Edited by China Merchants: comments on the Optimization of Stock Index Futures Trading arrangements by CICC & GF Securities Co., LTD.: stock Index Futures are loosened and the brokerage plate is given priority.

The impact of two events in the brokerage industry over the weekend is noteworthy: the landing of the new rules of the big collection and the further loosening of stock index futures.GF Securities Co., LTD. believes that the rectification requirements and schedule of the new rules of the big collection business are in line with expectations, and the impact on the industry as a whole is neutral.The development of derivatives market is an inevitable trend in the environment of opening to the outside world. The gradual relaxation is expected to enhance the market risk preference.To provide securities firms with greater trading hedging and product creation business space, the securities sector is expected to give priority to benefit from this release.

China Merchants also believes that with the development of the market, the growth of stock index futures participants and the improvement of the level of risk management in the industry, there is a foundation for stock index futures to return to normal trading. If stock index futures trading returns to normalization, multi-strategy trading investors are expected to enter the market, and market activity is expected to increase significantly. The trading volume of CSI 300 stock index futures was 877000 in November, compared with a peak of 45.49 million in December 14. The current trading volume is only 2 per cent of the peak, and the subsequent market volume is very flexible.

At the same time, China Merchants believes that the return to normality of stock index futures will be a clear signal that industry policy will further return to marketization. The exploration of A-share marketization is expected to go further, including the liberalization of the policy of mergers and acquisitions and the pilot project of Science and Technology Innovation Board, which will become a useful exploration for the long-term development of the capital market. Under the background of strengthening the direction of marketization in the long term and protecting the market activity in the short term, the securities industry is facing a major opportunity period of a new cycle of market-oriented policies.

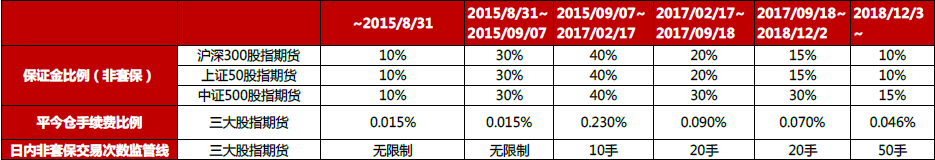

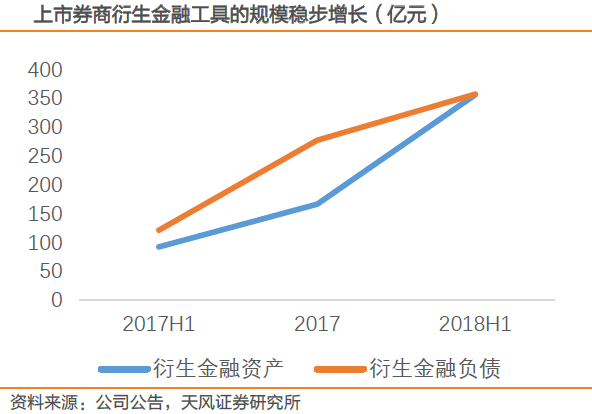

Tianfeng Securities believes that the resumption of normal trading of stock index futures is expected to be good for brokerage business in two aspects. First of all, the trading volume and position of stock index futures will improve marginally. From January to October 2018, the turnover of stock index futures will be 12.06 trillion yuan, accounting for 15.74% of the turnover in Shanghai and Shenzhen, an increase of 6.34% over the previous year. After the reduction of transaction costs, the improvement of stock index futures business volume is worth looking forward to; secondly, the normalization of stock index futures will greatly increase the activity of the stock market, and then increase the market trading volume. The proprietary business of securities firms in mature markets is not trend, the source of business is trading as the center, the use of financial instruments such as stock index futures is very important for securities firms to develop their own business.

GF Securities Co., LTD. believes that in the medium term, the forecast industry's return on equity (ROE) level in 2018 is expected to be less than 4%. With the acceleration of Science and Technology Innovation Board and the sustained and healthy development of the derivatives market, the industry's ROE is expected to return to the normal level of 5% to 6% in 2019. It is recommended to continue to pay attention to the investment value of leading securities firms. Under a series of support policies, the improvement of asset quality of securities firms is expected to further promote the valuation and repair of the sector. with reference to the heavy holdings of public offering funds in the third quarter, the allocation proportion of the brokerage sector in the third quarter is 0.96%, up slightly from 0.92% at the end of the last quarter, and is still in a state of substantial low allocation. at present, the securities sector is valued at 1.21 times PB in 2018, and there is still room for improvement.

GF Securities Co., LTD. suggested to continue to pay attention to the head brokerage: China International Capital Corporation, CITIC, Huatai, etc., corresponding to 2018 PB valuation of 1.34,1.29,1.27 times.