Avi-Tech Holdings (SGX:1R6) Will Pay A Dividend Of SGD0.0075

The board of Avi-Tech Holdings Limited (SGX:1R6) has announced that it will pay a dividend of SGD0.0075 per share on the 18th of May. This makes the dividend yield 6.6%, which will augment investor returns quite nicely.

See our latest analysis for Avi-Tech Holdings

Avi-Tech Holdings Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Avi-Tech Holdings was paying out quite a large proportion of both earnings and cash flow, with the dividend being 509% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

EPS is set to fall by 14.9% over the next 12 months if recent trends continue. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 107%, which is definitely a bit high to be sustainable going forward.

Avi-Tech Holdings' Dividend Has Lacked Consistency

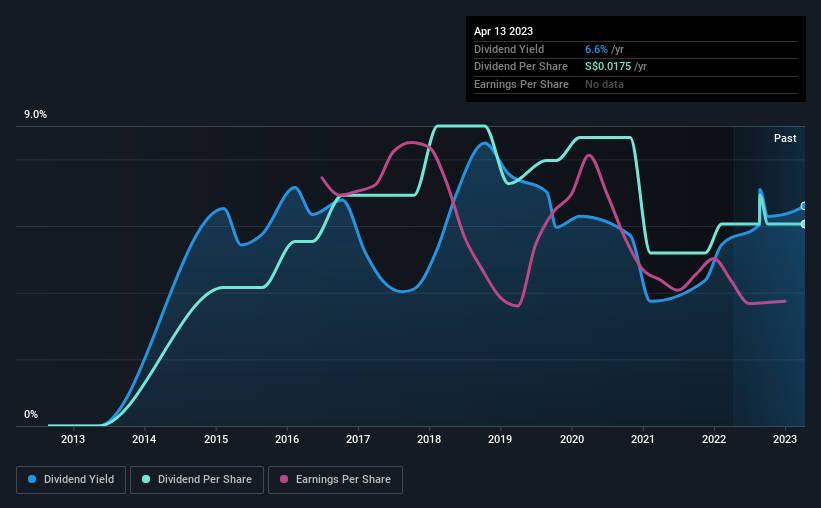

It's comforting to see that Avi-Tech Holdings has been paying a dividend for a number of years now, however it has been cut at least once in that time. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2015, the dividend has gone from SGD0.012 total annually to SGD0.0175. This implies that the company grew its distributions at a yearly rate of about 4.8% over that duration. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though Avi-Tech Holdings' EPS has declined at around 15% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The track record isn't great, and the payments are a bit high to be considered sustainable. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Avi-Tech Holdings has 4 warning signs (and 3 which are significant) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance