Refined from Huatai's "Market Research report on Health products Industry"

Recently, an article entitled "10 billion Healthcare Empire Quan Jian, and the Chinese Family in its Shadow" was published on moments, and another health product fraud was exposed, less than half a year after the last Hongmao medicinal wine incident. For a time, the efficacy and value of health products were questioned by the public, and some people even commented that "the only effect of health products is that there is no harm."

Are health products really useless? What is the real health food industry like? Are there any conscientious health care products on the market? Huatai's health products industry research report may be able to take you to find out.

First of all, let's clarify the definition of health products:

Internationally, health products generally refer to dietary supplements (Dietary Supplements). The United States Department of Health and Human Services divides dietary supplements into traditional tablets, capsules, powders, functional drinks and energy bars.

In China, health food is health food, and the Food Safety Law is classified as "special food". According to the General Standard of Health (functional) Food, health (functional) food is a kind of food, which has the commonness of general food, can regulate the function of human body, and is suitable for specific population consumption, but not for treatment.

From the above two definitions, we can infer that Quan Jian's core products, magic foot pads, anion sanitary napkins, and fire therapy are not real health products. The magic of the legendary oriental magic medicine is absolutely unreliable, and all health products that claim to cure diseases should be kept away.

The health food industry in the period of growth

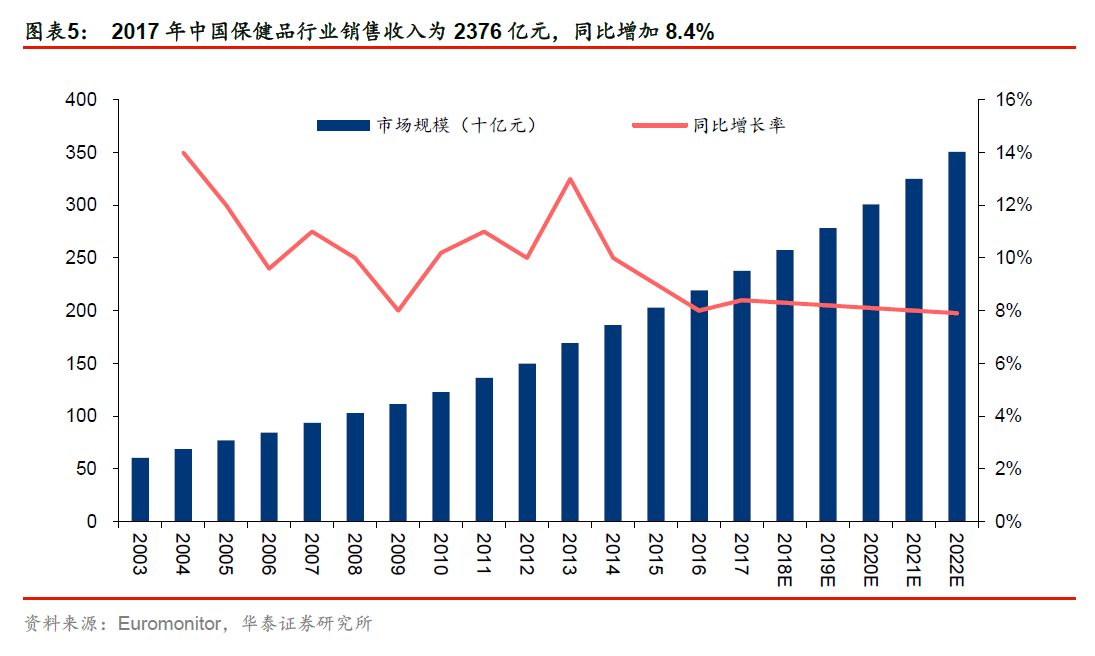

The growth rate of China's health products market is relatively fast, with industry sales revenue of only 44.2 billion yuan in 2002, 11.86 percent compound growth rate in 2002-2017, and 237.6 billion yuan in 2017. It is expected that the market size will reach 350 billion yuan in 2020.

In terms of sales, China's health product market accounted for 16% of the global health product market in 2017, making it the world's second largest consumer market after the United States.

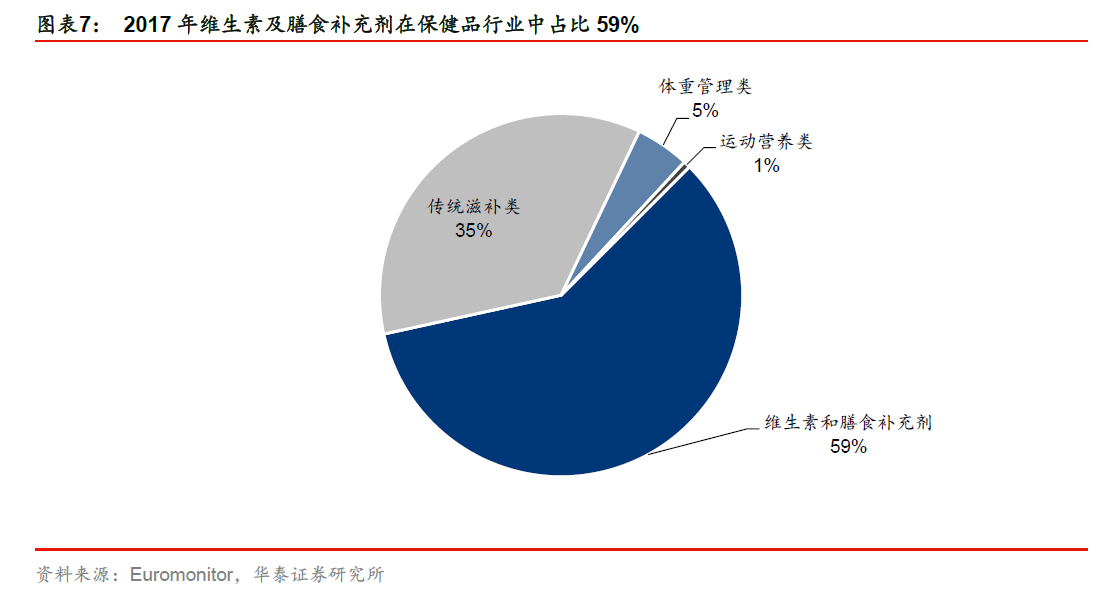

Specifically, vitamins and dietary supplements accounted for the largest proportion of health products in 2017, with a market size of 140 billion yuan, accounting for 59% of the total size of the health products industry, with a five-year compound growth rate of 12%, followed by traditional tonic products. the market size is 85.2 billion yuan, accounting for 35%.

Weight management and sports nutrition are emerging categories, the absolute scale is still small but the growth rate is relatively fast. According to Roland Berger's forecast, the industry size of weight management and sports nutrition will grow at a compound rate of 15% from 2017 to 2020, respectively.

Fierce competition and low industry concentration

China's health products industry has a large number of manufacturers and a high degree of market dispersion.

According to the statistics of the State Food and Drug Administration, there were 2317 manufacturers of health products in China by the end of 2017. Among them, the vast majority of manufacturers are small enterprises with weak brands, accounting for about 98% of all manufacturers.

In 2017, the CR5 of China's health products industry (the market share of the top five companies) was 19.8%.The producing area of health food in China is relatively concentrated, with about 50% of the enterprises located in six coastal provinces and cities, namely, Beijing, Guangdong, Shandong, Shanghai, Jiangsu and Zhejiang.

The top five market share of the industry are Infinite Pole, Nutrilite, Tomson Bei Jian, Tianshi Group and Dong E E Jiao. Among them, Infinity, Nutrilite and Tiensi are all direct selling enterprises. In the field of non-direct selling, Tomson Beijian has a great advantage in market share, with a market share of 2.9% in 2017.

The concentration of China's health products industry is lower than that of Australia and Japan, and similar to that of the United States. Compared with the world's major health product markets, the CR5 of China's health product industry in 2017 is slightly higher than that of the United States (18.4%) and slightly lower than that of Australia (33.2%) and Japan (24.6%).

Huatai believes that in China, the reason for the low concentration of the health products industry is that the industry was once under-regulated, the industry barriers are low, and it is easier for merchants to obtain the "Blue Hat Interactive Entertainment Technology" qualification of health products; and compared with other food industries, the profit margin of the health products industry is higher.