Report summary

The transition period is coming to an end, and there is a possibility that the UK will leave the European Union without a deal. The UK officially left the European Union in January of this year, but there is a one-year transition period. The UK remains within the EU customs union and single market during the transition period. If a new trade agreement is not reached, the economic and trade relationship between the two sides will return to the WTO framework after the transition period.

Negotiations between Britain and Europe are nearing their deadline, and there are still differences in the Brexit agreement. After the UK officially left the European Union on January 31, 2020, the UK and the EU entered the transition period stipulated in the Brexit Agreement, which continued until December 31, 2020. As of September 10, 2020, after 8 rounds of negotiations, the two sides still have not reached an agreement, and the two sides have not agreed to extend the transition period. Theoretically, if no agreement can be reached before December 17 and the transition period is not postponed, then Britain will leave the European Union without a deal. The next trade negotiations will be held on September 28, which will also be a key point in time for the Brexit issue.

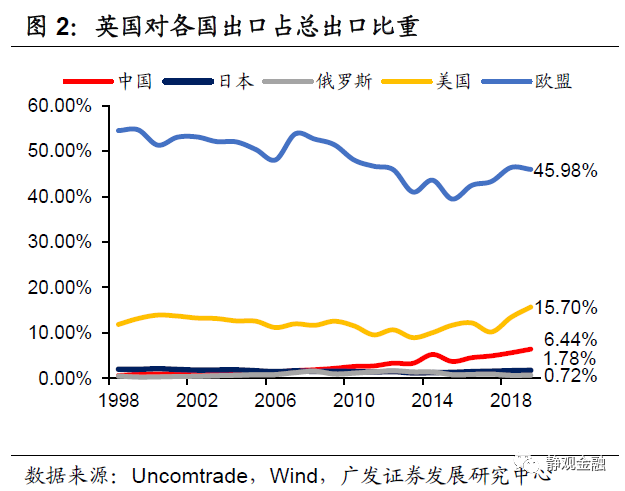

The three major differences brought negotiations between Britain and Europe to a standstill. From March 2, 2020 to September 10, 2020, Britain and Europe conducted a total of 8 rounds of negotiations. The attitude of the two sides is becoming increasingly negative and there are three major differences: the two sides still disagree on establishing a level playing field for trade; the two sides continue to dispute over fishing rights; the “Internal Market Act” proposed by the British Parliament will give Britain the power to interpret and amend the Brexit Agreement, causing great dissatisfaction in the EU.

Although the possibility of a no-deal Brexit cannot be ruled out, there is still hope that the impasse in negotiations will be broken.

Although the possibility of a no-deal Brexit cannot be ruled out, there is still hope that the impasse in negotiations will be broken.

Economic pressure has made Britain and Europe tend to gather to warm up. Currently, the two sides have a tough attitude or are due to diverting internal conflicting claims. In the short term, the economy brought about by the health incident and the unfavorable pressure on epidemic prevention in some European countries will cause governments to tend to shift internal conflicts to the outside world. Judging from this, Britain and the European Union are temporarily holding a tough stance in negotiations in line with their actual needs. Furthermore, the two sides are also competing in negotiations to obtain greater concessions. However, the health incident has hit the European economy extremely hard, and trade between Britain and the EU has always been in a state of mutual dependency. The EU envoy is Britain's largest import and export trade target. The UK is also the EU's number one export market. In a situation where the two sides are so dependent on trade, economic pressure will still make European countries tend to join forces to warm up.

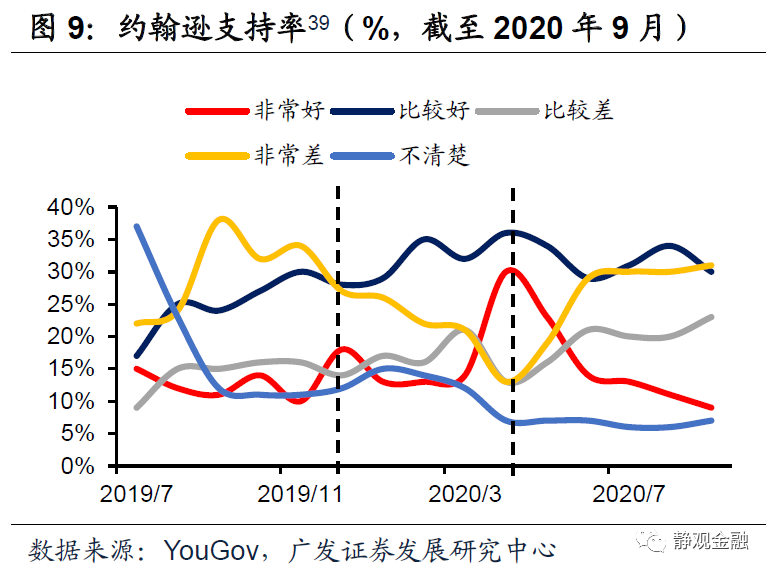

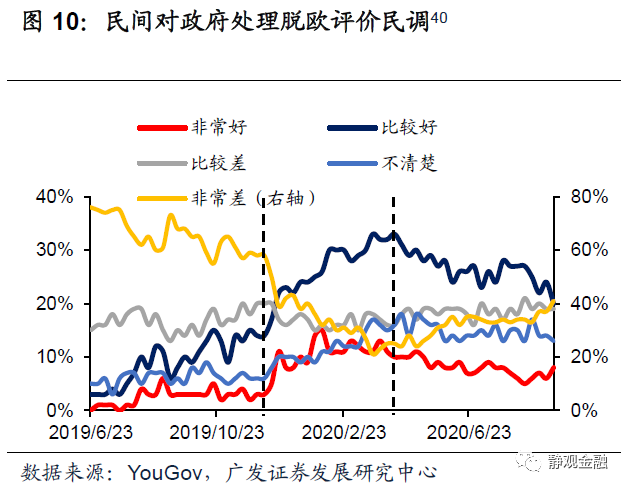

Public pressure may drive the British government to reach an agreement with the European Union. Judging from the polls, most people don't support a no-deal Brexit. The Brexit negotiations progressed quite a bit in November of last year. Britain and Europe successfully entered a transition period, and the proportion supporting the government's handling of Brexit increased; and as negotiations between Britain and Europe reached an impasse in the first half of the year, the proportion dissatisfied with the government's handling of Brexit polls increased, which also caused Johnson's approval rating to decline since May. In a situation where public opinion is oriented against leaving the European Union without a deal, it is likely that the British government will still seek an agreement with the European Union.

There is room for negotiation on all three major differences. As far as trade regulations such as government subsidies are concerned, first, the EU's internal rules of the single market itself are flexible. In recent years, the EU's government subsidy regulations on cultural and creative industries, small and medium-sized enterprises, infrastructure, etc. have already been relaxed. Furthermore, the British government's subsidies are inherently low as a share of GDP, and this disagreement is actually of little significance to the two sides. As far as fishing rights are concerned, the fishery and aquaculture segment accounts for only 0.02% of the UK's GDP, so there is no need to lose a large amount due to small factors. Furthermore, for the UK, the establishment of a “bilateral border” in Northern Ireland is not an unacceptable condition. Compared to the failure to reach a trade agreement, none of the three major differences touched on the core interests of the two sides, and there is room for negotiation. It is not ruled out that an agreement can be reached when the negotiations are nearing completion.

The no-deal Brexit situation will still disrupt the market.

Review of the impact of Brexit on major asset classes: The impact on exchange rates is greater than equity bonds. We selected 4 key points in the Brexit process to analyze the impact of the Brexit incident on major assets: the results of the Brexit referendum were announced on June 24, 2016; the Brexit agreement was repeatedly rejected by the House of Commons on May 24, 2019, and Theresa May resigned; strong Brexiteer Boris Johnson took over as Prime Minister of the United Kingdom on July 23, 2019; and the UK officially passed the Brexit agreement on January 23, 2020. Overall, the impact of the Brexit incident on capital markets is gradually weakening. Furthermore, the incident had a big impact on the foreign exchange market and had a relatively small impact on stocks and bonds.

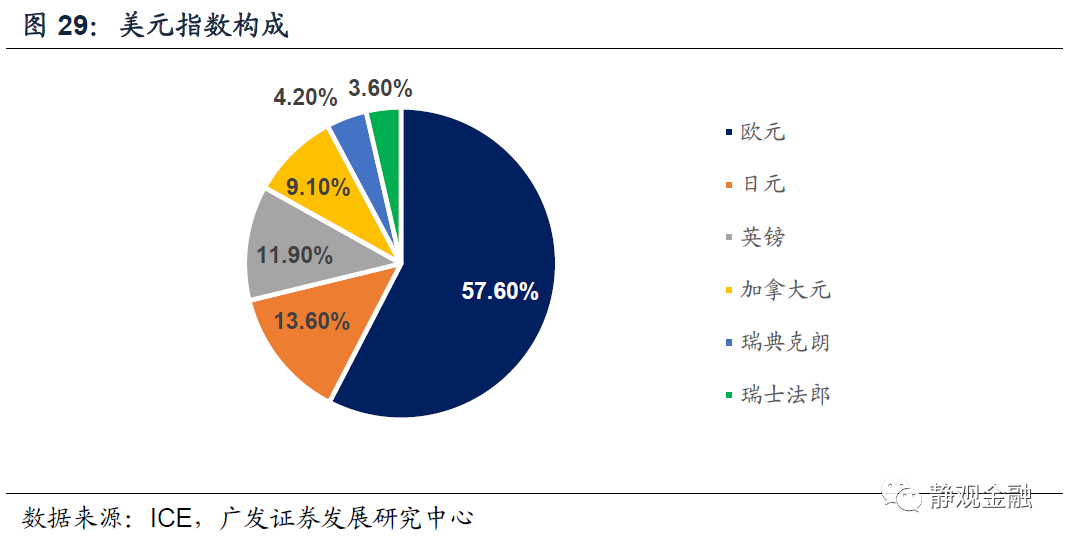

The risk of a no-deal Brexit will lift the former European currency may continue to be pressured, and it will be difficult for the US dollar to depreciate further for the time being. Since the 2016 Brexit referendum, the impact of the incident on global capital markets has gradually weakened. Even if Britain eventually leaves the European Union without a deal, the probability that European and American stock markets will be affected under broad currency expectations is within a manageable range. However, a no-deal Brexit will have a huge impact on the British economy in the short term, and the EU will also be greatly affected, so once it occurs, it is likely that it will greatly disrupt the short-term exchange rate market. We believe that the Brexit incident still had a big impact on the trend of European currencies and the US dollar in Q4. As long as the risk of Britain leaving the European Union without a deal is lifted, European currencies will be under pressure, and it will be difficult for the US dollar index to depreciate further; once the UK's no-deal Brexit is confirmed, the pound and euro are likely to undergo monthly adjustments, and the US dollar index will clearly rebound; if Britain and the EU reach a Brexit agreement during this time, European currencies will be boosted, and the US dollar may depreciate again.

body

1. The transition period is coming to an end, and there is a possibility that Britain will leave the European Union without a deal

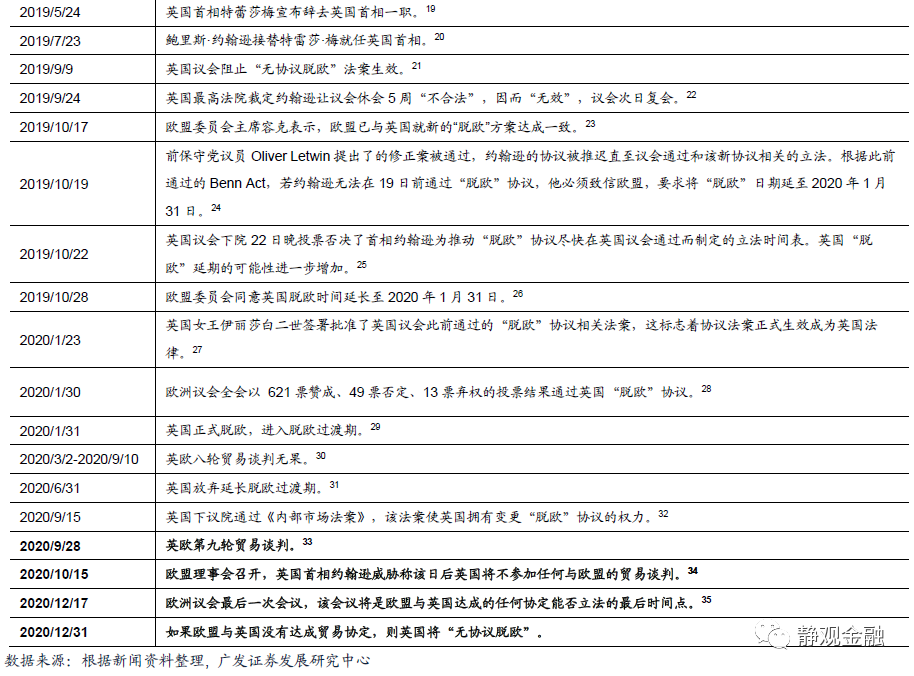

On June 24, 2016, Britain's “Brexit” referendum. The Brexit campaign won 52% of the vote to kick off the Brexit process. On July 13, 2016, Theresa May succeeded Cameron as Prime Minister of the United Kingdom, but during her two-year career as prime minister, she was unable to push Britain and the European Union to reach a Brexit agreement. Boris Johnson succeeded Theresa May as Prime Minister of the United Kingdom on July 23, 2019. The Brexit agreement was reached between Britain and the European Union in October of that year, and the UK officially left the European Union in January 2020. However, in the “Brexit Agreement” of January of this year, a one-year transition period was set, and Britain will remain within the EU customs union and single market during the transition period, but if a new trade agreement is not reached, the economic and trade relationship between the two sides will return to the WTO framework. Currently, the two sides are discussing economic and trade rules after the transition period. Theoretically, if the two sides have neither agreement nor continued postponement of the transition period before the European Parliament on December 17, then Britain will leave the European Union without a deal. In other words, at present, we cannot rule out the possibility of Britain leaving the European Union without a deal.

(1) Negotiations between Britain and Europe are approaching the deadline, and there are still differences in the Brexit agreement

After the UK officially left the European Union on January 31, 2020, the UK and the EU entered the transition period stipulated in the Brexit Agreement. The transition period lasts until December 31, 2020. During the transition period, the two sides will temporarily negotiate issues such as trade and personnel movements after Brexit, with most of the original relationships unchanged. As of September 10, 2020, after 8 rounds of negotiations, the two sides still have not reached an agreement, and the two sides have not agreed to extend the transition period. Although the transition period will last until December 31, the deadline for the two parties to reach an agreement may be earlier than that date. First, the British Prime Minister has stated many times that Britain will not continue to participate in negotiations between Britain and Europe after mid-October; secondly, any agreement reached between Britain and Europe needs to be reviewed and approved by the European Parliament. Since the last time in the year the EU Parliament met on December 17, in theory, this may also be the deadline for the Brexit agreement. The next trade negotiations will be held on September 28, which will also be a key point in time for the Brexit issue.

(2) Three differences brought negotiations between Britain and Europe to a standstill

Although the Brexit Agreement was reached between the UK and the EU in January of this year, this version is based on a bilateral agreement during the transition period. The current negotiations between Britain and the European Union are aimed at the economic and trade relationship between the two sides after the end of the transition period. If the two sides cannot reach a Brexit agreement or postpone the transition period within the year, then after December 31, Britain will have to leave the European Union without a deal, that is, the economic and trade relationship between Britain and the EU will return to the WTO framework.

From March 2, 2020 to September 10, 2020, Britain and Europe conducted a total of 8 rounds of negotiations. Judging from the progress, the two sides have become more and more negative, and progress has stalled. The two sides still have three major differences. First, the two sides still disagree on establishing a level playing field for trade. Second, the two sides continue to dispute over fishing rights. Third, the “Internal Market Act” proposed by the British Parliament will give Britain the power to interpret and amend the “Brexit Agreement”, causing great dissatisfaction in the European Union and reversing the progress of negotiations.

Trade issues: Similar to Canada and Japan, the UK is seeking a less restrictive free trade agreement with the EU. Getting rid of the original EU's internal single market rules is also one of the reasons Britain is seeking to leave the European Union. However, out of consideration of the closer trade relationship between Britain and Europe, the EU insists that the free trade agreement between the two sides must be based on the requirements of EU regulations for a level playing field. These requirements include labor rights, environmental protection, market access standards, and government subsidies. The current differences between the two sides mainly focus on government subsidies. According to EU regulations, member governments can only provide government trade subsidies if approved by the European Commission. However, the UK believes that it should have the freedom to provide trade subsidies after leaving the European Union.

Fishing rights issue: Britain wants to fully enter the EU market to sell its fish, but it doesn't want to abide by the long-term fishing quota set by the EU Common Fisheries Policy before Brexit, that is, how many fish can EU member states catch. Britain hopes to be able to independently decide on the allocation of this quota. This proposition is also an important commitment of Brexit and Prime Minister Johnson during the election campaign. The EU, on the other hand, wanted to maintain the status quo, rejected Britain's request to raise the fishing quota for British fishing vessels from 25% to 50%, and threatened that Britain might ban the sale of fishery products to the EU market.

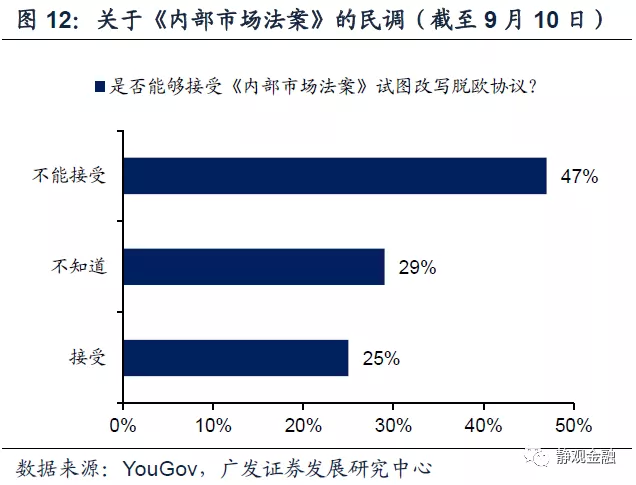

The topic of the right to follow up the interpretation of the agreement focusing on the “Northern Ireland” issue: The “Internal Market Act” was passed in the British House of Commons on September 15. The bill will allow Britain to reinterpret the contents of the “Brexit Agreement” in the future, in particular the establishment of a “bilateral border” between Northern Ireland and the setting of trade subsidies with Northern Ireland to comply with EU regulations. Once the bill is passed, it will mean that Britain has actually denied its commitment to Northern Ireland in the Brexit Agreement, and the progress of the current negotiations will be drastically reversed.

2. Although the possibility of a no-deal Brexit cannot be ruled out, there is still hope that the impasse in negotiations will be broken

(1) Economic pressure makes Britain and Europe tend to gather to warm up

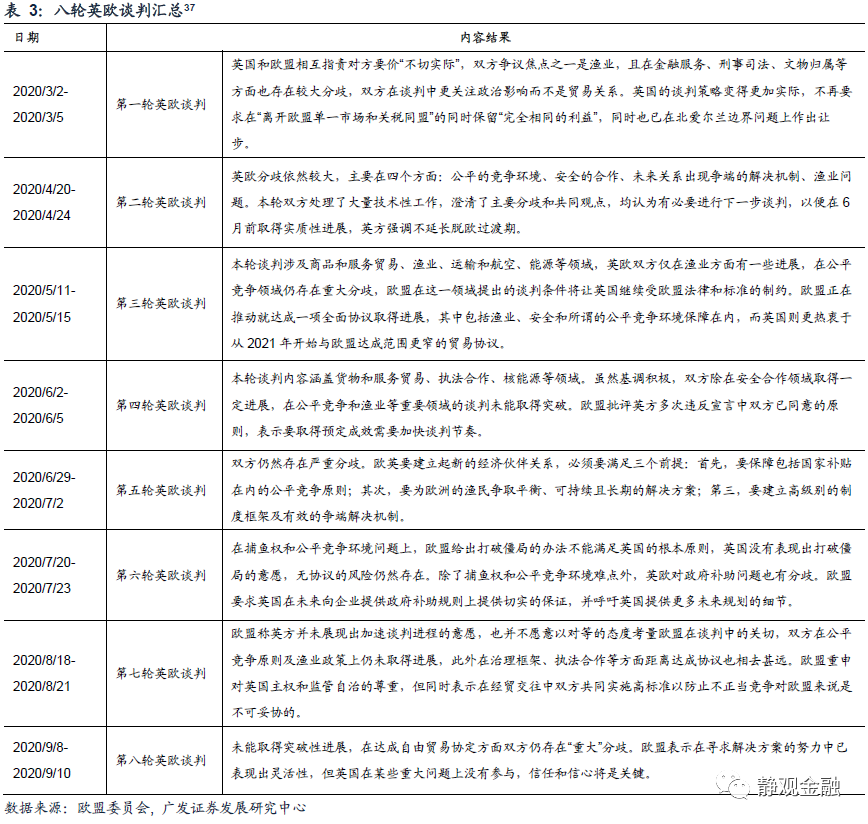

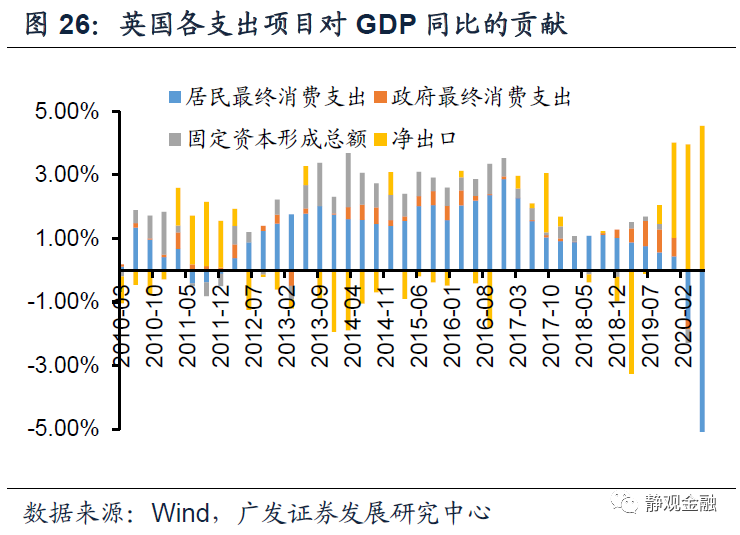

Currently, the two sides have a tough attitude or are due to diverting internal conflicting claims. In the short term, the economy brought about by the health incident and the unfavorable pressure on epidemic prevention in some European countries will cause governments to tend to shift internal conflicts to the outside world. Judging from this, Britain and the European Union are temporarily holding a tough stance in negotiations in line with their actual needs. Furthermore, the two sides are also competing in negotiations to obtain greater concessions. For example, Britain's threatening to introduce the “Internal Market Act” and British Prime Minister Johnson's threat to leave the European Union without a deal before October 15 are both negotiation strategies, similar to last year's Q3. Looking back, the health incident has hit the European economy extremely hard. According to the European Commission's June forecast, the economic growth rate of all EU countries will fall below -4.5% this year, the EU economy will decline -8.3%, and the British economy will decline -9.7% due to the impact of the health incident. In a situation where the two sides are so dependent on trade, economic pressure will still make European countries tend to join forces to warm up.

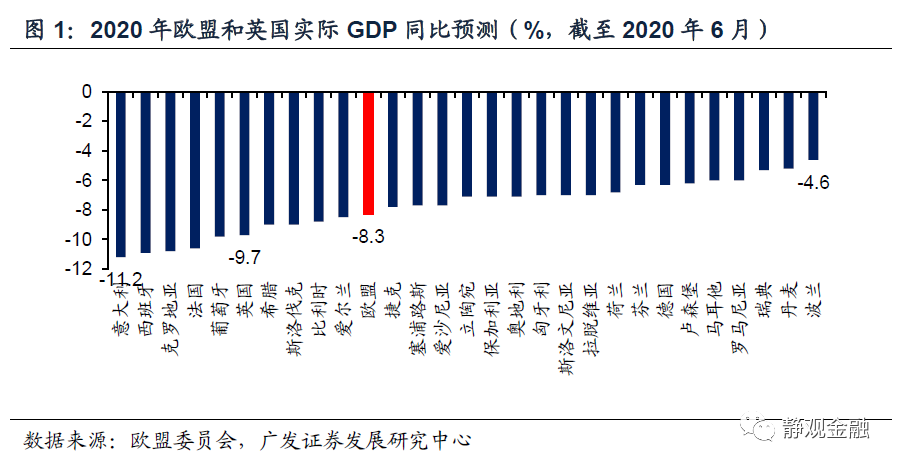

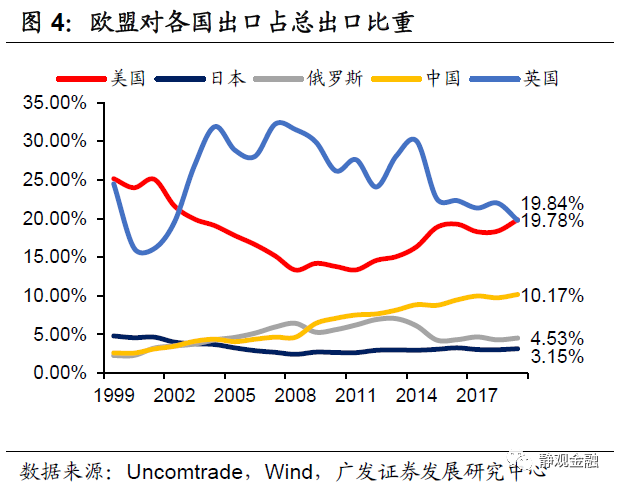

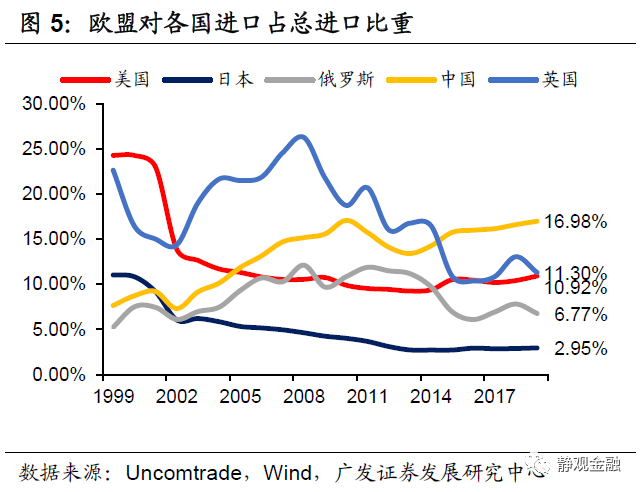

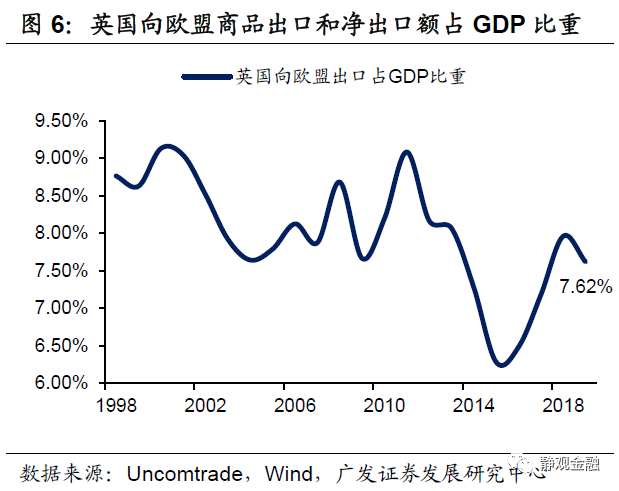

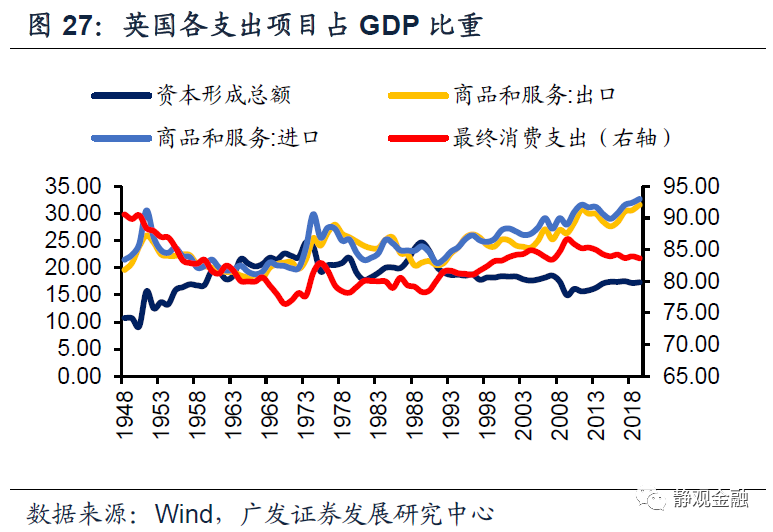

Trade between the UK and the EU has always been tied to each other. The EU is Britain's largest import and export trade target. According to Uncomtrade data, in 2019, UK merchandise exports to the EU accounted for 45.98% of total UK exports, and imports of goods to the EU accounted for 49.46% of total UK imports, all of which are far higher than trade targets such as the US and China. After Britain promoted Brexit, the share of exports did not fall but increased, and the share of imports was also resilient. In 2019, UK merchandise exports to the EU accounted for 7.62% of GDP. It shows that the EU market is extremely important to the UK's import and export trade. The UK is also the EU's number one export market. In 2019, the EU's merchandise exports to the UK accounted for 19.84% of the EU's total exports, and the EU's merchandise imports to the UK accounted for 11.30% of the EU's total imports, which is only lower than the US. In 2019, EU exports to the UK accounted for 2.75% of GDP, and net exports to the UK accounted for 1.73% of GDP.

(2) Public pressure may drive the British government to reach an agreement with the European Union

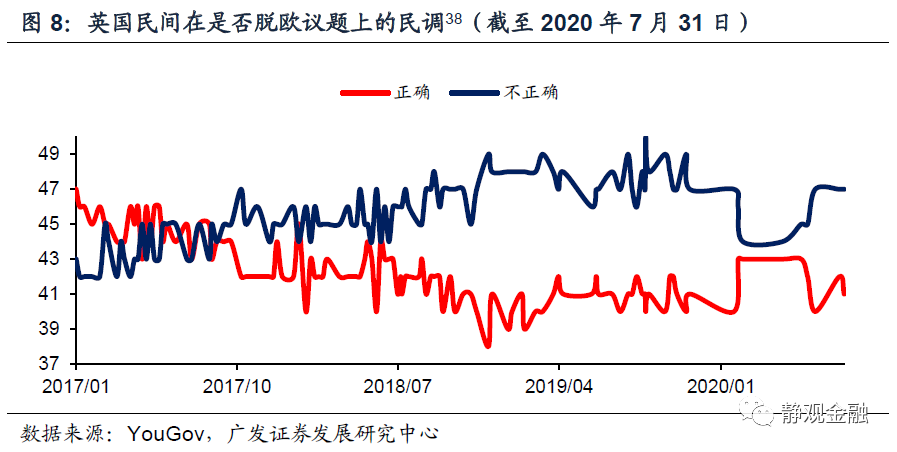

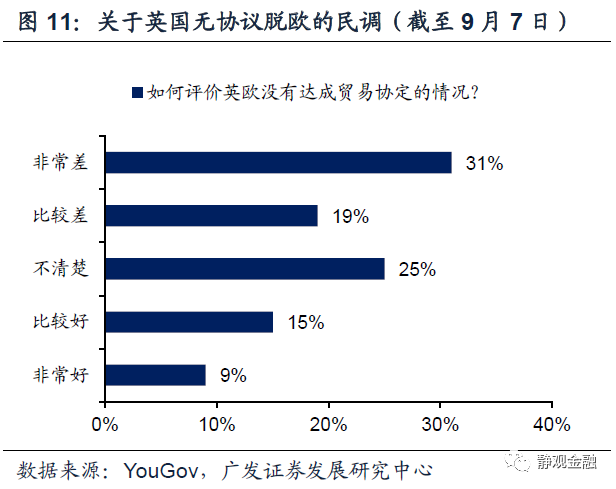

Judging from public opinion polls, there is no consensus among the British public on whether they should leave the European Union, yet most people do not support a no-deal Brexit. The Brexit negotiations progressed quite a bit in November of last year. Britain and Europe successfully entered a transition period, and the proportion supporting the government's handling of Brexit increased; and as negotiations between Britain and Europe reached an impasse in the first half of the year, the proportion dissatisfied with the government's handling of Brexit polls increased, which also caused British Prime Minister Johnson's approval rating to decline since May. In a situation where public opinion is oriented against leaving the European Union without a deal, it is likely that the British government will still seek an agreement with the European Union. Of course, there is no pressure for Boris Johnson to be re-elected for the time being. He will probably maintain a tough attitude to seek better conditions until the end of negotiations between Britain and Europe. It is inevitable that the negotiation process will have twists and turns in the short term.

(3) All three differences have room for negotiation

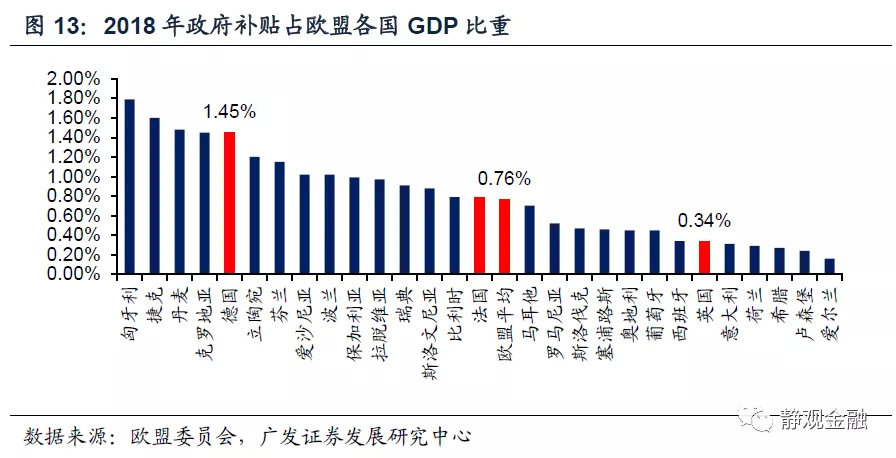

As far as trade regulations such as government subsidies are concerned, first, the EU's internal rules of the single market itself are flexible. In recent years, the EU's government subsidy regulations on cultural and creative industries, small and medium-sized enterprises, and infrastructure have been relaxed. Furthermore, the share of UK government subsidies in GDP is already low. In 2018, the figure was only 0.34%, lower than Germany's 1.45%, France's 0.79%, and the EU average of 0.76%. This difference is actually of little significance to the two sides. As far as fishing rights are concerned, the fishery and aquaculture segment accounts for only 0.02% of the UK's GDP [41], so there is no need to lose a large amount due to small factors. As far as the “Internal Market Act” is concerned, judging from public opinion polls, the bill itself is not popular in the UK. Furthermore, the “bilateral border” of Northern Ireland, which the bill targets, is not an unacceptable condition for Britain; Britain accepted this condition under pressure from Brexit last October. All in all, compared to the failure to reach a trade agreement, none of the three major differences touched on the core interests of the two sides, and there was room for negotiation. The possibility of reaching an agreement nearing the end of the negotiations is not ruled out.

3. The no-deal Brexit situation will still disrupt the market

(1) Review of the impact of Brexit on major asset classes: The impact on exchange rates is greater than equity bonds

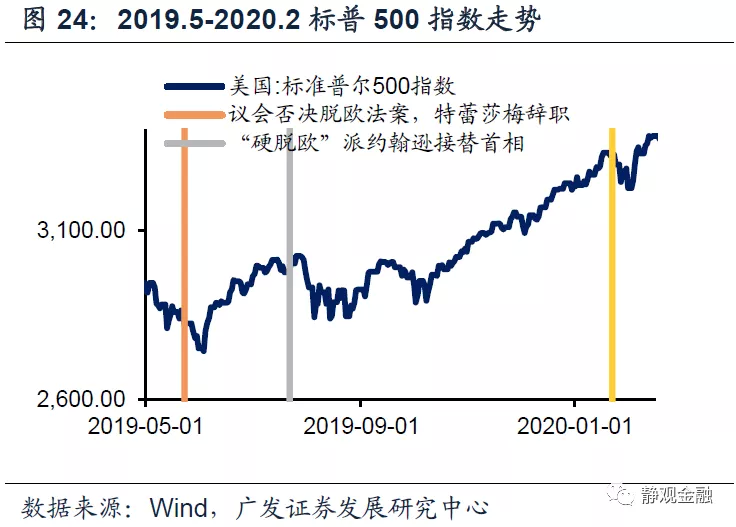

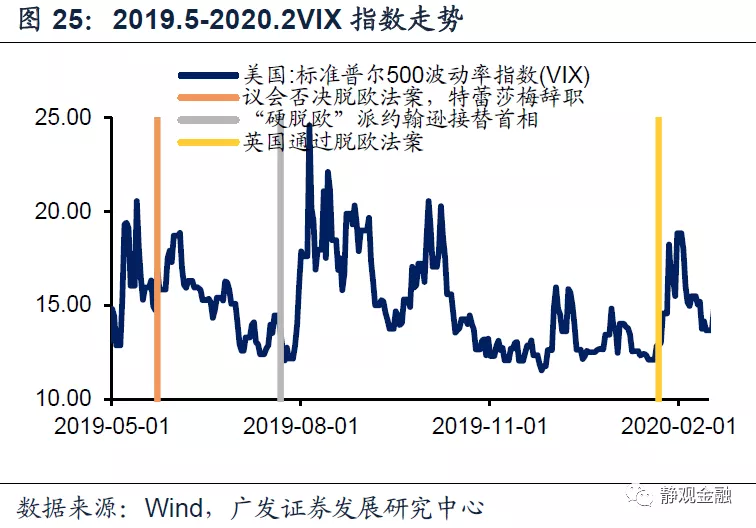

We selected 4 key points in the Brexit process to analyze the impact of the Brexit incident on major assets: the results of the Brexit referendum were announced on June 24, 2016; the Brexit agreement was repeatedly rejected by the House of Commons on May 24, 2019, and Theresa May resigned; strong Brexiteer Boris Johnson took over as Prime Minister of the United Kingdom on July 23, 2019; and the UK officially passed the Brexit agreement on January 23, 2020. Overall, the impact of the Brexit incident on the capital market is weakening. Among them, the impact on the foreign exchange market is greater and the impact on equity bonds is relatively small.

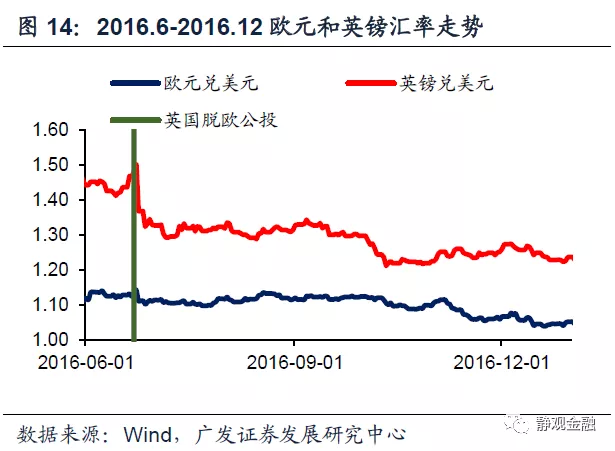

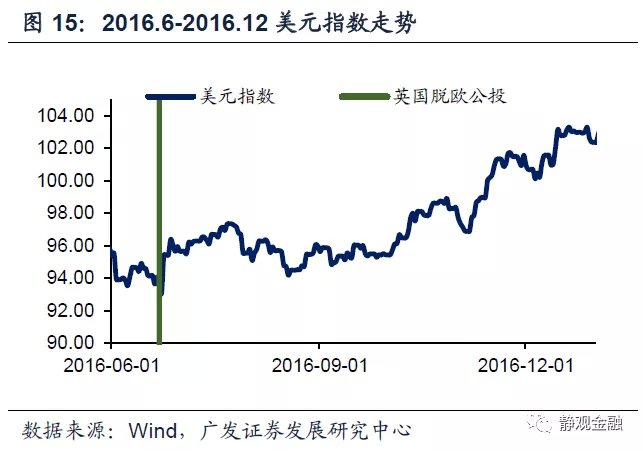

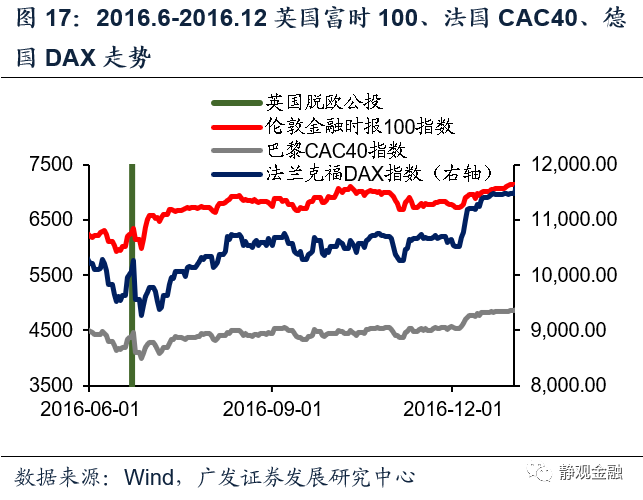

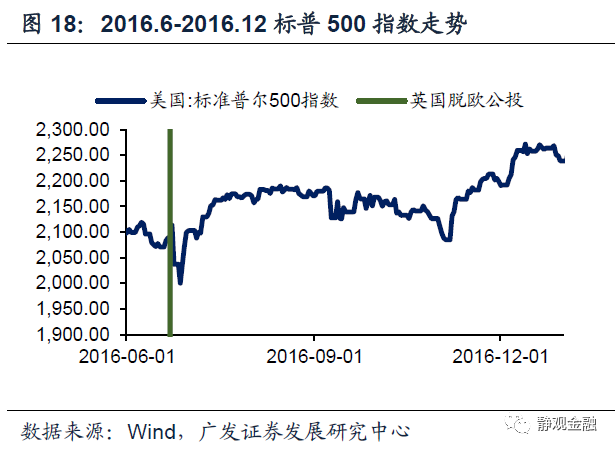

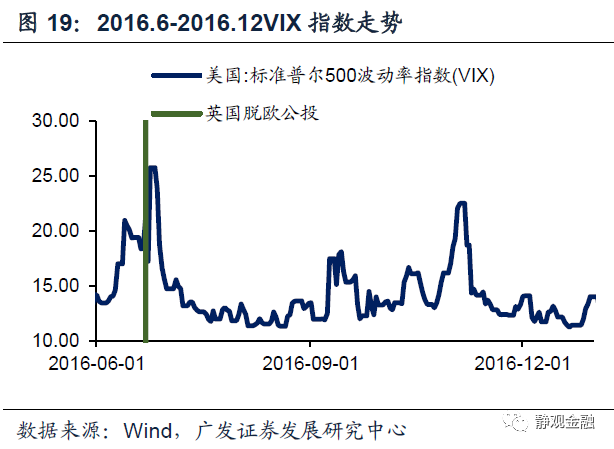

On the day the Brexit referendum results were released on June 24, 2016, the US dollar and European bond markets rose, European currency exchange rates fell, and European and American stock markets fell sharply. The US dollar index rose 2.53%, the EUR/USD exchange rate fell 2.68%, and the GBP/USD exchange rate fell 8.85%; the S&P 500 index fell 3.59%, the British FTSE 100 fell 3.15%, Germany's DAX fell 6.82%, and the French CAC40 fell 8.04%; 10-year US bond yields fell 17 BPs, 10-year Eurozone bonds fell 14 BP, and 10-year British Treasury yields fell 26 BP.

From June 23 to December 31, 2016, the US dollar index surged 9.99%, the euro fell 7.92% against the US dollar, and the pound fell 17.60% against the US dollar. Meanwhile, the S&P 500 rose 5.94%, the British FTSE 100 rose 12.70%, Germany's DAX rose 11.93%, and France's CAC40 rose 8.88%. European and American bond markets showed mixed results. Meanwhile, 10-year US bond yields rose 71 BP, 10-year Eurozone bonds rose 15 BP, and 10-year British Treasury yields fell 20 BP.

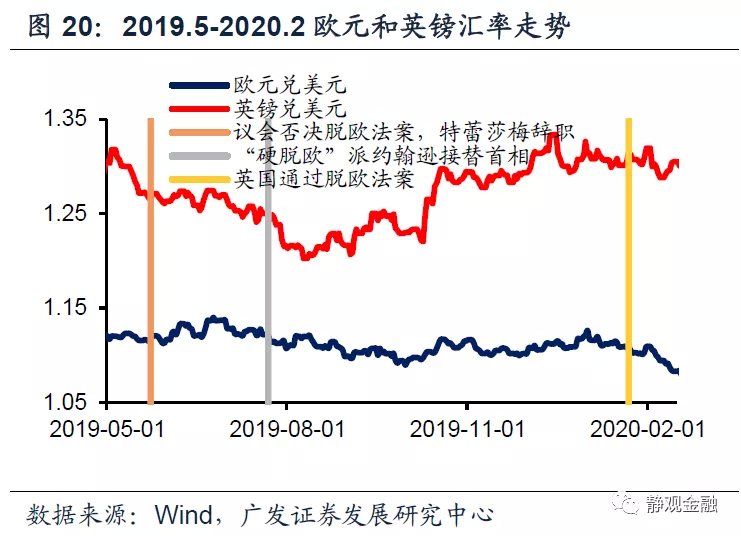

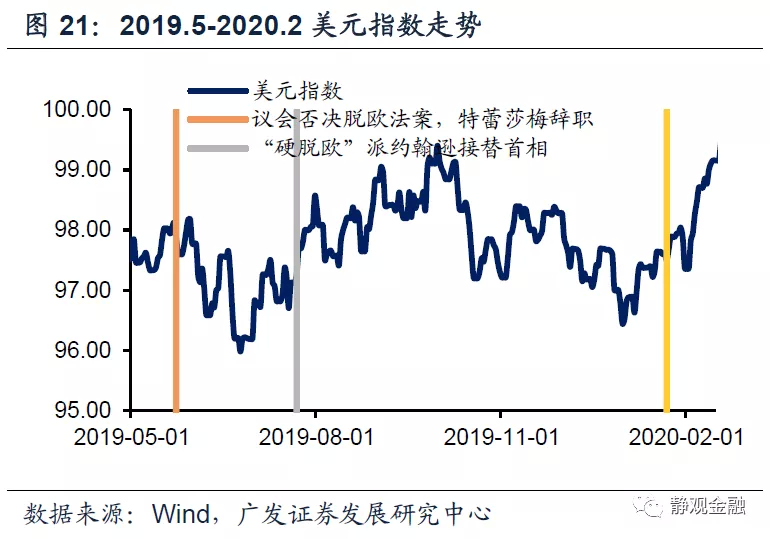

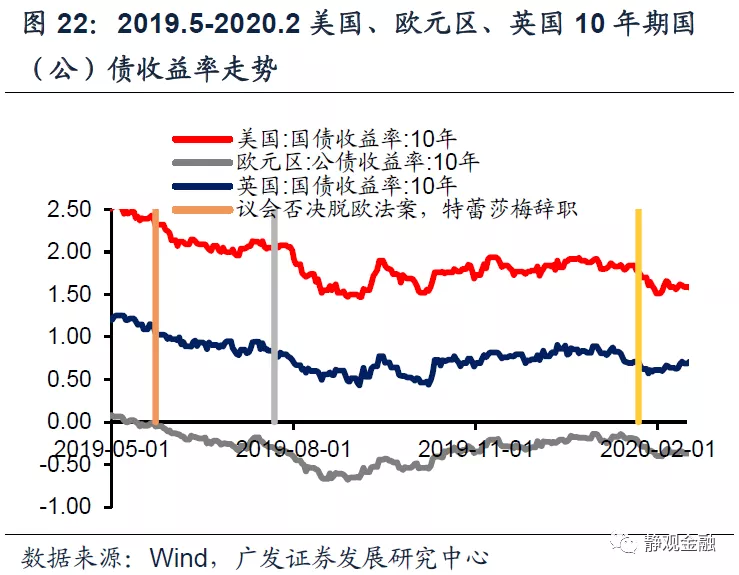

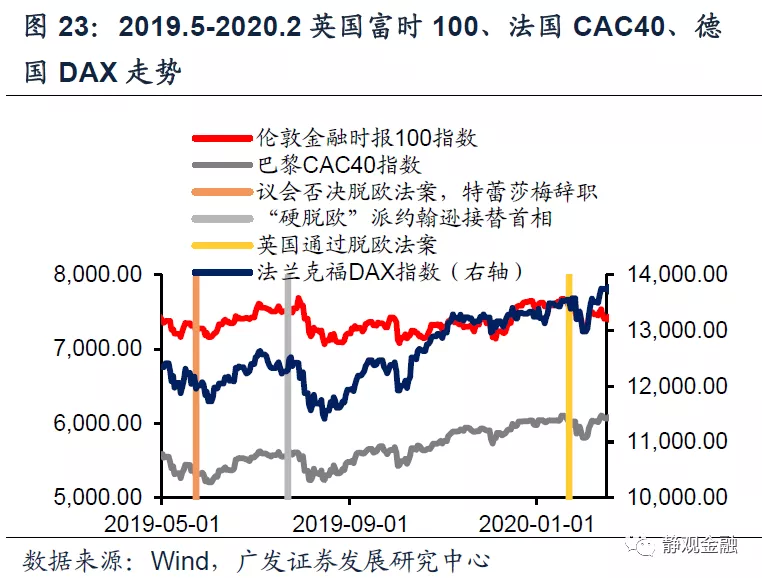

After Theresa May's resignation, the US dollar and European and American bond markets rose, European currency exchange rates fell, and European and American stock markets fell more or less, but the overall change was not significant. From May 24 to May 28, 2019, the US dollar index rose 0.38%, the EUR/USD exchange rate fell 0.41%, and the GBP/USD exchange rate fell 0.46%; the S&P 500 index fell 0.84%, the UK FTSE 100 fell 0.12%, Germany's DAX rose 0.13%, and the French CAC40 fell 0.07%; 10-year US bond yields fell 6 BPs, 10-year Eurozone bonds fell 4 BP, and 10-year British Treasury yields fell 1 BP.

After Boris Johnson came to power, the risk of a hard Brexit rose. The US dollar and European and American bond markets rose, European currency exchange rates fell, and European and American stock markets fell more or less, but apart from large exchange rate changes, other assets did not change much. From July 23 to July 31, 2019, the US dollar index rose 0.89%, the EUR/USD exchange rate fell -0.67%, and the GBP/USD exchange rate fell -2.24%; the S&P 500 index fell 0.83%, the British FTSE 100 rose 0.40%, Germany's DAX fell 2.42%, and the French CAC40 fell 1.77%; 10-year US bond yields fell 6 BP, 10-year Eurozone bonds fell 7 BP, and 10-year British Treasury yields fell 6 BP.

The UK officially passed the Brexit agreement on January 23, 2020, marking a decline in the risk of a hard Brexit. The UK and European stock markets were clearly boosted. From January 23 to January 24, 2020, the UK FTSE 100 rose 1.41%, Germany's DAX rose 1.41%, and France's CAC40 rose 0.88%.

(2) The risk of a no-deal Brexit is lifted before European currencies may continue to be pressured, and further depreciation of the US dollar will be difficult for the time being

Although the Brexit incident has been going on for 4 years, as far as the economy is concerned, our understanding of a no-deal Brexit is still in a state of “discussion on paper,” and only when it actually happens can it finally be realized. Assuming a worst-case scenario, once negotiations between Britain and Europe break down, the UK and the EU will adopt a most-favoured-nation (MFN) tariff rate consistent with the current EU common foreign tariff for all goods after the transition period. According to estimates by research institute civitas (2016) [42], it is estimated that the weighted average MFN tax rate for UK imports from the EU will rise to 5.8%, and the weighted average MFN tax rate for EU imports from the UK will rise to 4.5% according to the MFN tariff rate to be implemented after Brexit. In the short term, rising tariffs after Brexit will have an impact on British consumption, imports and exports, and further drag down the economy. In 2018, the IMF estimated that in the case of a no-deal Brexit, the Eurozone economic growth rate would drop by 1.5 percentage points [43]. Furthermore, according to the Bank of England's estimates [44], a no-deal Brexit will cause the UK's GDP to drop by 8% in a single quarter, and trade barriers will reduce UK trade by about 15% by 2023.

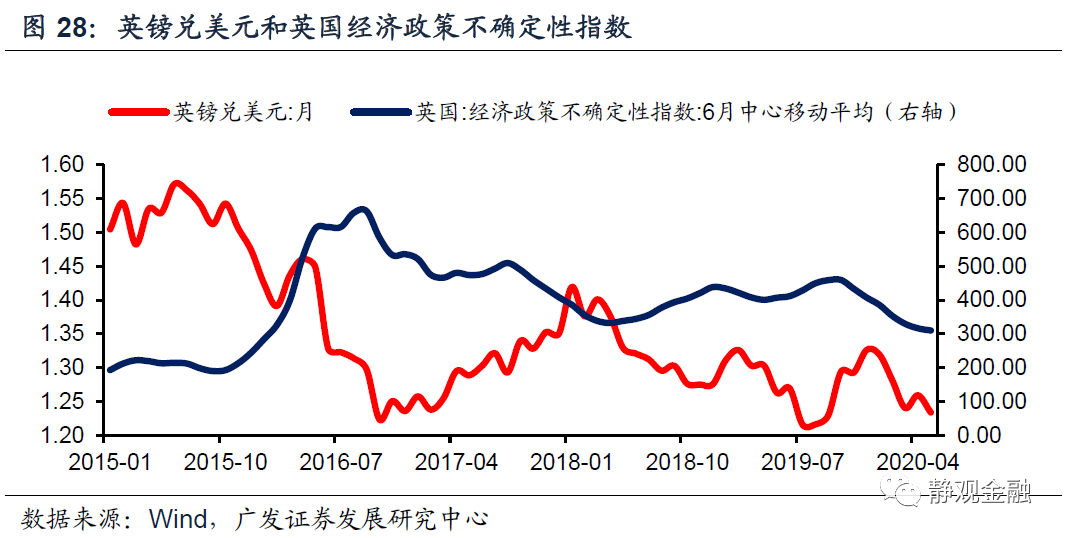

As mentioned earlier, the impact of the incident on global capital markets has gradually weakened since the 2016 Brexit referendum. Even if Britain finally leaves the European Union without a deal, the probability that European and American stock markets will be affected under broad currency expectations is within a manageable range. However, a no-deal Brexit will have a huge impact on the British economy in the short term, and the EU will also be greatly affected, so once it occurs, it is likely that it will greatly disrupt the short-term exchange rate market. Since 2016, the UK Economic Policy Uncertainty Index (EPU) is highly negatively correlated with the trend of GBP/USD, and changes in the UK's economic policy uncertainty index have mainly depended on Brexit prospects and health events this year. Since the market once again became concerned about Britain's no-deal Brexit in September, the trend of the pound has weakened, the euro has stopped rising, and the US dollar index has rebounded. We believe that the Brexit incident still had a big impact on the trend of European currencies and the US dollar in Q4. As long as the risk of Britain leaving the European Union without a deal is lifted, European currencies will be under pressure, and it will be difficult for the US dollar index to depreciate further; once the UK's no-deal Brexit is confirmed, the pound and euro are likely to undergo monthly adjustments, and the US dollar index will clearly rebound; if Britain and the EU reach a Brexit agreement during this time, European currencies will be boosted, and the US dollar may depreciate again.

Risk warning

(1) Results of negotiations between Britain and Europe exceeded expectations

(2) European, American and British monetary policies exceed expectations

(3) The UK and EU economies exceeded expectations

虽无法排除无协议脱欧可能,但谈判僵局仍有希望打破。

虽无法排除无协议脱欧可能,但谈判僵局仍有希望打破。