Profits fell significantly in the first half of 2020, underperforming even in 2008. The 23 per cent year-on-year decline in profits of overseas Chinese stocks in the first half of 2020 was even larger than that of the 2008 financial crisis, highlighting the serious negative impact of prevention and control measures such as public health incidents and shutdowns. The new economy plate is quite resilient, but the upstream cycle plate and financial plate which are greatly affected by health events lag behind. But we expect the worst to be over and future profits are expected to recover gradually. We maintain our forecast of 4.7% year-on-year decline in overseas Chinese stock profits from top to next 2020, with profits in the financial sector expected to decline 1.4% and those in the non-financial sector down 12.1%.

Overall situation: a significant decline in the first half of the year, mainly dragged down by the energy, financial and transportation sectors

Based on the summary and analysis of the results in the first half of 2020, we have updated the earnings of overseas Chinese stocks (listed in Hong Kong and the United States), including overall growth, growth drivers, growth quality and growth prospects. The main findings are as follows:

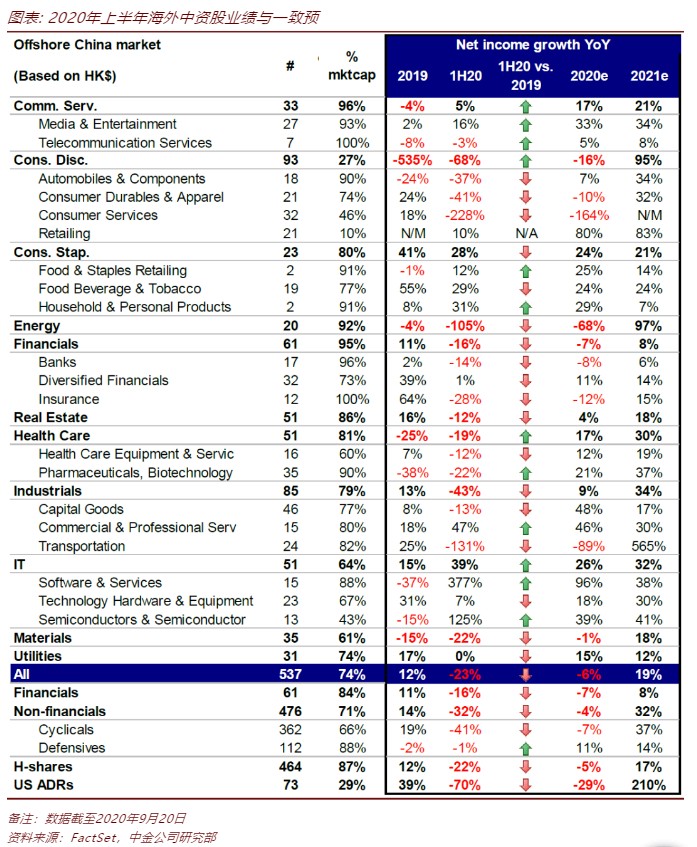

i. 2020Profits fell significantly in the first half of the year, with a performance even lower than 2008年。In Hong Kong dollar, comparable terms, profits of overseas Chinese stocks fell 23 per cent year-on-year in the first half of 2020 (up 12 per cent in 2019), even more than the 2008 financial crisis, highlighting the serious negative impact of prevention and control measures such as public toilets and shutdowns. Energy and banking sectors are a serious drag, affecting the overall profit growth rate of 14 percentage points; other sectors affected by health events and a sharp decline in profits include insurance, transportation, optional consumption and so on.

i. 2020Profits fell significantly in the first half of the year, with a performance even lower than 2008年。In Hong Kong dollar, comparable terms, profits of overseas Chinese stocks fell 23 per cent year-on-year in the first half of 2020 (up 12 per cent in 2019), even more than the 2008 financial crisis, highlighting the serious negative impact of prevention and control measures such as public toilets and shutdowns. Energy and banking sectors are a serious drag, affecting the overall profit growth rate of 14 percentage points; other sectors affected by health events and a sharp decline in profits include insurance, transportation, optional consumption and so on.

ii.The new economy plate is quite resilient, but the upstream cycle plate and financial plate which are greatly affected by health events lag behind.Prevention and control measures such as health incidents and "city closure" have led to serious differentiation among the various plates.

On the one hand, the media, entertainment, daily consumption, online retail and information technology sectors were almost unaffected by health events, with positive growth. On the other hand, the upstream cycle sectors such as energy and materials, as well as sectors such as transportation, consumer services, cars, consumer durables and clothing, which were directly affected by health events such as "city closures", saw a significant year-on-year decline in profits in the first half of the year, with some falling by more than 100%. In addition, financial sector profits fell 16 per cent year-on-year in the first half (up 11 per cent in 2019), dragged down by the banking and insurance sectors, mainly affected by the financial system handing profits to entities. Nevertheless, the share of profits in the banking sector rose to 49 per cent in the first half of the year.

iii.However, the sharp decline will not continue, 2020Consensus expectations indicate that the recovery is under way.The full-year profit decline in 2020 may narrow to 6%, corresponding to 11% year-on-year growth in the second half of 2020 (23% year-on-year decline in the first half of 2020), in line with the recent trend of high-frequency data.

Growth drivers: deteriorating income and profit margins are the main reasons for the sharp decline in earnings in the first half of the year

Compared with 2019, the decline in the profits of overseas non-financial Chinese stocks in the first half of 2020 was mainly affected byThe impact of a sharp drop in sales revenue(first half of 2020-9% vs. 2019 + 6%), in line with negative GDP growth and China International Capital Corporation Macro Group nominal GDP growth forecast (2020 + 2.8% vs. 2019 + 7.8%). Among them, revenue from the transportation, energy, automobile and durable goods sectors decreased significantly.

Although costs and expenses have declined, but 2020Profit margin narrowed slightly to 5% in the first half of the year, the lowest level in nearly a decade. Among them, the profit margins of transportation, energy, consumer durables and clothing sectors declined significantly, while the profit margins of public utilities, media & entertainment and consumer goods sectors improved compared with 2019. In addition, compared with 2019, the proportion of interest expenses to EBIT has increased, but the share of tax costs has decreased.

Quality of growth: slower turnover and increased inventory lead to deterioration of cash flow; leverage ratio rises further

As demand is disturbed by prevention and control measures such as health incidents and shutdowns, the quality of enterprise growth has deteriorated, which is mainly reflected in the following aspects:

Cash flow management:The sharp decline in sales and the passive increase in inventory led to a sharp rise in the inventory-to-sales ratio, and accounts receivable also increased, but the growth rate was slower than inventory. As a result, the growth rate of operating cash flow slowed down in the first half of 2020 compared with the same period last year, and the growth rate relative to income and profit also declined, in line with expectations.

Balance sheet and solvency:Overall financial leverage (debt / total assets, approximately 230%) and net asset-liability ratio (net debt / equity) increased in the first half of 2020, especially in the real estate, energy and daily consumption sectors. As a result, the interest coverage of earnings before interest and tax has declined, mainly because fees are more rigid and less, but the tax cost coverage of earnings before interest and tax has improved.

ROEDown to 2016The lowest level since the first half ofMainly due to a decline in net profit margin and asset turnover, although the financial leverage ratio has increased. In terms of the sector, the return on net assets of the daily consumption, information technology, health care, public utilities and telecommunications sectors has improved, but the return on net assets of the transportation sector has fallen by 13%, and the return on net assets of the energy and optional consumer sectors has also declined by a large margin.

Outlook: improved revenue and profit margins drive gradual recovery of profits

Although the profits of overseas Chinese stocks fell sharply in the first half of 2020,We expect the worst to be over and future profits are expected to recover gradually.

Income sideThe overall economy began to recover from the bottom of the first quarter in March, initially driven by real estate and infrastructure investment demand and related demand, but manufacturing investment and retail sales (especially offline sales) have begun to catch up. High-frequency data from industrial enterprises show the same trend.

In addition, as income gradually recovers, we note that inventories are also beginning to decline. If demand continues to improve, we expect active inventory replenishment, which will boost revenue growth.

In terms of profit marginCorporate profit margins have also recovered over the past few months as revenues have gradually improved. In addition, M1-M2 is generally about six months ahead of PPI, and we expect that a widening gap in M1-M2 growth may boost PPI improvement, thereby boosting overall profit margins.

On the wholeWe maintain the top-down2020The profit of overseas Chinese stocks fell 4.7% year on year.The financial sector's profits are expected to decline 1.4% year on year.Profits in the non-financial sector fell 12.1% year on year.。

So far this year, MSCIChina Index earnings consensus is expected to fall significantlyEarnings per share are currently expected to decline 9.6% year-on-year in 2020, but earnings per share in 2021 are expected to increase by 19.7% year-on-year, with earnings in the transportation, energy, automotive, consumer durables, clothing and real estate sectors likely to increase significantly in 2021. At the same time, software and services, daily necessities, media & entertainment and food retail sectors are all expected to recover in 2020.We expect the earnings forecast to be adjusted downwards rapidly or nearing the end, mainly considering that the earnings adjustment sentiment has turned positive recently.. After we get more information about the recovery in the second quarter, we will further update our earnings forecast.

i. 2020年上半年盈利显著下滑,表现甚至不及2008年。按港元、可比口径,海外中资股2020年上半年盈利同比下滑23%(2019年同比增长12%),下滑幅度甚至大于2008年金融危机,凸显了公共卫生间和停工停产等防控措施的严重负面影响。能源和银行板块拖累较为严重,影响整体盈利增速14个百分点;其他受卫生事件影响较大、盈利出现大幅下滑的板块包括保险、交运、可选消费等。

i. 2020年上半年盈利显著下滑,表现甚至不及2008年。按港元、可比口径,海外中资股2020年上半年盈利同比下滑23%(2019年同比增长12%),下滑幅度甚至大于2008年金融危机,凸显了公共卫生间和停工停产等防控措施的严重负面影响。能源和银行板块拖累较为严重,影响整体盈利增速14个百分点;其他受卫生事件影响较大、盈利出现大幅下滑的板块包括保险、交运、可选消费等。