Report summary

Real estate has been the biggest highlight of the US economy since the health incident.

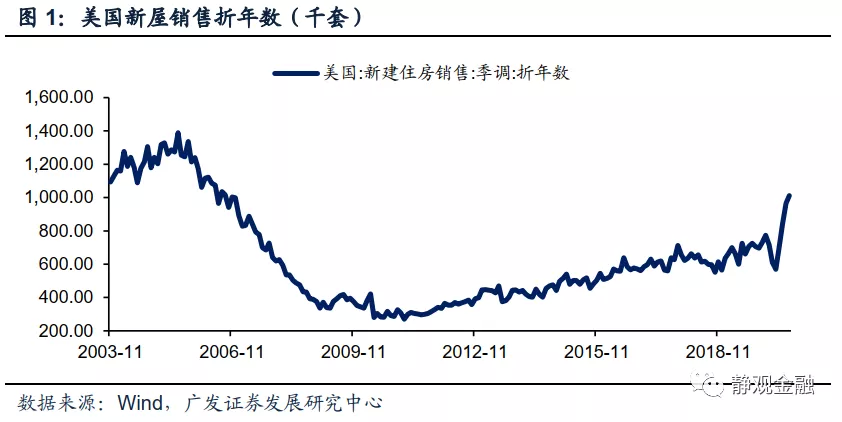

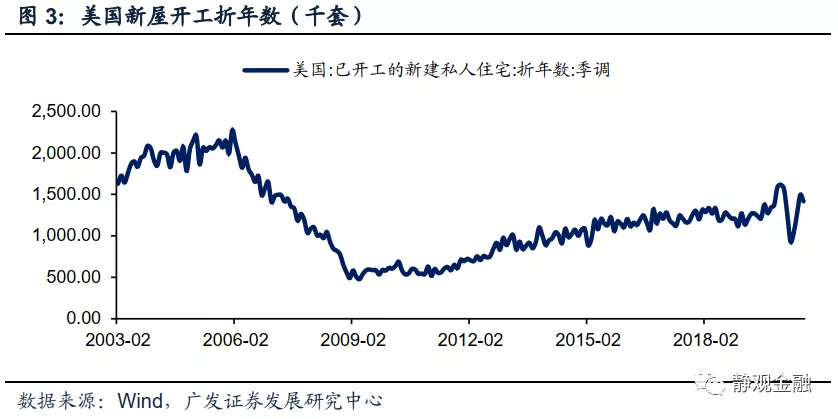

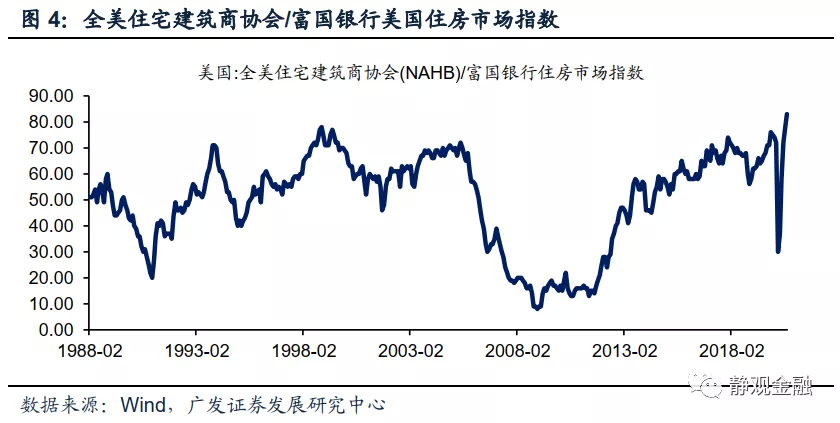

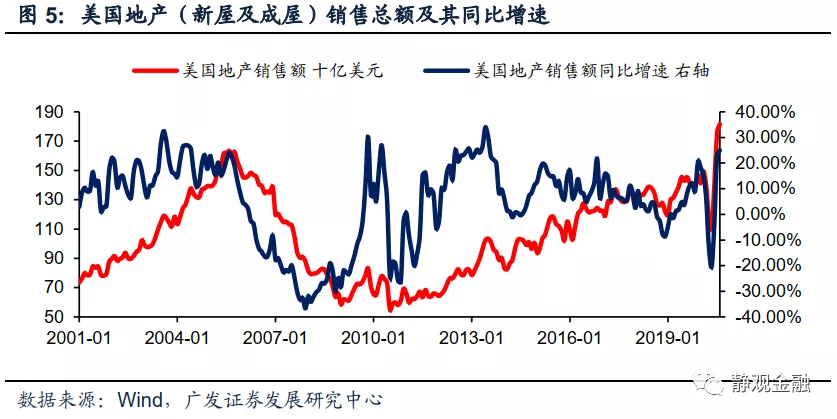

US states gradually pushed for the resumption of work at the end of April. All economic data showed a month-on-month improvement in May. Most of the year-on-year growth was still negative, but new home sales already showed double-digit year-on-year growth in May. Subsequently, in August-September, the year-on-year growth rate of new home sales in the US all exceeded 40%; in June, existing home sales in the US rebounded year-on-year and became positive in July; in June, new home starts in the US were revised year-on-year, reaching 23.1% higher in July; and in September, the National Association of Home Builders (NAHB) /Wells Fargo housing market index climbed to 83, a record high since the index became available in 1985. Furthermore, according to our estimates, the total amount of real estate (new and existing homes) sales in the US reached a record high in August this year, about US$181.65 billion, an increase of 24.9% over the previous year.

How is real estate driving the US economy and how sustainable is it?

H2 real estate boosted the nominal GDP of the US by about 0.7-1.0 percentage points in 2020.Since 2000, the value added of the real estate construction and real estate services industry has still accounted for 13%-15% of GDP, which is roughly the same as China, Japan, the United Kingdom, and the Eurozone. However, since industries such as furniture and home appliances rely more on imports, unlike countries such as China and Japan, US real estate has a shorter driving chain for the economy. In other words, the overall impact of US real estate on the economy is indeed weaker than that of some major manufacturing countries, but it is not that low. According to our estimates, 2020 H2 real estate will drive the US nominal GDP by about 0.7-1.0 percentage points. Among them, real estate construction will drive the US nominal GDP by about 0.2 percentage points, and the impact of real estate services on the US nominal GDP may reach 0.5-0.8 percentage points.

H2 real estate boosted the nominal GDP of the US by about 0.7-1.0 percentage points in 2020.Since 2000, the value added of the real estate construction and real estate services industry has still accounted for 13%-15% of GDP, which is roughly the same as China, Japan, the United Kingdom, and the Eurozone. However, since industries such as furniture and home appliances rely more on imports, unlike countries such as China and Japan, US real estate has a shorter driving chain for the economy. In other words, the overall impact of US real estate on the economy is indeed weaker than that of some major manufacturing countries, but it is not that low. According to our estimates, 2020 H2 real estate will drive the US nominal GDP by about 0.7-1.0 percentage points. Among them, real estate construction will drive the US nominal GDP by about 0.2 percentage points, and the impact of real estate services on the US nominal GDP may reach 0.5-0.8 percentage points.

Health incidents have fueled a real estate sales boom in some parts of the world.The boom in real estate sales since the outbreak of the health incident was not limited to the US, but has been reflected in many countries and regions around the world. The real estate boom in the Eurozone, the United Kingdom, and South Korea is also very high. We believe that the health incident has contributed to an increase in demand for improved housing and a decrease in the cost of buying a home, which in turn has triggered a resounding recovery in real estate sentiment in some countries and regions around the world.

In the short term, the popularity of real estate sales in the US and even around the world may temporarily cool down by the end of the year.Reason 1: The demand for improved housing is likely to be on the pulse. We have observed that since the health incident, the US homeownership rate has soared from 65.1% to 67.9%, while the all-time high in 2004 was only 69.2%. Reason 2: The downward trend in home purchase costs has come to an end. Furthermore, although the monetary policies of various countries will not be tightened, further easing will be difficult, and the downward trend in mortgage interest rates may be coming to an end. Reason 3: Low inventories may cause Americans to soon face a “no home to buy.” Before the health incident broke out, US real estate inventories were at historically low levels. As of August, the inventory removal time for new homes in the US was only 3.3 months, and the inventory removal time for existing homes was only 3 months.

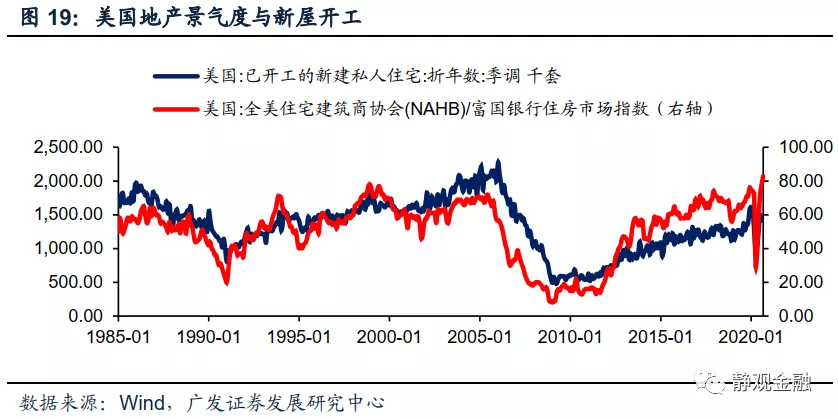

In the short term, US real estate investment will continue to drive the economy until at least H1 2021.The extremely low inventory level has led to a significant increase in the willingness of US real estate developers to speed up inventory replenishment. In September, the US NAHB real estate market index climbed to 83, the highest level since data became available. Since the NAHB real estate market index is 2-3 quarters ahead of new housing starts, in the short term, the impact of real estate investment on the economy may continue until H1 2021.

After the health incident was disrupted, US real estate still had long-term fundamental support.

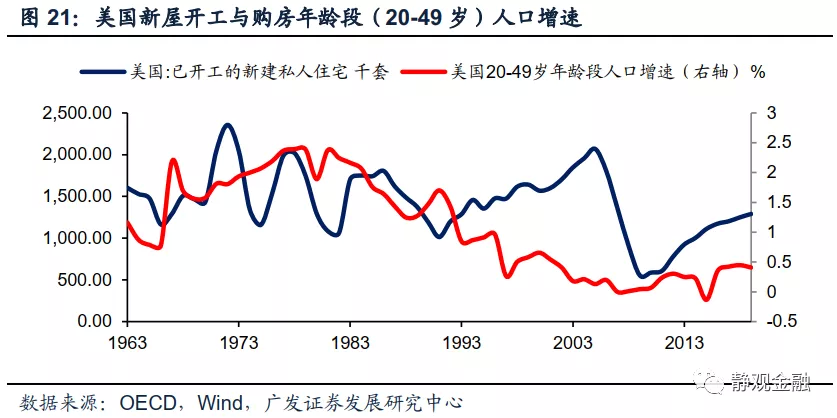

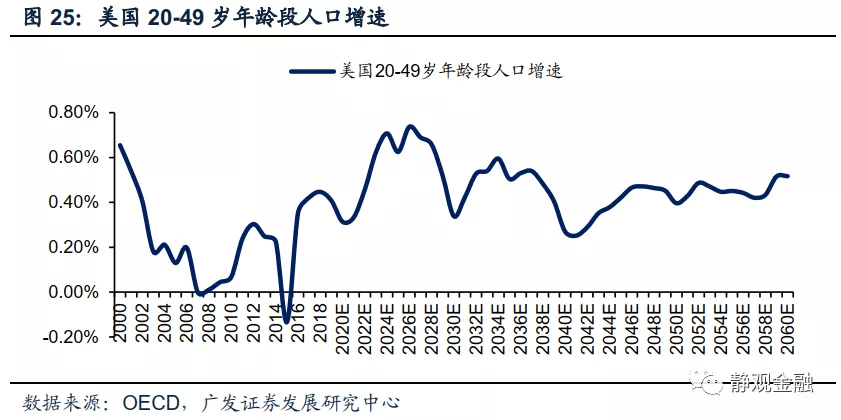

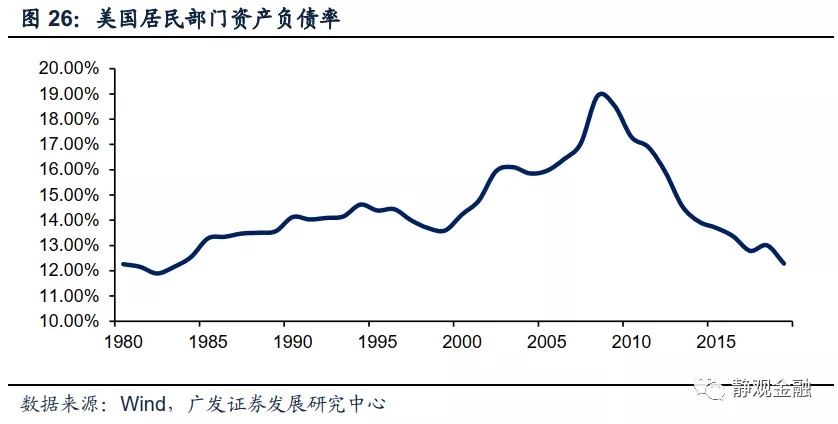

Since the 1960s, the US real estate cycle has been synchronized with the US residents' credit cycle, but it can also be divided into four stages:The 60-80s of the last century, the 90s, 2000 to before and after the financial crisis. Although the growth rate of third-stage US residential mortgage loans was comparable to that of the first stage, there was no real estate bubble in the US in the 60-80s, and there was an obvious real estate bubble before the financial crisis. This contrast is likely related to differences in population structure: the credit cycle of American residents in the 60-80s of the last century was the same as the growth cycle of the home-buying age group (20-49 years old), but it deviated from 2000 until before the financial crisis.

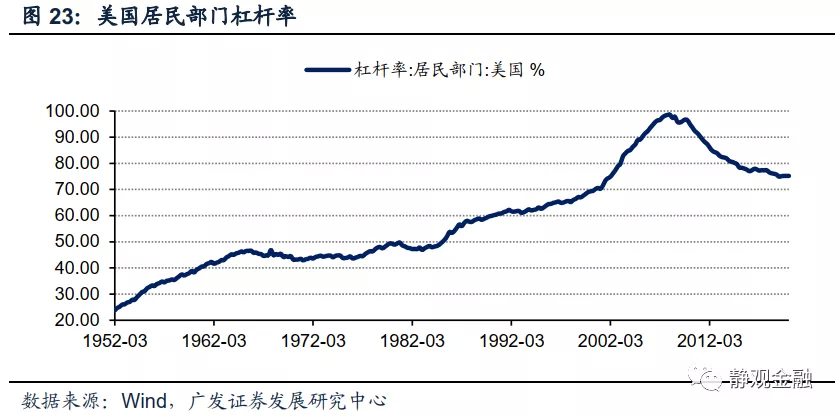

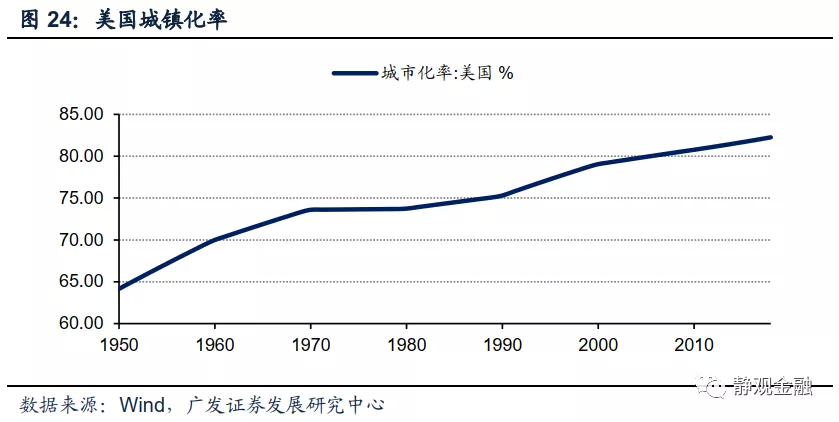

There have been differences in the macro-driving forces of the four stages of US real estate since the 1960s.The US real estate cycle in the 60-80s of the last century (including the rising cycle and the decline cycle) was driven by a combination of two fundamental factors: the growth cycle of the home-buying age population and the change in the urbanization rate; the recovery in the US real estate boom in the 90s was driven by a single factor of rising urbanization rates; the boom in US real estate from 2000 to before the financial crisis was driven by speculative behavior that relied entirely on residents' leverage; the recovery in US real estate after the financial crisis reflected natural restoration in the residents' deleveraging stage after the demographic factor improved.

Demographic factors and residents' leverage ratios have long-term support for US real estate.Demographic factors and the rate of urbanization are fundamental factors that determine the long-term trend of real estate. The residents' leverage ratio reflects the residents' ability to buy homes, while the level of interest rates affects the residents' willingness to buy homes in the medium cycle. The US urbanization rate reached 82.3% in 2018, making it difficult for this factor to continue to drive US real estate. However, the growth rate of the US population in the 20-49 age group (age group for home buyers) will continue to pick up in 2017-2026, and the balance ratio of US residents fell to its lowest level since 1983 in 2019. As a result, US real estate may still have an upward cycle of 5-8 years. In other words, the short-term popularity of real estate sales boosted by health incidents may indeed cool down by the end of the year. Nor can it be ruled out that the tightening of the Federal Reserve's monetary policy will put a phased crackdown on US real estate at some point in the future, but based on population factors and residents' leverage levels, we still believe that US real estate has long-term fundamental support.

Main text

1. Since the health incident, real estate has become the biggest highlight of the US economy

Real estate data has been the most impressive in the US economy since the health incident broke out. US states gradually pushed for the resumption of work at the end of April, so all economic data showed a month-on-month improvement in May. Most of the year-on-year growth was still negative, but new home sales already showed double-digit year-on-year growth in May (same increase of 16.3%). Subsequently, in August-September, the year-on-year growth rate of new home sales in the US all exceeded 40%; in June, existing home sales in the US rebounded year-on-year and became positive in July; in June, new home starts in the US were revised year-on-year, reaching 23.1% higher in July; and in September, the National Association of Home Builders (NAHB) /Wells Fargo housing market index climbed to 83, a record high since the index became available in 1985. Furthermore, according to our estimates, the total amount of real estate (new and existing homes) sales in the US reached a record high in August this year, about US$181.65 billion, an increase of 24.9% over the previous year.

II. What is the impetus and sustainability of real estate on the US economy

(1) H2 real estate boosted US nominal GDP by about 0.7-1.0 percentage points in 2020

First, although the urbanization rate in the US has reached 82% and real estate is no longer growing, the value added of the real estate construction and real estate service industry has still accounted for 13%-15% of GDP since 2000, which is roughly comparable to China, Japan, the United Kingdom, and the Eurozone. However, since industries such as furniture and home appliances rely more on imports, unlike countries such as China and Japan, US real estate has a shorter driving chain for the economy. In other words, the overall impact of US real estate on the economy is indeed weaker than that of some major manufacturing countries, but it is not that low.

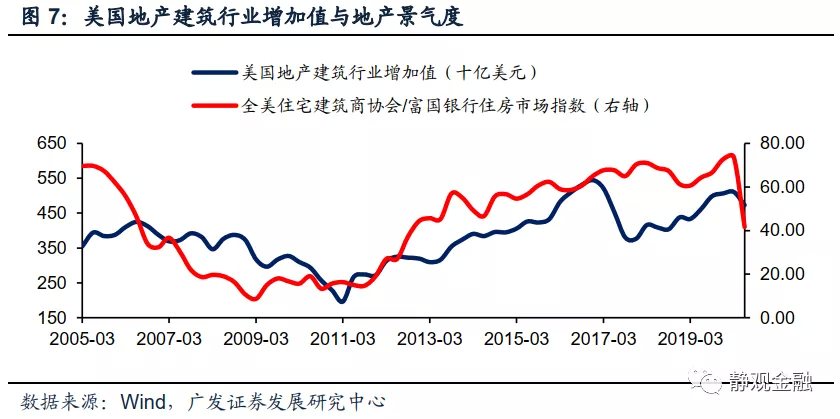

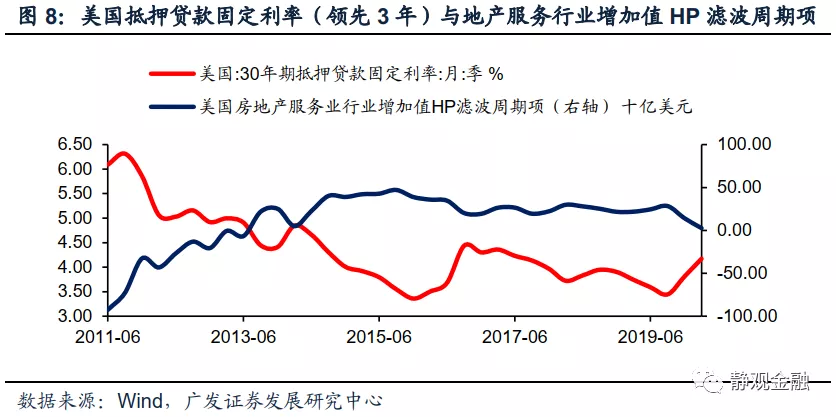

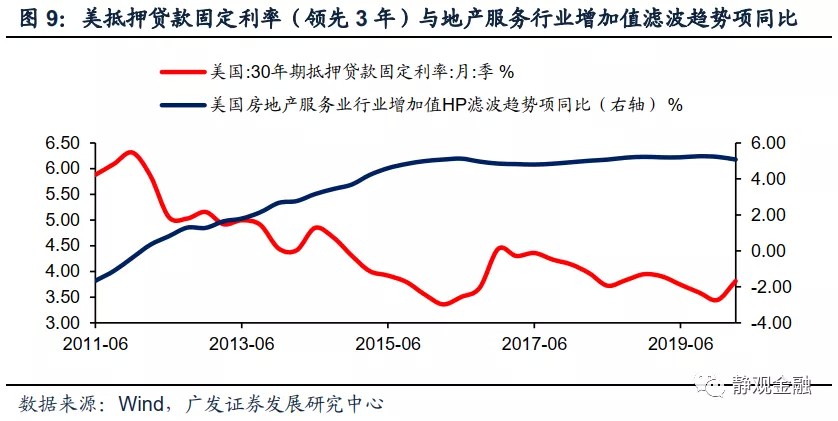

We used the National Association of Builders/Wells Fargo Real Estate Market Index as a leading indicator to predict the value added of the US real estate construction industry, leading about 4 quarters; using the 30-year mortgage fixed interest rate as the leading indicator of value added in the US real estate services industry, leading about 12 quarters. From this, we estimate that 2020 H2 real estate will drive the nominal GDP of the US by about 0.7-1.0 percentage points. Among them, real estate construction will drive the nominal GDP of the US by about 0.2 percentage points, and the impact of real estate services on the US nominal GDP may reach 0.5-0.8 percentage points.

(2) In the short term: sales popularity may cool down by the end of the year, driven by investment, or continue until 202H1

1. Health incidents have driven a real estate sales boom in some parts of the world

After the health incident, the US real estate boom will increase significantly. At present, this conclusion has been confirmed. We believe that the sharp rise in US real estate sentiment since May is the result of a resonance of long-term and short-term factors. Looking at the long term, the growth rate of the US home-buying age group continued to pick up in 2017-2026, compounded by the fact that the balance ratio of US residents was at its lowest level since 1983, making it possible for residents to relax their credit and increase leverage. Looking at the short term, the boom in real estate sales since the outbreak of the health incident has not been limited to the US, but has been reflected in many countries and regions around the world.

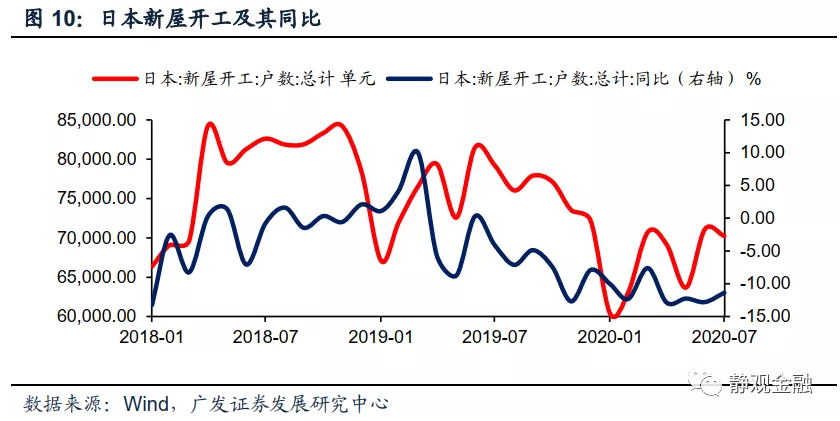

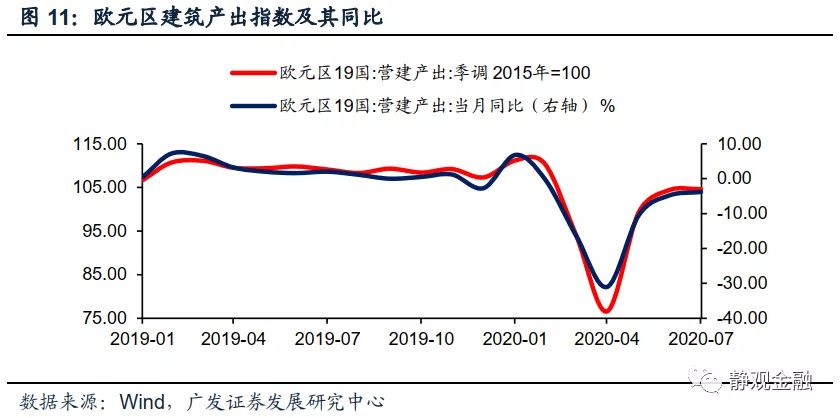

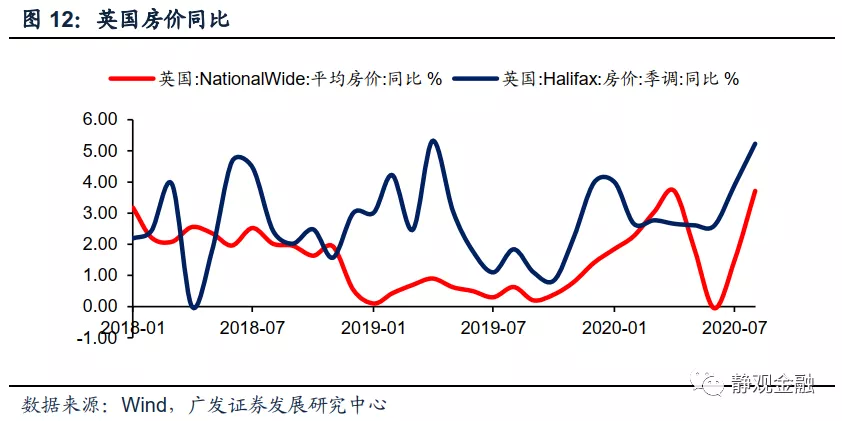

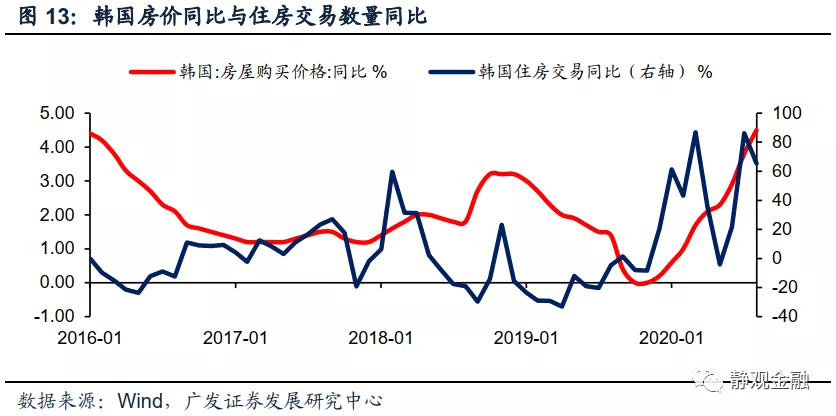

As can be seen from Figure 11-13, real estate sentiment in the Eurozone, the United Kingdom, South Korea and other places was also high after the health incident, but the Japanese real estate data shown in Figure 10 was weak. We believe that judging from the two factors of demand for improved housing driven by health incidents and falling home purchase costs, there is a resurgence in real estate sentiment in some countries and regions around the world. However, the contrast in Japanese real estate data may be related to the Olympics originally scheduled for this year. Under the impetus of the Olympics, Japanese real estate already showed some signs of “overheating” in 2018-2019, and the failure of the Olympics dealt a blow to the Japanese real estate sector. In other words, the short-term popularity of housing sales in the US and parts of the world is a result of real estate partly benefiting from health incidents.

2. Looking back, the popularity of real estate sales in the US and even around the world may temporarily cool down by the end of the year

Reason 1: The demand for improved housing is likely to be on the pulse.We have observed that since the health incident, the US homeownership rate has soared from 65.1% to 67.9%, while the all-time high in 2004 was only 69.2%.

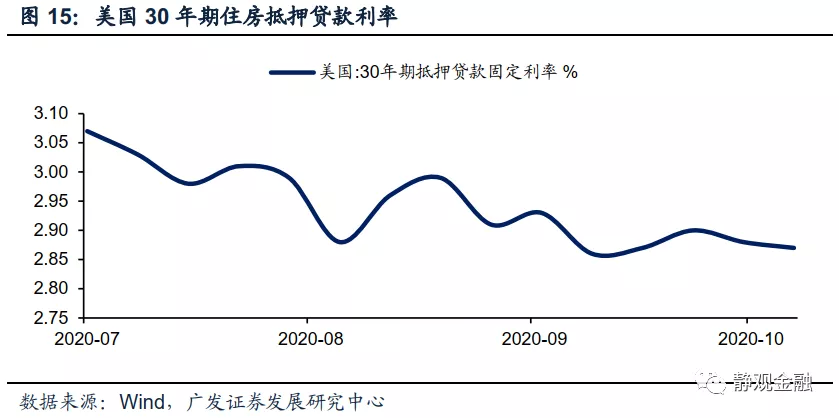

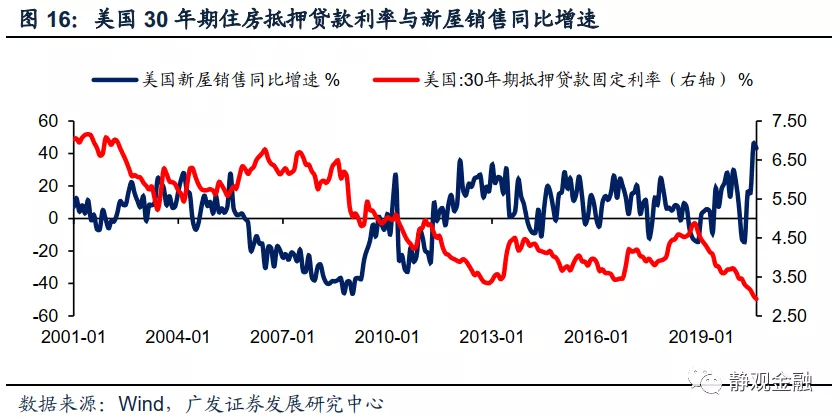

Reason 2: The downward trend in home purchase costs has come to an end.Furthermore, although the monetary policies of various countries will not be tightened, further easing will be difficult, and the downward trend in mortgage interest rates may be coming to an end. The fixed interest rate for 30-year mortgages in the US fell below 3% in July, but it fluctuated between 2.8-2.9% starting in mid-September. The anchor of the fixed interest rate for US 30-year mortgages is the 10-year US bond yield. We mentioned in our previous report that as long as negative interest rates are not implemented, there is no room for a sharp decline in long-term US bond yields. Currently, the Federal Reserve has range-managed US bond yields of 10 years and up. As a result, fixed interest rates for 30-year mortgages in the US are likely to be at the end of a downward trend. Although they will not pick up in the short term, it is difficult to further stimulate real estate sales.

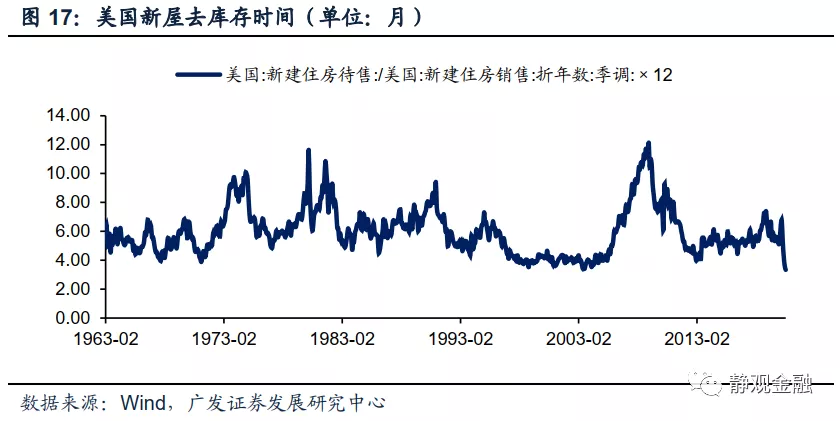

Reason 3: Low inventories may cause Americans to soon face a “no home to buy.”Before the health incident broke out, US real estate inventories were at historically low levels. As of August, the inventory removal time for new homes in the US was only 3.3 months, and the inventory removal time for existing homes was only 3 months. Since inventory replenishment may not keep up in the short term, the popularity of real estate sales in the US at the end of the year may face passive cooling due to “no houses to buy.”

3. In the short term, US real estate investment will continue to drive the economy until at least 2021 H1

As shown in Figure 19, the US real estate sentiment (NAHB real estate market index) led the US new home construction by about two quarters. The NAHB real estate market index climbed to 83 in September. This is the highest level since data were available. It is expected that new US housing starts will continue to rise from Q4 2020 to Q1 2021. Furthermore, as mentioned earlier, the inventory removal time for new and existing homes in the US has now dropped to a historically low level, and it is expected that US real estate developers will speed up inventory replenishment in the next 2-3 quarters. Therefore, in the short term, the impact of real estate investment on the economy may continue until H1 2021.

3. After the health incident was disrupted, US real estate still has long-term fundamental support

(1) According to differences in driving forces, US real estate can be divided into four stages since the 1960s

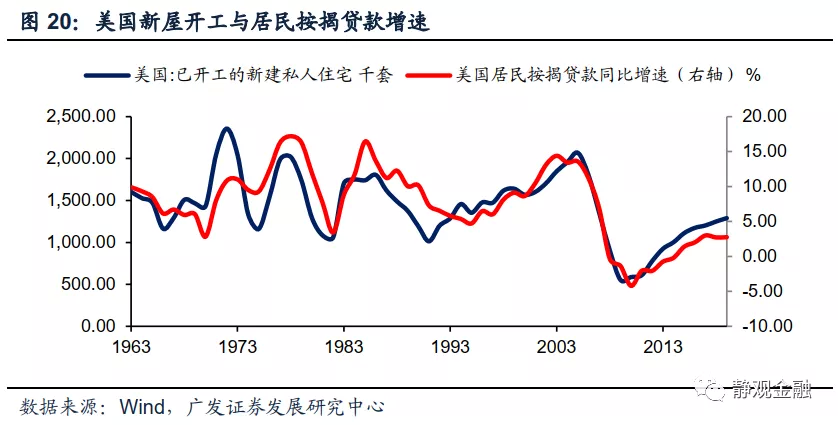

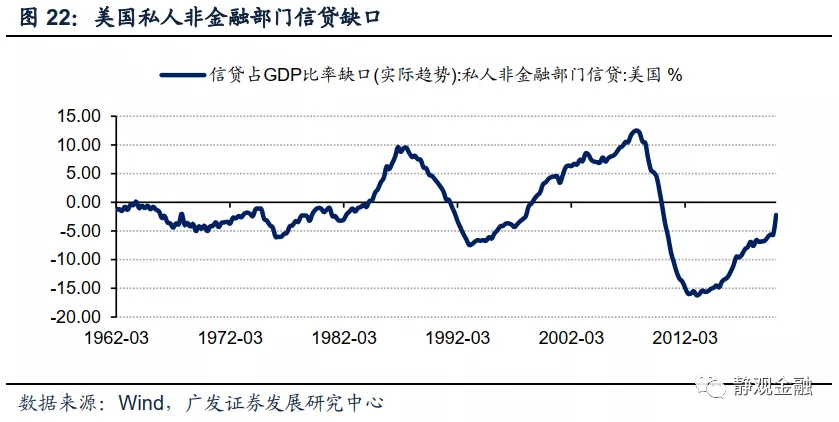

As shown in Figure 20, since the 1960s, the US real estate cycle has been synchronized with the credit cycle of US residents, but it can also be divided into four stages: the 60-80s of the last century, the 90s, 2000 to before the financial crisis, and after the financial crisis. Although the high growth rate of US residential mortgage loans in the third phase (just before the financial crisis) was comparable to the high in the first phase (60-80s), the impact of the residential sector leveraging process in these two stages on the macroeconomy and the residential sector was extremely different. The Bank for International Settlements (BIS) defines the HP filter cycle item for non-financial private sector credit as a share of GDP as a credit gap, and its warning value is 10%. Generally speaking, when the private credit gap exceeds 10%, it indicates that there is a real estate bubble. As can be seen from Figure 22, there was no real estate bubble in the US in the 60-80s, but there was an obvious real estate bubble before the financial crisis. This contrast is likely related to differences in population structure: the credit cycle of American residents in the 60-80s of the last century was the same as the growth cycle of the home-buying age group (20-49 years old), but it deviated from 2000 until before the financial crisis.

The reason why we have divided the US real estate cycle into four stages since the 1960s is because the macro-driving forces of US real estate in these four stages are not consistent: the US real estate cycle in the 60-80s of the last century (including the upward cycle and the decline cycle) was driven by two fundamental factors: the growth cycle of the home-buying age population and changes in the urbanization rate; the recovery in the US real estate boom in the 90s was driven by a single factor of rising urbanization rates; the US after the financial crisis was driven entirely by speculative behavior leveraged by residents; the US after the financial crisis The recovery in real estate reflects natural restoration during the residents' deleveraging phase after population factors improved.

(2) Demographic factors and residents' leverage ratios have long-term support for US real estate

In summary, the population factor and the urbanization rate are fundamental factors that determine the long-term trend of real estate. The residents' leverage ratio reflects the residents' ability to buy homes, while the interest rate level affects the residents' willingness to buy homes in the medium cycle.

The US urbanization rate reached 82.3% in 2018, making it difficult for this factor to continue to drive US real estate. But as we reported “Other than real estate, what are the highlights of the US economy?” As explained in, according to the OECD's estimates, the growth rate of the US population in the 20-49 age group (age group for home buyers) will continue to pick up in 2017-2026, and the balance ratio of US residents fell to its lowest level after 1983 in 2019. As a result, US real estate may still have an upward cycle of 5-8 years. In other words, the short-term popularity of real estate sales boosted by health incidents may indeed cool down by the end of the year. It is also impossible to rule out future tightening of the Fed's monetary policy (according to the report “A Sandbox Review of the US Election Results and Their Impact”, if Trump is re-elected to the Federal Reserve may tighten monetary policy around 2023, and if Biden is elected, currency tightening time may be brought forward to near 2022), but based on population factors and residents' leverage levels, we still believe that US real estate has long-term fundamental support.

Risk warning

(1) The Federal Reserve's monetary policy exceeded expectations

(2) Changes in the US population structure and immigration policies exceeding expectations

(3) The US election exceeded expectations

(4) Health incidents in the US have exceeded expectations

2020年H2地产对美国名义GDP拉动约0.7-1.0个百分点。2000年以来地产建筑及地产服务行业增加值在GDP当中的比重仍占到13%-15%,与中国、日本、英国、欧元区大抵相当。但是由于在家具、家电等领域较多依赖进口,因此与中国、日本等国不同,美国地产对经济的拉动链条较短。换言之,美国地产对经济的整体拉动确实弱于部分制造大国,但并不低。根据我们的估算,2020H2地产将拉动美国名义GDP约0.7-1.0个百分点,其中地产建筑对美国名义GDP的拉动约为0.2个百分点、地产服务对美国名义GDP的拉动或达到0.5-0.8个百分点。

2020年H2地产对美国名义GDP拉动约0.7-1.0个百分点。2000年以来地产建筑及地产服务行业增加值在GDP当中的比重仍占到13%-15%,与中国、日本、英国、欧元区大抵相当。但是由于在家具、家电等领域较多依赖进口,因此与中国、日本等国不同,美国地产对经济的拉动链条较短。换言之,美国地产对经济的整体拉动确实弱于部分制造大国,但并不低。根据我们的估算,2020H2地产将拉动美国名义GDP约0.7-1.0个百分点,其中地产建筑对美国名义GDP的拉动约为0.2个百分点、地产服务对美国名义GDP的拉动或达到0.5-0.8个百分点。