Source: CSC FINANCIAL CO.,LTD study

Since the beginning of this year, the giants have made frequent moves in the direction of cross-border e-commerce.Meituan launched e-commerce "global shopping"; Pinduoduo launched Temu to enter the United States in September; Tiktok accelerated its global layout, increasing investment in markets such as Southeast Asia, the United Kingdom and the United States; Shein layout in Brazil, Japan and other places; BABA injected capital into Lazada and released independent stations. Investigate the reasonCross-border e-commerce is one of the few businesses that have bucked the trend since the epidemic. Driven by factors such as strong policy promotion, increased e-commerce penetration in emerging markets, and the absolute performance-to-price ratio of Chinese goods, giants have explored a new growth curve one after another. the era of e-commerce led by the giant has begun.

We believe that the development of China's cross-border export e-commerce has gradually become the trend of the times, which also means that enterprises need to achieve the leap from product export to brand going out to sea.

Export e-commerce series 1: cross-border ecological continuous improvement, Chinese brands go global

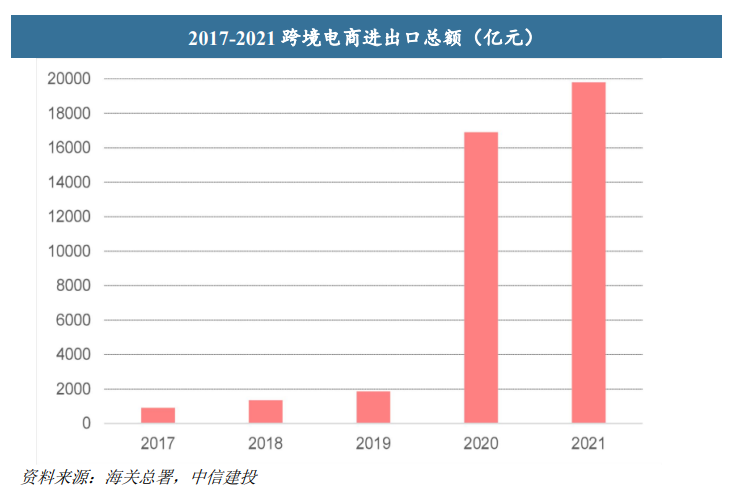

Export cross-border e-commerce has entered a stage of vigorous development, with a scale of nearly 1.5 trillion in 21 years, and is expected to maintain rapid growth.In recent years, China's cross-border e-commerce has maintained a rapid growth trend. according to data from the General Administration of Customs, China's cross-border e-commerce imports and exports totaled 1.98 trillion yuan in 2021, an increase of 15% over the same period last year. Among them, the scale of export cross-border e-commerce reached 1.44 trillion yuan, an increase of 24.5% over the same period last year. Although export e-commerce has been affected by rising sea freight and Amazon.Com Inc's closure of stores, it has maintained rapid growth, which fully proves the market vitality and growth resilience of cross-border e-commerce exports. According to the enterprise survey data, in the past five years, the registration of cross-border e-commerce-related enterprises in China has increased year by year. There were 10900 new units in 2021, an increase of 72.2% over the same period last year. We believe that the development of China's cross-border export e-commerce has gradually become the trend of the times, which also means that enterprises need to achieve the leap from product export to brand going out to sea.

Export cross-border e-commerce has entered a stage of vigorous development, with a scale of nearly 1.5 trillion in 21 years, and is expected to maintain rapid growth.In recent years, China's cross-border e-commerce has maintained a rapid growth trend. according to data from the General Administration of Customs, China's cross-border e-commerce imports and exports totaled 1.98 trillion yuan in 2021, an increase of 15% over the same period last year. Among them, the scale of export cross-border e-commerce reached 1.44 trillion yuan, an increase of 24.5% over the same period last year. Although export e-commerce has been affected by rising sea freight and Amazon.Com Inc's closure of stores, it has maintained rapid growth, which fully proves the market vitality and growth resilience of cross-border e-commerce exports. According to the enterprise survey data, in the past five years, the registration of cross-border e-commerce-related enterprises in China has increased year by year. There were 10900 new units in 2021, an increase of 72.2% over the same period last year. We believe that the development of China's cross-border export e-commerce has gradually become the trend of the times, which also means that enterprises need to achieve the leap from product export to brand going out to sea.

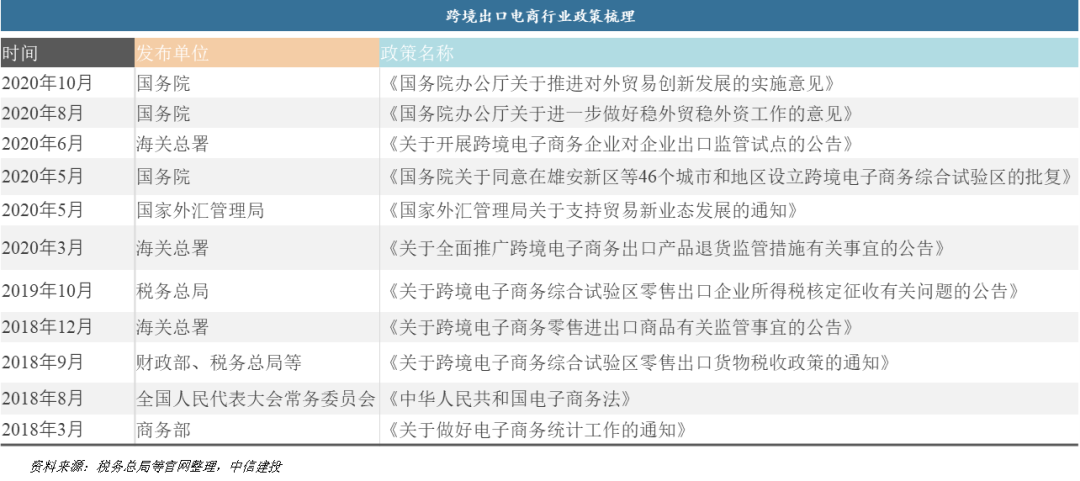

The disadvantageous factor is the point, the favorable factor is the side:Since the beginning of 20 years, the industry has started to grow rapidly, but over the past 21 years, the industry has also experienced many unfavorable factors, including: (1) large-scale closure of Amazon.Com Inc; (2) rising sea freight; (3) copyright litigation; (4) exchange rate fluctuations; (5) tariffs in Europe, the United States and other places. But at the same time, there are more favorable factors to continue to promote: (1) strong national policy support, there are already 155 cross-border e-commerce demonstration zones; (2) domestic platform enterprises accelerate their overseas layout, Pinduoduo launched the Temu platform in September, BABA injected US $910 million into Lazada, and Tiktok announced that the GMV target for the next five years will reach US $470 billion. In more and more regions, more and more Chinese-background e-commerce platforms are included in the downloads of Top10; (3) the market space is broad: China's export growth to countries along the RECP and "Belt and Road Initiative" has increased significantly.In the first quarter of this year, China's exports to ASEAN cross-border goods increased by 98.5%, and cross-border e-commerce exports to countries along the "Belt and Road Initiative" route increased by 92.7%.In the future, there are strong growth prospects in emerging markets and mature European and American markets; (4) freight prices continue to decline: as the global epidemic gradually liberalizes, supply and demand gradually reach a new balance, and shipping prices continue to decline, we believe that, with the subsequent launch of new ships and the efficiency of the existing fleet, shipping prices are expected to be further reduced. (5) the absolute advantage of China's manufacturing industry, China's whole industrial chain determines that many Chinese products have economies of scale that can not be compared with other countries, and Chinese exports have great cost advantages, especially in intelligent manufacturing products and other industries. it is expected to gradually occupy the market by virtue of strong performance-to-price ratio. We believe that despite many unfavorable factors, such as high shipping costs, repeated US tariff policies, and Amazon.Com Inc closure, the development of export e-commerce in the future is still the trend of the industry, and we are still optimistic about the future prospects of the industry.

Under the big β of the industry, we continue to be optimistic about the brand, boutique and global investment opportunities of enterprises.2022 is the first year of concentrated listing of cross-border e-commerce enterprises, and there are many enterprises in the listing process, such as Seville era, Zhiou Technology, Sanbaisuo, Huabao Xinneng, Green United Technology, three-state shares, Glibo, Yanwen Logistics, Zi Muyu and so on: we believe that as more and more enterprises go to the capital market, more and more products begin to go global. The industry is expected to continue to bring branding, boutique, globalization opportunities.

Investment advice:We are optimistic about the development opportunities of industry platforms: tripartite platforms (BABA Express, Shopee, Lazada, Amazon.Com Inc, Pinduoduo, etc.), independent stations (SheIn, Shopify Inc, Anker (owned by Anke Innovation), PatPat, etc.), vertical leading sellers (pet (Yuanfei pet), mobile energy storage (Huabao new energy), home (to European technology), electronics (Green Union technology), etc.), generic sellers (Saiwei era, three-state shares, etc.)

Risk hints: freight rate fluctuation risk, exchange rate fluctuation risk; global macro-economy is not as expected; copyright litigation risk; overseas competition leads to shipments less than expected; Amazon.Com Inc platform impact.

Export e-commerce series 2: portable energy storage goes global, which is the representative of "made in China + global marketing" and the trend of products going out to sea.

The global trend of China's portable energy storage is a typical representative of the "made in China + global marketing" mode.Overseas portable energy storage products are popular in 2022, benefiting from the demand for outdoor and emergency scenarios, the industry maintains rapid growth, and according to the China Chemical and physical Power Industry Association, global shipments are expected to reach 31.1 million units in 2026, maintaining the rapid growth of CAGR48%, when the industry scale is expected to reach 90 billion yuan. Although the product sales network is spread all over the world, the manufacturing source and head players are dominated by Chinese enterprises. About 90% of the products are manufactured in China, and Huabao Xineng, Zhenghao Technology, Delanminghai and other enterprises have been in the forefront of Amazon.Com Inc BSR for a long time. This not only depends on the strong momentum of "made in China", but also the successful exploration of the globalization of Chinese products. We believe that more and more Chinese-made products will go global in the future. Enterprises not only need to rely on "made in China-Smart" to create the ultimate cost-effective goods, but also need to go global to enjoy the dividends brought by branding and technological research and development.

"made in China + Global Marketing" is also the trend of Chinese product branding.2022 is the first year for many export e-commerce to go public: Huabao Xinneng, Yuanfei Pet, Yanwen Logistics, Saiwei era, Yidian World and many other enterprises began to go to the capital market to empower, including pan-product sellers, boutique sellers, service vendors, logistics enterprises and so on. The year 2022 is also a year for Chinese platforms to vigorously expand overseas markets: Pinduoduo Temu platform launched in the United States, BABA continued to increase Lazada investment and expand the European market, Tiktok launched a global live e-commerce feast, extreme Rabbit Express continued to expand the Middle East-Africa and other markets, Shein has become the world's top unicorn. Chinese enterprises and Chinese products have an unprecedented desire to go global: (1) benchmarking drive: the global success of enterprises represented by Shein has set a benchmark for giants to go out to sea. BABA, JD.com, Pinduoduo, tiktok and other platforms have not only begun to lay out Europe and the United States, but also continue to lay out emerging markets such as the Middle East, Southeast Asia, Latin America and Africa. (2) opening the path: the explosive growth of B2C/B2B export e-commerce brought about by the epidemic since 2020 has opened the path for many Chinese enterprises to sell their products to the world, and many enterprises, such as Saiwei and three States, have also grown rapidly with the help of tuyere, and have entered the capital market one after another. (3) Ecological prosperity: compared with the previous individual operations, enterprises now go to sea mainly based on ecology, including not only products, but also SaaS, logistics, marketing, platform and many other links. The ecology of going out to sea is booming, the links of enterprises going to sea are constantly simplified, and the cost is constantly reducing. (4) domestic pressure: domestic consumption power is under great pressure from the economic downturn, so going out to sea is not only a firm direction for some enterprises, but also a choice that some enterprises have to make. We believe that under the condition of high base and steady growth of export e-commerce, "made in China + global marketing" has gradually become the consensus of products going out to sea, and made in China can determine the cost of products, but only global marketing can bring higher product premium and return more product profits to enterprises such as "specialization and innovation".

We continue to be optimistic about the "brand, technology, channel, supply chain" opportunities brought about by the globalization of Chinese products. In the short term, due to the uncertainties brought about by the global economic downturn and geopolitics, export e-commerce is experiencing another round of pain.However, we believe that with the help of policy promotion, market development, ecological improvement and cost advantage, the industry is expected to improve in the long run. We continue to be optimistic about: (1) tripartite platforms (BABA Express, Lazada, Pinduoduo Temu, etc.); (2) leading vertical sellers (pet (Yuanfei pet), mobile energy storage (Warburg Xinneng), home (to European technology), 3C (Anke innovation), etc.); (3) pan-product sellers (Saiwei era, three-state shares, Hua Kai Yibai, etc.) (4) Logistics & service enterprises (Yanwen Logistics, Longteng Group, Shifang, etc.).

Product features:Portable energy storage has the characteristics of safety, portability, stability, environmental protection and so on. Compared with traditional diesel generators and lead-acid batteries, it has great advantages. These characteristics determine that portable energy storage has a very good application scene, outdoor activities and emergency reserve are the main use scenarios. At present, the capacity is mainly divided into 100-500Wh, 500-1000Wh and 1000Wh.

Market space:At present, the market is mainly in Europe, America and Japan. The prevalence of outdoor culture and the disaster-prone geographical environment in some areas have made the United States traditionally the most important seller of portable energy storage. In 2020, the United States accounted for 47.3% of global applications, while Japan, which ranked second, had frequent disasters such as earthquakes, making the emergency function the main application. According to the China Chemical and physical Power Industry Association, the replacement of traditional fuel engines is expected to reach nearly 20% by 2026. Global shipments reached 31.1 million units, maintaining the high growth rate of CAGR48%. Based on the logic of rising volume and price in the future, the scale of the industry is expected to reach 90 billion yuan.

Market pattern:(1) domestic enterprises: mainly including Huabao Xineng, Zhenghao Technology, Delaminghai, Anke Innovation, etc., with their first-mover advantage and deep cultivation of overseas markets, they have occupied a place in the global market; follow up XIAOMI, Huawei, Bulls and other domestic well-known companies continue to join the industry (2) overseas enterprises: overseas players mainly include American companies such as Champion Power and Westinghouse, who continue to maintain industry competitiveness by virtue of their local advantages, especially in the US market; (3) Product market: due to the relatively low threshold and large, small and medium-sized players, the product competition between 100-500Wh is the most fierce. And 500-1000Wh and 1000Wh above, products because of its relatively high threshold, the growth rate is still good, but also Anke, XIAOMI and other enterprises continue to enter the direction.

Cost price:(1) Raw material cost: the cost of portable energy storage equipment mainly comes from the core, electrical control, structural components, accessories and other parts, of which the core cost accounts for the largest proportion. From 2021 to the second quarter of this year, some cell costs remain high, looking forward to a reduction in costs brought by subsequent scale advantages; (2) cost of sales: at present, most online portable energy storage devices are sold through DTC and three-party platforms. Among them, DTC is directly affected by advertising costs, and advertising traffic costs continue to rise with the implementation of overseas privacy policies; while for sales on three-party platforms, taking Amazon.Com Inc's general goods as an example, the platform needs to extract 8% of the 15% commission; (3) Freight costs: at present, domestic power sources are mainly sent to the United States and other places by sea, and the continuous decline in shipping prices is conducive to reducing product transportation costs. (4) Terminal price: we believe that the price reduction space of enterprises is limited on the basis of raw materials, cost of sales, platform commission and freight, while in the accelerated competition in the industry, large companies with cost and channel advantages will continue to be dominant; at that time, many small and medium-sized sellers will withdraw from the market one after another, and the industry is expected to usher in the logic of rising volume and price.

Outlook for the future:We continue to be optimistic about the growth of the industry, but there may be a lot of uncertainty in the short-term price war. (1) short-term new growth points are domestic and European demand: the United States and Japan have rapidly become the Red Sea market due to the large outdoor emergency demand and well-developed e-commerce channels, while the domestic outdoor economy is growing very fast. and there are many uncertainties in the European energy crisis, so we are optimistic about the new incremental opportunities brought by the domestic and European markets. (2) We are optimistic about the companies with advantages in channel, cost control, technology and marketing. Price war is the only way for many industries. With reference to the development path of domestic sharing portable battery before, we believe that after this industry competition, companies with advantages in channel, cost control, technology and marketing are expected to enjoy long-term dividends; (3) We are optimistic about the increase in sales brought about by the big boost in the fourth quarter. Sales in the United States declined month-on-month in August, first, Prime Day greatly promoted part of the demand in July, second, the August of outdoor camping has passed, and third, the US penetration rate has been at a high level; we are optimistic about the rebound in industry sales in the fourth quarter: on the one hand, there is a big boost such as Singles' Day, Christmas and Black 5 in the fourth quarter, on the other hand, the fourth quarter is also accompanied by rising demand.

Recommended concerns are as follows:Anke Innovation (Trading), Huabao Xinneng (Dianxin & Home Appliances), XIAOMI, Zhenghao Technology.

Risk hint: the industry competition aggravates the risk, the overseas sales fall short of the expected risk, the tripartite platform policy compliance risk, the industry growth below the expected risk.

Export e-commerce series 3: e-commerce goes out to sea across borders, and the giant leads the sail

Since the beginning of this year, the giant has made frequent actions in the direction of cross-border e-commerce, Meituan e-commerce launched online "global shopping"; Pinduoduo launched Temu to enter the United States in September; Tiktok accelerated its global layout, increasing investment in markets such as Southeast Asia, the United Kingdom and the United States; Shein layout in Brazil, Japan and other places; BABA injected capital into Lazada and released independent stations. The reason is that cross-border e-commerce is one of the few businesses that have bucked the trend since the epidemic. Driven by factors such as the vigorous promotion of policies, the improvement of e-commerce penetration in emerging markets, and the absolute performance-to-price ratio of Chinese goods, giants have explored a new growth curve one after another. the era of e-commerce led by the giant has begun.

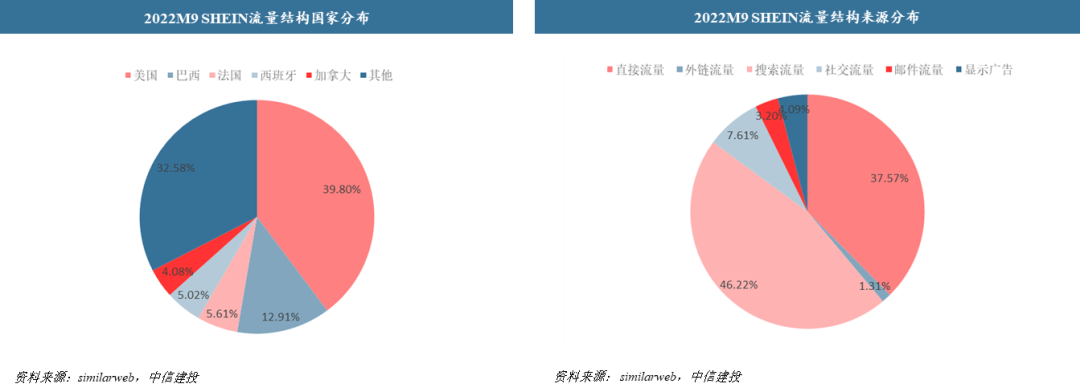

(1) SHEIN: fast fashion cross-border leader, the rapid growth of users and GMV.SHEIN is an international B2C independent fast fashion cross-border e-commerce company. From 2017 to 2020, GMV has maintained an annual growth rate of over 100%, with 2021 GMV exceeding 100 billion RMB. In the first half of 2022, the company achieved US $16 billion in GMV, an increase of more than 50% over the same period last year, and is expected to achieve its 22-year GMV target of US $30 billion ahead of schedule. The company's revenue mainly comes from European and American markets, accounting for about 70%; the markets in the Middle East, Latin America and Southeast Asia are growing rapidly. In terms of cost, the company's 21-year gross profit margin is about 55%, and the net profit rate is about 3%. The cost mainly comes from logistics costs and sales expenses, which account for about 50%. According to sensor Tower data, the company's MAU and downloads continue to improve, in the "people, goods, market" aspects of the company has a strong competitive advantage. (1) in terms of "people": the average unit price of the company is US $60-70, which is mainly aimed at the middle consumers; at the same time, because of its cost-effective fast fashion characteristics, its products are very popular with Generation Z. according to Sensor Tower, 37% of the company's google play users are under 25, while Amazon.Com Inc is 21%. In terms of gender, the majority of Shein users are women. According to sensor Tower, women account for 72% of the company's 22Q3google play users, while women account for 43% of Amazon.Com Inc. With the acceleration of SheIn in men's clothing and other investment, the proportion of male users is expected to further increase in the future. (2) in terms of "goods": the company's main business is fast fashion women's wear, while the category continues to expand. Actively expand to men's wear, children's wear, accessories, shoes, bags and other fashion items, the company has 12 brands, such as MOTF, SHEIN, PESTIN, etc., each brand has different product positioning and pricing. (3) in terms of "market": the company started as an independent station and first used 1P mode, but with the continuous increase of scale and traffic, the company continues to move towards an open platform. at the same time, the company also further increases its traffic by opening stores in Amazon.Com Inc channels and offline stores.

(2) AliExpress & Lazada: (1) AliExpress: AliExpress started as a B2B model, and then expanded to B2C Magi C2C, cloud computing and payment services.According to similarweb, China Express ranked seventh in terms of global online market traffic in January 2022. AliExpress enables consumers from all over the world to buy goods directly from Chinese and even global manufacturers and distributors, which is an important layout of BABA's overseas globalization strategy. The seller on the website can be a company or an individual. Business covers more than 220 countries or regions around the world, the main trading markets are Russia, the United States, Spain, Pakistan, France and other countries, supporting 18 language sites. It is different from Amazon.Com Inc in that it only serves as an e-commerce platform and does not sell products directly to consumers. In terms of B2B, BABA International Station has served 26 million + overseas buyers and 200000 + sellers, with a cumulative export value of more than 100 billion US dollars; in B2C business, the number of overseas transaction buyers has exceeded 150 million, and the seller side of the platform has covered 22 industries, supporting local payment methods in 51 countries; Taobao Tmall merchant resources can be accessed with one click. "Cangfa + supply + market" multi-wheel drive, AliExpress comprehensive capacity continues to improve: (a) Cangfa: over the past 22 years, the preferred warehouse orders have increased 6 times, South Korea's Weihai warehouse can reach 3 days; overseas warehouse orders have increased by 30%, mainly from the European and American markets, and can reach 5 days in the core 9 countries of Europe. (B) supply: the company has high-quality domestic companies and individual suppliers. In 2022, more than 1600 merchants have been transformed into gold medal sellers, more than 400 merchants have been transformed into sellers with annual sales exceeding US $1 million, and more than 1000 Mall sellers have been introduced. (C) Market: the company has also been effective in expanding into emerging markets. Buyers have increased significantly in emerging markets such as South Korea, the United States and Brazil, and the penetration rate in the international market is expected to break further in the future. (2) Lazada:Lazada is the leading e-commerce company in Southeast Asia, targeting "Taobao" and "Tmall" in Southeast Asia respectively with Shopee. The main e-commerce model of the platform is B2C. Local brands in Southeast Asia and Chinese trend brands are the main sellers. Consumers in six Southeast Asian countries are the main users. Lazada has a logistics network and payment system that fully covers Southeast Asia. The number of active consumers in fiscal years 2017 and 2021 reached 23 million and more than 100 million respectively. The CAGR reached 63%. At present, BABA holds more than Lazada80% and has an absolute controlling shareholding. At the same time, BABA provides personnel, technology, traffic and other support for the company. In terms of platform realization, similar to domestic Taobao e-commerce, it mainly comes from commission, advertising, payment and value-added services, of which the commission rate of LazMall platform is between 4% and 6%, the advertising monetization rate is about 2%, the payment rate is about 2%, and the monetization rate of value-added services is about 1.2% color 1.7%.

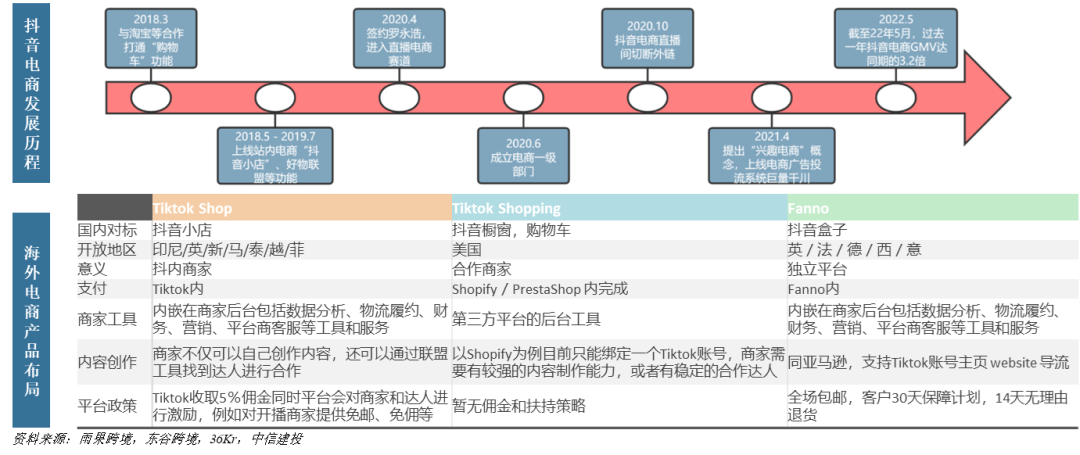

(3) Tiktok: taking the replication of domestic mature model as the overall strategy, it is still in the exploratory stage.Tiktok e-commerce draws lessons from the development experience of domestic Douyin e-commerce, relying on the huge traffic entrance of Tiktok, gradually extends the domestic mature model to overseas markets. Since 2020, Tiktok has gradually carried out its layout in North America, Southeast Asia, Europe and other places, building e-commerce tool system, improving e-commerce infrastructure layout, and providing various forms of e-commerce services. Tiktok e-commerce GMV for the whole year of 2021 is about 1 billion US dollars. In the first half of this year, GMV has reached last year's volume, the annual GMV target is about 2 billion US dollars, and the 2023 GMV target is 23 billion US dollars. Tiktok e-commerce team also set a target of 470 billion US dollars GMV within five years this year, and plans to complete the expansion of more than 10 key countries by the end of 2023. Tiktok draws lessons from the successful experience of Douyin e-commerce to build a closed-loop e-commerce. The current development trajectory of Tiktok e-commerce is basically the same as that of Douyin when it tested e-commerce in China. Douyin's follow-up operation experience can be used by Tiktok (e-commerce and payment business in major focus stations) and is expected to help it achieve great-leap-forward growth. Reviewing the development process of Douyin e-commerce, we can see that the whole domestic live e-commerce has experienced the development stage of "function pilot-external chain cooperation-independent closed loop-live broadcast with goods-independent platform", and through the creation of an independent e-commerce platform, expand e-commerce business except the main station. Tiktok e-commerce model is similar to domestic Douyin e-commerce. At present, it is divided into three parts: Tiktok Shop, Tiktok Shopping and Fanno, which respectively target domestic Douyin stores, Douyin shop windows and Douyin boxes. The open areas, payment models and platform policies of each part of the business are distributed differently according to regional e-commerce penetration. We believe that the overall e-commerce stage of Tiktok is at an early stage, which is still dominated by third-party cooperation, which is 3-4 years later than the domestic Douyin commercialization timeline. Relying on the huge traffic entrance of Tiktok, the mature domestic live e-commerce model is gradually extended to overseas markets, and the annual e-commerce GMV in 2021 is about US $1 billion. Regional layout, the performance of the newly opened market is strong, we believe that the European and American e-commerce market is relatively resistant, and the huge increment of e-commerce is expected to appear in Southeast Asia in the short term. E-commerce will be the most important increment of Tiktok except advertising in the future. The GMV target for this year is about $2 billion, the GMV target for 2023 is $23 billion, and it is expected to reach more than $50 billion in 2024.

(4) Temu: the first stop to enter the full range of e-commerce platform in the United States.Cross-border e-commerce Temu made an initial attempt at its first stop in the United States on September 1, 2022, hoping to create a low-cost cross-border e-commerce platform for full-product e-commerce. The Temu platform unifies the pricing of investment goods and overseas implementation, opens the market through pricing in the short term, focuses on mid-range users in the long term, and emphasizes the brand value of the platform rather than explosive products strategy. According to Sensor Tower data, Temu US market downloads and MAU continue to rise, with an average daily GMV of US $1.5 million. GMV is expected to reach US $300-500 million by the end of the year, US $3 billion in 23 years, and the company's target is US $50 billion within 5 years. Temu overseas marketing expenses are 7 billion yuan. We believe that Pinduoduo relies on the advantages of the domestic cost-effective supply chain, and under the attraction of strong investment and extremely low-cost goods, platform users are expected to continue to improve. Temu short-term goods yard positioning is different from the main station, but the long-term development strategy is the same. (1) about "people": unlike Pinduoduo's main site, which focuses on long-tail users, the target group of Temu users is mid-range users. Although Temu is offering discounts of 20% on the first order, $49 free of freight, $0.99 and 30% coupons at this stage, we believe that this is only a strategy for Temu to attract attention and open the market in the early stage. Due to the high cost of going to sea for a long time, the logistics cost in overseas market is high and difficult to compress, the proportion of performance cost in unit price will be difficult to reduce to the extreme, and it is easy to expand the loss by focusing on low-end users for a long time. Therefore, the current price of $0.99 has also gradually rebounded and set purchase restrictions and other strategies, and the unusually low prices will be gradually withdrawn in the later stage, which is more in line with the platform's strategy of focusing on brand value rather than the popular style of large items. (2) about "goods": in terms of product categories, Temu first introduced beauty makeup and home furnishings in the early days, but long-term hope to build a full range of e-commerce, 3P model will also gradually improve, really become the "overseas version of Pinduoduo" rather than "Shein platform version". In terms of pricing, the current stage of Temu pricing power is in the hands of the platform, and hope that the supplier's price is low enough, so it is more suitable for the factory as the main supplier, similar to Pinduoduo's early development path. (3) about "market": in domestic e-commerce, Pinduoduo takes single sku as its core recommendation logic, while Taobao takes store praise, sales volume and store grade as important reference factors. In overseas e-commerce, Amazon.Com Inc's strategy is similar to Pinduoduo's main station. Temu stressed in the official live broadcast that its store orientation of all categories is different from that of China, but store orientation is easier to attract brand goods, and branding is "ultimately the same."

Risk hints: the global macroeconomic downturn leads to lower-than-expected risks in e-commerce penetration and user spending power; Fed hawks exceed expectations; China-listed stocks are delisted; exchange rate fluctuations bring about exchange losses; freight rate fluctuations lead to higher costs; overseas competition intensifies or faces the risk of lack of competitiveness; localization operation is not as expected; tariff risk increases significantly. The risk brought by the national local enterprise protection policy; the risk of a sharp rise in supply chain costs; the risk of copyright litigation; the risk of anti-monopoly policy.

Edit / jayden

出口跨境电商进入蓬勃发展阶段,21年规模已近1.5万亿,有望持续保持高速增长。近年来中国跨境电商保持快速增长趋势,根据海关总署数据显示,2021年,我国跨境电商进出口1.98万亿元,同比增长15%;其中出口跨境电商规模达1.44万亿元,同比增长24.5%,虽然出口电商受到海运费上涨,亚马逊封店等一系列影响,但其仍保持高速增长,充分证明跨境电商出口的市场活力和增长韧性。根据企查查数据显示,近5年来,我国跨境电商相关企业注册量逐年上升。2021年新增1.09万家,同比增长72.2%。我们认为,中国跨境出口电商的发展逐渐成为大势所趋,也意味着企业需要实现从产品出口到品牌出海的跨越。

出口跨境电商进入蓬勃发展阶段,21年规模已近1.5万亿,有望持续保持高速增长。近年来中国跨境电商保持快速增长趋势,根据海关总署数据显示,2021年,我国跨境电商进出口1.98万亿元,同比增长15%;其中出口跨境电商规模达1.44万亿元,同比增长24.5%,虽然出口电商受到海运费上涨,亚马逊封店等一系列影响,但其仍保持高速增长,充分证明跨境电商出口的市场活力和增长韧性。根据企查查数据显示,近5年来,我国跨境电商相关企业注册量逐年上升。2021年新增1.09万家,同比增长72.2%。我们认为,中国跨境出口电商的发展逐渐成为大势所趋,也意味着企业需要实现从产品出口到品牌出海的跨越。