Country Garden Holdings raised a total of about HK $11.4 billion in the three rights issues. However, Country Garden Holdings's frequent discounted rights issue once caused controversy, and the market reaction to the first two rounds of rights issue was also very negative.

Country Garden Holdings announced a rights issue on the Hong Kong Stock Exchange on the morning of December 7. it was Country Garden Holdings's second rights issue in 30 days and the third in six months.

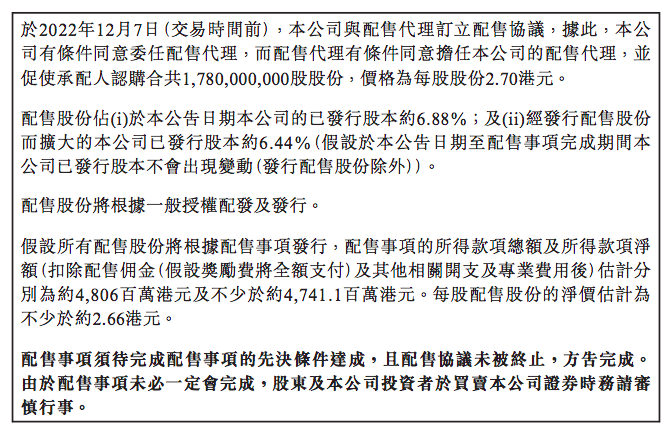

According to the announcement, Country Garden Holdings intends to place a total of 1.78 billion shares at a price of HK $2.70 per share. The placing shares account for about 6.88% of the issued share capital of the company, and about 6.44% of the issued share capital of the enlarged company.

The total proceeds from the placing and the net proceeds (after deducting the placing commission and other related expenses and professional fees) are estimated to be about HK $4.806 billion and not less than HK $4.741 billion respectively. The net price of each placing share is estimated to be not less than about HK $2.66.

The total proceeds from the placing and the net proceeds (after deducting the placing commission and other related expenses and professional fees) are estimated to be about HK $4.806 billion and not less than HK $4.741 billion respectively. The net price of each placing share is estimated to be not less than about HK $2.66.

Country Garden Holdings shares were trading at HK $3.17 as of Tuesday's close. This also means that the discount of Country Garden Holdings's rights issue price has reached 14.8%.

In fact, Country Garden Holdings just completed a round of rights issue financing last month.

Country Garden Holdings announced on November 15 that the company would place 1.463 billion new shares at HK $2.68 per share, raising a total of about HK $3.92 billion, and that the net proceeds would be used for foreign debt refinancing and general working capital. At that time, the discount of the matching price was 18%.

In addition, as early as July, Country Garden Holdings also conducted a rights issue at a price of HK $3.25 per share, a discount of 12.6%, with a total of 870 million shares subscribed by the allottees, with a net proceeds of about HK $2.79 billion.

Country Garden Holdings raised a total of about HK $11.4 billion in the three rights issues. However, Country Garden Holdings's frequent discounted rights issue once caused controversy, and the market reaction to the first two rounds of rights issue was very negative. Country Garden Holdings's share price fell 15 per cent after the rights issue news was announced.

When asked why the company issued shares when the share price was not very advantageous, Country Garden Holdings CFO Wu Bijun said at Country Garden Holdings's interim results meeting that the company did not think it was necessary to carry out a rights issue when the stock price was high, and did not anticipate that the industry would be so cold. First, when the share price fell to more than HK $3, the market was also more pessimistic, uncertain when sales would pick up; second, when they saw opportunities in the bond market, they hoped to balance the three statements. The money from equity financing was mainly used for bond buybacks, which was also a repair to the statement.

Recently, the real estate winter ushered in an inflection point, the policy side of multiple benefits continue to release, "three arrows at the same time", Country Garden Holdings received more than 300 billion bank credit support.

Continuous positive also promoted Country Garden Holdings's share price to rebound. Country Garden Holdings's shares have risen 217 per cent since November 1, rising from as low as HK $1.

Edit / lydia

配售事项的所得款项总额及所得款项净额(扣除配售佣金及其他相关开支及专业费用后)估计分别为约48.06亿港元及不少于约47.41亿港元。每股配售股份的净价估计为不少于约2.66港元。

配售事项的所得款项总额及所得款项净额(扣除配售佣金及其他相关开支及专业费用后)估计分别为约48.06亿港元及不少于约47.41亿港元。每股配售股份的净价估计为不少于约2.66港元。