Recently, Auto Home, the largest car traffic lead platform in China, was collectively “uprised” by many car dealers for bucking the trend and increasing prices. Affected by this news, Auto Home's stock price also experienced a sharp drop.

A number of dealers have suspended cooperation

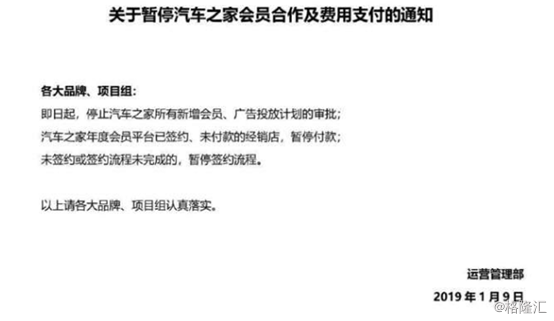

On January 13, according to some sources, Shanghai Yongda Group issued a notice suspending all “cooperative approval of new members and advertising plans by Auto Home. Those that have not signed a contract will be suspended; those that have signed up for the membership platform without payment will be suspended, and payments will be suspended.”

Actually, this isn't the first time a car dealership and a car home are in conflict. Currently, at least 4 dealers in the market have intensified their conflict with Auto Home, including Zhongsheng Group, Express Group, Pangda Group, and now Yongda Group.

Earlier, Li Hong, CEO of Express Group, publicly stated on Weibo: “A vertical website that started as a car dealer actually wanted to rely on monopoly to erode when it became prosperous.”

Li Hong also attached a screenshot of auto distribution industry analyst Li Yanwei's circle of friends on Weibo: In a previous report on the Internet, it can be seen that in recent years, prices for members of a certain website have continued to rise. Prices for the deluxe edition have already exceeded 510,000 yuan, but last year many dealers lost a lot of new car sales. “If vertical websites are abandoned, dealers can save some of the costs. If manufacturers adjust the dealer subsidy method and abandon bundled advertising subsidies and change to direct subsidies, it is beneficial for dealers to arrange their own budgets flexibly.”

It is worth noting that there has been news earlier that China's second-largest dealer group, Zhongsheng Group, has issued internal documents stating that it will suspend cooperation with Auto Home. The main reason is that drainage costs are getting higher and higher due to limited channels for attracting customers.

At the time, Auto Home also issued a statement saying that it had not received official information from official channels that Zhongsheng Group wanted to block Auto Home. The cooperation between Auto Home and Zhongsheng Group is mutually beneficial. Past cooperation has progressed very smoothly.

However, Li Hong also posted an internal email from Zhongsheng Group on Weibo this time, further confirming the veracity of the previous news that Zhongsheng and Autohome will be suspending cooperation.

Affected by the incident where several major dealers suspended cooperation, the stock price of Auto Home, which is listed on the US stock market, has plummeted.

As of yesterday's close, Auto Home's stock price fell 13.82% to close at 67.490 US dollars/share.

(Market source: Futu Securities)

Price increases against the trend have worsened the situation for dealers

According to our understanding, for car dealers to promote on relevant automobile websites, they first have to pay to buy members, and then the website will feed back online customer information to the dealer to help increase potential customer leads.

According to feedback from several major dealers, it is easy to see that Auto Home's fees for dealers once again rose again in 2019, which was the main reason that caused dealers to suspend cooperation.

An independent brand dealer said, “The dual-platform car and the standard version of Easy Car, which were launched last year, can still be accepted for a total of 190,000 yuan. This year, the dual platform must launch the deluxe edition and above. The cost has increased dramatically by 130,000 yuan, totaling more than 300,000 yuan.” According to another dealer, the discounted price of Auto Home's deluxe edition was 96,600 yuan last year, and the discounted price this year was 125,500 yuan. The price increase is already close to 30%.

Some dealer heads also said that in 2018, Auto Home's cheapest member cooperation still required more than 160,000 yuan a year, while well-run dealers only had a sales profit of more than 500,000 yuan a year. In 2019, Auto Home dealer members added smart and technological editions to the original standard and deluxe editions, which greatly increased membership prices.

For vertical automobile media of the same type, the cost of Understanding Car Die, which is making headlines today, is only about 100,000 yuan.

In addition, the lead conversion rate is too low, which also causes dissatisfaction among dealers. A person familiar with the matter said, “Forget the expensive websites such as Auto Home, Easy Car, Pacific, iCard, and Know Your Car. If there is little traffic now, fraud will begin.” Some dealers said, “Of the 2,000 leads we receive in a month, half are fake phone calls, empty numbers, or a large number of customers who have left no information at all.”

However, on the other hand, Autohome's almost monopoly position in the industry has also made many dealers feel helpless. Currently, Auto Home is the most visited car website in the world. Even though there are competitors such as Easy Car Network, Pacific Auto Network, iCard Auto, and Know Car, they are far from Auto Home in terms of magnitude. According to Alexa statistics, the average number of weekly views of Auto Home's website reaches tens of millions, while its competitors are only a few million.

According to statistics from Auto Home, Auto Home provided 110 million leads in 2018. Each dealer can obtain an average of 4,580 leads per year, and the conservative number of vehicles that help dealers sell is over 6 million vehicles.

In addition to Auto Home's increase in membership fees, the 2018 auto market was cold, and the sad days of dealers were also a major trigger for the outbreak of this incident.

Recently, the China Automobile Association released 2018 automobile sales data, showing that China's automobile sales in 2018 were reported at 28.08 million units, the first annual decline since 1990; passenger car sales in China in 2018 were 23.71 million units, down 4.1% from the previous year. The retail sales volume of passenger cars in December 2018 was 2.26 million units, a year-on-year decline of 19%.

By model, according to data from the Passenger Federation, in 2018, car sales were 11.17 million units, down 4% year on year, SUV sales volume was 9.51 million units, down 5.5% year on year, and MPV sales were 1.66 million units, down 17.4% year on year. Negative growth covered all market segments. Among them, since the second half of the year, the SUV market has declined significantly. In September-December, SUV sales declined by 10%, 15%, 18%, and 19%, respectively.

At a time when the entire automobile sales industry is in such a slump, Auto Home bucked the trend and raised membership fees, which is undoubtedly adding insult to injury for dealers.

Compared to the current situation where dealers are “under a lot of pressure” to survive, Auto Home's performance report is quite impressive. According to Auto Home's financial report for the third quarter of 2018, Auto Home's revenue for the third quarter was RMB 1,888.4 million, up 33.5% year on year; net profit attributable to Auto Home was RMB 681.3 million, up 59.9% from RMB 466.1 million in the same period last year.

Although its performance is still impressive, after selling to Ping An in China in 2016, in the eyes of many people, the current Auto Home is no longer the car house that Li Xiang founded in the first place.

In 2016, Australia Telecom, the original majority shareholder of Auto Home, sold 47.7% of its shares in Auto Home to Ping An Insurance Group of China, and Ping An of China officially joined Auto Home. After the acquisition was completed, Ping An of China quickly completely cleaned up the original management of Auto Home and began a transformation.

However, the current price increase of Auto Home bucked the trend and was also viewed by netizens as a sign that China Peace wanted cash flow.

Currently, Auto Home's cooperation has been suspended by many dealers due to price increases against the trend, which is likely to affect its advertising revenue, and at the same time, it is also likely to push the lead market with more car traffic to eager competitors.