This week we saw the Nanofilm Technologies International Limited (SGX:MZH) share price climb by 16%. But that's small comfort given the dismal price performance over the last year. During that time the share price has sank like a stone, descending 63%. It's not that amazing to see a bounce after a drop like that. Arguably, the fall was overdone.

While the stock has risen 16% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Nanofilm Technologies International

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Nanofilm Technologies International share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But other metrics might shed some light on why the share price is down.

With a low yield of 1.5% we doubt that the dividend influences the share price much. Nanofilm Technologies International's revenue is actually up 10% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

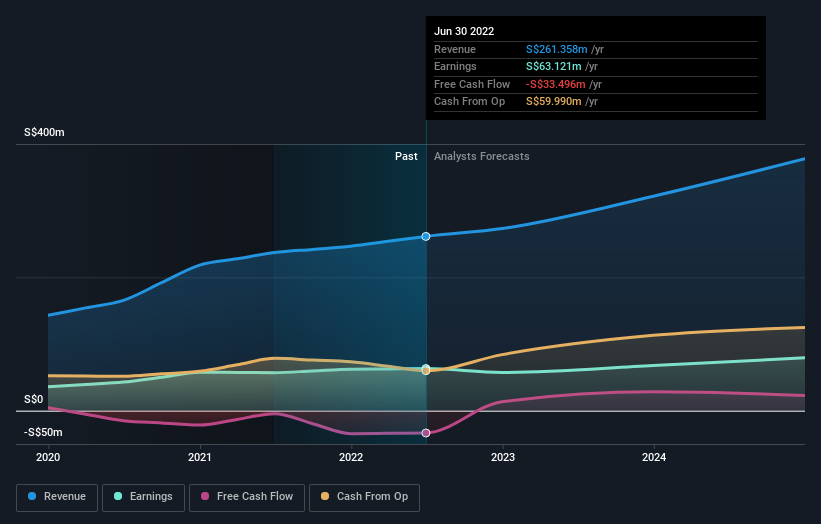

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

SGX:MZH Earnings and Revenue Growth December 6th 2022

SGX:MZH Earnings and Revenue Growth December 6th 2022This free interactive report on Nanofilm Technologies International's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Nanofilm Technologies International shareholders are down 62% for the year (even including dividends), the market itself is up 5.0%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 37% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Nanofilm Technologies International that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.