The rivalry between AT&T (T 1.88%) and Verizon Communications (VZ -0.53%) has raged for decades. Though they started as Baby Bells in separate regions following the breakup of the original AT&T (the current AT&T was Southwestern Bell and later became SBC Communications and the current Verizon was Bell Atlantic), the advent of wireless and broadband has turned them into archrivals.

Now that AT&T has divested its media assets, both companies focus primarily on developing 5G broadband. They also pay generous dividends to their shareholders, differentiating them from the more growth-oriented T-Mobile, which does not offer a payout.

This leaves income investors in the telco industry with a choice. Consequently, they should look more closely at the two companies to see which would serve them better.

The case for AT&T

The investment case for AT&T has changed dramatically during this decade. The company finally admitted its DirecTV and WarnerMedia acquisitions were costly mistakes. To this end, it has mostly divested both assets. The WarnerMedia divestment led to the formation of Warner Bros. Discovery and a $40 billion cash infusion. AT&T used most of that cash to reduce its total debt to about $136 billion.

And to the dismay of many dividend investors, the telecom stock slashed its payout after increasing its dividend for 35 straight years. At the current $1.11 per share, shareholders still earn about a 5.5% cash return at current prices. But with no streak of payout hikes to defend anymore, another cut in the dividend is more likely as the reputational damage has already taken its toll on the stock.

Despite the pain of those moves, the better cash position frees AT&T to invest more heavily into its 5G network. That is likely a welcome relief to its customers, as its leading market share is constantly threatened by Verizon and T-Mobile.

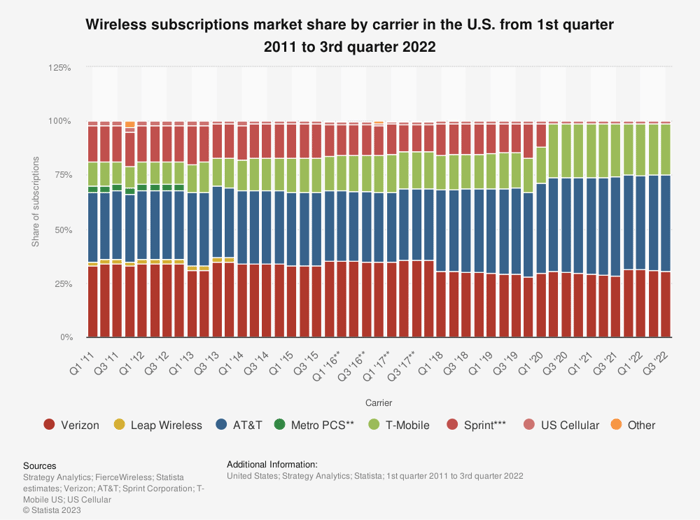

Data source: Statista, Strategy Analytics, FierceWireless, AT&T, Verizon, T-Mobile, Sprint, and US Cellular.

Additionally, its P/E ratio of 7 is another factor that may attract investors. Considering the necessity of wireless service in today's society and the lack of competition, it can likely keep churn to a minimum if it makes the investments in its network that it can now afford more easily.

Why some investors might consider Verizon

In contrast, Verizon largely avoided the costly mistake of going into media. Although it owned the AOL and Yahoo! assets for a time, those businesses cost a fraction of what AT&T spent on DirecTV and the former WarnerMedia. Moreover, according to J.D. Power, Verizon has typically led the industry on quality, recently winning the most network quality ratings for the 30th time in a row.

However, that quality has come at a cost, as Verizon spent $53 billion on C-band spectrum in 2021, more than its two peers combined. Spectrum is "wireless real estate" that gives Verizon exclusive access over prime frequencies in a given area.

That purchase left Verizon with $151 billion in total debt versus $92 billion in equity, the company's value after subtracting liabilities from assets. And unlike AT&T, it has no cash from divestments to pay down debt. Even though Verizon's P/E ratio of 8 is only slightly higher than that of its archrival, those liabilities could make it seem cheap for a reason.

Another challenge is the dividend. At $2.61 per share annually, the dividend has risen for 16 straight years and offers a cash return of 6.3%. That makes the high-yield dividend stock attractive to investors wanting a stable, growing income stream. But with AT&T walking away from a 35-year payout increase streak, some investors may push Verizon to follow a similar course.

AT&T or Verizon?

When comparing the two stocks, investors should probably lean toward Verizon. The elevated debt levels are concerning, and that increases the danger of a cut in the payout when divestitures and lower dividend costs have reinvigorated AT&T. However, companies can slash dividends at any time, and shareholders tend to see annual payout hikes as a sign of confidence in the payout.

Verizon largely avoided the costly mistakes that likely contributed to AT&T reducing its dividend. Hence, even with the higher debt levels, Verizon looks like the more solid pick.