Edited by GF Securities Co., LTD.: peak return, Road turn-- Macroeconomic Analysis and Prospect in 2019

1. Logic: the nominal growth cycle of China and the United States

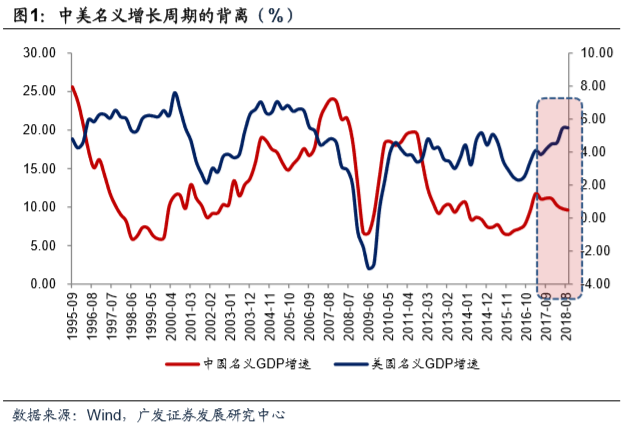

(1) looking back at 2018: the deviation of the nominal growth cycle between China and the United States.

The macro environment in 2018 is basically dominated by three clues: first, trade friction between China and the United States; second, active deleveraging; and third, raising interest rates in the United States.Behind the three clues is the divergence of the nominal growth cycle between China and the US, which has been relatively rare in the past 20 years.

Asset pricing in this environment is a relatively "tangled" existence: the uncertainty of trade friction is equivalent to an unknown variable in the economic growth function that is difficult to verify, and it is necessary to guard against downside risks at any time; in order to counteract the uncertainty of this external environment, we need microeconomic stability and fiscal and monetary policy to maintain a certain degree of expansion. However, fiscal policy and monetary policy are respectively constrained by the debt space under entity deleveraging, the ability of credit expansion under financial deleveraging, and the environment of internal and external interest spreads under rising interest rates in the United States, which can only remain roughly neutral.

Fundamentals 1: Sino-US trade friction

The origin of trade friction is the conflict of incremental assets between China and the United States.GF Securities Co., LTD. has pointed out that the root cause of this round of trade friction between China and the United States is the conflict of incremental assets. The stock assets of China and the United States have been a complementary relationship in the past decade; after experiencing the export industry chain and the real estate industry chain, if China wants to continue to upgrade its industry, it needs to further upgrade to middle-and high-end manufacturing plus new service industries. this competes with the Trump administration's goal of "bringing manufacturing back to the United States".

IMF concluded that in the most serious case, the impact of trade frictions on China's GDP is 1.6%. If the exchanges between China and the United States on bilateral economic and trade relations make positive progress, there will be a round of upward revaluation of risky assets; vice versa.

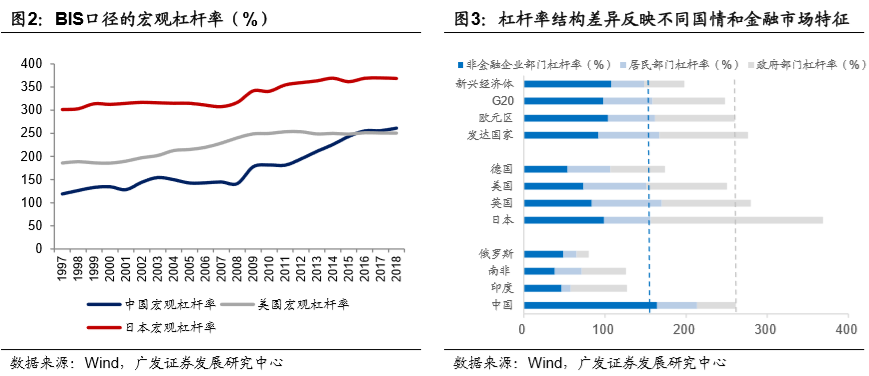

Fundamental 2: China takes the initiative to deleverage

Active deleveraging in the US interest rate hike cycle is to reduce asset-side risk.From the leverage data, China's macro leverage ratio is roughly the same as the average level of developed countries. Among them, the leverage ratio of government is low, but that of non-financial enterprises is high, which is related to the characteristics of the system, that is, some state-owned enterprises assume quasi-government functions.

The positive effect of active deleveraging has some problems to be solved: from the dualization of credit markets to the rapid decline of infrastructure. Deleveraging has achieved two remarkable results: first, financial deleveraging has reduced the leverage risk of some financial products (new rules on asset management); second, entity deleveraging has initially established incremental rules for local borrowing (new rules on asset management, hidden debt).

The impact of the transition of policy from deleveraging to stable leverage.On the whole, this process will reduce the uncertain discount of risky assets. If the ultimate goal of deleveraging is to clear quickly, the economy will experience a bout of pain and asset prices will include clear discounts. If this process is replaced by stable leverage, the situation of active and systematic adjustment of the economy will be excluded.

Fundamentals 3: impossible triangle and neutral monetary policy

The interest rate spread between China and the United States is one of the essential logic of the macro view in 2018, and it is also the reason why interest rates remain sticky for a considerable part of 2018.China and the United States are the two most important powers in the global economy. In 2018, when the US interest rate hike cycle continues, Sino-US interest rate spreads and internal and external equilibrium have become one of the key logic at the macro level. For example, for policy, more attention needs to be paid to the impact of the "impossible triangle".

Impossible triangle means that it is theoretically impossible to have both the free flow of capital, the stability of exchange rate and the independence of monetary policy. Overall monetary policy in 2018 is neutral, and even Q3 and Q4, which have increased downward pressure on the economy, are mainly based on awe of the impossible triangle. This is one of the important factors affecting asset pricing in 2018.

(2) looking forward to 2019: the closure of the nominal growth cycle between China and the United States.

That will change significantly in 2019. First, growth between China and the US will become more common. The actual GDP of the United States should be in the top region by now, and the momentum of nominal GDP is weaker than expected. The nominal growth cycle of China and the United States will be closed in 2019. Secondly, China has transitioned from rapid deleveraging to stable leverage. As the economy enters the second stage of "two rounds of slowdown", the need for stable growth will further increase, and the constraints of structural adjustment will no longer be obvious. Third, the US interest rate hike may be nearing the end, the interest rate gap constraint between China and the US will also be weakened, and there will be room for China's monetary policy and financial conditions to be repaired.

Point 1: the early easing of the interest rate hike cycle in the United States

The Federal Reserve has raised interest rates eight times since it began to raise interest rates at the end of 2015. There are four signs that U. S. economic growth may be near its peak and is already weak. Judging from the changes in crude oil prices, the upward momentum of US nominal GDP in 2019 may be lower than expected. Fears of a slowdown and recession are also rising in financial markets.

Change point 2: the second stage of China's two rounds of slowdown

Export and shed reform are the two yardsticks to observe this round of economy. By 2018 Q3, exports and new real estate starts are already at the top of experience. The first phase of the economic slowdown in 2018 Q3 and Q4, mainly reflected in foreign trade orders contraction, real estate data inflection point and enterprise expected contraction. The first half of 2019 will be the second stage of economic slowdown, mainly manifested by a substantial decline in export and real estate investment data.

Change point 3: the opening of the space for the repair of China's monetary policy and financial conditions

Most of 2018 is characterized by a neutral monetary environment and a tight financial environment. With the peak of the US interest rate hike cycle in 2019, China's monetary policy space will be opened. The expansion of social finance may continue to be constrained by the dualization of credit, but the policy will continue to repair the financing environment through some means, and there is a high probability that marginal improvement will occur. With regard to interest rate cuts, GF Securities Co., LTD. believes that there are still no conditions, and if the window appears, it may not be until the beginning of the second quarter.

(3) Summary

The stock market may have more time in the machine session in 2019 than in 2018.On the whole, PPI does not have enough adjustment depth, which is related to the impact of supply contraction, which may go through more than two quarters of raw material and industrial product price adjustment period. In this coordinate system, the rate of return of the equity market has been adjusted for about 7 quarters, and the rate of return is not far from the historical bottom. So although the fundamental adjustment continues, the stock market is likely to spend more time in 2019 than in 2018.

2. Outlook: 2019

(1) expectation from five aspects

Export: the double landing of fundamental cycle and the influence of trade friction

Exports will face four pressures in 2019.Logically, the pressure on exports in 2019 includes: 1) A high base was formed in 2018. 2) the average PPI in 2019 will not be too high; some Q3 exporters just raised their prices in 2018 after trade frictions. 3) the influence of landing tariff in the early stage of trade friction continues to appear. 4) the impact of a slowdown in the US economy and a further slowdown in demand in other parts of the world.

GF Securities Co., LTD. initially estimated that export growth would slow to a low single digit in the first half of 2019.This is a more neutral assumption that volatility in financial markets will not trigger the global economy into crisis mode or quasi-crisis mode; and that bilateral tariffs on trade frictions between China and the US will not continue to rise.

Real estate: it is estimated that the new construction will return to low equilibrium first.

GF Securities Co., LTD. estimates that the growth rate of new starts in the first half of 2019 will follow and return to a low equilibrium.From the law of experience, there is no need to be too pessimistic about real estate sales, which is currently in the second half of the three-year sales adjustment cycle. The contribution of real estate demand (sales and investment) to the first half of 2019 is lower than that of 2018. The bank tends to think that the policy will still be cautious in relaxing regulation and control in the real estate sector: first, the long-term mechanism of "housing speculation" has formed certain expectations; second, this round of real estate inventory is relatively low, which stimulates demand in the case of low inventory. Prices are easy to rise.

Infrastructure: it would be reasonable to return to nominal GDP levels

The calculation of the growth rate of infrastructure investment in 2019: the neutral case is an increase of about 7%. At the current stage of development, it is reasonable for China's infrastructure growth to remain near the nominal GDP growth rate.One of the processes that infrastructure construction needs to modify is to control the cost and risk of debt. In 2018, the new regulations on asset management and hidden debt have been completed to regulate the new borrowing, so the infrastructure needs to be moderately repaired from the previous overshoot and return to a reasonable level. At the current stage of development, China's infrastructure growth rate is reasonable near the nominal GDP growth rate.

Manufacturing: it can be understood as three forces, and the overall pressure is still there.

Investment in manufacturing in 2018 is basically upward for the whole year.The first force is "dislocation", in which investment lags behind profits in a short period. The second force is the "replacement", that is, the renewal of equipment under the Jugla cycle. The third force is "emerging", which is the new industrial layout under the 13th five-year Plan.

From this framework to understand the manufacturing investment in 2019, the latter two logics still exist, but the first logic may enter the negative contribution range.GF Securities Co., LTD. estimates that the growth rate of manufacturing investment in 2019 will be lower than that in 2018. One of the coordinates that can provide reference is the inventory cycle, and manufacturing investment is empirically synchronized with the inventory cycle.

Consumption: can be divided into five parts, with different trends

The total retail sales of consumer goods in 2018 is weak as a whole, and consumption as a whole is the shadow indicator of nominal GDP.From the perspective of nominal GDP, the growth rate of nominal GDP will be downward in 2019, and the growth rate of consumption will still not be too high.

(2) Summary

GF Securities Co., LTD. estimates that the growth rate of exports and new real estate starts will fall back to a low level in the first half of 2019, manufacturing investment will be affected by lagging revenue cycles, and infrastructure will gradually repair to the level of nominal GDP. The economy stabilized at the end of Q2 or the beginning of Q3 in 2019, with an annual growth rate of about 6.3%. Based on employment and fiscal constraints, at least until the middle of the year, the "six stability" will be the main tone of policy. We can understand the possible policy mix from three angles: internal and external equilibrium, upstream and downstream equilibrium, short-term and medium-term equilibrium.

3. Risk hint

One of the risks is the possibility that trade frictions will continue to deepen; the second is that US stocks, which are overvalued, could trigger risks in global financial markets if they adjust too sharply.