Edited from Anxin Securities: "5G Series report Seven: 5G promotes PCB/ Copper clad Laminate Industry upgrading, Core Asset value revaluation", Caitong Securities: "5G PCB Logic carding: five-year accumulative 60 billion Space"

This is the second report on 5G dehydration.

Tuyere industry | 5G full carding 1Rank 5G investment strategy

The high prosperity of the PCB industry not only benefits from the construction of 5G infrastructure, but also includes the application of later 5G scenarios, such as consumer electronics such as 5G mobile phones, intelligent driving, etc., which has a wide demand, and the development level of its industry also reflects the development speed and technical level of China's electronic information industry to a certain extent.

The sharp rise in the price of raw materials, the increase in R & D investment and the high pressure of environmental protection policies have intensified the Matthew effect of the domestic PCB industry chain. With the rapid growth of the domestic PCB industry and the gradual improvement of the degree of concentration, the international leader will be born. Shennan Circuit, currently ranked first in China, is only ranked 20th in the world.

1. PCB: mother of Electronic products

PCB (PrintedCircuitBoard), that is, printed circuit board, plays a supporting and interconnecting role in electronic equipment.All electronic equipment or products should be equipped with PCB board.To make its downstream demand sustained and stable.The development level of its industry can reflect the development speed and technical level of electronic information industry in a country or region to a certain extent.PCB, namely printed circuit board (PrintedCircuitBoard), is called "the mother of electronic products".

According to Prismark, the global PCB industry has maintained an average annual compound growth rate of about 4 per cent over the past decade. The global PCB output value in 2017 was 58.8 billion US dollars, a year-on-year growth rate of 8.60%.China's PCB output value is 29.7 billion US dollars, a year-on-year growth rate of 9.70%, which is higher than that of the whole world.From the regional distribution of PCB output value, the focus of PCB industry continues to shift to Asia. China has become the most important player of PCB in the world, accounting for more than 50% of global PCB output value.In 2018, the growth rate of capital leaders maintained an average of 20% to 25%, and the growth rate of output value far exceeded the industry average.

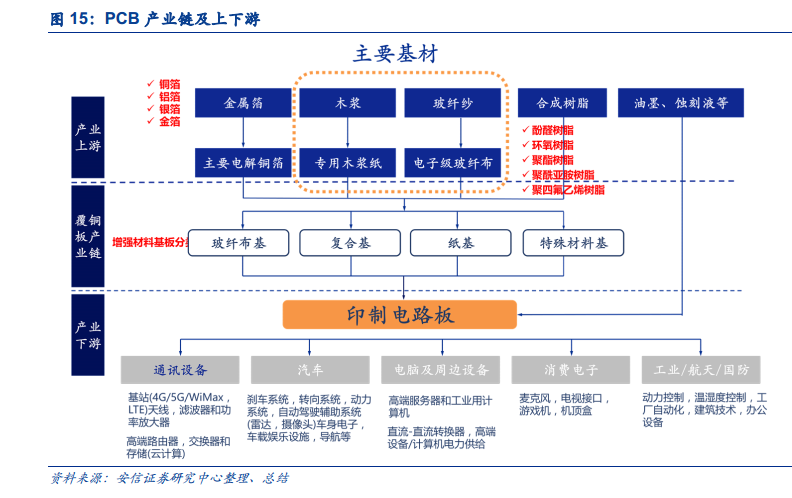

From the link of PCB industrial chain, it is in the middle reaches of the whole industrial chain.The upstream are all kinds of raw materials for the production of PCB, including copper clad laminate, copper foil, copper ball, semi-curing sheet, gold salt, ink, dry film and other chemical materials.The main raw materials of flexible circuit board also include covering film, electromagnetic film and so on.

Downstream is mainly used in computers, communication equipment, industrial control, automotive electronics, consumer electronics, aerospace and other fields, covering a wide range of areas.Among them, communications, computers and consumer electronics are the three most important application terminals in the PCB industry, accounting for 27%, 27% and 14% of the demand, respectively, directly affecting the development of the upstream PCB industry.

2. Demand side: 5G communication equipment will be the core driving force of China's PCB industry in the next 3 years.

PCB industry has entered a mature period, the traditional application market has been saturated, the key to growth depends on the downstream emerging segments. Prismark believes that cars and communications equipment will take over consumer electronics and become the new engine of industry growth over the next five years.

Whether automotive electronics (life-threatening) or communication equipment (single equipment is of great value and wide involvement), manufacturers will directly authenticate the upstream materials of the equipment.The market of smart driving and new energy vehicles is growing rapidly in recent years, but the certification threshold of the automobile board market is higher, especially the core devices with high added value, such as ADAS and energy management, which Chinese mainland manufacturers are difficult to break through in a short time.

Relatively speaking, the downstream equipment manufacturers in China's communication field have changed from followers to leaders in the 5G era, Shennan Circuit and Shanghai Power Co., Ltd. have occupied the main share of 4G equipment manufacturers' PCB procurement market, and 5G is expected to realize the domestic substitution of upstream higher-end high-end high-frequency / high-speed board materials.With the gradual arrival of 5G comprehensive commercial era, the growth prospect of communication PCB is broad. The mass construction and upgrading of communication base stations will form a huge demand for high-frequency high-speed boards, and PCB will usher in the demand for upgrading and replacement. Considering the number of base stations and the value of a single base station, it is estimated that the market space brought by 5G base stations for PCB is more than 4-5 times that of 4G.

3. Three factors deconstruct the PCB opportunity of 5G: bring more than 60 billion incremental opportunity

To understand the incremental opportunities in the 5G era, we must first understand the infrastructure of the 5G system.In summary, the 5G system architecture is mainly divided into three parts: terminal, access network and core network.

CaiTong Securities believes thatThe influence of the development of 5G communication technology on PCB can be deconstructed into three multiplier factors: "total amount", "unit dosage" and "unit price".PCB incremental space = total terminal / base station x PCB area per unit terminal / base station x PCB price. Conservative estimationCaiTong Securities believes thatWithin five years, the incremental space created by 5G for PCB will reach 61.8 billion, and China's PCB industry is expected to usher in massive growth opportunities.

4. Current situation of the industry:The sharp rise in raw material prices, the increase in R & D investment and the high pressure of environmental protection policies have intensified the Matthew effect of the domestic PCB industry chain.

1) the price increase cycle of raw materials such as copper foil and epoxy resin has been started in the past 17 years.As of July 18, the price of copper foil has increased by about 20% compared with that at the beginning of 17, and the price of epoxy resin has increased by about 44% compared with that at the beginning of 17. With the rise in the price of the substrateThe price of copper clad laminate, the core raw material of PCB, also went up, with an average annual price increase of 10% to 20%.Resulting in a substantial increase in the cost of raw materials for PCBPCB factories of small and medium-sized enterprises are facing greater cost pressure.

2) Local governments strictly implement pollution discharge targets to control the total amount of pollution discharge.The environmental protection tax has been formally implemented in the past 18 years, and the environmental protection policy has become more stringent.Under the influence of environmental protection policy, PCB manufacturers in many areas of the country are forced to limit production and stop production, and a large number of PCB industry-related manufacturers are forced to close down due to the lack of emission targets.

3) the global PCB industry is moving in the direction of high precision, high density and high reliability, constantly reducing size, cost, performance, lightweight, productivity and pollution, in order to adapt to the development of downstream electronic equipment industry, which meansEnterprises will further increase their investment in technology research and development and equipment.

Under the triple pressure of stricter environmental protection, rising prices of raw materials and increasing investment in R & D, small and medium-sized manufacturers in the PCB industry chain are gradually withdrawing from the market.Leading enterprises such as Shennan Electric, Jingwang Electronics, Shengyi Technology and other large companies hold the advantages of environmental protection indicators and capital scale, pick up to expand production capacity to seize market share, PCB industry concentration will be further enhanced.

5. Analysis of key stocks in 5G related PCB plate

1)Shanghai Power Co., Ltd.: 4G cycle dormant, 5G inflection point approaching

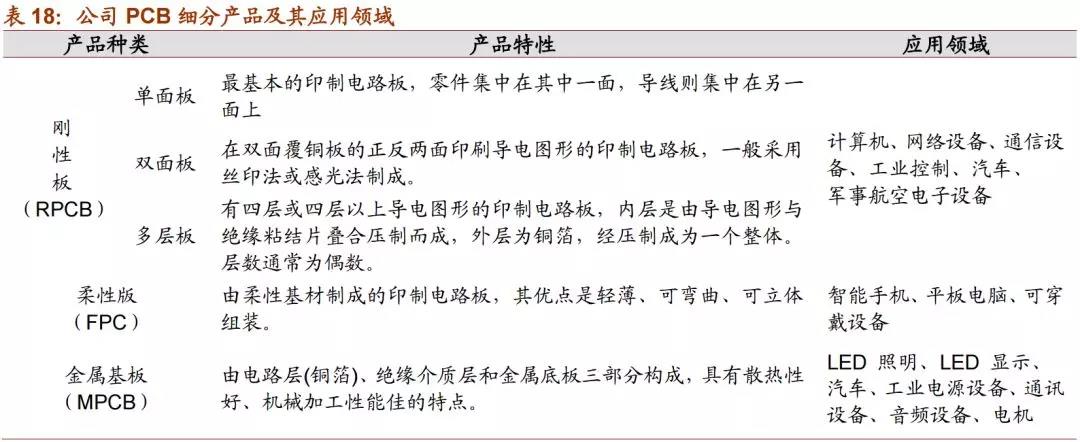

Shanghai Power Co., Ltd. was founded by Mr. Wu Ligan, a legendary entrepreneur of Taiwan printed Circuit Board (PCB). For many years, the company has been engaged in the main business of rigid PCB and steady operation. At present, nearly 97% of the company's income comes from rigid PCB business, of which communication equipment board and high-end automobile board account for 62.8% and 25.5% of the company's revenue respectively.

Holding the core equipment vendor customer resources, 5G is expected to maintain a high share.In 2016, the sales of the top five customers accounted for 73.2% of the company's total revenue (the top three accounted for 57%), and the total sales increased by 33.1% over the past 15 years. The top five customers of the company are world-class giants in the field of communications (Huawei, Nokia), server (Cisco Systems) and auto parts (mainland). Among them, the certification threshold in the field of communications and server equipment is high and the cycle is long, which is difficult to shake once the status of the core supplier is determined. In the 4GLTE network construction phase, the company has occupied an important position in the PCB procurement of equipment manufacturers such as Huawei and Nokia, and its share has further increased in the past two years, and 5G is expected to maintain a high share.

4G cycle is dormant, 5G endogenous inflection point is coming.The company's headquarters Kunshan Factory, Huangshi Hushi and Huli Weidian are the company's three major operating platforms. From 2013 to 2015, the company's performance declined sharply due to the relocation of the new factory in Kunshan. The company sacrificed short-term gross profit in difficult times, persisted in production in the old Kunshan plant, and maintained a stable share of 4G cycle in the procurement of communications equipment manufacturers. At present, the company's new plants in Kunshan and Huangshi have been relocated, capacity utilization and yield have recovered steadily, and the trend of endogenous improvement is obvious. In addition, the company has received a total of 814 million government relocation compensation in Kunshan Development Zone over the past 16 years (the balance of deferred income to be amortized is 573 million). The money is used to reset the production capacity of the company's new plant, and the new equipment fully meets the high-precision requirements of 5G, paving the way for grabbing market share.

2)Shennan circuit: one of the leaders of communication PCB, layout package substrate and electronic assembly

Domestic PCB leader, the company has three businesses of PCB, packaging substrate and electronic assembly, forming a unique "three-in-one" business layout and providing one-stop solution.In the first half of 2017, more than 70 per cent of Shennan's revenue came from PCB.

Shennan Circuit has three businesses: printed circuit board, packaging substrate and electronic assembly. The main feature is the leading technology, the company has significant advantages in high-density, high multi-layer PCB board products, can achieve up to 100 layers, thickness-to-diameter ratio 30:1 and other products. Due to the company's leading technology, mainly aimed at the middle and high-end markets and products, the product price is also higher than the industry average. For example, the average PCB sales price of the company is 2800 yuan / square meter, while that of some peers is only 800,000 yuan / square meter. In 2017, the gross profit margins of the company's packaging substrate, printed circuit board and electronic assembly were 26%, 22% and 19%, respectively.

The downstream communications sector accounts for a prominent proportion of revenue, accounting for more than 60% of revenue in 2017. Its core customer Huawei has contributed about 1GP3 revenue, other core customers ZTE, GM and so on. With the growth of major customers in the communication field in recent years, Shennan circuit motherboard (backplane) products have developed rapidly and become the regional leader in China. With the advent of the 5G era, the corporate communications sector will usher in explosive growth opportunities. The company's strategic positioning technology is leading, with the goal of creating a world-class integrator of electronic circuit technology and solutions.

3) Shengyi science and technology: copper clad laminate leader, leading the breakthrough in the localization of 5G high-grade materials

The company is firmly in the global TOP2 of copper clad laminate industry:The company's business is mainly copper clad laminate and bonded sheet production. According to Prismark statistics (income caliber), since 2013, the company has steadily ranked second in the rigid copper clad laminate industry in the world, and the gap with the first Kingboard has gradually narrowed. In 2016, the company has a production capacity of 83.22 million meters for bonded sheets and 70.67 million square meters for copper clad laminates (including 8.29 million square meters of flexible plates). We predict that with the expansion of the company's Songshan Lake and Shaanxi production lines and the completion and commissioning of the first phase of Jiujiang Plant and Shengyi specialty materials from 2018 to 2020, the company's total capacity of copper clad laminate is expected to exceed 100 million square meters per year.

The high-frequency / high-speed plate of Shengyi Science and Technology is becoming more and more abundant, and the 5G cycle is expected to take the lead in realizing large-scale localization.Shengyi is expected to represent domestic independent brands in the 5G cycle and enhance its market share in the field of high-frequency and high-speed copper clad laminates. According to Prismark statistics, Shengyi is the company with the most complete specifications of CCL in China, but it still mainly produces various grades of FR-4 (including high Tg, lead-free and halogen-free compatible products) and composite CCL products such as CEM-1, CEM-3 and so on. The company currently has a number of high-frequency, high-speed product systems, such as S7439, S7136H (independent) and GF series (cooperation with Japan's ZTE), but its market share is low. In 2016, the company invested in the establishment of Jiangsu Special Materials, which is expected to achieve a PTFE material production capacity of 88000 square meters per month. In the 5G cycle, we are optimistic that the company will gain the market share of downstream equipment manufacturers (Huawei, ZTE) and local leading PCB processing manufacturers (Shennan Circuit and Shanghai Power) through cost advantages, and realize the localization of high-frequency / high-speed plate scale.