Refined from Tianfeng Securities: "the depth of China's life insurance will peak in 2032, grasp the growth of gold for 15 years!" "

Insurance series research

Tuyere Industry | Insurance Series 1: three drivers of Insurance Stock Price

Tuyere Industry | Insurance Series 2: five Development courses of Insurance Enterprises in China

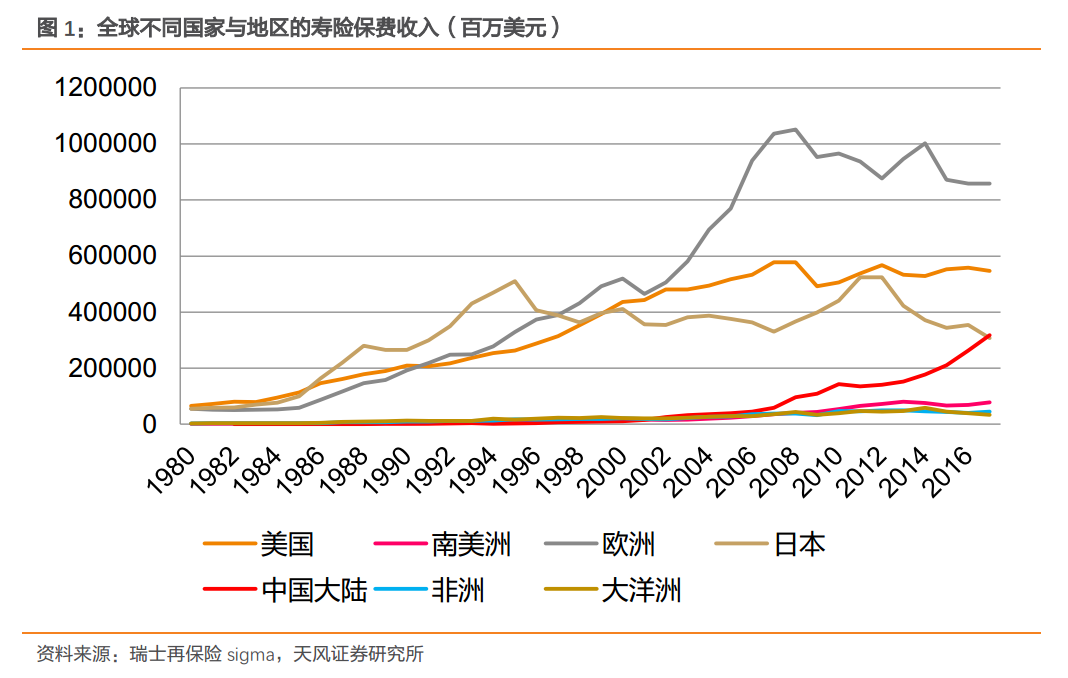

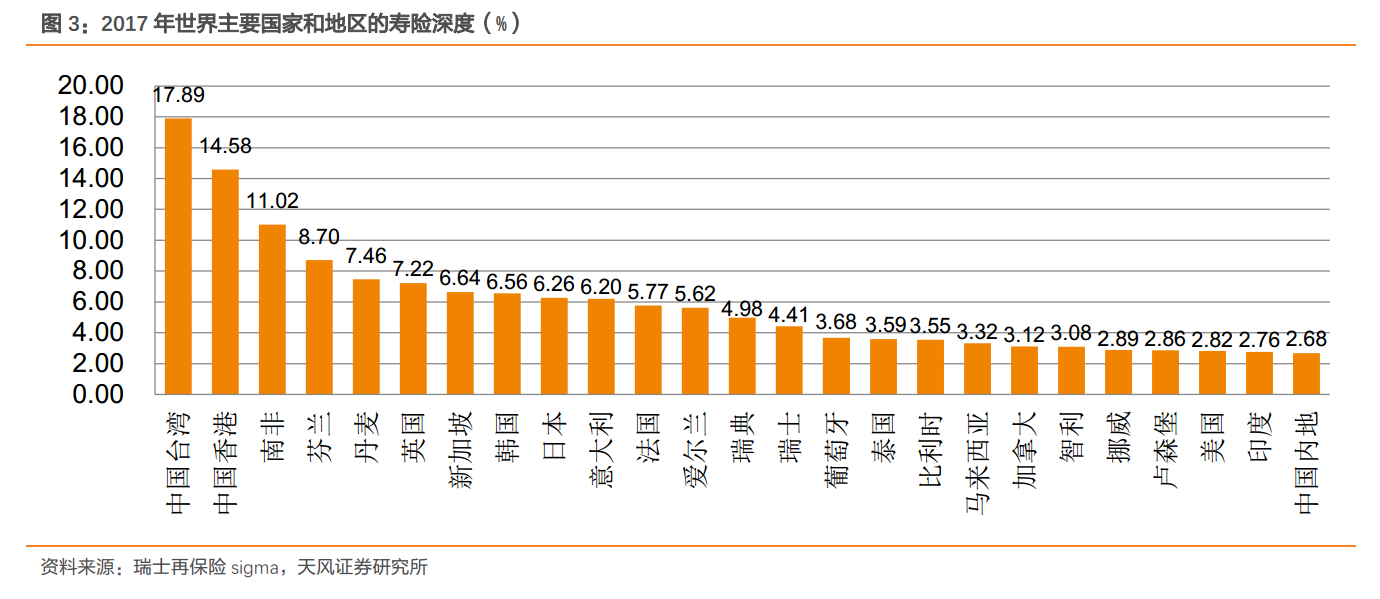

Tianfeng Securities pointed out thatThe average annual compound growth rate of life insurance premiums in China from 2001 to 2017 is as high as 20.7%, far higher than the world average of 3.9%, and has become the main driving force for the growth of life insurance in the world.In 2017, China's life insurance premium income reached US $317.6 billion, surpassing Japan (US $307.2 billion) and ranking second in the world after the United States (US $546.8 billion).Life insurance depth (insurance depth refers to the ratio of premium income to GDP in a certain place, reflecting the position of the insurance industry in the whole national economy. ) has risen from 0.86% in 2000 to 2.68% in 2017, still below the global level3.3%There is a big gap between the average level and the developed countries.

Tianfeng Securities believes thatChina's economic growth path is not essentially different from that of developed countries, and at the same time, in line with international standards in insurance supervision, China's life insurance depth still has a lot of room for improvement.Under the neutral assumption, China's life insurance depth will peak at 6.68% in 2032, with a 15-year golden growth period.

Specifically, the main long-term optimistic factors of China's life insurance are as follows:

1. Economic factors: the per capita GDP continues to grow, the leverage ratio of residents increases steadily, and moderate inflation is conducive to improving the depth of life insurance.

1) the relationship between per capita GDP and life insurance depth is an S-shaped curve. When the per capita GDP reaches 30000-50000 US dollars, the life insurance depth will peak. China's per capita GDP in 2017 is equivalent to Japan's economic level in 1978. We believe that China's per capita GDP is still in a medium-and long-term stage of medium-and high-speed growth, and the depth of life insurance is expected to continue to increase during this period.

2) the increase of residents' leverage ratio is beneficial to stimulate the demand for life insurance. based on the Swedish experience, during the period of economic growth, the depth of life insurance is highly consistent with the change of residents' leverage ratio, and the leverage ratio of Chinese residents is still lower than that of developed countries. With the improvement of consumption on China's economy, residents' leverage ratio is expected to increase steadily.

3) High inflation will erode the purchasing power of insurance premium, reduce the real income level of residents, and restrain consumers' demand for life insurance. China's medium-and long-term moderate inflation level will help to increase the depth of life insurance with economic growth.

2. Demographic factors: the increase in the proportion of people aged 35-54 and mortality is conducive to the improvement of the depth of life insurance.

The main results are as follows: 1) people aged 35-54 have both demand and abundant product supply, and they are the main consumers of insurance, which basically determines the balanced consumption scale of the whole life insurance market. Based on the current demographic structure of China, we expect that the demographic dividend will contribute to the continuous improvement of the depth of life insurance in the next 5 years, and the demographic structure will have a negative impact on the depth of life insurance in 5-10 years.

2) the mortality rate can measure the risk of people's life to a certain extent. The higher the mortality rate, the more risk factors that lead to death, which will stimulate consumers' awareness of security. Based on the new data, the depth of life insurance and mortality change in the same direction. At present, China's life insurance industry is in the early stage of development, and the correlation between mortality and the depth of life insurance is weak.

3. Social factors: the level of urbanization and education are positively related to the depth of life insurance, and the social security expenditure changes in the same direction with the depth of life insurance before the maturity of the life insurance market.

1) before the maturity of the life insurance market, the rapid economic growth can lead to the simultaneous improvement of social security expenditure and the depth of life insurance. The degree of protection of China's social security system is limited, the gap of residents' security is large, and the social insurance expenditure and the depth of life insurance change in the same direction.

2) the higher the level of urbanization, the looser the relationship between the urban population, the more dependent on the social risk diversification mechanism (such as insurance), and the stronger awareness of risk protection, higher income and stronger purchasing power of life insurance. China still has more than a decade of urbanization, which will lead to the continuous improvement of the depth of life insurance.

3) the higher the level of education, the higher the recognition and purchasing power of life insurance to a certain extent (high level of education often leads to high income). The overall education level of Chinese citizens is still in the stage of long-term improvement, which contributes to the improvement of the depth of life insurance.

Tianfeng Securities believes that in a neutral case, the depth of life insurance in China will reach a peak of 6.68% in 2032, and the life insurance industry still has a 15-year golden growth period.In the golden growth period when the depth of life insurance is increasing, the volatility of life insurance cycle is weaker than that of economic cycle, mainly because there is a large gap in residents' security. the long-term security needs of residents are related to long-term factors such as future risk expectations and family structure, and the impact of short-term economic fluctuations is limited.