Source: Wall Street

Raising the best lending rate or marginal increase in bank costs and mortgage loan costs, but the marginal impact on the financial conditions of Hong Kong stocks is relatively limited.

HSBC is not far behind after the Hong Kong Monetary Authority raised it by 75 basis points.

On Thursday, the Hong Kong Monetary Authority of China raised its benchmark interest rate (BR) by 75 basis points to 3.5%, the fifth consecutive increase. A few hours later,HSBC announced that it would raise the Hong Kong dollar best lending rate (BLR) to 5.125 per cent from 5.0 per cent. The new rate will take effect on Friday, raising BLR for the first time since 2018.In addition, its dollar savings rate was raised to 0.50% from 0.25%.

On Thursday, the Hong Kong Monetary Authority of China raised its benchmark interest rate (BR) by 75 basis points to 3.5%, the fifth consecutive increase. A few hours later,HSBC announced that it would raise the Hong Kong dollar best lending rate (BLR) to 5.125 per cent from 5.0 per cent. The new rate will take effect on Friday, raising BLR for the first time since 2018.In addition, its dollar savings rate was raised to 0.50% from 0.25%.

According to media reports, the market expects that after HSBC raises interest rates, other local banks in Hong Kong will also raise BLR.

Li Ruofan, global market strategist at DBS China Hong Kong Finance Markets Department, told the media that the upward adjustment of BLR may have an emotional impact on the Hong Kong property market.

The impact of raising the best lending rate

CICC analysts Liu Gang, Chen Nan and Ding Keyue said in their "CICC: an Analysis of Hong Kong's interest rate hike Mechanism and Market impact" that raising BLR may marginally increase bank costs and push up real estate mortgage interest rates.However, as the BLR increase lags behind the already higher capital interest rate, the incremental impact on the overall financial conditions of Hong Kong stocks is limited.Specifically:

1. Increase BLR or marginal increase in bank costs:

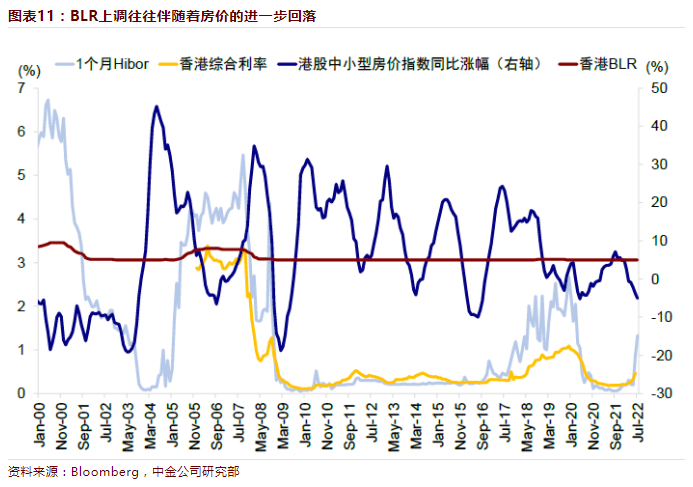

BLR is closely related to the cost side (deposit interest rate) of Hong Kong banks, so an increase in BLR may have a marginal impact on banks' net interest margin. The Hong Kong composite interest rate (a measure of banks' overall financing costs) is highly correlated with deposit rates and BLR, which also showsThe BLR hike could mean that the period in which Hong Kong's net interest margin has risen sharply in the interest rate hike cycle is over.Judging from the correlation between BLR-Hibor and bank net interest margin, the current increase in BLR may have a negative impact on the profit margins of Hong Kong banks.

two。 Push up the cost of mortgage loans or increase the pressure on Hong Kong's property market:

Against the backdrop of the upward Hibor, Hong Kong's Central Plains property price index (Centa-city Index) has fallen year-on-year since March 2022, and the small and medium-sized housing price index fell 5.1 per cent in July.If the BLR is further raised in the future, it may increase the interest payment pressure on housing mortgage loans. Historically, house prices have often come under pressure after Hong Kong banks raised their BLR.Hong Kong property prices fell by about 8.4 per cent in February 2019 after banks raised BLR by 12.5 per cent in September 2018.

3. The marginal impact on financial conditions is relatively limited:

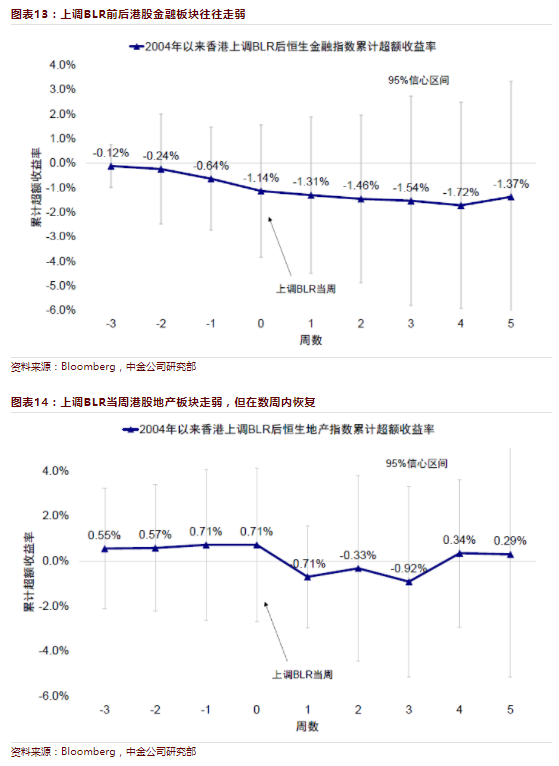

As the BLR adjustment lags behind, the marginal impact of BLR changes on the financial conditions of Hong Kong stocks is relatively limited when the financial conditions of Hong Kong stocks have been taken into account.

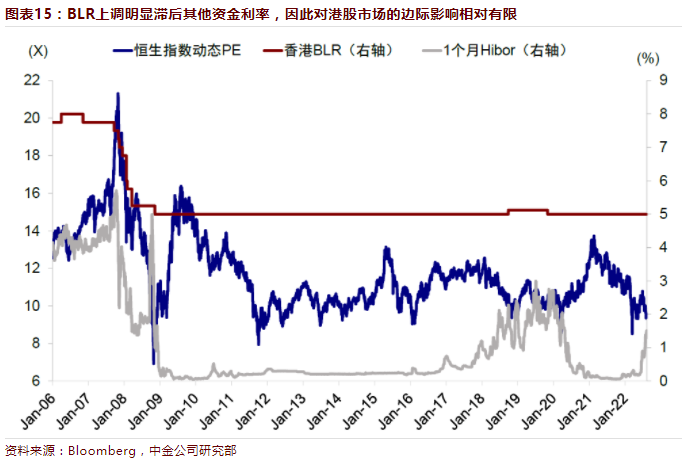

We use backtracking to measure the changes in excess returns in Hong Kong stock markets and sectors before and after the BLR increase to capture the impact of this event. In the specific calculation, based on the CAPM model, we measure the changes of Hong Kong stocks (Hang Seng Composite Index) relative to MSCI global excess returns before and after 9 BLR increases since 2004.

The results show that there is no significant return change in the Hong Kong stock market before and after the increase of BLR.Within five weeks of the BLR increase, the cumulative excess return of Hong Kong stocks was only 0.92%, which was significantly lower than that before the increase.

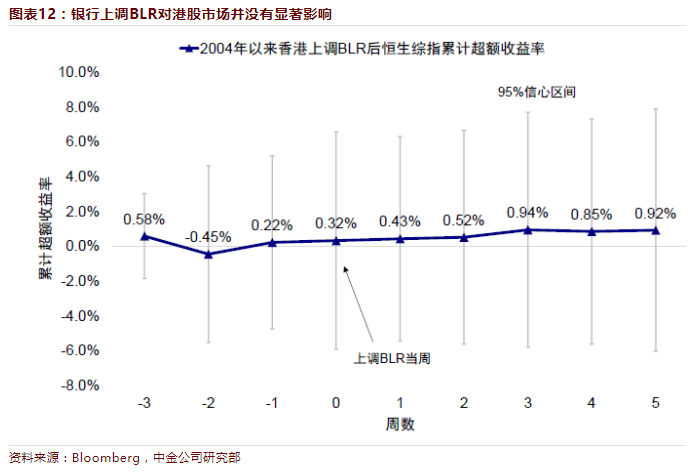

By contrast, the financial sector (the Hang Seng Financial Index) began to weaken a few weeks before the BLR increase, with cumulative excess returns of-1.72% in the fourth week after the increase. The real estate sector (the Hang Seng property Index) weakened slightly after the BLR increase, but basically recovered its decline in the fourth week after the increase.Thus, the upward adjustment of BLR has no significant impact on the overall short-term performance of Hong Kong stocks, but has a greater impact on the financial and real estate sectors, which is basically consistent with the conclusions we have analyzed above.Looking ahead, the future performance of Hong Kong stocks depends more on China's growth and earnings outlook, as well as expected changes in Fed policy.

Edit / roy

周四,中国香港金融管理局将基准利率(BR)上调了75个基点至3.5%,为连续第五次上调利率。几个小时后,汇丰宣布将港元最优惠贷款利率(BLR)从5.0%上调至5.125%,新利率将于周五生效,为2018年以来首次上调BLR。此外,其美元储蓄利率从0.25%上调至0.50%。

周四,中国香港金融管理局将基准利率(BR)上调了75个基点至3.5%,为连续第五次上调利率。几个小时后,汇丰宣布将港元最优惠贷款利率(BLR)从5.0%上调至5.125%,新利率将于周五生效,为2018年以来首次上调BLR。此外,其美元储蓄利率从0.25%上调至0.50%。