Edited by CITIC: "Top Ten prospects for Macroeconomic and Financial Markets in 2019"

Zhou Jintao, the former chief economist of CITIC Construction Fund, who died two years ago, was a leader in macro analysis, leaving some market predictions to be gradually confirmed and some predictions to be confirmed. One of the most important predictions is:

For people over the age of 40, their first chance in life is in 2008, the second chance is in 2019, and the last time around 2030, if you can seize it once, you can become a middle class.

People who were born after 1985 and are now under the age of 30 can only have their first chance in 2019.

What are the macro factors that investors need to pay attention to in 2019?There are only three opportunities for wealth in life, will there really be one in 2019?

1. Will monetary policy become looser in 2019?

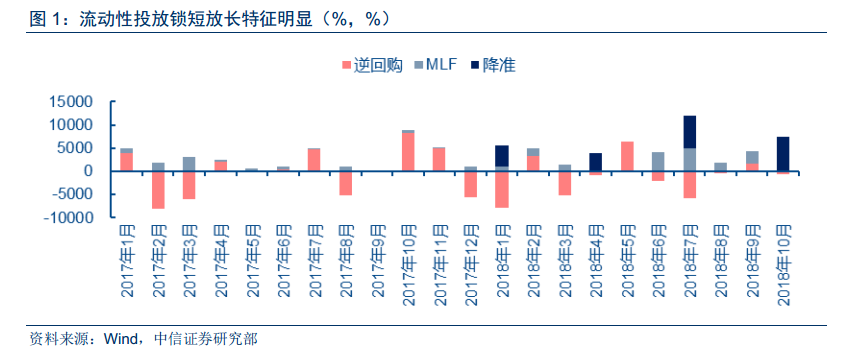

The starting point of monetary policy in 2019 is mainly based on domestic contradictions, and monetary policy next year is expected to show a combination of reserve requirement reduction and interest rate reduction.Among them, RRR reduction is still the main tool for quantity investment, followed by MLF, followed by reverse repurchase, and it is expected that there will be two RRR cuts in 2019; if banks' risk appetite continues to decline, credit expansion is blocked, and the wide credit and cost reduction effect of liquidity supply is still very weak, then price tools need to be used to guide the decline in financial market costs and bond yields through OMO interest rate cuts; deposit and loan benchmark interest rate cuts guide bank credit rates to decline.

2. Will the fiscal deficit ratio break through in 2019?

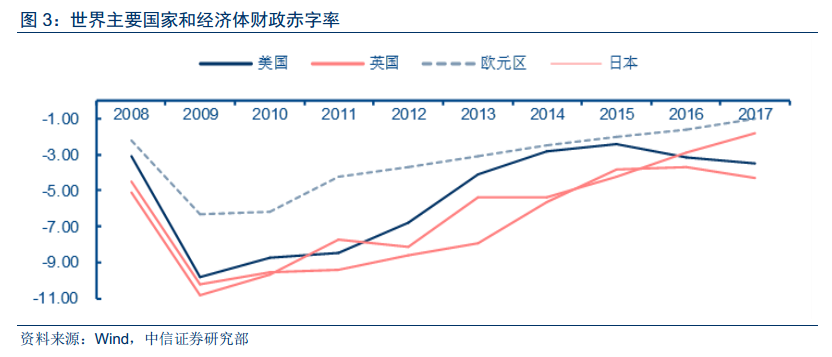

It is necessary and feasible for the fiscal deficit ratio to exceed 3%.On the one hand, when the deficit ratio of many overseas developed countries has already exceeded 3%, there is no need to adhere to the warning line of 3% under the inherent requirements of large expenditure and large finance; on the other hand, moderate leverage by the central government can reduce the leverage pressure on local governments, enterprise departments, and resident departments. In terms of the pace of issuance, it is estimated that 3.8 trillion of treasury bonds and 4.1 trillion local bonds will be issued in 2019, of which special bonds are estimated to be at least 1.7 trillion, totaling about 8 trillion yuan of treasury bonds and local debt. Due to the small gap in the maturity scale of policy bank bonds in the past three years, it is expected that the total issuance will remain at about 5 trillion yuan in 2019, which will not cause excessive supply pressure.

3. What are the new features of the deleveraging process in 2019?

From the perspective of macro leverage as a whole, it has entered the stage of stable leverage, while in the face of increasing downward pressure on the economy, increased external uncertainty and the outbreak of credit default risk, the balance of policy objectives will gradually tilt from deleveraging to risk prevention.At present, the biggest risk is the mutually reinforcing cycle of economic downturn and credit default, and local government debt disposal, the main position of structural deleveraging, will also face a certain degree of adjustment.Recent policy-level measures to stabilize the stock market and the buyback system, the suspension of new rules and even the rapid promotion of Science and Technology Innovation Board can be seen as a direction for the development of equity and even, to some extent, the use of equity to resolve claims to reduce leverage.

4. What new changes will take place in real estate supply and demand in 2019?

The impact of regulation and control policies on the real estate market does not stop at various restrictions (purchase restrictions, sales restrictions, loan restrictions, price restrictions, etc.), but affects the overall ecology by constructing other conditions that affect supply and demand. on the supply side, such as long-term rental apartments, rural collective property rights turned to leased land, etc., the demand side dredged the core area function through urban planning and transportation construction. Long-term mechanism construction, such as Hefei, Shenzhen and other places to launch land for sale, real estate tax and so on will curb speculative demand.However, no matter from the perspective of the real estate industry chain's dependence on economic growth or the local government's short-term dependence on government fund income, house prices are mainly stable, and rigid demand will be the main customer group in this environment.

5. Can the growth rate of consumption improve in 2019?

The recent weakening of consumption is mainly due to the decline of related consumption after the beginning of the school year and the delayed consumption effect of "Singles Day".But even from the perspective of sales on the "Singles Day" day, the sales of the whole network increased by about 24% compared with the same period last year, down 11% from the growth rate of 43% last year. The growth rate of consumption for the whole year is also historically low. Structurally, car consumption is a major drag (purchase tax relief is cancelled).The growth rate of social consumption is expected to stabilize at more than 9.5% in 2019. In the long run, under the policy of expanding domestic demand, if more tax cuts on value-added tax and corporate income tax are introduced, the government will extend subsidies for the purchase of new energy vehicles, and even the reduction of the overall tariff rate under the measures of opening up to the outside world will provide some support for long-term consumption, and with the long-term trend of improving the quality of consumption, consumer credit has room.

6. Can the scale of social financing rebound?

Judging from the current situation of social finance, credit accounts for more than 65% of the stock of social finance, and it is still the main supporting force of social financing. in order to maintain the steady development of the economy, credit is expected to remain stable under the cooperation of policies next year. However, the structural problems still need to be paid attention to. At present, the economy is in a period of transition, and medium-and long-term loans to residents dominated by traditional housing loans and real estate-related corporate loans may still face a downward trend. but at the same time, bill financing with relatively short maturity and less risk may be more preferred by banks. This also reflects that the lack of current financing demand is an important reason for the downturn in social integration data.So although the social finance data are expected to stabilize between the end of this year and the end of next year, it will take time for social financing to rebound and move from monetary leniency to broad credit.

7. What will happen to the export growth rate under the influence of trade frictions?

Domestic exports will face greater pressure in the first half of 2019.Export growth remained relatively steady in the third quarter of 2018 against the backdrop of Sino-US trade frictions, and export growth in October was even the fastest in nearly five years. However, domestic exports are expected to show downward pressure in 2019 after short-term factors such as the devaluation of the renminbi and the rush of US exports before tariffs have dissipated. If trade frictions ease, then there is a high probability that the exchange rate will stabilize or even appreciate, superimposing the overdraft factors that grabbed exports in the early stage, and exports will be under pressure; if trade frictions continue or even increase, then the imposed tariffs will weaken the competitiveness of domestic exports and put pressure on domestic and foreign exports.

8. What is the pressure of RMB exchange rate?

Under the framework of impossible triangle, the free flow of capital, exchange rate stability and monetary policy independence are faced with a rebalance. Under the background of downward pressure on the domestic economy and the Fed's continuous tightening of monetary policy, the importance of domestic monetary policy independence has increased. With the current current account under pressure to shift from a surplus to a deficit, foreign exchange reserves will become more precious, and the past practice of stabilizing the exchange rate by consuming foreign exchange reserve ammunition will face higher costs. Moreover, at present, China's financial market has become more open, relying on capital controls to prevent capital outflow pressure has a certain role, but it is more difficult. therefore,It is difficult to achieve the rebalance of the "impossible triangle" simply by sacrificing capital controls. Sacrificing exchange rate stability and making the exchange rate more market-oriented will help solve the problem of impossible triangulation and help to hedge against the downward pressure on the domestic economy.

9. When will there be an inflection point in corporate profits?

The turning point of the corporate profit cycle may be in the second or third quarter of next year.The average profit growth rate of enterprises lags behind the new increment of social finance by about two quarters, and the trend of social finance data directly determines the duration of the current profit cycle. We believe that the social finance data are expected to show signs of stabilization in the fourth quarter of this year, and then transmit to end demand and corporate earnings, so the inflection point of the corporate earnings cycle is likely to occur around the second to third quarters of next year.

10. Will the pace of the Fed's rate hike change?

The current Fed's continued tightening of monetary policy will slow the impact of the decline in the economic outlook next year.As Powell points out the three major risks to the US economy next year, and we see that real long-term interest rates in the US, such as mortgage rates, are rising significantly and faster than the 10-year Treasury yield. Take the 30-year mortgage rate, for example, which was around 5-6 per cent before the subprime crisis in 2007 and has now risen to 5 per cent.

Judging from the liquidity conditions of the US market, the future excess reserve interest rate (IOER) faces further downward pressure, that is, the spread with the federal funds rate ceiling will further widen from 5BP.The Fed is almost certain to raise interest rates in December, and the IOER increase is likely to be less than the ceiling of the federal funds rate again. In the past, the Fed's monetary policy operations and the maintenance of interest rate corridors were based on the scarcity of reserves, which could have a huge impact on liquidity if the current reserves of nearly $2 trillion were restored to close to zero. But whether it will be restored or not,The increases in IOER reflect tightening liquidity conditions and further raising funding costs.