The "after-sleep income" of the Li Ka-shing family is really enviable.

According to the latest survey by the Daily Mail, the British water, energy, railway and other livelihood infrastructure companies owned by Li Ka-shing's family have madePre-tax income of 2.6 billion pounds.

The Li Ka-shing family received a dividend of 1 billion pounds, accounting for nearly 40 per cent of total income.

This means that as long as Britons continue to use water, electricity and trains, the Li Ka-shing family will receive a steady stream of "after-sleep income", and the proportion is quite high.

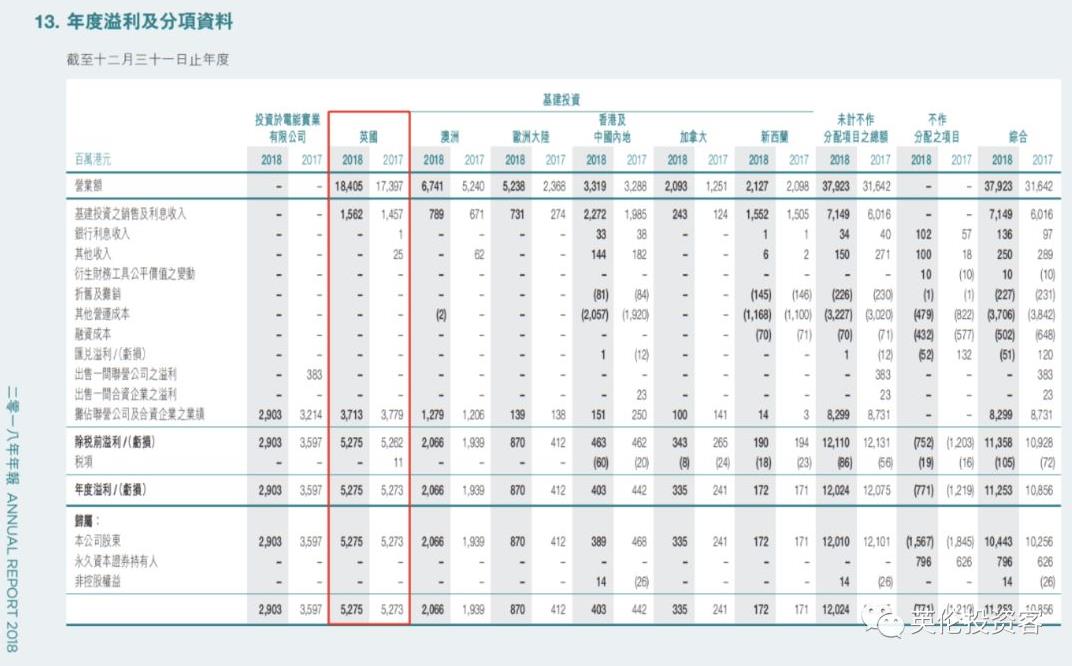

CK Hutchison's latest annual report also shows that the Li Ka-shing family'sCK InfrastructureThe profit mainly comes from its UK portfolio, which accounts for the total revenue.43.64%。

Of the Li family's UK assets, UK Power Networks is the most profitable, generating nearly £800m in revenue.

In total, the UK grid supplies electricity to 1/4 of the UK's population, including about 8.25 million users in London, south-east and east England.

Overall, the Li family's Cheung Kong infrastructure controls nearly 30 per cent of the UK natural gas market, 1/4 of the electricity distribution market and about 5 per cent of the water supply market.

Overall, the Li family's Cheung Kong infrastructure controls nearly 30 per cent of the UK natural gas market, 1/4 of the electricity distribution market and about 5 per cent of the water supply market.

A list of British companies owned by CKI

Because of its scarcity, British infrastructure assets not only have stable performance and guaranteed returns, but also have extremely low risk. Some industries even have national endorsements, which can continuously generate safe and lasting stable income, which is very in line with the interests of the family.

British Infrastructure shares in Lee's Empire

After tasting the benefits of "after-sleep income", the Li family hopes to continue to buy in the UK and replenish their ammunition by listing.

Last year, it was revealed by Bloomberg that Victor Li, who had just succeeded Li Ka-shing, was considering a public listing of CKI's UK assets in London.

A London listing could help CKI replenish more capital and give it enough ammunition to buy more UK assets in the future.

How much British infrastructure does the Li family hold to control the lifeblood of British people's livelihood?

Everyone knows that Li Ka-shing divested mainland Hong Kong, moved to Europe, and made a large position in the United Kingdom.

The livelihood infrastructure sector, which has just been exposed by the Daily Mail, happens to be Cheung Kong's largest asset in the UK.

Over the past decade, under the leadership of Victor Li, the then head of Cheung Kong Infrastructure, CKI has created aBritain's vast infrastructure empire includes everything from ports to gas, from electricity to water to rail networks:

1. Port

Portof Felixstowe

In 1991, Hutchison Whampoa acquired a 75 per cent stake in Port of Felixstow, the UK's main cargo port.

London Thamesport

In 1998, Hutchison Ports (Europe) Limited, a subsidiary of Hutchison Whampoa Port, signed a conditional agreement to purchase London Thamesport Thames Port. The cargo port is located in Isle of Grain, Kent.

Portof Harwich

1998 wholly-owned acquisition of Portof Harwich, located in Essex, England.

2. Gas

NorthernGas Networks of Northern Natural Gas Company

In 2005, CKI, then controlled by Victor Li, bought Northern Gas, an infrastructure company in northern England, for £2.4 billion.

Wales & West Utilities, a gas distribution company

In 2012, CKI, under Victor Li, announced a £645 million acquisition of Wales and West Utilities, a British gas company. WWU's transmission and distribution network serves 7.4 million customers and covers nearly 1/6 of the UK.

3. Electricity

Seabank Power power plant

In 2010, CK Infrastructure bought a 50 per cent stake in the Seabank Power power plant in Bristow for £212 million.

UK Power Networks, a British power company

In 2010, CKI bought the British power company for 5.8 billion pounds. As a result, it has obtained about 1/4 of the electricity distribution market in London, south-east and east England.

4. Water supplies

Northumbrian Water Group of Water supply Company

In 2011, CKI bought Northumbrian Water Group, a water company in northern England, for £4.8 billion. About 5% of Britain's water supply market is an asset of the Li family.

5. Railway

Eversholt Rail railway

In 2015, CK Investments, jointly owned by Li Ka-shing, reached an agreement to buy Eversholt Rail Group, which owns about 28 per cent of passenger trains in the UK, from investors such as 3i Infrastructure, a private equity firm. Li Ka-shing's business will pay 2.5 billion pounds.

The rest of the Li family invests in the UK

In addition to infrastructure assets, the Li family has a number of locations in the UK. Cheung Kong Hutchison, the parent company of Cheung Kong Infrastructure, has grown into the largest single overseas investor in the UK, with a total investment of more than £30 billion and nearly half of the group's revenue comes from Europe, according to Financial Times statistics.

According to the Cheung Kong Hutchison Industrial report, 47% of CK Hutchison's revenue comes from Europe, 11% from Canada and 12% from Hong Kong.Only 9% come from mainland China.

It is worth noting that CKI, not CK Hutchison's parent company, accounts for 46 per cent of UK revenue above. For CK Hutchison's parent company, the UK accounts for only 19 per cent.

Li Ka-shing cashed out of Hong Kong on the mainland (British investment map)

After cashing out, Li Ka-shing placed a heavy position in the UK (British Investment Chart)

Li Ka-shing's entry into the UK began in the 1990s, when investment was mainly made.Focus on port acquisition and real estate project development。

After starting from the port and real estate, the Li family's investment territory in the UK continues to expand, andCovering retail, telecommunications, medicine and other fields, the logic is to start from clothing, food, housing and transportation to buy all aspects of the lives of the British people:

1. Retail

An important member of Hutchison WhampoaWatsons GroupThe predecessor was the Hong Kong pharmacy founded in 1841 After being acquired by Hutchison Whampoa Group in 1981, it began to expand its business in the direction of beauty products, health products, distilled water and wine cellars.

The retail industry acquired by the Lee Group in the UK is completed by the Watsons Group.

Savers Health drugstore

Watsons Group, owned by Hutchison Whampoa, acquired the British SaversHealth chain in 2000, extending its business to Europe.

Superdrug drugstore

In 2002, Watsons acquired the Dutch Kruidvat Group and joined more well-known European brands, including the British health and beauty retailer Superdrug.

The Perfume Shop perfume chain

In 2005, Watsons successfully acquired the famous British perfume chain MerchantRetail Group and its main business The Perfume Shop.

2. Telecommunications

Telecom operator Three Mobile

In the early 1980s, Hutchison Whampoa Group launched a mobile phone and network business in Hong Kong. In the early 1990s, Hutchison Communications (UK) launched Orange-branded digital personal communication services. After 2000, with the development of 3G services, Orange was replaced by the new brand Three.

3. Real estate development projects

RoyalGate Kensington apartment

The Royal Gate Kensington (RoyalGate Kensington) apartment, completed in 1998, is Hutchison's first overseas property development. The project, located between Kensington and Chelsea, an upscale London neighborhood, covers an area of about 22000 square feet and offers 132 apartments.

Belgravia Place apartment

In 2001, Hutchison Whampoa jointly developed Belgravia Place with the Grosvenor Group (GrosvenorEstate). The project is located in Belgravia, "one of the richest regions in the world" (belonging to Westminster City and Kensington-Chelsea), covers an area of about 1 acre and has its own private square.

Montevetro apartment

The Montevetro apartment is located in Batterwest on the south bank of the Thames, near the huge supply of nine elm trees. The Montevetro apartment consists of five buildings overlooking the River Thames and the St. Mary's church.

Albion Riverside apartment

Also located on the south bank of the Thames, the Albion Riverside apartment is a landmark riverside building with maximum views of the Thames and Chelsea on the other side of the river. The project was completed in 2003.

Chelsea Waterfront apartment

Just opposite the Ponte Whitlow apartment in 2003, Hutchison Whampoa developed a new apartment, Chelsea Waterfront. The project covers an area of 8.8 acres and has a 600-meter riverside area. The two towers are 37 and 25 stories high respectively. Two upscale apartments of Hutchison Whampoa on the other side of the river can be seen from Chelsea Waterfront. Hutchison Whampoa has three real estate projects on the banks of the Thames in west London.

Deptford large parcel

The Deptford site, which has been hoarded by Hutchison Whampoa for more than 10 years, is located in south-east London, covering an area of 41.2 acres and involving a total investment of 1 billion pounds. It is planned to build 3500 houses and community centers on the basis of protecting the historical heritage on the site. The project was approved by Boris Johnson, then mayor of London, in March 2016.

On the other side of the plot is the Canary Wharf City.