There are not many melons, but big is good.

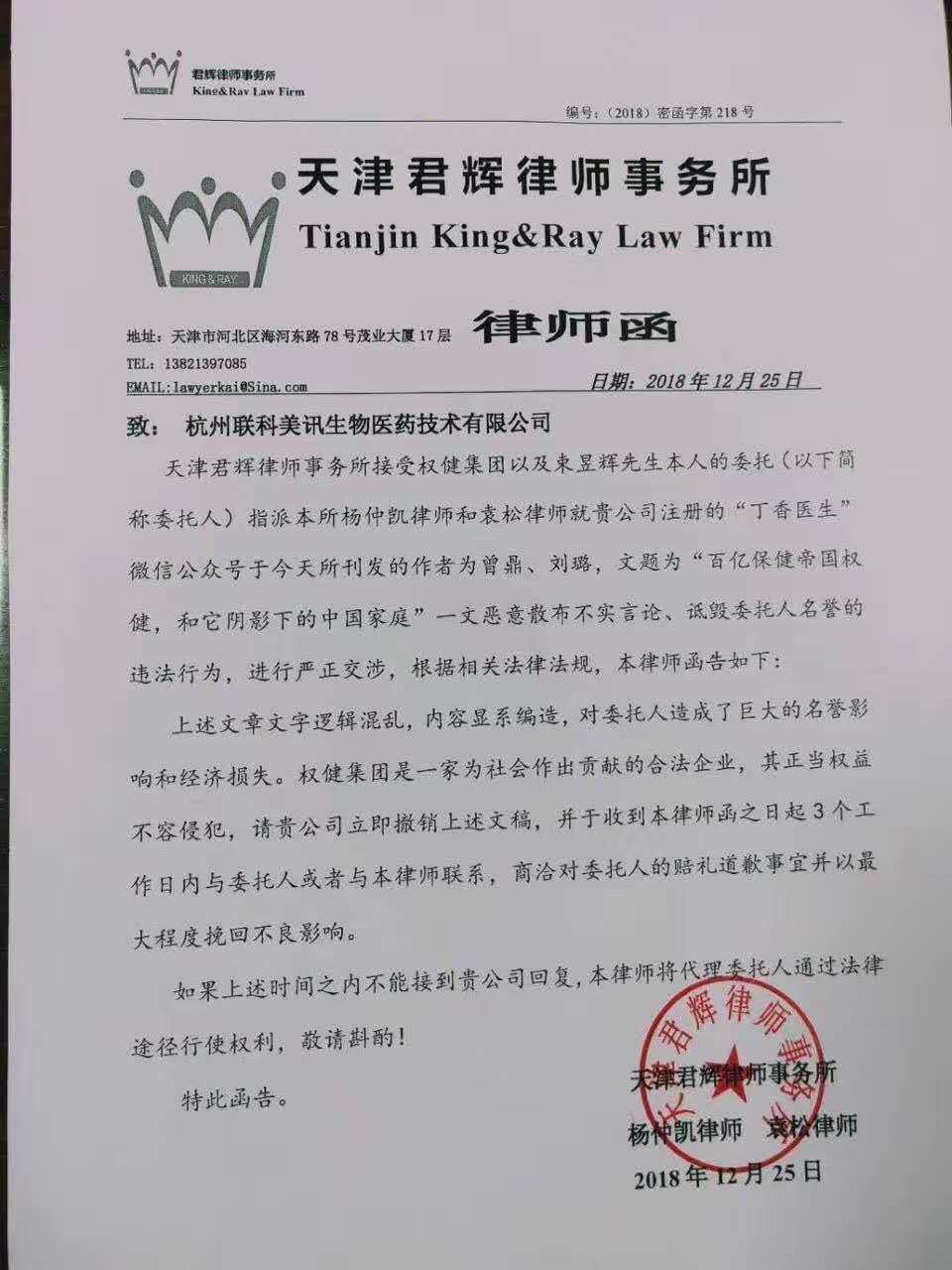

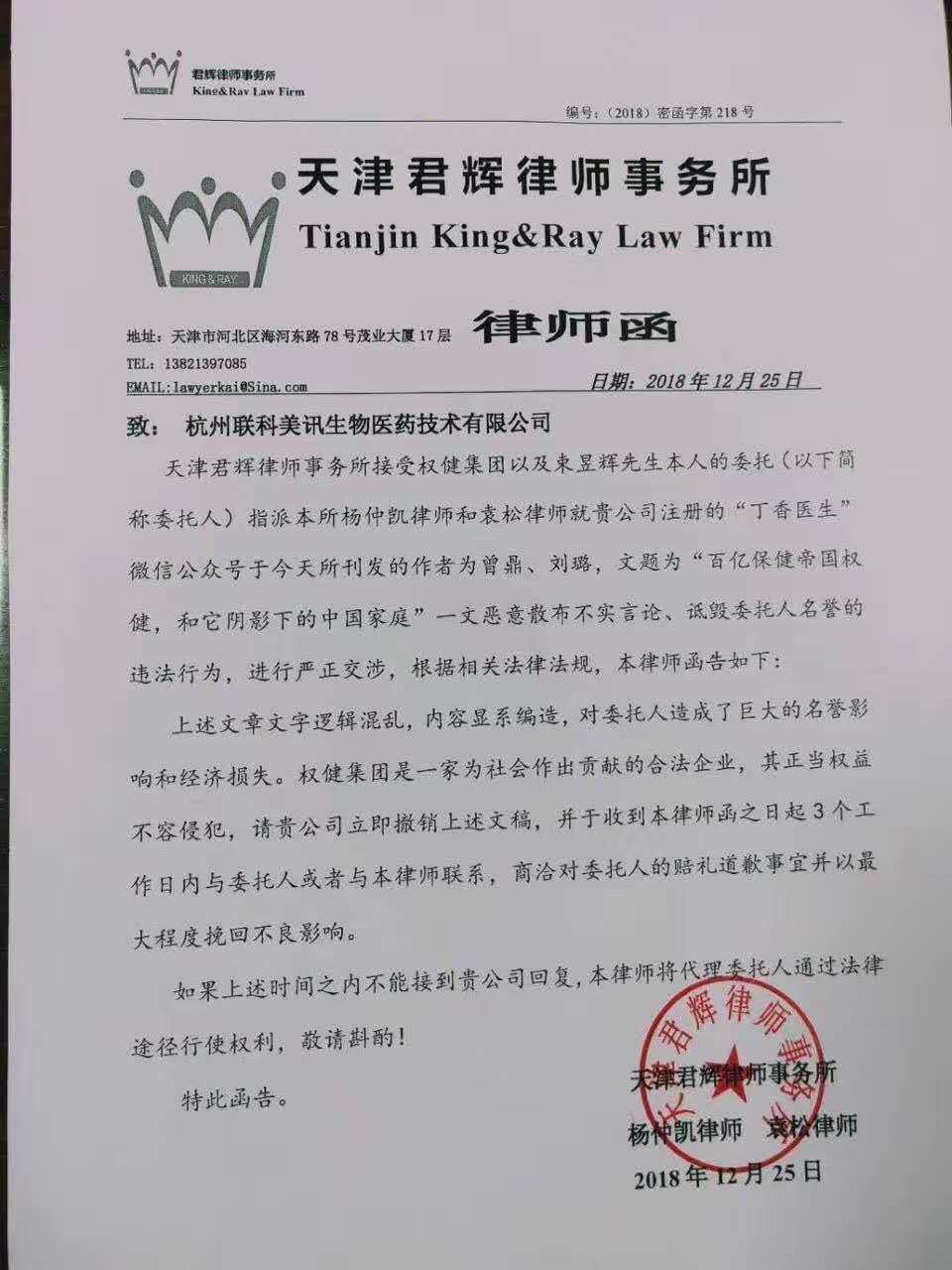

The pharmaceutical sector has been tortured by "4x7" out of shape, and a manuscript of "Quan Jian Health Care products Empire" has put the health products industry at the end of the pharmaceutical "disdain chain" into dust. In the early morning of December 26th, Zhitong Financial APP learned that Quanjian Natural Medical Technology Development Co., Ltd. issued a "solemn statement" through the official WeChat account, saying that the screen-brushing article released by "Dilac Doctor" was "10 billion health care empire Quan Jian, and the Chinese family in its shadow" was false, accusing it of "using false information collected from the Internet to slander Quan Jian and seriously infringe upon Quan Jian's legitimate rights and interests." It causes the public to misunderstand the Quan Jian brand. " The statement also asked the "lilac doctor" to withdraw the manuscript and apologize, saying that Quan Jian would protect his own rights and interests through legal channels. As soon as the lawyer's letter was published, Dr. clove responded positively to Quan Jian's "refutation of rumors": "I will not delete the draft and will be responsible for every word. Welcome to let me know." You go back and forth, the lilac doctor is hot, Quan Jian is hot. All kinds of people beat the drowning dog, and in a few words, they once again "hate the guts of health products." Affected by it, the capital market immediately fell into restlessness, with A-share Tomson Beijian and Qinghai Qingtian falling 1.42% and 1.18% respectively. Although the Hong Kong stock health products sector dodged a bullet because of "Christmas", they were still in trouble at the opening on the 27th, such as Jinhuo Pharmaceutical (01110), Ruannian International (02010), Dongyang Guang Medicine (01558) with "Cordyceps sinensis".

As soon as the lawyer's letter was published, Dr. clove responded positively to Quan Jian's "refutation of rumors": "I will not delete the draft and will be responsible for every word. Welcome to let me know." You go back and forth, the lilac doctor is hot, Quan Jian is hot. All kinds of people beat the drowning dog, and in a few words, they once again "hate the guts of health products." Affected by it, the capital market immediately fell into restlessness, with A-share Tomson Beijian and Qinghai Qingtian falling 1.42% and 1.18% respectively. Although the Hong Kong stock health products sector dodged a bullet because of "Christmas", they were still in trouble at the opening on the 27th, such as Jinhuo Pharmaceutical (01110), Ruannian International (02010), Dongyang Guang Medicine (01558) with "Cordyceps sinensis". The "brilliance" of the bossQuan Jian was attacked, and many "upheavals" in the health products industry were exposed one by one. Even if the merchants'"tactics" are unbearable, this piece of fat meat in the health product market is not small.

The "brilliance" of the bossQuan Jian was attacked, and many "upheavals" in the health products industry were exposed one by one. Even if the merchants'"tactics" are unbearable, this piece of fat meat in the health product market is not small.

According to Zhitong Financial APP, in May 2017, Roland Berger, a world strategic management consulting firm, released a report on the market of Chinese health products, predicting that the average annual growth rate of Chinese health products will be about 8% from 2015 to 2020, and the market size is expected to be about 180 billion yuan by 2020. Despite the fact that the growth rate has been 8% over the past few years, but in factAs early as the 1980s and 1990s, all kinds of health products began to advance by leaps and bounds, creating one myth after another. For example, urban streets and rural corners are covered with advertising slogans such as "Sanzhu Oral liquid", "Heart K", "Sun God Oral liquid", "Madame Oral liquid", "Anli No. 1" and "brain Platinum".Among them, the most successful ones are Zhu Baoguo of "wife Oral liquid", Lan Xiande of "Anli No.1", and Shi Yuzhu of "brain Platinum". After all, the former has been successfully transformed into the head of three listed companies, including Lizhu Pharmaceutical (01513). The latter has become A-share Jiaotong University, while Shi Yuzhu is even more carefree. Let's start with Zhu Baoguo. Zhitong Financial APP learned that in October 1992, Zhu Baoguo, 29, came to Shenzhen to start a business with a start-up capital of 20 million yuan and a prescription for female health care oral liquid that he bought for 90, 000 yuan. After a series of operations such as choosing a site to build a factory and purchasing equipment, we finally set up a health products company called "wife Pharmaceutical" (later renamed Health Yuan Pharmaceutical and listed on the A-share market) to produce "wife Oral liquid." In 1993, when advertisements were still on the radio, Zhu Baoguo was the first to use the mouthful slogan of "three women one yellow, three women two empty, three women three happy" on the big pages of major newspapers, instantly making people remember the brand of "wife Oral liquid." Soon, Zhu Baoguo advertised on CCTV and hired Mao Amin to endorse him, making his wife's oral liquid famous all over the country. In the same year, the annual sales of his wife's oral liquid reached more than 30 million, with sales reaching 160 million in 1994. Success earned Zhu Baoguo the first bucket of gold in his life. In 2001, Zhu Baoguo pushed his wife's pharmaceutical industry into A-shares, with his family holding 74.2%. In March 2002, Zhu Baoguo, who was still addicted to the joy of the listing of "wife Pharmaceutical", received a phone call from Xu Xiaoxian, the former head of Lizhu Pharmaceutical, inviting Zhu Baoguo to come to Hong Kong to discuss important matters. But for his own reasons, Zhu Baoguo did not choose to go, but replied, "wait until the matter at hand is finished." Who would have known that early the next morning, Xu Xiaoxian rushed to Zhu Baoguo's office and said bluntly that he would transfer his shares in Lizhu Pharmaceutical to Zhu Baoguo at a price of 4.27 yuan per share. In fact, because of the limitations of health products, Zhu Baoguo wanted to get involved in the pharmaceutical industry for a long time, but he was unable to make the trip because he did not have a good target. As for Xu Hsiao-hsiao, he wants to change the hands of Lizhu medicine. For Zhu Baoguo, it can be said that "happiness comes too suddenly." We should know that before the transfer, Lizhu Pharmaceutical was listed in A shares and issued B shares, with strong independent research and development capabilities and core advantage products. In 2001, annual sales were about 1.4 billion. When Xu Xiaoxian made an offer of 4.27 yuan per share, Zhu Baoguo was so excited that he didn't make a counteroffer. Half an hour later, he drafted the contract on the spot and signed the draft. A week after the contract was signed, Lizhu Pharmaceutical quickly announced the payment, delivery and termination of the shareholders' meeting originally held at the end of the month. It is conceivable how satisfied Zhu Baoguo is with the "cake" of Lizhu Pharmaceutical Co., Ltd. After joining Lizhu Pharmaceutical, Zhu Baoguo released his ambition to gain absolute control. To this end, in 2005, Zhu Baoguo proposed a high proportion of "10 to 6" rights issue. This directly dealt a fatal blow to Guo Jiaxue, who held about 12 per cent of the company and did not have much cash at the time, diluting the latter's 12 per cent stake to 7 per cent. In the end, Guo Jiaxue sold his shares. With absolute control, Zhu Baoguo carried out rectification, overthrew all the company's original old system, and borrowed the experience of the listed company's "wife pharmaceutical industry." Also benefiting from Zhu Baoguo's "power politics", Zhitong Finance saw that Lizhu Pharmaceutical revenue increased by 2% in the first quarter of 2007 compared with the same period last year, and net profit ushered in a qualitative leap to 219.29%. And in January 2014, through the successful conversion of B shares to H shares, landing on the Hong Kong motherboard.![1545882340436022.png 图片2.png]() About the same time as Zhu Baoguo's "start-up", in 1987, Anli No. 1 was born in the hands of Lan Xiande and his colleagues in the Department of Biology of Shanghai Jiaotong University. In 1990, Shanghai Anli Biological Food Factory (formerly known as Anli of Jiaotong University) was established. Compared with Helios, which has an annual revenue of 1.3 billion yuan, and compared with the three plants founded by Wu Bingxin, who once worked as a dealer, Anli No. 1 can only be willing to be a younger brother. Although he is a younger brother, Lan Xiande has never "muddled along". On the contrary, he has found another way to put advertisements on advertising. Anli of Jiaotong University is not stingy, but it is different from the mode of indiscriminate bombing. The concept of Anli of Jiaotong University is "knowledge marketing", which is also related to the main battlefield of Anli, which is to build a sales network to major cities and periphery of the country with East China as the main base. Anli of Jiaotong University pays attention to the knowledge structure of consumers and uses news feature films, newspapers and other ways to promote and popularize science, which is more conducive to the establishment of brand image. Anli of Jiaotong University does not engage in diversification, so Anli of Jiaotong University survived and lived a good life. Zhitong Financial APP consulted the company's previous prospectus. Since May 1998, Jiaotong University's Onli products have ranked first in the industry except for three months in terms of market share and comprehensive ranking of health tonic products. With "first", in 2001, Anli of Jiaotong University listed in A shares as a winner, but the share price of "Wind blown Chicken eggshell" sank since its peak in June 2015, and fell in love with equity investment, such as increasing its holdings many times. It has acquired 22.97% of Tai Ling Pharmaceuticals (01011). It is not unsuccessful.Little brother's "loneliness"Of course, if a boss succeeds, someone is bound to lose.It is like the spring in Qinghai that has changed its name to Qianhai Health (00911) and sold Cordyceps sinensis.When it comes to Hengfa ginseng, we have to think of the legendary Lu Jianming. Zhitong Financial APP learned that in the late 1990s, Lu Jianming and his wife, Lu Jianming, who bought and sold DRAM modules in the United States, set up a company called Luwei, but in view of the strong demand for DRAM modules in Asia and Hong Kong, his wife Shen Wei moved the company back to Hong Kong in 2004 and established Crystal Core Technology (03638) in 2005. In 2011, Lu Jianming was promoted from a member of general affairs management to director and chairman of Liquor Technology. During his tenure, through his own efforts to increase the company's revenue from millions to HK $12 million in fiscal year 2015, management saw a steady improvement in performance and elected him as CEO of the company in June 2016. In other words, crystal core technology is officially dominated by Lu Jianming. After six months as CEO of Crystal Core Technology, Lu Jianming proposed to change the company's name to "China Qianhai Financial Holdings Co., Ltd." in January 2017, but later changed it to "Huabang Financial Holdings" because the board of directors felt that it was "not ideal". And it was approved on March 31. In fact, this is not the first time Lu Jianming has participated in renaming a listed company. In early 2016, Hengfa Panax quinquefolium, which mainly engaged in the import and export of American ginseng, was forced to "sell its shell" because its funds were broken. Taking advantage of this opportunity, Lu Jianming acquired control of the company at a low price of "subscribing for a total of 31.2 billion shares issued by Hengfa American ginseng at a price of HK $0.01a per share". Since then, the company quickly changed its name to "Qianhai Health". Since then, the rustic Hengfa American ginseng has become a high-end Qianhai health. Although the name is louder, but in front of Lu Jianming's financial skills, the company's share price continues to be immortal. According to Zhitong Financial APP, the stock fell more than 47 per cent in the 183 trading days from August 1, 2016 to May 1, 2017, with the highest price falling from HK $0.214 to HK $0.072. At the time of the immortal share price of Qianhai Health, in May 2017, Lu Jianming began to increase his holdings of the stock substantially and frequently, which led to a rise in the share price. And this move, also let investors think that "thousands of shares players want to do stock prices, and other shipments." Regardless of the delivery of the goods, the increase of holdings has not stopped until June 2018, when it bought back a total of 36.89 million shares this year, accounting for 0.217% of the issued share capital at the time of the passing of the ordinary resolution. However, as soon as we turned around, we began to play with the merger of "10 and 1" shares and reduce the share premium, and the net profit in the middle of 2018 was only HK $12.114 million, and the "penny stocks" became more and more detailed.

About the same time as Zhu Baoguo's "start-up", in 1987, Anli No. 1 was born in the hands of Lan Xiande and his colleagues in the Department of Biology of Shanghai Jiaotong University. In 1990, Shanghai Anli Biological Food Factory (formerly known as Anli of Jiaotong University) was established. Compared with Helios, which has an annual revenue of 1.3 billion yuan, and compared with the three plants founded by Wu Bingxin, who once worked as a dealer, Anli No. 1 can only be willing to be a younger brother. Although he is a younger brother, Lan Xiande has never "muddled along". On the contrary, he has found another way to put advertisements on advertising. Anli of Jiaotong University is not stingy, but it is different from the mode of indiscriminate bombing. The concept of Anli of Jiaotong University is "knowledge marketing", which is also related to the main battlefield of Anli, which is to build a sales network to major cities and periphery of the country with East China as the main base. Anli of Jiaotong University pays attention to the knowledge structure of consumers and uses news feature films, newspapers and other ways to promote and popularize science, which is more conducive to the establishment of brand image. Anli of Jiaotong University does not engage in diversification, so Anli of Jiaotong University survived and lived a good life. Zhitong Financial APP consulted the company's previous prospectus. Since May 1998, Jiaotong University's Onli products have ranked first in the industry except for three months in terms of market share and comprehensive ranking of health tonic products. With "first", in 2001, Anli of Jiaotong University listed in A shares as a winner, but the share price of "Wind blown Chicken eggshell" sank since its peak in June 2015, and fell in love with equity investment, such as increasing its holdings many times. It has acquired 22.97% of Tai Ling Pharmaceuticals (01011). It is not unsuccessful.Little brother's "loneliness"Of course, if a boss succeeds, someone is bound to lose.It is like the spring in Qinghai that has changed its name to Qianhai Health (00911) and sold Cordyceps sinensis.When it comes to Hengfa ginseng, we have to think of the legendary Lu Jianming. Zhitong Financial APP learned that in the late 1990s, Lu Jianming and his wife, Lu Jianming, who bought and sold DRAM modules in the United States, set up a company called Luwei, but in view of the strong demand for DRAM modules in Asia and Hong Kong, his wife Shen Wei moved the company back to Hong Kong in 2004 and established Crystal Core Technology (03638) in 2005. In 2011, Lu Jianming was promoted from a member of general affairs management to director and chairman of Liquor Technology. During his tenure, through his own efforts to increase the company's revenue from millions to HK $12 million in fiscal year 2015, management saw a steady improvement in performance and elected him as CEO of the company in June 2016. In other words, crystal core technology is officially dominated by Lu Jianming. After six months as CEO of Crystal Core Technology, Lu Jianming proposed to change the company's name to "China Qianhai Financial Holdings Co., Ltd." in January 2017, but later changed it to "Huabang Financial Holdings" because the board of directors felt that it was "not ideal". And it was approved on March 31. In fact, this is not the first time Lu Jianming has participated in renaming a listed company. In early 2016, Hengfa Panax quinquefolium, which mainly engaged in the import and export of American ginseng, was forced to "sell its shell" because its funds were broken. Taking advantage of this opportunity, Lu Jianming acquired control of the company at a low price of "subscribing for a total of 31.2 billion shares issued by Hengfa American ginseng at a price of HK $0.01a per share". Since then, the company quickly changed its name to "Qianhai Health". Since then, the rustic Hengfa American ginseng has become a high-end Qianhai health. Although the name is louder, but in front of Lu Jianming's financial skills, the company's share price continues to be immortal. According to Zhitong Financial APP, the stock fell more than 47 per cent in the 183 trading days from August 1, 2016 to May 1, 2017, with the highest price falling from HK $0.214 to HK $0.072. At the time of the immortal share price of Qianhai Health, in May 2017, Lu Jianming began to increase his holdings of the stock substantially and frequently, which led to a rise in the share price. And this move, also let investors think that "thousands of shares players want to do stock prices, and other shipments." Regardless of the delivery of the goods, the increase of holdings has not stopped until June 2018, when it bought back a total of 36.89 million shares this year, accounting for 0.217% of the issued share capital at the time of the passing of the ordinary resolution. However, as soon as we turned around, we began to play with the merger of "10 and 1" shares and reduce the share premium, and the net profit in the middle of 2018 was only HK $12.114 million, and the "penny stocks" became more and more detailed.![1545882431231293.png 图片3.png]() Similarly, A-share Qinghai Spring and its boss Zhang Xuefeng have also had a "bad reputation" in recent years, and their medicines, health products and food have been questioned by the market and institutions many times. Take the event of "challenging CFDA" on March 30, 2016, its Cordyceps sinensis business is almost coming to an end. Zhitong Financial APP had "tracked" the incident, mainly because the arsenic content of Cordyceps sinensis pure powder tablets exceeded the standard by 4-7 times, and the company's production of polar grass had not been able to organize production in accordance with GMP, so it was ordered by CFDA to stop the pilot work of health food. The issuance of this announcement means that Qinghai has completely lost its only legal identity for the production and operation of extremely grass in spring. Because extreme grass is the company's main product, its sales revenue accounts for nearly 80% of the main business income. According to market sales statistics: in the first three quarters of 2015, the sales income of pure powder tablets of Cordyceps sinensis in spring in Qinghai is about 750 million yuan, and it is estimated that the sales scale of polar grass in 2015 is about 1 billion yuan. As a result, the listed company faces huge losses overnight. It seems that no matter how bullish the enterprise is, and then endorse it with the development of the national economy, it can not resist the restriction of the relevant laws and regulations of the national medicine and food. In fact, it is not the first time that Cordyceps sinensis pure powder has fallen into crisis. In 2009, the Ministry of Health issued the notice of the Ministry of Health on further standardizing the management of health food raw materials. Cordyceps sinensis shall not be used as a common food raw material; on December 7, 2010, the Food production Supervision Department of the AQSIQ issued an official document, "it is strictly forbidden to use Cordyceps sinensis as a food raw material to produce ordinary food." However, in the case of unfavorable policies, Qinghai Spring continued to produce and sell pure powder slices of Cordyceps sinensis according to the "Qinghai Provincial Standard for processing Chinese Herbal slices of Cordyceps sinensis" published by Qinghai Food and Drug Administration in 2010. The good times will not last long. In 2012, CFDA again issued a notice to crush and press Cordyceps sinensis into slices in the classification of traditional Chinese medicine, adding the "pilot work program of Cordyceps sinensis for health food", allowing Cordyceps sinensis to be directly used as the raw material of health food, so that the pure powder slices of Cordyceps sinensis in spring in Qinghai has been justifiably changed from traditional Chinese medicine to health products. Also because of the policy, the sales quota of Cordyceps sinensis pure powder tablets in spring in Qinghai reached 5 billion yuan in 2012, more than twice the total sales of the second to sixth places of related products. In November 2014, Wang Hai, an anti-counterfeit activist, suspected that the classic 5X lozenges produced in spring in Qinghai did not contain cordycepin and sent them to a testing center in Beijing for testing. The test results are surprising. According to the staff of the testing center, the detection limit of the detection instrument is 5.63 μ g / g. "No Cordycepin has been detected (not equal to no cordycepin at all), but there may be, but because of extremely small amounts, it cannot be detected." As soon as the news came out, Qinghai Spring fell into the quagmire of suspected false propaganda. Similarly, at the end of January 2016, CFDA issued a "consumption Tip on Cordyceps sinensis products" based on market testing, saying that long-term consumption of Cordyceps sinensis will lead to excessive intake of arsenic and may bring health risks, among which the pure powder tablets of Cordyceps sinensis in spring in Qinghai are mainly monitored by relevant departments. Although, with regard to the measures of the relevant departments, Qinghai Spring made a public "challenge" to the Food and Drug Administration through letters and the Internet on February 17 and March 4, 2016, respectively, applying for disclosure of relevant information about "consumption tips", including documents such as manufacturers, product batches and test results of Cordyceps sinensis, Cordyceps sinensis powder and pure powder tablets tested by this monitoring and inspection. This move in spring in Qinghai did not wash away its grievances. On the contrary, the State Administration of Food and Drug Administration immediately sent a document to explain: "since the production of extreme grass products in spring, Qinghai has been unable to solve this problem, and the national standard for arsenic content is that the total limit value of arsenic in health food is 1.0mg/kg (" Food Safety National Standard Health Food "). According to the sampling test of 26 batches of polar grass products produced in spring in Qinghai from 2013 to 2015, the content of Kun was always between 4. 4-9.88mg/kg, 4-9 times higher than the standard. " Finally, the pure powder tablets of Cordyceps sinensis in spring in Qinghai were ordered to be removed from the shelves and the pilot work of health food was stopped. With regard to being forced to take it off the shelves, Qinghai expressed its attitude to the secondary market in spring, which may lead to the real risk of stopping production and operation in spring, and affect the digestion of its finished and semi-finished products, so that the company will face the risk of huge losses in the future. At present, the serious impact on pharmaceutical production and operation in Spring will also lead to the possibility that Qinghai Spring stocks will be implemented other risk warning measures (namely ST), and the performance commitments made during the company's restructuring will not be fulfilled. In fact, CFDA's law enforcement opinions will even cause incalculable risks and losses, or even annihilation, to the spring of Qinghai. But there is still a strange voice in the industry: "the spring death in Qinghai is not wronged." Until now, the performance of Qinghai Spring is still in a state of decline, with an operating income of 189 million yuan in the first half of 2018., The year-on-year decline was 13.63%; the net profit was only 83 million yuan, down 2.3% from the same period last year.Transformation to deal with the spicy taste of "Huolu herbal tea" is not selling well.Whether health products can cure diseases is unknown, but the industry does make a name! (Tian Yuxuan / article)

Similarly, A-share Qinghai Spring and its boss Zhang Xuefeng have also had a "bad reputation" in recent years, and their medicines, health products and food have been questioned by the market and institutions many times. Take the event of "challenging CFDA" on March 30, 2016, its Cordyceps sinensis business is almost coming to an end. Zhitong Financial APP had "tracked" the incident, mainly because the arsenic content of Cordyceps sinensis pure powder tablets exceeded the standard by 4-7 times, and the company's production of polar grass had not been able to organize production in accordance with GMP, so it was ordered by CFDA to stop the pilot work of health food. The issuance of this announcement means that Qinghai has completely lost its only legal identity for the production and operation of extremely grass in spring. Because extreme grass is the company's main product, its sales revenue accounts for nearly 80% of the main business income. According to market sales statistics: in the first three quarters of 2015, the sales income of pure powder tablets of Cordyceps sinensis in spring in Qinghai is about 750 million yuan, and it is estimated that the sales scale of polar grass in 2015 is about 1 billion yuan. As a result, the listed company faces huge losses overnight. It seems that no matter how bullish the enterprise is, and then endorse it with the development of the national economy, it can not resist the restriction of the relevant laws and regulations of the national medicine and food. In fact, it is not the first time that Cordyceps sinensis pure powder has fallen into crisis. In 2009, the Ministry of Health issued the notice of the Ministry of Health on further standardizing the management of health food raw materials. Cordyceps sinensis shall not be used as a common food raw material; on December 7, 2010, the Food production Supervision Department of the AQSIQ issued an official document, "it is strictly forbidden to use Cordyceps sinensis as a food raw material to produce ordinary food." However, in the case of unfavorable policies, Qinghai Spring continued to produce and sell pure powder slices of Cordyceps sinensis according to the "Qinghai Provincial Standard for processing Chinese Herbal slices of Cordyceps sinensis" published by Qinghai Food and Drug Administration in 2010. The good times will not last long. In 2012, CFDA again issued a notice to crush and press Cordyceps sinensis into slices in the classification of traditional Chinese medicine, adding the "pilot work program of Cordyceps sinensis for health food", allowing Cordyceps sinensis to be directly used as the raw material of health food, so that the pure powder slices of Cordyceps sinensis in spring in Qinghai has been justifiably changed from traditional Chinese medicine to health products. Also because of the policy, the sales quota of Cordyceps sinensis pure powder tablets in spring in Qinghai reached 5 billion yuan in 2012, more than twice the total sales of the second to sixth places of related products. In November 2014, Wang Hai, an anti-counterfeit activist, suspected that the classic 5X lozenges produced in spring in Qinghai did not contain cordycepin and sent them to a testing center in Beijing for testing. The test results are surprising. According to the staff of the testing center, the detection limit of the detection instrument is 5.63 μ g / g. "No Cordycepin has been detected (not equal to no cordycepin at all), but there may be, but because of extremely small amounts, it cannot be detected." As soon as the news came out, Qinghai Spring fell into the quagmire of suspected false propaganda. Similarly, at the end of January 2016, CFDA issued a "consumption Tip on Cordyceps sinensis products" based on market testing, saying that long-term consumption of Cordyceps sinensis will lead to excessive intake of arsenic and may bring health risks, among which the pure powder tablets of Cordyceps sinensis in spring in Qinghai are mainly monitored by relevant departments. Although, with regard to the measures of the relevant departments, Qinghai Spring made a public "challenge" to the Food and Drug Administration through letters and the Internet on February 17 and March 4, 2016, respectively, applying for disclosure of relevant information about "consumption tips", including documents such as manufacturers, product batches and test results of Cordyceps sinensis, Cordyceps sinensis powder and pure powder tablets tested by this monitoring and inspection. This move in spring in Qinghai did not wash away its grievances. On the contrary, the State Administration of Food and Drug Administration immediately sent a document to explain: "since the production of extreme grass products in spring, Qinghai has been unable to solve this problem, and the national standard for arsenic content is that the total limit value of arsenic in health food is 1.0mg/kg (" Food Safety National Standard Health Food "). According to the sampling test of 26 batches of polar grass products produced in spring in Qinghai from 2013 to 2015, the content of Kun was always between 4. 4-9.88mg/kg, 4-9 times higher than the standard. " Finally, the pure powder tablets of Cordyceps sinensis in spring in Qinghai were ordered to be removed from the shelves and the pilot work of health food was stopped. With regard to being forced to take it off the shelves, Qinghai expressed its attitude to the secondary market in spring, which may lead to the real risk of stopping production and operation in spring, and affect the digestion of its finished and semi-finished products, so that the company will face the risk of huge losses in the future. At present, the serious impact on pharmaceutical production and operation in Spring will also lead to the possibility that Qinghai Spring stocks will be implemented other risk warning measures (namely ST), and the performance commitments made during the company's restructuring will not be fulfilled. In fact, CFDA's law enforcement opinions will even cause incalculable risks and losses, or even annihilation, to the spring of Qinghai. But there is still a strange voice in the industry: "the spring death in Qinghai is not wronged." Until now, the performance of Qinghai Spring is still in a state of decline, with an operating income of 189 million yuan in the first half of 2018., The year-on-year decline was 13.63%; the net profit was only 83 million yuan, down 2.3% from the same period last year.Transformation to deal with the spicy taste of "Huolu herbal tea" is not selling well.Whether health products can cure diseases is unknown, but the industry does make a name! (Tian Yuxuan / article)

The pharmaceutical sector has been tortured by "4x7" out of shape, and a manuscript of "Quan Jian Health Care products Empire" has put the health products industry at the end of the pharmaceutical "disdain chain" into dust. In the early morning of December 26th, Zhitong Financial APP learned that Quanjian Natural Medical Technology Development Co., Ltd. issued a "solemn statement" through the official WeChat account, saying that the screen-brushing article released by "Dilac Doctor" was "10 billion health care empire Quan Jian, and the Chinese family in its shadow" was false, accusing it of "using false information collected from the Internet to slander Quan Jian and seriously infringe upon Quan Jian's legitimate rights and interests." It causes the public to misunderstand the Quan Jian brand. " The statement also asked the "lilac doctor" to withdraw the manuscript and apologize, saying that Quan Jian would protect his own rights and interests through legal channels.

As soon as the lawyer's letter was published, Dr. clove responded positively to Quan Jian's "refutation of rumors": "I will not delete the draft and will be responsible for every word. Welcome to let me know." You go back and forth, the lilac doctor is hot, Quan Jian is hot. All kinds of people beat the drowning dog, and in a few words, they once again "hate the guts of health products." Affected by it, the capital market immediately fell into restlessness, with A-share Tomson Beijian and Qinghai Qingtian falling 1.42% and 1.18% respectively. Although the Hong Kong stock health products sector dodged a bullet because of "Christmas", they were still in trouble at the opening on the 27th, such as Jinhuo Pharmaceutical (01110), Ruannian International (02010), Dongyang Guang Medicine (01558) with "Cordyceps sinensis".

As soon as the lawyer's letter was published, Dr. clove responded positively to Quan Jian's "refutation of rumors": "I will not delete the draft and will be responsible for every word. Welcome to let me know." You go back and forth, the lilac doctor is hot, Quan Jian is hot. All kinds of people beat the drowning dog, and in a few words, they once again "hate the guts of health products." Affected by it, the capital market immediately fell into restlessness, with A-share Tomson Beijian and Qinghai Qingtian falling 1.42% and 1.18% respectively. Although the Hong Kong stock health products sector dodged a bullet because of "Christmas", they were still in trouble at the opening on the 27th, such as Jinhuo Pharmaceutical (01110), Ruannian International (02010), Dongyang Guang Medicine (01558) with "Cordyceps sinensis". The "brilliance" of the bossQuan Jian was attacked, and many "upheavals" in the health products industry were exposed one by one. Even if the merchants'"tactics" are unbearable, this piece of fat meat in the health product market is not small.

The "brilliance" of the bossQuan Jian was attacked, and many "upheavals" in the health products industry were exposed one by one. Even if the merchants'"tactics" are unbearable, this piece of fat meat in the health product market is not small.According to Zhitong Financial APP, in May 2017, Roland Berger, a world strategic management consulting firm, released a report on the market of Chinese health products, predicting that the average annual growth rate of Chinese health products will be about 8% from 2015 to 2020, and the market size is expected to be about 180 billion yuan by 2020. Despite the fact that the growth rate has been 8% over the past few years, but in factAs early as the 1980s and 1990s, all kinds of health products began to advance by leaps and bounds, creating one myth after another. For example, urban streets and rural corners are covered with advertising slogans such as "Sanzhu Oral liquid", "Heart K", "Sun God Oral liquid", "Madame Oral liquid", "Anli No. 1" and "brain Platinum".Among them, the most successful ones are Zhu Baoguo of "wife Oral liquid", Lan Xiande of "Anli No.1", and Shi Yuzhu of "brain Platinum". After all, the former has been successfully transformed into the head of three listed companies, including Lizhu Pharmaceutical (01513). The latter has become A-share Jiaotong University, while Shi Yuzhu is even more carefree. Let's start with Zhu Baoguo. Zhitong Financial APP learned that in October 1992, Zhu Baoguo, 29, came to Shenzhen to start a business with a start-up capital of 20 million yuan and a prescription for female health care oral liquid that he bought for 90, 000 yuan. After a series of operations such as choosing a site to build a factory and purchasing equipment, we finally set up a health products company called "wife Pharmaceutical" (later renamed Health Yuan Pharmaceutical and listed on the A-share market) to produce "wife Oral liquid." In 1993, when advertisements were still on the radio, Zhu Baoguo was the first to use the mouthful slogan of "three women one yellow, three women two empty, three women three happy" on the big pages of major newspapers, instantly making people remember the brand of "wife Oral liquid." Soon, Zhu Baoguo advertised on CCTV and hired Mao Amin to endorse him, making his wife's oral liquid famous all over the country. In the same year, the annual sales of his wife's oral liquid reached more than 30 million, with sales reaching 160 million in 1994. Success earned Zhu Baoguo the first bucket of gold in his life. In 2001, Zhu Baoguo pushed his wife's pharmaceutical industry into A-shares, with his family holding 74.2%. In March 2002, Zhu Baoguo, who was still addicted to the joy of the listing of "wife Pharmaceutical", received a phone call from Xu Xiaoxian, the former head of Lizhu Pharmaceutical, inviting Zhu Baoguo to come to Hong Kong to discuss important matters. But for his own reasons, Zhu Baoguo did not choose to go, but replied, "wait until the matter at hand is finished." Who would have known that early the next morning, Xu Xiaoxian rushed to Zhu Baoguo's office and said bluntly that he would transfer his shares in Lizhu Pharmaceutical to Zhu Baoguo at a price of 4.27 yuan per share. In fact, because of the limitations of health products, Zhu Baoguo wanted to get involved in the pharmaceutical industry for a long time, but he was unable to make the trip because he did not have a good target. As for Xu Hsiao-hsiao, he wants to change the hands of Lizhu medicine. For Zhu Baoguo, it can be said that "happiness comes too suddenly." We should know that before the transfer, Lizhu Pharmaceutical was listed in A shares and issued B shares, with strong independent research and development capabilities and core advantage products. In 2001, annual sales were about 1.4 billion. When Xu Xiaoxian made an offer of 4.27 yuan per share, Zhu Baoguo was so excited that he didn't make a counteroffer. Half an hour later, he drafted the contract on the spot and signed the draft. A week after the contract was signed, Lizhu Pharmaceutical quickly announced the payment, delivery and termination of the shareholders' meeting originally held at the end of the month. It is conceivable how satisfied Zhu Baoguo is with the "cake" of Lizhu Pharmaceutical Co., Ltd. After joining Lizhu Pharmaceutical, Zhu Baoguo released his ambition to gain absolute control. To this end, in 2005, Zhu Baoguo proposed a high proportion of "10 to 6" rights issue. This directly dealt a fatal blow to Guo Jiaxue, who held about 12 per cent of the company and did not have much cash at the time, diluting the latter's 12 per cent stake to 7 per cent. In the end, Guo Jiaxue sold his shares. With absolute control, Zhu Baoguo carried out rectification, overthrew all the company's original old system, and borrowed the experience of the listed company's "wife pharmaceutical industry." Also benefiting from Zhu Baoguo's "power politics", Zhitong Finance saw that Lizhu Pharmaceutical revenue increased by 2% in the first quarter of 2007 compared with the same period last year, and net profit ushered in a qualitative leap to 219.29%. And in January 2014, through the successful conversion of B shares to H shares, landing on the Hong Kong motherboard.

About the same time as Zhu Baoguo's "start-up", in 1987, Anli No. 1 was born in the hands of Lan Xiande and his colleagues in the Department of Biology of Shanghai Jiaotong University. In 1990, Shanghai Anli Biological Food Factory (formerly known as Anli of Jiaotong University) was established. Compared with Helios, which has an annual revenue of 1.3 billion yuan, and compared with the three plants founded by Wu Bingxin, who once worked as a dealer, Anli No. 1 can only be willing to be a younger brother. Although he is a younger brother, Lan Xiande has never "muddled along". On the contrary, he has found another way to put advertisements on advertising. Anli of Jiaotong University is not stingy, but it is different from the mode of indiscriminate bombing. The concept of Anli of Jiaotong University is "knowledge marketing", which is also related to the main battlefield of Anli, which is to build a sales network to major cities and periphery of the country with East China as the main base. Anli of Jiaotong University pays attention to the knowledge structure of consumers and uses news feature films, newspapers and other ways to promote and popularize science, which is more conducive to the establishment of brand image. Anli of Jiaotong University does not engage in diversification, so Anli of Jiaotong University survived and lived a good life. Zhitong Financial APP consulted the company's previous prospectus. Since May 1998, Jiaotong University's Onli products have ranked first in the industry except for three months in terms of market share and comprehensive ranking of health tonic products. With "first", in 2001, Anli of Jiaotong University listed in A shares as a winner, but the share price of "Wind blown Chicken eggshell" sank since its peak in June 2015, and fell in love with equity investment, such as increasing its holdings many times. It has acquired 22.97% of Tai Ling Pharmaceuticals (01011). It is not unsuccessful.Little brother's "loneliness"Of course, if a boss succeeds, someone is bound to lose.It is like the spring in Qinghai that has changed its name to Qianhai Health (00911) and sold Cordyceps sinensis.When it comes to Hengfa ginseng, we have to think of the legendary Lu Jianming. Zhitong Financial APP learned that in the late 1990s, Lu Jianming and his wife, Lu Jianming, who bought and sold DRAM modules in the United States, set up a company called Luwei, but in view of the strong demand for DRAM modules in Asia and Hong Kong, his wife Shen Wei moved the company back to Hong Kong in 2004 and established Crystal Core Technology (03638) in 2005. In 2011, Lu Jianming was promoted from a member of general affairs management to director and chairman of Liquor Technology. During his tenure, through his own efforts to increase the company's revenue from millions to HK $12 million in fiscal year 2015, management saw a steady improvement in performance and elected him as CEO of the company in June 2016. In other words, crystal core technology is officially dominated by Lu Jianming. After six months as CEO of Crystal Core Technology, Lu Jianming proposed to change the company's name to "China Qianhai Financial Holdings Co., Ltd." in January 2017, but later changed it to "Huabang Financial Holdings" because the board of directors felt that it was "not ideal". And it was approved on March 31. In fact, this is not the first time Lu Jianming has participated in renaming a listed company. In early 2016, Hengfa Panax quinquefolium, which mainly engaged in the import and export of American ginseng, was forced to "sell its shell" because its funds were broken. Taking advantage of this opportunity, Lu Jianming acquired control of the company at a low price of "subscribing for a total of 31.2 billion shares issued by Hengfa American ginseng at a price of HK $0.01a per share". Since then, the company quickly changed its name to "Qianhai Health". Since then, the rustic Hengfa American ginseng has become a high-end Qianhai health. Although the name is louder, but in front of Lu Jianming's financial skills, the company's share price continues to be immortal. According to Zhitong Financial APP, the stock fell more than 47 per cent in the 183 trading days from August 1, 2016 to May 1, 2017, with the highest price falling from HK $0.214 to HK $0.072. At the time of the immortal share price of Qianhai Health, in May 2017, Lu Jianming began to increase his holdings of the stock substantially and frequently, which led to a rise in the share price. And this move, also let investors think that "thousands of shares players want to do stock prices, and other shipments." Regardless of the delivery of the goods, the increase of holdings has not stopped until June 2018, when it bought back a total of 36.89 million shares this year, accounting for 0.217% of the issued share capital at the time of the passing of the ordinary resolution. However, as soon as we turned around, we began to play with the merger of "10 and 1" shares and reduce the share premium, and the net profit in the middle of 2018 was only HK $12.114 million, and the "penny stocks" became more and more detailed.

About the same time as Zhu Baoguo's "start-up", in 1987, Anli No. 1 was born in the hands of Lan Xiande and his colleagues in the Department of Biology of Shanghai Jiaotong University. In 1990, Shanghai Anli Biological Food Factory (formerly known as Anli of Jiaotong University) was established. Compared with Helios, which has an annual revenue of 1.3 billion yuan, and compared with the three plants founded by Wu Bingxin, who once worked as a dealer, Anli No. 1 can only be willing to be a younger brother. Although he is a younger brother, Lan Xiande has never "muddled along". On the contrary, he has found another way to put advertisements on advertising. Anli of Jiaotong University is not stingy, but it is different from the mode of indiscriminate bombing. The concept of Anli of Jiaotong University is "knowledge marketing", which is also related to the main battlefield of Anli, which is to build a sales network to major cities and periphery of the country with East China as the main base. Anli of Jiaotong University pays attention to the knowledge structure of consumers and uses news feature films, newspapers and other ways to promote and popularize science, which is more conducive to the establishment of brand image. Anli of Jiaotong University does not engage in diversification, so Anli of Jiaotong University survived and lived a good life. Zhitong Financial APP consulted the company's previous prospectus. Since May 1998, Jiaotong University's Onli products have ranked first in the industry except for three months in terms of market share and comprehensive ranking of health tonic products. With "first", in 2001, Anli of Jiaotong University listed in A shares as a winner, but the share price of "Wind blown Chicken eggshell" sank since its peak in June 2015, and fell in love with equity investment, such as increasing its holdings many times. It has acquired 22.97% of Tai Ling Pharmaceuticals (01011). It is not unsuccessful.Little brother's "loneliness"Of course, if a boss succeeds, someone is bound to lose.It is like the spring in Qinghai that has changed its name to Qianhai Health (00911) and sold Cordyceps sinensis.When it comes to Hengfa ginseng, we have to think of the legendary Lu Jianming. Zhitong Financial APP learned that in the late 1990s, Lu Jianming and his wife, Lu Jianming, who bought and sold DRAM modules in the United States, set up a company called Luwei, but in view of the strong demand for DRAM modules in Asia and Hong Kong, his wife Shen Wei moved the company back to Hong Kong in 2004 and established Crystal Core Technology (03638) in 2005. In 2011, Lu Jianming was promoted from a member of general affairs management to director and chairman of Liquor Technology. During his tenure, through his own efforts to increase the company's revenue from millions to HK $12 million in fiscal year 2015, management saw a steady improvement in performance and elected him as CEO of the company in June 2016. In other words, crystal core technology is officially dominated by Lu Jianming. After six months as CEO of Crystal Core Technology, Lu Jianming proposed to change the company's name to "China Qianhai Financial Holdings Co., Ltd." in January 2017, but later changed it to "Huabang Financial Holdings" because the board of directors felt that it was "not ideal". And it was approved on March 31. In fact, this is not the first time Lu Jianming has participated in renaming a listed company. In early 2016, Hengfa Panax quinquefolium, which mainly engaged in the import and export of American ginseng, was forced to "sell its shell" because its funds were broken. Taking advantage of this opportunity, Lu Jianming acquired control of the company at a low price of "subscribing for a total of 31.2 billion shares issued by Hengfa American ginseng at a price of HK $0.01a per share". Since then, the company quickly changed its name to "Qianhai Health". Since then, the rustic Hengfa American ginseng has become a high-end Qianhai health. Although the name is louder, but in front of Lu Jianming's financial skills, the company's share price continues to be immortal. According to Zhitong Financial APP, the stock fell more than 47 per cent in the 183 trading days from August 1, 2016 to May 1, 2017, with the highest price falling from HK $0.214 to HK $0.072. At the time of the immortal share price of Qianhai Health, in May 2017, Lu Jianming began to increase his holdings of the stock substantially and frequently, which led to a rise in the share price. And this move, also let investors think that "thousands of shares players want to do stock prices, and other shipments." Regardless of the delivery of the goods, the increase of holdings has not stopped until June 2018, when it bought back a total of 36.89 million shares this year, accounting for 0.217% of the issued share capital at the time of the passing of the ordinary resolution. However, as soon as we turned around, we began to play with the merger of "10 and 1" shares and reduce the share premium, and the net profit in the middle of 2018 was only HK $12.114 million, and the "penny stocks" became more and more detailed. Similarly, A-share Qinghai Spring and its boss Zhang Xuefeng have also had a "bad reputation" in recent years, and their medicines, health products and food have been questioned by the market and institutions many times. Take the event of "challenging CFDA" on March 30, 2016, its Cordyceps sinensis business is almost coming to an end. Zhitong Financial APP had "tracked" the incident, mainly because the arsenic content of Cordyceps sinensis pure powder tablets exceeded the standard by 4-7 times, and the company's production of polar grass had not been able to organize production in accordance with GMP, so it was ordered by CFDA to stop the pilot work of health food. The issuance of this announcement means that Qinghai has completely lost its only legal identity for the production and operation of extremely grass in spring. Because extreme grass is the company's main product, its sales revenue accounts for nearly 80% of the main business income. According to market sales statistics: in the first three quarters of 2015, the sales income of pure powder tablets of Cordyceps sinensis in spring in Qinghai is about 750 million yuan, and it is estimated that the sales scale of polar grass in 2015 is about 1 billion yuan. As a result, the listed company faces huge losses overnight. It seems that no matter how bullish the enterprise is, and then endorse it with the development of the national economy, it can not resist the restriction of the relevant laws and regulations of the national medicine and food. In fact, it is not the first time that Cordyceps sinensis pure powder has fallen into crisis. In 2009, the Ministry of Health issued the notice of the Ministry of Health on further standardizing the management of health food raw materials. Cordyceps sinensis shall not be used as a common food raw material; on December 7, 2010, the Food production Supervision Department of the AQSIQ issued an official document, "it is strictly forbidden to use Cordyceps sinensis as a food raw material to produce ordinary food." However, in the case of unfavorable policies, Qinghai Spring continued to produce and sell pure powder slices of Cordyceps sinensis according to the "Qinghai Provincial Standard for processing Chinese Herbal slices of Cordyceps sinensis" published by Qinghai Food and Drug Administration in 2010. The good times will not last long. In 2012, CFDA again issued a notice to crush and press Cordyceps sinensis into slices in the classification of traditional Chinese medicine, adding the "pilot work program of Cordyceps sinensis for health food", allowing Cordyceps sinensis to be directly used as the raw material of health food, so that the pure powder slices of Cordyceps sinensis in spring in Qinghai has been justifiably changed from traditional Chinese medicine to health products. Also because of the policy, the sales quota of Cordyceps sinensis pure powder tablets in spring in Qinghai reached 5 billion yuan in 2012, more than twice the total sales of the second to sixth places of related products. In November 2014, Wang Hai, an anti-counterfeit activist, suspected that the classic 5X lozenges produced in spring in Qinghai did not contain cordycepin and sent them to a testing center in Beijing for testing. The test results are surprising. According to the staff of the testing center, the detection limit of the detection instrument is 5.63 μ g / g. "No Cordycepin has been detected (not equal to no cordycepin at all), but there may be, but because of extremely small amounts, it cannot be detected." As soon as the news came out, Qinghai Spring fell into the quagmire of suspected false propaganda. Similarly, at the end of January 2016, CFDA issued a "consumption Tip on Cordyceps sinensis products" based on market testing, saying that long-term consumption of Cordyceps sinensis will lead to excessive intake of arsenic and may bring health risks, among which the pure powder tablets of Cordyceps sinensis in spring in Qinghai are mainly monitored by relevant departments. Although, with regard to the measures of the relevant departments, Qinghai Spring made a public "challenge" to the Food and Drug Administration through letters and the Internet on February 17 and March 4, 2016, respectively, applying for disclosure of relevant information about "consumption tips", including documents such as manufacturers, product batches and test results of Cordyceps sinensis, Cordyceps sinensis powder and pure powder tablets tested by this monitoring and inspection. This move in spring in Qinghai did not wash away its grievances. On the contrary, the State Administration of Food and Drug Administration immediately sent a document to explain: "since the production of extreme grass products in spring, Qinghai has been unable to solve this problem, and the national standard for arsenic content is that the total limit value of arsenic in health food is 1.0mg/kg (" Food Safety National Standard Health Food "). According to the sampling test of 26 batches of polar grass products produced in spring in Qinghai from 2013 to 2015, the content of Kun was always between 4. 4-9.88mg/kg, 4-9 times higher than the standard. " Finally, the pure powder tablets of Cordyceps sinensis in spring in Qinghai were ordered to be removed from the shelves and the pilot work of health food was stopped. With regard to being forced to take it off the shelves, Qinghai expressed its attitude to the secondary market in spring, which may lead to the real risk of stopping production and operation in spring, and affect the digestion of its finished and semi-finished products, so that the company will face the risk of huge losses in the future. At present, the serious impact on pharmaceutical production and operation in Spring will also lead to the possibility that Qinghai Spring stocks will be implemented other risk warning measures (namely ST), and the performance commitments made during the company's restructuring will not be fulfilled. In fact, CFDA's law enforcement opinions will even cause incalculable risks and losses, or even annihilation, to the spring of Qinghai. But there is still a strange voice in the industry: "the spring death in Qinghai is not wronged." Until now, the performance of Qinghai Spring is still in a state of decline, with an operating income of 189 million yuan in the first half of 2018., The year-on-year decline was 13.63%; the net profit was only 83 million yuan, down 2.3% from the same period last year.Transformation to deal with the spicy taste of "Huolu herbal tea" is not selling well.Whether health products can cure diseases is unknown, but the industry does make a name! (Tian Yuxuan / article)

Similarly, A-share Qinghai Spring and its boss Zhang Xuefeng have also had a "bad reputation" in recent years, and their medicines, health products and food have been questioned by the market and institutions many times. Take the event of "challenging CFDA" on March 30, 2016, its Cordyceps sinensis business is almost coming to an end. Zhitong Financial APP had "tracked" the incident, mainly because the arsenic content of Cordyceps sinensis pure powder tablets exceeded the standard by 4-7 times, and the company's production of polar grass had not been able to organize production in accordance with GMP, so it was ordered by CFDA to stop the pilot work of health food. The issuance of this announcement means that Qinghai has completely lost its only legal identity for the production and operation of extremely grass in spring. Because extreme grass is the company's main product, its sales revenue accounts for nearly 80% of the main business income. According to market sales statistics: in the first three quarters of 2015, the sales income of pure powder tablets of Cordyceps sinensis in spring in Qinghai is about 750 million yuan, and it is estimated that the sales scale of polar grass in 2015 is about 1 billion yuan. As a result, the listed company faces huge losses overnight. It seems that no matter how bullish the enterprise is, and then endorse it with the development of the national economy, it can not resist the restriction of the relevant laws and regulations of the national medicine and food. In fact, it is not the first time that Cordyceps sinensis pure powder has fallen into crisis. In 2009, the Ministry of Health issued the notice of the Ministry of Health on further standardizing the management of health food raw materials. Cordyceps sinensis shall not be used as a common food raw material; on December 7, 2010, the Food production Supervision Department of the AQSIQ issued an official document, "it is strictly forbidden to use Cordyceps sinensis as a food raw material to produce ordinary food." However, in the case of unfavorable policies, Qinghai Spring continued to produce and sell pure powder slices of Cordyceps sinensis according to the "Qinghai Provincial Standard for processing Chinese Herbal slices of Cordyceps sinensis" published by Qinghai Food and Drug Administration in 2010. The good times will not last long. In 2012, CFDA again issued a notice to crush and press Cordyceps sinensis into slices in the classification of traditional Chinese medicine, adding the "pilot work program of Cordyceps sinensis for health food", allowing Cordyceps sinensis to be directly used as the raw material of health food, so that the pure powder slices of Cordyceps sinensis in spring in Qinghai has been justifiably changed from traditional Chinese medicine to health products. Also because of the policy, the sales quota of Cordyceps sinensis pure powder tablets in spring in Qinghai reached 5 billion yuan in 2012, more than twice the total sales of the second to sixth places of related products. In November 2014, Wang Hai, an anti-counterfeit activist, suspected that the classic 5X lozenges produced in spring in Qinghai did not contain cordycepin and sent them to a testing center in Beijing for testing. The test results are surprising. According to the staff of the testing center, the detection limit of the detection instrument is 5.63 μ g / g. "No Cordycepin has been detected (not equal to no cordycepin at all), but there may be, but because of extremely small amounts, it cannot be detected." As soon as the news came out, Qinghai Spring fell into the quagmire of suspected false propaganda. Similarly, at the end of January 2016, CFDA issued a "consumption Tip on Cordyceps sinensis products" based on market testing, saying that long-term consumption of Cordyceps sinensis will lead to excessive intake of arsenic and may bring health risks, among which the pure powder tablets of Cordyceps sinensis in spring in Qinghai are mainly monitored by relevant departments. Although, with regard to the measures of the relevant departments, Qinghai Spring made a public "challenge" to the Food and Drug Administration through letters and the Internet on February 17 and March 4, 2016, respectively, applying for disclosure of relevant information about "consumption tips", including documents such as manufacturers, product batches and test results of Cordyceps sinensis, Cordyceps sinensis powder and pure powder tablets tested by this monitoring and inspection. This move in spring in Qinghai did not wash away its grievances. On the contrary, the State Administration of Food and Drug Administration immediately sent a document to explain: "since the production of extreme grass products in spring, Qinghai has been unable to solve this problem, and the national standard for arsenic content is that the total limit value of arsenic in health food is 1.0mg/kg (" Food Safety National Standard Health Food "). According to the sampling test of 26 batches of polar grass products produced in spring in Qinghai from 2013 to 2015, the content of Kun was always between 4. 4-9.88mg/kg, 4-9 times higher than the standard. " Finally, the pure powder tablets of Cordyceps sinensis in spring in Qinghai were ordered to be removed from the shelves and the pilot work of health food was stopped. With regard to being forced to take it off the shelves, Qinghai expressed its attitude to the secondary market in spring, which may lead to the real risk of stopping production and operation in spring, and affect the digestion of its finished and semi-finished products, so that the company will face the risk of huge losses in the future. At present, the serious impact on pharmaceutical production and operation in Spring will also lead to the possibility that Qinghai Spring stocks will be implemented other risk warning measures (namely ST), and the performance commitments made during the company's restructuring will not be fulfilled. In fact, CFDA's law enforcement opinions will even cause incalculable risks and losses, or even annihilation, to the spring of Qinghai. But there is still a strange voice in the industry: "the spring death in Qinghai is not wronged." Until now, the performance of Qinghai Spring is still in a state of decline, with an operating income of 189 million yuan in the first half of 2018., The year-on-year decline was 13.63%; the net profit was only 83 million yuan, down 2.3% from the same period last year.Transformation to deal with the spicy taste of "Huolu herbal tea" is not selling well.Whether health products can cure diseases is unknown, but the industry does make a name! (Tian Yuxuan / article)