Photo Source: Pixabay

Amid the smoke of trade frictions, the curtain of earnings reports for US technology stocks has begun. This week, Alphabet Inc-CL C, Facebook Inc, Amazon.Com Inc, Microsoft Corp, Intel Corp and other companies will announce their financial results one after another. Among them, Alphabet Inc-CL C's parent company Alphabet will release its first-quarter 2018 results at 4:30 Beijing time on April 24th.

As one of the most influential technology companies in the world, Alphabet Inc-CL C's quarterly report will undoubtedly have a great impact on other technology industries. Market participants say that large technology companies will become the key to dominating the trend of US stocks for a period of time, so Alphabet Inc-CL C's quarterly report will receive a lot of attention. The highlights of Futu Information for you are as follows:

I. analysts' expectations

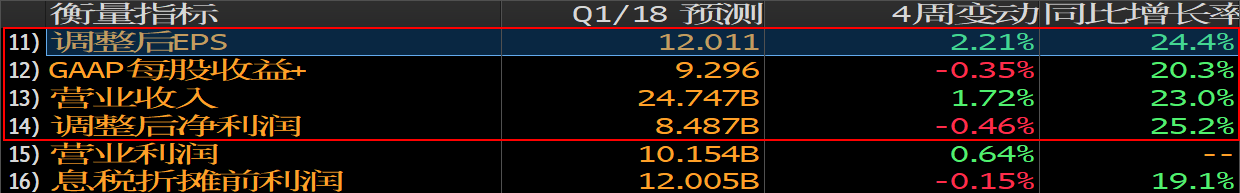

According to Bloomberg data,Analysts predict that Alphabet Inc-CL C's 2018 Q1 operating income will be $24.747 billion, up 23.0% from the same period last year; net profit will be $8.487 billion, up 25.2% from the same period last year; Alphabet Inc-CL A categoryAdjusted earnings per share were $12.011, up 24.4 per cent from a year earlier.

Source: Bloomberg

Analysts expect Alphabet's first-quarter earnings per share to average $9.28, compared with adjusted earnings per share of $11.75, according to market research firm FactSet. Taking into account the cost of traffic acquisition, revenue in the first quarter was $24.26 billion and the cost of traffic acquisition was $6.03 billion. Revenue from "other businesses" is expected to be $355 million.

In terms of ratings, Alphabet Inc-CL A (code: GOOGL) gave a "buy" rating to 34 of the 41 analysts covered by Bloomberg; seven gave a "hold" rating, accounting for 82.9%, accounting for 17.1%; and no analyst gave a "sell" rating. PredictedThe average target price is $1270.68.

Source: Bloomberg

Of the 12 analysts at Bloomberg, Alphabet Inc-CL C Category C(code: GOOG)A total of 10 gave a "buy" rating; accounting for 83.3%, 2 were given a "hold" rating, accounting for 16.7%; still no analysts gave a "sell" rating. PredictedThe average target price is $1285, with an offer of $1072.96 as of the publication date.

Source: Bloomberg

Second, the focus of this quarter's financial report

1. Three major adjustments have been made in the financial report.Alphabet announced the change earlier this month, which is likely to lead to a decline in revenue from the company's "other businesses" (Other Bets), which are more volatile, and provide a new way to measure the success of Alphabet advertising on third websites.

The smart home department Nest will be reintegrated into Alphabet Inc-CL C's hardware team from "other businesses" to record "other revenue".

With the new accounting standards, Alphabet must evaluate the value of the investment on a quarterly basis and report it in the income statement. For example, if the valuation of Uber has increased since Alphabet Inc-CL C's investment, then Alphabet must list the increase in the value of investment as income.According to Barclays analyst Ross. Ross Sandler said that based on Uber's current valuation, Alphabet's stake is worth more than $3 billion.

Previously, Alphabet Inc-CL C had to list the percentage change in paid clicks and the cost per click (advertising fee) on Alphabet Inc-CL C websites (Alphabet Inc-CL C search, Gmail, YouTube, etc.) and Alphabet Inc-CL C third-party websites (those that use Alphabet Inc-CL C's AdMob, AdSense or DoubleClick advertising products). But now, Alphabet Inc-CL C translates the indicators of online member sites into a percentage change in the number of shows (how often ads are viewed) and the cost of each display (display fees).

2. "other revenue" is the focus of attention.

One of Alphabet's most promising growth catalysts is its "other revenue" category, which consists of Google Play stores, Google cloud products and their hardware programs. Alphabet launched its new brand of Alphabet Inc-CL C-branded hardware devices in 2016, including Pixel mobile phones and Google Home smart speakers.

However, Morgan Stanley recently warned investors that Alphabet Inc-CL C's operating expenses in businesses such as hardware, cloud services and YouTube were much higher than expected.

Photo Source: Pixabay

3. It is predicted that Alphabet Inc-CL C's advertising revenue will grow strongly.

Zacks expects Alphabet Inc-CL C's advertising revenue to reach $25.79 billion this quarter, an increase of about 20.5% compared with the same period last year. In the fourth quarter of last year, Alphabet's advertising revenue grew 21.6% to $27.23 billion, accounting for 84.23% of total revenue.

As of the press date, Alphabet Inc-CL C rose 0.24% to US $1079.88 before the A market.

Source: Futu Securities

(editor\ Zhu Jingjing)