the volatility of the US financial market over the next few years.

Exploring the “Close View” of the US Financial Market

Looking at the short term, in the second half of October, the US dollar index fluctuated in the 91-95 range, but after entering November, the US dollar index may break through the range, but there are large variables in the direction; potential downside risks for US stocks are accumulating; US bond yields will remain low, which will provide a relatively relaxed international financial environment. The US election is still in turmoil, and the financial markets are preparing for a change of pace!

1 Looking back: The “October Surprise” of every election year

There are only about three weeks left until the US election on November 3, 2020, and the two presidential candidates are also making their final sprint. In the final sprint stage of the general election, the two candidates and their campaign teams often adopt a final winning or reversal strategy in response to election trends, in order to achieve the goal of establishing a win or reversing the election situation. Since this type of “ace strategy” is both unexpected and explosive, while attracting voters' attention, it also brings significant fluctuations to the market, and is known as the “October surprise.”

Historically, the “October Surprise” effect was indeed remarkable. Taking 1992-2016 as an example of the seven US election years, the monthly average of the CBOE Volatility Index showed a significant “October surprise” effect. The level of market volatility in October was significantly higher than in other months, and November, the election month, had the second highest volatility, and December, when voters voted, ranked third. As can be seen, the “October surprise” not only exists, but it will also cause ripples in November-December after that. This also causes market volatility in the fourth quarter of the presidential election year to be significantly higher during the four quarters of the year.

Comparing the monthly average of the CBOE Volatility Index for previous election years, it can be seen that the month with the highest market volatility in election years was not always October. Of the past seven election years, only 1992 and 2008/10 had the second-highest volatility of that year, and were not much different from the highest level. However, if you compare it with September, you can see that with the exception of 1996/10, where the volatility was slightly lower than September, the market volatility in October of all other election years was significantly higher than in September; compared to November, there was not much difference. In 3 of the 7 election years, the volatility in October was greater than in November, and the other four were more volatile in November. As can be seen, the impact of the “October surprise” on the market is likely to continue until election month.

Also,The US election year is also often a year of major changes in the global economy and financial markets. 1992 was a year of alternation between the economic crisis in the early 1990s and the new economic cycle; 2000 was the prelude to the bursting of the “Science Network bubble”; 2008 was the first global financial crisis second only to the “Great Depression”; 2012 was a year in which the European debt crisis deepened; and 2016 was the beginning of changes in the global political and economic environment.

In 2020, the health incident brought about the biggest shock wave. Beginning with the outbreak at the beginning of the year, it became a core variable in global financial markets. At one point, it triggered a major collapse in the global financial market in March, followed by the Federal Reserve's historic monetary easing, and the global economy also experienced the twists and turns of “closure — liberalization — tightening again.” In a context where vaccines and specific drugs have not yet achieved large-scale effective coverage, the current impact of health incidents is still fermenting. This has also led to health incidents becoming a hot topic in the 2020 US election. In the first half of the “October surprise”, one of the candidates for the US election, incumbent Republican President Trump, experienced a “diagnosis - medical treatment - rapid recovery” process, which brought significant fluctuations to global financial markets; in the next 20 days, how the “October surprise” will be interpreted and what new impact it will bring to the global market is the focus of market attention.

2. Looking ahead: The “October surprise” of the 2020 election year

The 2020 US presidential election is bound to be the “most special one” of all US elections, and the health incident that broke out in 2020 added a strange atmosphere and turbulent topics to this election.

According to polls, Biden once again took advantage of Trump's lead in October, which is basically the same as how Hillary was ahead of Trump in the same period in 2016. Since the 2016 election has already verified that under the electoral college system, an overall vote advantage does not mean final victory in the election; the vote flow in key swing states such as Pennsylvania, Michigan, Florida, Iowa, Wisconsin, and Ohio is even more critical. Judging from poll data from various states, with the exception of Florida, Iowa, and Ohio, where the polls for the two candidates were basically equal, Biden was in the lead in the polls in the other three key states, and the lead was higher than 5 percentage points. Therefore, judging from the polls, whether in national polls or key state polls, Biden is in a leading position, and the lead is quite obvious.

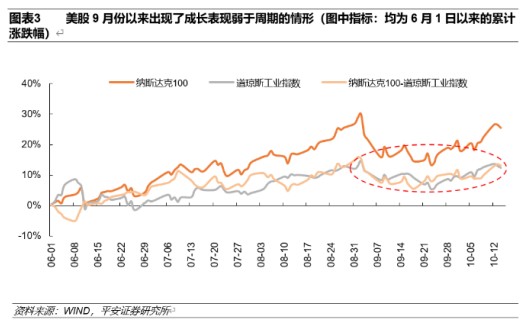

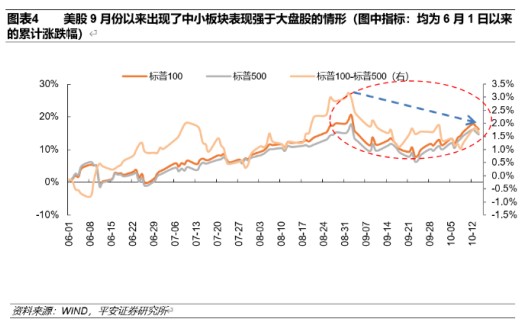

In addition to polls, judging from the recent performance of financial markets and gaming data, the market's bets on Biden's victory are beginning to show. As can be clearly seen from market trends since September, the rise in US stocks has changed from starring growth sectors such as technology listed on the NASDAQ to a more balanced rise. The performance of cyclical stocks has gradually caught up with growth, and the attention that small and medium capitalization stocks have received has also gradually overtaken large-cap stocks. This is called the “Blue Wave” in the international market, which is a reflection of expectations of technology leaders and industry oligarchs being taxed and split in anticipation of Biden's victory in the election. Looking at the bond market, 10-year US bond yields have risen recently, which also shows the market's bets on Biden after winning the election.

As far as the financial market is concerned, although Trump's rapid recovery after being diagnosed and seeking medical treatment brought significant fluctuations, the rebound in the US dollar index and the strong rise in global stock markets showed that the market did not change its betting behavior on Biden because of Trump's illness and recovery in October, and even increased bets on Biden's victory in the election.

However, Trump will still be sprinting over the next few months, as can be seen from his quick return to the campaign.As the incumbent president, although Trump is lagging behind in the election, there is no possibility of a reversal of the game.First, since Clinton took office in 1992, there has been no record of a failed re-election of an incumbent president. Whether it was George W. Bush of the Republican Party, or Clinton and Obama of the Democratic Party, were successfully re-elected; secondly, as the incumbent president, Trump, although further fiscal stimulus plans were blocked by the House of Representatives controlled by the Democratic Party, still has the initiative in temporary domestic policy and foreign strategy. Recently, its rhetoric about ever-changing fiscal plans and the legal “intimidation” of some senior members of the Democratic Party are examples. Again, although Biden relied on calm and rational expression to win the favor of more middle voters in the first round of debates, superior to Trump's excessive sentiments and frequent interjections, the results of the first round were not decisive in the three rounds of debates in previous elections. There are many examples where he won the first round of debate and lost in the last two rounds of debate. Considering that the second round of debate has been cancelled, the third round to be held in Nashville on October 22 will be critical. Whether Biden can continue to suppress Trump's outstanding performance in this round of debate is uncertain; it's not as simple as “winning without making mistakes.” If Biden performs below expectations or the election falls short of expectations, the fluctuations in the second half of the “October Surprise” will surely be significantly stronger than in the first half.

There are special circumstances that are also worth being wary of. The 2020 general election was affected by health incidents, and it is expected that most of the ballots will be delivered by mail. This has led to the problem that the voting cycle is too long and the counting process is slow. Moreover, since there is a precedent when Kennedy competed with Nixon in the election, mail-in ballots are also likely to be questioned (Trump's frequent accusations of mail-in voting and the “urgent” appointment of Supreme Court justices have shown signs of malaise).Once questions about mail-in ballots occur, it will cause greater fluctuations in the market than the “October surprise” in the past.

In addition to the presidential election, the US two-session election also deserves attention. If the party where the winner of the general election is in line with the dominant party in both houses of Congress, similar to Trump's pattern after the 2016 election, then no matter who is elected, the resistance to implementing new laws or fiscal plans within the US will drop significantly; and once the party where the winner of the election is in conflict with the party that has the advantage of both houses of Congress, then it will be difficult for the new president to implement the new plan within the US; if the two parties split into the two houses, the situation is somewhere between the above two. Although the efficiency of implementing the plan in the US will decrease, it will not be difficult for the new president to implement the plan in the US at any given time. Currently, the Democratic Party is fiercely competing for Senate seats in some swing states. If Biden wins the election and the Senate “turns blue” (that is, the Democratic Party takes the majority), then “Biden economics” will gradually move from the stage of heated discussion to the implementation stage, and some “signs” of the current shift in asset allocation of major asset classes will also take shape further.

3 Global Financial Market “Vision”: Increased Volatility Is Unavoidable

First, no matter who comes to power between the two candidates, Trump and Biden, could cause the volatility of global financial markets to soar.If Trump is re-elected, domestic and foreign policies may become more aggressive, leading to continued chaos in the international and US domestic political and economic situations. Internally, the game between the two parties will continue unabated, and the polarization between ethnic, rich and poor social classes will also become more serious. Both fiscal and trade deficits will continue to soar, ultimately putting further pressure on the US financial credit system. Externally, Trump's tough foreign policy will lead to further damage to the international governance system and rule framework, which will inevitably bring greater volatility to global financial markets.

If Biden wins the election, although his domestic and foreign policies may be more relaxed and frame-oriented than Trump's, the trend he has always advocated to raise taxes on the rich, as well as the monopoly investigation and split of large technology companies, will inevitably be bad for US stocks.It should be said that the trade-off currently prevailing in US stocks may be like this: once Biden is elected, although taxes on the rich will be raised, environmental spending will also increase; although it will “hit” large technology companies led by FAAMNG, it will actually greatly reduce uncertainty (and this is what the market fears the most). But if this trade-off is “wishful thinking,” the volatility of global financial markets will surely increase dramatically.

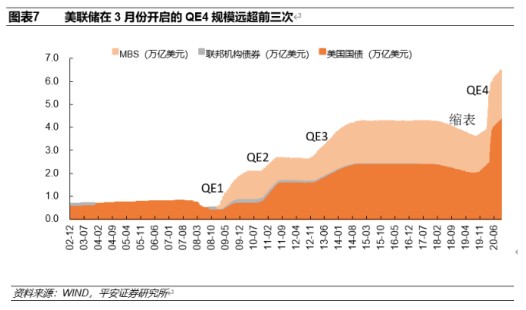

Second, the Federal Reserve's new monetary policy framework may also lead to an increase in the volatility of the US financial market in the future.One potential risk that the Federal Reserve's new monetary policy framework may face is how to deal with a situation where inflation starts to rise and the unemployment rate is still high, which is what we know as “stagflation.” Interestingly, this is also a major attack on modern monetary theory (MMT).

Looking at it now, the impact of the health incident on consumer and investment confidence is profound. The recovery of the US job market is bound to be a slow process; while the anti-globalization, autonomous and controllable trend may boost the prospects for medium- to long-term inflation. The base effect and the prospects for medium- to short-term inflation brought about by the slow recovery of health incidents in major exporting countries seem impossible to categorically rule out (although Tianliang monetary easing has been slow, inflation has been slow to arrive, which is also an unsolved mystery plaguing central banks in Western developed economies). Once it enters a “stagnant rise” situation, according to the setting of the Federal Reserve's new monetary policy framework, the high unemployment rate determines the direction of the Fed's monetary easing, and this may stimulate inflation to continue to rise, rising from a position slightly above the target level to a higher level. This may eventually require another Volck-style “iron fist” interest rate hike strategy to curb inflation. With the implementation of the Federal Reserve's new monetary policy framework, in a context where the benefits brought about by inertial easing and concerns about new problems brought about by the new framework are intertwined, investors' expectations for the future may be confused. The probability that the volatility of global financial markets will soar cannot be underestimated.

4 The “Close View” of the US Financial Market: Observing the Election Situation and Preparing for Change

$4.1: Sideways consolidation seeking a breakthrough

Since the US dollar index fell from a high of 103 at the end of March to 91 at the end of August, it has been in a sideways trend. It first rebounded slightly from the low of 91.7 at the end of August to 94.8 on September 25, then fell back to around 93. The oscillation range was (91,95).

We believe that as the US presidential election approaches, variables will increase and then decrease. This will cause the US dollar index to still wander within the (91,95) fluctuation range in the second half of October, but after entering November, the US dollar index may break through the previous sideways consolidation range, but there are still large variables in the direction. If Trump is re-elected, the US dollar index may usher in a wave of increases revised expectations, but it should be more difficult to break through 97; if Biden wins the election, the US dollar index may directly enter a long period of fluctuation and decline.

4.2 US stocks: downside risks are accumulating

After experiencing sharp fluctuations since the beginning of the year, US stocks have returned to a high level. There are three reasons: First, the restoration of the fundamentals of the US economy has yet to be falsified. In fact, during Trump's first term in office, the US economy was considered “outstanding” compared to other G7 economies; second, US technology companies represented by FAAMNG and the like still had very strong profit growth to support their high valuations. The impact of the health incident even strengthened this. Third, the Federal Reserve will still maintain extremely loose liquidity support.

However, as US stocks return to high levels, the potential risk of US stocks falling is accumulating. Regardless of the final outcome of the general election, high-tech giants represented by FAANMG will face the risk of antitrust investigations, and Biden has a strong tendency to raise taxes and split large companies. And the news from Europe on the other side of the ocean that the regulation of technology companies has been strengthened is also heart-wrenching. Even if US stocks have exclusive support from TINA (there is no alternative), there is still a potential risk of a sharp decline after significant weakness appears. As a result, although US stocks are still at a high level, the risk of falling is accumulating.

4.3 US debt: yield is difficult to rise

There is an explanation that the recent “rise” in US long-term bond yields may be the beginning of the upcoming large-scale sell-off of bonds.This is mainly based on the following two logics: first, once Biden is elected, the outlook for the US economy will be more clear; second, more fiscal stimulus will mean a greater supply of treasury bonds, causing US bond yields to rise. We think that's the statementIt's actually a bit exaggerated: First, on the economic side, although the US economy is recovering, the demand-side outlook is still weak due to excessive reliance on short-term bailout policies and the stagnation of a new round of fiscal stimulus plans; secondly, in the fourth quarter of this year, affected by health events and base effects, US inflation will continue to be low and will only rise in the first half of 2021; finally,Never forget that the Federal Reserve is the biggest “buyer” in the bond market.Until now, the Federal Reserve has been calling for monetary policy alone to be “too difficult to pay for,” and for faster and larger fiscal stimulus. We have reason to believe that the Federal Reserve will cooperate with the implementation of the US fiscal policy to the greatest extent possible, and there is no doubt about its ability and will to absorb the supply of additional US debt.

In the context of US bond yields remaining low, a high China-US dollar spread and a strong RMB exchange rate will make China's monetary policy space wider and more relaxed. This has created a more favorable external environment where China's monetary policy has returned to normalization over a period of time, with the main goal of supporting domestic economic construction and stabilizing the domestic financial environment.

To sum up: in the second half of October, the fluctuation range of the US dollar index will fluctuate in the 91-95 range, but after entering November, the US dollar index may seek a breakthrough, but there are large variables in the direction; the risk of a potential decline in US stocks is accumulating; US bond yields will remain low, which will provide China with a relatively relaxed international financial environment. The US election is still in turmoil, and the financial markets are preparing for a change of pace!

展望:2020大选年的「十月惊奇」

展望:2020大选年的「十月惊奇」