Refined from founder Securities: "looking for the signal of Economic bottom-- one of the Macroeconomic Outlook Series in 2019"

Abstract: since the second quarter of this year, with the weakening of China's macroeconomic data, the market has formed a consensus on the increased downside risks of China's economy in 2019, but there are still differences on some specific issues of economic growth next year. For example, will the risks of China's economic downturn be realized soon? Can the government's new round of steady growth hedge the risk of economic downturn in time? This article tries to make a corresponding analysis of the above two problems.

1. Prospects for exports and real estate investment

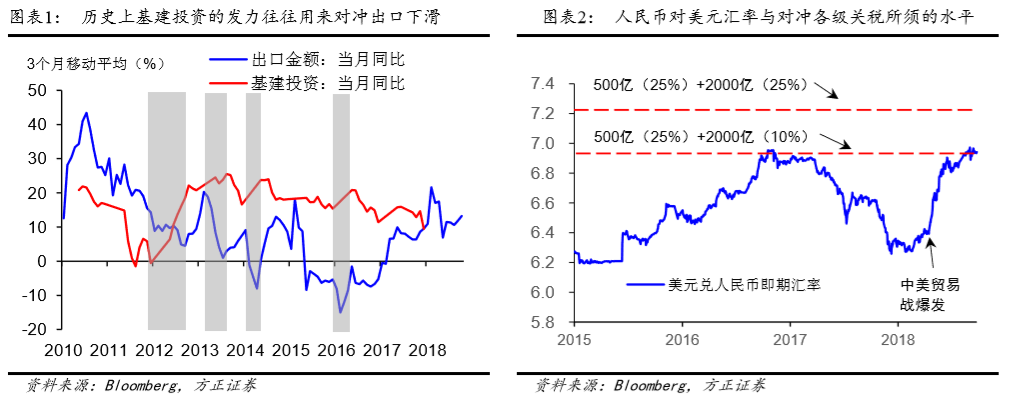

Exports and real estate investment have been the main drivers of China's cyclical recovery so far in 2016.In the future, whichever growth rate declines will realize the risk of economic downturn. Especially for exports, the rapid decline in export growth in history often corresponds to the increase in infrastructure investment, thus becoming a weather vane for the steady growth of the government.

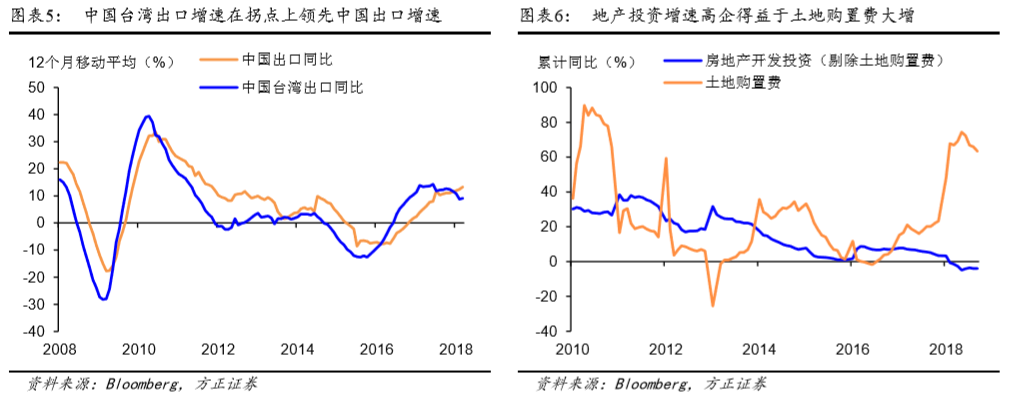

China's export growth will reach an inflection point in the coming quarter.The recent higher-than-expected growth in exports has still benefited from temporary factors such as exchange rate depreciation and the rush of exporters. However, from a series of forward-looking indicators, a significant decline in export growth in the first half of 2019 will be inevitable.

Real estate investment growth will also continue to face downward pressure in 2019.As shown in chart 6, the high growth rate of real estate investment so far this year is mainly due to the sharp increase in land purchase fees, while the investment growth rate of building installation and equipment purchase excluding land purchase fees is negative. In view of the fact that the growth rate of land purchase fees has slowed down since the third quarter, its investment in real estate development has also gradually weakened.

2. Soundness and economic bottom

At present, the market is more concerned about whether a new round of steady government growth can effectively hedge this risk than when the downside risks of fundamentals will materialize next year.

Judging from the effect of policy stimulus, the government's steady growth in 2018-2019 is likely to be significantly weaker than that in 2015-2016.Especially considering that the existing policy incentives have not yet been reflected in the overall social integration and the rebound in the impulse of public financial expenditure. As shown in figure 12, during each round of steady growth after the financial crisis, the impulse of aggregate social integration and public spending generally bottomed out 6-8 months ahead of nominal GDP. From this point of view, China's economic growth will continue to bottom out, at least in the first half of 2019.

3. The impact on the capital market

Given that a new round of steady growth is unlikely to underpin economic growth in the first half of 2019, the downward trend in long-end interest rates will not change, as shown in figure 13, the bottom of aggregate social integration and the impulse of public spending is also ahead of the peak of interest rates on 10-year Treasurys, and this leadership has gradually lengthened in recent years.

For the stock market, chart 14 shows that in each previous round of steady growth, the inflection point of EPS growth in the Shanghai Composite Index tends to lag behind the inflection point of policy stimulus by 3-5 quarters. Therefore, in addition to the external certainty of the Sino-US trade war, the decline in corporate earnings growth in 2019 will also be a major factor restricting the rebound of the market.

4. Risk hint

Sino-US trade war escalates