Thinking 1: from "JD.com Bailiao" to "digital science and technology", how does JD.com unfold the road of mathematics innovation?

JD.com Mathematics Department was established only 7 years ago, and currently maintains close business ties with JD.com Group, but the two are highly independent in terms of finance, personnel and institutions. JD.com has gone through three stages: digital finance, financial science and technology and digital science and technology. By the end of June 2020, JD.com has served more than 600 companies in the service field of financial institutions, more than 1 million small and micro businesses, more than 200000 small and medium-sized enterprises, and more than 700 large business centers in the field of merchant and enterprise services. in addition, it has also served more than 40 urban public service organizations, and established a huge offline Internet of things marketing platform, covering more than 300 cities. At present, the company's five senior executives are from the senior management of other companies, as of June 30, 2020, the company has a total of 9989 employees, of whom 6969 are R & D personnel or professionals, accounting for about 70%. In the first half of 2020, JD.com 's revenue exceeded 10 billion yuan and R & D expenses reached 1.619 billion yuan, accounting for 15.67 percent. The company has accumulated a large number of core technologies and has a total of 2230 patents or pending applications as of August 31, 2020. At present, JD.com Digital Planning Division is listed on the board, and the amount of funds raised is expected to exceed 20 billion yuan, which will be invested in various digital solution upgrade construction projects, open platform upgrade construction projects and supplementary liquidity. On the whole, the company has realized the full coverage of To

F, To B and To G driven by innovation.

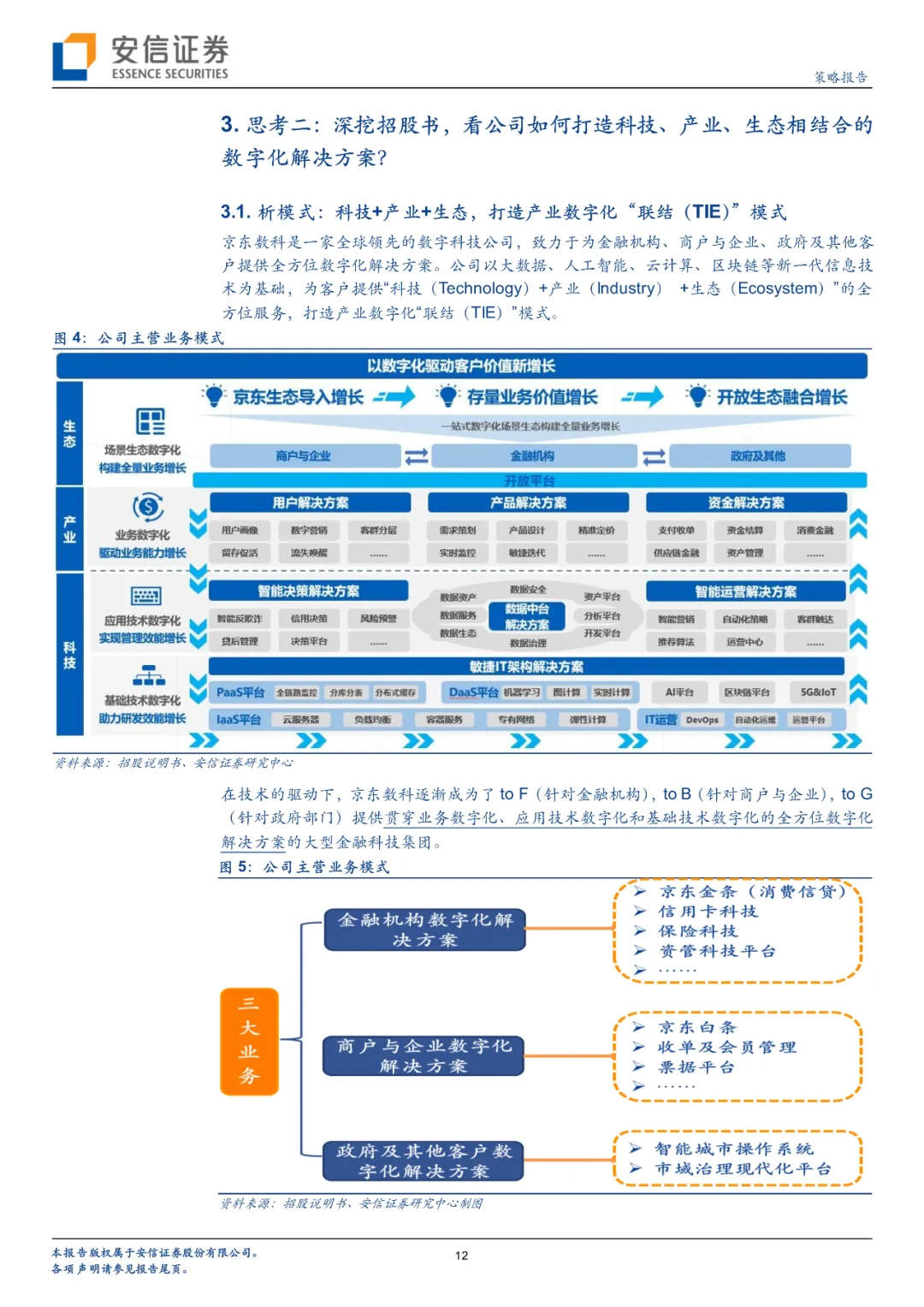

Thinking 2: dig the prospectus to see how the company can create a digital solution with the combination of science and technology, industry and ecology.

JD.com Mathematical Science put forward the industrial digital "TIE" model of the combination of science and technology (technology), industry (industry) and ecology (ecosystem) to provide customers with all-round services. The company has gradually formed three major businesses: to

F (digitization of financial institutions), to B (digitization of merchants and enterprises), and to

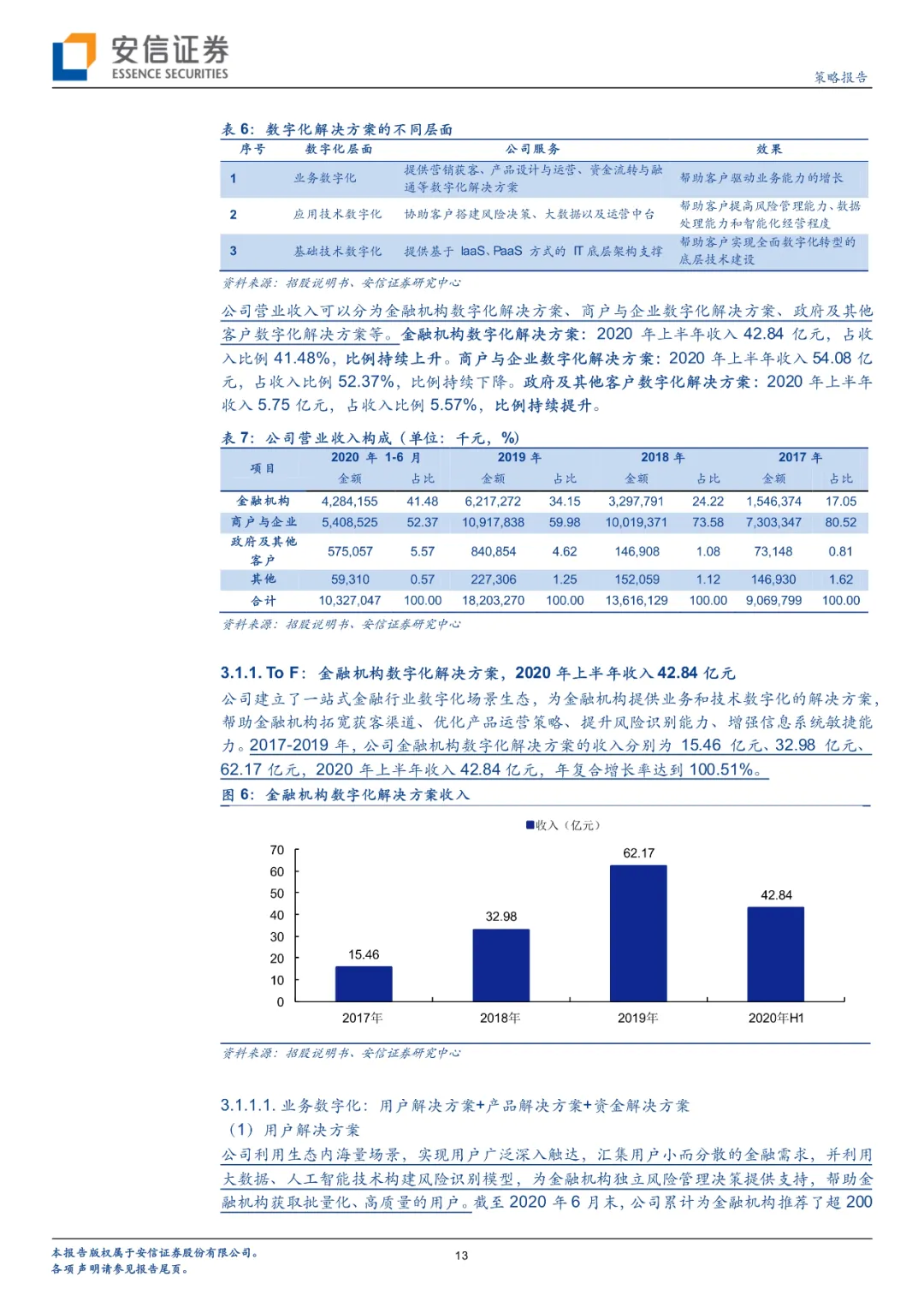

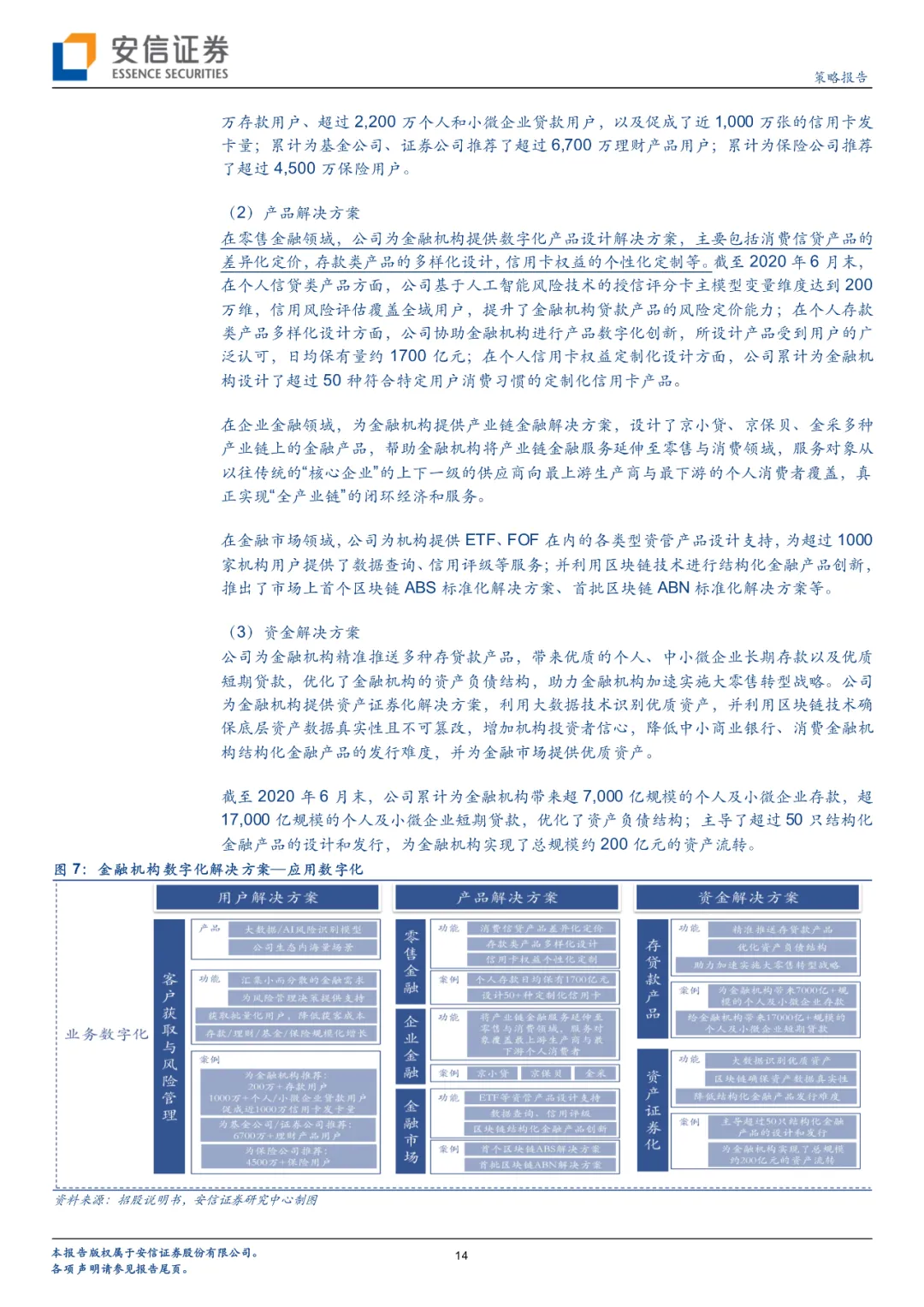

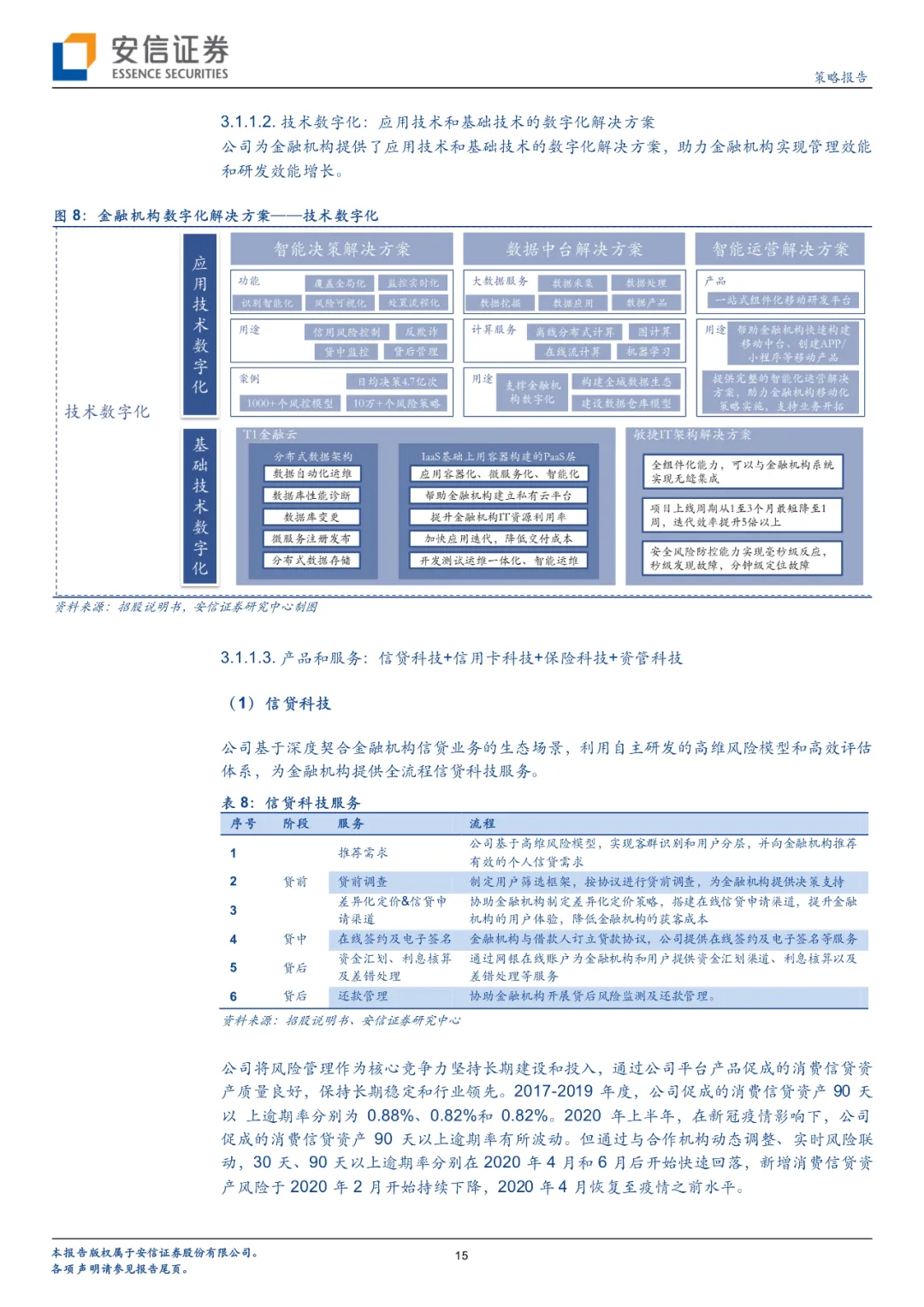

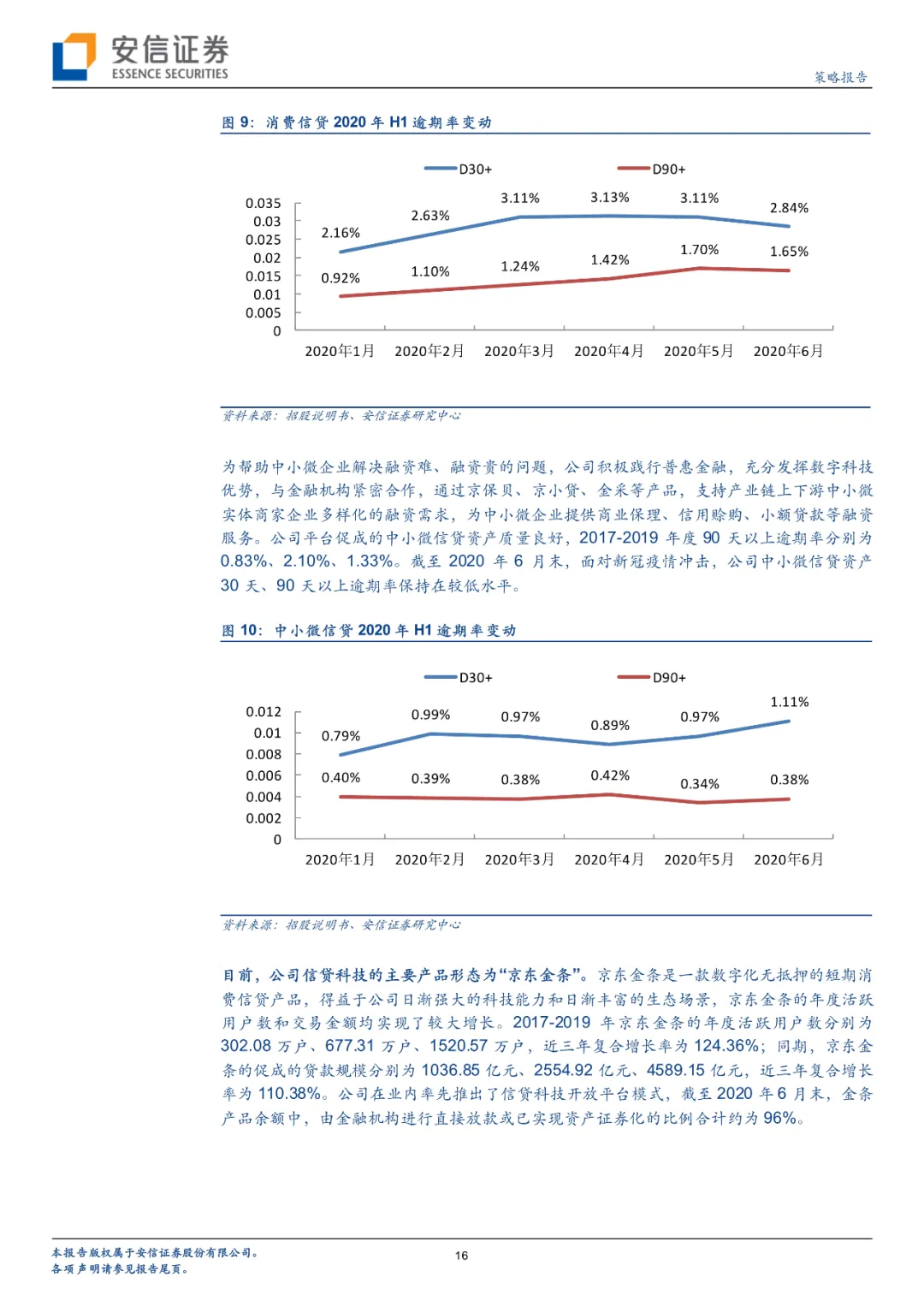

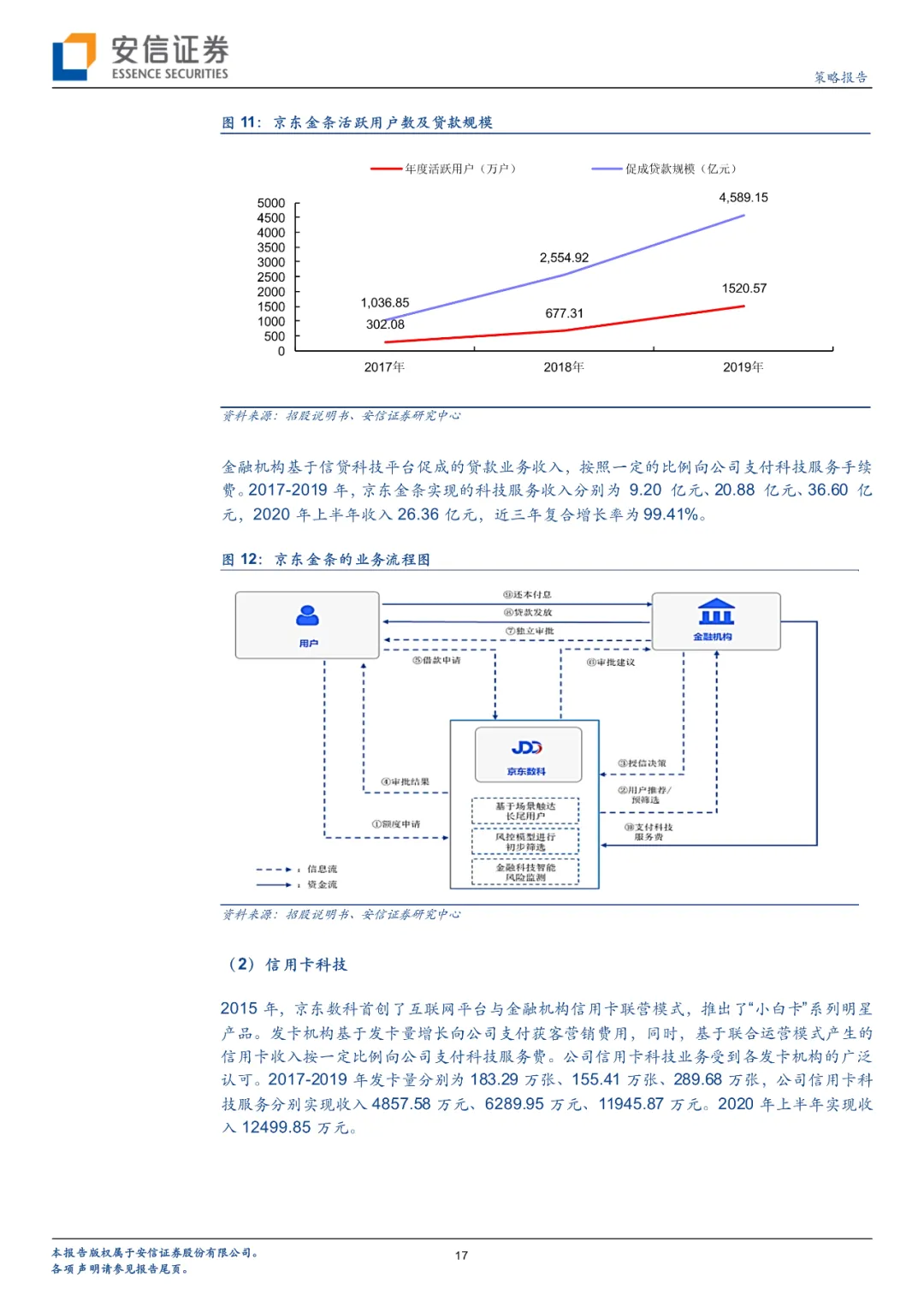

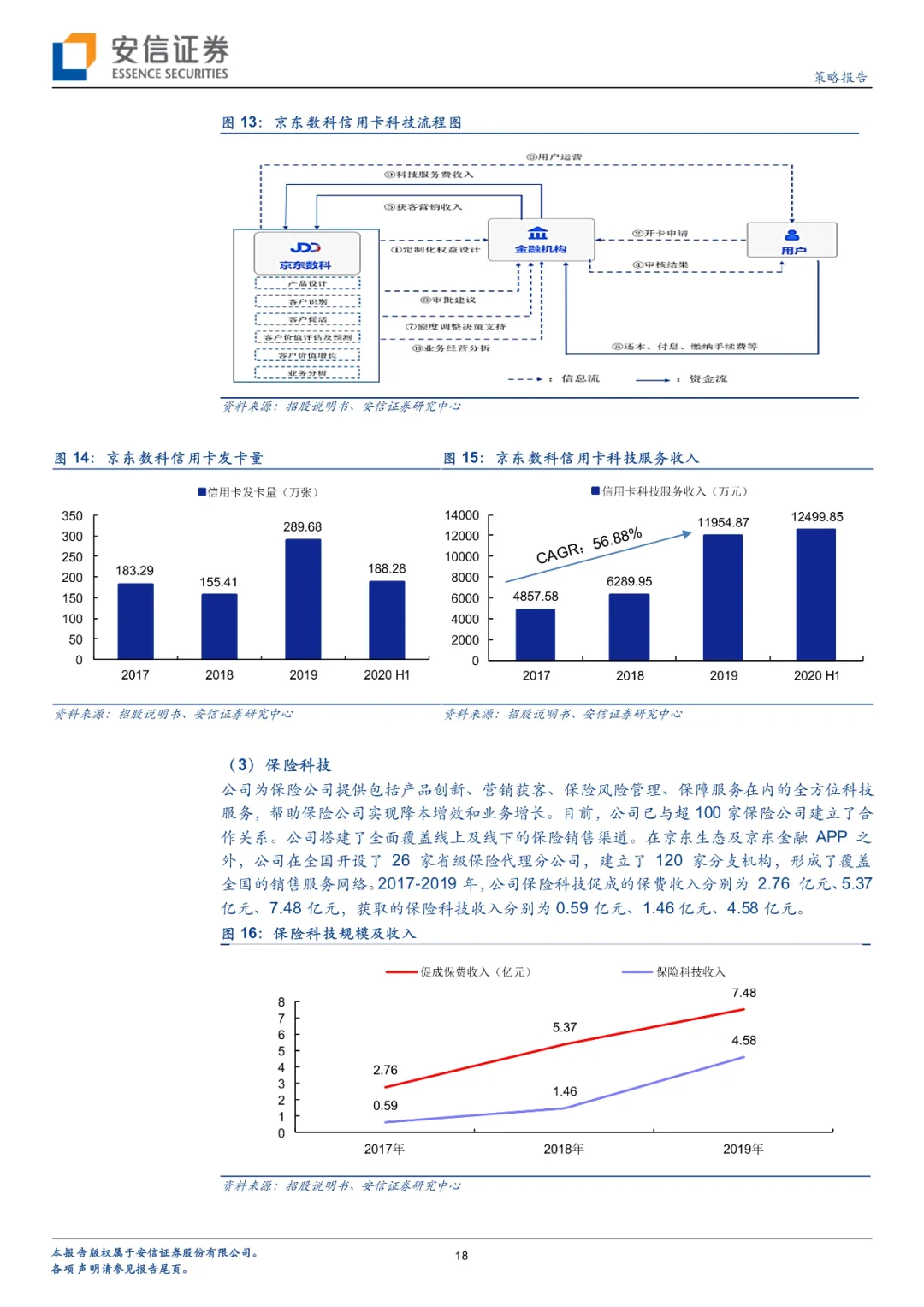

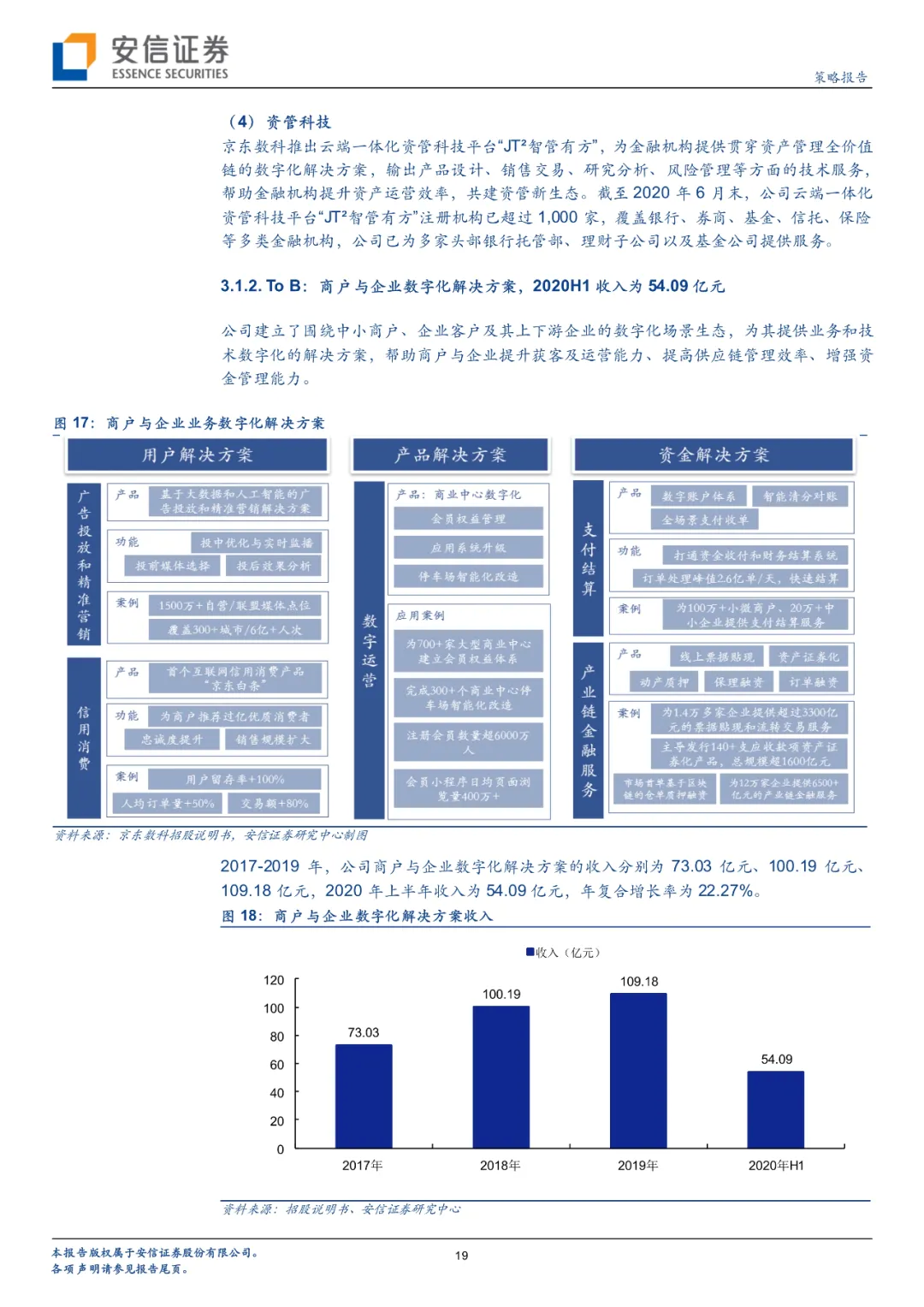

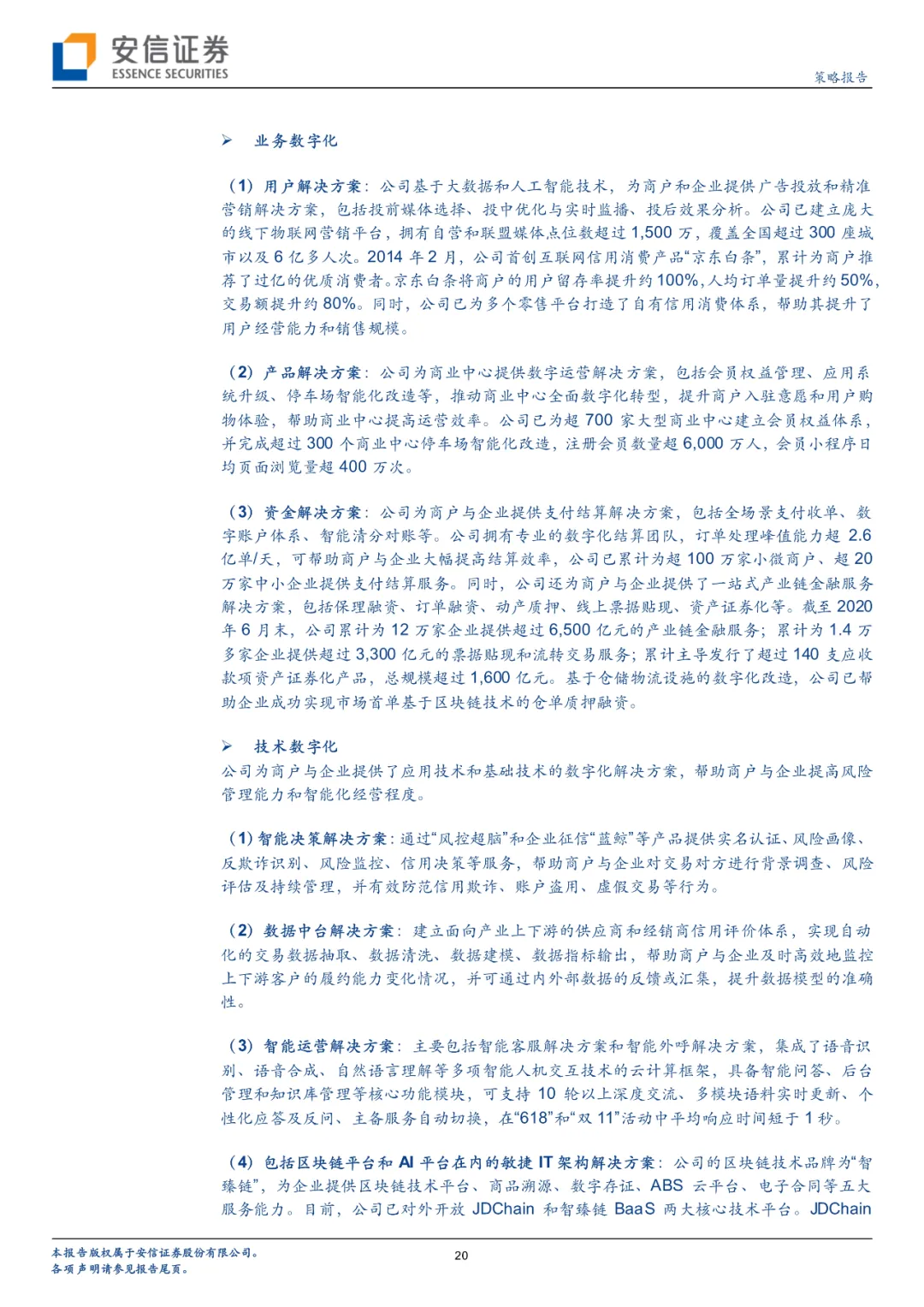

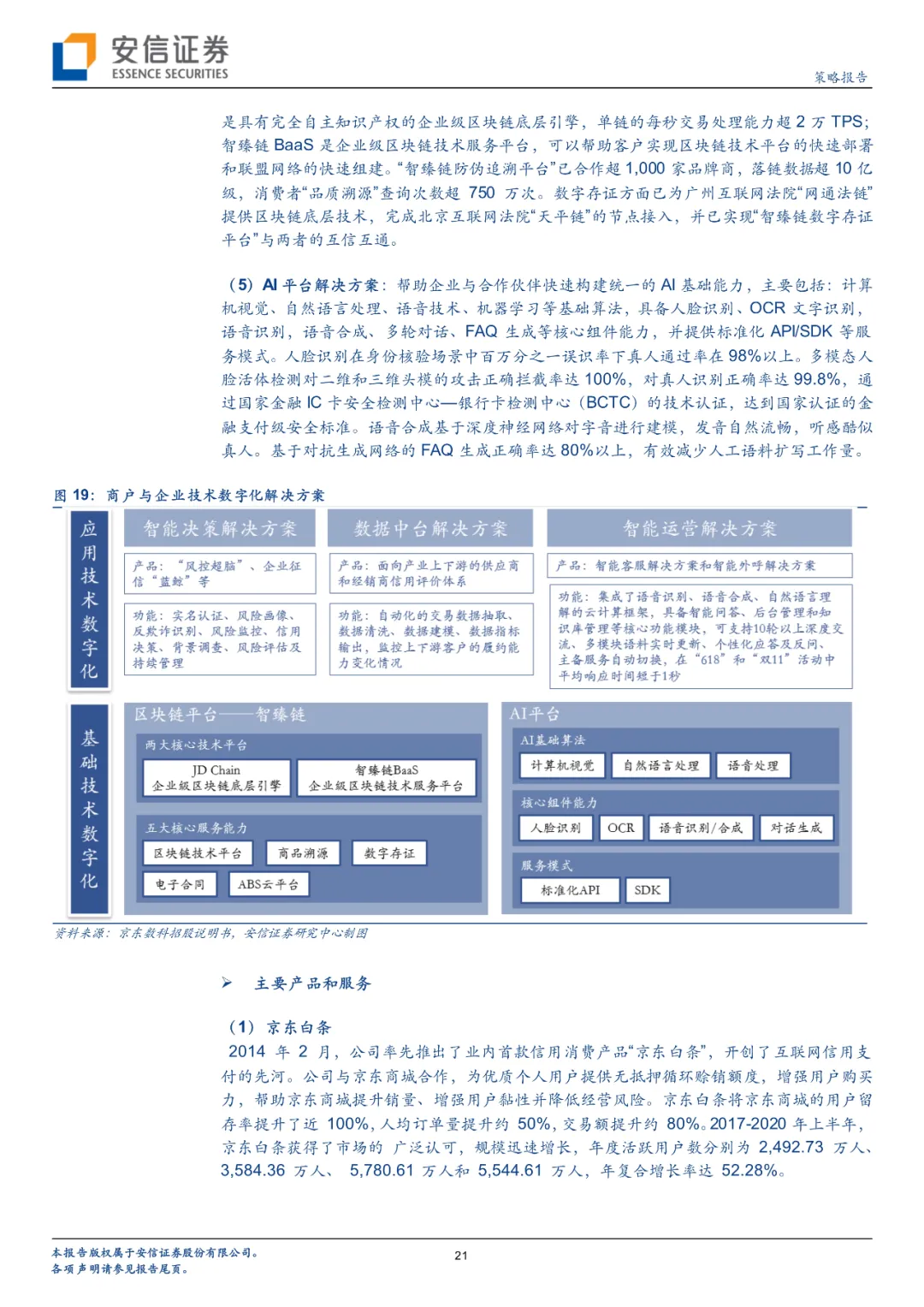

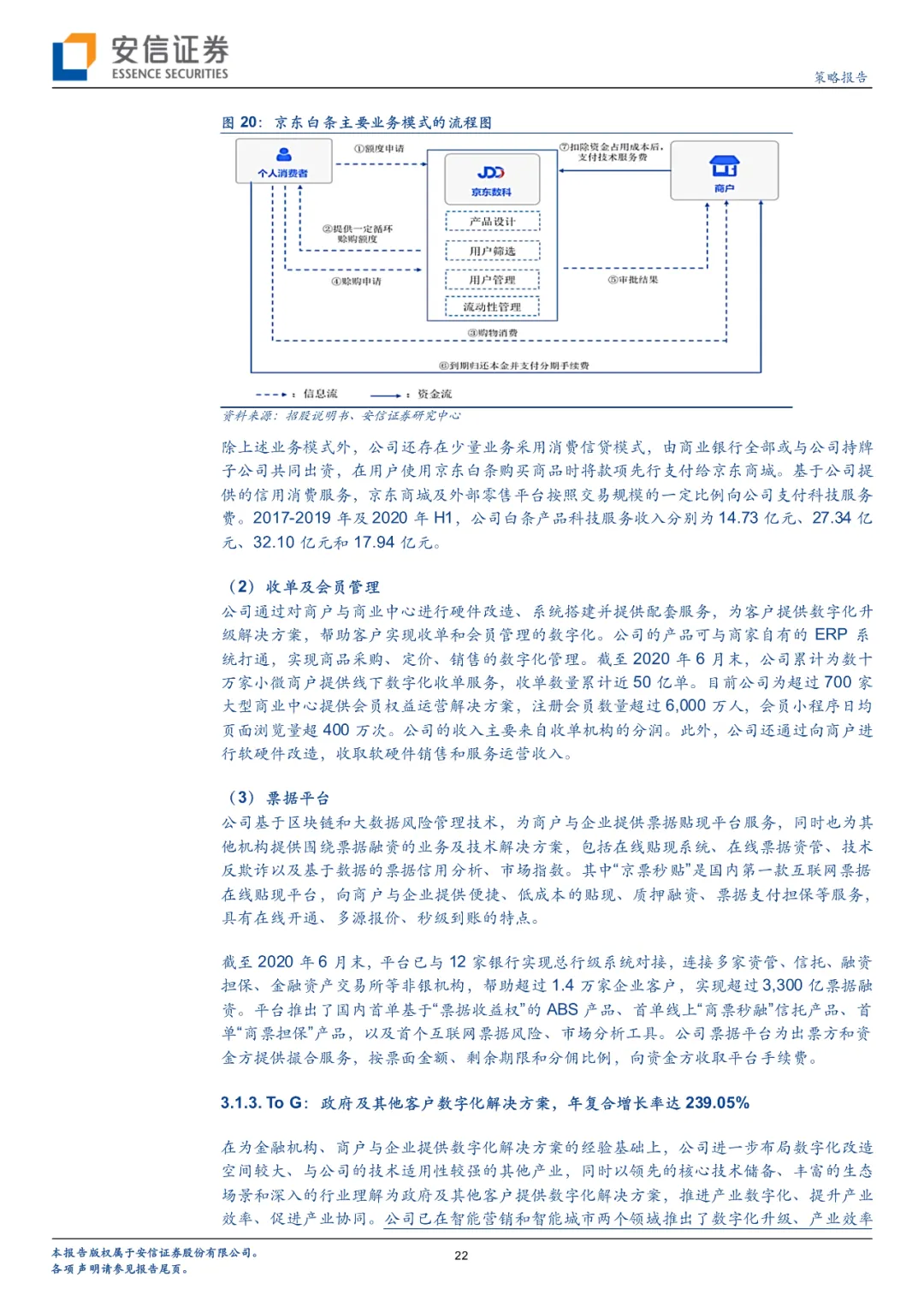

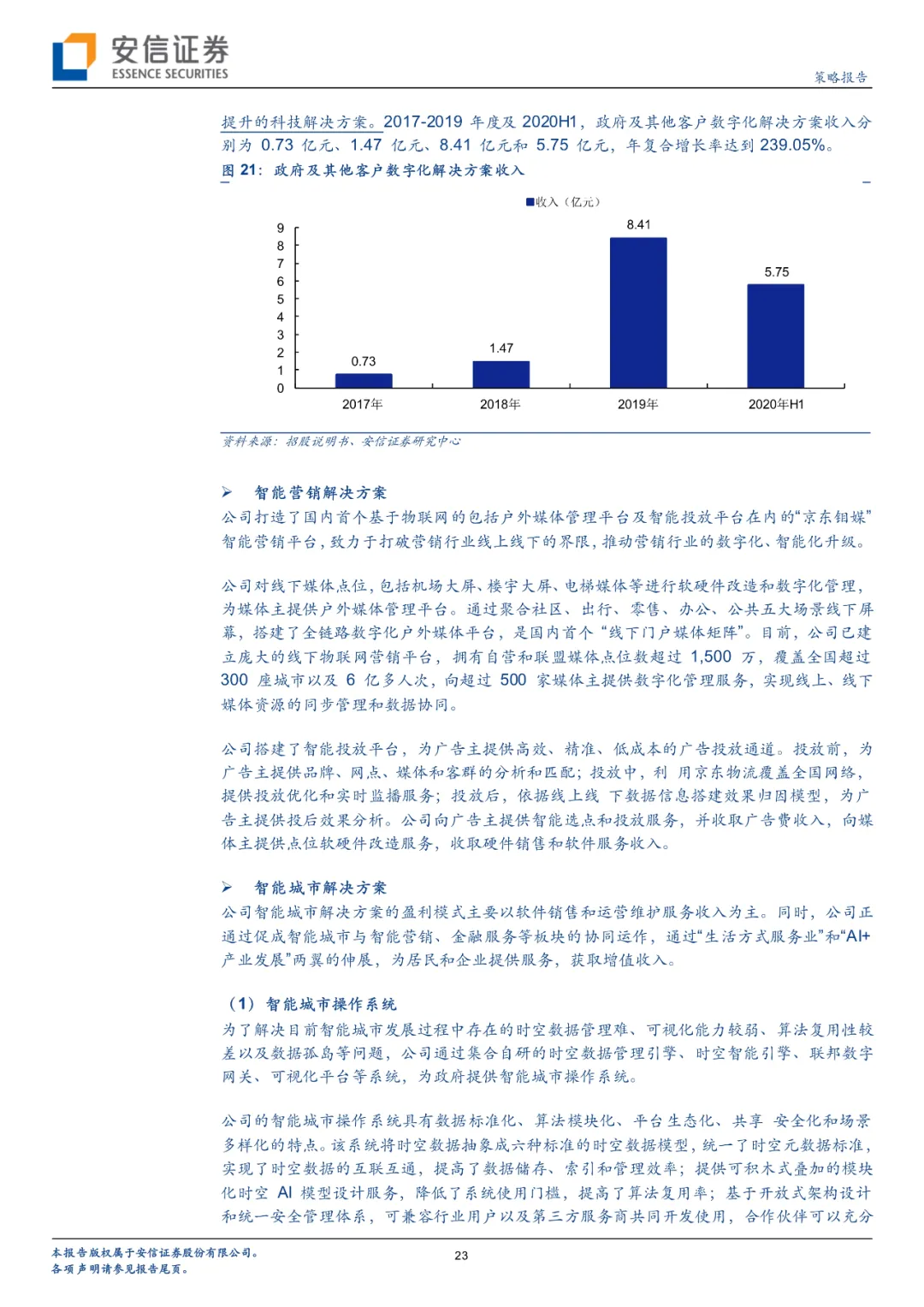

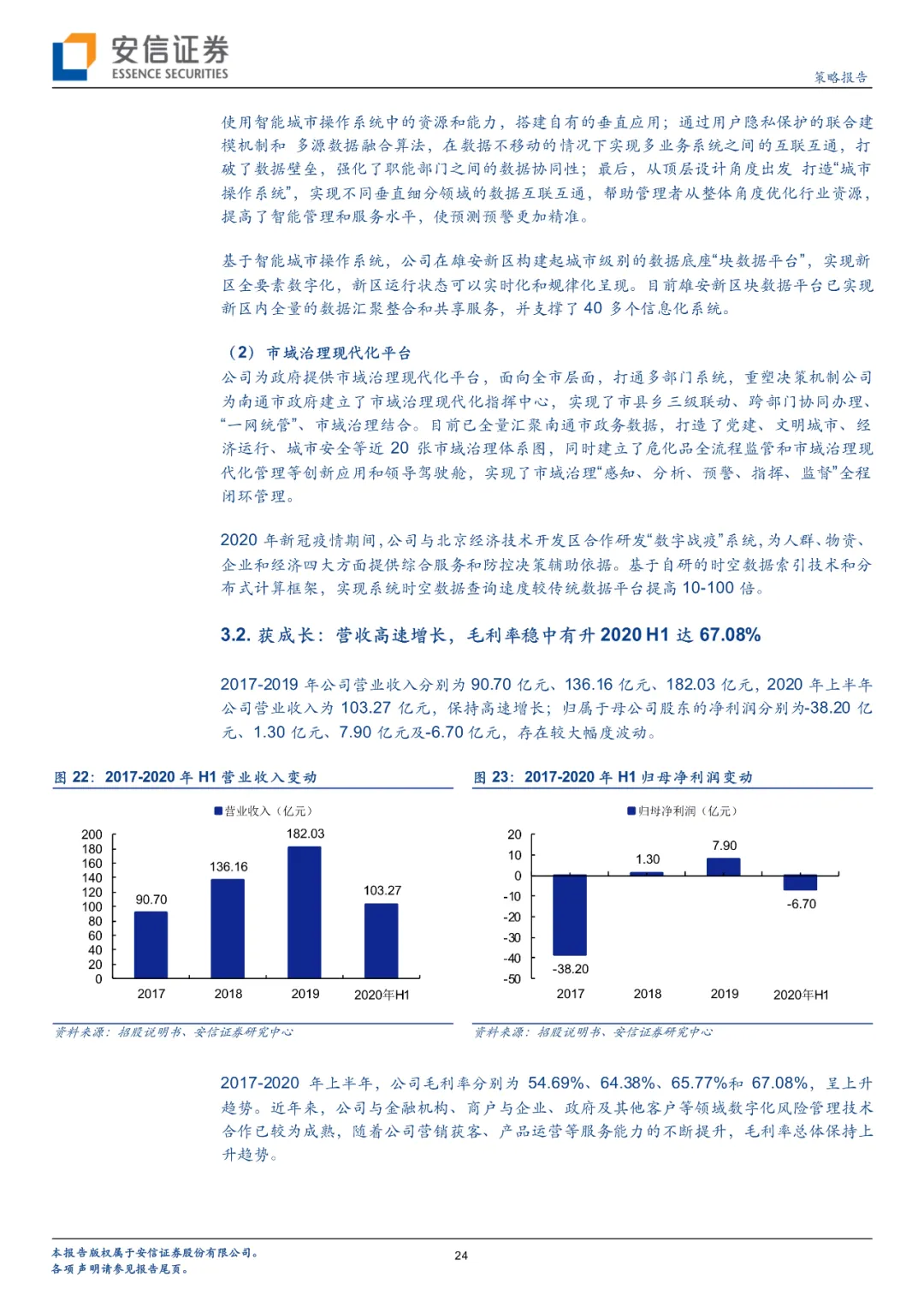

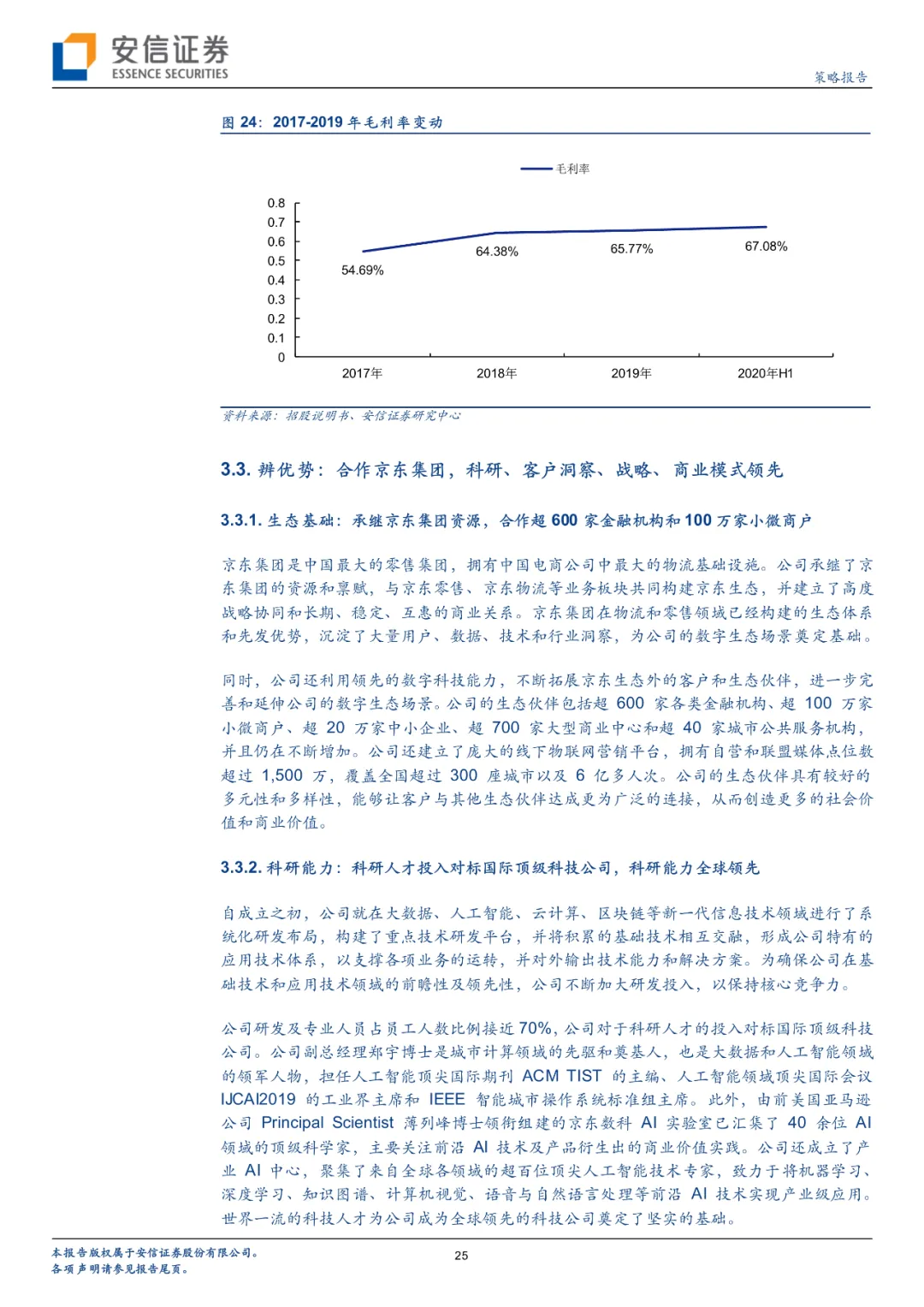

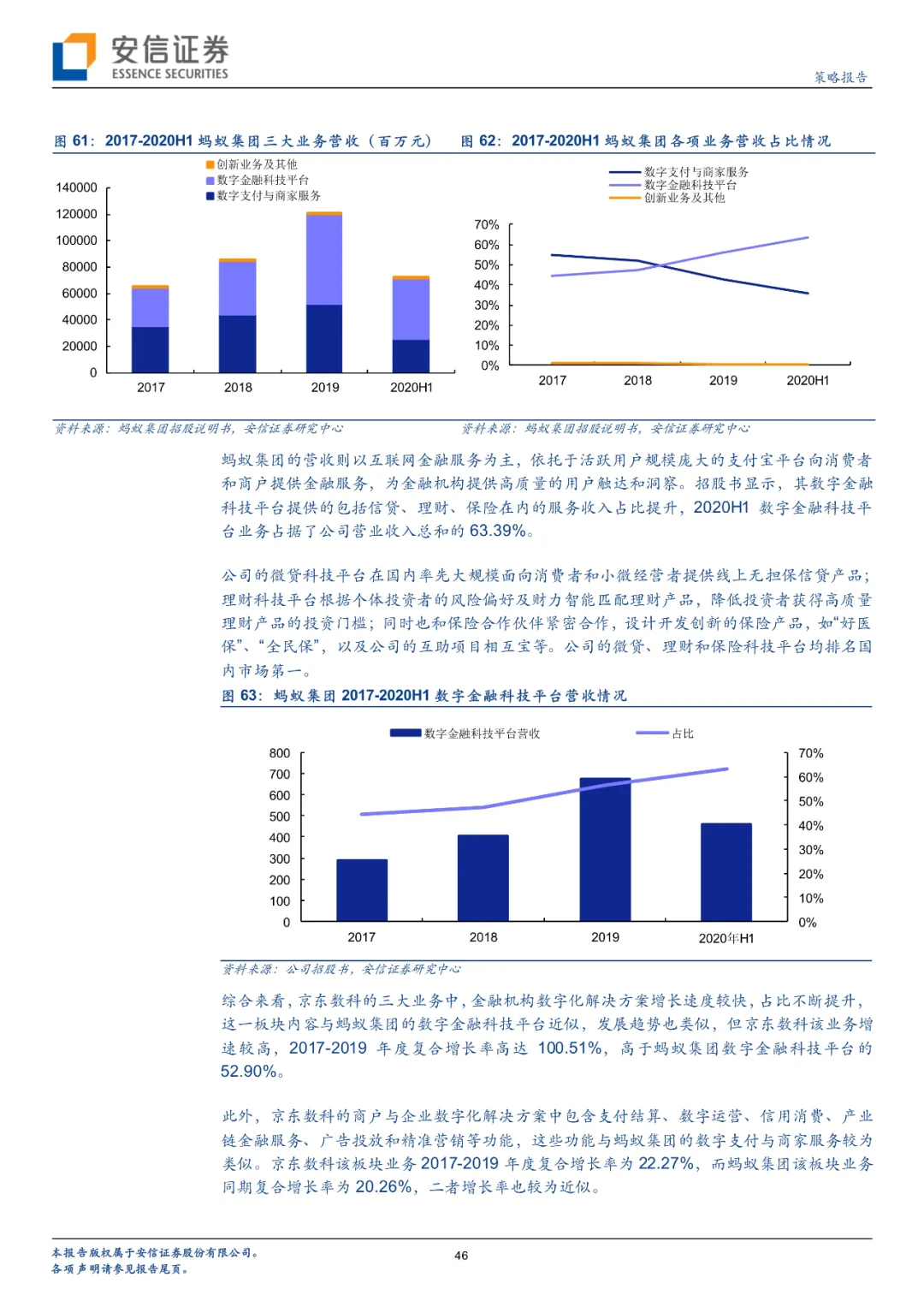

G (digitization of government and other industries). Each kind of digital solution includes three levels: business digitization, application technology digitization and basic technology digitization. Among the three major businesses, merchants and enterprises account for the highest proportion of business, with 2020H1 revenue reaching 5.409 billion yuan, accounting for 52.37%. The company provides digital solutions for merchants and enterprises around small and medium-sized businesses, enterprise customers and their upstream and downstream enterprises, among which the user solution "JD.com Bailiao" increases the retention rate of merchants by about 100%. The digital business of the government and other customers is the fastest growing. In 2017-2019, the compound growth rate of revenue reached 239.05%. The revenue of 2020H1 reached 575 million yuan, accounting for 5.57%. It provides digital management services to more than 500 media owners and helps Xiongan New District "Block data" platform to create an intelligent city model. The business importance of financial institutions has gradually increased, and the proportion of revenue has steadily increased from 17.05% in 2017 to 41.48% of 2020H1's 202020H1 revenue of 4.284 billion yuan. Among them, the user solution has recommended more than 2 million deposit users, more than 22 million people and small and micro business loan users for financial institutions, contributed to the issuance of nearly 10 million credit cards, and recommended more than 67 million users of financial products for fund companies and securities companies. Recommended 45 million insurance users for insurance companies. The products designed by the product solutions are widely recognized by users, with an average daily holding volume of about 170 billion yuan. Capital solutions have brought deposits of more than 700 billion individuals and small and micro enterprises to financial institutions, and short-term loans to individuals and small and micro enterprises of more than 1.7 trillion scale. From the perspective of profitability, the gross profit margin of Jingdong math has been rising steadily in recent years, reaching 67.08 per cent of 2020H1.

Thinking 3: what about the growth power and space of the industry in the era of digital science and technology?

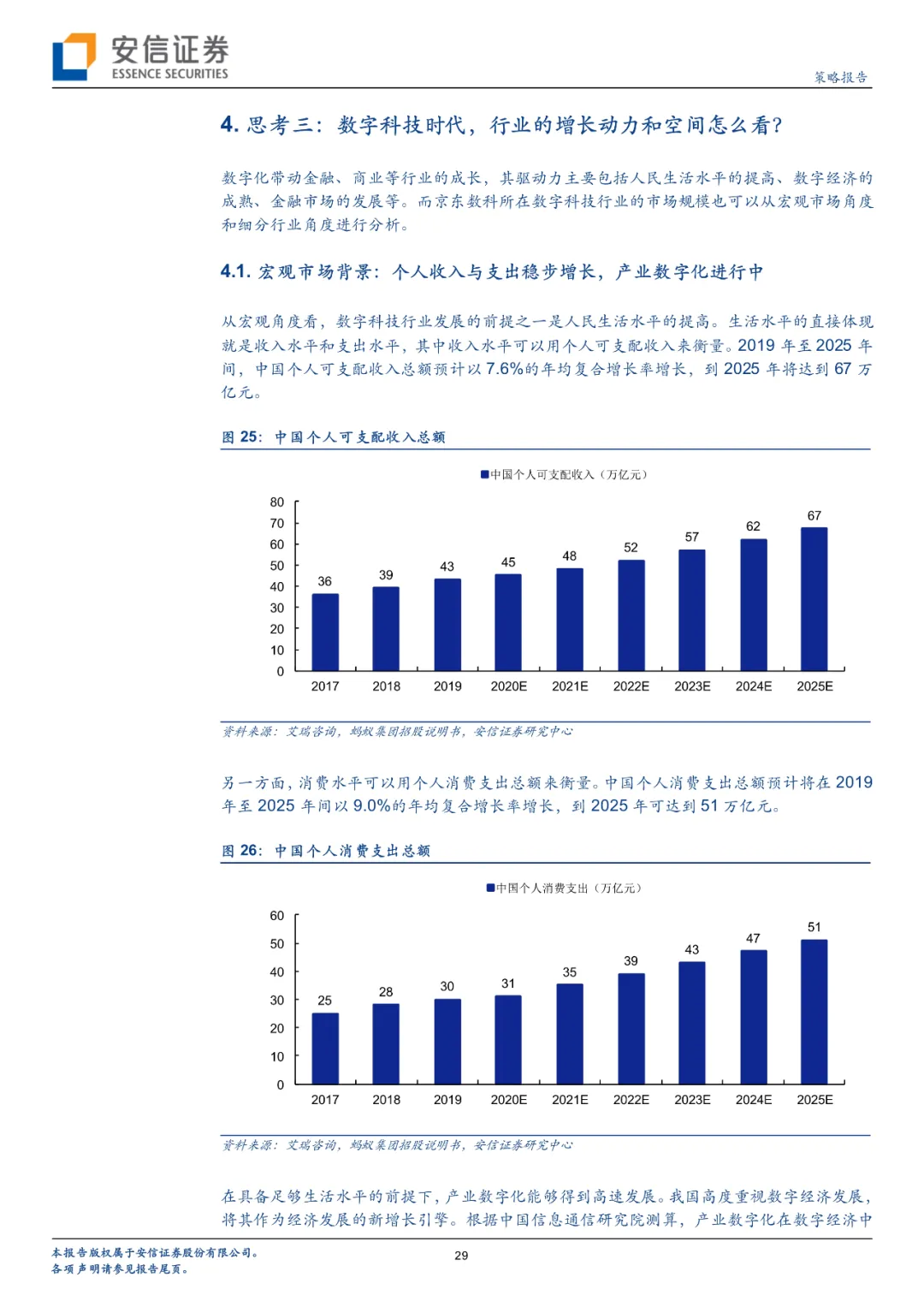

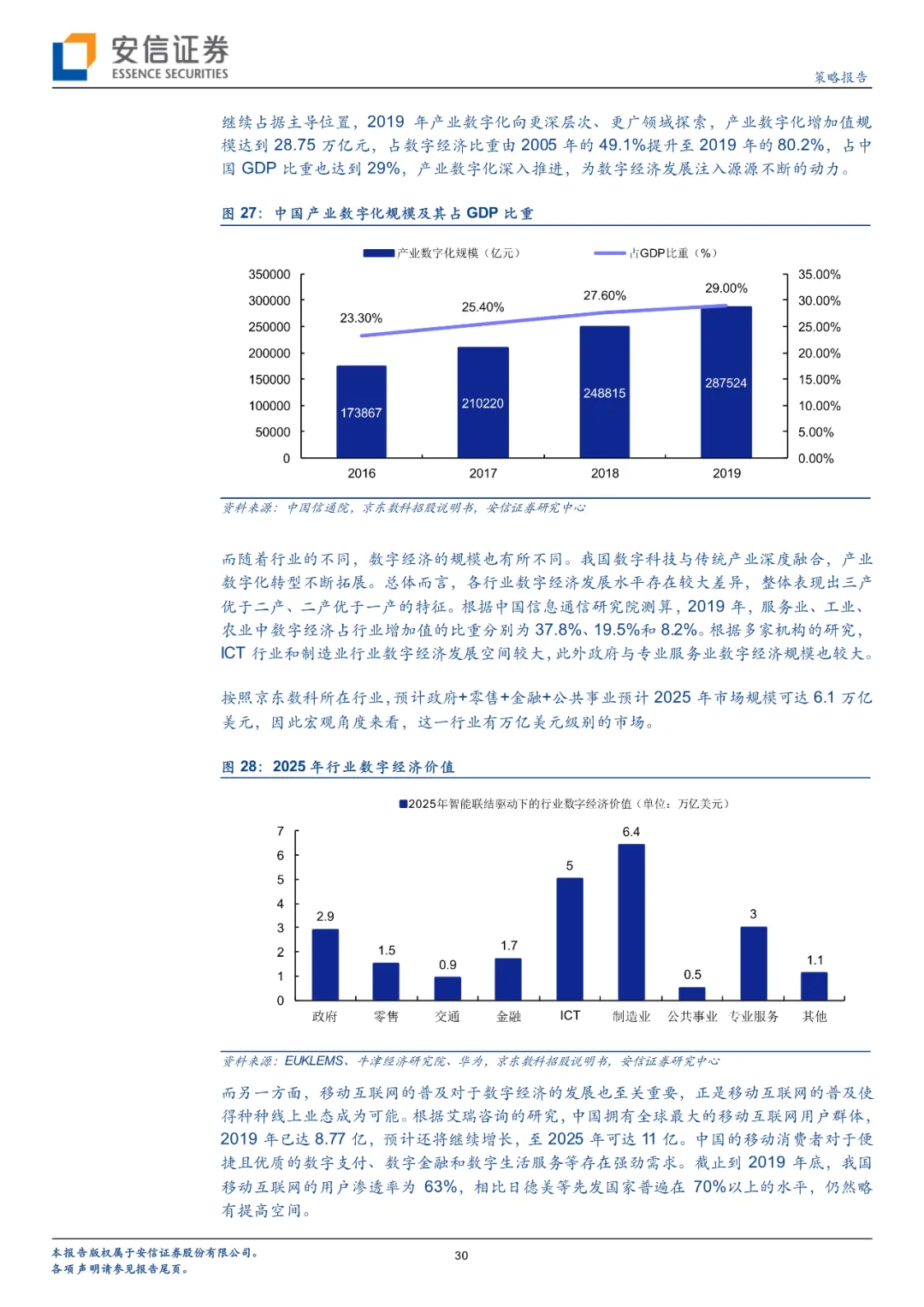

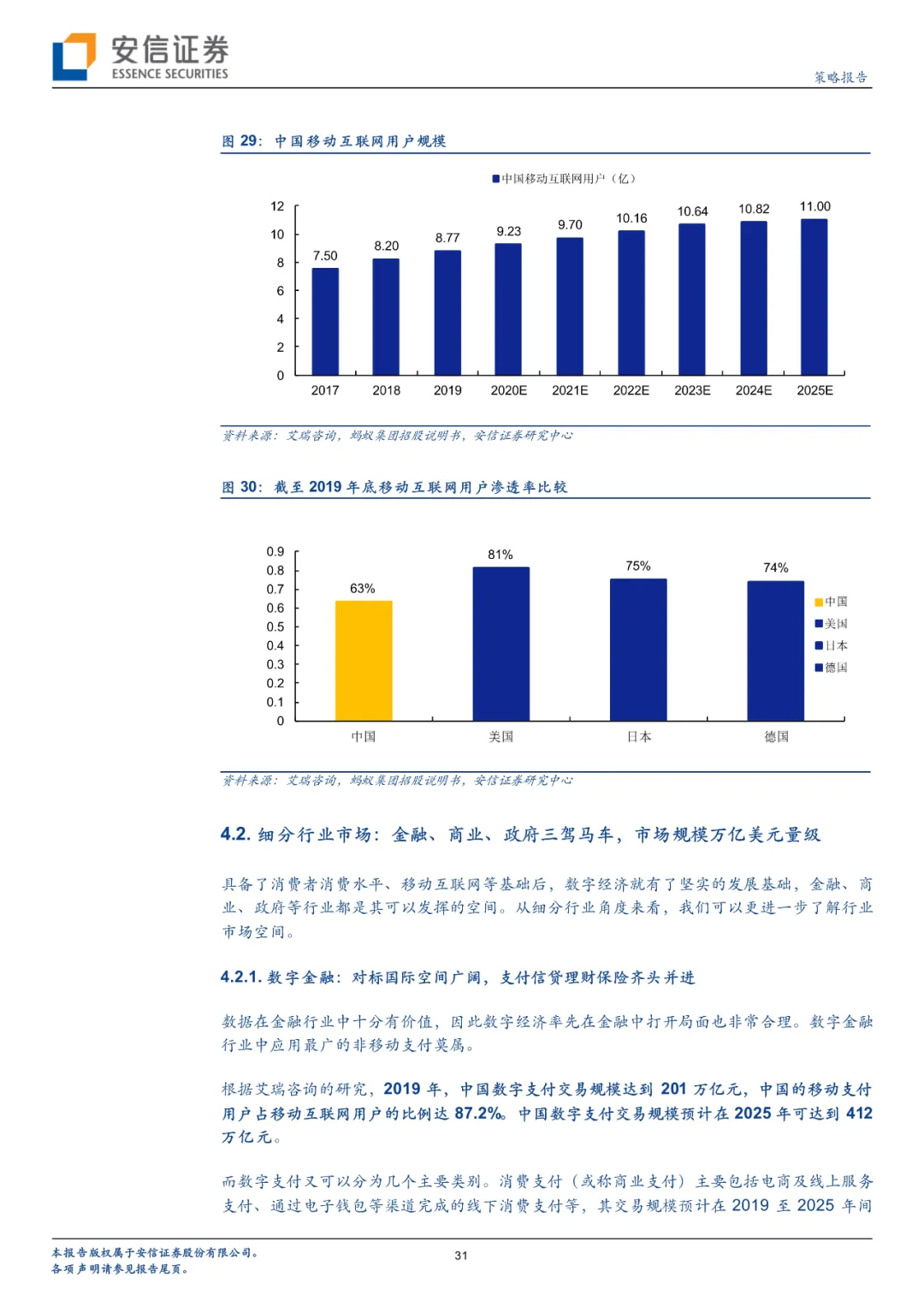

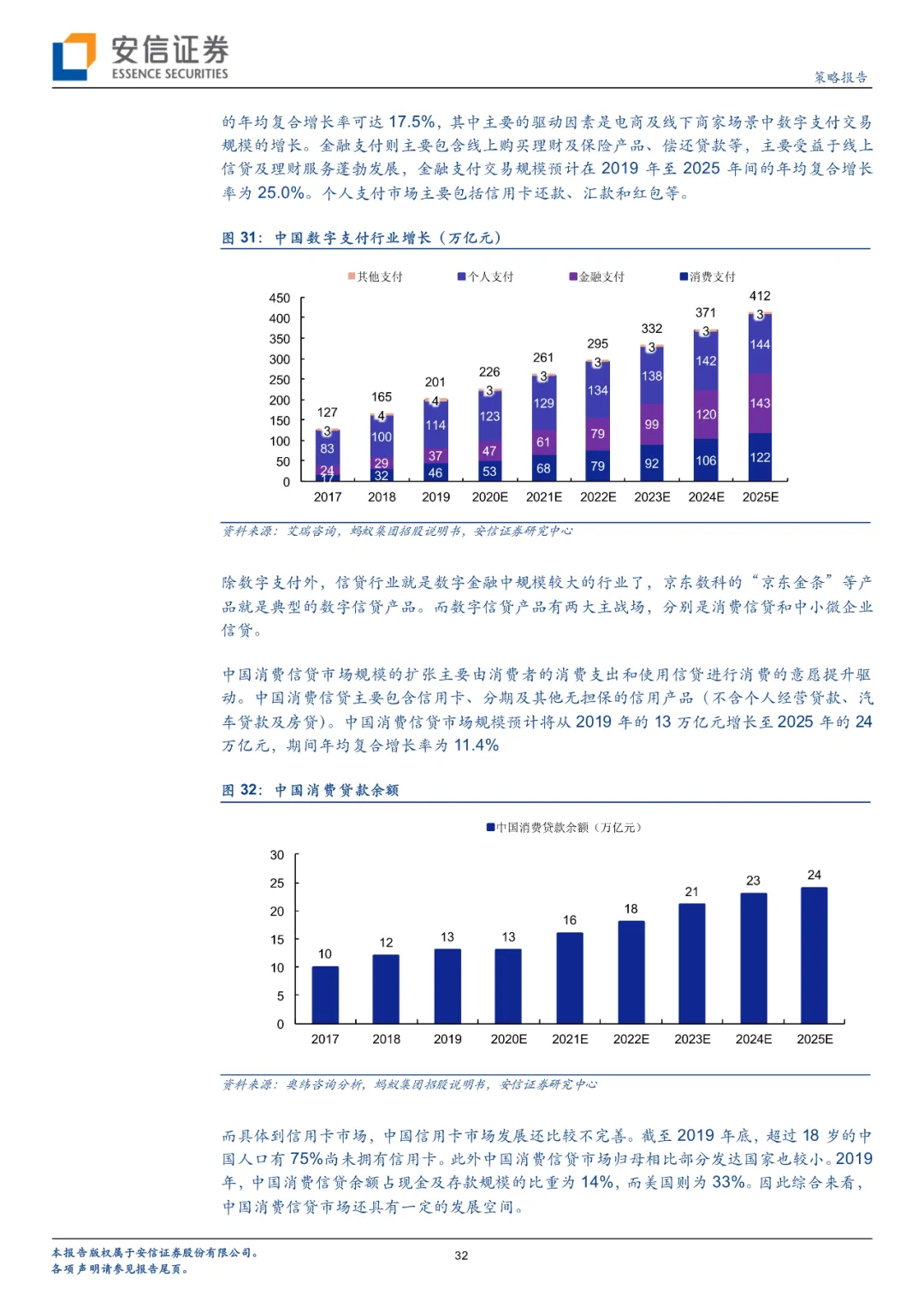

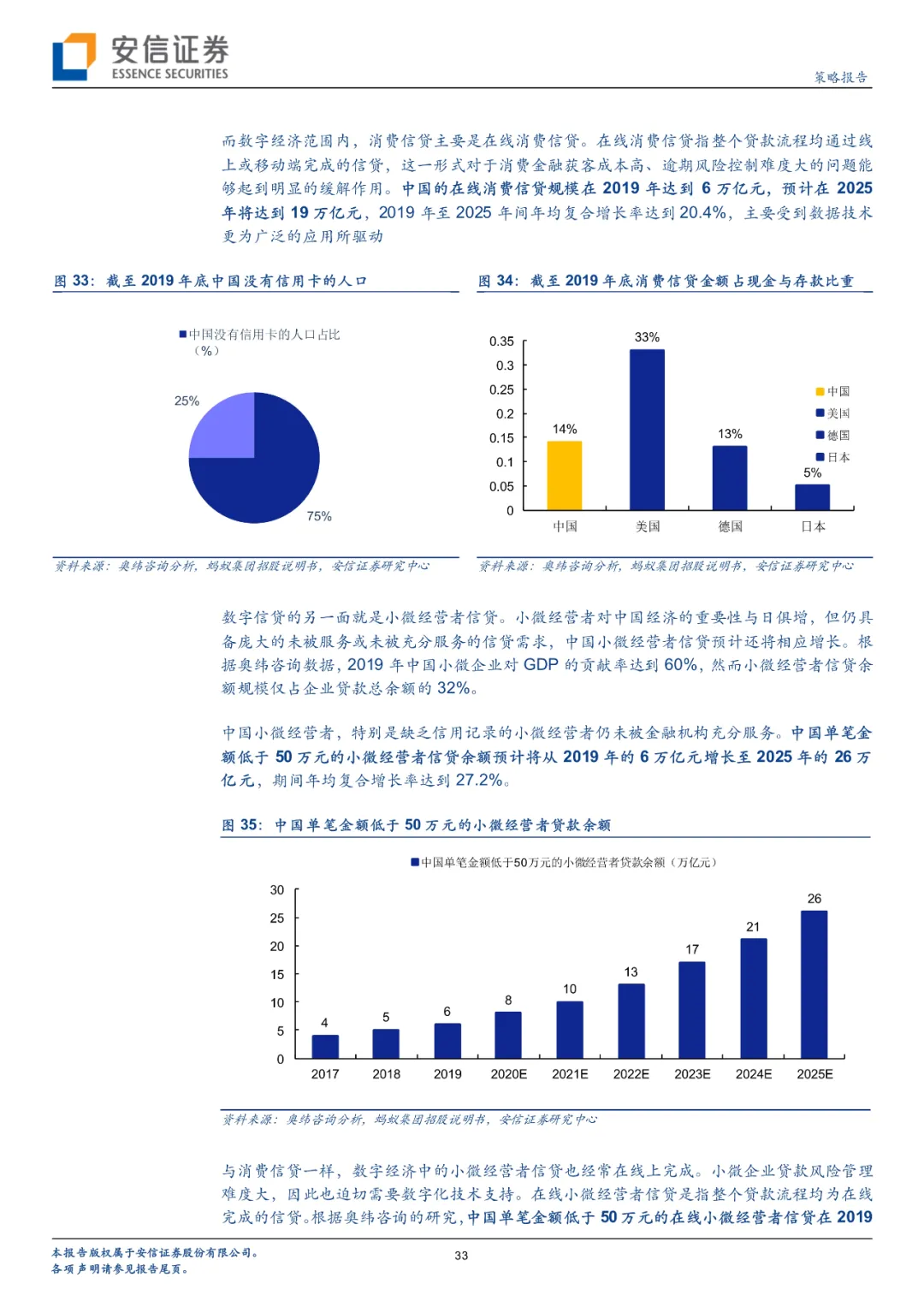

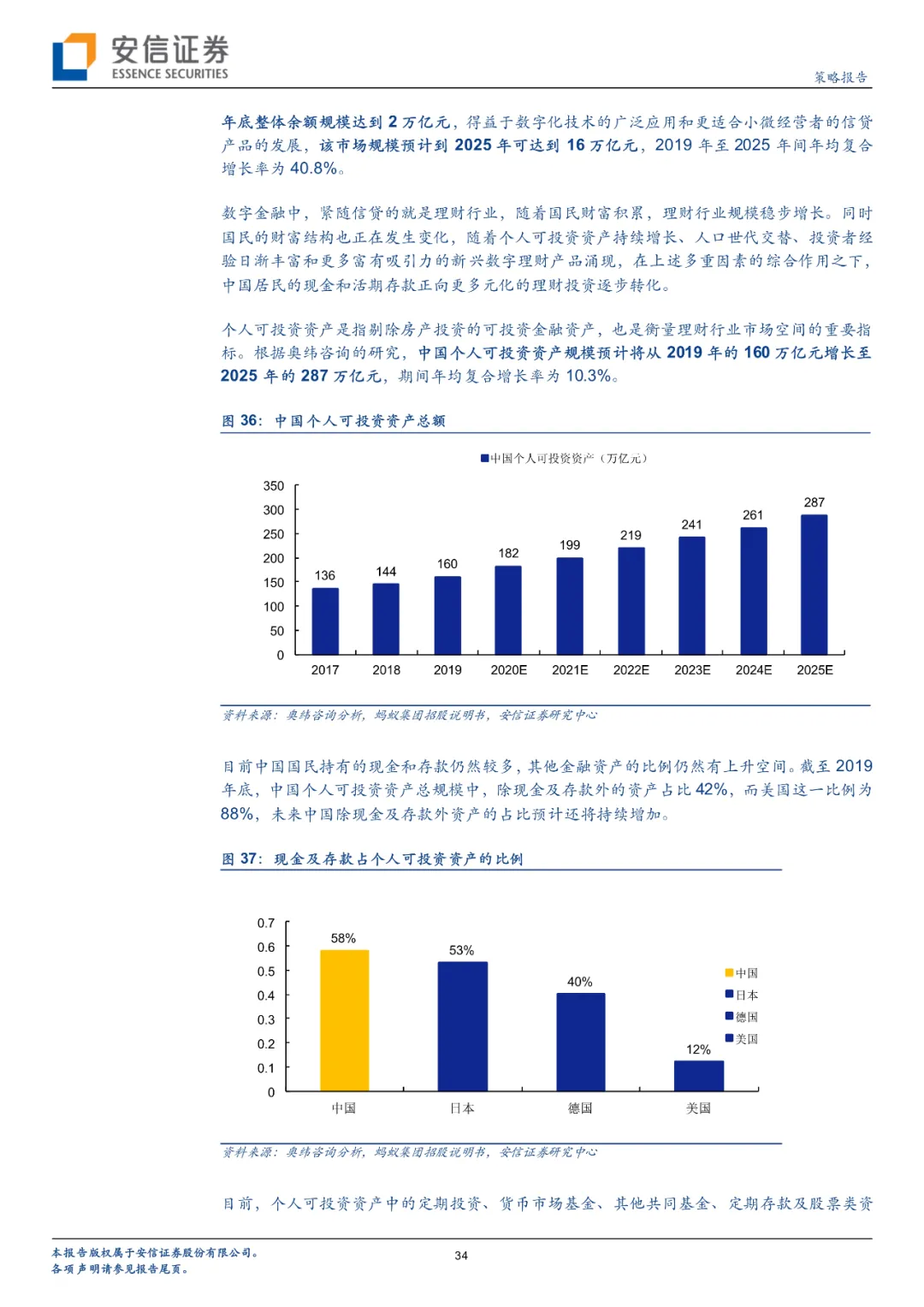

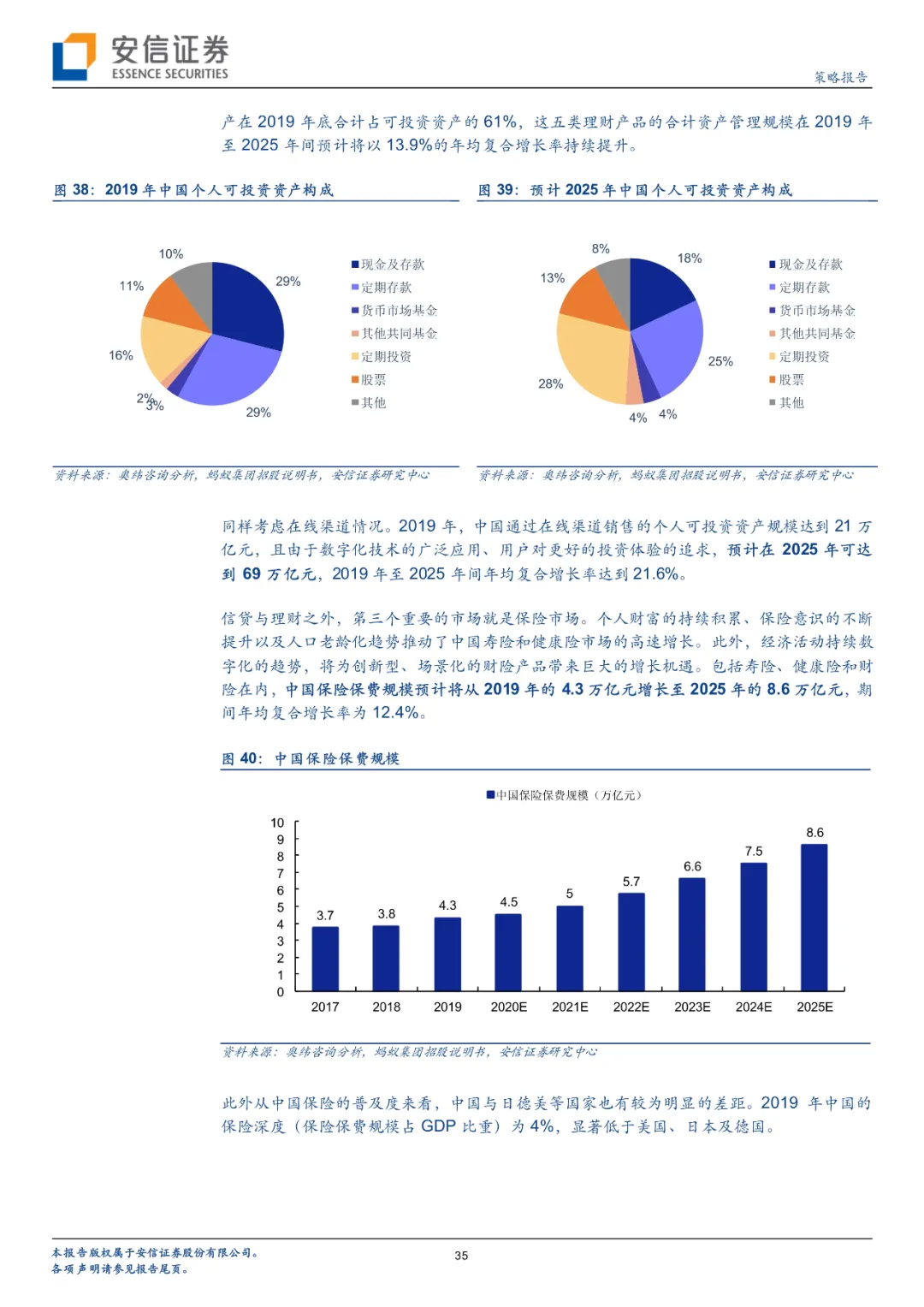

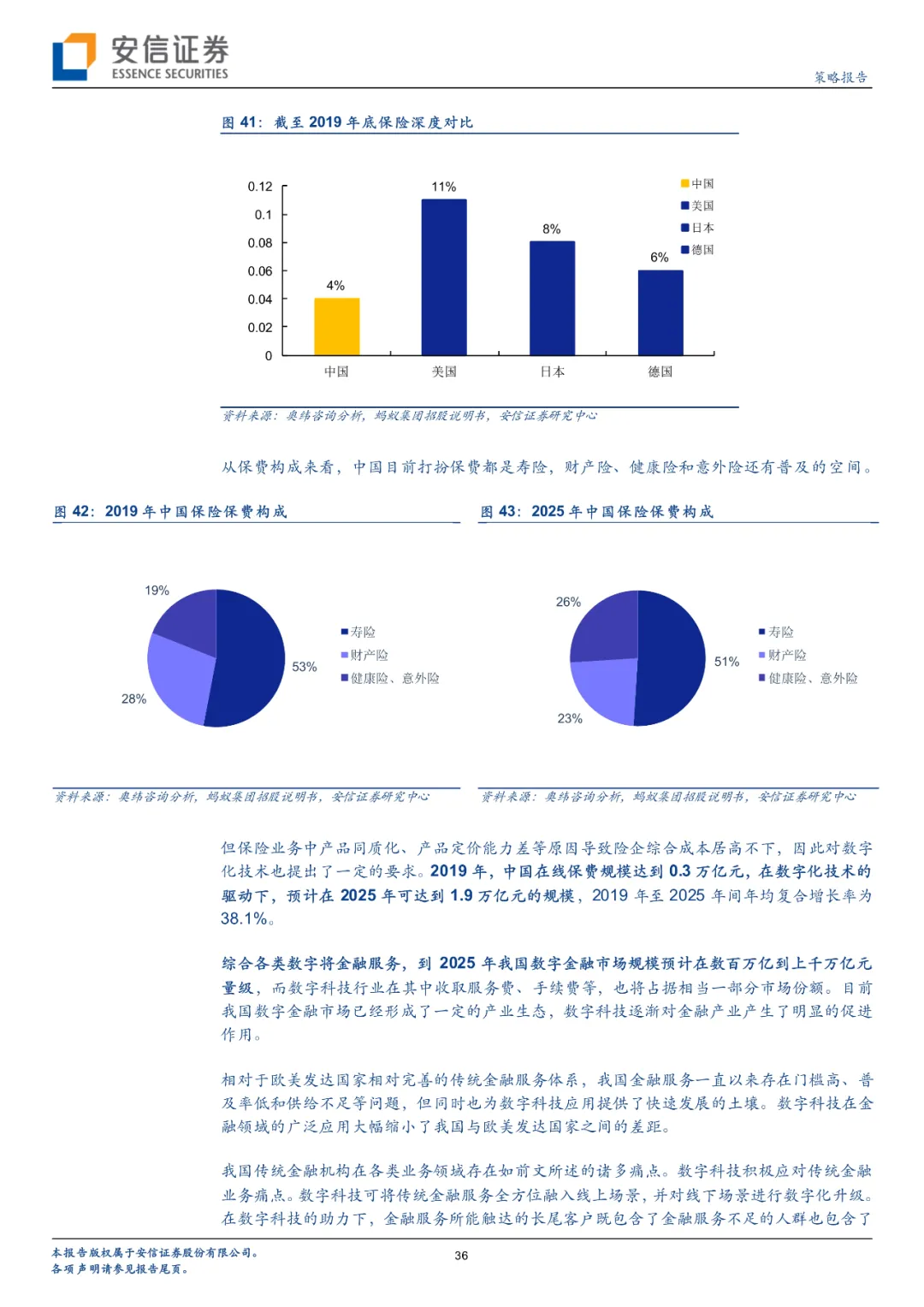

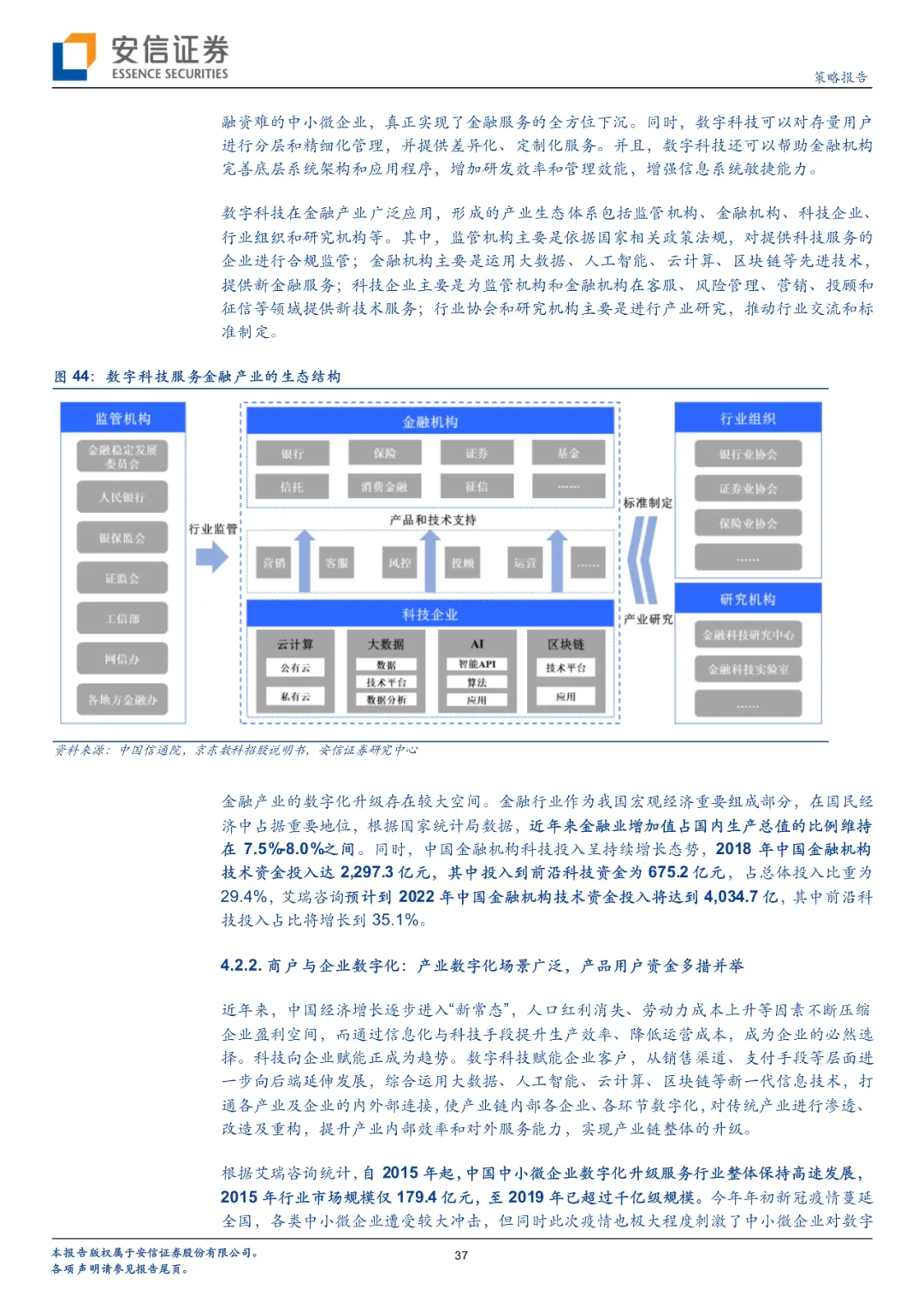

The development of the future digital economy market is related to the macroeconomic conditions and the development of market segments. On the macroeconomic front, China's total personal disposable income reached 43 trillion yuan in 2019, which is expected to reach 67 trillion yuan in 2025; China's total personal consumption expenditure reached 30 trillion yuan, which is expected to reach 51 trillion yuan in 2025; and China Mobile Limited's Internet users have reached 877 million. The penetration rate has reached 63%, and there is still some room for improvement. The above conditions provide a good foundation for the development of digital economy. It is estimated that the scale of industrial digitization in China has reached 28.75 trillion yuan in 2019, accounting for 29% of GDP, and is on the rise. In terms of industry segmentation, the compound growth rate of the digital payment market from 2019 to 2025 is expected to reach 11.4%, and the transaction size is expected to reach 412 trillion yuan; the compound growth rate of online consumer credit will reach 20.4%, and the market size is expected to reach 19 trillion yuan; the growth rate of online credit for small and medium-sized enterprises is expected to be 40.8%, and the market size is expected to reach 16 trillion yuan. The growth rate of the online financial management market is expected to be 21.6%, and the market size is expected to reach 69 trillion yuan; the growth rate of the online insurance market is expected to be 38.1%, and the market size is expected to reach 1.9 trillion yuan. Digital enterprises such as JD.com will charge a certain proportion of service fees from the huge market scale of many financial businesses. In addition, the digital market for merchants and enterprises has grown from 17.94 billion yuan in 2015 to more than 100 billion yuan in 2019; the size of the offline media market has grown from 54.99 billion yuan in 2015 to 76.8 billion yuan in 2017, and businesses such as the government and smart cities will also develop rapidly.

Thinking 4: comparative study, what are the similarities and differences between Ant Group and JD.com?

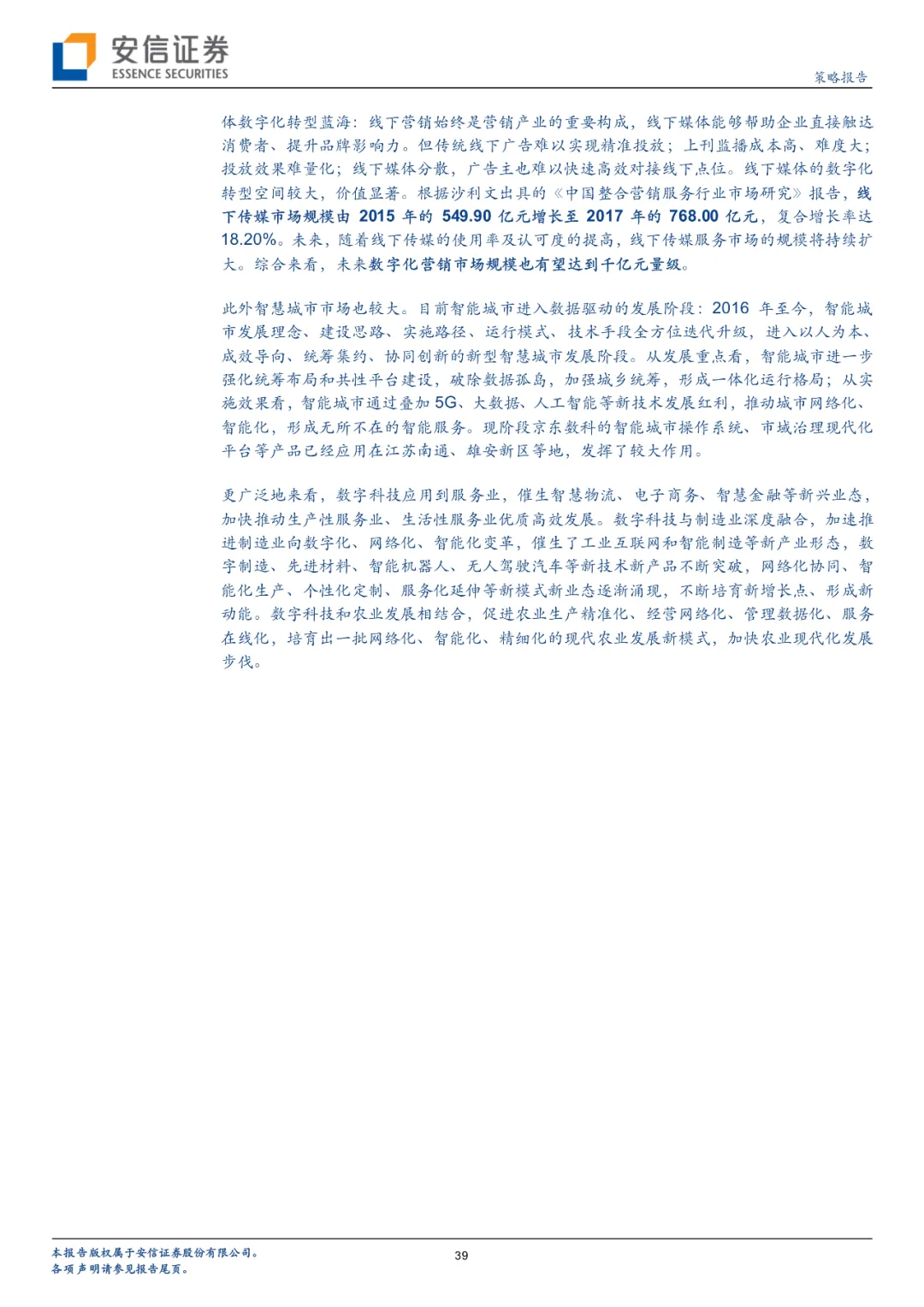

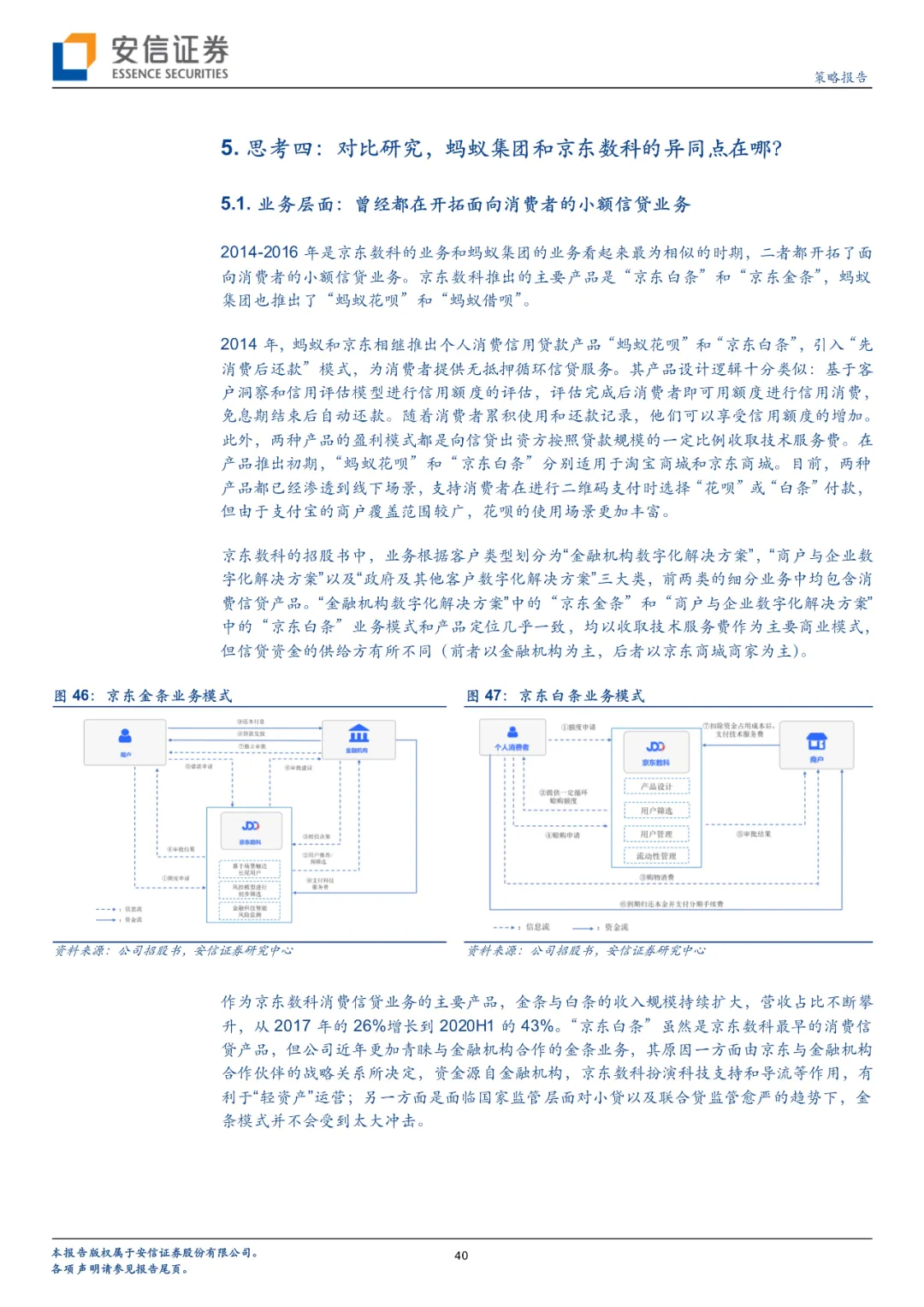

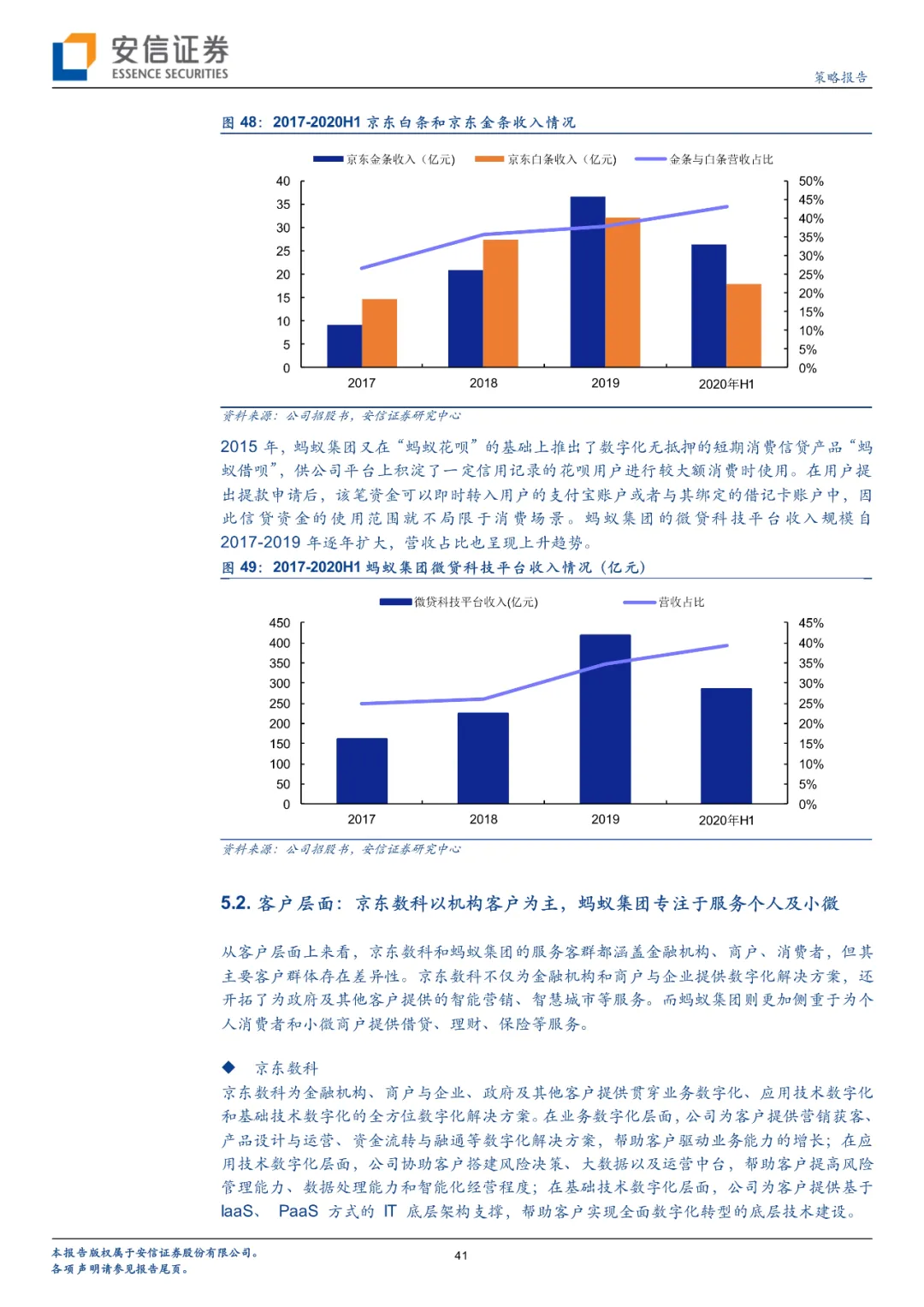

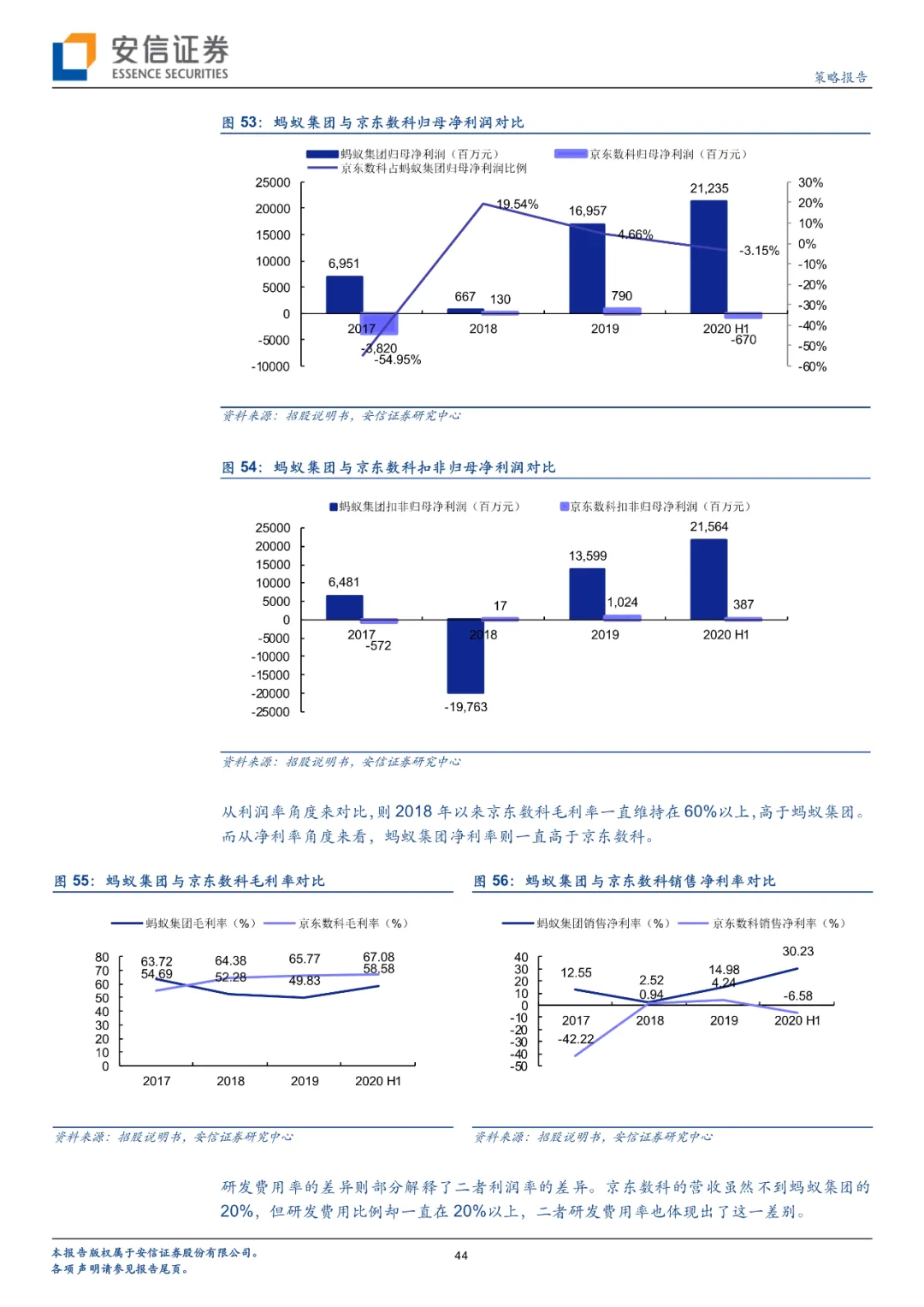

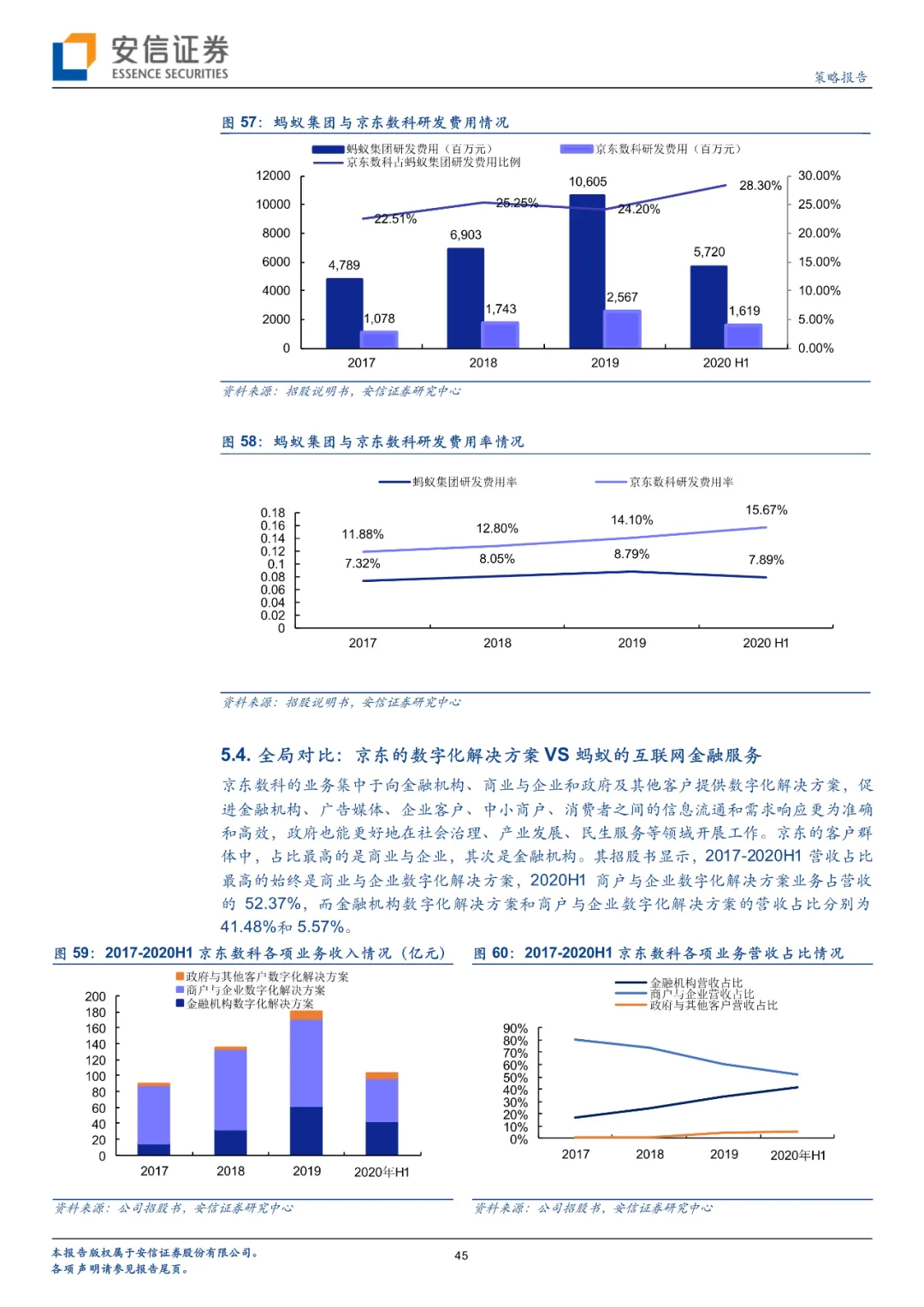

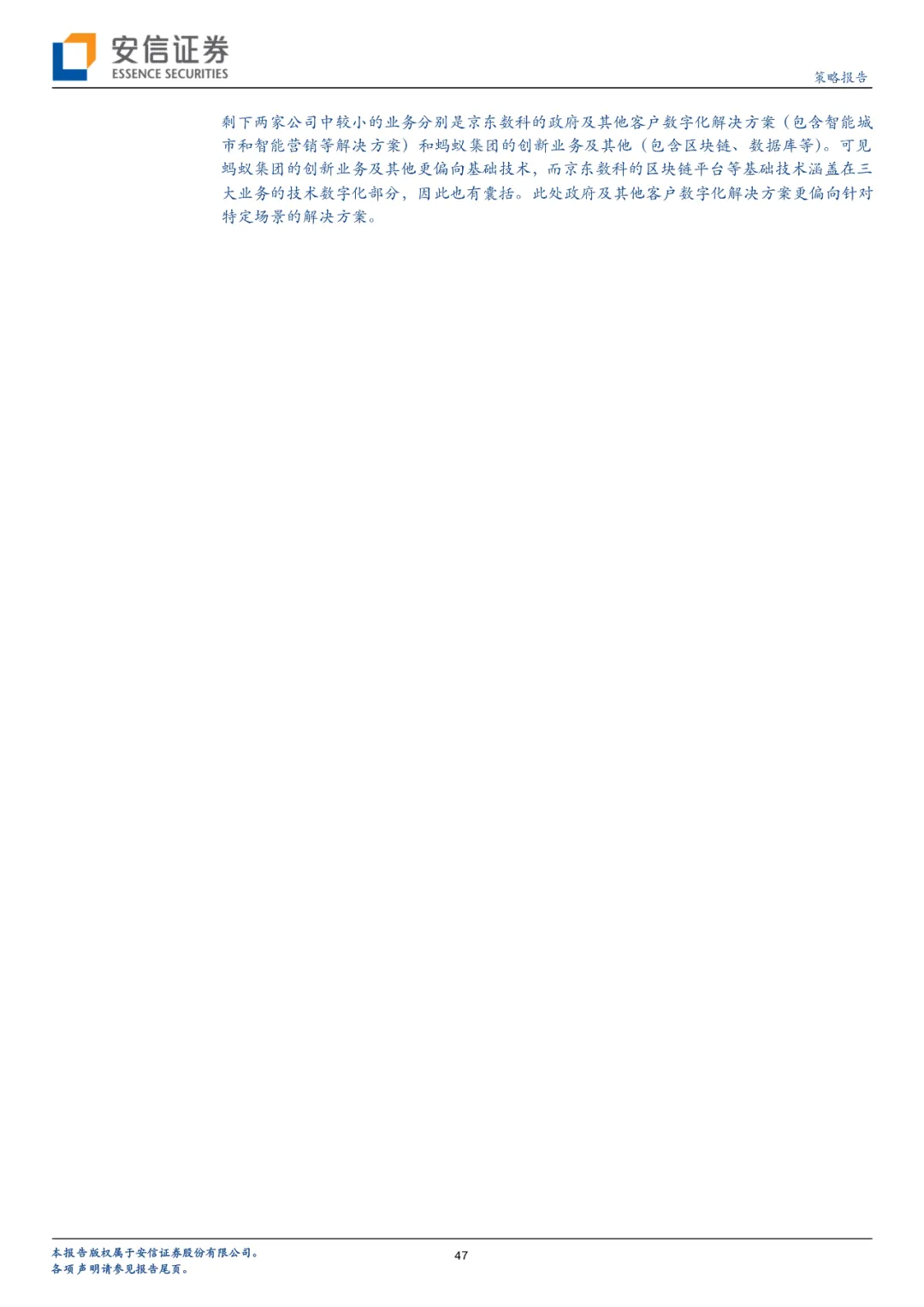

The finance-related business of JD.com and Ant Group has a high similarity, but each has its own characteristics. From the business level, the two businesses are highly similar from 2014 to 2016, and both have developed microfinance business. JD.com 's "JD.com White Bar" and "JD.com Gold Bar" are highly similar to Ant Group's "Ant Flower" and "Ant loan". In recent years, the credit business of both companies has also achieved rapid growth. The business income of JD.com 's white and gold bars has increased from 2.393 billion yuan in 2017 to 6.87 billion yuan in 2019, while the micro-loan technology income of Ant Group has increased from 16.187 billion yuan in 2017 to 41.885 billion yuan in 2019. At the customer level, JD.com Digital is mainly institutional customers, providing enterprises with digital solutions such as marketing customer acquisition, product operation, capital flow or data platform, risk control system, IaaS, PaaS and other technical support, as well as government digital services; while Ant Group customers are more individuals and small and micro enterprises, with Alipay as the core, cooperate with financial institutions to provide financial services. At the financial level, the Ant Group has a large scale of revenue and profits, and JD.com has a higher R & D expenditure rate. At present, JD.com 's digital business is still dominated by merchants and enterprise services, while Ant Group accounts for the highest proportion of financial technology platforms in its business.

Risk hint: the progress of industry digitization is lower than expected risk, industry competition aggravates risk, etc.

01 written in front: the Shanghai Stock Exchange accepts the listing request of Jingdong Mathematical Science and Technology Innovation Board, and there is a broad space for digital economy.

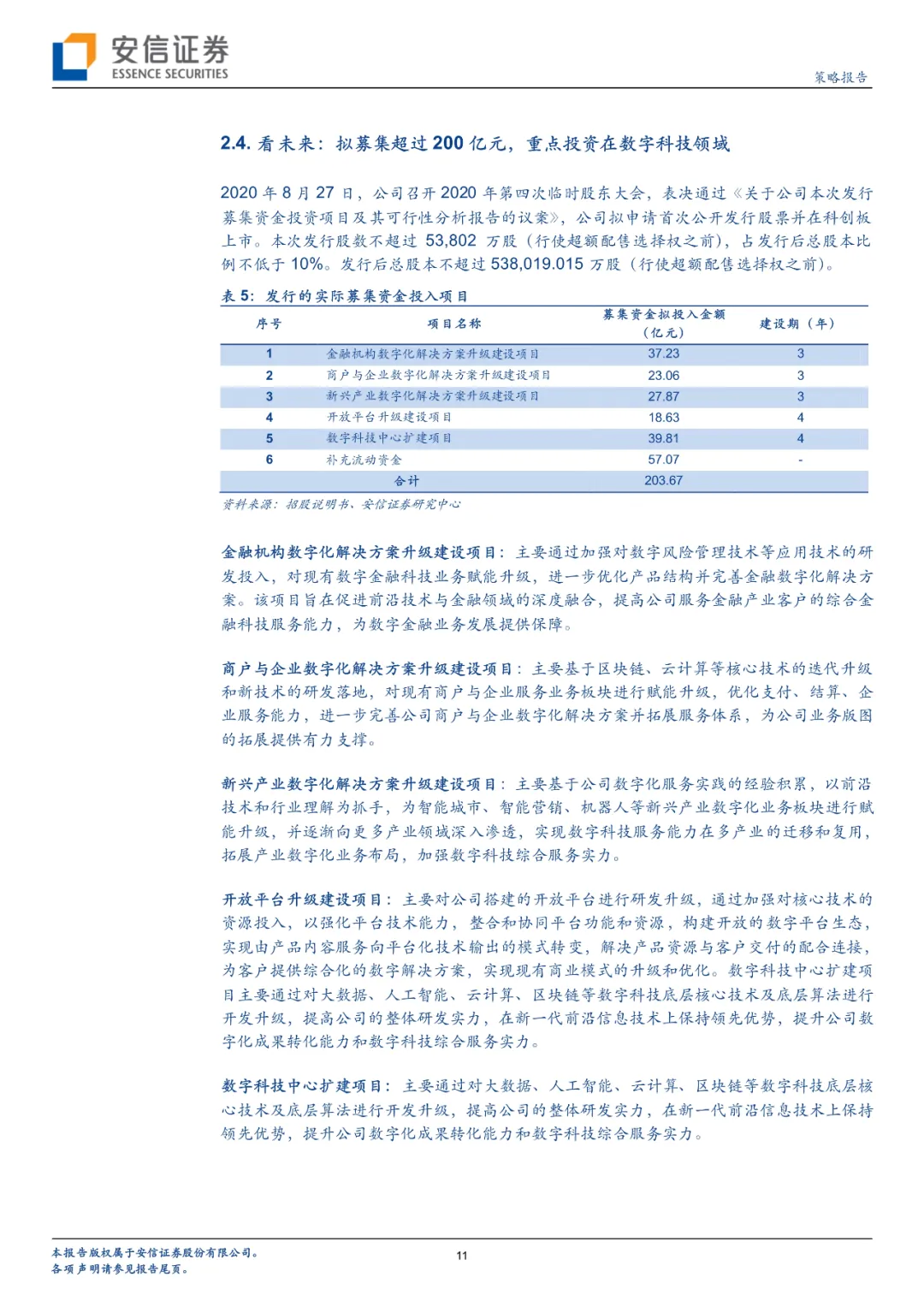

On September 11, 2020, the Shanghai Stock Exchange accepted the listing request of Jingdong Mathematical Science and Technology Co., Ltd. JD.com plans to issue no more than 53802

shares (before exercising the over-allotment option), all of which are new shares, accounting for no less than 10 per cent of the total share capital after the issue. The total share capital after the issue shall not exceed 5.38019015 billion shares (before the exercise of the over-allotment option). The financing is expected to exceed 20 billion yuan, and it is intended to invest in various digital solutions and open platform upgrading projects and digital science and technology center expansion projects, and supplement liquidity.

Since its independence in 2013, JD.com Mathematical Science has shifted from JD.com Finance to the broader field of digital economy, building an industrial digital "TIE" model of science and technology + industry + ecology. At present, it has formed three major business sectors: to F, to B, to

G, and representative products such as JD.com Bailiao and JD.com Gold Bar. Digital financial business and government digital business are growing rapidly, playing an important role in the digitization of various industries.

In the future, with the improvement of people's living standards and the further popularization of information technology products, the digital economy will be further developed, opening up trillions of industrial digital markets, and there is a broad space for the development of enterprises. At present, one of the most important enterprises competing with JD.com in this market is Ant Group, which is related but different in business, scale and other fields.

JD.com Mathematical Science, as a representative enterprise in the field of domestic digital economy, its listing is of great significance. This paper will analyze the development history, enterprise present situation, three main businesses, technical level, competitive advantage and market space of JD.com Mathematical Science. At the same time, it makes a comprehensive comparison in business, customer and finance between JD.com Mathematical Science and Ant Group, one of its main competitors.

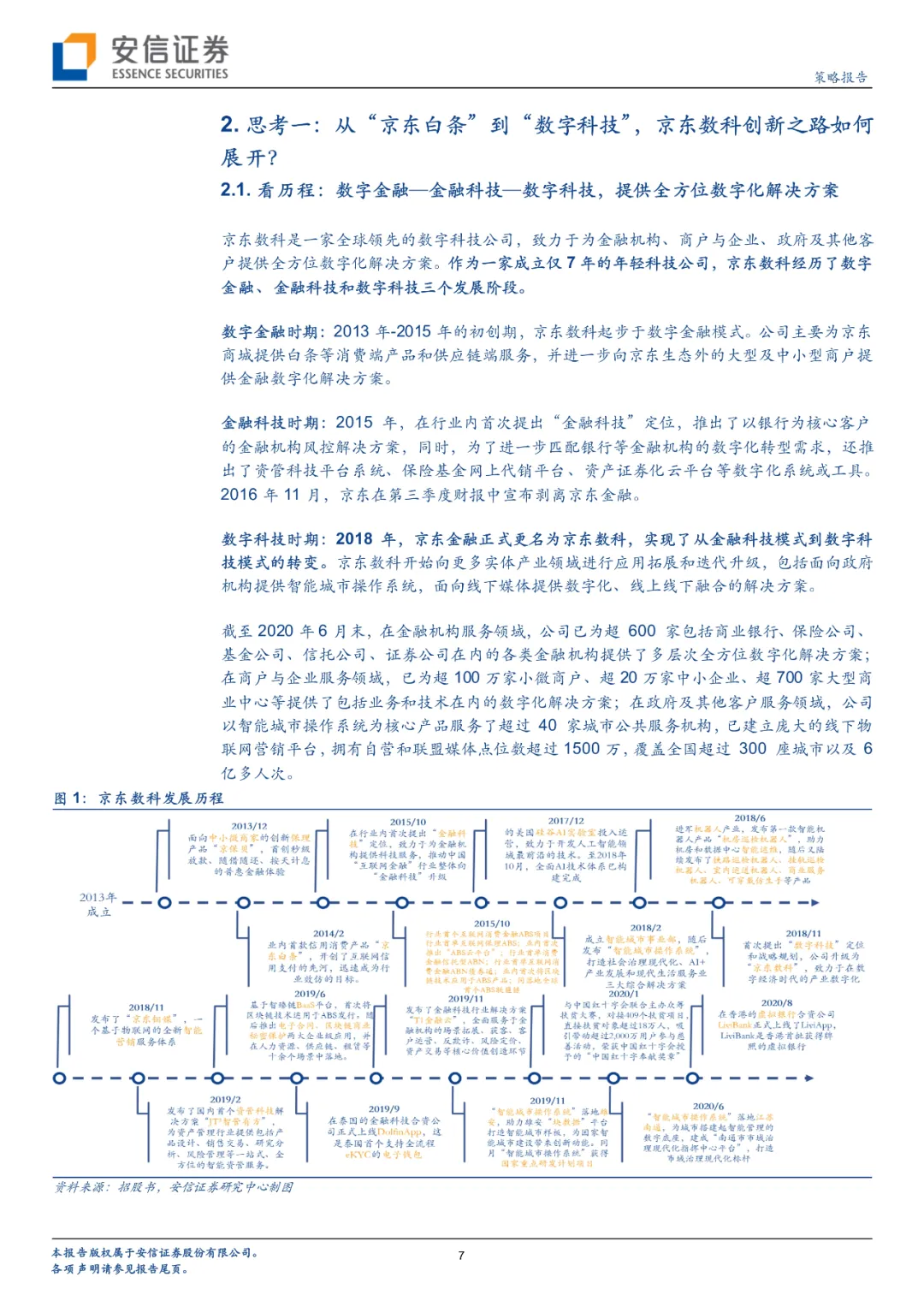

02 thinking 1: from "JD.com Bailiao" to "digital science and technology", how does JD.com develop the road of mathematics innovation?

2.1. Look at the course: digital Finance-Financial Technology-Digital Technology, providing omni-directional digital solutions

JD.com Digital is a leading global digital technology company dedicated to providing a full range of digital solutions to financial institutions, businesses and businesses, governments and other customers. As a young technology company established only 7 years ago, JD.com has experienced three stages of development: digital finance, financial technology and digital technology.

Digital financial period: in the initial period from 2013 to 2015, JD.com started from the digital financial model. The company mainly provides consumer products such as Bailiao and supply chain services for JD.com Mall, and further provides financial digital solutions to large and small and medium-sized businesses outside JD.com 's ecology.

The period of financial technology: in 2015, the orientation of "financial technology" was put forward for the first time in the industry, and a risk control solution for financial institutions with banks as the core customers was launched. At the same time, in order to further meet the needs of digital transformation of banks and other financial institutions, digital systems or tools such as asset management technology platform system, insurance fund online consignment platform and asset securitization cloud platform were also launched. In November 2016, JD.com announced the divestiture of JD.com Finance in his third-quarter financial results.

Digital science and technology period: in 2018, JD.com Finance officially changed its name to JD.com Mathematics, realizing the transformation from financial science and technology model to digital science and technology model. JD.com Mathematical Science began to expand and iteratively upgrade its applications to more physical industries, including providing smart city operating systems for government agencies and digital and offline integration solutions for offline media.

By the end of June 2020, the company has provided multi-level and omni-directional digital solutions to more than 600

financial institutions, including commercial banks, insurance companies, fund companies, trust companies and securities companies. In the field of merchant and enterprise services, digital solutions, including business and technology, have been provided for more than 1 million small and micro businesses, more than 200000 small and medium-sized enterprises, and more than 700 large business centers. In government and other customer service areas, the company has served more than 40 urban public service organizations with smart city operating system as its core product, has established a huge offline Internet of things marketing platform, and has more than 15 million self-operated and alliance media points, covering more than 300 cities and more than 600 million people across the country.

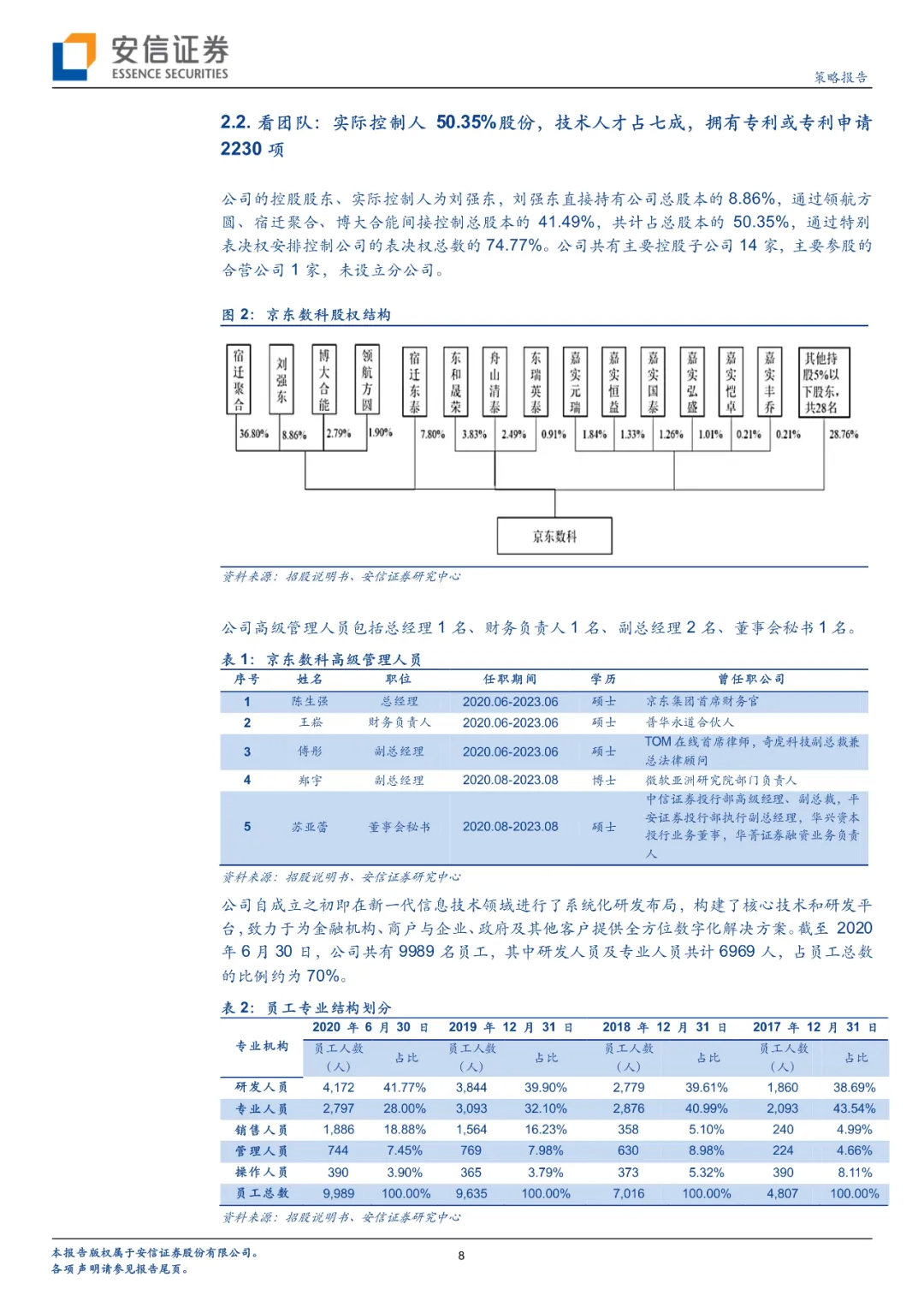

2.2. Look at the team: 50.35% of the actual controller, 70% of technical personnel, with 2230 patents or patent applications

The controlling shareholder and actual control of the company is Liu Qiangdong, who directly holds 8.86% of the total share capital of the company, and indirectly controls

41.49% of the total share capital through pilot Fangyuan, Suqian aggregation and Boda Holeng, accounting for 50.35% of the total share capital, and 74.77% of the total voting rights of the company through special voting arrangements. The company has 14 main holding subsidiaries and 1 joint venture company with no branch.

The senior management personnel of the company include 1 general manager, 1 financial responsible person, 2 deputy general managers and 1 secretary of the board of directors.

Since its inception, the company has carried out a systematic R & D layout in the field of new generation information technology, constructed the core technology and R & D platform, and is committed to providing all-round digital solutions for financial institutions, merchants and enterprises, the government and other customers. As of June 30th,

, the company had 9989 employees, including 6969 R & D personnel and professionals, accounting for about 70 per cent of the total number of employees.

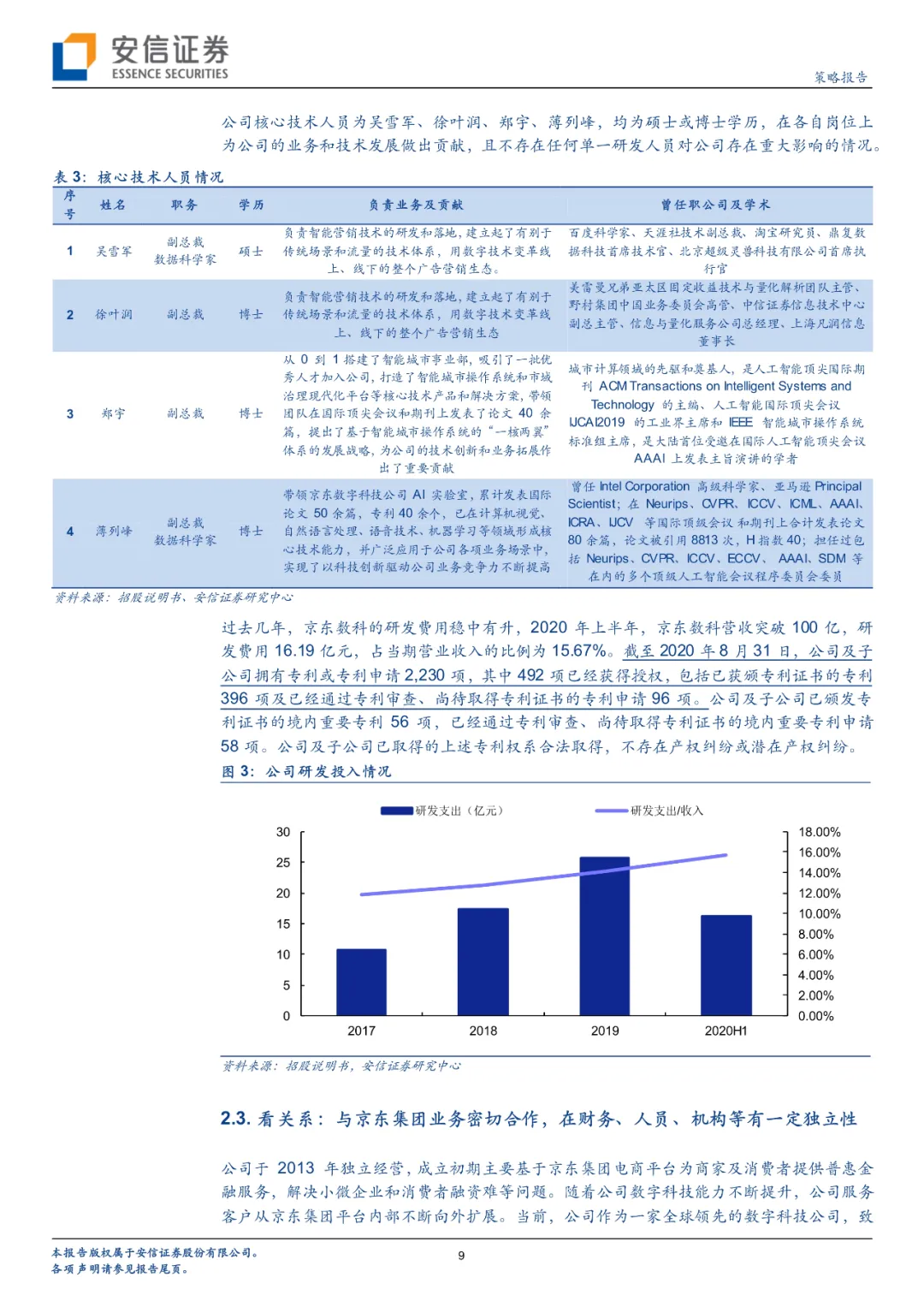

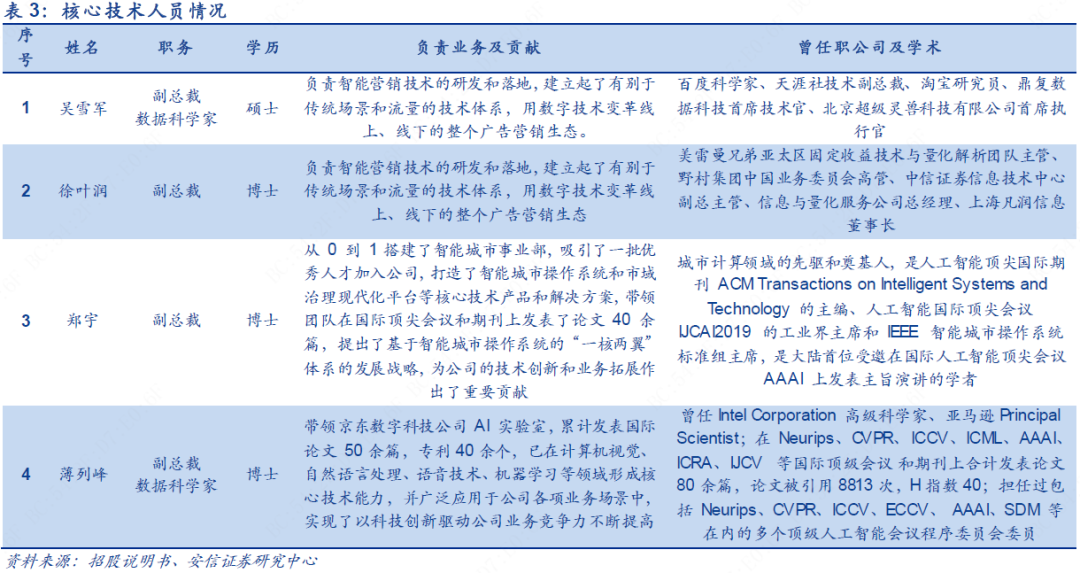

The core technical personnel of the company are Wu Xuejun, Xu Yerun, Zheng Yu and Bo Liefeng, all of whom have master's or doctoral degrees and contribute to the business and technological development of the company in their respective positions. and there is no significant impact of any single R & D personnel on the company.

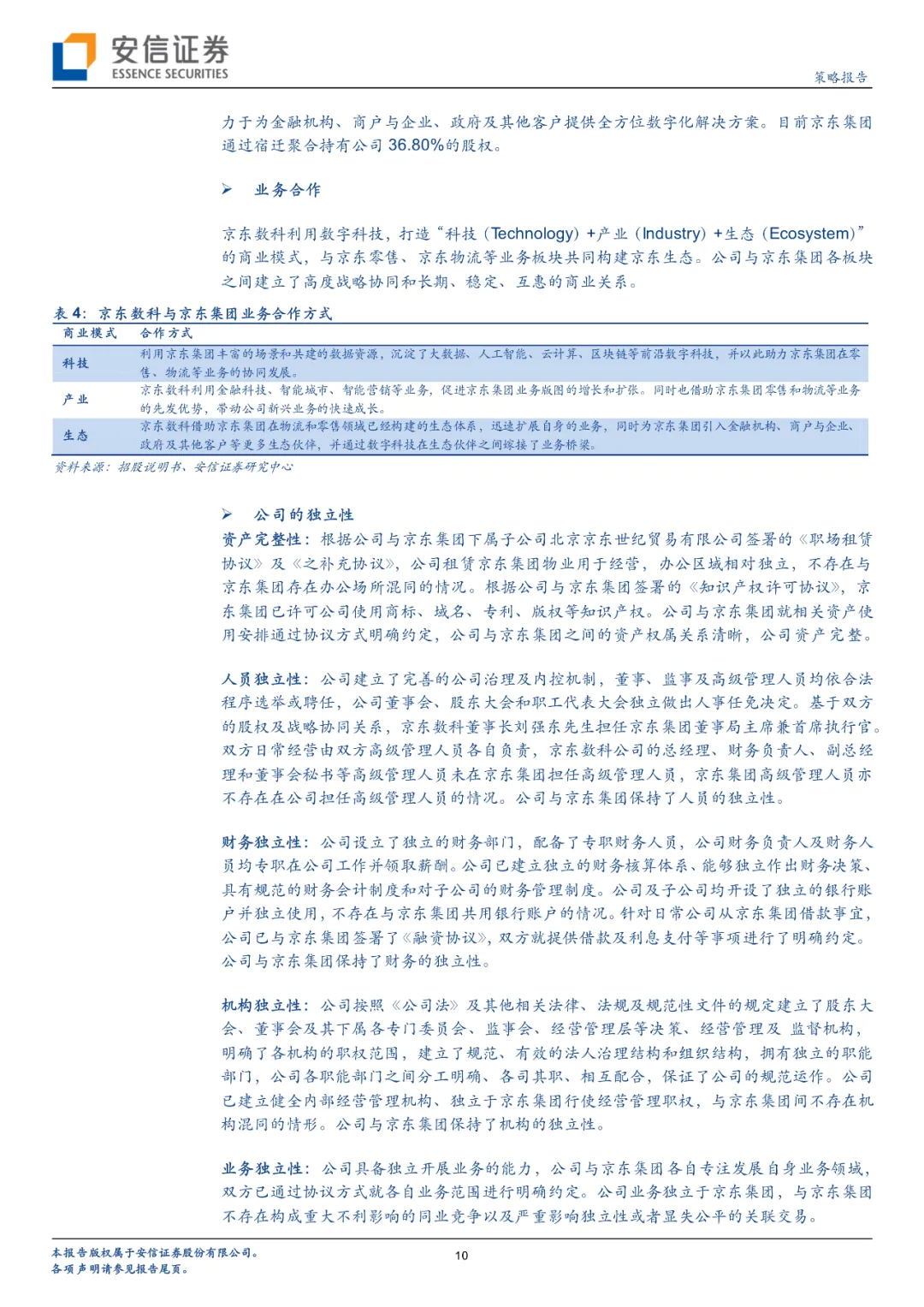

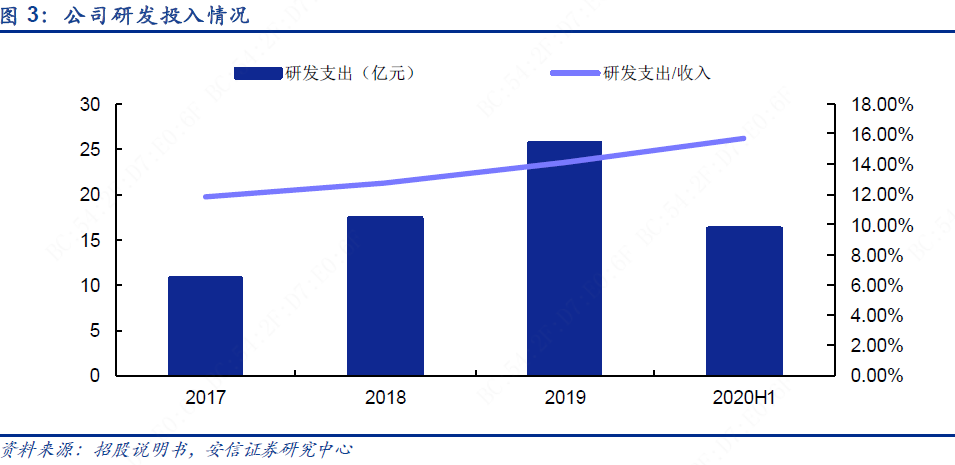

In the past few years, JD.com 's R & D expenses have risen steadily. In the first half of 2020, JD.com 's revenue exceeded 10 billion, and R & D expenses totaled 1.619 billion yuan, accounting for 15.67% of the current operating income. As of August 31, 2020, the company and its subsidiaries have 2230 patents or patent applications, of which 492 have been authorized, including 396 patents that have been granted patent certificates and 96 patent applications that have passed the patent examination and have yet to obtain patent certificates. There are 56 important patents issued by the company and its subsidiaries, and 58 important patent applications which have passed the patent examination and have yet to obtain patent certificates. The above-mentioned patent rights obtained by the company and its subsidiaries are legally obtained, and there are no property rights disputes or potential property rights disputes.

2.3. Look at the relationship: work closely with JD.com Group, and have a certain degree of independence in finance, personnel, organization, etc.

The company operated independently in 2013

. In the early days, it was mainly based on the e-commerce platform of JD.com Group to provide inclusive financial services for businesses and consumers to solve the financing difficulties of small and micro enterprises and consumers. With the continuous improvement of the company's digital technology capabilities, the company's customer service continues to expand from within the JD.com Group platform. Currently, as a leading global digital technology company, the company is committed to providing a full range of digital solutions for financial institutions, businesses and enterprises, governments and other customers. At present, JD.com Group holds a 36.80% stake in the company through Suqian aggregation.

The following is the full text of the content