Key points of investment

“Branding of goods for export across borders” and “branding of domestic electronics products” are two sides of the same coin.Cross-border e-commerce can be divided into cross-border import e-commerce and cross-border export e-commerce. This article focuses on exporting cross-border e-commerce. In recent years, cross-border e-commerce exports, represented by brands such as Anker and Zebao, have also experienced the process of “branding”. This is two sides of the same coin brand (Xiaomi, Antarctica, Strict Selection). Essentially, China's high-quality supply chain is branded through e-commerce.

Time and time: Global e-commerce retail is growing, and the penetration rate has deepened further as a result of public health events.Before the public health incident, eMarketer predicted a CAGR of 16.6% for the global retail e-commerce market and 13.4% for the US e-commerce market in 2019-23. Online consumer demand was stimulated after the public health incident occurred. According to the US Department of Commerce, by April 2020, the US e-commerce penetration rate had increased to 27%, an increase of 11 pct over the beginning of the year. The penetration rate of US e-commerce during the public health incident completed the increase over the past 10 years within 8 weeks.

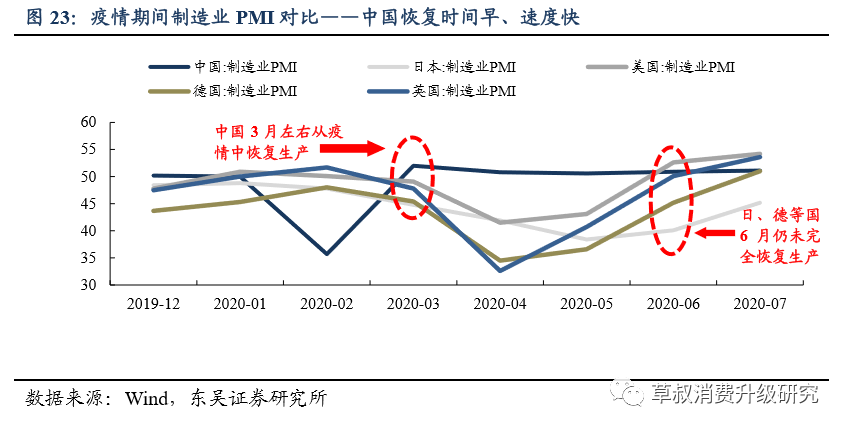

Location: Backed by a strong domestic supply chain, we can achieve “low price+quick reverse”.According to World Bank data, the value added of China's manufacturing industry accounted for 27.2% of annual GDP in 2019, second only to Ireland and Switzerland among the more than 200 countries it counted. It can be seen that the overall strength of China's manufacturing industry is at the highest level in the world. Several high-quality industrial chain clusters have been formed in China, and “low price+quick response” can be achieved through rapid delivery and small-batch order production. China's supply chain showed resilience during the public health incident. According to inference from various countries' manufacturing PMI, China's supply chain recovered early, was affected for a short time, and basically recovered in March.

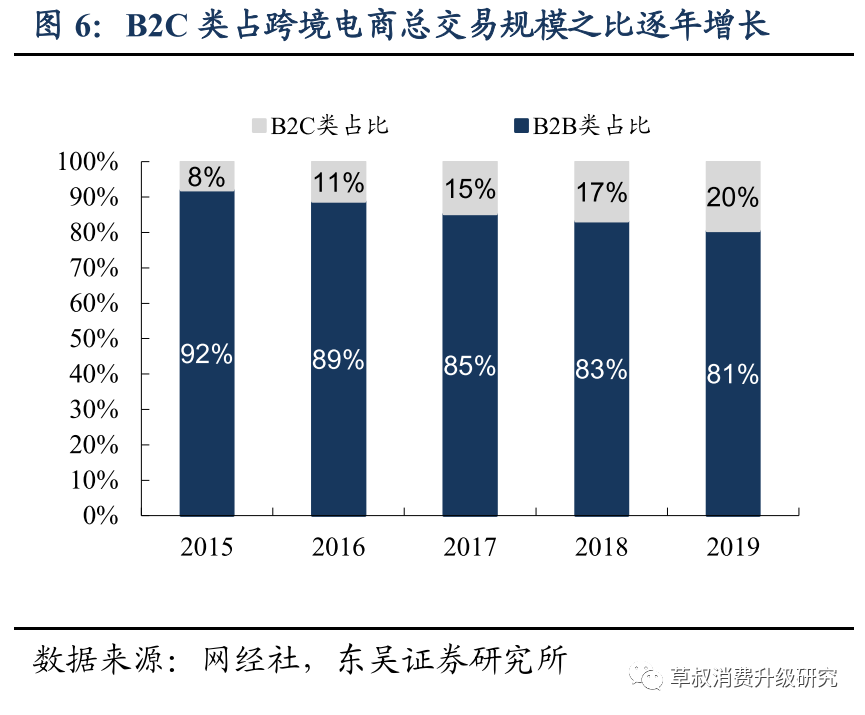

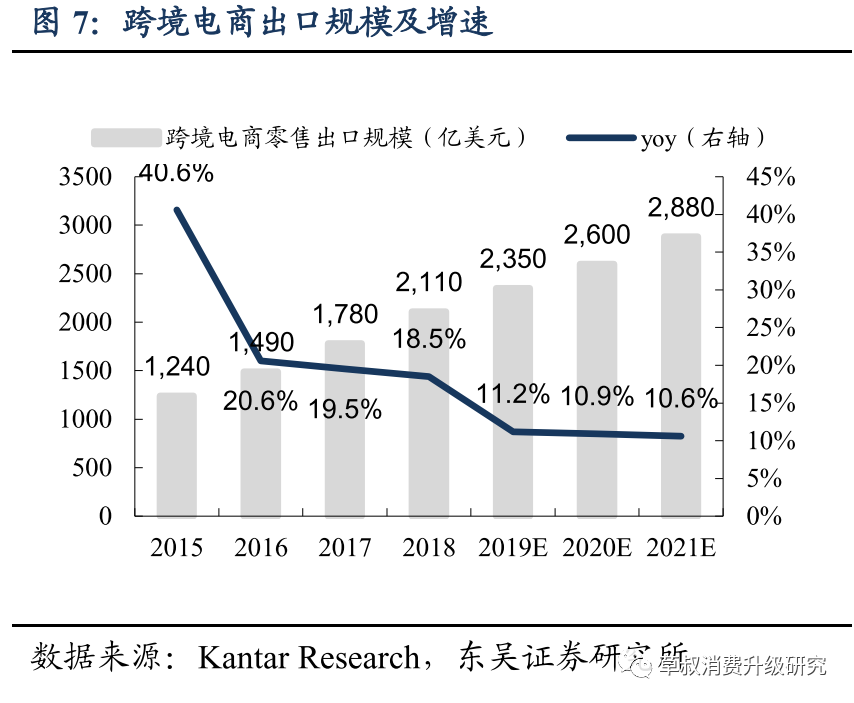

Backed by branding, deepening e-commerce penetration of overseas e-commerce, and strong supply chains, B2C exports of cross-border e-commerce are expected to maintain a high growth rate.According to transaction targets, cross-border e-commerce can be divided into B2B and B2C. According to data from the Internet Economic and Social Administration, the B2B category accounted for a higher share in 2019, reaching 80%; the B2C category grew faster, increasing from 8% in 2015 to 20% in 2019. B2C cross-border e-commerce directly reaches customers, can form brand awareness and control pricing power through time accumulation, and is expected to maintain a high growth rate in the future. According to data from the Internet Economic and Social Agency and Kantar, we expect the B2C cross-border export e-commerce market to reach 59.8 billion US dollars in 2020, and the growth rate in 2020/21 will be 30.5%/25.2% respectively.

Backed by branding, deepening e-commerce penetration of overseas e-commerce, and strong supply chains, B2C exports of cross-border e-commerce are expected to maintain a high growth rate.According to transaction targets, cross-border e-commerce can be divided into B2B and B2C. According to data from the Internet Economic and Social Administration, the B2B category accounted for a higher share in 2019, reaching 80%; the B2C category grew faster, increasing from 8% in 2015 to 20% in 2019. B2C cross-border e-commerce directly reaches customers, can form brand awareness and control pricing power through time accumulation, and is expected to maintain a high growth rate in the future. According to data from the Internet Economic and Social Agency and Kantar, we expect the B2C cross-border export e-commerce market to reach 59.8 billion US dollars in 2020, and the growth rate in 2020/21 will be 30.5%/25.2% respectively.

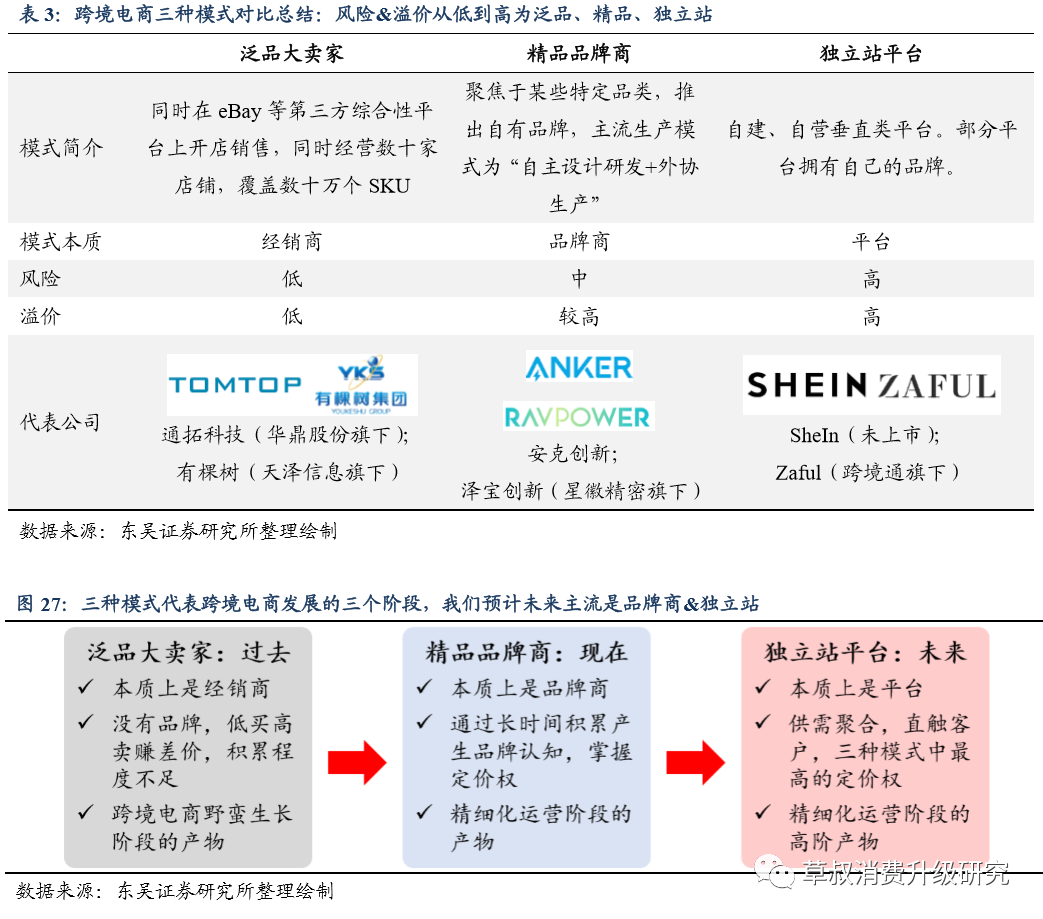

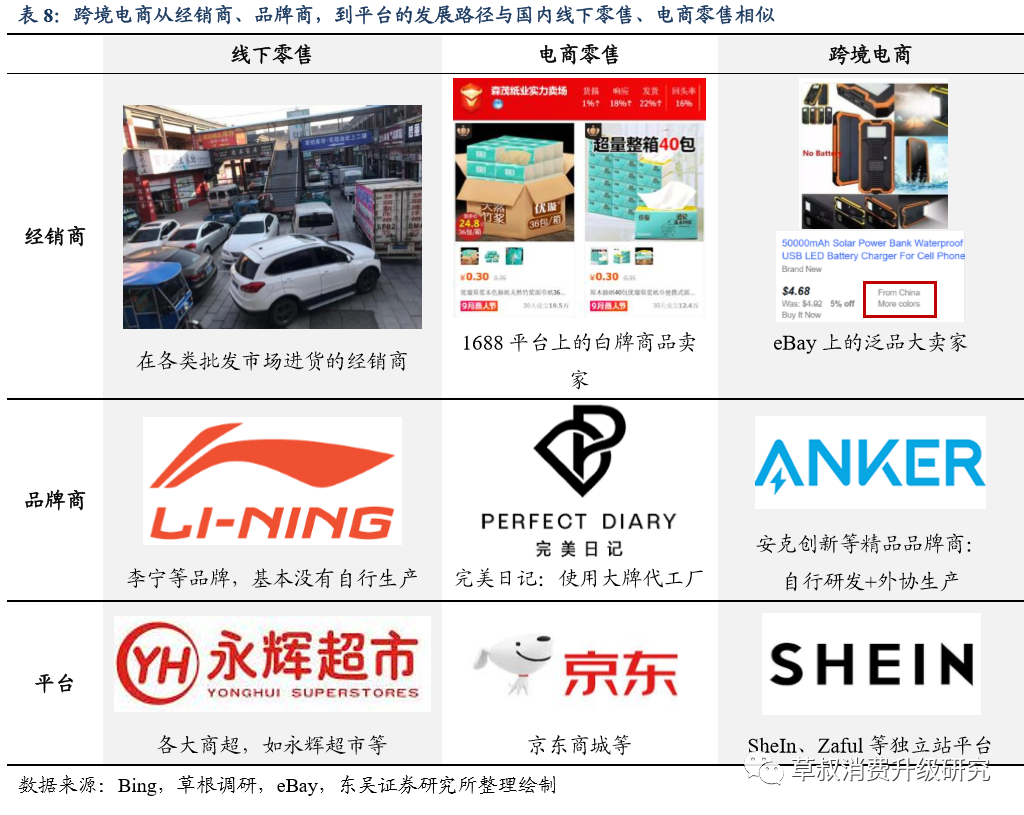

Currently, the three main models of cross-border e-commerce are: ① big sellers; ② boutique brands; ③ independent website platforms.The pan-product model earns the difference in price by buying low and selling high; the brand model forms a brand premium through accumulation; independent sites aggregate resources to form a platform. The three models correspond to dealers, brands, and platforms in traditional retail and e-commerce models, and fall into the three stages of industry development. The pan-product model has no accumulation, and the risk and value are the lowest; the platform model has the highest risk and value; the brand model balances risk and value while accumulating, and is currently the best racetrack overall.

Investment advice:Cross-border e-commerce is a more efficient export model, which is developing at an accelerated pace, spurred by favorable factors such as the rapid increase in global e-commerce penetration during public health incidents. In the three main models, brands have balanced the dimensions of accumulation, value, risk, etc., and are developing better. We are optimistic about the development of cross-border e-commerce for brands. We recommend focusing on Anker Innovation; secondly, brands such as Zebao Innovation (a subsidiary of Xinghui Precision) also deserve attention; independent websites such as SheIn have high risk and high potential, so it is recommended to keep an eye on them.

Risk warning:Trade frictions, foreign law/policy risks, overseas public health events, exchange rate fluctuations, etc.

Origin: A new channel of “Made in China, benefiting the world”, rapid development and vitality

1.1. Mainly export, B2C cross-border e-commerce is expected to become a future growth engine

Cross-border e-commerce is a new concept that has emerged in recent years and is gradually becoming known. It is generally defined as “an international business activity involving transaction subjects at different levels of customs, concluding transactions through e-commerce platforms, making payment and settlement, and delivering goods through cross-border logistics to complete transactions.”

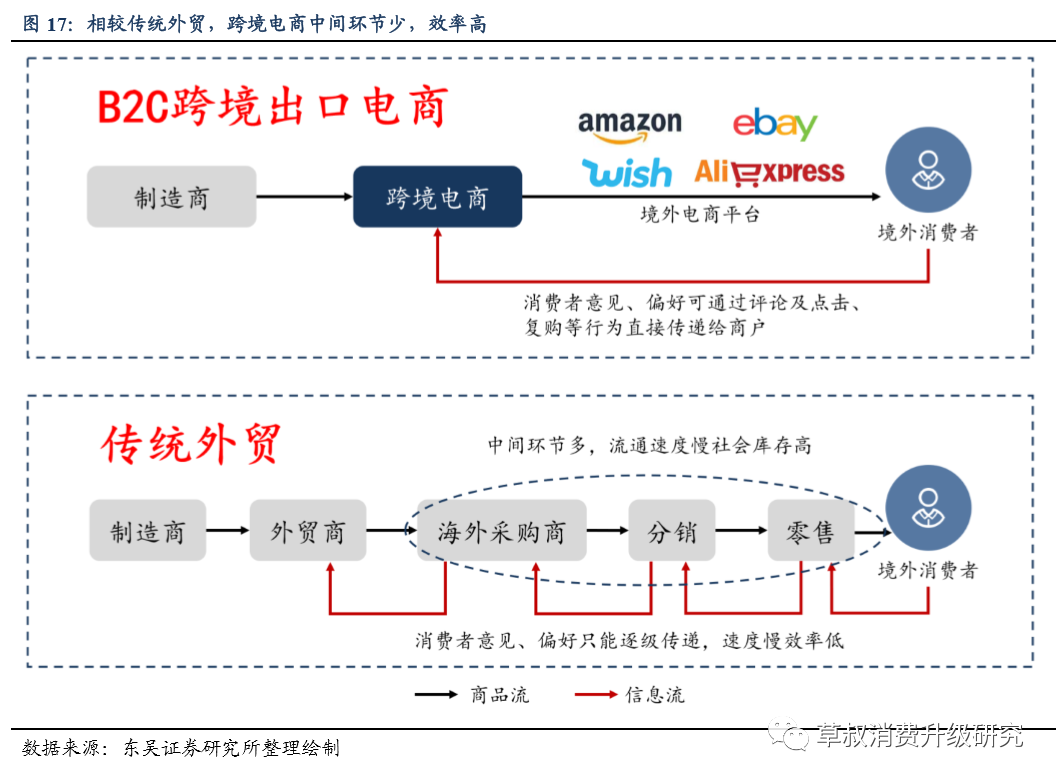

Cross-border e-commerce can be divided into cross-border import e-commerce and cross-border export e-commerce. This article mainly focuses on cross-border e-commerce exports.Cross-border e-commerce export is a new model for the foreign trade industry. Its core advantage is that the links are shorter and more efficient than the traditional foreign trade model, and can face consumers directly, obtain first-hand data, meet consumer needs more quickly and accurately, and achieve rapid reaction. In recent years, e-commerce for cross-border export has relied on China's increasingly developed and perfected manufacturing industry, relied on the leading advantages of China's e-commerce industry in operation and other aspects, and the gradual deepening of global e-commerce penetration, and achieved great development.

“Branding of goods for export across borders” and “branding of domestic electronics products” are two sides of the same coin.In recent years, cross-border e-commerce exports have also gone through a branding process: the first major e-commerce sellers mainly sold white-label products; in recent years, cross-border brands such as Anker Innovation and Zebao Innovation have begun to rise, and the branding process of cross-border e-commerce has continued to deepen. Cross-border e-commerce branding (such as Anker, Zebao) and domestic e-commerce branding (Xiaomi, Antarctica, carefully selected) are two sides of the same coin. Essentially, China's high-quality supply chain is branded through e-commerce. The difference between the two is that the former optimizes the foreign e-commerce system to a certain extent, while the latter is rooted in the domestic e-commerce system.

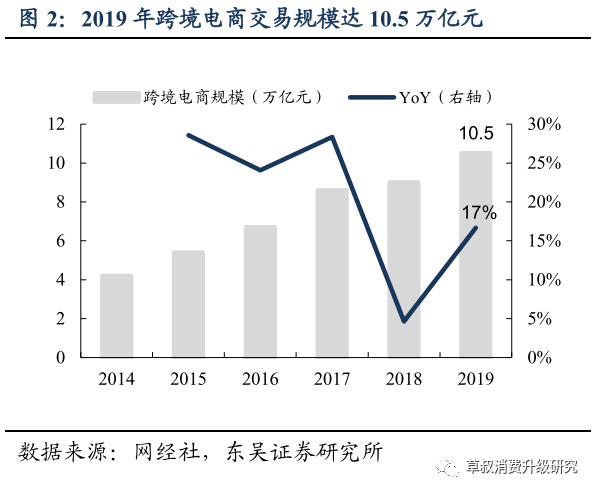

In 2019, the cross-border e-commerce market traded 10.5 trillion dollars, of which exports accounted for 77%.According to online economic and social data, the transaction scale of the cross-border e-commerce market reached 10.5 trillion yuan in 2019, an increase of 16.7% over the previous year, and the compound growth rate in 2014-19 was 20.1%. Export e-commerce is also dominated by cross-border e-commerce, accounting for 77% of the total transaction scale in 2019. There has been a downward trend in the share of e-commerce exports across borders in recent years, but they still account for the vast majority of the entire market.

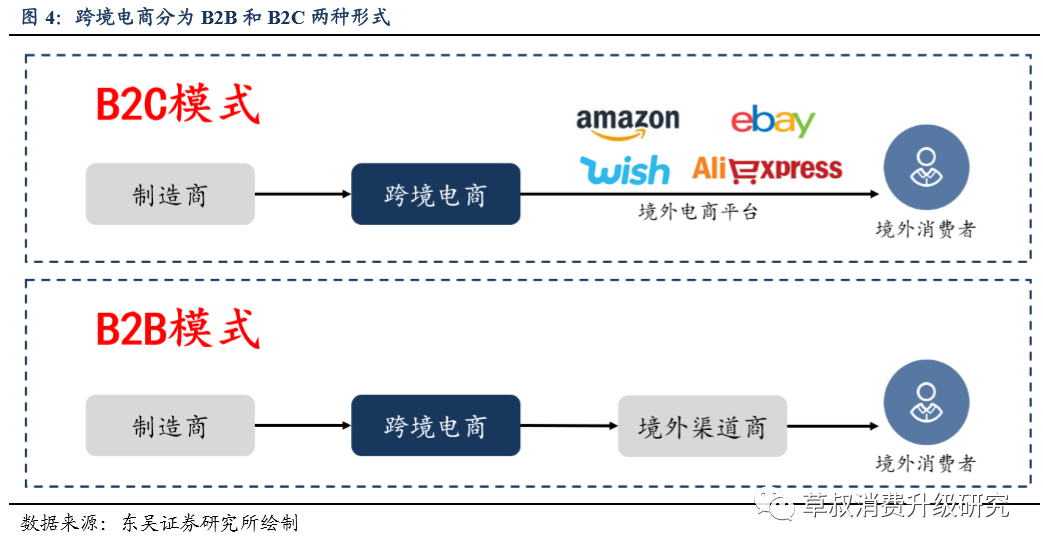

According to the different transaction targets, cross-border e-commerce can be divided into B2B and B2C categories. B2C cross-border e-commerce sells goods directly to overseas consumers through integrated e-commerce platforms such as Amazon and eBay or self-built independent sites such as ZAFUL and SheIn; B2B cross-border e-commerce sells products to overseas channel providers, and channel companies sell products to end consumers.

Although B2B cross-border e-commerce accounts for a higher proportion, such e-commerce is generally smaller in scale and the racetrack is highly fragmented. According to Yiguan data, 85% of cross-border e-commerce sellers are expected to have annual sales of less than 2.5 million US dollars in 2018, and only 2.5% of large sellers with sales exceeding 10 million US dollars. As can be seen from the 2019 map of China's cross-border e-commerce industry chain compiled by the Internet Economic and Social Service, the large companies in the B2B circuit are mainly platform-based companies such as Ali International and Global Resources Network. However, most of the larger cross-border e-commerce companies (such as Anker Innovation, Auji Technology, etc.) are B2C cross-border e-commerce.

According to online economic and social data, the share of B2C cross-border e-commerce is increasing year by year, with 15%/17%/20% respectively in 2017-19.

We believe that under the general trend of branding, B2C cross-border e-commerce is expected to maintain a high growth rate.According to the above two sets of data, we roughly estimate that the B2C cross-border export e-commerce market will reach 59.8 billion US dollars in 2020, with growth rates of 30.5% and 25.2% respectively in 2020. The two major drivers for the growth in cross-border B2C exports are the deepening branding process and the continued deepening penetration rate of overseas e-commerce, making B2C e-commerce a larger platform. We believe that the benefits of these two major factors will continue to be unleashed, driving the continuous growth of the B2C export cross-border e-commerce market.

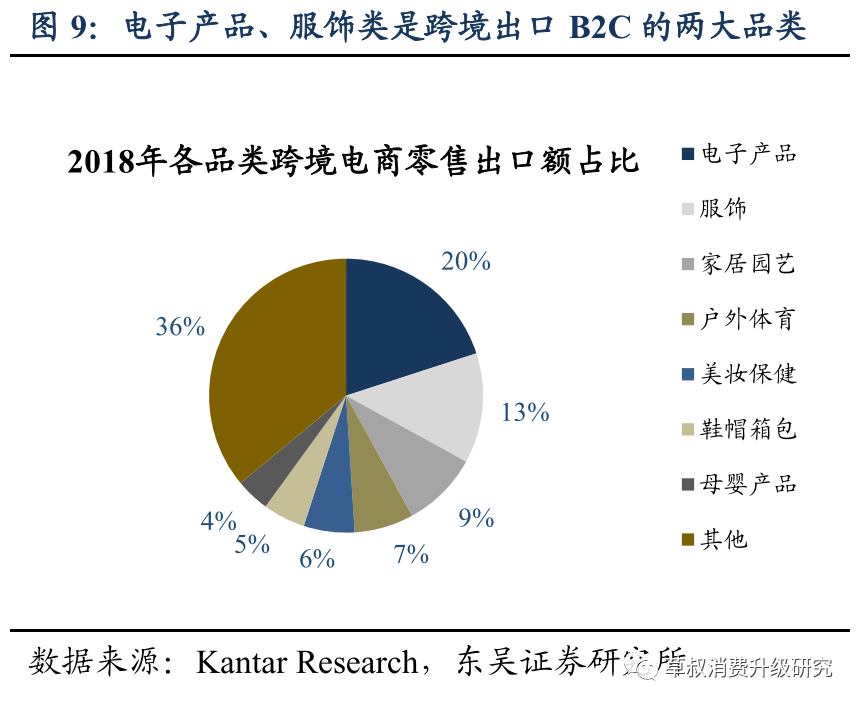

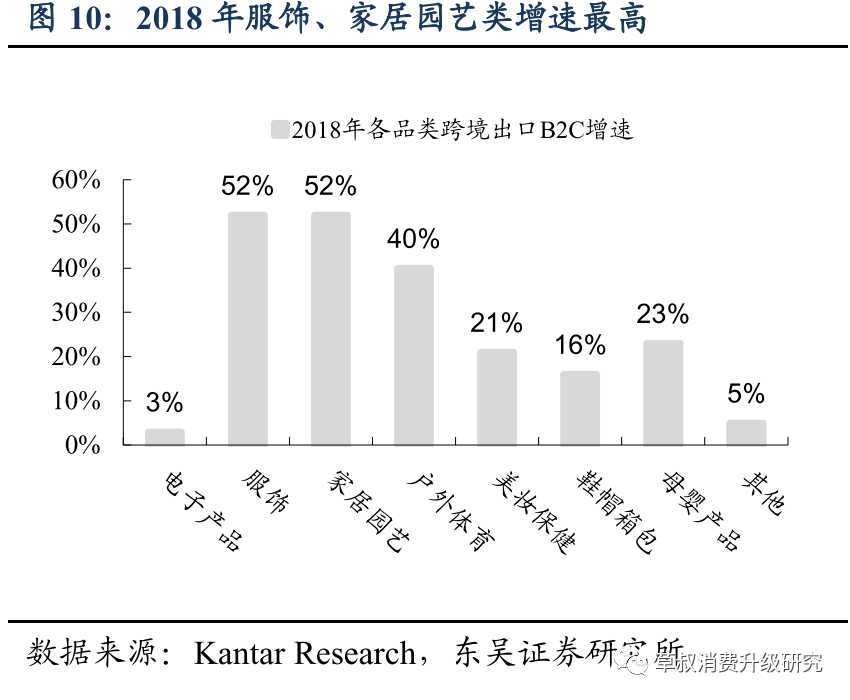

Judging from the categories of B2C cross-border e-commerce products, electronic products and clothing are the two main categories. The apparel category and home gardening category had the highest growth rate in 2018. According to Kantar

Research, the categories that accounted for the highest share of China's cross-border e-commerce retail export sales in 2018 were electronic products (20%), apparel (13%), home gardening (9%), and outdoor sports (7%) in that order. The highest growth rates were in the apparel category and home gardening category, with growth rates of 52%; while outdoor sports, maternal and child products, and beauty and health care categories also had high growth rates, with growth rates of 40%, 23%, and 21% respectively.

1.2. The industry is growing steadily, barriers are gradually forming, and developing towards branded and refined operations

The development process of cross-border e-commerce can be broadly divided into four stages. Early period (late 90s-2003): Still attached to traditional foreign trade. Cross-border e-commerce began in the late 90s. The first form was to display supply and demand information online and complete transactions offline. Online platforms only provide matchmaking services. Cross-border e-commerce at this stage is entirely dependent on traditional trade.

Startup period (2004-2010): Independent & formed. With the gradual improvement of e-commerce infrastructure, online trading platforms began to appear, and cross-border e-commerce gradually realized functions such as online transactions and order logistics management. This stage is still dominated by a trade-oriented business model, but merchants have begun to establish stable partnerships in supply chain factories one after another.

The period of barbaric growth (2010-2016): Growth & differentiation. With the formation of high-quality industrial clusters in the supply chain, cross-border e-commerce channels and categories expanded rapidly, the scale of industry transactions grew rapidly, and business models began to diverge, mainly divided into three models: pan-product retail, branded products, and self-built independent stations. In the midst of barbaric growth, problems such as inventory continued to surface, and enterprises began to optimize; the brand boutique model gradually grew, and cross-border e-commerce began to pay attention to product differentiation and independent research and development.

Steady growth period (2017 to date): Refined operation. As the upstream and downstream industrial chains are basically perfected, relevant laws and regulations and promotion policies have been implemented and improved, cross-border e-commerce has gradually been standardized. Companies have emerged from barbaric growth and are paying more and more attention to boutique development and the refined operation of brands. The competition is no longer simply for delivery and price, but for the comprehensive capabilities of enterprises. The product quality of cross-border e-commerce has been steadily improving, and the brand awareness of leading companies has gradually taken shape, and barriers have been formed to a certain extent.

Looking ahead, with the further penetration of overseas e-commerce and the development of emerging markets, the size of the cross-border e-commerce market is expected to continue to grow, but we think the main theme will be branding and refined operation. In the process, leading companies with brand awareness will gradually establish their positions, industry concentration is expected to increase significantly, and industry barriers will gradually form. In the next few years, we may see companies increase brand awareness through a series of measures, including placing more online advertisements, entering offline channels, developing high-end boutiques, etc., and companies with corresponding capabilities will have more room for growth.

Model advantage: strong supply chain+short link export, achieving cheap+fast response

2.1 Cross-border e-commerce relies on a strong domestic supply chain and has plenty of room for development and profit

We believe that the ultimate driving force behind the rise of cross-border e-commerce is China's strong manufacturing industry. According to World Bank data, the value added of China's manufacturing industry accounted for 27.2% of annual GDP in 2019, ranking among more than 200 countries in its statistics. In 2019, it was second only to Ireland and Switzerland. Considering that China has a larger GDP base, the overall strength of China's manufacturing industry is at the forefront of the world. According to the National Bureau of Statistics, the year-on-year growth rates of the value added of manufacturing industries above the scale of China in 2017-19 were 7.2%, 6.5%, and 6.0%, respectively. It can be seen that China's manufacturing industry is still in the process of continuous growth.

The domestic industrial chain has a good regional division of labor, and several high-quality industrial chain clusters have been formed. For example, Guangdong Province has high-quality industrial chains such as clothing, cosmetics, digital products, various small household appliances, jewelry, etc.; Zhejiang's industrial chain is dominated by bags, cosmetics, pet products and all kinds of small goods; towels and daily necessities in Shandong, clothing and home textiles in Jiangsu, and footwear in Fujian also have considerable advantages. Comparing cross-border e-commerce retail export data from Kantar statistics, categories such as electronics, clothing, and outdoor sports, which account for a relatively high proportion, are strong categories in China's industrial chain.

Regions with developed manufacturing and foreign trade are regions where cross-border e-commerce is well developed. According to Yiguan's 2018 statistics, most cross-border e-commerce sellers in China are concentrated in the four provinces of Guangdong, Zhejiang, Fujian, and Jiangsu. These four provinces account for 87%. What these four provinces have in common is that: ① are traditional major foreign trade provinces; ② have high-quality industrial chain clusters.

We believe that the geographical distribution of cross-border e-commerce exporters and the coincidence of high-quality industrial chains, and the coincidence of export categories and advantageous industries are sufficient to verify the relationship between the rapid development of cross-border e-commerce and a strong industrial chain. A strong industrial chain has also brought about lower purchasing costs of goods, which provides a cost-effective advantage and sufficient profit margin for e-commerce exports across borders.

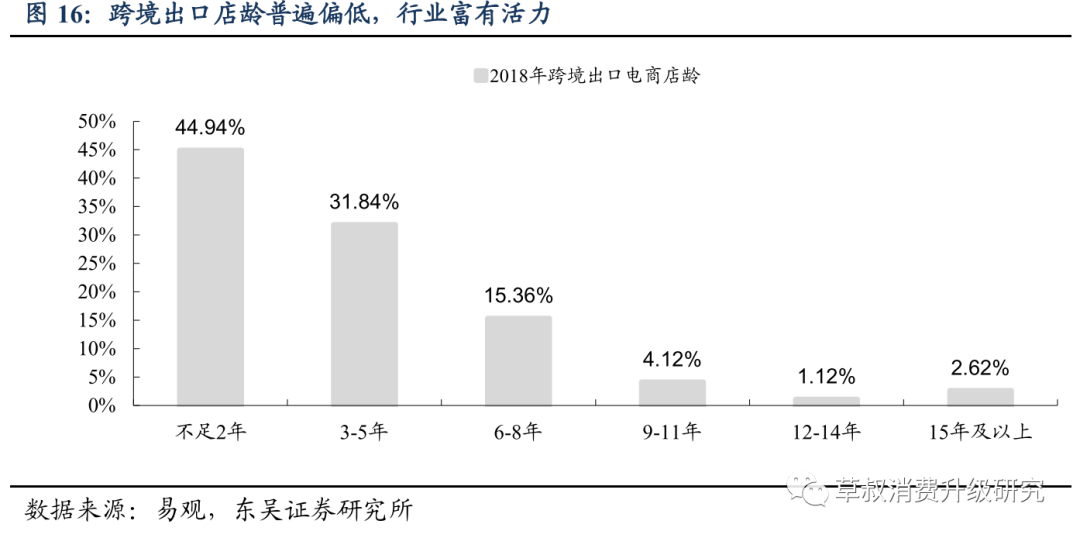

Based on the above benefits, the members of the cross-border e-commerce industry are relatively “young”, and the industry is full of vitality. According to Yiguan's 2018 statistics, 45% of cross-border export sellers are less than 2 years old, 32% of sellers are 2-4 years old, and more than 75% of merchants entered the market after 2014.

We think the above set of data can support two core ideas:

① The industry has excess revenue, and there are many new merchants entering the market; ②

The medium and long tail sections have not formed an obvious barrier, and entry/exit is frequent. It can be seen that the cross-border e-commerce industry is still developing very rapidly in the past two years. It has vigorous vitality and is at the peak of development. There are few retained enterprises established during the barbaric growth period in the early years, which also reflects the general trend of the industry developing towards standardized and refined operations in the future.

2.2 Cross-border e-commerce shortens the link directly to consumers, and the link is higher than traditional foreign trade

Compared with traditional foreign trade, the advantages of cross-border e-commerce are ① reducing intermediate links and improving efficiency; ② quick response to consumer feedback and demand. Under the traditional trade process, traders sell products to overseas buyers after purchasing goods, and then deliver them to end consumers through distribution links at all levels; in the cross-border e-commerce model, merchants can directly sell products to consumers through e-commerce platforms, or skip some procurement and distribution links directly to terminal retailers (that is, “B”

to Little B” mode). Communication between merchants and consumers is smoother, and more information can be obtained from consumers' purchasing behavior and reviews to optimize products and services.

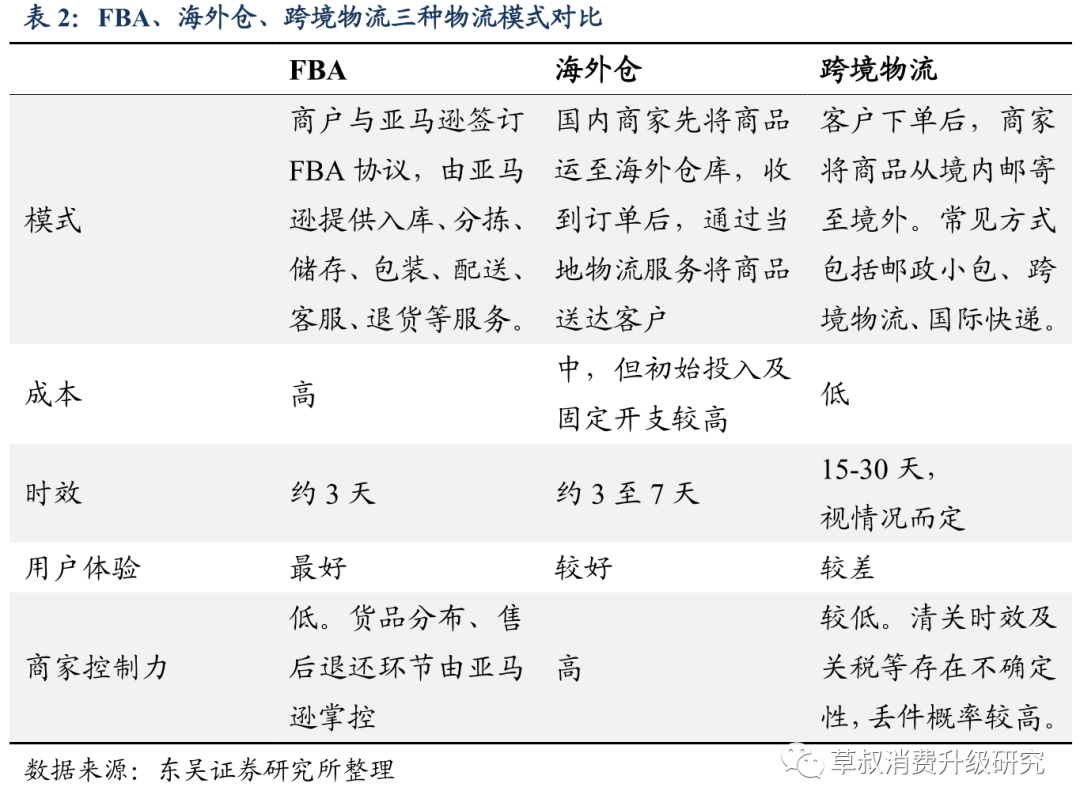

Corresponding to shortened links, since cross-border e-commerce requires products to be delivered directly to overseas retailers and even end consumers, its warehousing and logistics requirements are higher than traditional foreign trade. Looking at it now, the cross-border e-commerce logistics model is divided into three models: ① overseas warehouses; ② FBA warehouses; ③ cross-border logistics. Let's take a look specifically:

An overseas warehouse is a warehouse established or acquired by cross-border e-commerce companies overseas. Under this model, domestic merchants first ship products to overseas warehouses. When an order is received, the overseas warehouse completes the sorting, packaging and other processes to deliver the product to the customer through local logistics services. Overseas warehouses are a relatively asset-heavy model that requires high upfront investment to complete position/acquisition. At the same time, it will continue to incur certain fixed maintenance costs and operating expenses. The core advantage of overseas warehouses is that the marginal cost is lower than the other two models, which can have a certain scale effect, and at the same time provide buyers with a better delivery and return experience. Cross-border e-commerce using the overseas warehouse model includes cross-border communication, etc.

The FBA warehouse model means renting an Amazon warehouse. Merchants sign FBA (Fulfilment) with Amazon

by

Amazon) Service agreement, after which the goods are sent to Amazon warehouses around the world. Amazon provides services for warehousing, sorting, storage, packaging, delivery, etc., and Amazon also completes related services such as customer service and returns. The FBA process is independently operated by Amazon's closed business system. The service quality is high, and merchants are unable to interfere with it. Generally speaking, FBA's initial investment and fixed costs are lower than overseas warehouses, but after considering storage fees, delivery fees, and return costs, marginal costs may be higher than overseas warehouses. Amazon will prompt consumers on the page to use FBA to provide better services for corresponding products, which can further increase the confidence of overseas consumers.

Cross-border logistics includes forms such as postal parcels, special line logistics, and international express delivery. Small postal parcels are sent through traditional postal express delivery systems such as EMS and Hongkong Post; special line logistics centrally transports goods to distribution centers near the destination through air packagings, etc., and then transferred to the destination. Common routes include US special lines, European lines, Australian lines, etc. According to our grassroots research, since special line logistics can better balance cost and speed, it has become the most popular method of international logistics at present; international express delivery refers to the four major express delivery companies UPS, FedEx, DHL, and TNT. The service is good and the cost is high, and it is mostly used for expensive items.

Looking at cross-border logistics from a comprehensive perspective, the main disadvantages include: ① it usually takes 10-30 days, and the speed is slow (and the timeliness is uncertain due to customs clearance factors), ② the package loss rate is high, ③ it is uncertain whether it will be taxed when placing an order, ④ customs clearance may require customers to submit sensitive information such as passports, etc., and the comprehensive experience is not as good as the overseas warehouse and FBA warehouse model. However, it does not require prior investment from merchants, so it is the main choice for small and medium-sized cross-border merchants.

The supply chain+operating advantages that domestic enterprises have accumulated over a long period of time have been underdeveloped during public health incidents

3.1 Opportunity: The penetration rate of overseas e-commerce is growing, and domestic enterprises have rich experience and operational advantages

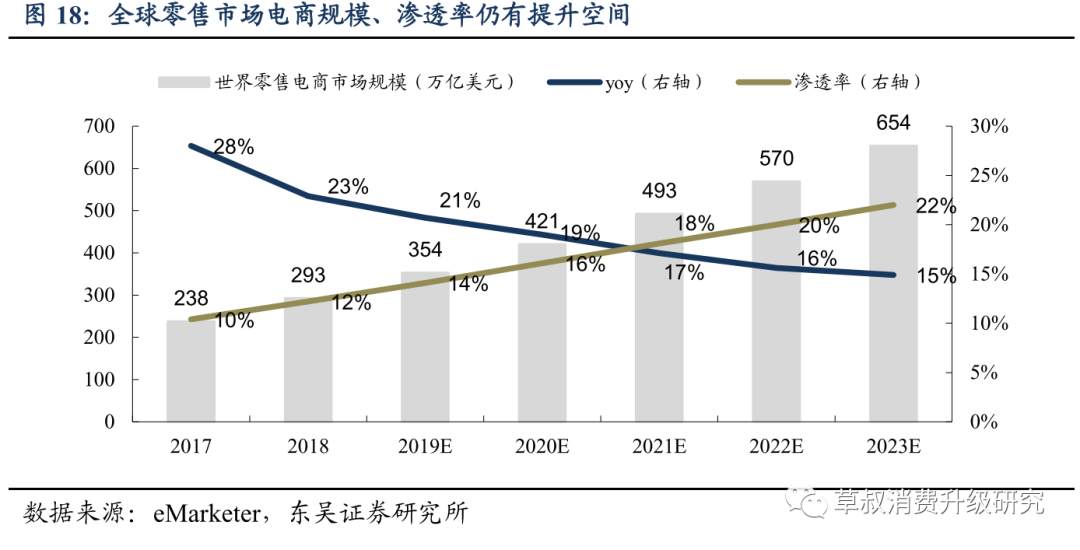

The overseas e-commerce market is still growing. According to eMarketer, the global retail e-commerce market reached 293 trillion US dollars in 2018, at the average US dollar exchange rate for that year (US dollar: RMB =

1:6 .6) Calculated, it is approximately RMB 1938 trillion. Before the public health incident, eMarketer predicted that the global retail e-commerce market would grow at a rate of 15% or more per year. By 2023, the market size would reach 654 trillion US dollars, with a CAGR of 16.6% in 2019-23. Meanwhile, the penetration rate of retail e-commerce (as a share of retail sales) will also increase from about 12% in 2018 to 22% in 2023, with an average annual increase of 2 pct.

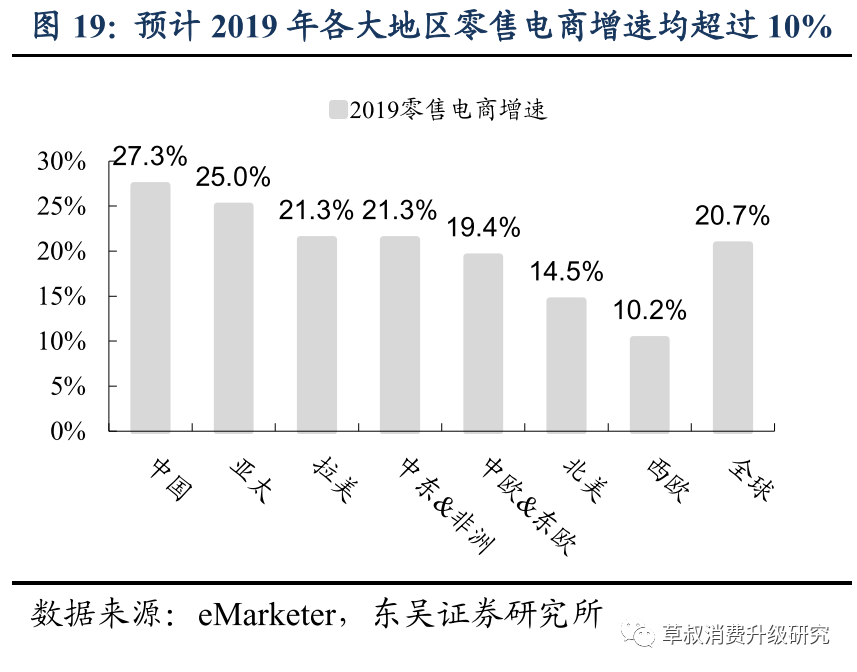

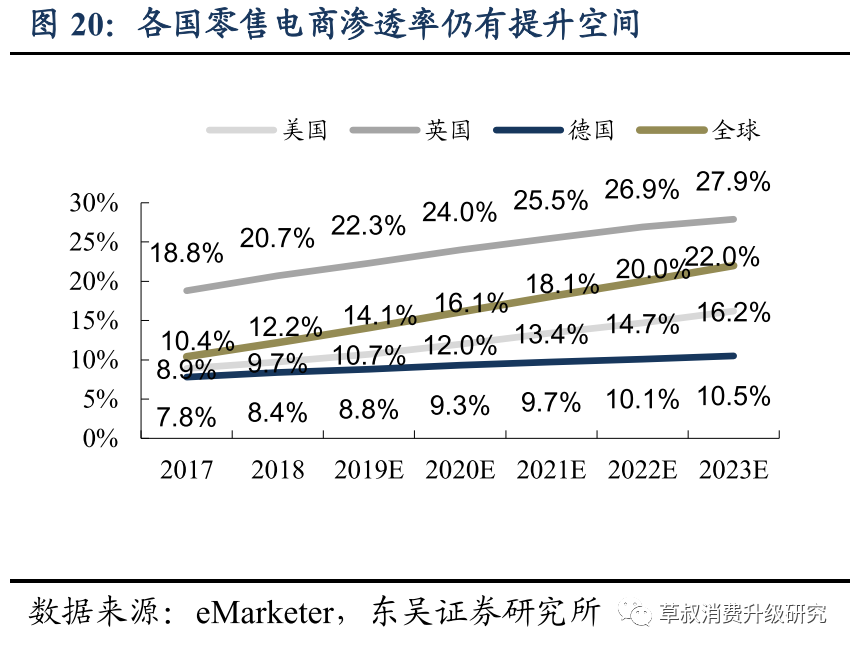

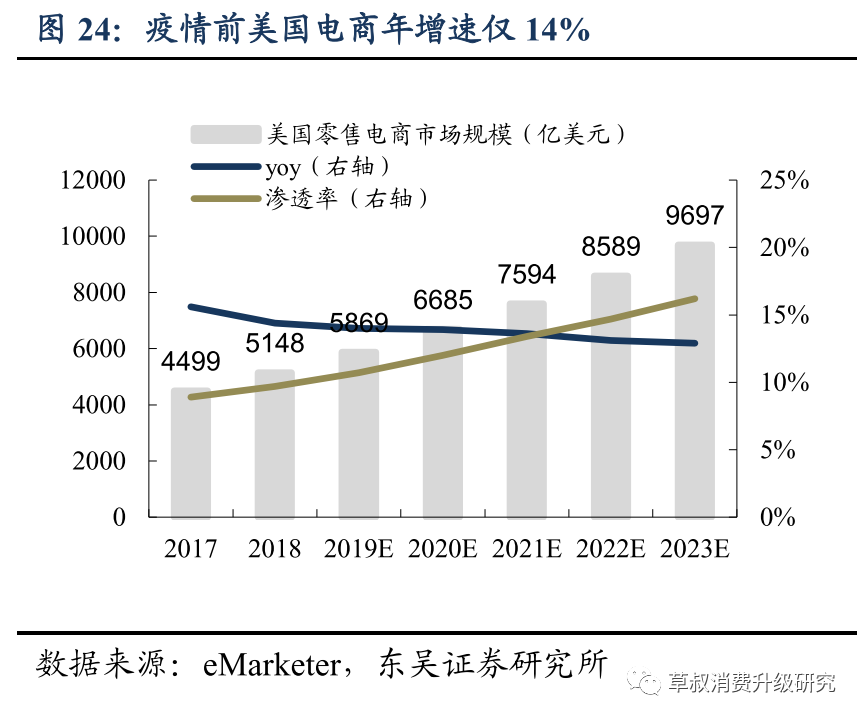

Online retail is a major global trend. Not only is there a high growth rate in all major regions, but there is also room for further development in developed countries. eMarketer predicts that the region with the fastest retail e-commerce development in 2019 will be the Asia-Pacific region, with a growth rate of 25%. Among them, China's retail e-commerce growth rate reached 27.3%; developed regions such as North America and Western Europe also had growth rates of more than 10%; other regions grew at around 20%. In developed countries, the US retail e-commerce market grew 14.4% year-on-year in 2018, and the CAGR in 2019-23 is expected to be 13.4%; the UK's growth rate in 2018 was 14.9%, and the CAGR in 2019-23 is expected to be 6.9%; Germany's growth rate in 2018 will reach 14.9%. Overall, there is still some room for improvement in the penetration rate of retail e-commerce in various countries, which is expected to drive the continued growth of the e-commerce market.

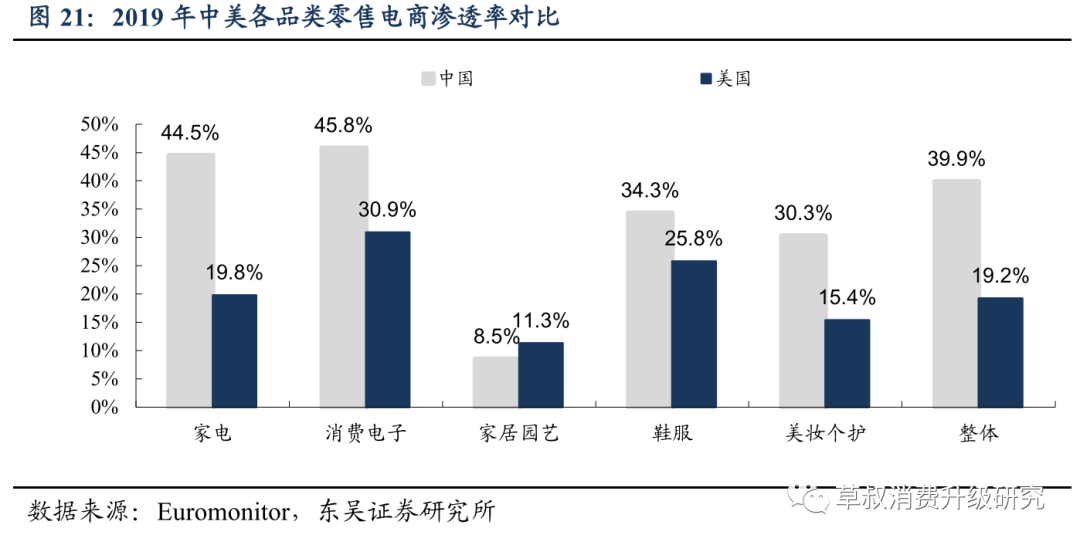

There is a high degree of room for improvement in the degree of online e-commerce for some of the major categories of cross-border exports. According to the above analysis, categories such as digital electronics, shoes, clothing, bags, and home gardening currently account for a relatively high proportion of e-commerce exports and are advantageous projects. Comparing the retail e-commerce penetration rate between China and the US in 2019, with the exception of home gardening, there is high room for improvement in the penetration rate of all categories, especially the home appliances and digital electronics categories. The penetration rate gap between China and the US reached more than 15%. As these categories become more online in the future, the size of the cross-border e-commerce market for related categories is expected to grow simultaneously.

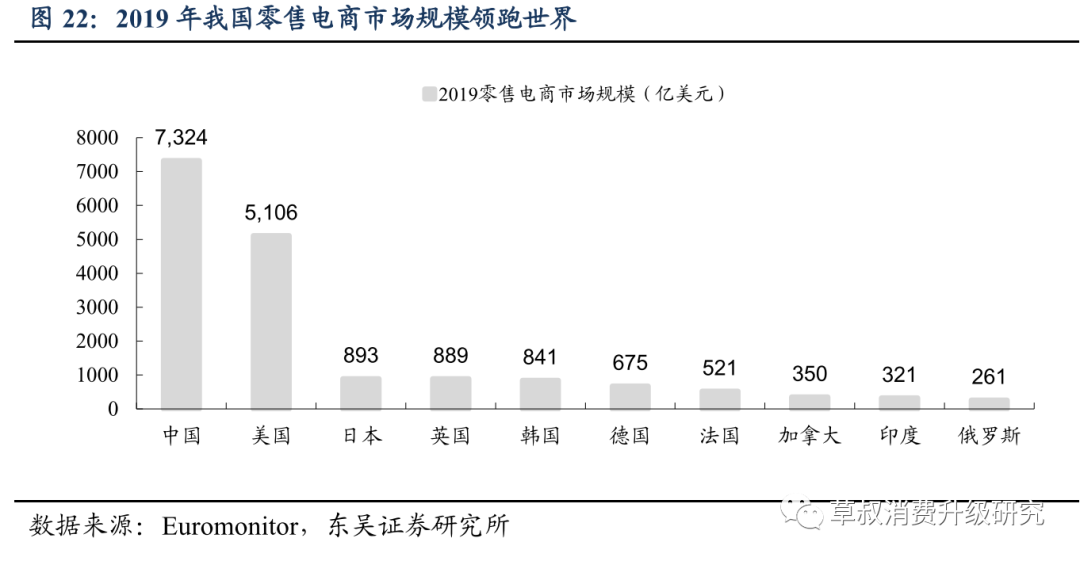

In the retail e-commerce industry, China is number one in the world in terms of market size. According to Euromonitor statistics, China's retail e-commerce market reached 73.24 billion US dollars in 2019, or 5.1 trillion yuan at the average exchange rate for that year. It is the country with the highest e-commerce retail sales, leading the US 43% in second place, and 8.2 times Japan in third place. The mature e-commerce market allows domestic merchants to have richer e-commerce operation experience, such as quickly responding to hot events and consumer needs, and actively interacting with KOLs to post social content. These advantages are expected to help cross-border e-commerce stand out in the competition with local merchants.

3.2 Catalysis: Public health events accelerate e-commerce of overseas retail, strong and early recovery of China's supply chain

Cross-border e-commerce benefited deeply during the public health incident and is optimistic about the development prospects of the industry: ① On the supply chain side, the domestic supply chain recovered faster. Judging from the PMI index, it was only affected to a certain extent in February, and the recovery was completed in March, while the supply chains of overseas developed countries were more affected and lasted longer; ② On the channel side, the public health incident triggered a new round of changes in retail channels in developed countries, reflecting the deepening of online penetration and concentration on leading retail giants. Cross-border e-commerce generally lays out online channels and large supermarket channels such as Walmart, which is expected to benefit deeply from it. Let's take a look specifically:

China's supply chain was restored earlier and faster during the public health incident. Looking at the manufacturing PMI index, China was only affected to a certain extent in February: the PMI index fell to 35.7 in that month and recovered to 52 the following month. Since then, it has remained above the boom-and-bust line. However, public health incidents in countries such as Britain, the US, Japan, and Germany began late and continued for a long time. These countries began to be hit by public health incidents in March, and it wasn't until June that they recovered one after another. The rapid recovery of China's manufacturing industry is a reflection of the high level of supply chain development and good political and economic order. We expect that after the public health incident, the position of China's manufacturing industry in the world will accelerate, and that high-quality large-scale buyers seeking stable supply will gradually increase the proportion of purchases made from domestic suppliers, so that cross-border e-commerce will benefit from it.

During the public health incident, foreign e-commerce markets ushered in a wave of accelerated penetration, mainly due to travel restrictions and other factors. Taking the US market as an example, according to eMarketer data and data from the US Department of Commerce, the retail e-commerce market size growth rate before the public health incident occurred was about 14%; the penetration rate was about 15%, showing a trend of continuous slow increase. Online consumer demand was stimulated after the public health incident occurred. According to data from the US Department of Commerce, by April 2020, the US e-commerce penetration rate had increased to 27%, an increase of 11 pct from the beginning of the year. The US e-commerce penetration rate completed the increase over the past 10 years during the 8-week public health incident.

The public health incident caused small and medium-sized enterprises to go out of business, accelerated changes in the competitive pattern of the US retail industry, and accelerated the process of going online. American companies such as Amazon and eBay can be called the originators of retail e-commerce, but the development of e-commerce in the US has been slow in recent years. One major reason is that its retail industry has already formed a multi-level, mature and stable pattern of large-scale supermarkets plus community supermarkets, and e-commerce is difficult to break. During the public health incident, many small and medium-sized retail companies were forced to withdraw from the market for various reasons, and the original pattern was broken. Therefore, we believe that the boom in the US e-commerce industry during the public health incident was not short-lived; they will break through the original shackles, and their penetration rate will reach a new level in the future. Small supermarkets have withdrawn from the market, leading companies have benefited from them, and the process of globalization has accelerated. Two factors have enabled large retail companies in the US to benefit from public health incidents: ① small supermarkets were forced out of the market because they were forced to close for a long time and were unable to even continue operating; ② Some merchants were unable to provide online services and home delivery services, and were unable to meet customer needs. As a result, demand flowed into leading supermarket chains such as Walmart and Target, which have online capabilities. The total revenue of these two companies in Q1 and Q2 both reached record highs, and the online business grew significantly; online giant Amazon's revenue growth rate also increased to a certain extent.

Three models of cross-border e-commerce: Big Seller & Boutique Brand & Independent Website Platform

Overall, at present, cross-border e-commerce mainly consists of three models, namely: ① big sellers; ② boutique brands; ③ independent website platforms. Let's take a look specifically:

Big pan-product sellers sell on various third-party platforms such as eBay, Amazon, Wish, and AliExpress at the same time. There are dozens or even hundreds of stores, and they operate hundreds of thousands of SKUs at the same time. Its stores cover a variety of categories, usually mainly small miscellaneous goods such as home life, clothing, etc. Different stores sell different categories of products to different customers. Under this model, the merchant does not have its own brand, and does not change the brand of the product, that is, they sell branded products as well as white label products.

This type of cross-border e-commerce is similar to a dealer, where you earn the difference in price by buying low and selling high. Both the premium and risk are lower in the three-middle model because the fixed expenses involved in this model are low, and it is difficult to accumulate high premiums through continuous operation. Companies listed under the Pan-Product Big Seller model include Tongtuo Technology (a subsidiary of Huading Co., Ltd.), Youkeshu, etc. Boutique brands focus on launching their own brands in specific categories. Using “independent development+outsourced production” as the mainstream production model, they can operate as few as a few hundred SKUs. This type of merchant sells through platforms such as eBay and Amazon, and can also enter traditional offline channels such as Walmart and Target. The mainstream production model is “independent development+outsourced production”. After the brand independently designs and provides some core materials, the production and processing is completed by an outsourced unit.

Boutique brands are similar to domestic e-commerce brands. Through long-term accumulation, they form brand awareness, control pricing power, and have higher premiums. The boutique model balances risk and premium, and is currently developing well. Listed companies include Anker Innovation, Zebao Innovation (owned by Xinghui Precision), and Auji E-Commerce (a company listed on the New Third Board, delisted in 2019).

Independent website platforms for cross-border e-commerce are usually self-built, direct-managed vertical platform models. Some independent website platforms (such as SheIn, etc.) have their own brands and have some similarities with the boutique brand model. They can all form perceptions and control pricing power through accumulation over a long period of time. We think it is difficult and risky to launch such platforms in the early stages, but in theory, the upper limit is also higher. Currently, such independent sites include apparel platforms represented by SheIn and Zaful (under Cross-border Connect), as well as digital electronics and miscellaneous goods platforms represented by Gearbest (a subsidiary of Cross-border Connect).

4.1 Big sellers of Pan-products: Direct sales abroad after product selection, mainly small groceries - Tongtuo Technology & Youkeshu

Cross-border e-commerce for big sellers of global products can operate hundreds of thousands of SKUs at the same time, covering multiple categories, usually small grocery categories such as home life, clothing, etc. This type of merchant sells on multiple third-party platforms such as eBay, Amazon, Wish, and AliExpress at the same time, and usually has multiple stores on one platform to sell different categories of products to different customers. Under this model, the merchant does not have its own brand, and does not change the brand of the product, that is, they sell branded products as well as white label products. Cross-border e-commerce under this model includes Tongtuo Technology, a subsidiary of Huading Co., Ltd., and Hekenshu. Let's take a look specifically:

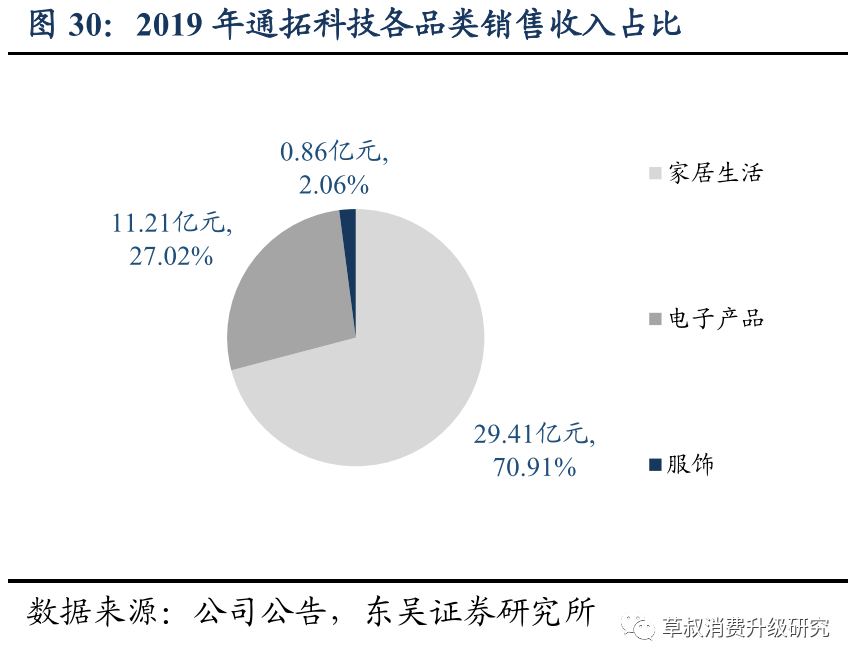

Tongtuo Technology was founded in 2004 and completed the merger and listing with Huading Co., Ltd. in March 2018. According to the company's official website, Tongtuo Technology is the pioneer of the omni-channel pan-supply chain cross-border e-commerce model. The company engages in import and export two-way cross-border e-commerce trade, mainly exports. In 2019, export business revenue accounted for 72%, imports accounted for 18%, and freight forwarders accounted for 10%. In terms of categories, as of June 2020, it has covered dozens of categories such as 3C, photography, clothing, home and outdoor, etc., with more than 550,000 SKUs. In terms of platforms, the company mainly sells through third-party platforms such as eBay, Amazon, and AliExpress (97.7% in 2019), and also through TOMTOP's own platform (2.3% in 2019).

Founded in 2010, Youkeshu has stores on more than 10 overseas e-commerce platforms. By the end of June 2020, the company had sold its products to more than 100 countries and regions on all continents through more than 10 mainstream e-commerce platforms such as eBay, Amazon, Wish, and AliExpress, as well as dozens of regional platforms such as Shopee and Lazada. The main products cover 3,000 subcategories in 19 categories, including 3C, outdoor, home and auto parts, and the number of SKUs exceeds 1 million. Through the pan-supply chain sales model, each store's product positioning and targeted customer segmentation are balanced to fully explore and meet customer needs.

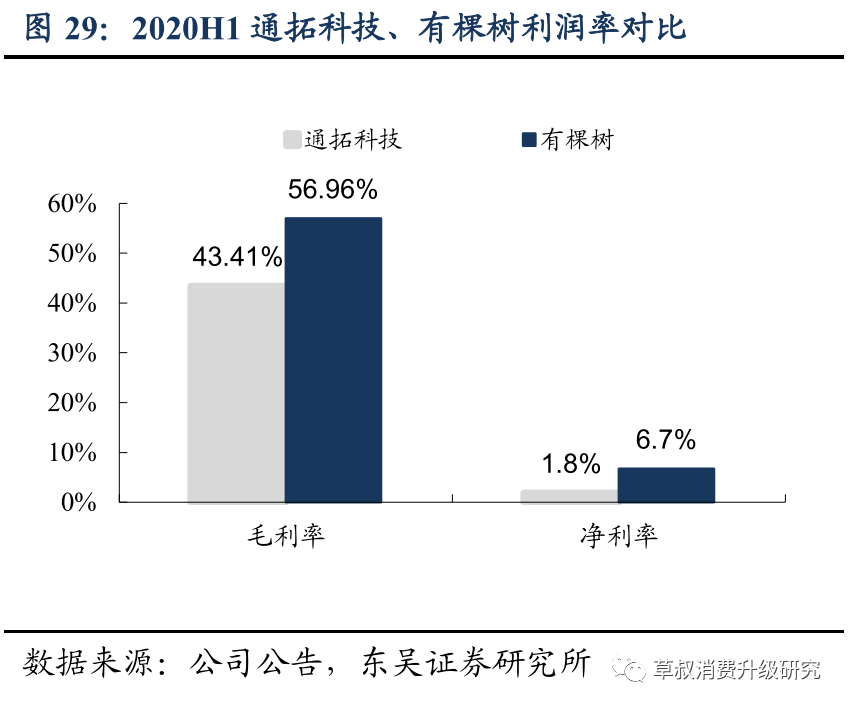

Comparing the financial data of the two companies: Tongtuo Technology is leading in revenue, with growth rates and higher profit margins. Tongtuo Technology (ST Huading E-Commerce Business) achieved revenue of 3.798 billion yuan in 2020H1, an increase of 64.69%; net profit of 70 million yuan, a decrease of 31.89%; gross margin was 43.41%, and net interest rate was 1.8%. Youkeshu achieved revenue of 2,234 million yuan in 2020H1, an increase of 238%; net profit of 150 million yuan, an increase of 83%; gross margin was 56.96%, and net interest rate was 6.7%.

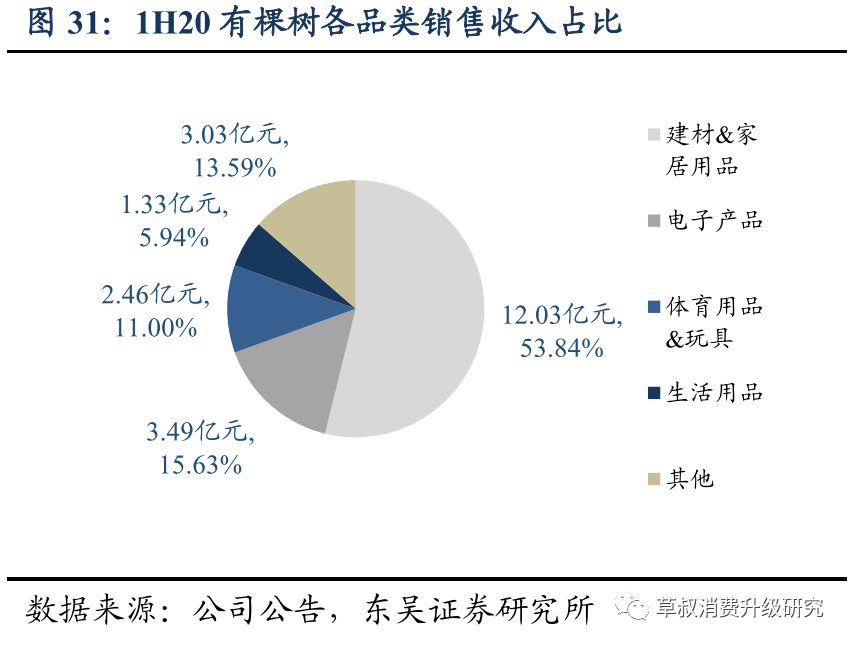

The products sold by big pan-product sellers are mainly all kinds of small products, similar to dealers & grocery stores. The first and two major categories sold by Tongtuo Technology and Youkeshu are household goods and electronic products. Although the exact division of categories between the two companies may be different, these two categories are basically all kinds of household goods and digital peripherals. The ticket price is also not high. For example, Tongtuo Technology's 2019 customer unit price was only 189 yuan.

4.2 Boutique brands: launch their own brands for specific categories, focusing on brand value - Anker, Zebao, etc.

The boutique brand model focuses on launching private brands in certain categories. With “independent development+outsourced production” as the mainstream production model, they can operate as few as a few hundred SKUs. This type of merchant can not only sell through platforms such as eBay and Amazon, but can also set up offline channels through supermarkets such as Walmart and Target. After the brand is established, they can even fight back against the domestic market from overseas.

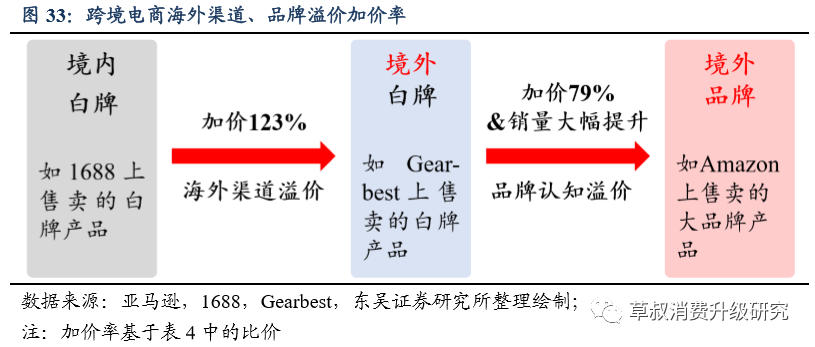

Comparing the price of 20,000 mAh mobile power banks, we found that both channels and brands have a lot of room for bargaining. One of the core advantages of boutique brands is that they can generate premiums through brand recognition. We selected 20,000mAh mobile power bank products compared to the Amazon Anker brand, the white label on the overseas Gearbest website, and the domestic white label price of 1688. After conversion to RMB, the price of overseas Anker products is 79% higher than that of overseas white brands, while overseas white brands are 123% higher than domestic white brands. Branded products also received higher sales: Anker products received 104,000 reviews on Amazon, while white-label product reviews on overseas and domestic e-commerce were less than 10.

In other words, selling domestic products abroad can generate a 123% premium; if you have high recognition brand endorsements, you can generate a further 79% premium, while also greatly increasing popularity and sales. Considering that it is not difficult to manufacture mobile power products, and that there are complete chip and battery solutions on the market, we think that overall, there is not much difference in materials and performance between these products. Therefore, we further believe that foreign channels and brand recognition can generate significant premiums.

Taken together, we think consumer digital and peripheral accessory products are developing well in the current brand boutique model (such as power banks, Bluetooth audio devices, etc.). The main reason is: ① The unit price of this category is not low and the degree of standardization is high. There are many similar products on the market, price competition is fierce, and companies are motivated to seek brand premiums; ② These fields have not yet formed leading brands with absolute market leadership, leaving plenty of room for their own brands. We believe that in the future, after other categories of cross-border e-commerce markets are developed to a certain extent, they will also develop into a branded boutique model.

Since the boutique brand model can further generate premiums and at the same time significantly increase sales, we are optimistic about the future development of this model. Currently, cross-border e-commerce that focuses on branded boutiques mainly includes Anker Innovation, Zebao Innovation (owned by Xinghui Precision), and Auji E-commerce. Let's take a look specifically:

4.2.1 Anker Innovation: Focusing on mobile device peripheral products, it has entered offline channels such as Walmart

Anker Innovation was founded in 2011 and listed on the GEM in August 2020. The company is mainly engaged in independent R&D, sales and design of its own branded mobile device peripheral products and smart hardware products. It owns brands such as Anker (charging+audio), Roav (intelligent innovation), and Soundcore (audio). The products are mainly sold to developed European and American countries, and occupy an industry-leading market share on the Amazon platform. In addition, they also have high market coverage in well-known offline channels such as Walmart, Best Buy, and Target.

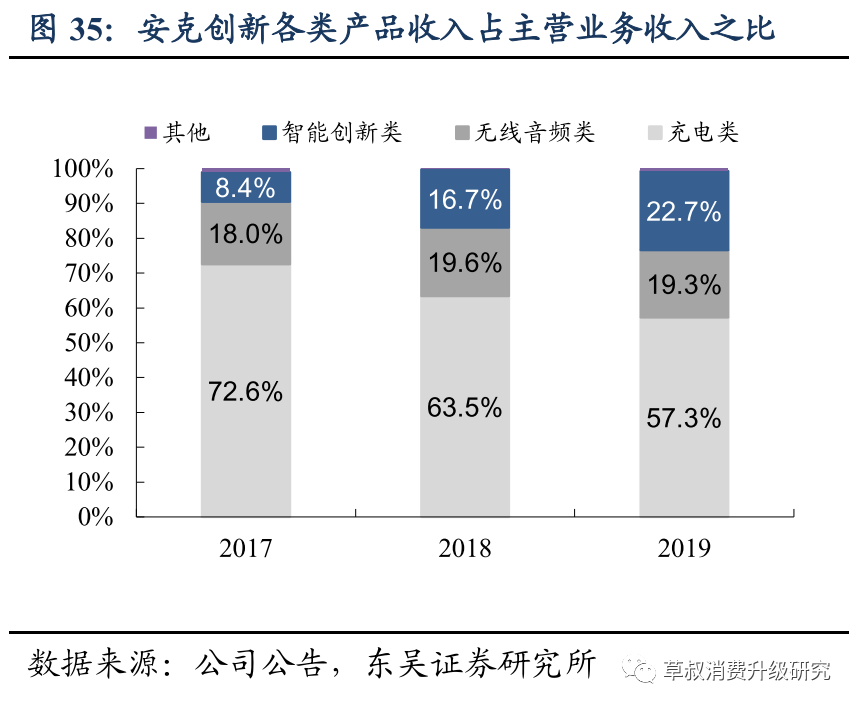

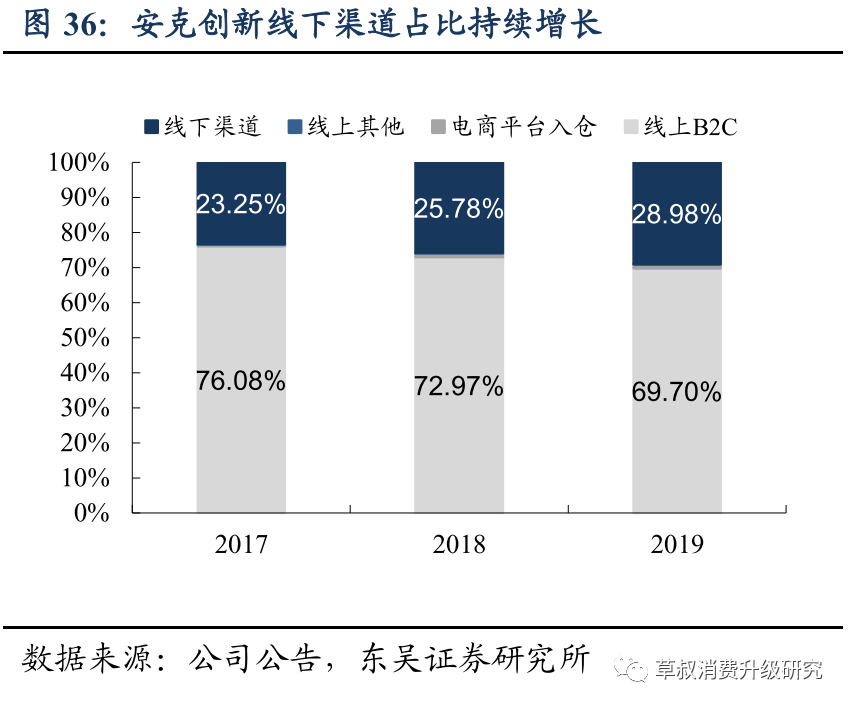

Revenue split: Mainly charging products, intelligent innovation is growing rapidly; products are mainly sold to developed countries in Europe and the United States. ① In terms of products, the charging category accounted for 57.33% of the main business revenue in 2019, the wireless audio category accounted for 19.25%, and the intelligent innovation category accounted for 22.72%. The charging category has always been the largest category, while the intelligent innovation category has grown rapidly in recent years. ② In terms of geography, North America and Europe, as the first markets developed by the company, ranked in the top two of all markets, accounting for 56% and 17% of main revenue. The company's sales channels are mainly online, and the proportion of offline is gradually increasing. Online accounted for 70% in 2019, including channels such as B2C platforms such as Amazon, e-commerce platforms such as Jingdong, and independent online websites for brands. In recent years, the company has gradually begun to enter offline channels such as Walmart and Target, and the offline share continues to grow at a rate of about 2 pct per year.

4.2.2 Zebao Innovation (owned by Xinghui Precision): Products cover digital peripherals, small household appliances, personal care, etc.

Zebao Innovation was founded in 2007, entered the Amazon platform in 2008, and was acquired by Xinghui Precision in 2018. Currently, it has six major brands: RAVPower (charging products), VAVA (smart hardware), Taotronics (Bluetooth headsets), Anjou (natural skin care and personal care), Sable (home textiles), and HooToo (digital accessories such as USB hubs). Products are mainly sold directly to developed countries such as the United States, Europe, and Japan through the Amazon platform.

Among Zebao's innovative product lines, power supplies, Bluetooth, and small household appliances accounted for a relatively high proportion, with 1H20 accounting for 15%, 23%, and 30% respectively. The furniture category is a new product line, with revenue reaching 247 million, accounting for 14%. In terms of growth rate, 1H20 computers, mobile phones, peripherals, and small household appliances all had a high growth rate of over 100%.

4.2.3 Aggie e-commerce: covering 3C digital, home health and other categories, sold globally through Amazon and eBay

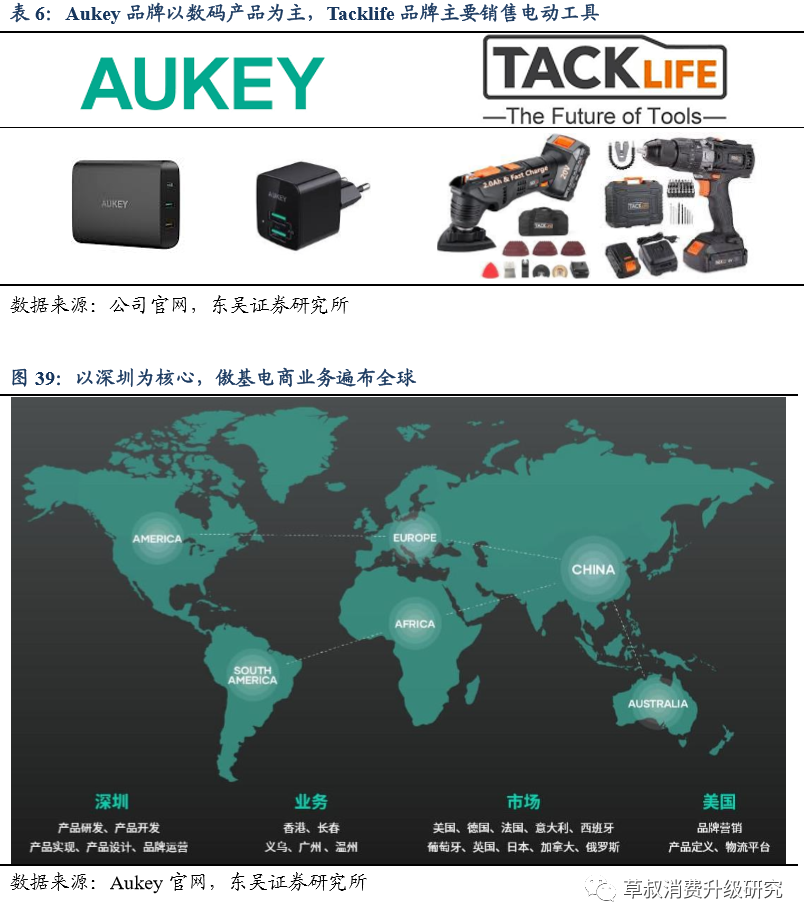

Aoji E-commerce was founded in 2005, entered the New Third Board in 2015, and later delisted from the New Third Board in 2019. The company is mainly engaged in R&D, design and sales of self-branded consumer technology products. It owns brands such as Aukey and Tacklife, covering fields such as 3C digital, power tools, smart appliances, home and health categories, and is mainly sold globally through third-party platforms such as Amazon and eBay. The company has product design, R&D and brand operation centers in Shenzhen, and brand marketing, product definition, and logistics platforms in the US. The markets it has entered include traditional developed countries such as the United Kingdom, the United States, Germany, and France.

4.2.4 Anker vs. Zebao vs. Auggie: Anker puts more emphasis on R&D and has the highest revenue and net profit

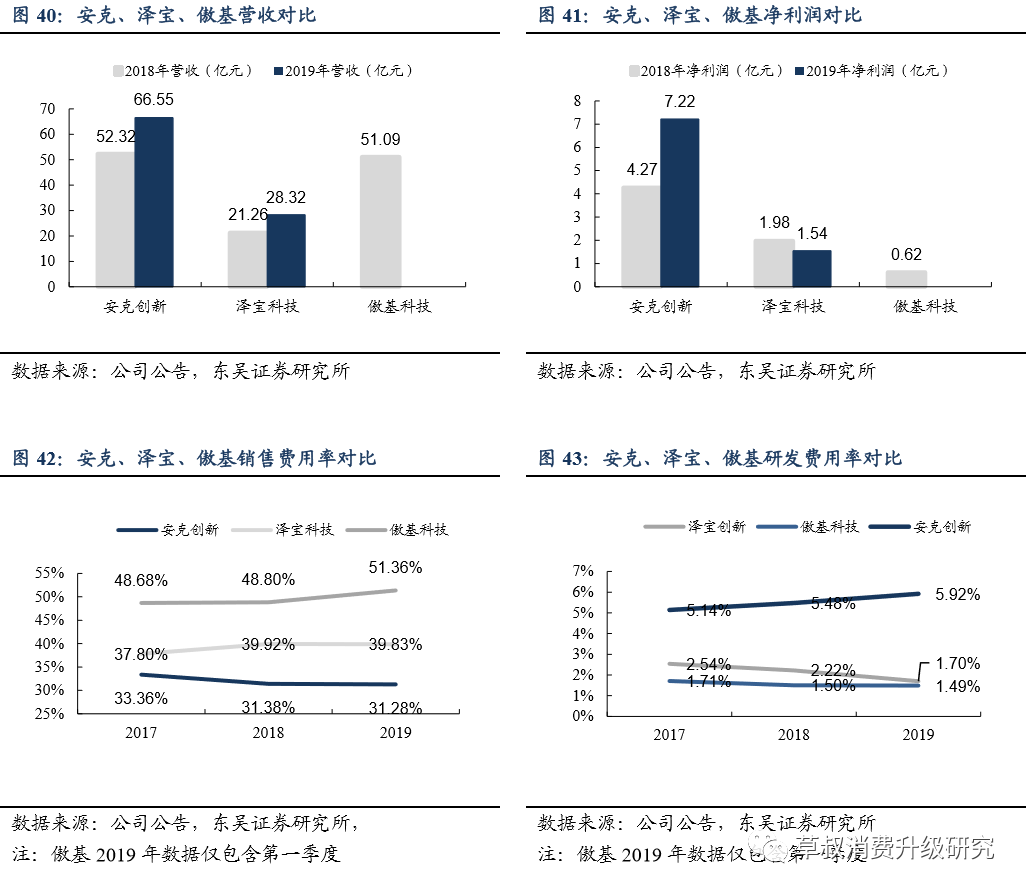

Comparing the three companies: Anker's innovation revenue and net interest rates were all the highest among the three companies. Anker Innovation's revenue in 2018/19 was 5.2 billion yuan/6.7 billion yuan, all higher than Zebao Technology's 2.1 billion yuan/2.8 billion yuan; Anker's revenue in 2018 was also higher than Agarge's revenue of 5.1 billion yuan. In terms of net interest rate, Anker's net interest rate in 2018/19 was 8.2%/10.9%, both higher than Zebao's 2.9%/5.4%; in 2018, Anker's net interest rate was also higher than Auggie's 3.9%. Anker Innovation is one of the most special companies, mainly because: ① Anker places more importance on R&D and is a more thorough company that follows the boutique route: its R&D expenditure rates in 2017-19 were above 5% and were on an upward trend; during the same period, the R&D expenses of Zebao and Agarge were between 1.5%-2.5%, showing a downward trend. ② Anker is already developing offline channels in North America and other places, so the sales expense ratio is even lower: in 2017-19, Zebao's sales expense ratio was about 40%, Agarge's sales expense ratio was about 50%, while Anker's sales expense ratio was only about 30%. This is because platform fees account for a relatively high share of cross-border e-commerce companies' sales expenses, and Anker's offline channels already account for 30% of this revenue.

4.3 Independent station platforms are beginning to shine, highest risk & maximum space - SheIn, ZAFUL, etc.

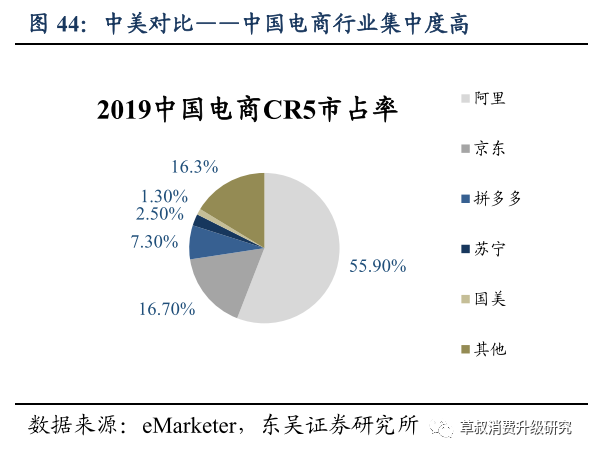

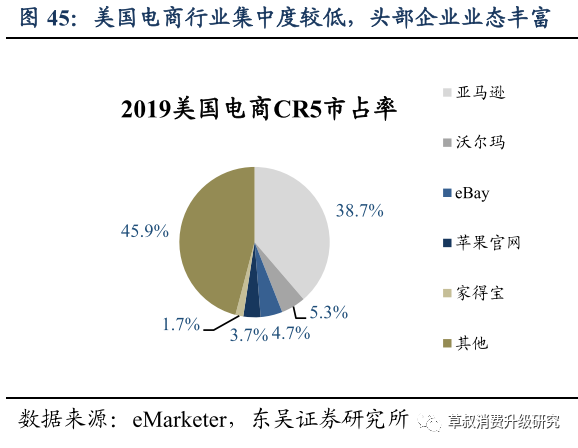

An independent site is a self-built platform model. It is usually a directly managed vertical platform. Currently, such independent sites include apparel platforms represented by SheIn and Zaful (under Cross-border Connect), as well as digital electronics and miscellaneous goods platforms represented by Gearbest (a subsidiary of Cross-border Connect). From the perspective of GMV and revenue, apparel platforms such as SheIn are developing well. We think this type of platform will be difficult to launch in the early stages, but in theory, the upper limit is higher. Foreign e-commerce markets are less concentrated, so independent platforms have a chance to succeed. Unlike the e-commerce market, which has a high concentration of domestic concentration and is dominated by centralized integrated platforms, the foreign e-commerce market is more fragmented: taking the US market as an example, the CR5 market share in 2019 was only 54%, far lower than the domestic market share of CR5, and the US CR5 market share was even lower than that of Taobao+Tmall.

Leading companies also have a richer business format: in the US, with the exception of the two giants Amazon and eBay, the official websites of brands such as Apple, the online section of traditional supermarkets such as Walmart, and vertical platforms such as Home Depot can all occupy a place in CR5; while the top four domestic companies, Ali, JD, Pinduoduo, and Suning, are all comprehensive e-commerce platforms (although there are differences in category focus). Therefore, we believe that independent websites are more likely to succeed in the fragmented e-commerce markets of developed countries such as the US. Currently, the largest independent site is SheIn; ZAFUL and Gearbest, which are part of Cross-border Connect, have also formed a certain scale.

4.3.1 SheIn: GMV's fast-growing independent FMCG apparel site, completed a new round of financing in 2020

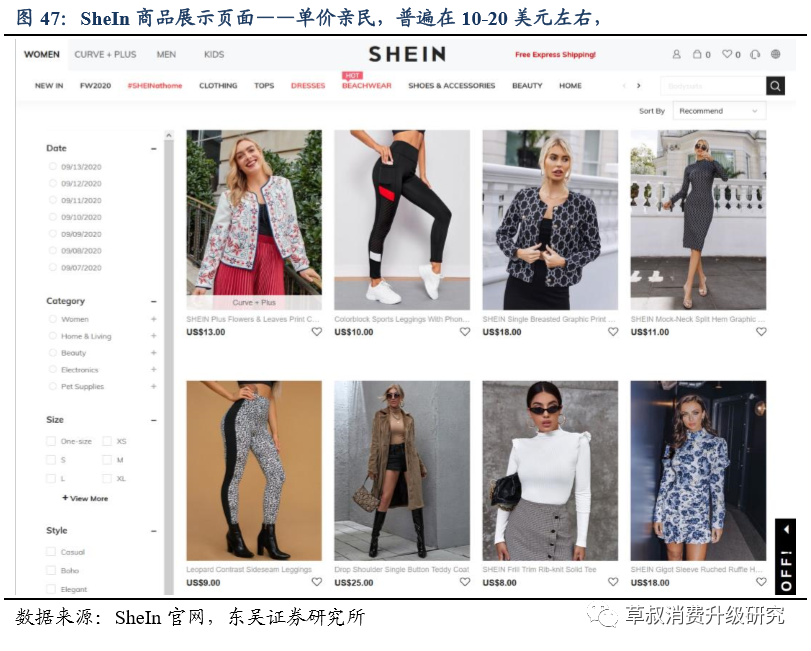

SheIn is a cross-border independent website platform with its own brand, targeting FMCG clothing, similar to Zara, Foever21, etc. Its products are mainly aimed at female consumers, providing clothing, accessories, shoes, luggage products, and has its own community, which provides services such as consumer experience sharing, shopping guides, and friendship.

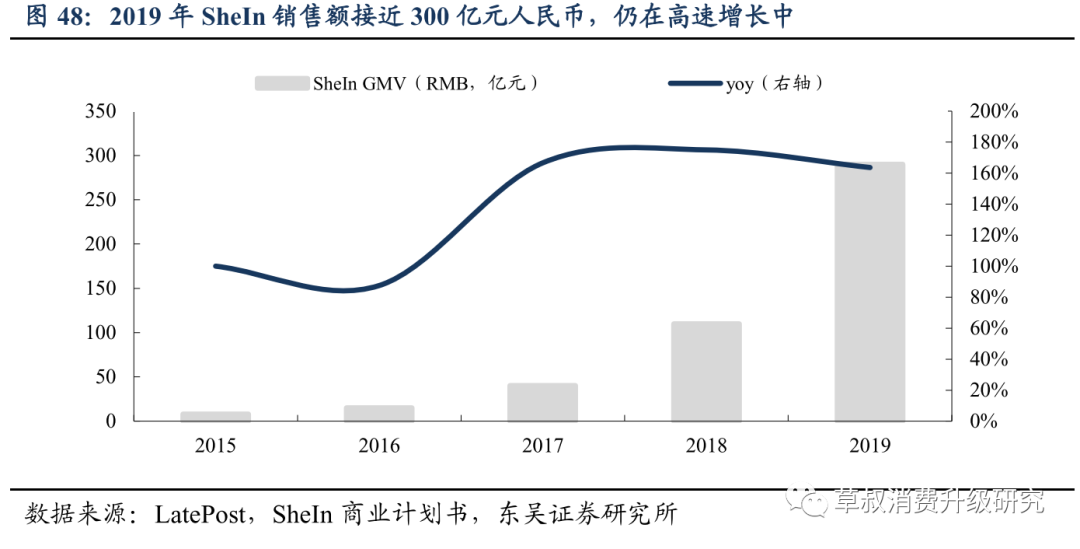

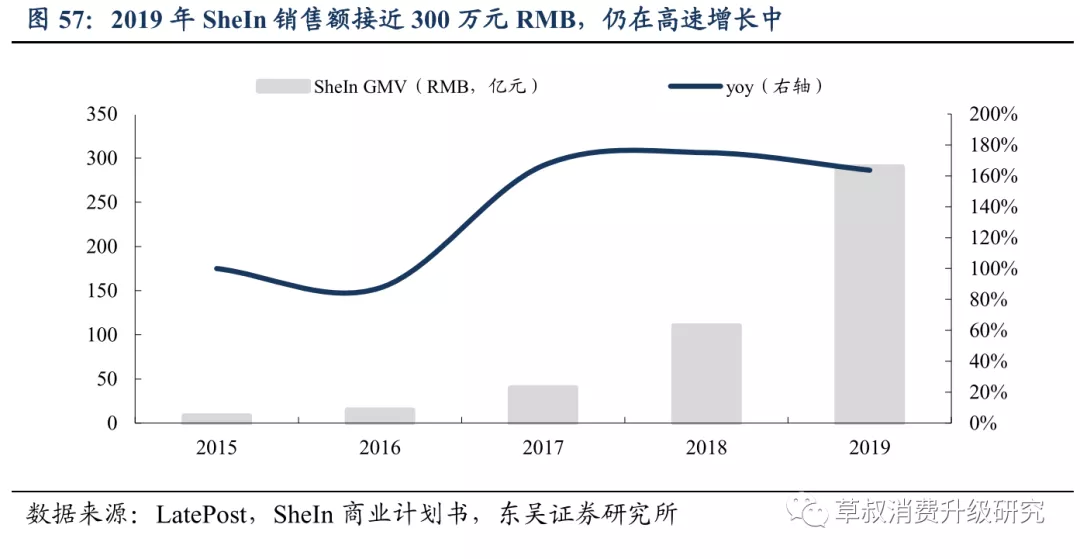

Backed by a high-quality supply chain+cross-border e-commerce model to improve efficiency, SheIn has a price advantage+rapid reverse advantage. According to LatePost statistics, in 2019, SheIn launched 150,000 new models, with an average of 400 new models added daily, which clearly surpassed the rate of 10,000 to 20,000 new products per year for typical FMCG clothing brands such as Zara; however, the pace of adoption continued to accelerate. In July 2020, the women's clothing category alone reached 2,000 new models per day. SheIn's price is also more affordable. Compared to Zara's average regular pricing of around $30, SheIn's pricing is generally around 10-20 US dollars, which is only half of Zara's.

FMCG requires high flexibility and usually requires factories to deliver quickly and place orders in small batches. Therefore, production sites are usually located near the company headquarters, and domestic high-quality apparel industry clusters provide SheIn a natural competitive advantage. According to an interview with LatePost, the company began establishing a supply system as early as 2014 when it incubated the SheIn brand; according to the SheIn business plan, in 2018-19, the company focused on transforming core aspects such as fabrics, printing and dyeing, and achieved 75% of factory direct procurement. Thanks to a high-quality supply chain, SheIn guarantees “fewer than three threads per garment, and no more than

3 cm long; size error 2

Strict quality “within cm”. In 2019, SheIn's sales were close to 30 billion yuan. According to data compiled later by LatePost from SheIn's business plans and interviews, SheIn's sales in 2019 were close to 30 billion yuan and reached a new high during the public health incident. In the first six months of 2020, SheIn's sales exceeded 40 billion yuan, and annual sales are expected to hit 100 billion yuan. The company's performance reached an inflection point in 2017 and the growth rate accelerated sharply, mainly because it has successively developed the Middle East, India and Africa markets since 2017.

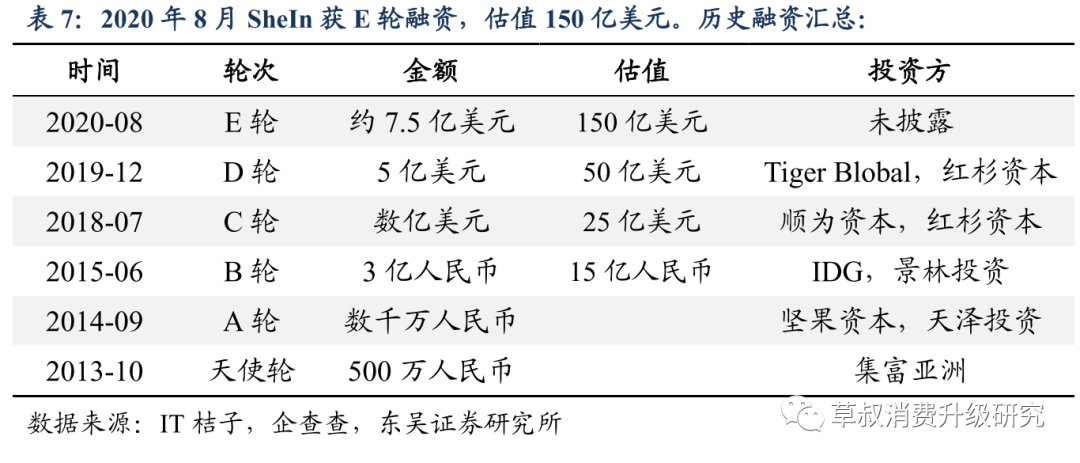

The excellent performance attracted attention from the capital market. Series E financing was completed in August 2020, with a valuation exceeding 10 billion US dollars. The company was founded in 2008 and is headquartered in Nanjing, Jiangsu. It was very low-key at the beginning of its establishment, and was gradually sought after by the capital market due to its excellent performance. In 2013/10, the company received 5 million angel rounds of financing from Jifu Asia. Since then, it has received a total of 5 rounds of financing from investors such as Nut Capital, IDG, and Sequoia Capital. In August 2020, the company received round E financing. According to IT Orange data, Series E financing accounted for about 5% of the equity, the post-investment valuation was 15 billion US dollars, and the financing amount was about 750 million US dollars.

4.3.2 Global Tesco: It owns clothing websites such as Zaful and integrated electronic websites such as Gearbest

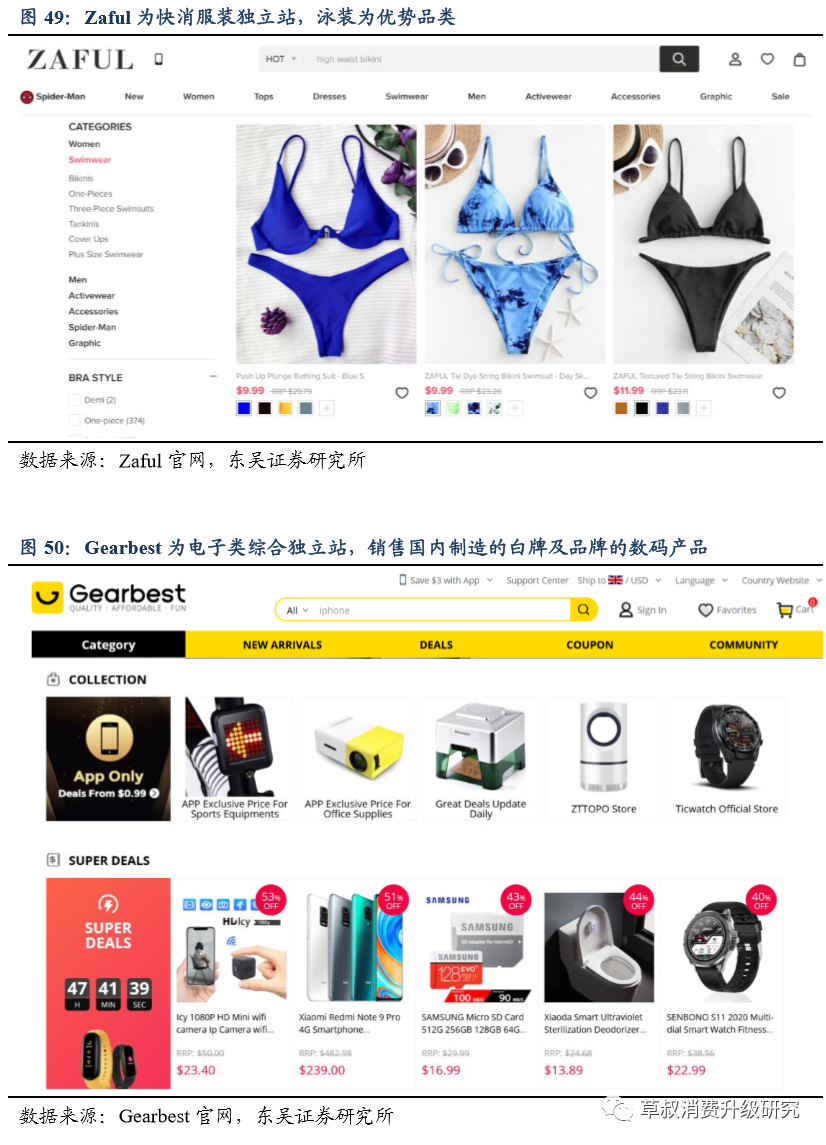

Global Tesco is a wholly-owned subsidiary of Cross-border Connect and was founded in 2007. Global Tesco is mainly based on the Pan-Product independent platform model. It has independent clothing websites Zaful and Gearbest. ZAFUL is similar to SHEIN. The dominant categories are swimwear/bikinis, etc.; Gearbest is an electronic integrated cross-border e-commerce independent website that sells white-label and branded electronic products made domestically, and follows a cost-effective route.

The company continues to strengthen the brand building of key channels such as Gearbest and ZAFUL. While continuing to deeply cultivate mature European and American markets, Gearbest is focusing on entering emerging markets such as Latin America, North Africa, and Eastern Europe, focusing on operating stations in 16 countries; ZAFUL, as an emerging global online fast fashion clothing brand, has added categories such as sportswear and menswear, greatly broadened its product line, focused on localized operations in 19 countries, and carried out a series of offline experiential brand activities targeting different market regions. In 2019, the company's electronics/clothing platform achieved revenue of 3.2 billion yuan/

1.9 billion yuan, and Gearbest/ ZAFUL registered users reached 50.98 million/ 39.86 million, respectively.

4.4 Summary: Optimistic about boutique brands, it is also recommended to continue to pay attention to the derivation of independent website platforms

The development path of cross-border e-commerce, from big sellers of generic products to boutique brands, to independent website platforms, is similar to the domestic offline retail and e-commerce retail industries. Essentially, they all first experienced barbaric growth, grew to a certain scale, then spawned brands, and then platforms. In offline retail: Dealers - merchants that purchased goods in various wholesale markets. Typical examples are buyers at the Guangzhou Wholesale Services Market in the 90s; brands — such as Li Ning, did not produce their own products and mainly controlled profits through brand premiums and channel management; platforms — supermarkets such as Yonghui Supermarkets and Bailian Co., Ltd. In e-commerce retail: dealers - merchants that sell white-brand products on platforms such as 1688; e-commerce vendors - Perfect Diary, big name foundries supply, and generate brand premiums through private domain operations and content operations; platforms - Jingdong Mall, etc. In cross-border e-commerce: dealers - big sellers of global products, the main model in the early stages of barbaric growth of cross-border e-commerce; brands - boutique brands such as Anker Innovation and Zebao Innovation, which have certain brand premiums; platforms - independent platforms such as SheIn and ZAFUL.

Overall, we are more optimistic about the brand model. Furthermore, we recommend paying close attention to the development of independent website platforms. We believe that the brand model forms a brand premium through accumulation over a long period of time, and has a good balance between risk and premium, and is the best racetrack overall. Some independent website platforms, such as SheIn, also have their own brands, so they have some characteristics of brands, such as forming premiums through accumulation. This type of independent website platform can have deep contact with consumers and is also more scalable. Overall, the upper limit is higher. However, the shortcomings are also quite obvious. For example, rapid reaction, high demand for capital, etc., it is a model with a high risk and high upper limit.

Investment advice: optimistic about the development of cross-border brands - it is recommended to focus on Anker Innovation

5.1. It is recommended to focus on high-quality targets in brand e-commerce - Anker Innovation

Established in 2011, Anker Innovation is mainly engaged in independent R&D, sales and design of its own brands of mobile device peripheral products and smart hardware products. It owns brands such as Anker (charging+audio), Roav (intelligent innovation), and Soundcore (audio). The products are mainly sold to developed European and American countries, and occupy an industry-leading market share on the Amazon platform. In addition, they also have high market coverage in well-known offline channels such as Walmart, Best Buy, and Target.

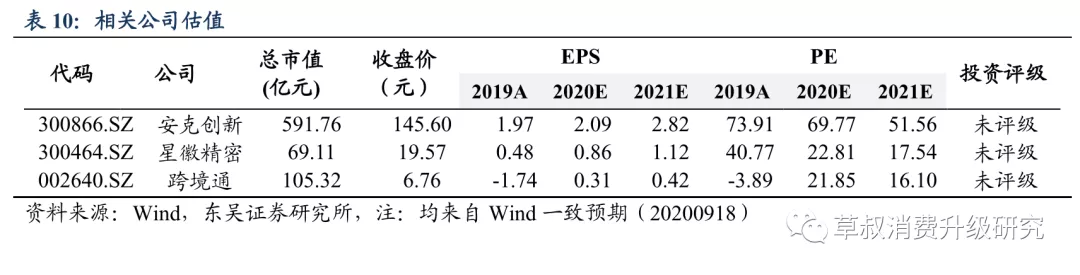

The company is a high-quality target in brand-type cross-border e-commerce and has three core advantages: ① high premiums, stable output of brand value, and relatively manageable risk as a brand; ② large scale and still growing rapidly; ③ Independent IPO equity relationships are clear, the founding team comes from foreign companies, and corporate governance standards.

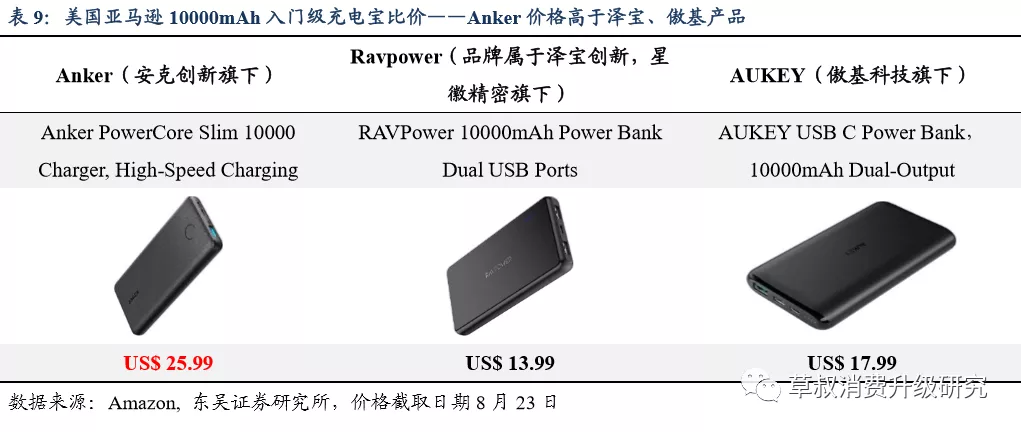

Strong brand awareness, higher premiums than other cross-border brands, stable output of brand value, and relatively manageable risk. By investing heavily in R&D and design, the company continues to enhance brand awareness through continuous introduction of high-end products. Comparing the price of a 10,000mAh mobile power bank with similar parameters on Amazon in the US: Anker's product costs 25.99 US dollars, which is significantly higher than the 13.99 US dollars of RAVPower products owned by Starhui Precision and the 17.99 US dollars of Aukey products owned by Aukey Technology. The selling price of the Anker brand is significantly higher than other brands, and the brand value is output steadily. As a brand, the company has lower risk than independent website platforms. It is an excellent target that balances risk and value and has unique advantages.

It was listed on the GEM market in August 2020. As an independent IPO company, Anker's shareholding relationship is clear. In contrast, cross-border e-commerce companies such as Zebao and Global Tesco are all listed through acquisitions, so Anker Innovation has an advantage in equity relationships. One of the main reasons why the company was able to go public through an independent IPO is that the company structure and management are standardized. This is due to the foreign background of the founder and core team: the founder Yang Meng was a senior Google engineer before founding the company; other core personnel have held R&D, design, sales and management positions in world-renowned high-tech companies such as Huawei, Dell, Philips, and others.

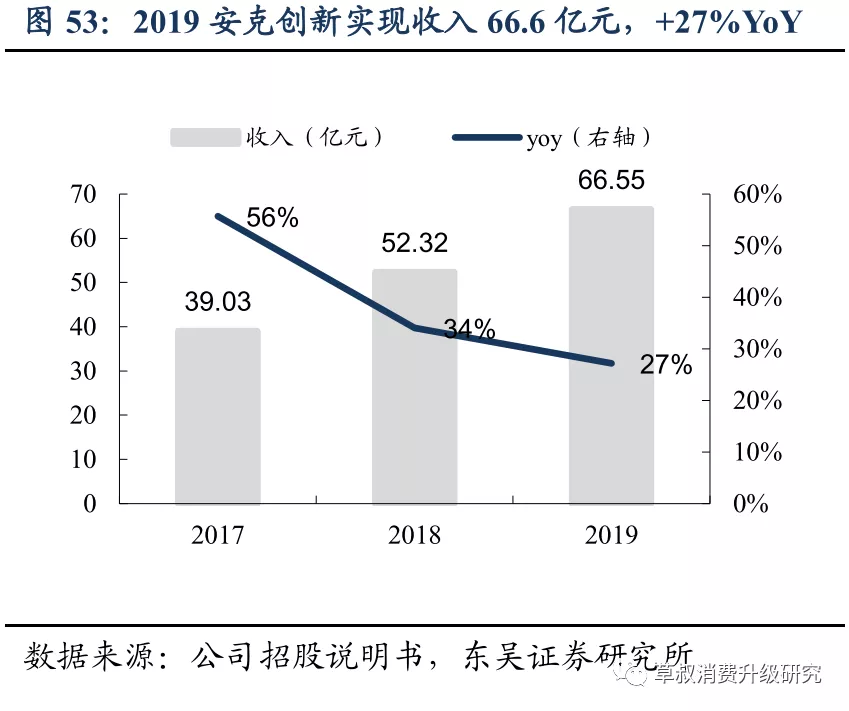

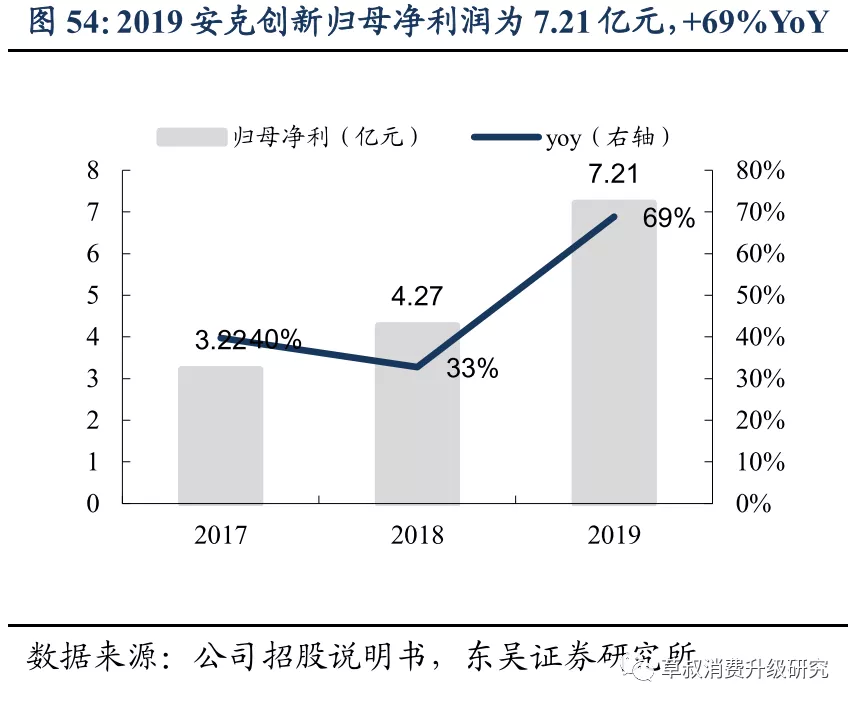

The company achieved revenue of 6.655 billion yuan in 2019, an increase of 27% over the previous year; Guimu's net profit was 721 million yuan, an increase of 69% over the previous year. The main reasons for the rapid growth in performance include the rapid development of the mobile device peripheral products industry and the company's continuous expansion of product lines and channels.

5.2. Cross-border brands such as Zebao Innovation and independent websites such as SheIn are also worth paying attention to

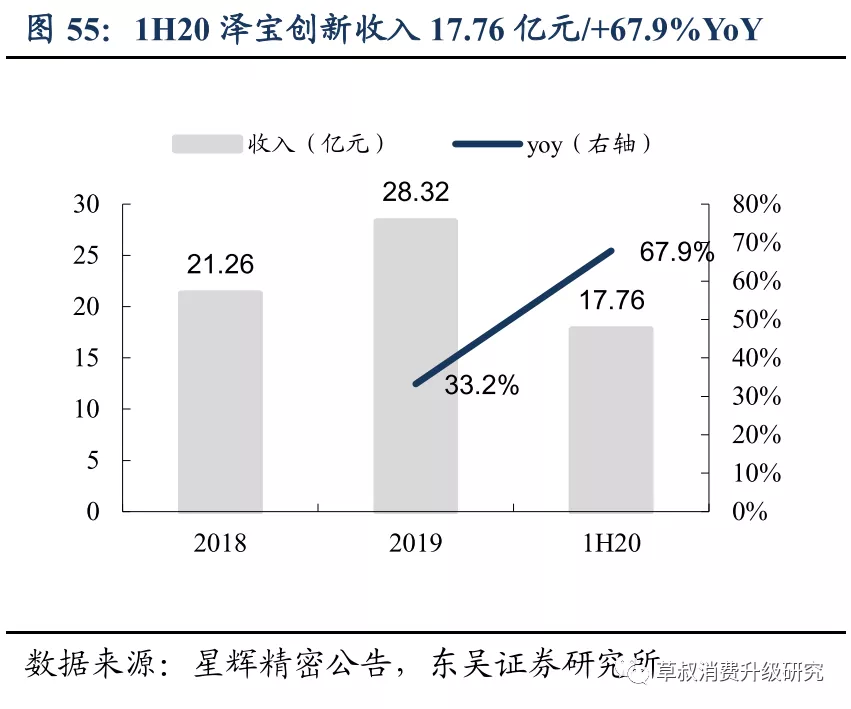

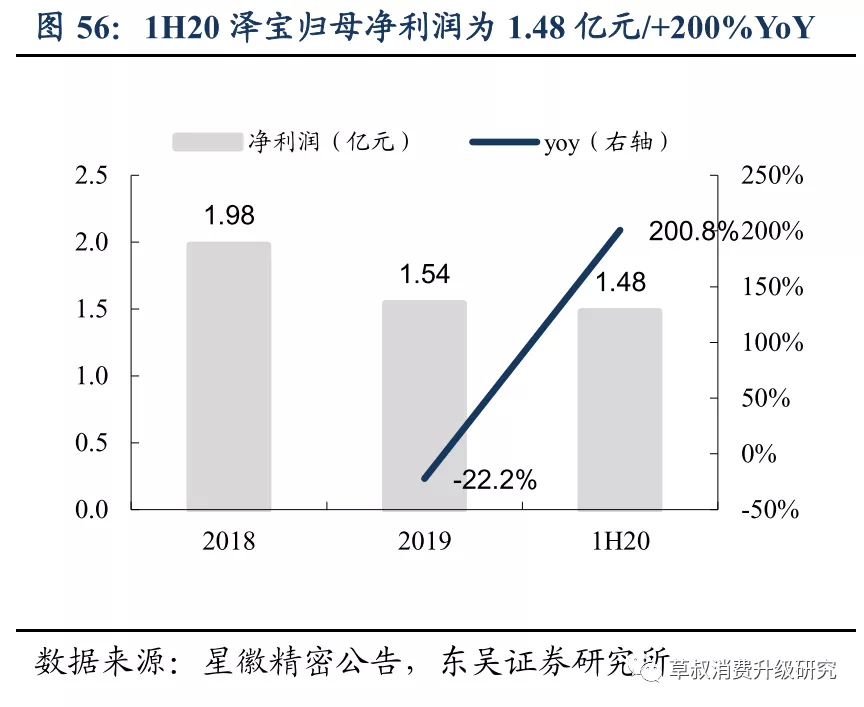

Zebao Innovation, acquired by Xinghui Precision in 2018, is a high quality target among boutique cross-border brands. It was founded in 2007 and entered the Amazon platform in 2008. Currently, it has six major brands: RAVPower (charging products), VAVA (smart hardware), Taotronics (Bluetooth headsets), Anjou (natural skin care and personal care), Sable (home textiles), and HooToo (digital accessories such as USB hubs). Products are mainly sold directly to developed countries such as the United States, Europe, and Japan through the Amazon platform. The strong performance of Zebao Innovation in the first half of 2020 contributed to a significant increase in Xinghui Precision's performance. Xinghui Precision achieved revenue of 2,054 million yuan in the first half of the year, an increase of 50.14% over the previous year; Guimu's net profit was 126 million yuan, an increase of 127.51% over the previous year; after deducting non-return mother's net profit of 128 million yuan, an increase of 148.29% over the previous year. Mainly because during the public health incident, the company successfully overcame the effects of delays in upstream and downstream resumption of work and poor recovery in the industrial chain, while the cross-border e-commerce business led by Zebao achieved significant growth: Zebao Innovation achieved revenue/net profit of 1,776 million yuan/148 million yuan in the first half of 2020, an increase of 67.9%/200.8% over the previous year. The pace of development was rapid, and it has become the company's main source of revenue/profit.

SheIn has accelerated its growth, catalyzed by public health events, and GMV is expected to exceed 100 billion in 2020. According to data compiled later by LatePost from SheIn's business plans and interviews, SheIn's sales in 2019 were close to 30 billion yuan and reached a new high during the public health incident. In the first six months of 2020, SheIn's sales exceeded 40 billion yuan, and annual sales are expected to hit 100 billion yuan. The company's performance reached an inflection point in 2017 and the growth rate accelerated sharply, mainly because it has successively developed the Middle East, India and Africa markets since 2017.

5.3. Investment advice

Cross-border e-commerce is a more efficient export trade model. Its development accelerated under the impetus of multiple favorable factors such as the rapid increase in global e-commerce penetration during the public health incident. Currently, the three main models are ① big sellers, ② boutique brands, and ③ independent website platforms. Among them, boutique brands have achieved a good balance in various dimensions such as accumulation, value, and risk, and have developed well in recent years. We are optimistic about the development of cross-border e-commerce for brands, and suggest focusing on Anker Innovation; secondly, brands such as Zebao Innovation (a subsidiary of Xinghui Precision) are also worth paying attention to; independent platforms such as SheIn have higher limits, although risky, and it is recommended to continue to pay attention to their derivation.

Risk warning

Customs policy changes: If the diplomatic situation continues to deteriorate and trade frictions between China and the US and other countries further intensify, other countries may continue to increase taxes on Chinese exports. This is likely to cause adverse situations such as declining profits and shrinking sales of cross-border e-commerce.

Uncertainty about public health events overseas: Public health incidents in some countries are still under control, which will affect the resumption of work in logistics and supply chains, thereby affecting the normal operation of cross-border e-commerce enterprises.

Overseas law/ policy risk: Cross-border e-commerce may be in a large number of different countries/

Regional operations face different legal systems, and carelessness may cause international business legal risks. Furthermore, as the international situation becomes tense, other countries may introduce unfriendly laws/policies.

Risk of exchange rate fluctuations: The main revenue of some cross-border e-commerce businesses comes from overseas, and performance is affected by exchange rate fluctuations.

在品牌化、海外电商渗透加深的大趋势及强大供应链加持下,B2C类出口跨境电商有望持高增速。据交易对象,跨境电商可分为B2B与B2C。网经社数据显示,2019年B2B类占比更高,达80%;B2C类增速更快,占比从2015年的8%提升至2019年的20%。B2C跨境电商直接触达客户,能通过时间积累形成品牌认知掌握定价权,未来有望保持高增速。我们根据网经社与Kantar的数据预计2020年B2C类跨境出口电商市场规模将达到598亿美元,2020/21年增速分别为30.5%/25.2%。

在品牌化、海外电商渗透加深的大趋势及强大供应链加持下,B2C类出口跨境电商有望持高增速。据交易对象,跨境电商可分为B2B与B2C。网经社数据显示,2019年B2B类占比更高,达80%;B2C类增速更快,占比从2015年的8%提升至2019年的20%。B2C跨境电商直接触达客户,能通过时间积累形成品牌认知掌握定价权,未来有望保持高增速。我们根据网经社与Kantar的数据预计2020年B2C类跨境出口电商市场规模将达到598亿美元,2020/21年增速分别为30.5%/25.2%。