On the 24th, the people's Bank of China launched the targeted medium-term Lending Facility (TMLF) operation in the second quarter of 2019. The operating objects are large commercial banks, joint-stock commercial banks and large city commercial banks that meet the relevant conditions and submit applications. According to the loan increment of small and micro enterprises and private enterprises of the relevant financial institutions in the first quarter of 2019, the operating amount is determined to be 267.4 billion yuan. The operation period is one year, and it can be renewed twice according to the needs of financial institutions when it expires, and the actual use period can reach three years. The operating interest rate is 3.15%, which is 15 basis points lower than the medium-term lending facility (MLF) interest rate.

Source: central Bank

After the TMLF operation by the people's Bank of China, the 10-year bond yield fell about 1 basis point in the short term, which is now at 3.83 per cent.

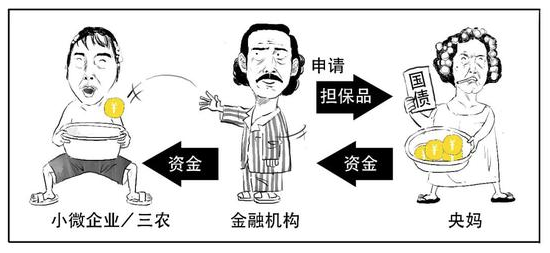

The full name of MLF is medium-term lending facility (Medium-term Lending Facility). Commercial banks and policy banks that meet the requirements of macro-prudence can apply to the central bank. MLF qualified collateral is mainly treasury bonds, central bank bills, policy financial debt, local debt, high-grade credit debt, small and micro, green and "three rural" financial bonds, green loans and so on. The term of the MLF loan is 3 months, 6 months or 1 year.

The central mother's requirements for the use of funds guide financial institutions to increase support for small and micro enterprises, "agriculture, rural areas and farmers" and other key areas and weak links. When the MLF loan is due, the financial institution and the central mother can agree on a new interest rate to continue. By adjusting the cost of medium-term financing to financial institutions, MLF has an impact on the balance sheets and market expectations of financial institutions, and promotes the reduction of social financing costs.

Analysts sayTMLF is not the "interest rate cut" that we traditionally understand, because the financing costs of the real economy will not be reduced immediately. TMLF is more like an "enhanced" version of MLF, equivalent to longer maturities, lower interest rates and a clearer MLF, so the effect of TMLF interest rate cuts is more reflected in the interbank money market.