Edited by Huatai: "will there be a hard Brexit in Britain?"

Last week, expectations of a slowdown in the Fed's interest rate hike and easing of trade conflicts did not bring a real improvement to the market last week. Risky assets gave a brief boost at the start of the week, but were quickly offset by slowing US economic data and renewed trade conflicts. The Treasury yield curve flattened, stocks fell, gold rose, the dollar loosened and market expectations for a downturn in economic growth increased.

This week, two important economic events in Europe will be the focus of the market:

December 11, 2018, the House of Commons of the British Parliament voted on Theresa May's Brexit agreement.

On December 13, 2018, the European Central Bank decided on interest rates.

1. The British House of Commons voted to leave the European Union: will the market fluctuate violently again?

Tomorrow (December 11), Britain will usher in a critical time for Brexit, when the House of Commons votes on the Brexit agreement.Huatai pointed out that the current market focus is on the possibility of Britain's "hard Brexit", which will hit the exchange rate of sterling and the British stock market in the short term, trigger a rise in global risk aversion, and even affect the pace of interest rate increases by the Federal Reserve, and the withdrawal of the ECB from the QE program next year may also be delayed. In the long run, it will have a far-reaching impact on the economy and global political pattern of Britain and the European Union in the next two decades.

On June 23, 2016, Britain held a referendum on Brexit. As a result, the unexpected political Black Swan incident, the passage of the Brexit vote, brought wild swings in international financial markets.On the day, the pound fell 8.8% against the dollar, and the euro fell 2.7% against the dollar, driving the dollar index up 2.5%. The UK's FTSE 100 index fell 3.1%, the US S & P 500 index fell 3.6%, and the Chinese A-share market on the other side of the ocean was also affected. the Shanghai Composite Index fell 3.2%. In the whole process of Brexit, it can be said that every move of the negotiations between the two sides affected the nerves of the market.

2. The reason for Brexit: budget and immigration

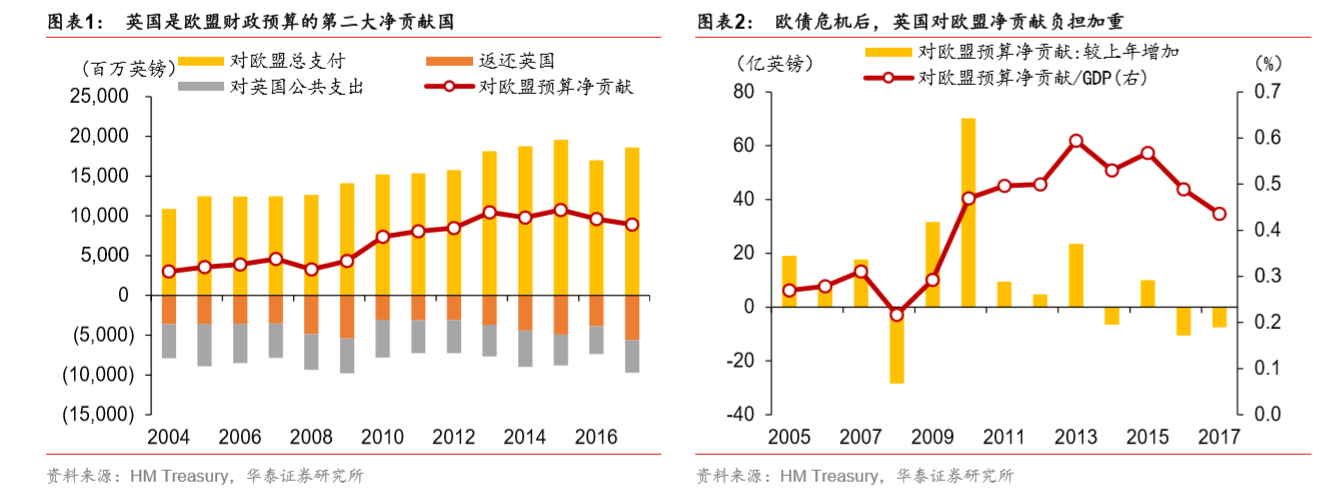

Budget and immigration are the core contradictions between Britain and the European Union.Britain is the second largest net contributor to the EU budget. After the European debt crisis, Britain's contribution has been further improved, which has become a heavy economic burden for Britain.

The eastward expansion of the European Union and the influx of African refugees into Britain through Europe have caused serious social problems while squeezing out resources such as employment. Out of all kinds of dissatisfaction with the European Union, the UK Independence Party was established and grew rapidly, and skepticism was high in Britain. In order to cater to public opinion, the then British Prime Minister Cameron made an election promise to trigger a referendum on Brexit.

3. Market focus: Britain is not afraid of Brexit, but "hard".

Generally speaking, there are two options for Brexit, one is "soft Brexit" and the other is "hard Brexit".

Soft Brexit means that Britain retains its position in the European single market after leaving the European Union.(for example, Norway is not a member of the European Union, but fully participates in the European single market)As a price, at free flow, physical boundaries(between Ireland and Northern Ireland)A certain compromise must be made.According to the draft released a few days ago, Britain will continue to participate in the European single market until the end of the transition period at the end of 2020. European citizens' right to live and work in the UK will not be affected, and the transition period can be extended. The UK and the EU also hope to establish a single free trade area as the ultimate bilateral relationship in the future. For investors who diversify in the global marketSoft Brexit is the most ideal solution under Brexit, and the economic and trade relations between Britain and the EU generally maintain the original level, which is good for the stock market.This is also the plan led by the current British Prime Minister Theresa May.

Hard Brexiters prefer to call themselves "cleanBrexit", that is, to completely break away from the EU and the European single market and deal with the EU in accordance with the principles of the WTO of the World Trade Organization. For investors, hard Brexit brings major uncertainty to the international trading environment.Brexit itself represents that Britain had to withdraw from agreements signed with the rest of the world as a member of the European Union in the past, signing a total of 22 bilateral agreements with individual countries and five multilateral agreements involving multiple countries, covering 52 countries. Leaving the EU means withdrawing from the 27 trade agreements, and Britain will renegotiate with 52 countries in an independent capacity in the future. If we do not fight for a Brexit agreement with the EU now, it will be more difficult and take more time for Britain to negotiate foreign trade in the future.

4. Progress of Brexit: House of Commons vote is crucial

On June 23, 2016, the British referendum kicked off the Brexit with the phrase "take off: stay = 51.9: 48.1". On March 28, 2017, the UK launched a two-year Brexit process. If Britain and the EU do not reach an agreement within two years, only all member states agree to extend the negotiation time, otherwise Britain will directly leave the European Union in two years' time.

The process of soft Brexit has made important progress before. On November 25 this year, the leaders of 27 EU countries except Britain unanimously adopted the draft Brexit agreement. Although the draft has made progress to the outside world, internal contradictions are the key to restricting whether the agreement can be reached.Theresa May is still hampered at home after the draft agreement was passed by the cabinet in November.The result of the House of Commons vote on December 11th will be a crucial point in determining the direction of Brexit.

5. Brexit path: the new agreement is expected, but hard Brexit is possible.

The latest reports from both the Treasury and the central bank point to the pessimistic outlook for the UK economy from "hard Brexit". At present, most MPs oppose Brexit without an agreement, arguing that a second referendum or the Norwegian model is the better option.The latest polls also reflect a stronger willingness to return to the EU or reach a new agreement in a second referendum.The latest news from the European Court of Justice shows that "withdrawing the Brexit decision" is also a possible option.However, Huatai believes that it is less likely to happen only if "the House of Commons vetoes the Brexit bill, the May government steps down, and a second referendum in support of remaining in the EU".In the current situation, it is still difficult for May's Brexit agreement to be passed by the House of Commons, and the more likely evolution path is for the House of Commons to vote down the current Brexit agreement, propose amendments to many of them, and renegotiate with the European Union. But under this pathHuataiIt is believed that the probability of "hard Brexit" is likely to rise again.