Global stock and foreign exchange markets suffered a massive sell-off today, which analysts said was due to heightened concerns about economic growth, especially after China's economic data and euro zone economic data fell short of expectations.

In the evening, the futures of the three major US stock indexes also fell nearly 1% before trading, with the Dow down more than 200 points, which seems to follow the earlier decline of Asia-Pacific stock markets.

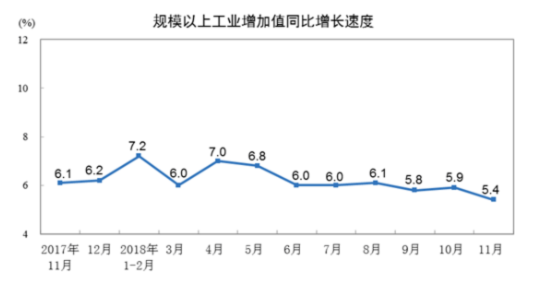

On the face of the news, the National Bureau of Statistics released economic data for November:

The growth rate of industrial added value above scale slowed to 5.4% year-on-year, and the growth rate of retail sales of social consumer goods slowed to 8.1% year-on-year, both of which fell short of market expectations.The growth rate of consumption was the lowest since May 2003.

The report also said that in the first 11 months, urban fixed asset investment was slightly better than expected, the growth rate of investment in real estate development was the same, the growth rate of retail sales of social consumer goods was the same, and the industrial added value above scale was lower than expected and previous value.

In response, Mao Shengyong, spokesman for the National Bureau of Statistics, said at a press conference that from November,The growth rate of some indicators has dropped somewhat, indicating that the downward pressure on the economy is greater, especially now that the external environment is more severe and complex, and variables and uncertainties are increasing.

He also said that China's economic growth is still within a reasonable range. It is necessary to combine China's economic operation with the overall environment of the world economy; we cannot look at November in isolation, but we should take a longer period of time and continue to look at the performance of the economy.

Julian Evans-Pritchard, an economist at Capital Economics, wrote thatThe latest data show that China's economy is under pressure both internally and externally, and policy efforts to support economic growth are still inadequate.

It also said that looking forward to the future.Even if China and the US can reach a lasting ceasefire on trade, the lagging effects of slowing global economic growth and slowing credit growth will still have a negative impact on economic activity in the coming months.

Eurozone economic data are also not satisfactory, with the latest PMI reports from France, Germany and the euro zone confirming that the economic data mentioned by Draghi overnight were lower than expected, adding to concerns about downside risks to economic growth:

The initial PMI of French manufacturing industry in December is 49.7Hit a 27-month lowThe initial PMI of the service industry in December was 49.6Hit a 34-month lowThe initial value of comprehensive PMI in December was 49.3, falling below the 50 mark for the first time since June 2017The lowest since November 2014.

German manufacturing PMI initial value 51.5 in DecemberHit a 33-month lowThe initial PMI of German service industry in December is 52.5Hit a seven-month lowThe initial value of German comprehensive PMI in December is 52.2Hit a 48-month low.

The initial value of manufacturing PMI of euro zone in December is 51.4; the initial value of service PMI of euro zone in December is 51.4; and the initial value of composite PMI of euro zone in December is 51.3.Manufacturing PMI hit a 34-month low in December, while services and comprehensive PMI both hit a 49-month low..

Williamson, chief economist of Markit, said companies are worried about the global economic and political environment.Trade frictions and Brexit have added to the uncertainty in the euro zone.

Williamson also pointed out that the survey showedThe auto industry shows signs of continuing to drag down the euro zone economy as a whole, and forward-looking indicators remain suppressed, suggesting stagnant demand growth and increasing downside risks to the economy.!

In addition, analysts also pointed out that the trigger for large fluctuations in the market will be the Federal Reserve.The meeting will be held from 18 to 19 December. The Fed is expected to raise interest rates to guide the pace of rate hikes next year.

"the market has a lot of different views on the path of the Fed to raise interest rates in 2019.Traders' expectations range from one to four interest rate increases."said Michael McCarthy, chief market strategist at CMCmarkets. (editor / Li Chen)