Core viewpoints

The group is the leader in retail real estate in the United States

Founded in the 1960s and listed in 1993, SPG.US has gradually developed into

REITS, the largest shopping mall in the United States, headquartered in Indianapolis, USA, founded by the Simon family. At the end of 2019, the Group owned, developed or managed 204 properties in the United States, including 106 Mall, 69

Premium Outlets, 14 Mills, 4 community retail centers and 11 other retail properties with a total area of 241 million square feet. In addition, the Group has

29 high-end OUTLETS and designer stores in Asia, Europe and Canada. The group also owns 22 percent of Paris real estate company Klepierre, which owns shopping malls in 15 European countries. At the same time, the group is a member of the Sipp

500 index.

The Group has a good and crisis-tested past performance.

Since its listing in 1993, the Group has shown good performance. Revenue increased from $440 million in 1993 to $5.24 billion in

2019, with CAGR reaching 24.4 per cent. FFO growth is also excellent, with FFO rising from US $100 million in 1994 to US $4.27 billion in 2019, and CAGR reaching 15.6%

.

It is worth noting that the Group has successfully overcome two serious economic crises since 1993

. Although past history does not mean that the group will continue to resolve the crisis in the future, it at least provides strong evidence for investors that the group has a strong ability to resist risks.

There is a good chance that the group will survive the economic and industry crisis caused by the public health incident.

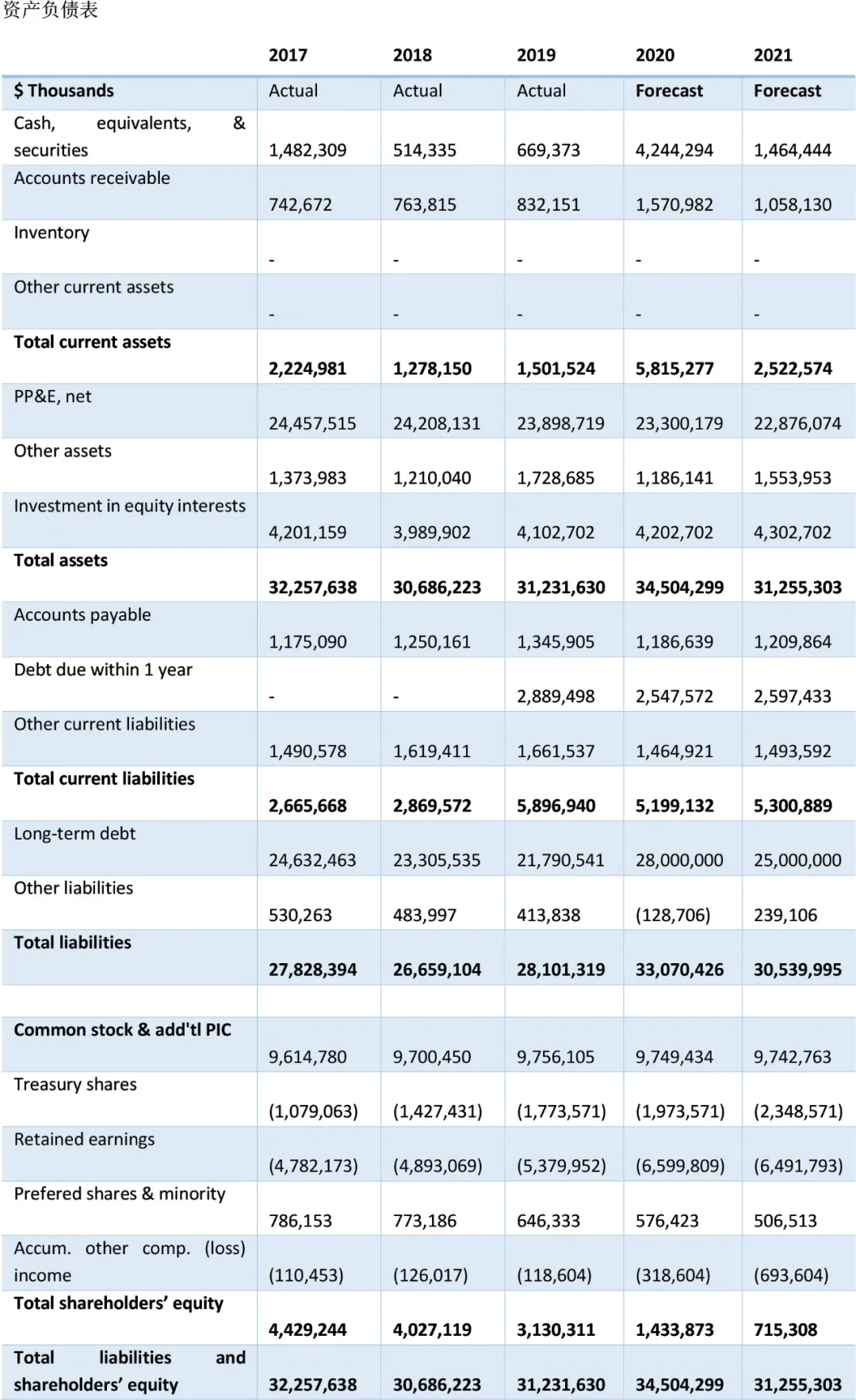

The outbreak of public health incidents in the United States has put the offline retail industry into a cold winter, while retail real estate is also in trouble. We believe that the industry reshuffle is inevitable, but we believe that the group will be able to tide over this difficulty. The financial situation of the group is still healthy. Since the listing, the interest coverage ratio of

EBITDA has shown an overall upward trend, reaching a historical peak of 5.7x in 2019, and declined in the first half of this year, but maintained at a high level of 4.7x

, and the solvency is guaranteed. In terms of liquidity, the maturity of the group's debt is relatively smooth, with maturing debt of $2.24 billion and $2.65 billion respectively from 2020 to 2021, while as of June 30 this year, the group has

$4.9 billion in credit resources available, enough to cover debt repayment needs this year and next.

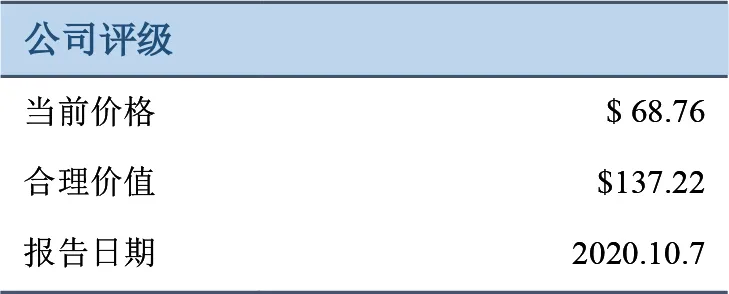

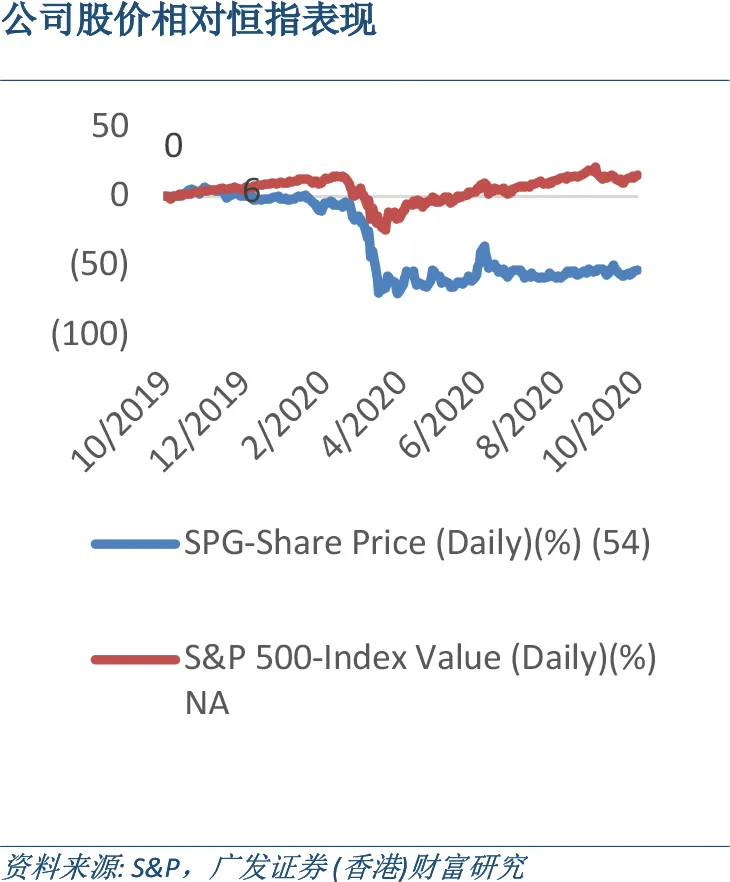

The current stock price valuation is very attractive.

After a sharp fall, the group's share price is valued at its lowest level since 2007. P/FFO (LTM) fell to 6.27 in the second quarter, below the level set during the 2008 financial crisis; the current dividend yield

7.6 per cent is also up from 6.8 per cent during the 2008 financial crisis. We believe that the current stock price fully reflects the uncertainty of the future and has a high margin of safety.

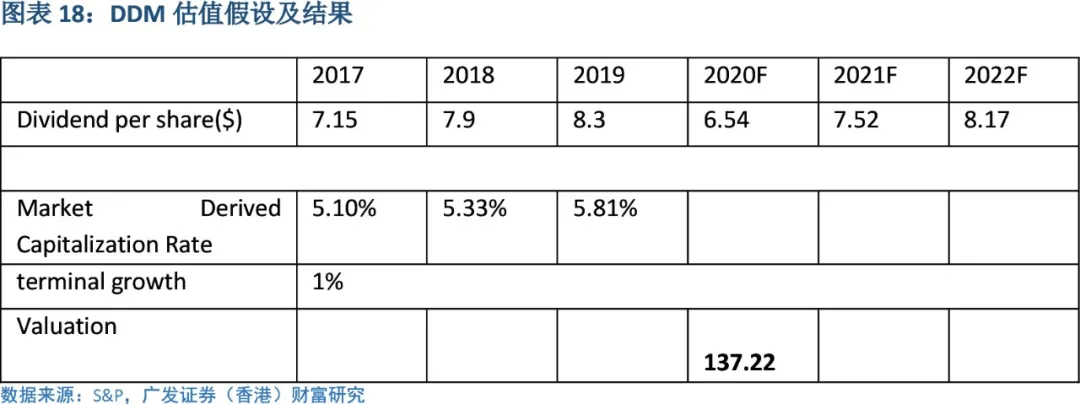

In terms of valuation, we use the DDM model, which is more mainstream for REITS. Based on a cap rate of 5.4 per cent (the average of implied cap rate

in the 2017-2019 market) and a sustainable growth rate of 1 per cent, we give a buy rating of a reasonable share price of $137.22.

Company introduction

Founded in the 1960s and listed in 1993, Simon Real Estate Group (Simon Property Group, Inc.) Gradually developed into the largest mall in the United States

REITS, headquartered in Indianapolis, USA, founded by the Simon family. As of the end of 2019

, the Group owned, developed or managed 204 properties in the United States, including 106 Mall, 69 Premium Outlets, 14 Mills, 4 community retail centers and 11 other

retail properties with a total area of 241 million square feet. In addition, the group has 29 high-end OUTLETS and designer stores in Asia, Europe and Canada. The group also owns 22 percent of Paris real estate company Klepierre

, which owns shopping malls in 15 European countries. At the same time, the group is a component of the Sip500 index.

At present, the Group has three main business lines: Mall, Premium Outlets and

Mill. Mall, with an area ranging from hundreds of thousands of square feet to millions of square feet, focuses on the fashion market, usually with a large department store as an anchor store. Premium

Outlets, with an average area of about 500, 000 square feet, is generally an open shopping street, and the basic business format is luxury stores such as high-end luggage and perfumes. Mill series are large-scale merchants with an area of more than one million square feet, covering clothing, catering, cinemas and other comprehensive formats.

Main points of investment

It is difficult to establish the market view that shopping malls will die out.

With the rising penetration of e-commerce in the United States, coupled with the impact of public health events, a number of large department stores such as Sears, JCPenney

closed down, and the prosperity of the US retail industry has plummeted. There are many market opinions that shopping malls will cease to exist in the future. We do not agree with this view. On the contrary, we believe that the demand for shopping centers still exists for a long time for the following reasons.

First of all, some goods and services cannot be replaced online. This includes goods that are of high value or require physical experience to make purchases, such as luxury goods. In terms of services, catering, health, entertainment and other needs can only be carried out offline. Secondly, the core of the shopping center is to rely on location and property quality to bring experience and convenience to customers, so as to bring traffic to merchants. The high-quality shopping center with convenient accessibility and good design can bring customers a better consumption experience and can not be replaced online, thus bringing more stable traffic. It is hard to imagine that consumers will complete all their consumption choices in front of the screen in the future, because offline experience is an indispensable part of consumption.

Finally, online and offline integration is in the ascendant. In order to solve the problem of the last mile of logistics and the gradual disappearance of online dividends, shopping malls have mature transportation, infrastructure and the characteristics of close to densely populated areas. therefore, it has become the focus of cooperation between e-commerce and traditional shopping centers.

recently, e-commerce giant Amazon.Com Inc has begun talks with traditional offline shopping center operators, the former intends to convert part of the latter's retail space into e-commerce logistics and distribution centers. This shows that traditional shopping malls are more likely to be integrated rather than subverted by e-commerce in the future.

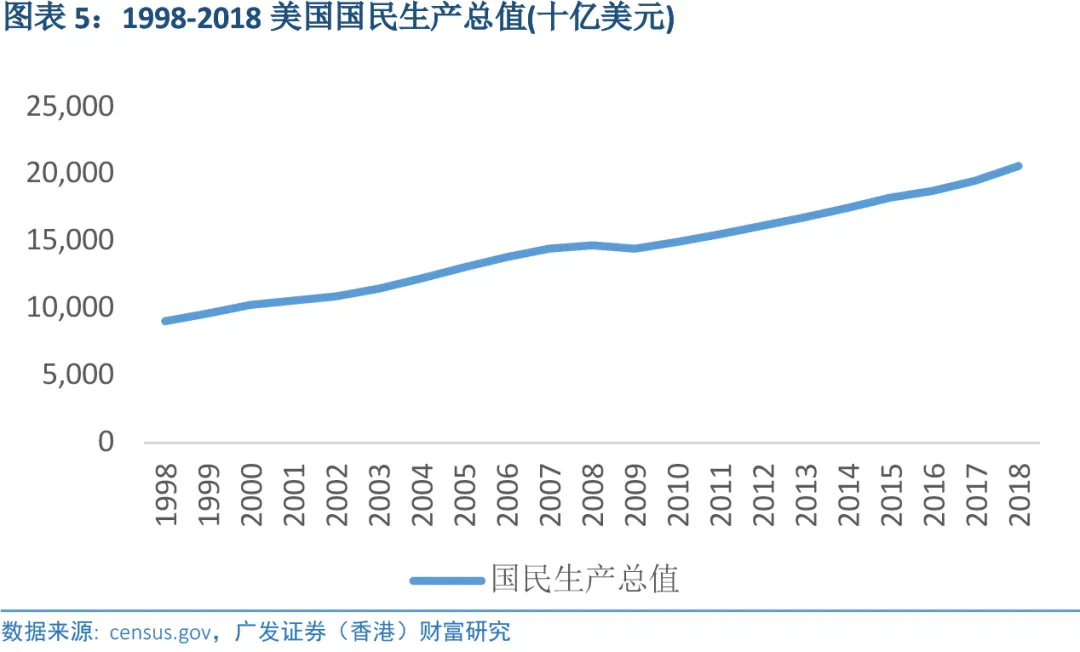

Household income growth in the United States is relatively steady

After the end of the financial crisis in 2009, the gross national product of the United States maintained sustained growth, and the growth rate increased. With the recovery of the economy, the average household income in the United States has achieved continuous positive growth since 2011

, and the growth rate is on the rise. Sound household income is the engine that supports consumption growth.

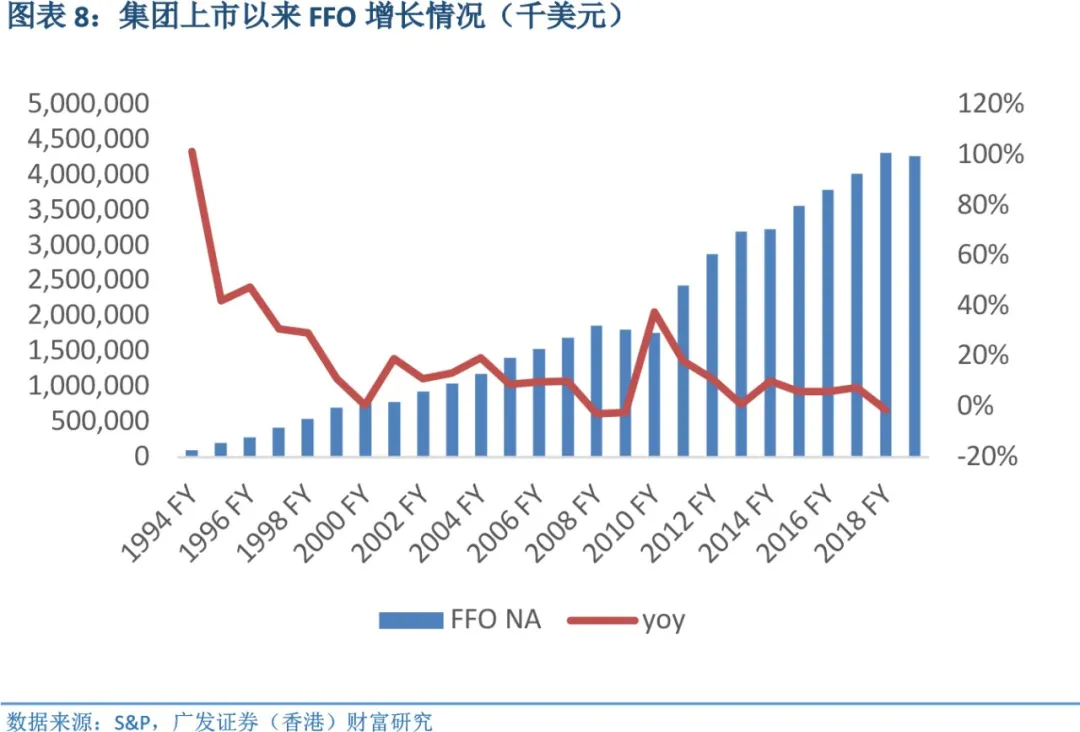

The Group has a good and crisis-tested past performance.

Since its listing in 1993, the Group has shown good performance. Revenue increased from $440 million in 1993 to $5.24 billion in

2019, with CAGR reaching 24.4 per cent. FFO growth is also excellent, with FFO rising from US $100 million in 1994 to US $4.27 billion in 2019, and CAGR reaching 15.6%

.

What is worth noting is the group's performance during the economic crisis. There have been two major economic crises in the United States since 1993 (excluding those caused by current public health events). The first was the recession caused by the bursting of the technology bubble from 2001 to 2004, and the rise in unemployment posed a major challenge to commercial real estate. However, there was no decline in the group's performance during the period, and FFO increased from US $790

to US $1.18 billion. The second is the financial tsunami that began in 2008, in which the economy from 2008 to 2011 is the most difficult. However, the group has maintained considerable resilience, with FFO falling only slightly from $1.86 billion in 2008 to $1.77 billion in 2010, a decline of

5%. In 2011, it surged to $2.44 billion

billion, a record high. Although past history does not mean that the group will continue to resolve the crisis in the future, it at least provides strong evidence for investors that the group has a strong ability to resist risks.

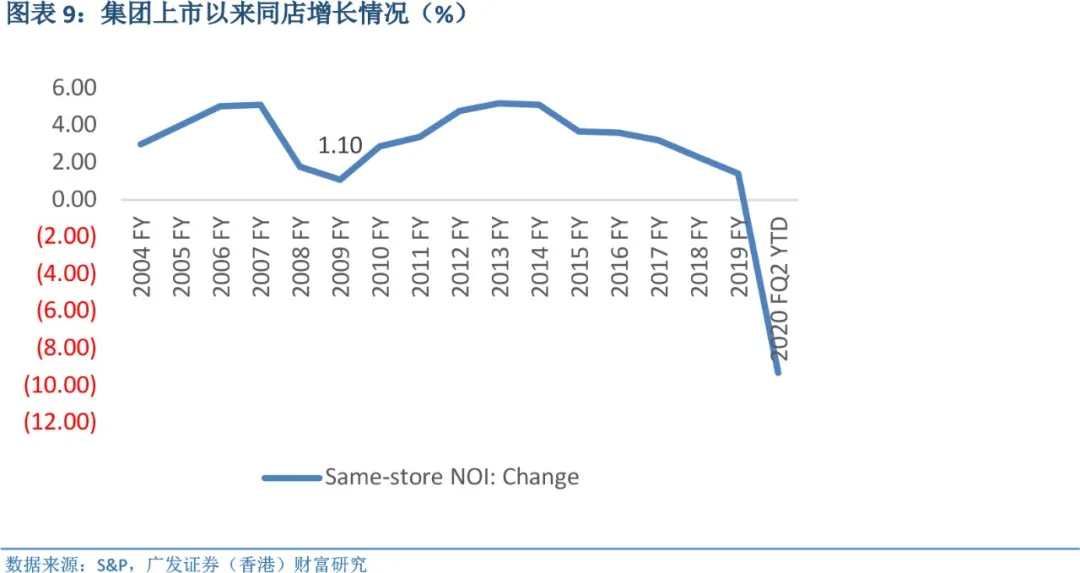

The group's good performance growth comes from the grasp of endogenous and epitaxial growth, as well as a more cautious risk control strategy. Endogenous growth depends on the continuous improvement of existing properties and the continuous optimization of the mix of merchants, which makes the unit area rent maintain a healthy growth in most of the time. In 2004-2019

, the growth rate of the same store in the group averaged 3.5 per cent. In terms of extension growth, while maintaining a healthy financial position (the EBITDA interest coverage ratio has been higher than

4 since 2015), the Group is good at using M & A strategies to achieve scale growth and become the most successful industry integrator.

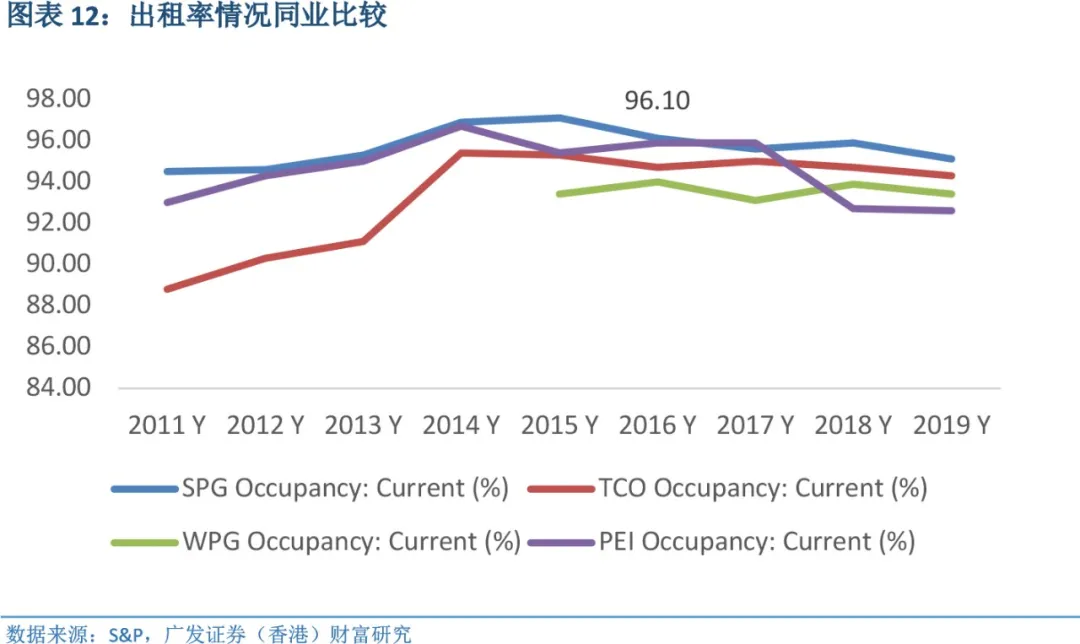

The excellent property quality and management ability of the Group can be proved by the comparison of the same industry. We choose the comparable TCO, WPG and PEI of the American mall class as the reference. In 2011-2019

, group same-store growth led its peers in most years, with an average annual growth rate of 3.6 per cent, compared with 3.0 per cent for TCO,-0.9 per cent for WPG and 0.9 per cent for

0.9 per cent. In terms of rental rate, the average rental rate of the group reached 95.7% in the same period, which was higher than the average of 1.8 pct of the other three. Excellent internal skills are the basis for the group's successful industry integration.

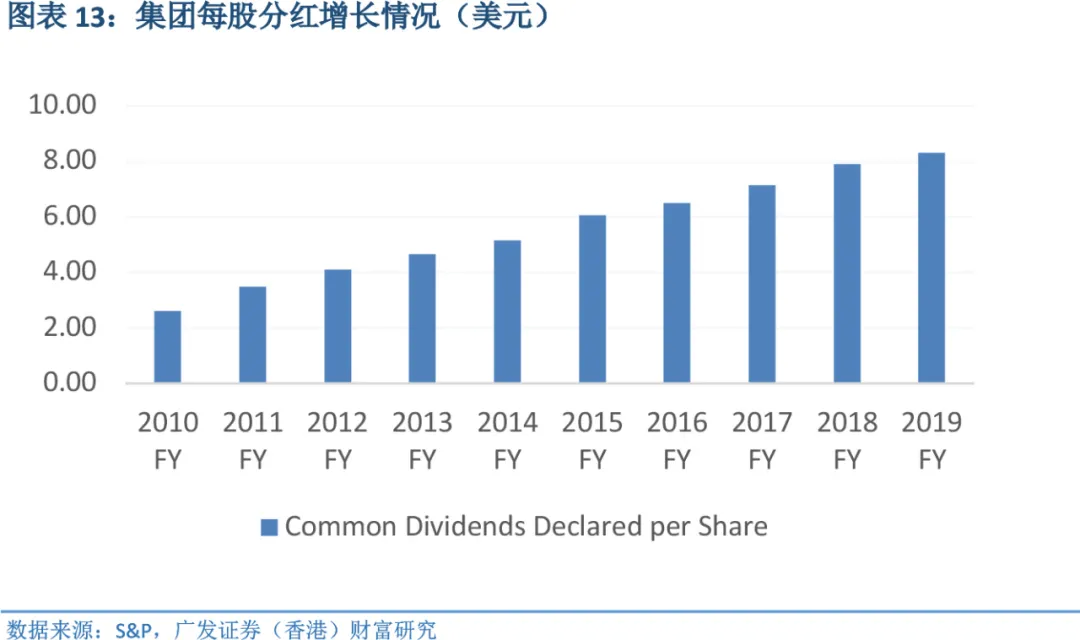

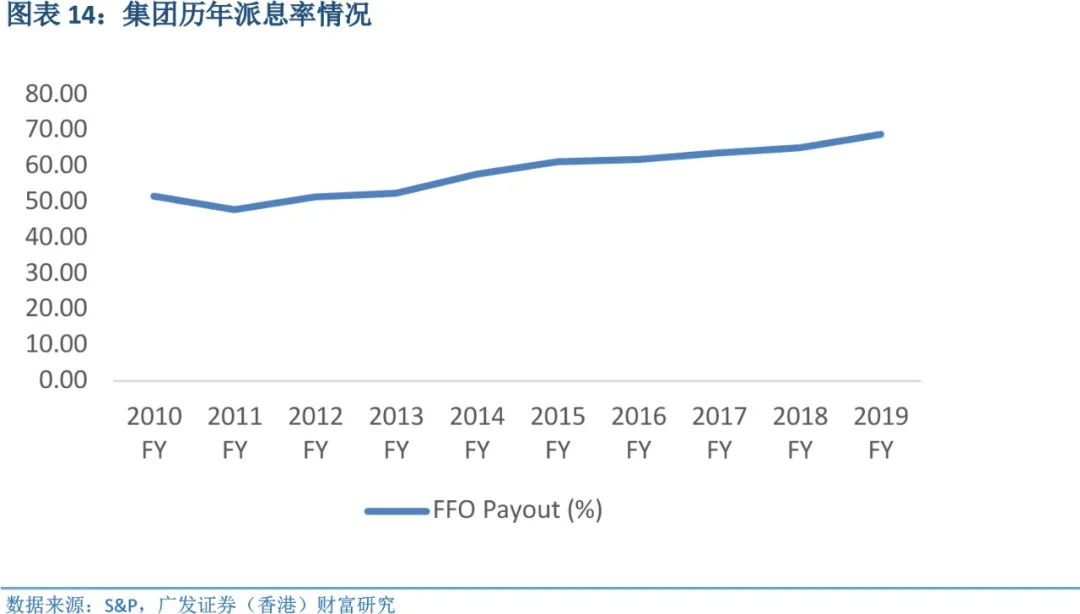

Excellent performance ultimately brings a good long-term return on investment. The group's dividend per share rose from $2.60 in 2010 to $8.3 in 2019, with CAGR reaching

12.3%. If investors buy at $70 at the beginning of 2010 and hold it all the time, the 2019 dividend provides a dividend return of 11.9%. In addition,

the average dividend payout rate of the group in 2010-2019 was 58.3%, there was no overdraft dividend, and there was a balance between the adequacy and sustainability of dividends.

There is a good chance that the group will survive the economic and industry crisis caused by the public health incident.

The outbreak of public health incidents in the United States has put the offline retail industry into a cold winter, while retail real estate is also in trouble. We believe that the industry reshuffle is inevitable, but we believe that there is a good chance that the group will be able to tide over this difficulty-the financial situation of the group is still healthy. Since the listing, the EBITDA

interest coverage ratio has shown an overall upward trend, reaching a historical peak of 5.7x in 2019, and declined in the first half of this year, but maintained at a high level of 4.7x

, and the solvency is guaranteed. In terms of liquidity, the maturity of the group's debt is relatively smooth, with maturing debt of $2.24 billion and $2.65 billion respectively from 2020 to 2021, while as of June

30 this year, the group has $4.9 billion of credit resources available, enough to cover debt repayment needs this year and next.

The current stock price valuation is very attractive.

After a sharp fall, the group's share price is valued at its lowest level since 2007. P/FFO (LTM) fell to 6.27 in the second quarter, below the level set during the financial crisis in 2008

; the dividend yield is now 7.6 per cent, up from 6.8 per cent during the 2008 financial crisis. We believe that the current stock price fully reflects the uncertainty of the future and has a high margin of safety.

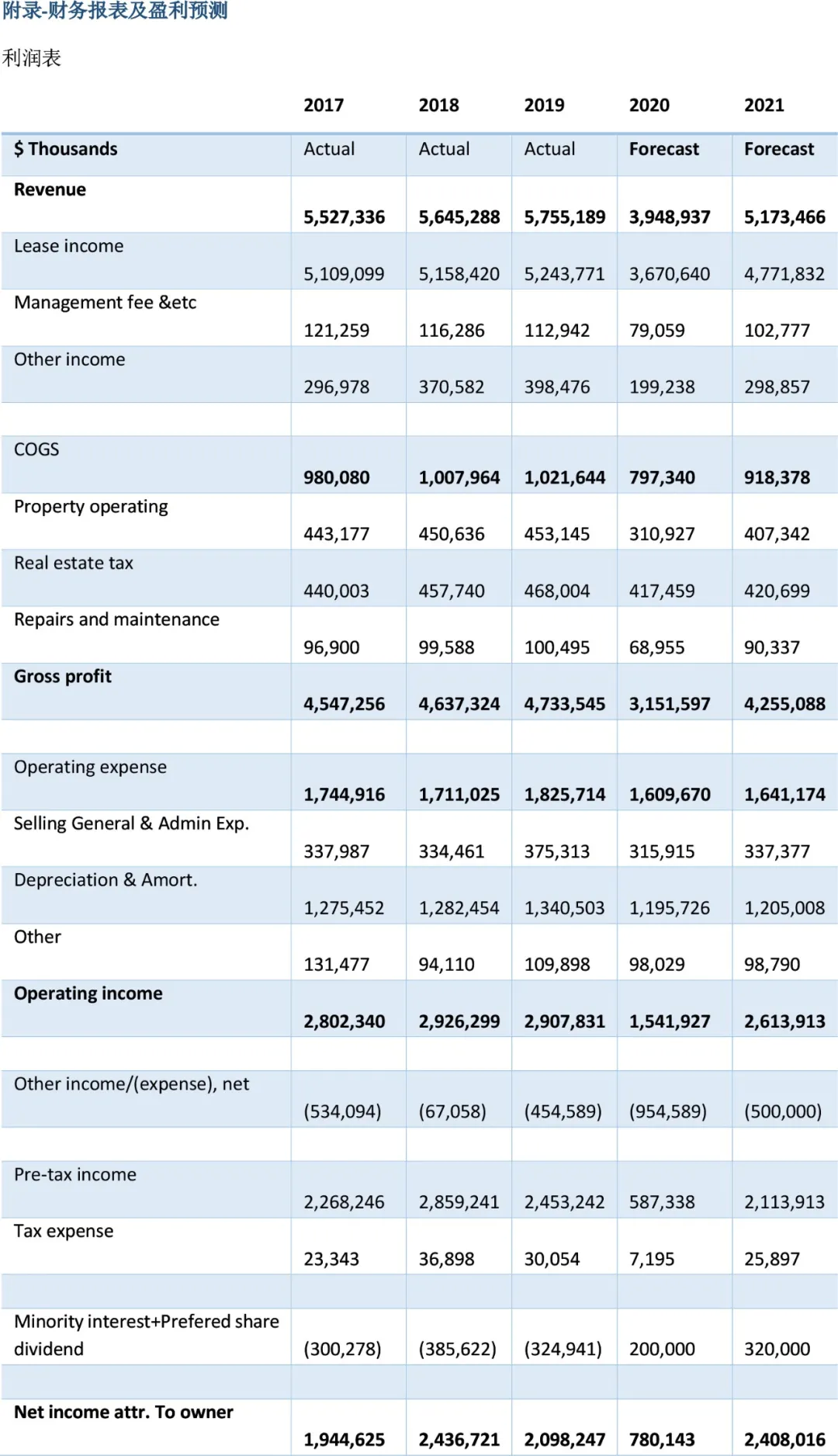

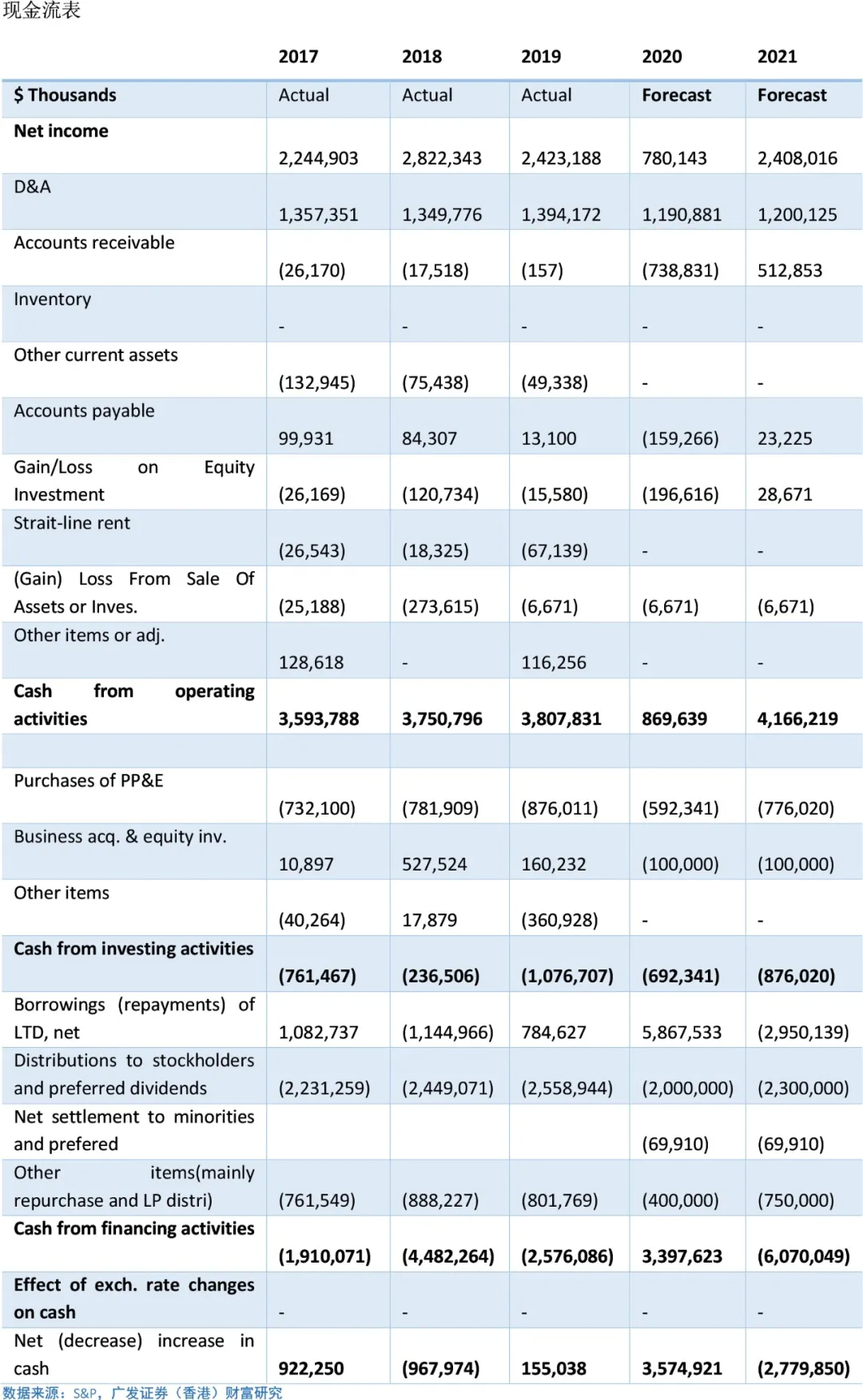

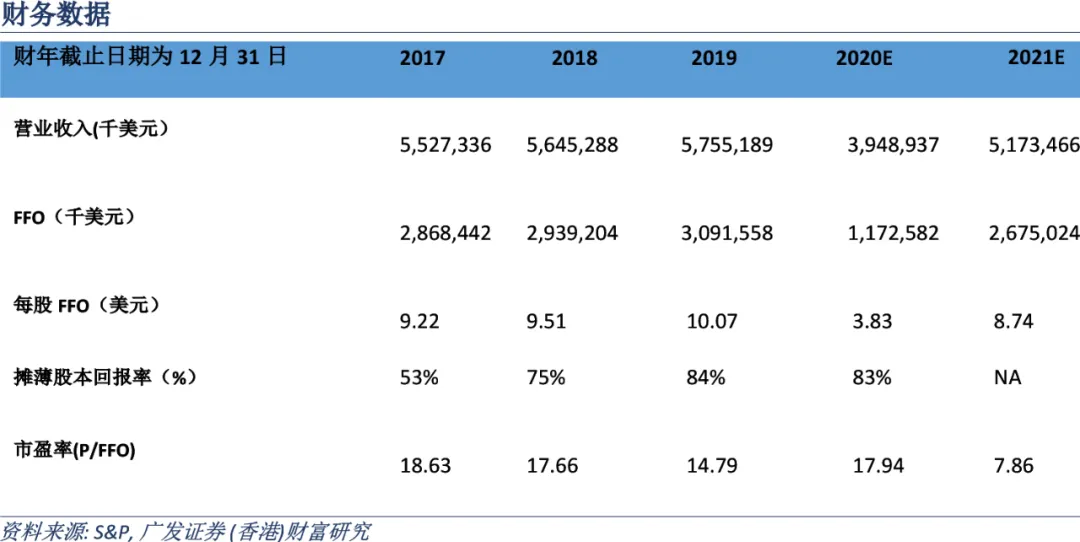

Profit forecast and valuation

Looking ahead, we expect 2020 to be the most difficult year for the group and a pick-up in 2021. We expect group revenue to grow by-31.4% and 31.0% in 2020 and 2021

, respectively. Specifically, based on the gradual remission of public health events (despite twists and turns), we believe that 20q2 will be the lowest point (management results will reveal a total of

10500 business days lost in the second quarter), while 20q3 and 20q4 will improve quarter by quarter. In 2021, the group will accelerate growth with the help of mergers and acquisitions.

In terms of valuation, we use the DDM model, which is more mainstream for REITS. Based on a cap rate of 5.4 per cent (the average of the implied cap

rate in the 2017-2019 market) and a sustainable growth rate of 1 per cent, we give a buy rating of a reasonable share price of $137.22.

Risk hint

As consumers are increasingly inclined to choose convenient and fast online shopping models, e-commerce continues to put pressure on physical retailing. Excluding retail products such as cars, gasoline, groceries and building materials, which are difficult to buy in traditional shopping malls, e-commerce sales will account for more than 20% of retail sales

. This also directly led to the "traditional retail apocalypse" in which a large number of physical retail stores began to close a large number of stores in the United States from 2010.

If public health event control is out of control, it will have a significant impact on the physical retail industry in the United States.

The litigation dispute with TCO is uncertain and may cause losses to the group.