Resume trading today

On Friday, with data from the US, Germany and France, and yields on three-month and 10-year Treasuries upside down, US stocks tumbled in panic, with the S & P 500 down 1.9 per cent, the Dow down 1.8 per cent and the Nasdaq down 2.5 per cent.

External sentiment plummeted, overshadowing the news of Science and Technology Innovation Board's first list debut, and the stock markets of China and Hong Kong opened sharply lower this morning.

The Hang Seng Index opened down more than 600 points in early trading. Although the decline narrowed with the rebound of A shares at one point, it fell again in the afternoon and rebounded slightly in late trading, but the Hang Seng Index eventually fell 590 points to lose the 29000-point mark to 28523 points, with a turnover of 109.3 billion yuan. There was a net outflow of 10.386 billion yuan from northward and 3.234 billion yuan from southward.

Individual A-share index showed differentiation, the gem index turned red twice in the morning, and CSI 1000 was even more powerful to maintain the red market for a good period of time, but it still fell behind the big market in late trading. The Shanghai Composite Index fell 1.97%; the Shenzhen Composite Index fell 1.80%; and the gem Index fell 1.48%.

Global stock markets also adjusted, with Japan down 3.01%, South Korea down 1.92% and Taiwan down 1.50%.

According to records, foreign investors sold 10 billion A shares this time, the second highest in history. The last time was on July 6, 2015, when the net outflow of foreign capital was 13.385 billion yuan, while the Shanghai Stock Exchange rose 2.4%.

With regard to the continued net inflow of foreign capital since the beginning of this year, this can be described as a "triumphant escape", which contrasts with the fact that Beishui has come to Hong Kong today.

Photo source: Futu Niuniu

In terms of Hong Kong blue chips, only AAC Technologies Holdings Inc. (2018.HK) and 0823.HK (leading) rose against the market, closing up 4.6 per cent and 0.4 per cent respectively.

China Shenhua Energy (1088.HK)The worst performer, with dividends disappointing investors by 6.9%. Last year, the company's revenue was + 6.2% to 264.1 billion yuan compared with the same period last year, and the net profit returned to the mother was-7.7% to 41.37 billion yuan, with a final dividend of 0.88 yuan per share.

Another blue chipShenzhou International Group (2313.HK)It also fell 6.2% due to lower-than-expected results. The company's revenue last year was + 15.8% to 20.95 billion yuan compared with the same period last year, and the net profit returned to its mother was + 20.7% to 4.54 billion yuan last year.

In addition, Hong Kong stocks have more performance, with 1263.HK falling 30.1%, 1765.HK down 9.8%, Greentown Services (2869.HK) down 9.7% and China National Building Material (3323.HK) down 5.8%.

In terms of the plate, the performance of Chinese financial stocks is the worst among internal insurance and securities firms. China Galaxy (6881.HK) is down 7.1%; CSC FINANCIAL CO.,LTD (6066.HK) is down 4.9%; GF Securities Co., LTD. (1776.HK) is down 4.6%; China people's Insurance (1339.HK) is down 4.3%; China Life Insurance Company Limited (2628.HK) is down 3.8%; and New China Life Insurance (1336.HK) is down 3.7%.

Individual stocksLi Ning Co. Ltd. (2331.HK)Li Ning Co. Ltd., a major shareholder, cashed out and the share price tumbled 9.1 per cent. Li Ning Co. Ltd. reduced his holdings of 148 million shares (about 6 per cent of the company's total share capital) through a placement at HK $11.72 per share, a 7.7 per cent discount to the previous closing price. The company's share price just rose to an 8-year high when Li Ning Co. Ltd., a major shareholder, cashed out.

Touch the concept of Science and Technology Innovation BoardTCL Electronics (1070.HK)It rose 9.1%, the highest level in nearly three years. Jingchen Semiconductor was selected as one of Science and Technology Innovation Board's first lists, while TCL Electronics still holds more than 11 per cent of the former since it bought the former in 2014.

In contrast, pure Science and Technology Innovation Board concept stock Fudan Zhangjiang (1349.HK) lost its first list, and its share price plummeted 13.8 per cent, but the company's share price has risen 88 per cent so far this year.

Judging from the performance of the market, although it plummeted today, there are still 104 A-share companies rising by the daily limit, not to mention individual indices that have turned red several times. Unsurprisingly, the shadow stocks of 9 Science and Technology Innovation Board enterprises have soared one after another, and many funds are still keen on speculation.

But even so, the capital speculation may only stay in the rotation between the plates, and today the funds will move from the earliest brokerages to military stocks.

Moreover, with the collapse of US stocks, foreign capital will become more cautious, and the net outflow of 10 billion yuan shows that foreign investors actually have a lot of flexibility rather than immutable buying, which means that any major adjustment in US stocks will be able to transmit to A shares.

For the A-share buffalo, major shareholders continue to reduce their holdings and foreign investment is uncertain. At present, all that is left is the concept of Science and Technology Innovation Board, but it is doubtful how much new capital this can attract.

Therefore, it is difficult to rely solely on inter-plate rotation of funds to push the index up again, and it is not realistic to hope that there will be another beta market in the short term.

At present, the safest stocks may not be pure white horse stocks (foreign investors are heavily positioned and evacuated at any time), nor are they pure concept stocks, but those stocks that have both safety margins and concepts as catalysts to attract hot capital.

● performance is beautiful, Yongsheng life service is not afraid of plate adjustment

It was a thunderstorm last week during the March earnings season, and the most tragic thing was that the long-term investors with heavy positions in China Resources Power Holdings (0836.HK) suddenly turned off the lights and ate noodles. However, there are also many companies that have made beautiful achievements, and Yongsheng Life Service (1995.HK), which has a "dark horse" temperament in the property management industry, is one of them.

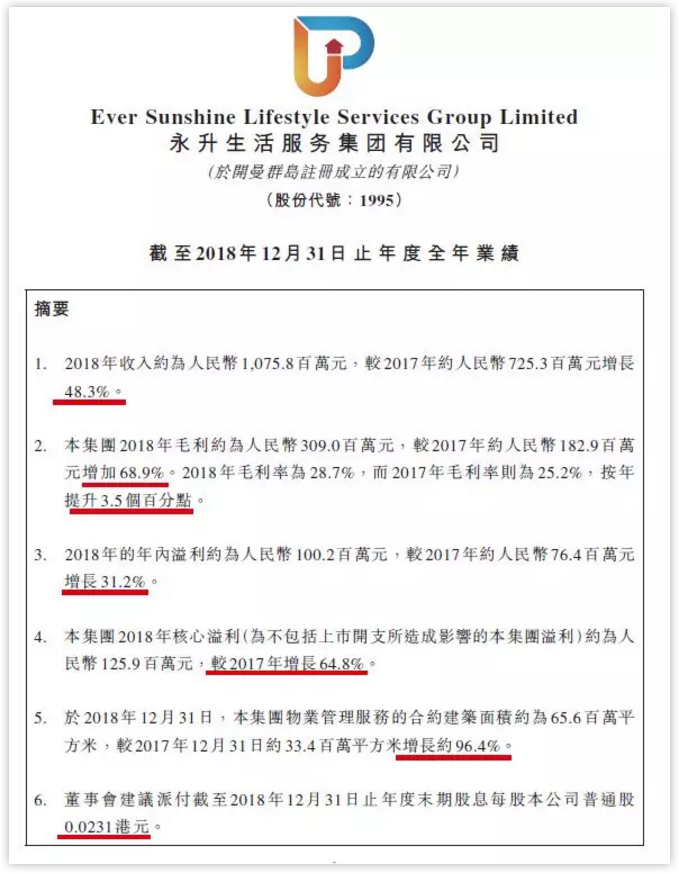

According to Yongsheng's performance disclosure in fiscal year 2018

The income during the period was 1.076 billion yuan (the same as the unit below), an increase of 48.3% over the same period last year.

Gross profit 309 million yuan, an increase of 68.9% over the same period last year

Gross profit margin 28.7%, an annual increase of 3.5 percentage points

Net profit of 100 million yuan, an increase of 31.2% over the same period last year

Core profit (excluding listing fees) 126 million yuan, an increase of 64.8% over the same period last year

Basic and diluted earnings per share are $0.0885, with a proposed final dividend of HK $0.0231 per share, with a dividend ratio of about 22%.

Source: company announcement

Such a beautiful performance is naturally recognized by the market. Even though the stock price was dragged down by the poor performance of White Horse Green City Service (2869.HK) in early trading, it still recorded a strong increase of 2.68% throughout the day, with a cumulative increase of 71.91% so far this year!

Xiaobian humble opinion, Yongsheng stock price can be so strong, although there are industry factors or plate effect (beta), but the company management factors (alpha) can not be ignored. And this is precisely the main reason why Greentown service has suffered a partial capital sell-off in the market today.

According to the disclosure of Greentown service performance, the profit in 2018 was 483 million yuan, up 24.73% from the same period last year.However, operating profit only increased by 6.53% year-on-year to 516 million yuan, seriously lower than market expectations, the core reason is that the company park service recorded a loss of 22.8 million yuan.

In other words, if the property management company does not have the support of major shareholders with a strong developer background, because the profit is basically too small, it does not have enough ability to explore new business. Once the business development is not good, the performance will change immediately.

In contrast to Yongsheng, on the one hand, the major shareholder Xuhui Holdings (884.HK) raised its sales target to 190 billion in 2019, effectively ensuring Yongsheng's high-quality management reserve area. According to CITIC's calculation, the compound annual growth rate of Yongsheng's managed area will be as high as 45% in the next three years (2019-2021), driving the company's profits to maintain an average growth rate of 70.17%.

On the other hand, Xuhui Holdings, a major shareholder, has gradually entered a profit release period. According to wind data, the market expects Xuhui to record profits of 7.114 billion and 8.636 billion respectively in 2019 and 2020.In other words, Xuhui has plenty of room to help Yongsheng explore value-added services, especially given that property management companies are valued much higher than real estate developers in the capital market.

Source: wind

Finally, Yongsheng management is clear about the development of the property management industry, fully aware that the development of value-added services can not be completed overnight, while value-added services almost do not have any threshold for development, Greentown can do, Vanke can also plagiarize, the only difference is the scale advantage and the charging standard.

Therefore, the company will adopt a more conservative attitude and learn the development strategy of excellent companies in the industry. To put it simply, Yongsheng will not do anything to lose money.

Therefore, although Yongsheng has recorded a large increase in the stock price since its listing, the valuation of the closing price is not excessive if taking into account the future development, especially considering that there is still a large volatility in the market, the valuation of the property management industry is likely to continue to rise.

● annual report is bright, the stock price is still down 3%, the market is very dissatisfied with China Merchants Bank?

China Merchants Bank (3968.HK) reported good results over the weekend, with net profit of 80.56 billion, up 14.8 per cent from a year earlier and total assets up 7.1 per cent from a year earlier. Net assets increased by 13.4% compared with the same period last year, reaching 1.24%, ranking first among listed banks, while the provision coverage rate continued to increase to 358.2%, greatly enhancing the ability to resist risks. The defect rate continued to decline, from 1.61% to 1.36%.

This result is quite good. The only drawback may be that the dividend payout rate remains unchanged at 24%.

But the market does not seem to be satisfied with the report. Today, China Merchants Bank opened low and left low, plunging 3%. Although the market fell, but this is good, there is no hedging effect?

The editor believes that the current high valuation of China Merchants Bank may be the culprit leading to the decline.

At present, China Merchants Bank is as high as 10 times PE,1.5 and PB, while several big brothers with more robust risks, Jianyin, Agricultural Bank of China and Bank of China, whether it is PE or PB, are only half of Zhaoyin. And the capital output, China Merchants Bank is only 1/3 of their or less. China Merchants Bank currently has a market capitalization of HK $900 billion and only needs to rise by 18% to surpass Bank of China Ltd. (3988.HK) in market capitalization.

This must be unreasonable, we are all banks, the development is to follow the economic cycle, China Merchants Bank does not want to outshine others, the valuation in the industry is too outrageous. Do you think China Merchants Bank can crowd out Bank of China into the four major banks?Not for five years.

Therefore, it is reasonable for someone to take advantage of the good to ship the goods.