Phoenix New Media Technology News Beijing time May 11 news, NVIDIA Corp (NASDAQ:NVDA) today released the first quarter of fiscal year 2019 financial results as of April 29. According to GAAP, NVIDIA Corp's revenue in the first quarter was $3.207 billion, up 66 per cent from $1.937 billion in the same period last year, while net profit was $1.244 billion, up 145 per cent from $507 million in the same period last year.

NVIDIA Corp's revenue in the first quarter exceeded expectations, but revenue from its data centre business fell below expectations, dragging down shares by more than 2 per cent in after-hours trading on Thursday.

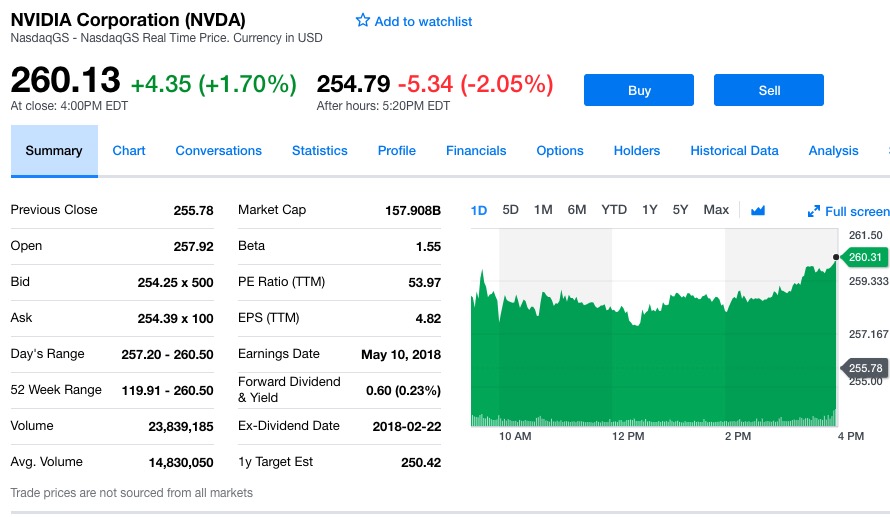

Stock price performance:

NVIDIA Corp shares fell 2.05% in after-hours trading.

NVIDIA Corp opened at $257.92 on the Nasdaq on Thursday. As of Thursday's close, NVIDIA Corp shares were up $4.35, or 1.70 per cent, at $260.13. NVIDIA Corp shares fell $5.34, or 2.05%, to $254.79 in after-hours trading as of 17: 20 EDT on Thursday (5:20 Beijing time on Friday). In the past 52 weeks, NVIDIA Corp's share price has peaked at $260.50 and as low as $119.91.

Highlights of the first quarter results:

Revenue was $3.207 billion, up 66% from $1.937 billion in the same period last year.

Gross profit margin was 64.5%, up 5.1% from 59.4% in the same period last year; according to non-Non-GAAP, gross profit margin was 64.7%, up 5.1% from 59.6% in the same period last year

Operating expenses were $773 million, up 30% from $596 million in the same period last year. Under non-American accounting principles, operating expenses were $648 million, up 25% from $517 million in the same period last year.

Operating profit was $1.295 billion, up 134% from $554 million in the same period last year; under non-US accounting standards, operating profit was $1.428 billion, up 124% from $637 million in the same period last year

Net profit was $1.244 billion, up 145% from $507 million in the same period last year; under non-US accounting standards, net profit was $1.285 billion, up 141% from $533 million in the same period last year

Diluted earnings per share were $1.98, up 151% from $0.79 a year earlier, while diluted earnings per share were $2.05, up 141% from $0.85 a year earlier.

Departmental performance:

The revenue of the game business in the first quarter was $1.72 billion, up 68% from the same period last year.

Revenue from the data center business reached a record $701 million in the first quarter, up 71% from a year earlier.

Revenue from the professional visualization (Professional visualization) business was $251 million in the first quarter, up 22% from a year earlier.

Revenue from the car business reached a record $145 million in the first quarter, up 4 per cent from a year earlier.

Return on Capital Program:

In the first quarter of fiscal 2019, NVIDIA Corp returned $746 million in cash to shareholders, including $655 million in share buybacks and $91 million in quarterly cash dividends. For the whole of fiscal year 2019, NVIDIA Corp plans to return $1.25 billion in cash to shareholders through quarterly cash dividends and share buybacks being paid out.

NVIDIA Corp will pay the next quarterly cash dividend of $0.15 per share to shareholders of record as of May 24, 2018, due on June 15, 2018.

Outlook for the second quarter:

Revenue is expected to be $3.1 billion, up or down by two percent

The gross profit margin is expected to be 63.3%, 63.5% according to non-GAAP, fluctuating 50 basis points.

Operating expenses are expected to be about $810 million, or $685 million under non-US GAAP.

Other income and expenditure are expected to be approximately $15 million

Excluding unsustainable items, the tax rate is expected to be 11.0%, fluctuating by one percentage point.