summary

From a payment platform to a one-stop service platform, the network effect has significant advantages

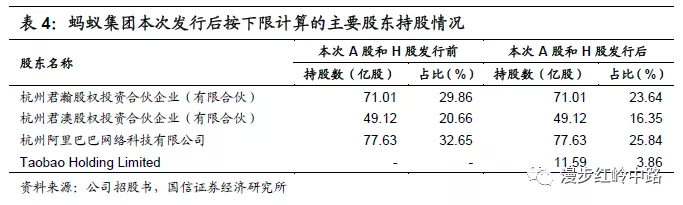

Ant Group first started with a payment business, but its current scope of services has gone beyond payments to become a one-stop service platform that includes many scenarios such as digital payments, digital life, and digital finance, providing inclusive financial services to more than 1 billion users and 80 million merchants. Ant Group's business model is to provide infrastructure support for digital life and digital finance through digital payments, maintain customer stickiness and activity through the two major scenarios of digital life and digital finance, and ultimately monetize through digital fintech platforms.

Ant Group has a large number of users and covers a large number of life scenarios and financial scenarios, creating a bilateral network effect and a remarkable competitive advantage. Ant Group currently mainly monetizes through digital fintech platforms, but considering its large number of users, the possibility of other monetization methods is not ruled out in the future.

The combination of a huge user base and broad market space brings growth to the company

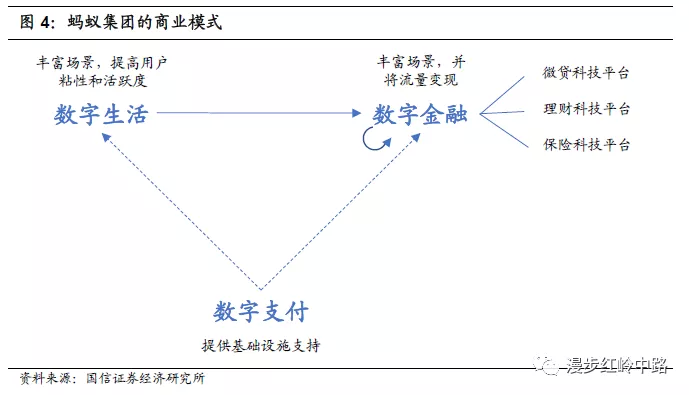

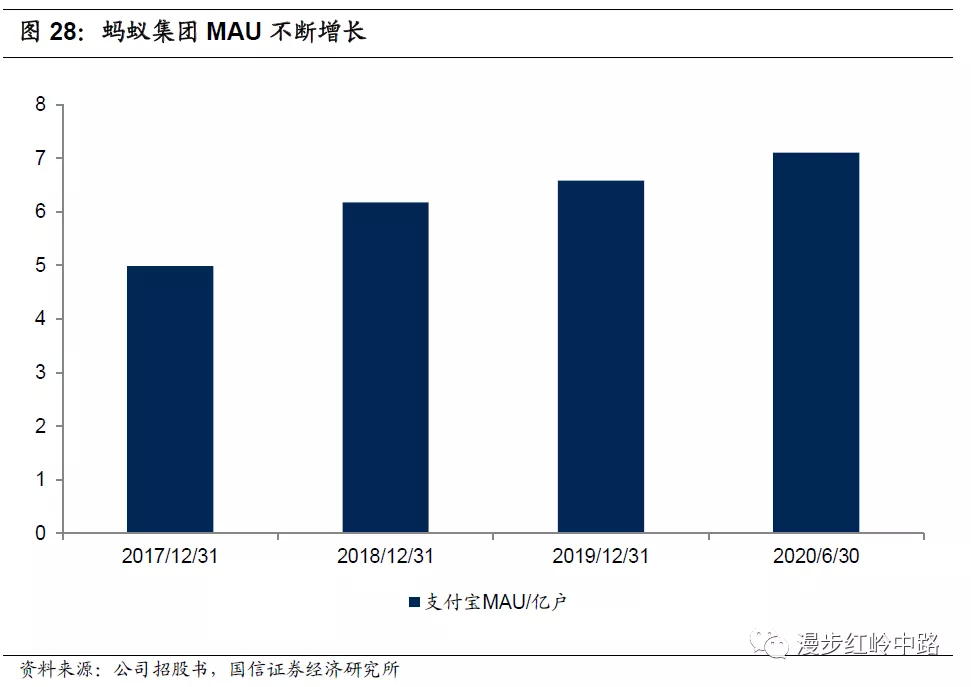

Ant Group's current revenue mainly comes from digital payments and merchant services, and digital fintech platforms (including micro-finance technology platforms, financial technology platforms, and insurtech platforms). The digital payment market where it is located has entered a period of steady growth; the micro-loan market for the long-tail customer base where it is located still has a lot of room for growth, while the financial management and insurance underwriting market space is even broader. Ant Group's monthly active users reached 710 million at the end of June 2020. The traffic advantage is remarkable, and there is still room for further improvement. The combination of a huge user base and broad market space brings growth to the company.

On the other hand, after the digital payment market enters a period of steady growth, the competitive landscape will stabilize. We believe this will help reduce the company's sales expense ratio; in the long run, the maturity of the digital payment market means that the share of revenue in this sector will also gradually decrease, leading to a gradual increase in the company's gross margin. This will all enhance its long-term profitability.

Investment advice

Combining absolute valuation and relative valuation, we believe that the company's stock value corresponding to 2020 dynamic PE is 40 to 60 times, corresponding to the company's overall value of 1.7 to 2.5 trillion yuan. Ant Group has a large number of active users and rich application scenarios. It has a unique business model, remarkable competitive advantages, and rapid performance growth. Investors are advised to pay active attention.

Risk warning

Other risks, including valuations, profit forecasts, and equity assumptions, are detailed in the text.

Report text

01Valuation and investment advice: the overall value is 1.7 to 2.5 trillion yuan

We use both absolute valuation and relative valuation methods to estimate a company's reasonable value range. It should be noted that when we measure the data for each share in the later article, we estimate it based on the share capital of 30.039 billion shares. This share capital is the lower limit of the share capital after issuance as disclosed in the prospectus.

1.1 Absolute valuation

There is sufficient competition in every market where Ant Group is located, but Ant Group's massive users have brought it a huge traffic advantage, making it possible for the digital fintech platform business to develop rapidly, thus bringing about the company's growth. We assume that the company's net profit growth rate for the past three years is based on the profit forecast later, assuming that the sustainable growth rate is the nominal GDP growth rate, and assuming that the mid-stage semi-explicit period revenue growth rate is gradually approaching the sustainable growth rate. From a company's perspective, as the share of revenue from the payment business decreases and the share of revenue from other businesses rises, its gross margin is expected to gradually increase; over time, we expect that as the overall growth rate of the subsequent industry slows down, the sales expense ratio will decrease; we assume that other key indicators will remain stable.

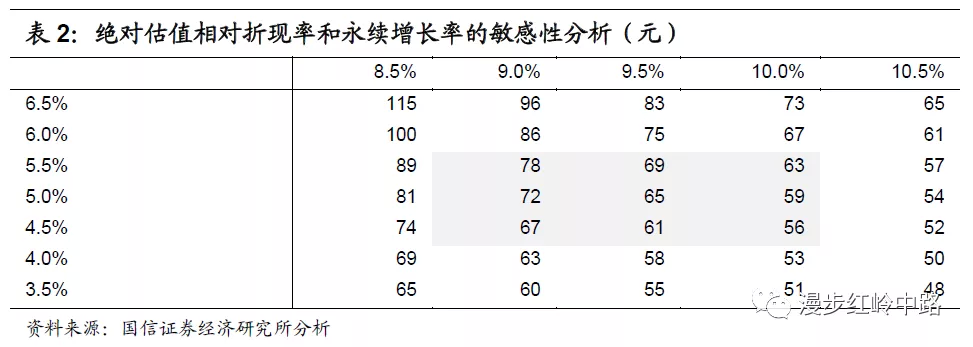

We use the FCFE valuation method. In addition to the main assumptions above, the other two main assumptions are WACC and the sustainable growth rate. The company currently has no long-term transaction data to calculate WACC, so based on the discount rate commonly used in the past, we simply assume that it is 10%, and we assume a sustainable growth rate of 5%. Based on the above main assumptions and sensitivity analysis to WACC and the sustainable growth rate, it was determined that the company's reasonable value range was 56 to 78 yuan.

Sensitivity analysis of absolute valuations

This absolute valuation is more sensitive to WACC and the sustainable growth rate. The following table is an analysis of the sensitivity of the company's absolute valuation to changes in these two factors.

1.2 Relative valuation

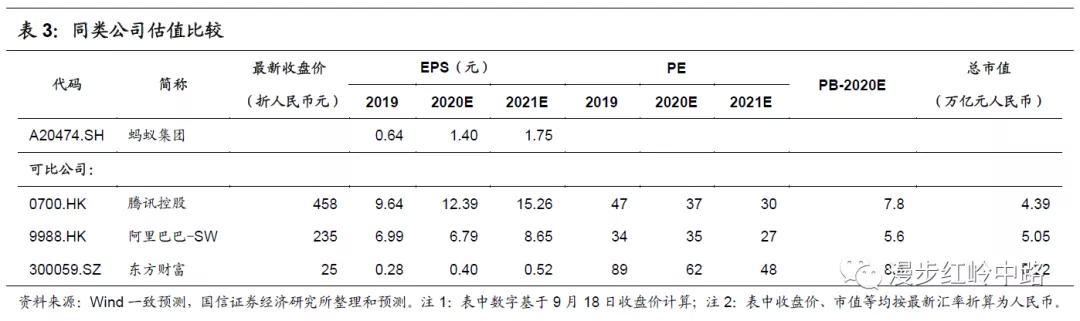

The business carried out by Ant Group is highly unique. We select Internet companies that partially coincide with or are closely linked to their business as benchmarks, including Tencent Holdings, Alibaba, and Oriental Wealth, and are valued using the PE method. Referring to the valuation of comparable companies and considering scale factors, we gave the company 40 to 60 times PE in 2020, and the corresponding reasonable price range was 56 to 84 yuan.

1.3 Investment advice

Combining the above aspects of valuation, we believe that the company's stock value corresponding to the 2020 dynamic PE is 40 to 60 times, and the corresponding company's overall value is 1.7 to 2.5 trillion yuan. Ant Group has a large number of active users and rich application scenarios. It has a unique business model, remarkable competitive advantages, and rapid performance growth. Investors are advised to pay active attention.

02Ant Group Overview

2.1 Company Profile: Providing Inclusive Financial Services to Consumers and Small and Micro Operators

Ant Group is Alipay's parent company. It is also an open fintech platform. Together with other partners, Ant Group provides inclusive financial services to consumers and small and micro operators. Ant Group also mentioned in its prospectus that “we were born to serve the small, and inclusion is our philosophy.” Ant Group provides customers with a full range of services such as digital payments, digital finance, and digital lifestyle through the Alipay App, making itself a one-stop service platform. The services it provides benefit more than 1 billion users and 80 million merchants.

2.2 Historical Evolution: From Alipay to Ant Group

Alipay was founded by Alibaba Group in 2004. It initially provided a secured transaction mechanism for buyers and sellers on Taobao to promote the development of e-commerce. It later began to provide services to other customers outside of the Alibaba Group, and went from online to offline, and eventually penetrated into all aspects of users' lives. In terms of company names, Alipay's parent company Zhejiang Ali changed its name to Ant Financial in 2014 and Ant Group in 2020.

2.3 Business area: Mainly located in mainland China

Ant Group is currently also actively developing international business, but in recent years the vast majority of revenue has still come from the mainland. In 2017, 2018, 2019 and the first half of 2020, the company's revenue from overseas regions accounted for 5.2%, 5.0%, 5.5% and 4.4%, respectively, mainly from cross-border payments and merchant services.

2.4 Shareholders and actual controllers

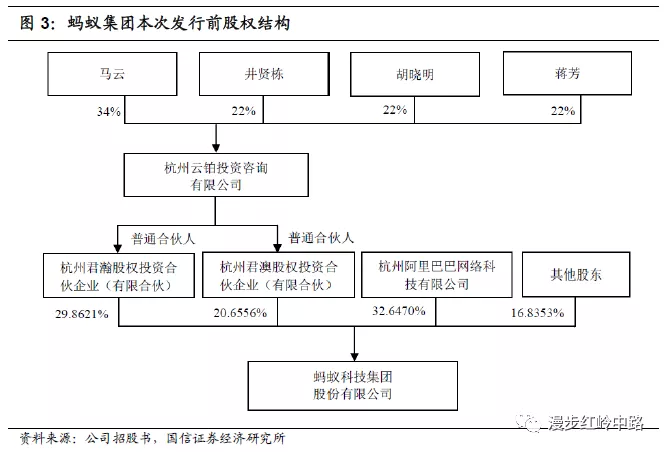

As of August 24, the stock structure of Ant Group before issuance is shown in the following figure. The actual controller of the company is Jack Ma.

Alibaba Group is another important shareholder of Ant Group, and the two sides cooperate closely. Alibaba Group provides Ant Group with rich application scenarios and other support services, while Ant Group provides digital payment and other services to Alibaba Group. The two sides are also cooperating in other areas such as data sharing. The related transaction revenue collected by Ant Group from Alibaba in the first half of 2020 was mainly payment processing and guaranteed transaction service revenue, about 4 billion yuan, accounting for 15.4% of Ant Group's digital payment and merchant service revenue, and 5.5% of Ant Group's total revenue.

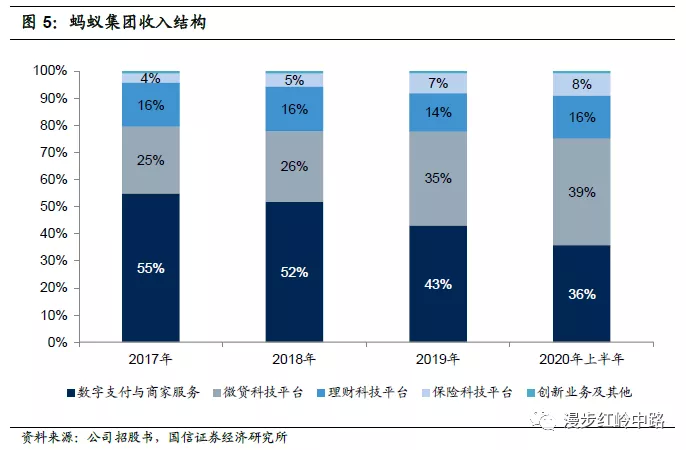

According to information disclosed in the prospectus, during the current issuance of A shares and H shares, in addition to issuing new shares, Ant Group will also issue no more than a certain amount of H shares to Ant International's Class B and Class C share holders. In addition, it can also use an over-allotment option of no more than 15% of the amount issued. Ant Group's total share capital after this issuance is not less than 30.039 billion shares. When the number of issues issued is calculated according to the lower limit and excessive allocations are not taken into account, the shareholding situation of the major shareholders after the issuance is completed is shown below.

2.5 Board, Management, and Employee Motivation

Currently, the board of directors of Ant Group has 9 directors, including 3 executive directors, shareholder directors, and 3 independent directors. Jing Xiandong, the current executive chairman of the group, joined Alipay in 2009 and has been the executive chairman since 2018; current CEO Hu Xiaoming has held this position since 2019.

Ant Group has set up and implemented employee incentive plans since 2014, including the 2013 Stock Economic Beneficiary Incentive Plan and the Pre-IPO Overseas Employee Incentive Plan. Ant Group disclosed in its prospectus that it plans to establish an incentive plan for domestic and foreign employees after listing. After listing, Ant Group plans to use no more than 914 million shares for employee incentives for the next 4 years or so through additional issuances or repurchases. This may lead to stock dilution after listing, but the impact is not significant.

03Understanding Ant Group's business model

3.1 From a secured transaction mechanism to a one-stop service platform

As early as Taobao was founded, there was a problem where buyers were afraid that sellers would not ship after payment, and sellers were afraid that the other party would not pay after delivery. Alipay was created to solve this problem. Therefore, Alipay was not so much a payment tool as it was a guaranteed transaction mechanism; payment was only one component of it. This secured transaction mechanism has established the trust of Taobao buyers and sellers, greatly promoted the development of Taobao, and Alipay has accumulated a large number of users along with the development of Taobao.

Since then, Alipay's application scenario expanded from Taobao to the outside world, broke away from its prototype, and gradually developed into a one-stop service platform. Alipay has expanded from e-commerce to other online scenarios such as lifestyle payments, and from lifestyle scenarios to financial scenarios. The introduction of QR code payments has promoted the development of scenarios from online to offline. Finally, Alipay can basically cover the vast majority of scenarios where individual consumers use payment functions, promoting the advent of a cashless society. As application scenarios become more and more abundant, Alipay has also transformed into Ant Group and developed into a one-stop service platform.

Although Ant Group started with payment, its current scope of services has gone beyond simple payments. The number of scenarios and users form positive feedback, extending to all aspects of daily life, and even in some scenarios where Alipay is used, there is no need to use payment functions (such as green codes, etc., which are commonly used in health incidents). However, in the minds of users, given Alipay's historical evolution, the public's first impression of Ant Group may still be biased towards keywords such as payment and finance, which are closely related to this.

3.2 Positive feedback between scenarios and users, significant competitive advantage

As mentioned earlier, Ant Group has developed into a one-stop service platform, providing users with a full range of services such as digital payments, digital finance, and digital life through the Alipay app. The relationship between these three parts can be simply understood: Ant Group provides infrastructure support for digital life and digital finance through digital payments, maintains customer stickiness and activity through the two major scenarios of digital life and digital finance, and monetizes through digital finance.

On the one hand, Ant Group has a large number of users, which contributes to the expansion of one side of the scenario. On the other hand, the more complete the coverage scenario, the more convenient the user experience, thus forming an obvious bilateral network effect and consolidating its competitive advantage. Currently, the Alipay App already has more than 1 billion users and more than 80 million merchants. Its further enrichment of scenarios is mainly used to increase user activity, not to acquire customers. Currently, Ant Group mainly monetizes through microfinance technology platforms, financial technology platforms, and insurance technology platforms, but considering its large number of users, the possibility of other monetization methods is not ruled out in the future.

3.3 Further enrich scenarios and increase user activity

Based on Ant Group's business model, it currently has a large number of users. We believe that increasing user activity through richer scenarios is the focus of subsequent development, which will also help further deepen its moat. Ant Group explained its development strategy in its prospectus. The first step is to increase the number of active consumers and active merchants of Alipay. Specifically, it is “to further increase user activity and the scale of annual digital financial services by expanding scenario-based digital financial products for a wider range of people” and “further enhance user activity by continuously expanding various application scenarios in daily life...” Therefore, in addition to financial data, we will also focus on its expansion in terms of scenarios in the future.

04Dismantling Ant Group's profit statement

4.1 Revenue side

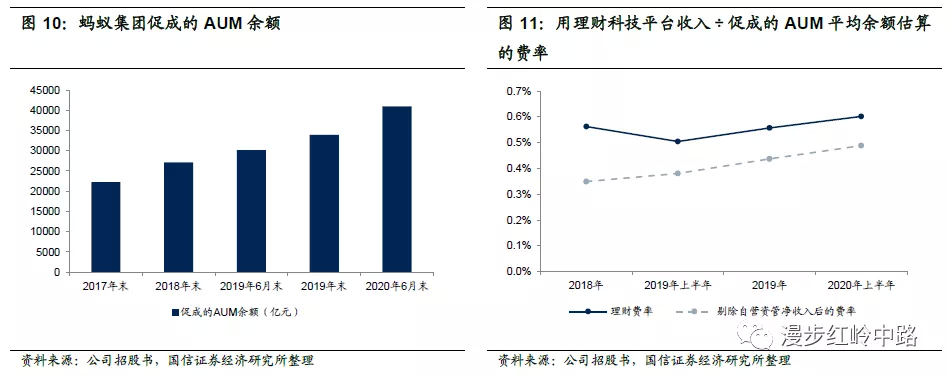

Ant Group's revenue mainly comes from four sectors, including digital payments and merchant services, micro-finance technology platforms, financial technology platforms, and insurance technology platforms. In the first half of 2020, these four revenue segments accounted for 99% of total revenue. The pricing methods for each segment of the business are complicated, and the revenue also includes some miscellaneous items, so we simplified the analysis process to calculate the overall rate based on the total revenue and overall size of the four businesses, instead of splitting the rates in more detail.

(1) Digital payments and merchant services

Ant Group provides payment services to consumers and merchants, and charges transaction service fees as a percentage of the transaction size. Revenue from digital payments and merchant services also includes interest income from customer provisions.

(2) Microfinance technology platform

Ant Group provides platform services to financial institutions, mainly banks and trusts, and charges technical service fees based on the percentage of interest income received by partners (for convenience, we consider this simplification as charging technical service fees according to the credit scale promoted); some loans are operated by the company itself, and the corresponding net interest income is also included in the revenue of the micro-finance technology platform.

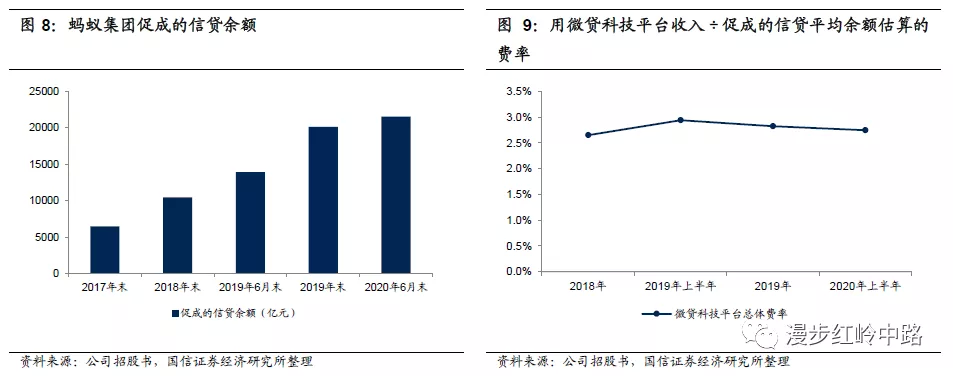

Credit balances promoted by Ant Group include credit balances of partners (including online merchant banks), holding subsidiaries, and credit balances that have completed securitization. Among them, partners' credit balances account for the vast majority. At the end of June 2020, Ant Group's net self-operated loans amounted to 36.2 billion yuan, accounting for only 1.7% of the contributed credit balance. The initiated ABS balance was 1708 billion yuan, accounting for 7.9% of the contributed credit balance, and the remaining 90% was distributed through partners.

The company received net interest income from holding part of its own loans. In the first half of 2020, the net interest income from self-operated microloans was 1.37 billion yuan, accounting for 4.8% of the revenue of the microfinance technology platform, accounting for a small share. We will no longer differentiate them separately to measure yield. Furthermore, in the asset securitization process, Ant Group still needs to confirm corresponding assets, including asset management and trust plans, and continued involvement in assets of about 8.1 billion yuan due to holding secondary shares or retaining some of the risks and rewards for the transferred loans during the loan transfer process. The amount is not large, and the risk exposure is manageable.

(3) Financial technology platform

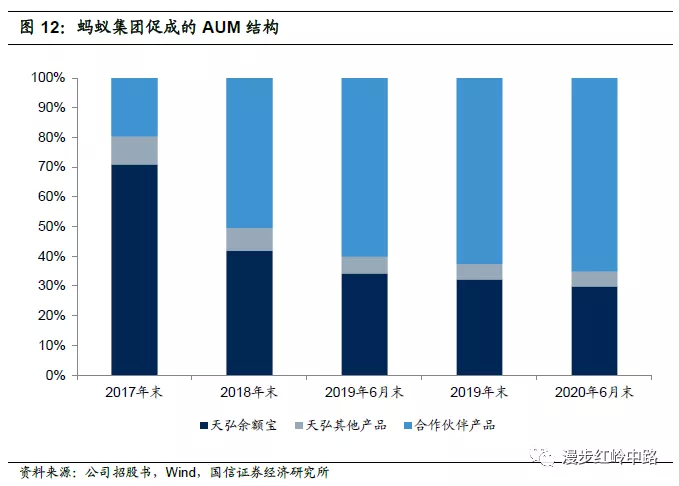

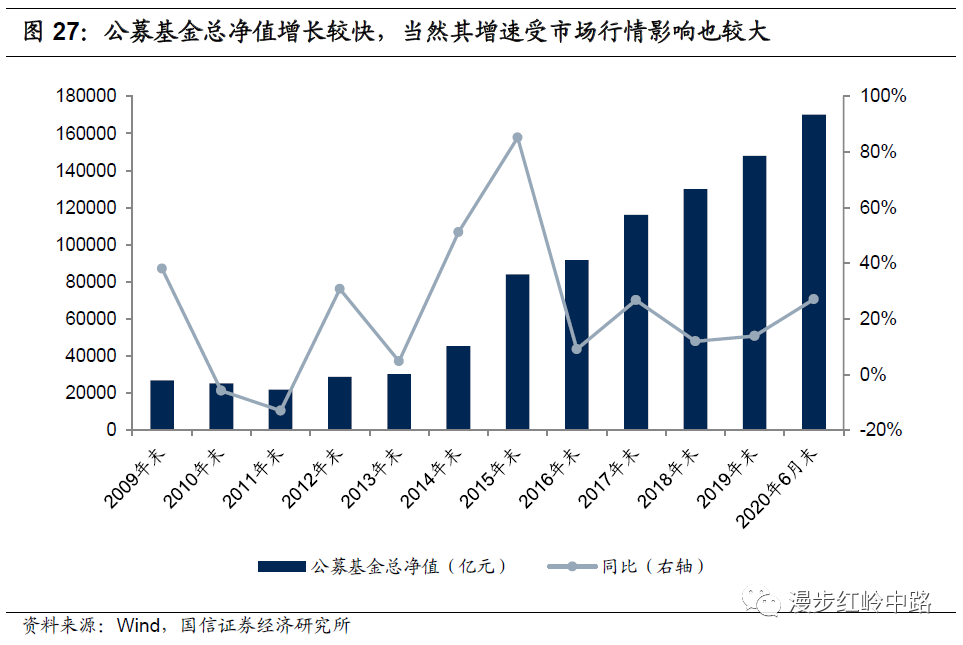

Ant Group provides consignment services to financial institutions, mainly public funds, and charges technical service fees according to the promoted AUM; the income of Tianhong Fund, a holding subsidiary, is also included in the revenue of the financial technology platform.

AUM promoted by Ant Group includes partners and AUM from Tianhong Fund. Originally, AUM promoted by Ant Group was mainly based on Tianhong Yubao, but since 2018, it has increased product diversion and expanded a richer range of consignment products, and the share of third-party products has gradually increased. In the first half of 2020, the revenue generated by Tianhong Fund from asset management business accounted for 18.8% of the financial technology platform revenue after deducting service fees for internal settlement of financial technology platforms. The share is still high, but it has declined markedly compared to previous years.

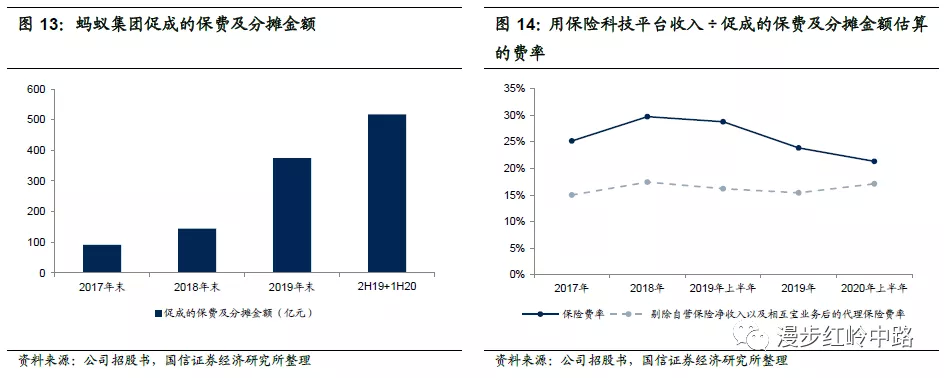

(4) Insurance technology platform

Ant Group provides agency services to insurance companies and charges technical service fees according to the premiums contributed; management fees drawn by Mutual Bao and premium income from Cathay Pacific Insurance, a holding subsidiary, are also included in the revenue of the insurance technology platform. Cathay Pacific Insurance's premium income after deducting insurtech platform service fees for internal settlement, the remaining self-operated net income in the first half of 2020 was 1.61 billion yuan, accounting for 26% of insurance business revenue, but in recent years, its share has declined markedly. Coupled with the increase in mutual insurance contributions (its management fee rate is 8%), the estimated overall rate rate has decreased.

(5) Innovative business and others

Ant Group's innovation business and other revenue currently account for a relatively small share, only about 1%. Innovative business and others include Ant Chain technology services, financial cloud technology services, etc., as well as administrative and support services provided to related parties. Ant Chain began generating revenue in 2019. For an introduction to Ant Chain, please refer to our report “Ant Chain: Giving Trust to the Digital Economy” published on July 24, 2020.

4.2 Cost side

Ant Group's operating costs are mainly transaction costs paid to financial institutions, service costs paid to partner service providers, and operation and maintenance costs such as broadband and customer service. These costs are mainly driven by the scale of payment transactions. These three types of costs have always accounted for about 96% of Ant Group's operating costs in recent years. The cost rate estimated using “operating cost ÷ payment scale” has continued to rise in the past three years, mainly due to the increase in transaction fees charged by financial institutions and the increase in service cost rates brought about by the expansion of offline payments.

4.3 Expense side

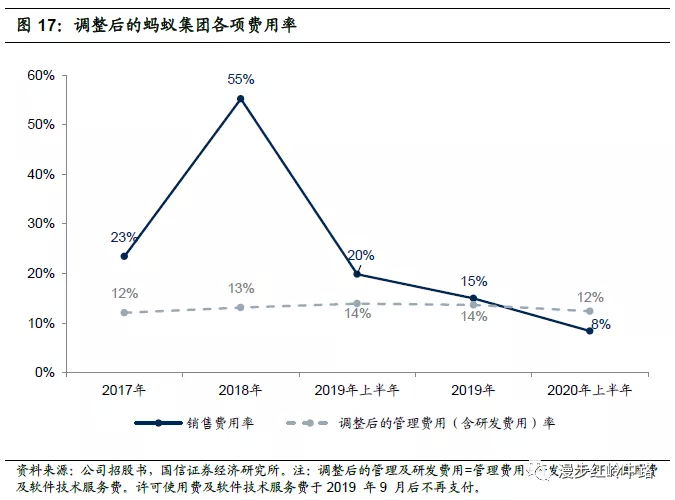

From the cost side, Ant Group's expenses are mainly sales expenses and management expenses (we include R&D expenses in management expenses), and financial expenses account for a very small proportion. Among them, sales expenses are mainly promotion and advertising expenses, such as the distribution of rewards to users through the Alipay app, promotion activities through partners, etc., which are highly volatile, while the management cost rate is basically stable.

4.4 Other net income

We have consolidated income and expenses other than revenue, costs, expenses, taxes, and additional and interest expenses (the latter two account for a small part) into “other net income.” The composition of other net income is complex, but the main components are interest income, investment income, and profit and loss from changes in fair value. These three types of profit and loss mainly come from financial assets. Judging from the data of recent years, the relative ratio of other net income to operating income is not significant.

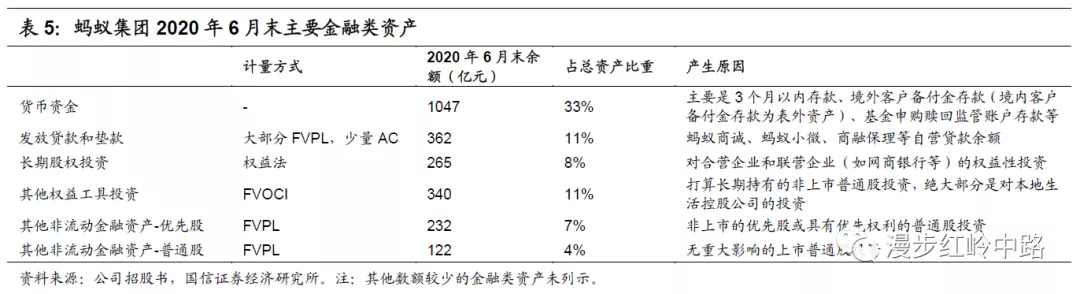

What needs to be clarified is that Ant Group's financial assets are basically generated from operating business, not from engaging in financial investment business.

05Current market space outlook

The company's future profit growth depends on the market space and competition situation where its main business is located. The former determines the ceiling, and the latter determines changes in the company's market share, pricing, and cost rates. Let's look at the market space first, and analyze the competitive situation in the industry in the next part.

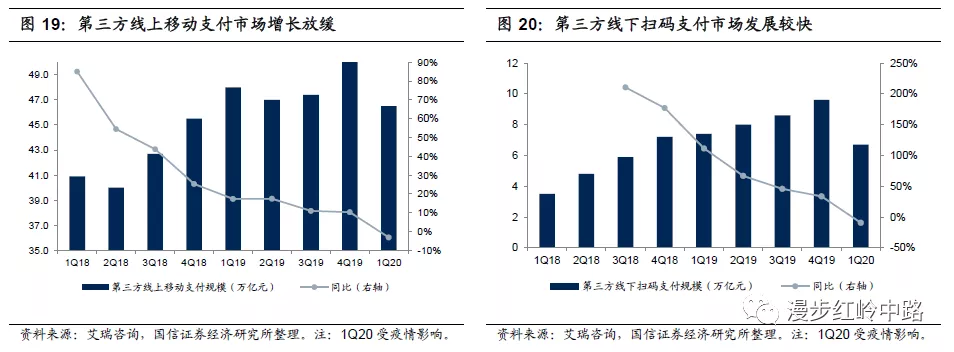

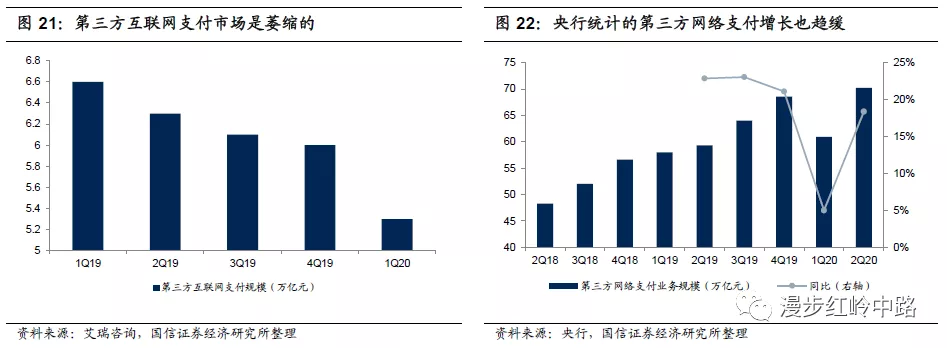

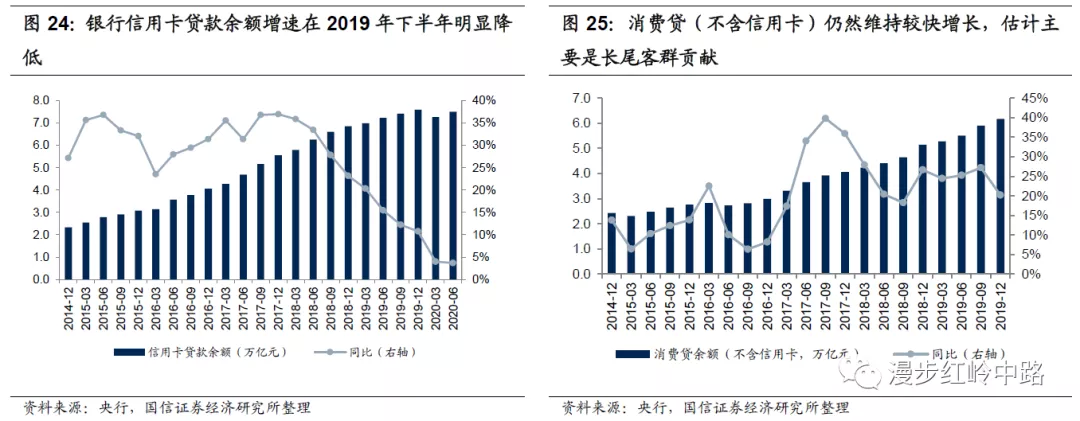

5.1 Digital payment market: Entering a period of steady growth, the subsequent growth rate is expected to gradually slow down

Judging from daily experience, Ant Group's digital payments should mainly be online mobile payments, code scanning payments, and internet payments. Statistics related to digital payments are quite complicated. We use multiple data to cross-judge: 1) Judging from iResearch's statistics, online mobile payments are still the mainstream of digital payments, but the growth rate of this market has stabilized; the scale of code scanning payments is not as large as online, but they are growing rapidly; Internet payments have gradually declined; 2) Judging from the growth rate of third-party online payments disclosed by the central bank, the growth rate in recent quarters has been around 20%; 3) Third-party payment institutions have made 100% of their reserves since January 2019, but judging from the increase in total reserves, if there are no health events Impact. The growth rate is also estimated to be around 20%. Overall, as the penetration rate increases, the digital payment market has entered a period of steady growth with a growth rate of about 20%. We expect that the growth rate in the next few years may gradually trend towards an increase in total social consumption, that is, from about 20% to about 10%.

5.2 Microfinance market: There is still plenty of room for consumer loans for long-tail customers, and the operating loan market is relatively mature

Most of Ant Group's micro-loans are consumer loans, and a small portion are operating loans. Of the 2.15 trillion yuan credit balance promoted at the end of June 2020, 1.73 trillion yuan was consumer loans and 0.42 trillion yuan was operating loans.

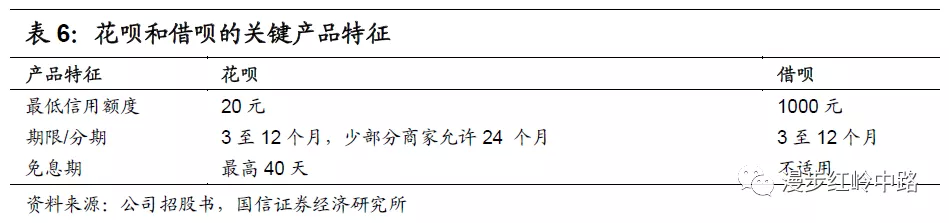

Ant Group's consumer loan products are mainly Huabei and Loan. Among them, Huabei is similar to a credit card, while Loan is a cash loan. Both products are mainly short-term loans. According to data disclosed by Ant Group, we estimate that the balance of consumer loans issued by Ant Group through partners at the end of June 2020 is about 1.5 trillion yuan, while its partner banks and trusts are banking financial institutions. The latter's RMB consumer loan balance (excluding credit cards) during the same period was about 6.3 trillion yuan, which means that Ant Group has a very high market share.

The consumer loan market for the leading customer group has matured, while the consumer loan market for the long-tail customer group is still growing rapidly. The decline in the yield on public loans from 2014 to 2015 and the sharp rise in bad risks of public loans caused banks to carry out retail transformation one after another in the next few years, promoting the rapid development of the consumer loan market. Generally speaking, banks' consumer loan customer base is dominated by leading customers. Their advantages are low interest rates, large amounts, and flexible terms; Internet institutions such as Ant Group are dominated by long-tail customer groups. Although interest rates are very high, they can compete in a differentiated manner with banks by relying on scenario guidance and accumulated large amounts of user data to reduce operating costs and risk costs, and can compete with banks in a differentiated manner, mainly to meet users' short-term and small-scale turnover needs. Judging from the growth rate of bank credit card loan balances, the leading customer base market may have matured; however, the consumer loan balance of the long-tail customer group has maintained a relatively rapid growth rate.

Consumer loans are a supply-driven market. Currently, many Internet institutions or consumer finance companies operate in the long-tail customer market. It is estimated that the balance of online consumer loans will continue to grow relatively rapidly in the short term. The uncertainty facing this market is that increased loan issuance may lead to increased risk, such as common debt risk or credit risk due to declining customers. It is currently difficult for us to determine where the boundaries of this market lie. When predicting Ant Group's profit, we will also conduct a scenario analysis of the credit balance it has contributed to.

Unlike the consumer loan market, personal business loans are a relatively more mature market, and the balance of personal business loans issued by financial institutions has not been growing rapidly in recent years. If Internet institutions can solve risk pricing problems with lower operating costs through big data and other means, online personal business loans may grow relatively faster.

Overall, we estimate that the online consumer loan and personal business loan markets will maintain a moderate growth rate of 15% to 20% in the next few years, and use this as a reference benchmark for subsequent assumptions.

5.3 Financial Management and Insurance Markets: More Space

Apart from Tianhong Yubao, Ant Group's financial management business is mainly financial marketing. The products sold on behalf of Ant Group include public funds, fixed term products, bank deposits, etc. As China's residents' wealth increases and their awareness of financial management increases, young people in particular are increasingly inclined to buy various wealth management products on mobile apps, there is broad scope for long-term development of this market, that is, the market not only expands its own scale, but also includes the transfer of users from traditional consignment agencies such as banks to Internet charge-back agencies. Ant Group's prospectus quotes Oliver Wyman Consulting's research, arguing that “the size of personal investable assets sold through online channels in China... the compound annual growth rate between 2019 and 2025 reached 21.6%”. The results of this study provided us with some reference.

In terms of insurance business, products represented by Ant Group include life insurance, health insurance, financial insurance, etc. A small amount of financial insurance on its platform comes from its subsidiary Cathay Pacific Insurance. Ant Group's prospectus quotes Oliver Wyman's research, arguing that “in 2019, China's online premiums... are expected to reach 1.9 trillion yuan in 2025, with an average compound annual growth rate of 38.1% from 2019 to 2025.”

06The market in which it is located is competitive, and Ant Group has a traffic advantage

6.1 There is sufficient competition in the respective markets

(1) Digital payment market

Digital payment is originally a business with network effects, but if the network effect does not bring about a monopoly, and another platform that can rival it appears, then competition also exists; furthermore, payments need to rely on scenarios before they occur, and potential competitors extended from other scenarios may divert part of the traffic. Ant Group's existing competitors are mainly WeChat Pay, which has the same huge number of users.

We believe that in the payment business, the core competitive advantage is the number of consumers. From a merchant's point of view, if the two platforms do not delay customer payments, there is not much difference in choosing either platform; from the consumer's point of view, with the exception of some scenarios where only specific payment methods can be used, there are many payment method options for most scenarios, and the conversion cost is very low (especially considering the emergence of aggregated payments and the possible promotion of mutual recognition of QR codes), so payment depends on habits and subsidies.

The digital payment market has passed a stage of rapid development. Currently, the number of users of Alipay and WeChat Pay is already very large, user habits are gradually being developed, and changing user habits through subsidies is difficult and expensive. Therefore, we expect the digital payment market pattern to remain generally stable in the future. This also means that investment in marketing activities can be reduced, and sales expenses will be reduced.

In terms of fees, the current online payment processing fee rate is relatively stable, and the offline code scanning payment rate is relatively low, so there is some room for improvement.

(2) Microfinance Market

The microfinance market is highly competitive. In terms of personal consumer loans, traditional financial institutions have already entered this field and relied on low interest rates, large amounts, and short and flexible loan terms to acquire leading customers, while Internet financial institutions continue to pour in to serve long-tail customers. For borrowers, there is no difference between which platform to borrow from, which means that a price war is inevitable. We believe that institutions that can gain more market share under the price war need to have two advantages: one is to have stronger risk control capabilities, which can price risks more accurately, thereby achieving a win-win situation with borrowers; second, they have stronger marketing methods and more traffic. Relying on a wide range of application scenarios and a large amount of accumulated data, Ant Group combines these two advantages. At the same time, we also need to pay attention to two points. First, Ant Group is facing potential competition from WeBank, which has a large user base in the microfinance field. Second, Ant Group's market share in this market is already very high. We estimate that the subsequent growth rate of its microfinance business will gradually slow down and the structure will be optimized, and Huabei's share may gradually increase.

There is uncertainty in terms of rates due to various factors such as interest rates, risks, and policies. We will simply assume that they remain stable later.

(3) Financial management and insurance markets

In recent years, the share of Ant Group's proprietary fund business has been declining, while the share of funds sold to third parties has increased rapidly. In terms of financial marketing, the competitors that Ant Group faces are mainly other Internet affiliate agencies and traditional commercial banks. Considering Ant Group's massive user advantage, the scale of its consignment sales is expected to maintain rapid growth despite fierce competition.

In terms of fees, the current Internet consignment fee rate is already floor price, and competition is extremely fierce. Therefore, we believe that Ant Group's consignment fee rate will not be reduced, yet whether it can rise in the short term mainly depends on changes in the structure of its consignment products. There is some volatility due to factors such as secondary market conditions. We will assume that they will remain stable later.

In terms of insurance agents, since the current share of this part of the business is still relatively low, we simply assume that its growth rate is consistent with the overall growth of the industry; in terms of rates, we estimate that the company's comprehensive consignment rate after excluding Cathay Pacific Insurance's self-operated net income and Mutual Insurance business in the past few years has been around 16%, so as the share of third-party consignment sales increases, the overall rate will approach this rate.

6.2 Ant Group has a traffic advantage, which brings business growth

A large number of users have brought Ant Group growth. There is sufficient competition in all markets where Ant Group is located. It is not easy for any party participating in the competition to obtain long-lasting and excessive profits. However, Ant Group's massive users have brought them huge traffic advantages, making it possible for the digital fintech platform business to develop rapidly, thus bringing about the company's growth.

Judging from MAU, Ant Group's user advantage has continued to increase in recent years, and there is still some room for improvement. Benefiting from increased marketing activities, Alipay's MAU grew by 120 million in 2018, another 90 million in the last year and a half, and reached 710 million at the end of June 2020. Currently, Alipay's annual active users exceed 1 billion, so there is still room for improvement in MAU. From another perspective, the combined MAU of WeChat and QQ for the two national apps at the end of June 2020 exceeded 1.2 billion, and their regular reports revealed that the MAU for payment services was over 800 million at the end of June 2018 and the end of 2019. Therefore, with little change in the short-term population structure, we can regard these more than 800 million people as the MAU ceiling for mobile payments. According to the current growth rate, we expect Alipay's MAU to reach its ceiling in 2022, and subsequent business growth will mainly depend on in-depth exploration of user needs.

07Profit forecasting

7.1 Profit forecast in a neutral scenario

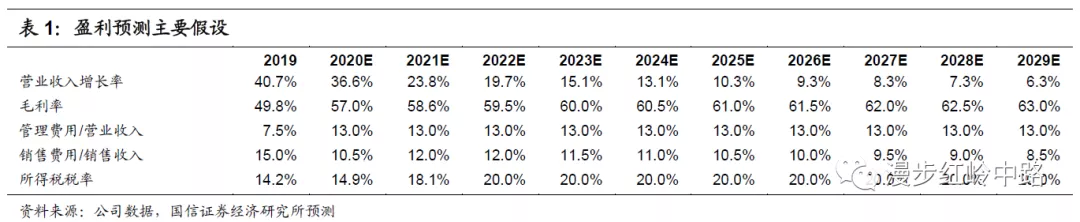

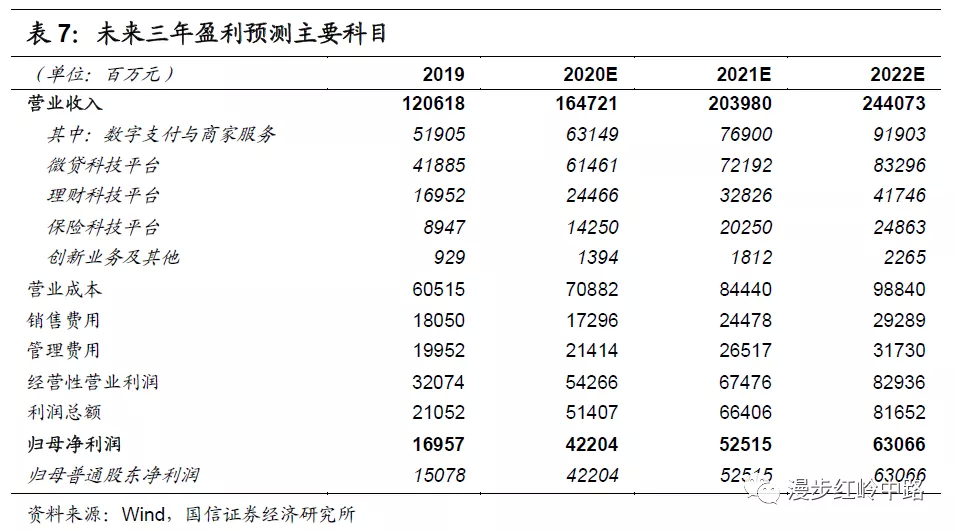

Based on the previous analysis, we made the following key assumptions and obtained a profit forecast for the next three years (that is, 2020 to 2022) under a neutral scenario:

Regarding the digital payment business, considering the increasing penetration rate of digital payments and the gradual maturity of the market, we expect the subsequent growth rate to fall back to less than 20%. Also, considering the temporary impact of health events on this year's payment scale growth (subsequent assumptions will also consider this), assuming that the scale of payment transactions in the next three years will increase 16%, 17%, and 15% year-on-year; Ant Group's payment rates have declined over the past few years, mainly due to centralized reserve deposit. We expect that this year the central bank will pay interest to reserve accounts, which will help increase payment rates. Also, considering that payment revenue since 2019 is not enough to fully cover transaction costs and service costs, there is currently some room for price increases in offline code scanning payment rates, assuming that the payment rates will gradually increase to 0.049%, 0.051%, and 0.053% in the next three years;

Regarding the microfinance technology platform business, we expect this market to maintain a moderate growth rate of about 15% to 20% in the previous article, but considering that Ant Group's market share is already large and there is potential competition, the subsequent growth rate is expected to decline. We assume that the credit balance promoted over the next three years will increase 18%, 17%, and 14% year on year, with an annual increase of around 400 billion yuan, while the rate is assumed to remain at 2.8%;

For the financial technology platform and insurtech platform business, we appropriately refer to Oliver Wyman's research results on market space quoted in Ant Group's prospectus, and in conjunction with the previous analysis, we make the following assumptions: 1) Assuming that the AUM growth rate for the next three years is 40%, 30%, and 25%, we carefully assume that the company's overall future financial management rate will remain at the level of 0.60%; 2) simply assume that the premium and contribution rate growth rates for the next three years will be 100%, 50%, 30%, and overall rates of 19%, 18%, and 17%, respectively;

Operating costs: 1) The company's transaction cost ratio has increased in recent years. We believe it is mainly due to the weakening of bargaining power with banks after centralized deposit of provisions. This impact was fully reflected in 2019, so it is expected that subsequent transaction rates will stabilize; 2) The service cost ratio has continued to rise in recent years, mainly due to the company's increased offline payment business expansion, and may still rise slightly in the future; 3) the ratio of other costs to payment scale has remained stable. Overall, considering the increase in the share of offline payments, we expect the company's operating cost ratio (operating cost ÷ payment scale) to rise slightly in the short term. Assuming that the next three years will be 0.055%, 0.056%, and 0.057%, respectively;

Sales expenses: With the sharp increase in Alipay's MAU and the gradual stabilization of the payment market pattern, it is estimated that the sales expense ratio will not increase significantly; however, considering that the sales expenses rate in the first half of this year was low due to health events, it is expected that the subsequent sales expenses rate will be higher than in the first half of this year, assuming that the next three years will be 10.5% (equivalent to about 12% in the second half of this year), 12%, and 12% respectively;

Management expenses (including R&D expenses): The company's management fee rate after excluding license fees and software technology service fees in the past few years has basically stabilized at around 13%. We assume that it will continue to be stable in the future;

Actual income tax: The company's recent actual income tax rate is low due to factors such as the use of previous years' loss compensation. We believe that as the company's profitability increases, the income tax rate will gradually return to normal levels. It is estimated that the actual income tax rates for the next three years will be 15%, 18%, and 20%, respectively;

Share capital: Assuming that the share capital will increase to 30.039 billion shares after the issuance is completed, according to the lower limit calculated in the prospectus.

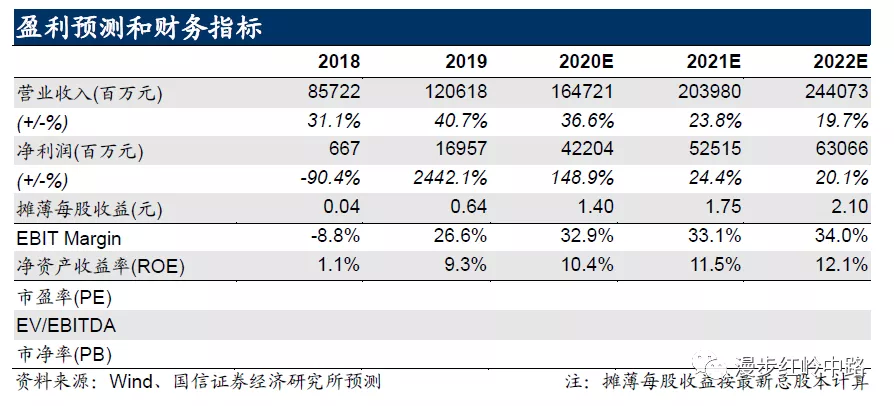

Based on the above assumptions, we obtained that the company's revenue from 2020 to 2022 was 164.7 billion yuan, 204 billion yuan, and 244.1 billion yuan, respectively, up 37%, 24%, and 20% year on year; net profit was 42.2 billion yuan, 52.5 billion yuan, and 63.1 billion yuan respectively, up 149%, 24%, and 20% year on year.

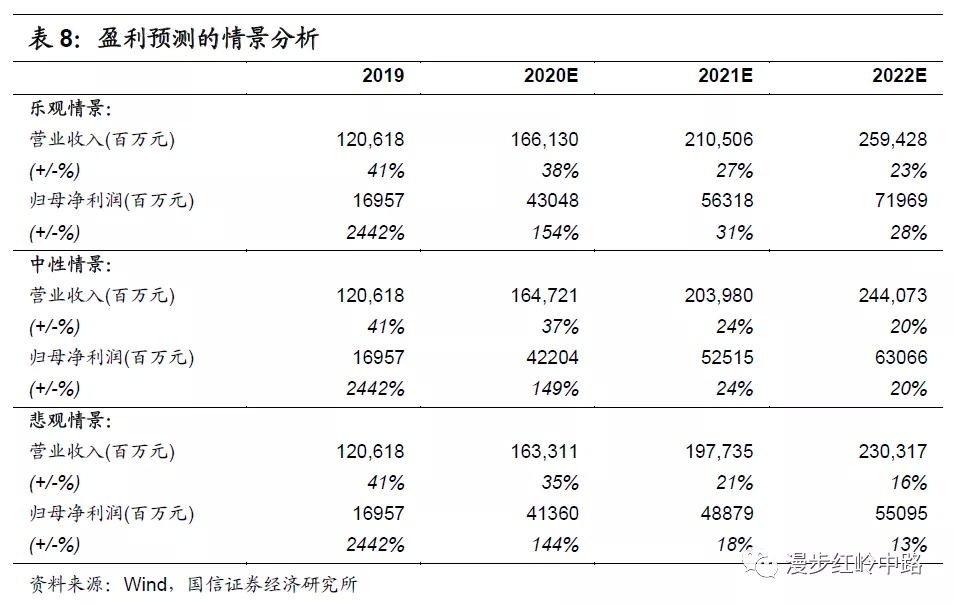

7.2 Sensitivity analysis of profit forecasts

In Ant Group's business line, microfinance technology platforms account for a high share of revenue and face greater uncertainty than other businesses. Ant Group also indicated in its prospectus the risks of changes in regulation and regulations in the online lending and consumer finance industry. We mainly conduct a sensitivity analysis of the revenue of this business:

As mentioned earlier, under a neutral scenario, we assume that the credit balance promoted in the next three years will increase by 18%, 17%, and 14% year on year;

Under an optimistic scenario, assuming that the company is not affected by regulatory and regulatory changes, and considering that the credit balance promoted by the company maintains good asset quality, especially considering that the share of consumer credit overdue loans for 90 days or more due to health events in the first half of this year rose only from 1.05% in 2019 to around 2.05% and stabilized, while the overdue rate has stabilized at 3% in recent months, the asset quality performance of small and micro operators' credit is even better, demonstrating the company's ability to control risk under pressure. Under this scenario, the credit balance it has contributed to may maintain rapid growth. Assuming that the credit balance contributed in the next three years will increase by 23%, 27%, and 24% year-on-year;

Under a pessimistic scenario, it is assumed that due to the large credit balance promoted by the company, it has an important impact on the banking industry. In particular, considering the common debt risk that may arise as the scale expands and other Internet companies enter the industry, the company controls the resulting credit balance growth. Assume that under this scenario, the credit balance it will facilitate in the next three years will increase 13%, 7%, and 4% year-on-year.

The increase in operating income and net profit under different scenarios is shown below.

08Risk warning

Valuation risks

We used absolute valuation and relative valuation methods to calculate a reasonable valuation of the company, but this valuation was calculated on the basis of many assumptions. In particular, the calculation of the company's free cash flow in the next few years, the WACC assumption, the assumption of a sustainable growth rate, and the selection of valuation parameters for comparable companies all added the judgment of many individuals:

1. There is a risk that the calculation value of free cash flow for the next ten years will be too high due to optimistic estimates of the company's revenue and profit growth during the explicit period and semi-explicit period, leading to an optimistic valuation;

2. WACC has a great influence on the company's valuation. If we assume that the WACC of the company is low, it may cause the risk of the company's valuation being overestimated. We have conducted a sensitive analysis of this;

3. We assume that the company's sustainable growth rate will be 5% after the next ten years, that the industry in which the company is located may change adversely after the next ten years, and that the company's continued growth is actually very low or negative, leading to the risk of the company's valuation being overestimated. We have conducted a sensitive analysis on this;

4. At the time of relative valuation, we selected Internet companies close to or closely related to the company's business for comparison, but the company's business is unique, so it is difficult to find a completely comparable company, which may cause the relative valuation to be biased; we chose the 2020 dynamic PE of a comparable company as a reference for relative valuation, which may not fully consider the risk that the overall market valuation is too high.

The risks of profit forecasting

Our profit forecast for the next three years is based on a number of assumptions, which involve a lot of personal subjective judgment:

1. The digital payment market, micro loan market, financial management and insurance market where the company is located is highly competitive, including mutual competition between stock competitors and the addition of potential competitors. Therefore, the competitive pattern may change, leading to an increase in business scale or the risk that the processing fee rate obtained will fall short of expectations. Increased competitive pressure may also cause the company's sales expenses to increase beyond expectations;

2. The company mainly monetizes its business through digital fintech platforms, involving various financial fields such as banks, insurance, and funds. These business areas are all strictly regulated, and the regulatory environment may change dynamically, resulting in the risk that the company's business development falls short of expectations. Among these, the risks faced by the microfinance technology platform business are relatively high and have a large impact on the company's revenue. We have conducted a separate sensitivity analysis on this;

3. The company's business involves the acquisition and use of user data. Regulators may enact new laws and regulations related to data security and privacy protection, or adopt stricter supervision, which may adversely affect the company's business development.

Other risks

The company has invested heavily in financial assets, including equity investments, and may invest more in the future. If the value of the invested company falls or causes large losses, etc., it may adversely affect the company's performance.

In the profit forecasting process, we assumed the company's future share capital according to the lower limit disclosed in the prospectus, and did not consider factors such as overallotment options, which may have an impact on indicators calculated based on per-share data.

We assume that the issue price is discounted according to a reasonable valuation center, and there is a risk that the actual amount of capital raised will not match the assumptions.