Edited by Sino-Thai Securities: "behind the collapse in oil prices is a new round of global deceleration-why does the supply 'faith' collapse? "

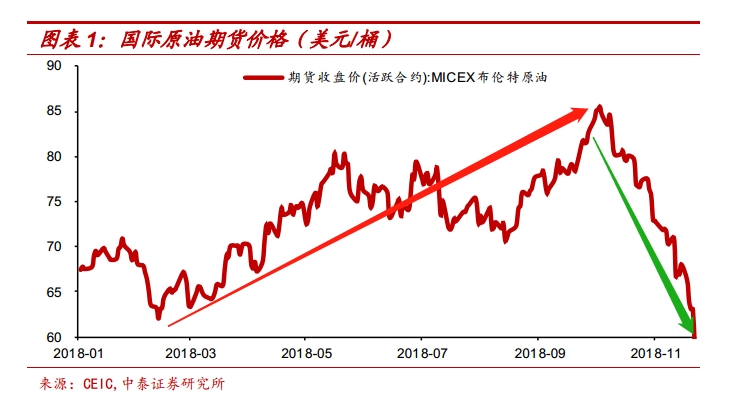

Since October, international Brent crude futures have fallen sharply after hitting a four-year high of $85 a barrel, falling nearly 30 per cent from 86 to 60 in less than two months. Zhongtai Securities believes that the signal from the sharp drop in crude oil is:The global economy is already in a new downward channel.There is a saying in the preface to the inescapable Economic cycle: "I have seen so many seasoned businessmen become penniless because they do not understand the recession."The top priority for investors in a new round of global economic slowdown is how to survive the winter.

1. The price of metal commodities has fallen, while the oil price has skyrocketed: it shows that demand is weakening, and the factor that dominates the early price rise of crude oil lies in the supply side.

Before October, the international price of crude oil rose sharply this year. The price of oil futures soared from $67 a barrel at the end of last year to a high of nearly $86 a barrel in early October, up nearly 30 per cent in a few months.

Before October, the international price of crude oil rose sharply this year. The price of oil futures soared from $67 a barrel at the end of last year to a high of nearly $86 a barrel in early October, up nearly 30 per cent in a few months.

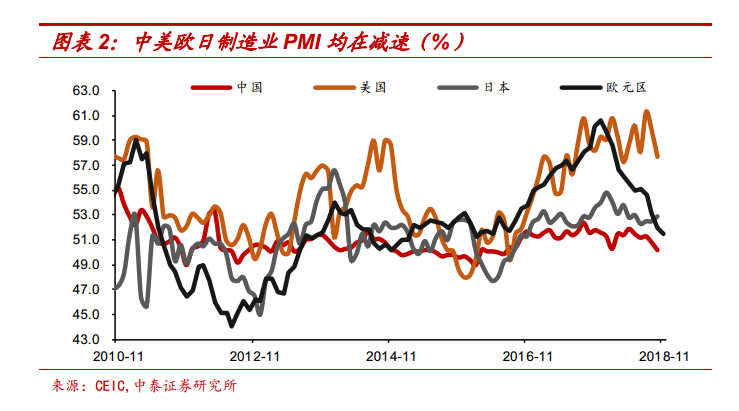

China's manufacturing PMI fell to 50.2 from 51.6 at the end of last year, the eurozone fell from 60.6 to 51.5 and Japan from 54 to 52.9. In terms of year-on-year GDP growth, China fell from 6.8 per cent in the fourth quarter of last year to 6.5 per cent in the third quarter of this year, the eurozone fell from 2.7 per cent to only 1.7 per cent and Japan fell from 2.0 per cent to 0.4 per cent.

Moreover, the increase in global crude oil demand in the past few years has all come from China, and the slowdown in China's economic growth also means that the demand facing the global crude oil market is weakening and does not support a sharp rise in crude oil prices.

On the other hand, the demand brought about by economic growth is the dominant factor affecting the overall trend of the global commodity market, and the trends of international oil prices and metal commodity prices have maintained a high degree of consistency over the past decade.However, since the beginning of this year, international metal commodity prices have obviously weakened, but oil prices have soared, and the two trends have deviated significantly.All these show that the factor that dominates the early crude oil price rise lies in the supply side.

2. Political factors are dominant and supply is suppressed.

First, OPEC and Russian production restrictions:OPEC and Russia decided to limit crude oil production from the end of 2016 and extended the production limit again to the end of 2018 in November 2017. Although it was agreed to increase production at the June meeting, it is difficult to release short-term capacity quickly.

Second, US sanctions against Iran have led to a sharp decline in Iranian crude oil production, while it is difficult for other OPEC countries to increase production to make up for the gap:The United States resumed sanctions against Iran after it announced its withdrawal from the Iran nuclear deal in May. Iran's crude oil production has fallen sharply from a high of 3.82 million b / d in May to less than 3.3 million b / d today. At the same time, due to the impact of the domestic economic crisis, Venezuela's crude oil production has also been greatly reduced. While it is difficult for other OPEC countries to increase production to make up for the gap, the gap between global crude oil supply and demand is still close to 500000 barrels per day by the end of the third quarter.

Third, the Kashuji reporter incident in Saudi Arabia has also triggered market concerns about Saudi crude oil production:Against the backdrop of sharp cuts in Saudi and Venezuelan crude oil production in a short period of time, it is hoped that Saudi Arabia and Russia will increase production to make up for the gap. Faced with the impact of high oil prices on the US economy, US President Donald Trump has repeatedly pressed Saudi Arabia to increase production. But from a realistic point of view, Saudi crude oil production is not so fast, and the Kashuji incident has increased market concerns about strained relations between the United States and Saudi Arabia.

3. Supply repression is difficult to last.

In the case of weak demand, supply-side repression is very important, and once the supply repression is alleviated, it will cause a serious crackdown on oil prices. Saudi Arabia and Russia agreed to increase production, and the United States granted "immunity" to eight countries, including China, to import Iranian crude oil, which also eased the pressure on the supply side. Looking ahead, Sino-Thai Securities believes that oil prices will remain weak in the future. On the one hand, the strategy of "limiting production and ensuring prices" in OPEC and Russia is difficult to maintain for a long time. On the other hand, the probability of significant tension between the United States and Saudi Arabia is low, and the effect on oil prices is relatively limited.

4. The root lies in demand: a new global slowdown!

Similar to the adjustment of oil prices, there has been a significant adjustment in the prices of domestic commodities such as steel since November.In the final analysis, the general adjustment in global commodity markets is due to a lack of support for global demand. China has been the main source of incremental demand for the global economy over the past decade, and its economic growth has slowed since the second half of last year. The economies of Europe and Japan have also weakened sharply so far this year, and it is difficult for the US economy to escape the big cycle of the global economy.

Therefore, the global economy is already in a new downward channel, risky assets will be under pressure, and gold will be more and more safe-haven.

在10月份之前,今年的国际原油价格是大幅上涨的。布油期货价格从去年底的67美元/桶,飙升至10月初高点时接近86美元/桶,几个月时间涨幅接近30%。

在10月份之前,今年的国际原油价格是大幅上涨的。布油期货价格从去年底的67美元/桶,飙升至10月初高点时接近86美元/桶,几个月时间涨幅接近30%。