Key content

Panel prices are rising and are expected to be 2023Restore the balance between supply and demand every year

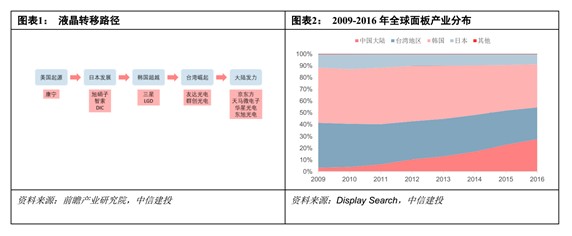

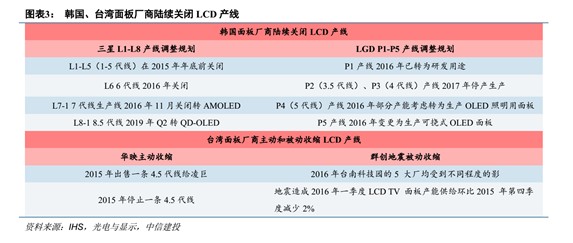

Review of the previous round of the 2016-2017 panel market: the contraction of supply-side production capacity has caused the trend of panel price increases to spread across all sizes. Demand side preferences for large sizes are strong, and there is a trend of mobile phones and televisions switching to larger sizes. Within two years, domestic leader BOE's revenue increased 93%, Guimu's net profit increased 3.63 times, and the corresponding stock price increased 1.1 times.

2. This wheel panel market: Since this year, panel prices have been affected by public health incidents and have been affected by a roller coaster. After reaching a low of the year in the second quarter, in the past two months, panel prices have gradually picked up and even increased by 20% to 30%. Currently, price increases are continuing.

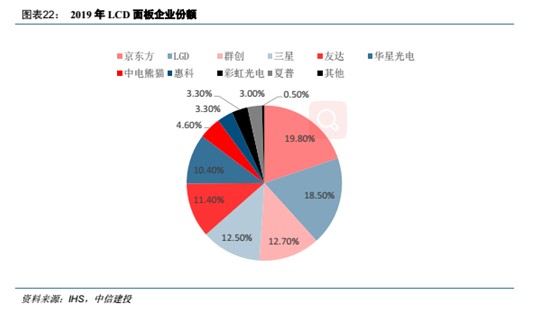

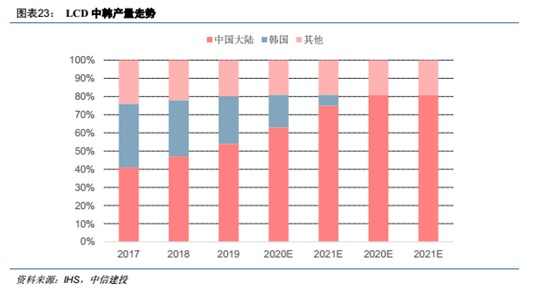

3. How long will the panel market continue: low-efficiency production capacity on the supply side has been cleared, the pattern of the industry's top two players is clear; demand side public health incidents have picked up after the blockade was lifted. As industry inventories fall to a historic position, panel prices rebounded after short-term pressure, and will remain bullish next year. As South Korea (LG/Samsung) withdrew 20% of production capacity, the industry's supply-demand ratio reached 13.3% in 2021. Supply is relatively tight, and supply is expected to return to a 15% balance by 2023.

The penetration rate of OLED panels is gradually increasing, and the proportion of the mainland market is increasing

Market demand for AMOLED panels is currently dominated by smartphones. It is expected that by 2020, as the planned production capacity of China's OLED industry gradually enters the production period, China's OLED production capacity will account for about 28% of the world's total production capacity, making it the world's second largest OLED producer after South Korea.

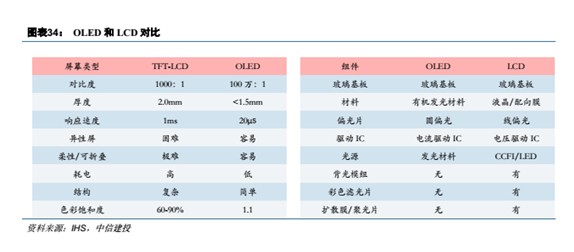

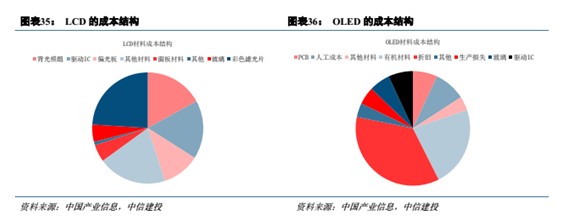

The LCD panel industry chain is gradually improving, and efforts are still needed to localize the OLED industry chain

With the shift of LCD panels to the mainland, the LCD panel industry chain is becoming more and more perfect. Upstream materials (liquid crystal materials, polarizers, glass substrates, targets, etc.), midstream processing and manufacturing (cleaning equipment, etching equipment), and subsequent processes (cutting, circuit boards, backlight module assembly) have basically been replaced by domestic production. In addition to upstream light-emitting material intermediates and thick monomers being replaced domestically for OLED panels, the main production line equipment and materials are still mainly imported.

Supply and demand for panels continue to be tight, and investment opportunities are clear

As South Korea's panel production capacity is withdrawn, inefficient production capacity is cleared, the pattern is restructured, and production capacity is gradually concentrated in China's top two (BOD TCL Technology) panel production capacity. As the remaining 4 domestic production lines expand production, it is expected that the balance between supply and demand will return by 2023. According to the release of the latest panel in early October, continuing the trend since June, prices were still rising in early October. The average price of a 55-inch laptop reached $150, up 3.4% from $145 in late September; as for a 14-inch laptop, the average price rose slightly by 1.1% from the previous period, from $27.7 to $28. We think panel investment opportunities are clear, and we are optimistic about domestic panel manufacturers and upstream panel localization rate opportunities.

Risk warning

1) Prolongation of public health events; 2) Decline in prices; 3) Decline in sentiment

Industry catalysts: 1) The volume of 5G panel application scenarios exceeded expectations; 2) The growth rate of large panel sizes exceeded expectations