Author: Ye Zi

Source: Rongzhong Finance

The industry generally believes that the listing of Youxin is expected to inject a shot of strength into the used car e-commerce market where it is difficult to burn money and there is no hope of profit, but the truth is that when Youxin landed on the NASDAQ, it was a bloody listing, and development is far from meeting expectations.

After Mercedes-Benz, there was another big event in the automotive field!

On April 17, the US stock market opened on Tuesday, and the used car e-commerce premium stock price opened high and low, and experienced two “falls and stops”. The stock price once fell by more than 50%, then the sharp rebound broke down again, and finally the decline narrowed to 36.07% to 1.95 US dollars. It is worth noting that since it went public in the US under the name “the first stock of used car e-commerce”, Youxin's stock price has been shrinking. After this shorting, the current market value is about 570 million US dollars, down nearly 80%.

However, the trigger for this storm stemmed from the previous day, the investment agency jCapitalResearch (JCapitalResearch) published a shorting report on Youxin. The report questioned Youxin's exaggeration of car sales by as much as 40%, and the debt level was high, so there was a risk of going out of business. The report also said that Dai Kun, founder of Youxin Group, received a sum of 100 million US dollars before the company went public, and another amount of about 180 million US dollars in December 2018, cashed out a total of 280 million US dollars from Youxin.

Affected by the shorting report, Youxin's stock price plummeted. Afterwards, Youxin made a statement about changes in stock prices caused by the malicious shorting report, saying that the report irresponsibly made a number of accusations against Youxin, believing that these distorted interpretations of facts and malicious accusations were worthless.

Furthermore, Youxin also denied a series of accusations such as data falsification, and believed that the report's claim that Dai Kun, founder, chairman, and CEO of Youxin, sold the company's shares to cash out before listing was even more nonsense.

Youxin said that in order to protect the interests of all shareholders and investors, after carefully reviewing the shorting report, it will make a separate statement in an open and transparent manner in the near future, firmly refuting any false accusations that try to challenge the company's business, management, and operating information.

As of press release, after Youxin issued a statement, before the US stock market, Youxin's stock price rose again. At one point, the increase reached 15%. At one point, the intraday stock price was close to 3 US dollars, with an intraday increase of nearly 53%, and finally closed up more than 51%.

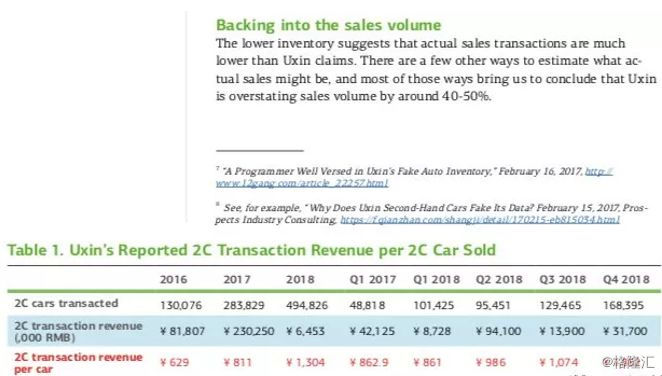

Shorting is real and false

According to JCapital Research's shorting report, Youxin exaggerated the trading volume by 40-50% and faced the risk of bankruptcy. The founder transferred US$280 million. As of mid-2018, Youxin reported 5,963 sales staff. According to media interviews, Youxin's best sales staff can sell up to 10 cars per month, but most people sell an average of 3 to 4 cars per month. Assuming each salesperson sells 5 cars a month, the company can sell 35,7780 vehicles within a year. However, according to the Youxin report, sales volume in 2018 was 814,498 units. Of these, 319672 were sold to dealers. According to the data, Youxin may have overestimated sales by 40-50%.

Also, Dai Kun, the founder of Youxin, cashed out $280 million in truth or falsehood. According to the report, Dai Kun took the first batch of 100 million US dollars before going public, then obtained another 180 million US dollars in December 2018. At that time, stocks were still regular. Two other insiders profited $270 million from the same deal. The money did not come from cash flow.

According to the report, one month before the company's IPO, Dai Kun repaid the loan on May 28, 2018, and transferred 31 million shares, worth $3.68 per share, for a total of US$114 million (page 176 of the prospectus). Meanwhile, on May 14, 2018, Dai Kun arranged for Youxin to grant them 17.7 million shares at a cost of 58,9631 yuan, and the company records them as compensation at the time of grant (prospectus PF-138). These shares were granted on the day of the initial public offering (June 27), but in reality, the 17.7 million shares redeemed in the transfer were replaced two weeks later (May 28) at a price of $65.3 million. Based on the issuance prices of the A series and C series shares that have already been transferred, it is estimated that the price of the remaining 13.3 million shares transferred by Dai Kun is 720,000 yuan.

In fact, Dai Kun received 107.7 million US dollars in cash from Youxin, the principal amount of the loan was exempted, and the total stock value was 7.2 million US dollars. This cash came from a company that had suffered heavy losses and was heavily indebted. One month before the initial public offering, Dai Kun obtained 100 million US dollars in cash from the deal. At that time, shareholders are usually locked in.

In addition, the report also bluntly pointed out that serious problems with UXIN used cars include: concealing debts, that is, the financial statements disclosed by Youxin Group in China show that the level of debt is astonishingly high and there is almost a risk of bankruptcy, but these debts are not disclosed to US investors; falsifying value, the book value of cars on the platform is artificially raised to more than double the actual value, causing the company to obtain more mortgages with less collateral, and the value of the collateral is far lower than the default amount of debt covered by it. JCAP believes that Youxin has obtained loans that far exceed actual needs through this method, enabling company insiders to withdraw cash, and that Youxin's management has removed far more than a reasonable level of cash from the company. Circular transactions. JCAP believes that Youxin is using special software embedded in POS machines to absorb funds from other unrelated third party transactions, achieve revenue growth, and encourage both parties to complete transactions through POS machines as much as possible by providing subsidies.

The report also mentioned that Youxin's poor reputation and reputation in China is not well known to Western investors, but through a simple Chinese search, you can find hundreds of news stories, blog posts, and legal lawsuits alleging Youxin fraud. The company is clearly plagued by consumer lawsuits, and has been repeatedly reported by consumers to the Chinese government consumer rights agency that it has increased unreasonable expenses in selling loans. The report concludes by saying that Youxin has no good faith statement, so it is impossible to value it. Therefore, investors with good credit are strongly advised to speed up the pace of exit.

The sequelae of bleeding to market

When it comes to domestic used car e-commerce, there are Melon Seeds and Renren Cars in the front, then there are big car searches and car pop-ups. There are many players on the platform. However, the only listed platform is Youxin.

On June 27, 2018, Youxin went public on Nasdaq with an issue price of 9 US dollars per share and a total market value of 2,761 billion US dollars. Founder and CEO Dai Kun holds 24.9% of the shares. Based on the issue price, the corresponding value of the shares held by Dai Kun reached 687 million US dollars. At 7 o'clock US time that morning, Dai Kun sat in front of the camera and connected to the domestic communication site. Facing more than 200 media outlets on the other side of the screen, Dai Kun greeted them warmly and smiled from time to time. It was hard to hide his joy.

The industry generally believes that the listing of Youxin is expected to inject a shot of strength into the used car e-commerce market where it is difficult to burn money and there is no hope of profit, but the truth is that when Youxin landed on the NASDAQ, it was a bloody listing, and development is far from meeting expectations.

According to data, Youxin originally planned to issue 38 million shares to raise 399 million to 475 million US dollars. However, the issue price on the same day was set at 9 US dollars/share, which is 28% lower than the highest price in the original inquiry range of 10.5 to 12.5 US dollars, far below Youxin's valuation of 3.2 billion US dollars after the previous round of financing. Furthermore, with both the issuance price and total issuance volume reduced, Youxin received only US$225 million in financing after the IPO, which was 59% lower than the expected maximum of US$546 million.

According to the analysis of its listed financial data, the latest unaudited performance report for the fourth quarter and full year ended December 31, 2018 published by Youxin, showed that revenue for the fourth quarter was 1,1367 million yuan, up 61.6% year on year, while net loss was 314.6 million yuan, net loss for the same period last year was 901.6 million yuan; for the whole of 2018, Youxin's revenue was 3315.4 billion yuan, up 69.9% year on year.

On the other hand, CarMax, the number one used car platform in the US, which it targets, shows that the company's total revenue rose from US$4.08 billion to US$4.32 billion, and net profit rose to US$192.6 million, higher than analysts' expectations.

Looking at traded vehicles, CarMax used car sales rose from US$3.43 billion to US$3.63 billion, and wholesale vehicle sales rose from US$527.2 million to US$543.8 million. The average price of used cars rose 0.3% to $19,978. In Q4 of 2018, Youxin traded 168,000 vehicles, and transaction service fee revenue was about US$46.3 million; 2C loan service fee revenue was about US$90.3 million; and 2B transaction service fees were US$21.2 million, a year-on-year decrease of 16.4%.

When Youxin went public, the 2C loan business was always the most profitable, accounting for half of revenue. Half of the transaction volume of nearly 500,000 customers purchased used cars through installment payments provided by the platform. In 2018, Youxin's 2C loan revenue was 1,774 billion yuan, an increase of 87.8% over the previous year, but in 2017, the growth rate was 200%, which is lower than the 2C loan revenue growth rate. It can be said that whether in terms of revenue, net profit, or business revenue analysis, there is a big gap between Youxin and Carmax.

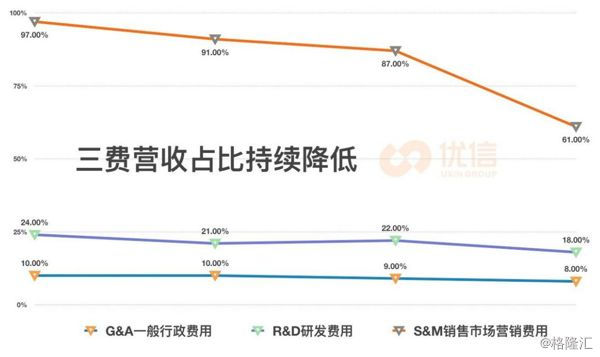

In addition to this, over the past three years, Youxin has spared no expense in marketing. In 2018, marketing expenses accounted for 81% of revenue, which means 80% of the money earned by Youxin was spent on marketing. What's even more exaggerated is that in 2017, Youxin invested all of its revenue in marketing and also posted money to advertise. The ratio of marketing to revenue was on par with that of Pinduoduo, which was bombarded all over the screen.

Youxin's 2018 Q1-Q4 three fees accounted for a share of revenue

Meanwhile, along with Youxin's 2018 report and fourth quarter financial report, issues relating to Youxin's “routine loans” for used cars have also attracted extensive discussions.

On the complaints gathering platform, there are nearly 600 complaints about Youxin used cars, while there are nearly 200 complaints on the Black Cat Complaints Platform. Most of the complaints are about Youxin inducing the signing of contracts, loans to buy cars into financial leases, and unexplained increases in loan principal.

Financial reports show that user loans have become the biggest source of income, yet they have been criticized by “routine loans.” This may have added a bit of embarrassment to Youxin's reputation as a “used car e-commerce.” However, in the face of continued losses, there is also a shortage of credit capital flows. According to the 2018 annual report, there is only 800 million yuan left in cash and cash equivalents on its books.

The life and death situation of used cars in troubled times

In recent years, for used car e-commerce companies, advertisements have opened up markets, products won users, and services have left word of mouth. After this kind of “brainwashing” promotion, users' perception of the brand has already been established, and consumption habits of completing transactions online have been cultivated.

However, due to different business models, used car e-commerce has gradually moved to a different runway. Along with the macroeconomic downturn at this stage, the growth rate of the used car market is slowing down, and unit prices are under pressure, the collection of this information seems to indicate that the used car market is not going well, yet used car e-commerce, which was rapidly invaded and destroyed in previous years, is also experiencing a new round of “cold waves.”

In our country, prices in the used car market are not open and transparent, so in many cases, consumers have poor car buying experiences on used car e-commerce platforms. Negative news such as Youxin, Melon Used Cars, and Renren Car have all been reported by the media. However, for used car e-commerce platforms, it is difficult to resolve relevant vehicle source quality information and after-sales service system issues in a short period of time. Furthermore, the relevant laws and regulations in the field of used cars in China are not perfect, making it difficult for e-commerce platforms to provide relatively complete and effective guarantees. As a result, many problems have arisen in domestic used car (e-commerce) transactions. The previous Mercedes-Benz incident can be seen in the previous Mercedes-Benz incident.

In fact, looking at used car e-commerce in 2018, many companies are setting up offline stores across the country. Just take Big Car Search as an example. It has digitized 9,000 4S stores across the country, more than 70,000 new car networks, 90% of medium and large used car dealers, and more than 5,500 authorized car brands. On the one hand, by clearing customs and setting up offline stores, the platform can make up for shortcomings in the supply chain and after-sales service levels of some e-commerce businesses. On the other hand, offline physical stores can enhance users' trust in used car transactions.

However, after the horse racing circuit, the company discovered that it was not suitable to operate and manage offline physical stores, leading to huge waste of capital and even seriously affecting online business.

According to data released by international consulting agency Roland Berger, the actual sales volume of used cars in China will reach 10.2 million units by 2020, with a compound annual growth rate of 20.7%. Today, used car e-commerce, represented by Renren Auto, Youxin, and Melon Zi, has gone through at least 8 major business model adjustments. Youxin is listed on the NASDAQ, Renren Auto has reached the F+ round, and Melon has received 1.5 billion US dollars from Sun Zhengyi in the D round, but competition in the used car market is no longer a matter of money. Facing a huge market in the future, where exactly are the opportunities for used car e-commerce?