Refined from Guoxin Securities: "Investment Strategy of the Real Estate Industry in 2019-the Power of cycle, the Dawn of Policy"

Editor's note: the lifting of sales restrictions in Heze, Shandong Province has triggered a heated discussion in the market. what will be the trend of the real estate industry in 2019? Guoxin Securities maintains the "overweight" rating of the industry through the research framework of cycle theory, and firmly looks at the dominant real estate stocks.

1. An overview of the research framework

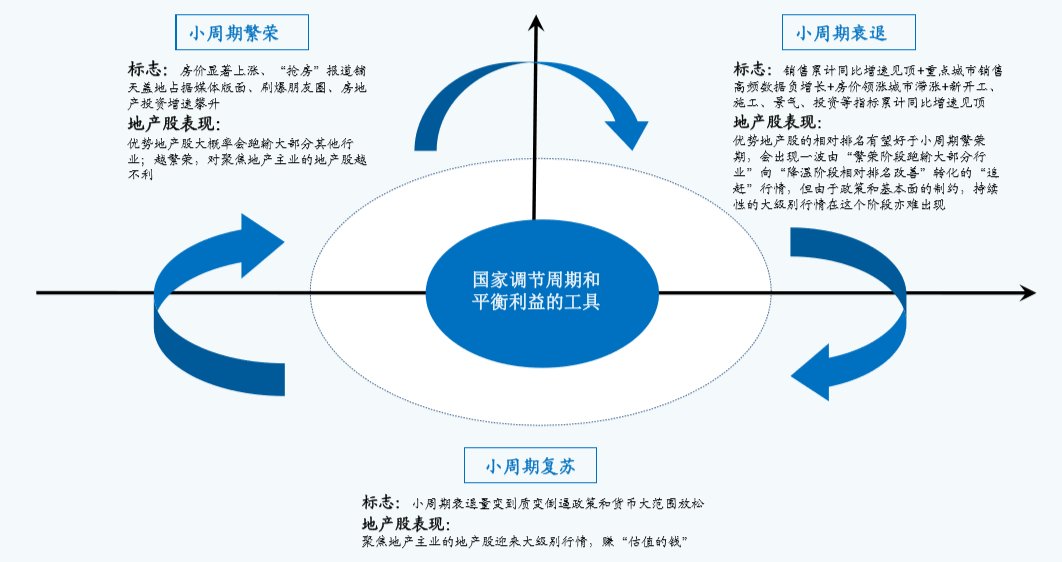

Au Ruiming Real Estate A-share small cycle theoretical framework:「Boom-bust-recovery"cycle

Source: Guoxin Securities Economics Research Institute

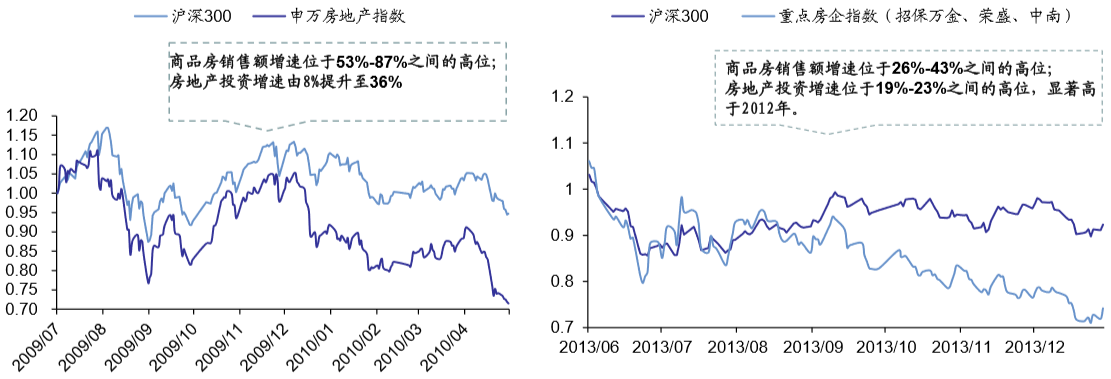

The more prosperous the industry is, the more worried the real estate stock price is.」。For example, real estate stocks outperformed the market during the boom period from the second half of 2009 to the first half of 10 years, the excess income of real estate stocks during the boom period in 2013 dropped sharply and outperformed the market, and the reports of "house grabbing" in the first half of 2016 were full of media, but the trend of dominant real estate stocks was weak.

Comparison between real estate stock index and Shanghai and Shenzhen 300

Source: wind, Guoxin Securities Economics Research Institute

The cooler the industry, the better it will be for property prices.For example, real estate stocks outperformed the market during the recovery period from the end of 2008 to the first half of 2009, the 2012 recovery period significantly outperformed the market, and the large-scale market of real estate stocks during the recovery period in 2014. The following picture shows that "since the start of this cooling period, dominant real estate stocks have outperformed the market":

Source: wind, Guoxin Securities Economics Research Institute

The core assumption of the research framework: commercial housing development is still a pillar industry in China.

The essential characteristic of China's real estate industry-- the national adjustment cycle and the tool to balance interests.

Source: wind, Guoxin Securities Economics Research Institute

2. The trend of the real estate industry in 2019: similar to 2012

Review of the Real Estate Industry in 2012

Fundamentals:Compared with the small-cycle recovery period of the real estate industry in 2008 and 2014, when the recovery phase began at the end of 2011, the year-on-year growth rate of new commercial housing sales across the country did not show negative growth, and in October 2011, the year-on-year growth rate of new commercial housing sales remained at a relatively high level of 18.5%.

Year-on-year growth rate of sales of newly built commercial housing

Source: wind, Guoxin Securities Economics Research Institute

Policy aspects:In order to stimulate the economy, from 2010 to 2012, the central government successively issued a number of support policies on "unfair 36 articles", promoting the development of small and medium-sized enterprises, promoting industrial transformation, revitalizing the Northeast, vigorously promoting water conservancy reform of financial services, and so on. At the same time, the government's strict statement that "adhere to the real estate regulation and control policy and promote the reasonable return of housing prices" has not changed.

The economic slowdown is gradually emerging in 2011.

Source: wind, Guoxin Securities Economics Research Institute

Real estate stock market:After the local fine-tuning of the policy, a big round of real estate stocks appeared in 2012. Although it was affected by the policy several times during the period, it did not change the upward trend of shock. In 2012, the shares of Sunshine City, Huaxia Happiness, Rongsheng Development, Poly Real Estate, China Merchants Real Estate and Vanke A rose by 255%, 249%, 170%, 112%, 105% and 89%, respectively.

Real estate stocks come out of the trend opportunity in 2012

Source: wind, Guoxin Securities Economics Research Institute

Prospect of the real estate industry in 2019

Current changes in the fundamentals of the real estate industry:The sales of newly-built commercial housing have dropped significantly, the transaction volume in the key 40 cities has gradually declined, and the sales of the first, second and third and fourth lines have dropped significantly; the land market has cooled obviously, the land auction in many provinces accelerated in the third quarter, and local financial pressure may have appeared.

Industry key indicators Forecast in 2019:Guoxin Securities expects the fundamentals to fall first and then stabilize in the future. under the background that the above policy relaxation is expected to be basically fulfilled, it is expected that the sales area and sales of new commercial housing will grow by-5% year-on-year in 2019, real estate investment will grow by 3% year-on-year, and new construction will be the same as in 2018.

Forecast of cumulative year-on-year growth rate of sales in the coming year

Source: Wind, Guoxin Securities Economics Research Institute

Maintain the "overweight" rating of the industry and firmly look at superior real estate stocks.

Profit forecast and valuation of key companies (the amount involved is denominated in RMB)

Source: wind, Guoxin Securities Economics Research Institute

3. Risk

Market risk

If the cooling of the real estate industry exceeds market expectations and the policy is slow to warm up.

The risk of the research framework

The research framework of the above strategic recommendations is the "A-share small-cycle theoretical framework of District Ruiming Real Estate", and its core assumption is that commercial housing development is still the pillar industry in China. If the medium-and short-term rise of an industry with the same market capacity as commercial housing development and can replace the pulling effect of commercial housing development on China's macro-economy, then the above research framework will fail, and the corresponding strategic recommendations will also fail.