It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Zhejiang China Commodities City Group (SHSE:600415), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Zhejiang China Commodities City Group

Zhejiang China Commodities City Group's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Zhejiang China Commodities City Group has grown EPS by 31% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Zhejiang China Commodities City Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While Zhejiang China Commodities City Group did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

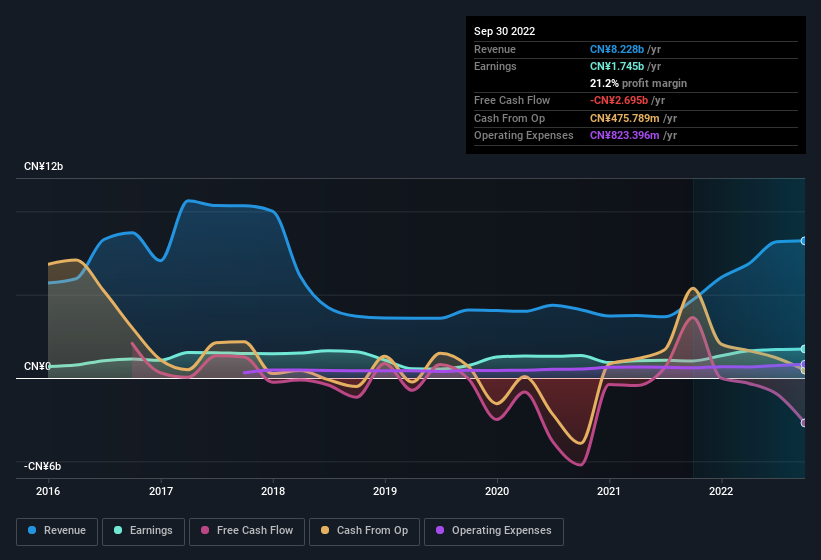

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

SHSE:600415 Earnings and Revenue History December 8th 2022

SHSE:600415 Earnings and Revenue History December 8th 2022While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Zhejiang China Commodities City Group?

Are Zhejiang China Commodities City Group Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations between CN¥14b and CN¥45b, like Zhejiang China Commodities City Group, the median CEO pay is around CN¥1.3m.

The Zhejiang China Commodities City Group CEO received total compensation of just CN¥492k in the year to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Zhejiang China Commodities City Group Deserve A Spot On Your Watchlist?

You can't deny that Zhejiang China Commodities City Group has grown its earnings per share at a very impressive rate. That's attractive. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. Before you take the next step you should know about the 3 warning signs for Zhejiang China Commodities City Group (2 don't sit too well with us!) that we have uncovered.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.