Refined from Guosheng Securities "US interest rate hike VS China" interest rate cut, where do global liquidity and large categories of assets go? "

At 3: 00 a.m. on December 20, the Federal Reserve announced its December interest rate resolution: raising the target rate range for federal funds by 25 basis points from 2.00% to 2.25%, reducing the number of GDP increases from three to two in 2019; downgrading GDP growth forecasts for 2018 and 2019; raising unemployment forecasts for 2020 and 2021; and lowering PCE inflation forecasts for 2019 and 2019. By contrast, the people's Bank of China created the targeted medium-term Lending Facility (TMLF) on December 19th, which can be regarded as a targeted interest rate cut.

Against the backdrop of recent concerns about a slowdown in economic growth, analysts at Guosheng Securities have predicted the trend of large categories of assets such as the dollar, Treasuries, US stocks, crude oil and gold in 2019.

Us dollar: short rise and long fall

The Fed has gradually raised interest rates to support the dollar, which has risen 7.7 per cent since April, driven by good employment, wage data and inflation expectations. In the short term, the Fed is expected to raise interest rates twice next year, but the ECB will raise interest rates at least after the summer of 2019, while Brexit remains uncertain, and the dollar is likely to remain strong in the short term.

However, given that the Fed is already in the second half of raising interest rates and the dollar strength cycle is over, monetary policy of other major central banks other than the Fed has also begun to tighten (the ECB announced that it would fully withdraw from QE at the end of the year and start raising interest rates after the summer of 2019; the Bank of Japan began to scale back its bond purchases at the beginning of the year; and economies such as Canada, Norway, Australia and South Korea are also interested in entering the rate-raising cycle), the dollar is under pressure in the medium to long term.

Us Treasuries: 10-year US Treasuries still have room for upside

With interest rate hikes and shrinking tables continuing, 10-year Treasury yields still have room to rise, and highs are expected to be above 3.3% in 2019.

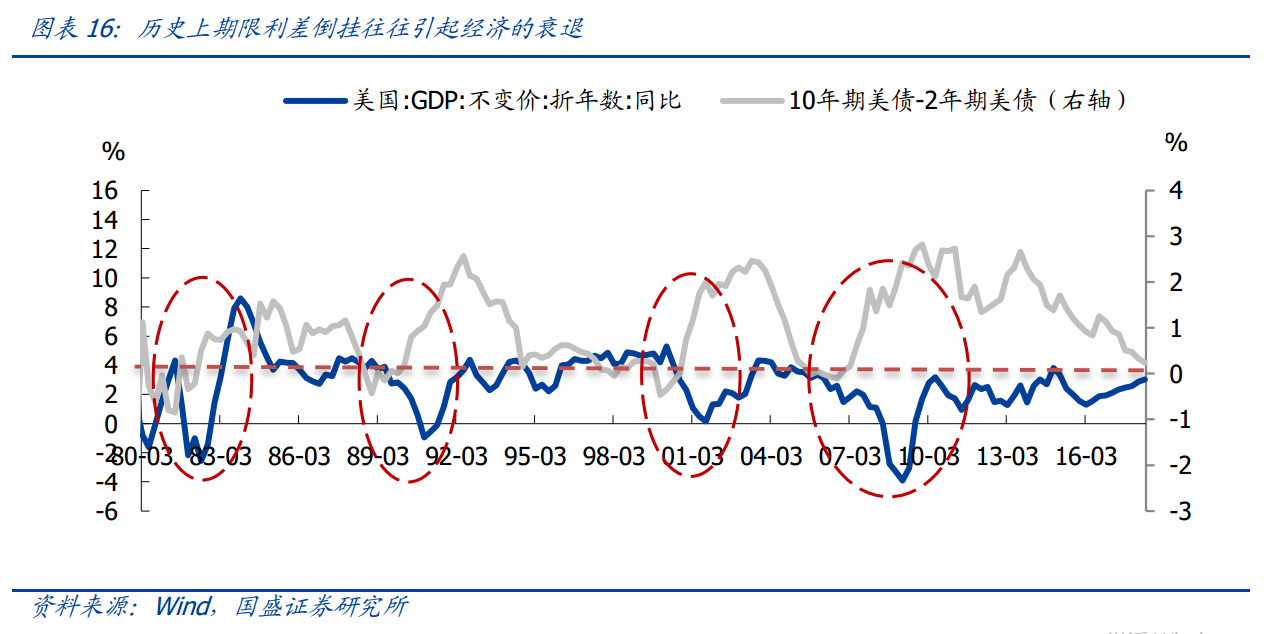

On December 4, long-term Treasury yields plummeted and US maturity spreads narrowed sharply or even upside down, rekindling concerns about the weakening of the US economy. Historically, the narrowing or even upside-down of term spreads have triggered economic recessions to varying degrees, but there is a time lag of 3-12 months. Guosheng believes that although there is a certain signal of recession in this upside down, there is no risk of a cliff decline in the US economy in the short term, and it is more likely to decline slowly in the next 1-2 years.

In the long run, it is expected that 1-2 in the futureThe peak of US debt is likely to be 3.3%Above.

The reasons are as follows:1) Historical experience shows that 10-year US bonds often rise with the upward trend of benchmark interest rates; 2) the Fed's shrinking schedule will mainly affect US long-term bond interest rates. After 2019, the Fed will probably slow down the pace of raising interest rates, but will speed up the process of shrinking the table. it means that starting from 2019, the upward speed of short-end interest rates in the United States slows down, the upward speed of long-end interest rates accelerates, and the divergence of long-end spreads is expected to ease.Based on two scenarios, 2019-2021In 2008, the shrinking table is equivalent to the term spread upward 21.92bp-57.33bpCombined with the Federal Reserve, it is expected that in 2019Keep the federal funds rate at 3% inThe level corresponds to 10.5-year Treasuries are expected to rise to 3.3%Above.

Us stocks: weakening

The performance of US stocks is highly related to economic fundamentals, and with the marginal slowdown of the US economy in the future, US stocks are likely to enter a bear market.

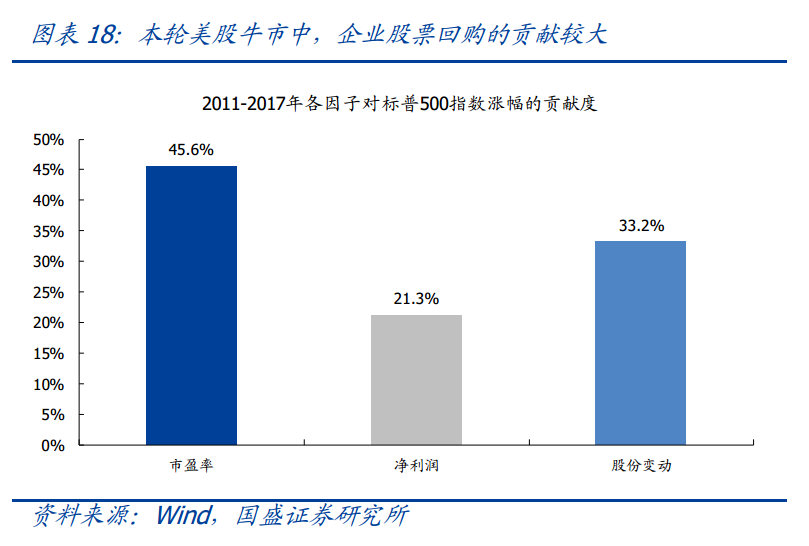

In addition, in addition to the fundamentals, share buybacks of listed companies contributed 33% to the bull market of US stocks. The data show that the trend of new debt of US non-financial companies is ahead of the scale of share buybacks, as the Fed continues to tighten money, credit spreads at the end of the superimposed economic cycle tend to widen, and US corporate financing costs will continue to rise. Given that the leverage ratio of the US corporate sector has reached an all-time high, the decline in the growth rate of corporate debt will lead to a continued decline in the size of share buybacks, which will be a drag on the performance of US stocks in the context of the poor economic outlook.

Oil prices: central downside

Constrained by the increase in production in the United States and Russia and the decline in global demand, the oil price hub is expected to decline next year.

It should be pointed out that the implementation of OPEC production cuts and Iran's crude oil supply will still cause uncertainty to crude oil supply and demand. Follow-up still need to pay close attention to: 1) in December 2018, OPEC and oil exporters announced that they would cut oil production by 1.2 million b / d in 2019, of which 800000 b / d in OPEC members and 400000 b / d in non-OPEC countries. However, at present, Russia is not willing to reduce production, and the actual effect of production reduction remains to be seen. 2) the exemption of eight countries, including China, from US sanctions against Iran will expire in May 2019, and if the sanctions against Iran are upgraded in the future, it will support a sharp rise in oil prices.

Gold: central uplink

The dollar is weakening in the medium to long term, superimposed by the global economic downturn, European risk events have not yet been cleared, and the gold price center is expected to rise next year.

Looking back, Guosheng expects2019In 2000, the gold center moved up, and the specific trend was low in the front and high in the back, for the following reasons:1) corresponding to the above-mentioned trend of the US dollar, with the marginal decline of the US economy and the slowdown of the number of interest rate increases by the Federal Reserve, the rise of the US dollar may be limited, thus weakening the crackdown on gold prices. 2) risk events such as the French uprising and Brexit may drag down the euro zone economy; it is difficult to ease trade frictions between China and the United States, and Sino-US relations will be a major global variable in the coming decades, which is expected to extend to technology, industry and even finance outside trade. The demand for risk aversion of gold is increasing day by day. 3) although the crude oil price center goes down in 2019, it will not fall back below $50, and it is expected that the world will be in a state of stagflation in 2019, which is good for gold prices. 4) although the Fed's shrinking schedule will lead to a rise in long-term interest rates, the crackdown on gold is expected to be offset by inflation, with a limited upside in 10-year real Treasury yields and a limited crackdown on gold prices.