In the process of growing up in China's post-80s and 90s, the Levi's, which sells for nearly 1,000 yuan, is the same as Nike Inc's board shoes, Adidas sweatshirts and the latest iPod-it is a symbol of fashion trendsetters on high school campuses, and almost all young people have longed for a pair of red-label Levi's jeans.

Then, with the reshaping of people's consumption habits by e-commerce and the invasion of many fast fashions, such as Uniqlo and Hymm, the classic Levi's lost in "sticking to the classic" and gradually no longer won the altar by young people.

This time back to the public view, once again listed in the United States, Levi's is ready, are you still wearing his jeans?

How does Big Brother return to the $5 billion club?

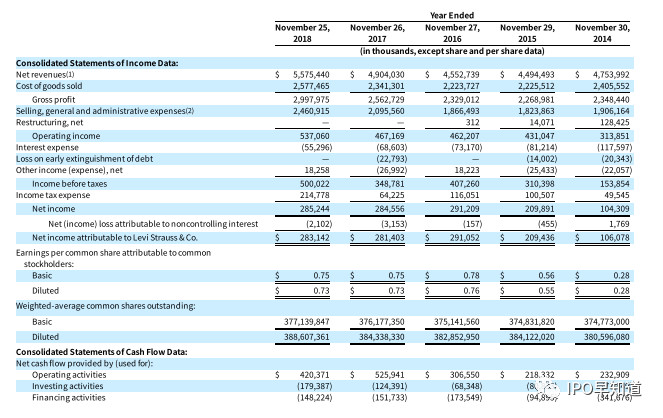

According to Levi's 's financial report,In the fiscal year ended November 25, 2018, Levi's Group's sales reached $5.58 billion, up 14% from the same period last year.Of this total, direct retail sales rose 18 per cent year-on-year, wholesale channel sales increased 11 per cent year-on-year, net profit was basically flat at $285 million, and debt decreased by 50 per cent to $444 million from $910 million in 2011.

Source: prospectus

Levi's highlighted in its earnings report that this is the first time since 1999 that Levi's Group's annual revenue has exceeded US $5 billion. This is also the proof that Levi's is back on the path of healthy development under the market shock, aesthetic changes and performance turbulence in the past 20 years.

Returning to the $5 billion club, Levi's also has the strength to take advantage of the hot iron to usher in a big move in the capital market.

You know, after Levi's 's performance reached $7.1 billion in 1997, it never broke that figure, but its performance plummeted. It wasn't until 2011 that the addition of Chip Bergh, a former CEO of Procter & Gamble Co, brought Levi's to life.

In Chip Bergh's plan, Levi's must become a true lifestyle brand, not just a jeans maker.

In the early years, the average age of Levi's consumers was still 47, and the decline in performance was hampered by restrictions on the main product, men's pants. thereforeFirst of all, Chip Bergh's strategy is to develop women's clothing business and new products while stabilizing the existing core business.These new categories, which are in line with the market demand trend, have re-attracted people's attention and brought new profit growth points to Levi's. The product structure of Levi's began to change, and the proportion of core men's wear business continued to decline. In the long run, Levi's also plans to further expand other product categories, such as shoes and coats, which accounted for 6 per cent of net income in fiscal 2018.

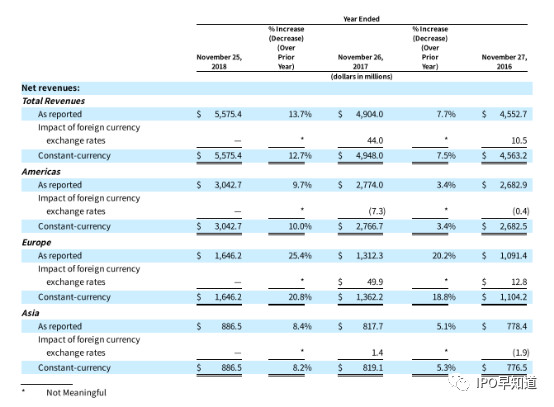

Another important strategy of Chip Bergh is globalization layout.He actively expanded beyond Europe and the United States, including China, India, Brazil and other emerging markets. At present, Levi's Group has about 3000 outlets in more than 110 countries around the world. In the fiscal year ended November 25, 2018, Levi's Group's sales in the US market were $3.043 billion, up 10% from a year earlier, sales in Europe were $1.646 billion, up 20.8% from a year earlier, and sales in Asia, including China, were $887 million, up 8.2% from a year earlier.

Source: prospectus

With regard to the subsequent global layout, Chip Bergh stressed that the Chinese market has always been the top priority of the group's development strategy. At present, only 5% of the brand's sales come from China, which has great potential to improve compared with 20% of its global clothing market.

In addition to developing new products and global layouts, Chip Bergh also sees opportunities for joint cooperation.In recent years, Levi's has been working with other brands or designers to launch joint cooperation series to regain the love of young consumers, such as Supreme, Off-White, Air Jordan and so on. Levi's x Air Jordan 4 series has become the finalist of the top ten sneakers in 2018. The sense of scarcity created by cooperation with well-known brands is one of the main factors to get a positive response from consumers, and it also creates a hot topic for Levi's.

For the IPO, the document shows that Levi's plans to raise $100m through IPO for "general corporate purposes" such as working capital and capital expenditure, and seeks to expand its operations in emerging markets such as China, India and Brazil. But this amount may be adjusted later, and the media previously reported that Levi's 's goal is to raise $600m to $800m.

It is the right time to fight again with IPO.

For the clothing industry, nothing can drive sales and the market more than the current trend.The revival of vintage cowboy style has created new opportunities for Levi's.

John D Morris, a senior brand clothing analyst, said, "now is a good time for Levi to go public again, as the growth of casual wear tends to level off and consumer preferences once again shift to retro American denim style." "

According to a study released by NPD Group in September 2018, the value of the American denim market has reached $16.4 billion. The denim market is expected to grow by 6.7 per cent from 2018 to 2023, according to Mordor Intelligence, a research firm.

There are signs that the denim business is much better than before. Although the competition in the industry will be more obvious, it is clear that Levi's, which has a history of more than 166 years, is capable of capturing the mass market. After Levi's submitted its prospectus, the share prices of American denim companies such as Abercrombie&Fitch, American Eagle Outfitters and VF fell.

And, with the rapid development of Internet e-commerce, people are more inclined to buy well-known brands of clothing online. Levi's is one of the brands with high recognition. According to the annual list of American consumers' favorite brands released by US market research agency Morning Consult in May 2018, Levi's is the only fashion brand selected, with a positive rating of 71.9 points.

Other risks

In an interview with the media at the end of 2018, Chip Bergh said"when the brand is successful, the biggest risk is complacency, and there will be more changes to Levi's in the future. "

Levi's may not be complacent, but it faces other risks.

According to SEC documents, the top 10 customers of Levi's Group accounted for 30%, 28% and 27% of total net income from 2016 to 2018, and the company did not sign a long-term contract with them. If the main customers of these companies suddenly stop the agreement, it will have a greater adverse impact on the performance and financial position of the company.

And Levi's is not the only denim company expected to enter the capital market in the near future. Weifu has previously said it plans to spin off its jeans business, including Lee and Wrangler, into a separate listed company, which is expected to be completed in the first half of 2019.

In addition, the decline of US retail industry, the impact of online retail companies and the uncertainty of global trade relations are all negative factors that can not be ignored.

In any case, as the "ancestor" of jeans, Levi's has been popular for a century and a half, from the United States to the world, and has become a fashion acceptable to men, women and children all over the world. Once again landing in the capital market, whether you can get the preference of investors again depends on Levi's.