On May 16, Tencent announced its financial report for the first quarter of 2018. The performance greatly exceeded investor expectations. Revenue reached 73.53 billion yuan, an increase of 48% over the previous year; net profit of the mother was 23.29 billion yuan, up 61% year on year.

The barometer shows that the sky is clear, is that accurate?

Tencent has always claimed to be a barometer of Hong Kong stocks. Its first-quarter results are so promising that it will inevitably influence the general market trend. Sure enough, on May 17, Tencent Holdings opened with a stock price of 423.1 and rose 7%, and the market also opened higher and rose 0.985% on the same day, which seems to have given the Hong Kong market, which has continued to be sluggish recently, a trend of recovery. Unfortunately, Tencent's strong performance did not succeed as a “surprise” for the market. The Hang Seng Index declined again after opening high in early trading, falling 0.54% throughout the day.

So, can Tencent's positive performance give the market a boost?

Is Tencent bullish or bearish

First of all, we still have to see why Tencent's performance has greatly exceeded expectations this time, and whether there is any potential for continued growth, so as to judge whether Tencent's stock price will continue to rise. Only then can we judge the future trend of the market. After all, if you can't see that the growth rate exceeds expectations, then you don't think about believing in the company's subsequent development and thus throwing large sums of money into the pool.

Tencent's data for the first quarter is impressive. The main reason is that online games performed very well, with revenue reaching 28.78 billion yuan, up 26% year on year and 18% month on month. Investors also expressed some concerns about Tencent in the fourth quarter of last year due to the slowdown in the growth rate of online game revenue, and doubted the development prospects of the online game industry as a whole. This year, due to steady growth in mobile game pesticides, speed cars, etc., Tencent has maintained its position as a leader in online games. Also, the recently released Chicken Eating and Fortnite will soon launch a new fee system, which can bring a lot of growth impetus to client-side games. There is no doubt that the currently anticipated large growth space hit investors hard on the face of last year's bearish investors.

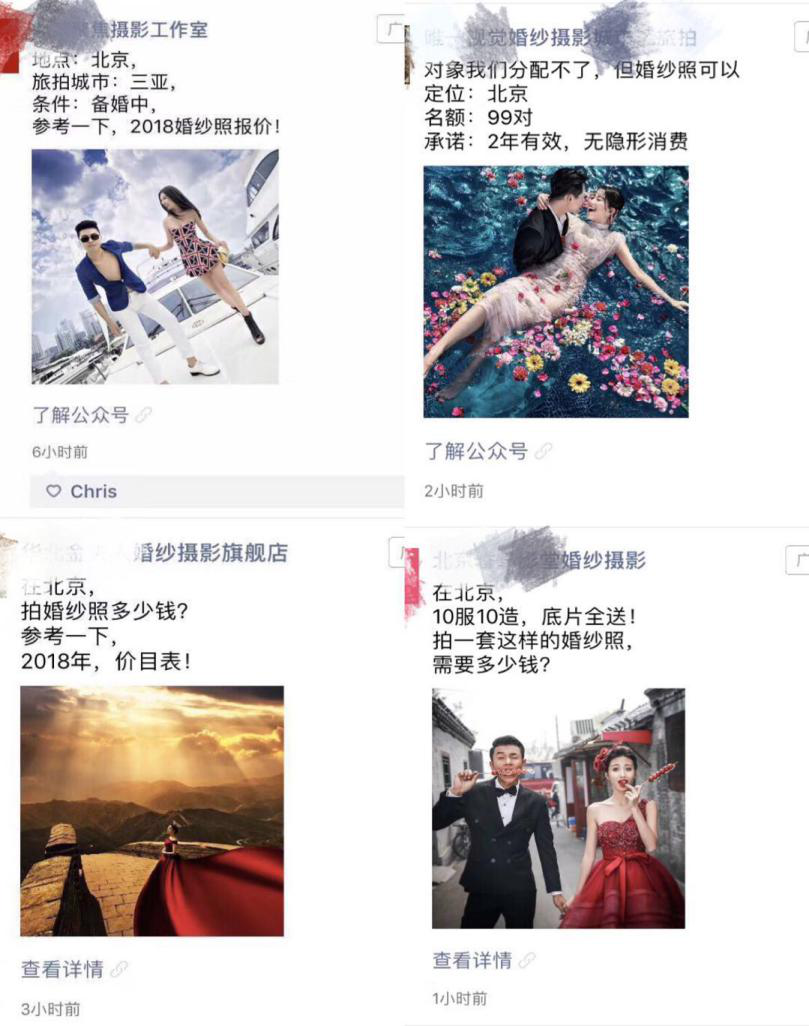

Furthermore, there is considerable confidence in the development of Tencent's social media platform and advertising business. Currently, the number of advertisements for the circle of friends is only two per day. Compared to peers, it is considered a clear stream in the social world. Also, there is still a lot of room for improvement in the accuracy of advertising now. The single dog friends around me all receive advertisements such as “wedding photography” every day. I don't know if it's to stimulate single dogs to get rid of their independence quickly, or if Tencent hasn't put precision marketing on the agenda at all. Tencent has so much traffic. In the future, not to mention a slight increase in advertising placement, this part of the profit can be greatly increased. We only need to improve the accuracy of advertising a little, and advertisers' advertising expenses will continue to rise steadily.

If you have so much confidence in the future of Tencent, then there is an expectation that the stock will rise in the future. As for the current increase in stocks, which is not obvious, it may be affected by the MSCI adjusted index mix. If investors want to increase their positions in China's A-shares and Hong Kong's mid-size H-shares, it is likely to affect Tencent Holdings' positions. In addition, it is also possible that the market estimates that Tencent's performance may not remain ideal, and investors will not buy accounts for performance. However, this just happens to be a once-in-a-lifetime opportunity to go long, and some investors who are eager to try it out can take advantage of it.

Starting an exchange rate defense war, what should the Hang Seng Index do?

The recent trend of the Hang Seng Index is worrying. Apart from the fact that Tencent, a leading stock, has not shown the increase it should have, the Hong Kong government's intervention in the exchange rate market once again after a lapse of 13 years has probably had quite an impact. Since February, the exchange rate of the US dollar against the Hong Kong dollar has risen sharply, and the Hong Kong dollar has been on the verge of depreciation. In order to prevent the further depreciation of the Hong Kong dollar, the Hong Kong Monetary Authority began buying a large amount of Hong Kong dollars in April to expand the Hong Kong dollar market to maintain the stability of the Hong Kong dollar exchange rate. However, the exchange rate defense war started on this side is bound to have a significant impact on the Hong Kong stock market. If the outside world starts short selling on a large scale, the banking system must ensure sufficient capital to maintain liquidity, thereby repelling the bears to hold on to the financial market. The cost is a sacrifice for the stock market. After all, capital is limited, so it is impossible to maintain the exchange rate while also ensuring the stability of the stock market. So this is one reason why the Hang Seng Index has performed poorly recently.

As for the trend of the Hang Seng Index this year, the editor believes that even with the good performance of the blue-chip stock Tencent, it is still not recommended to go long. In addition to saving the Hong Kong Exchange's impact on the stock market, the editor also believes that 2018 has reached the end of the ten-year cycle of the Hong Kong market. After a recent period of fluctuations, Hong Kong stocks are likely to repeat the nightmare of 1998 and 2008 and face a sudden collapse, falling 30,000 or even lower. If investors are bold, they might as well try shorting. Of course, the editor is not responsible for the results.

The author of this article is Liu Shuye, Huiyue Finance Research Department

The above article only represents the author's opinion and has nothing to do with the position of this site