Under the weak revenue growth of Netflix (NFLX.US), Disney (DIS.US) has joined the streaming battlefield with a new model.

The Zhitong Finance app learned that Netflix's performance in the fourth quarter was poor, with revenue of 4.19 billion US dollars, up 27.4% year on year, slightly lower than the forecast of 4.21 billion US dollars; net profit was 134 million US dollars, down 28% year on year. Furthermore, free cash flow deteriorated to negative $1,315 billion, up 1.5 times year over year.

Although Netflix's total number of paying users increased by 8.84 million to 139 million in the fourth quarter, which was better than company guidelines and market expectations, its deteriorating cash flow and debt have increasingly become a “heartache” in the market. At this point, Disney is getting closer and closer with Hulu.

After Disney completed the acquisition of Fox at the end of July last year, the streaming media Hulu was completely included in the bag. Currently, Disney has three major streaming platforms, and each focuses on different types of content: ESPN+ focuses on live sports, Disney Play focuses on family fun content, and Hulu targets a variety of people, including R-rated and adult content.

On the streaming battlefield, Netflix and Disney are in different camps. Netflix represents the high-risk and high-return “subscription” faction, while Disney has incorporated its strategy in the film industry, and “subscription+billing” seems to be moving more steadily.

Radical Netflix

In 2013, Netflix achieved great success with its debut novel “House of Cards”, gained worldwide popularity, and has gone all the way to where it is today through the “homemade content+user subscription” model. However, problems also followed one after another. Problems such as Netflix's worsening cash flow, accelerated money burning, and increased debt costs became a crisis in the eyes of Wall Street analysts.

The user subscription model is like a lever, leveraging high-quality content while also leveraging content risk. Since this model is extremely dependent on users, the success or failure of homemade content has to be linked to user subscriptions. If a homemade drama does not drive an increase in user subscriptions, it can be considered a failure.

This is like a blockbuster phenomenon in the game industry. No one can predict whether the content will become a hit until it is introduced to the market. Judging from now on, although Netflix has received many awards, the only IP content with a long cycle is “House of Cards,” and the drama's popularity declined sharply in the final season after its reputation declined.

Tianfeng Securities believes that Netflix's winning films at the Emmy Awards are mainly word-of-mouth dramas. What actually drives the movie-watching craze is still Strange Stories, Women's Prison, etc. that suit the public's taste in watching movies. However, although the company said that it received 80 million viewers one month after the release of Bird Box, the interactive selling point was poor, and they believed that “where is the next house of cards” or “who is Netflix's old friend” is the company's problem.

This is also a flaw in the user subscription model that cannot be ignored. Furthermore, some Wall Street analysts said they would prefer Netflix to see more profit growth opportunities rather than just subscriber growth data.

Attack on Disney

Disney, on the other hand, has followed its billing method in the film and television industry. Through the “subscription+split” model adopted by Hulu, it appears to be more stable and stable.

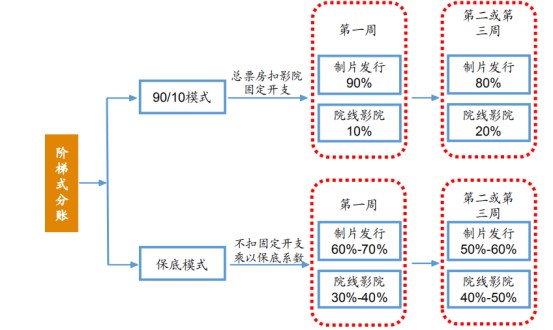

The division of accounts in the North American film and television industry has made the region's film companies very powerful. Previously, Disney raised the split ratio to a fixed 65% before “Star Wars 8” was screened, and the film must be screened in the largest cinema for at least 4 weeks. This is extremely demanding for theaters, but in the face of Disney, which has many popular IPs, theaters also have to compromise.

(Source: Hollywood Research Institute, AMC Financial Report, GF Securities Development Research Center)

Producers and theaters in North America usually use tiered billing rules, and producers often receive a higher percentage of profit than theaters. Disney, which has always been strong in the movie market, is now also introducing a split account model into streaming media operations.

In the operation of Hulu, Disney uses a “subscription+billing” model. As a content provider, while directly exporting content to subscribers through Hulu, it also divides accounts for Hulu's advertisements and copyright. Thus, unlike Netflix, which bets on the success or failure of its own content on user subscriptions, Disney shares production risks through the “splitting of accounts.”

The Zhitong Finance app learned that Hulu announced at the beginning of 2019 that it had 25 million subscribers. Currently, there are three billing plans: Hulu is 7.99 US dollars per month, Hulu does not include ads at 11.99 US dollars per month, and Hulu+ TV channels at 39.99 US dollars per month.

“Small but beautiful” iQiyi

At home, IQ.US (IQ.US), which is often used as a benchmark for Netflix, has also developed a third billing method, but compared to Netflix and Disney, this model is still only “mosquito meat.”

iQiyi is the first platform in China to launch a split account model. The split account online drama “Demon Out of Changan”, which was launched in November 2016, had a return on investment of over 400% over a year-long billing cycle. The paid splitting model is that paying members can watch major online movies and online series for free, while drama operators can obtain relevant accounts based on the number of effective hits on the series.

Currently, Youku and Tencent Video have also introduced their own account splitting standards. The distribution of online dramas in the market is divided into two types: 1. Top online dramas mainly sell copyright fees, and are also divided according to the number of clicks; 2. Each time a person watches for more than six minutes to count a valid click, the account can be split 0.42 yuan.

Looking at the online drama “Fuyao,” according to iQiyi's billing rules, the third stage of this drama's account splitting will end on September 15, 2019. According to the Yunhe data prediction model, by the end of the billing period, the total return of the producer and the total broadcast value of the producer+platform were about 730 million yuan and 970 million yuan respectively.

Seen from this perspective, the split account model can be described as a win-win situation for producers and platforms, and iQiyi, as a platform, can also greatly reduce production risks, but this is not the case.

In reality, top dramas don't choose a model that simply relies on clicking to split accounts. After all, top dramas have high content value, and their own bargaining power is also high. It can achieve profit through copyright sales, so it will not bear the risks associated with account splitting. Therefore, the split account model is more suitable for “small but beautiful” content. As competitors follow up on high-quality content, iQiyi will still face the possibility of losing potentially popular content.

Judging from the above three streaming media styles, Netflix, Disney+Hulu, and iQiyi all have different levels of aggressiveness, but the battle line has always been “content+copyright.” Judging from this, Disney, which has a rich IP, may catch up with Netflix at a faster pace.