Edited by Evergrande Research Institute: "US stocks continue to plummet: us economy peaked, Real Estate and inventory cycle Down" and Northeast Securities: "US Government shutdown, French riots-- overseas Macro-Weekly observation"

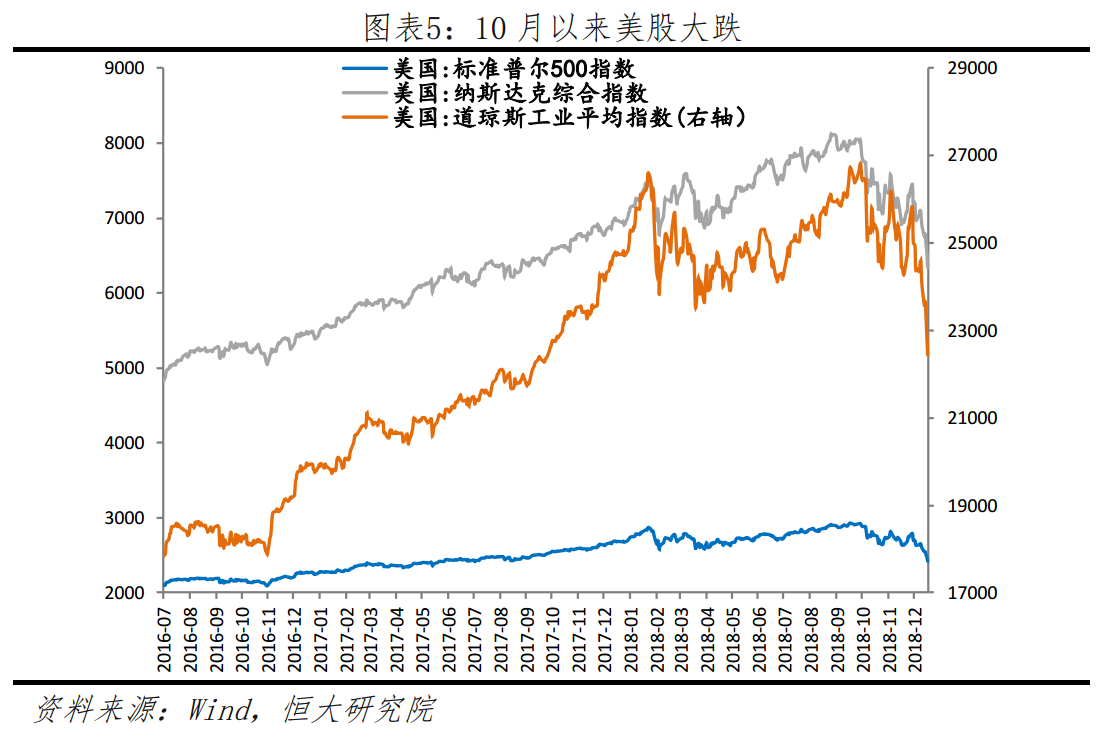

Since the beginning of October, US stocks have continued to plummet. As of December 21, the Nasdaq, S & P 500 and Dow have fallen by 21.2%, 17.4% and 15.8% respectively since the beginning of October, with full-year cumulative returns of-9.6%,-10.4% and-9.6%. On December 21, US Eastern time, US stocks plummeted again, with the Nasdaq, the S & P 500 and the Dow falling 3.0%, 2.1% and 1.8% respectively in a single day, down 8.4%, 7.1% and 6.9% in a week, the biggest weekly decline since the third quarter of 2008.

Evergrande Research Institute emphasizesThe US economy is recovering but may gradually reach its peak. Similarly, the collapse of US stocks does not mean that the collapse of US stocks is coming to a bear path, but is more likely to be a shock adjustment, because the fundamentals of the US economy are still quite healthy.

However, the current major economic indicators show that the US economy has peaked and declined.

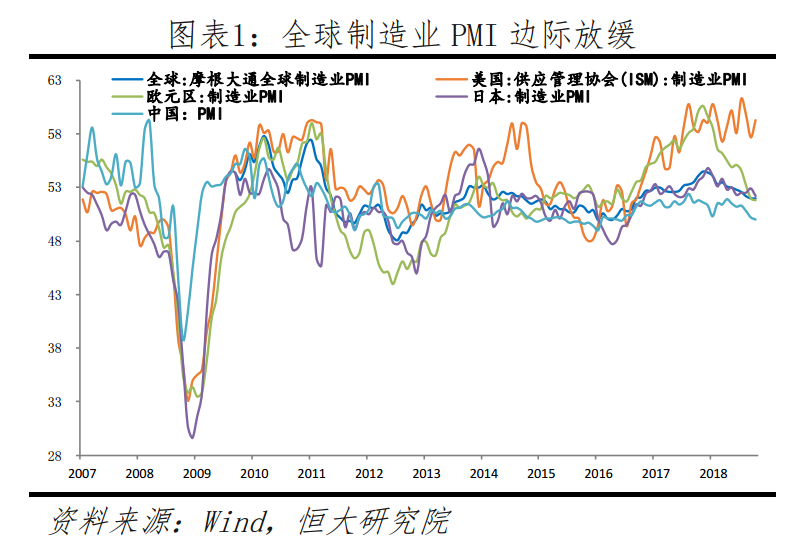

In November, the overall downward trend of global manufacturing PMI remained unchanged at its lowest level since November 2016, while US manufacturing PMI fell back.

Part of the Treasury yield curve is upside down, the global economy is slowing marginally, the Federal Reserve continues to raise interest rates, and interest rates are at their highest level in eight years, limiting investment demand.

With the Federal Reserve raising interest rates, the current U. S. real estate boom has begun to inflection point, housing sales, prices, investment all show that the real estate boom is declining.

The investment cycle of production capacity and equipment is in a slow downward stage, which slows down the marginal contribution to growth.

The Federal Reserve raised the federal funds rate at its December meeting, but the overall attitude was dove.

From a micro point of view, Northeast Securities expects that personal consumption will decline to a certain extent in the future.

With consumer spending accounting for 2/3 of U.S. economic activity, the higher-than-expected rise in November bodes well for continued high growth in the fourth quarter. On the other hand, personal consumption is expected to fall in the future as the savings rate picks up, due to higher-than-expected spending and lower-than-expected incomes, which to some extent depress the savings rate.

But the final consumer confidence index of the University of Michigan in December was 98.3, higher than expected at 97.4, with a previous value of 97.5. The upward revision of the consumer confidence index in December reflects the optimism of US consumers in the good economic and employment conditions.