As of the morning of April 15, the Hang Seng Index had risen more than 16% this year, reversing the decline in 2018 and surpassing the 30,000 point mark for the second time.

But take a closer look at each plate, the inner silver stock is one of which the valuation repair is relatively slow. Since the beginning of the year, domestic bank stocks have risen 9.95%, much lower than the rise of the Hang Seng index. And after the previous rise, the domestic bank stock index has been tidying up sideways for more than two months, the current PB is only 0.731 times, the undervaluation advantage is obvious, while the recently released credit and social finance data show that the economy has stabilized.

Under the stimulation of undervaluation + short-term economic stabilization, internal bank stocks may have some performance, and the "dark horse" may be screened out, and the layout in advance may be rewarding.

To this end, Zhitong Financial APP collated the Q4 detailed data of the top ten domestic bank stocks in 2018 and split them one by one to find the opportunities.

Differentiation of net profit growth compared with the same period last year

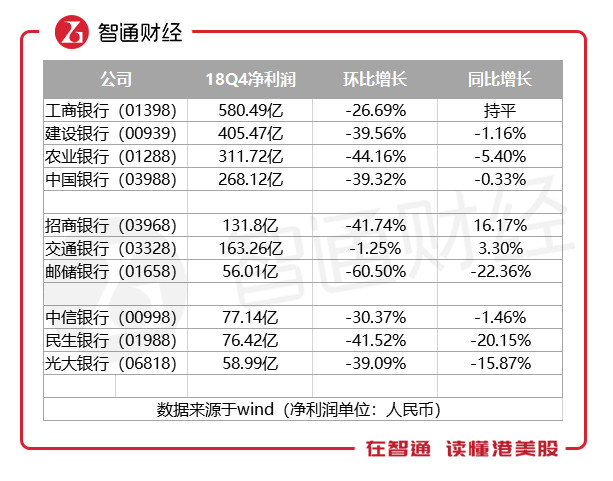

In terms of net profit, the overall performance in the fourth quarter of 2018 is not satisfactory.

Compared with the third quarter, net profit declined to varying degrees in the fourth quarter, mainly due to seasonal factors. With the exception of Bank of Communications (03328), which fell 1.25% month-on-month, other banks' net profit fell sharply compared with the same period last year. Postal savings Bank (01658) halved directly, falling by more than 60%.

In order to eliminate the seasonal factors, the year-on-year method can better reflect the operation of the bank. Compared with the same period last year, the net profits of the banks are divided. Among them, Industrial and Commercial Bank of China (01398), China Merchants Bank (03968) and Bank of Communications recorded year-on-year growth. China Merchants Bank has the brightest growth rate, up 16.17% year-on-year, while Bank of Communications also grew 3.3%.

The opposite is the year-on-year decline in net profits of other banks. Postal savings Bank and Minsheng Bank both fell by more than 20%, while China Everbright Bank also fell by more than 15%. This shows that in the face of the same depressed economic environment, different banks will have different results, and this is the "touchstone" for testing the ability of banks.

However, the net profit is relatively simple, because the net profit is affected by three major items: net interest income, net fee income and impairment of asset losses. only by decomposing and comparing each item one by one can we see it more clearly.

The performance of net interest income of industrial, construction and agricultural banks is poor.

Net interest income can be divided into asset size and net interest spread. the faster the growth of assets, the stronger the ability of banks to expand.

From the specific data, there are also differences in the expansion of the scale of assets. Of the four major banks, only Bank of China (03988) increased 1.62 per cent month-on-month, while ICBC fell 1.77 per cent. While joint-stock banks have some performance, the brighter ones are China Merchants Bank and CITIC Bank (00998), with total assets growing at 3.69% and 3.58% respectively.

With the exception of the month-on-month decline in Industry and Commerce, China Construction Bank and Agricultural Bank of China, the other seven all recorded positive growth. On the whole, the size of assets has a positive effect on net profit.

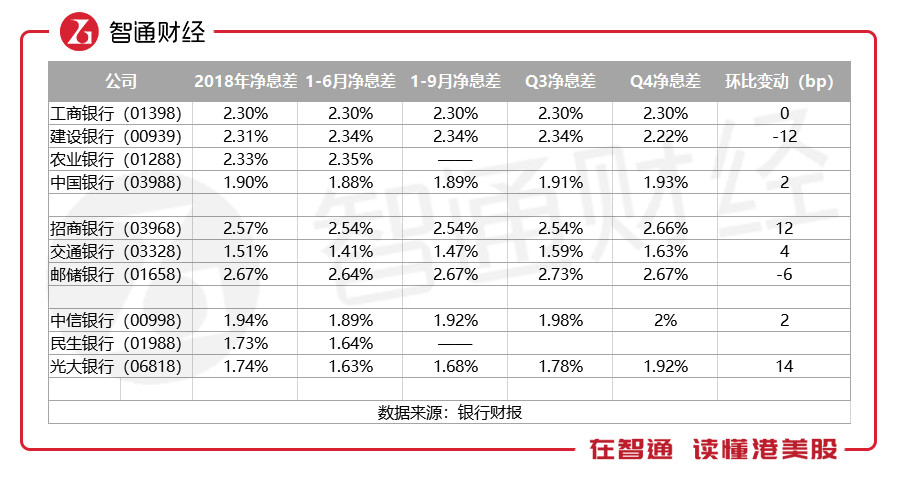

In terms of net interest margin, among the four major banks, the net interest margin of ICBC, China Construction Bank and Agricultural Bank of China declined in the second half of the year compared with the first half of the year, dragging down the level of the whole year. The net interest margins of the other seven banks increased to varying degrees in the second half of the year.

As Agricultural Bank and Minsheng Bank did not release the net interest margin data for the first three quarters, the specific values of the two can not be calculated directly, but this does not affect the comparison of other banks. In the fourth quarter, CCB's net interest margin fell 12 percentage points from the previous quarter, followed by Postal savings Bank, which fell 6 percentage points from the previous quarter. The net interest margin of China Merchants Bank and Everbright Bank increased by 12 and 14 percentage points respectively.

On the whole, the net interest margin of banks diverged in the fourth quarter, but the overall improvement showed a positive effect on net profit. It is worth noting that, with the advantage of the cost side, the net interest margin of Postal savings Bank and China Merchants Bank is lower than that of the four major banks.

In terms of comprehensive asset size and net interest margin, CCB, Agricultural Bank and ICBC performed worst in net interest income in the fourth quarter. the three major banks all shrank in varying degrees in asset size, and the net interest margin of China Construction Bank declined greatly compared with the previous month. ICBC is flat. Although the net interest margin of Agricultural Bank can not be calculated, it is not good to look at the overall data in the second half of the year. China Merchants Bank performed best, growing both in terms of asset size and net interest margin.

China Merchants Bank net fee income "Waterloo"

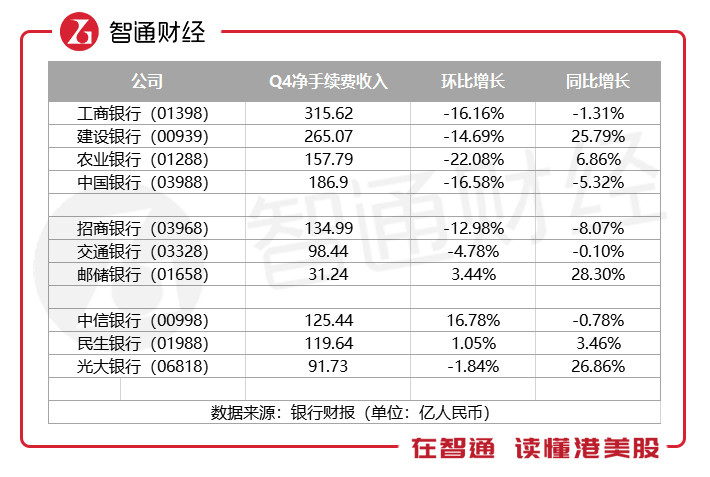

From the perspective of net fee income in the fourth quarter, the impact on net profit as a whole is negative. In the month-on-month data, only savings bank, Citic bank and Minsheng bank recorded positive growth. Among them, Citic Bank increased by 16.78% month-on-month. Other banks have declined to varying degrees, with the four major banks leading the decline, reflecting that the economy continued to decline in the fourth quarter of last year compared with the third quarter.

In the year-on-year data, the differentiation is obvious. China Construction Bank, Postal savings Bank and Everbright Bank have all increased by more than 20%. What is interesting is that China Merchants Bank, which has an outstanding performance in net interest income, has a "Waterloo" in the index of net fee income, which is down nearly 13% from the previous month and more than 8% from the same period last year, which is the largest year-on-year decline among the ten banks.

This is because retail business and wealth management business have developed rapidly in recent years, and the proportion of retail and financial management in fee income has continued to rise. in large state-owned banks, the proportion of these two businesses in fee income has increased to 60%. Joint-stock banks account for nearly 80%.

China Merchants Bank is best known for its retail business, a large part of which is credit card business. During the economic downturn, the use of credit cards by the public has decreased, so the net fee income of China Merchants Bank will fluctuate more year-on-year.

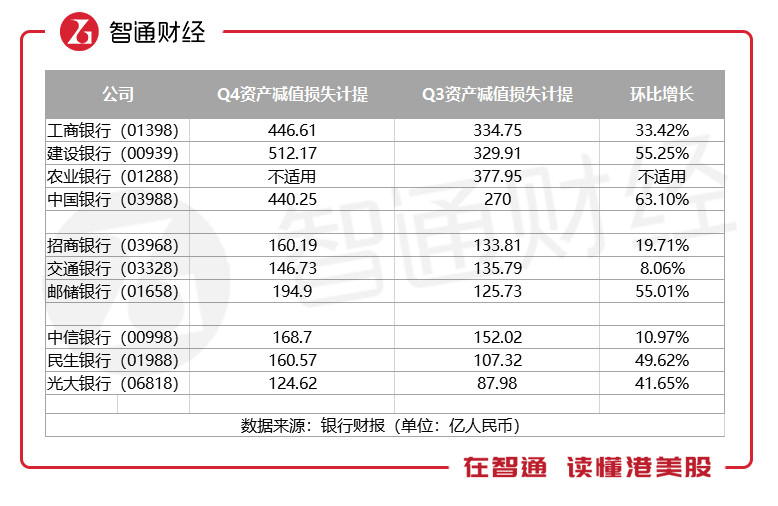

There has been a substantial increase in the provision for impairment losses on assets.

Different from other indicators, the provision of asset impairment loss is a "uniform" growth, with a significant reduction in net profit. Although the Agricultural Bank of China has not released specific data under the adjustment of accounting standards, the provision growth is inevitable.

From the specific data, the losses of China Construction Bank, Bank of China and Postal savings Bank increased by more than 50% month-on-month, while those of Bank of Communications and Citic Bank increased by 8.06% and 10.97% respectively. However, it is worth noting that the low provision of assets does not mean that the bank's assets are of high quality.

Because each bank's provision standard and provision for bad debts are very different, when the provision coverage is large, bad debts can be reduced. Therefore, some banks can smooth the profits through the provision of asset losses to cover up the real operating conditions.

However, there is also an indicator to verify the provision of asset losses. The lower the 90-day overdue rate of a bank, but the higher the provision coverage, the more credible the bank's asset authenticity.

On the whole, the provision of asset losses has had a greater impact on net profit, especially Postal savings Bank, Minsheng Bank and Everbright Bank, the performance of these three banks in net interest income and net fee income is mediocre, and there is not much decline, but the sharp increase in asset loss provision has greatly reduced the net profit, resulting in a big decline in net profit in the fourth quarter compared with the same period last year.

Minsheng Bank's asset quality is at the bottom.

However, net profit is only a measure of the profitability of banks, and a more comprehensive conclusion can only be drawn after a comprehensive comparison of other indicators related to assets.

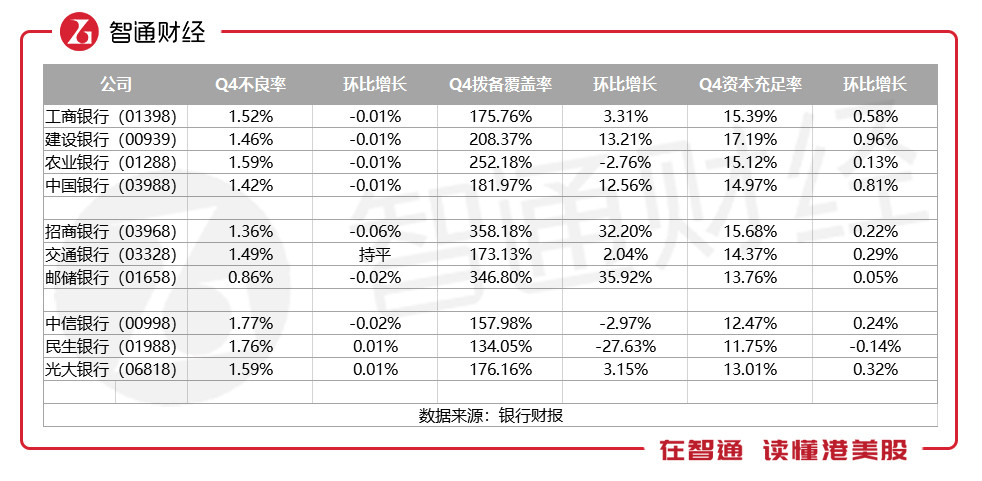

In the fourth quarter, the overall defect rate decreased, with China Merchants Bank falling by-0.06%, while Minsheng Bank and Everbright Bank increased by 0.01% instead of decreasing. At the same time, the defect rate of Minsheng Bank was also relatively high, second only to CITIC Bank. The Postal savings Bank has the lowest defect rate, only 0.86%, followed by China Merchants Bank at 1.36%.

In terms of provisions, China Merchants Bank won the championship with a provision ratio of 358.18%, followed by savings banks, with both sides recording an increase of more than 30% in the fourth quarter. The lowest is Minsheng Bank, where the provision coverage rate decreased by 27.63% from the previous month to 134.05%.

And Minsheng Bank also has the lowest asset adequacy ratio among the top 10 banks, with only 11.75%, followed by Citic Bank and Everbright Bank. The asset adequacy ratio of the four major banks is generally higher, but the asset adequacy ratio of China Merchants Bank is 15.68%, which is higher than that of the four major banks.

Whether it is the defect rate, the provision coverage ratio, or the asset adequacy ratio, it is gradually getting better, which also reflects the environment of strict supervision of the financial industry. Through the three indicators, the quality of the target has been obvious, China Merchants Bank is the most eye-catching, Minsheng Bank is at the bottom.

High valuation leader China Merchants Bank

According to the three indicators that affect the net profit and the three indicators of asset quality, the best one is still China Merchants Bank. Although the bank's net fee income fluctuated in the fourth quarter, it has little impact on the overall business. And after the economy improves this year, the business is expected to pick up momentum again.

Secondly, we can pay attention to the Postal savings Bank, whose performance dropped sharply in the fourth quarter compared with the same period last year, but mainly because of the provision of asset impairment, and the bank has a certain advantage in defect rate and provision coverage. Is it possible for the substantial provision of asset impairment to take the initiative to compress net profit?

Minsheng Bank is one of the "worst". Although the total assets have expanded, the net interest margin has improved in the second half of the year, and the net fee income has increased compared with the same period last year, due to the increase in the provision of asset impairment and the bottom of the defective rate, provision coverage ratio and capital adequacy ratio, the valuation of China Merchants Bank is only 0.55 times PB, while the current valuation of China Merchants Bank is 1.75 times PB. Minsheng Bank estimates that the value of China Merchants Bank is less than a fraction of that of China Merchants Bank.

Judging from the average valuation of Minsheng Bank over the past three years, the current valuation of Minsheng Bank is somewhat undervalued, but standing at the moment, is it buying the leading China Merchants Bank with high valuation or the undervalued "bottom" people's livelihood? Maybe you already have the answer in mind.