Author: Akihara Shunji

Source: QYJEQYJE (QYJEQYJE)

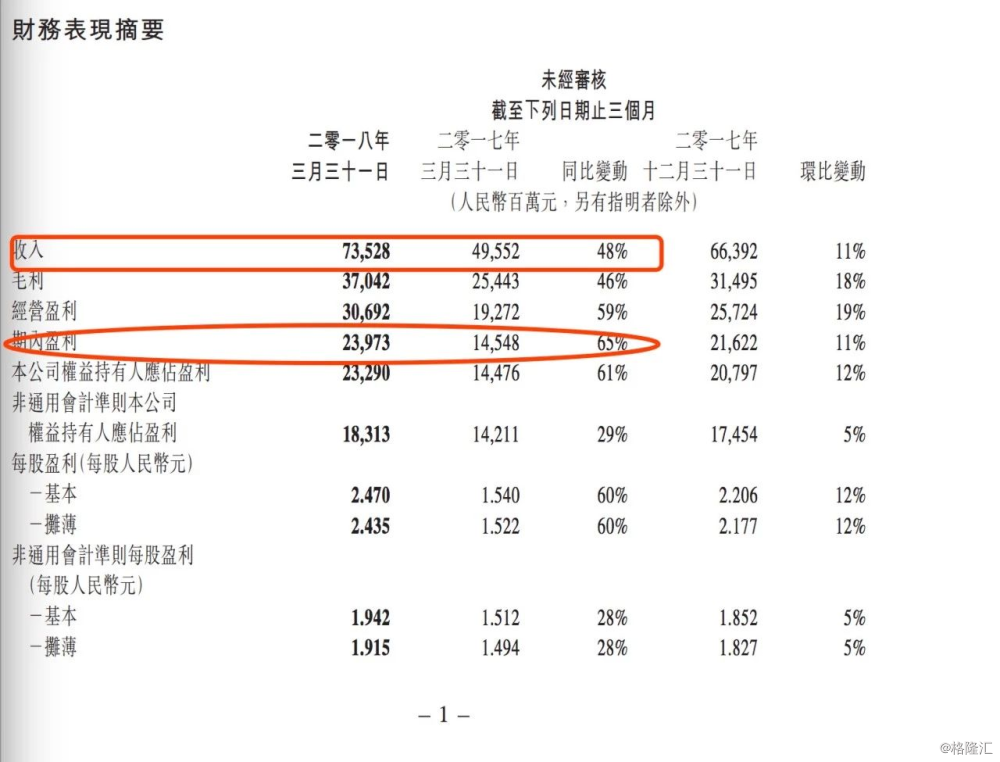

As soon as Tencent's quarterly report came out, my eyes were blinded:

The revenue growth rate is as high as 48%, and the profit is as high as 65%;

The 450 billion US dollar company was actually still able to maintain the growth rate during adolescence, and has gorgeously hit many bearishers in the face.

As a conservative, I also saw that I was stunned — I couldn't help but cry with joy. Dad Ma was so cocky.

You need to know that in the last annual report, the revenue growth rate for the fourth quarter fell directly to 37%, and Tencent's stock price also plummeted from 480 to 380. The repurchase of the expressway this time is bound to be a pleasant surprise.

Of course, this means that the stock price must be “whistling” up... We won't discuss topics such as what's going up or how much here.

Although everyone is in high spirits, I still see some problems:

Look, out of the nearly 24 billion dollars in profit, there is another net income of about 7.5 billion dollars.

How much is this profit worth? Find the notes and see the following information:

There are actually 6 billion dollars that are included in current profit and loss based on changes in fair value.

Moreover, these 6 billion dollars are not subject to income tax under tax law (since no shares are actually sold, the tax law does not tax, and the balance sheet confirms deferred income tax liabilities, so I used profit after tax before).

This shows that the overall profit is roughly 60/240, which means 25% is watery.

Isn't that a pothole ratio? Tencent, which has no dreams, knows how to trick children.

Continue reading the material afterwards:

Looking at this explanation, I instantly understood: Huya has recently gone public, bringing about a reassessment of fair value.

Listed on May 11, Tencent released financial reports on May 16. The time difference between the two is really a coincidence.

This is a prospectus from Huya. Before raising capital, Lin held 34.6% of the shares, which is a long-term equity investment.

Continue to chop:

Linen is a wholly-owned subsidiary of Tencent.

In an instant, I understood this wave of operations: Tencent took advantage of Huya's listing in early May to adjust other net earnings, which eventually led to changes in profit and loss.

Use this listing information in a timely manner to carry out accounting adjustments before the first quarter earnings report is announced. Simply put, it is a statement adjustment item that is part of an audit, and it complies with IFRS standards.

Huya has invested 462 million US dollars, accounting for about 35% of the shares. Currently, Huya has a market value of 3.8 billion US dollars, so this long-term equity investment, through fair value revaluation, has brought about a change in fair value of about 5.5 billion yuan, and the remaining 500 million yuan will make a small fuss.

Here, I won't discuss whether there are any misleading suspicions for investors: at least in my opinion, if Tencent discloses its first quarter report as early as May 11, then Tencent's net profit will fall around 18 billion yuan, in line with market expectations. However, Tencent's total share capital is around 9.5 billion, so this one-time income actually only affects changes in the stock price of one or two yuan.

However, since Huya went public, I don't know if the management had any intention of using future balance sheet matters to whitewash profits.

Anyway, the profit became around 24 billion dollars, and I won't analyze the rest. The company's stock price has not left the valuation range and is in line with market expectations.

But even so, 65% profit with a 25% discount is still acceptable. After all, the growth rate of 48.75% is higher than my expectations. Therefore, Tencent's stock price should still be pulled back. Of course, it may be calculated according to 48PE, hahaha, if I say this, don't listen to it; everyone can make their own estimates.

Interested students can also check the cash flow situation and verify it.